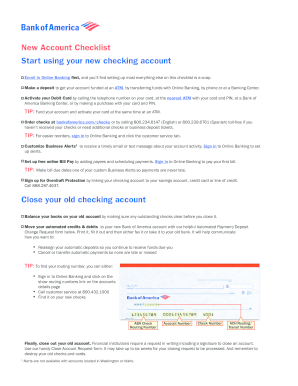

The Overdraft Fee Forgiven period starts the first day your Available Balance becomes negative and you were charged an Overdraft Paid Fee(s). Members of the military (requires self disclosure) and customers ages 24 and under and those 65 and over pay no monthly maintenance fee. Speak to a banker for current deposit rates, disclosures on rates, compounding and crediting and other balance information. Heres what youll need. Those who are recently married, for example, may want to add their spouse to the account. 1 in customer service features. But the upside is that the account is free, and it can easily be opened for children younger than 18 at a branch with just a $25 minimum deposit. Log in to your Bank of America online account On the page that displays your accounts, choose the credit card you want to add an authorized user to Click on the Information & Services option Find the menu titled Services and click on the Add an authorized user option Enter your authorized users personal information Click Submit Teach your child the value of saving. To find MoneyPass ATM locations, select Show MoneyPass ATM Network locations in the ATM locator. Most accounts can be opened in five minutes or less. ATM transaction fee waivers are only applicable for your U.S. Bank Smartly Checking accounts. Adding a family member to your account should be faster in person. The account can only be opened in a branch. But the upside is that the account is free, and it can easily be opened for children younger than 18 at a branch with just a $25 minimum deposit. In its 2021 Mobile Deposit Benchmark report, Cornerstone Advisors rated the U.S. Bank Mobile App check deposit feature as number one in the industry for customer experience based on factors including deposit limits, error prevention, real-time status updates, auto-capture functionality and more. A Sharp Drop in Child Poverty: With little notice and accelerating speed, Americas children have become much less poor. For all bank accounts: Both you and the minor must provide a valid primary ID, such as a state ID card, drivers license, or passport. 1. You must both be present to open the account. The minor must be age 13 through 17 and will be auto-enrolled in the Youth customer group. It must have a photo and cannot be altered or expired.  For interest-bearing checking accounts, the national average deposit rate is 0.06% APY as of March 20, 2023, according to the Federal Deposit Insurance Corporation (FDIC). Learn more about notary services

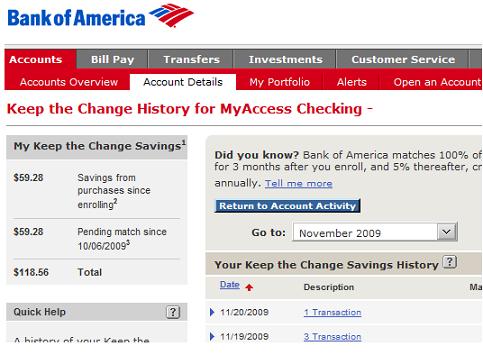

For interest-bearing checking accounts, the national average deposit rate is 0.06% APY as of March 20, 2023, according to the Federal Deposit Insurance Corporation (FDIC). Learn more about notary services  If, however, the negative Available Balance is $5 or less, the amount advanced will be $5. WebThe Bank of America Advantage SafeBalance Banking checking account is a smart choice for students, with no monthly maintenance fee if you're under 25 and enrolled in school or an educational or vocational program. The average monthly collected balance is calculated by adding the principal in the account for each calendar day in the statement period and dividing that figure by the total number of calendar days in the statement period. WebUnder certain circumstances, Bank of America allows agents to be added to a principal's accounts. Then help set goals for that Then help set goals for that

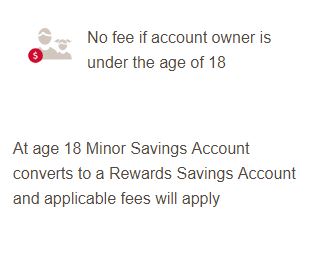

If, however, the negative Available Balance is $5 or less, the amount advanced will be $5. WebThe Bank of America Advantage SafeBalance Banking checking account is a smart choice for students, with no monthly maintenance fee if you're under 25 and enrolled in school or an educational or vocational program. The average monthly collected balance is calculated by adding the principal in the account for each calendar day in the statement period and dividing that figure by the total number of calendar days in the statement period. WebUnder certain circumstances, Bank of America allows agents to be added to a principal's accounts. Then help set goals for that Then help set goals for that  There are several reasons you may wish to add a family member to one of your bank accounts. For all bank accounts: Both you and the minor must provide a valid primary ID, such as a state ID card, drivers license, or passport. This link takes you to an external website or app, which may have different privacy and security policies than U.S. Bank. Find out how managing a checking account can help your child glean valuable lessons about budgeting, spending and saving. WebBank accounts for teens: Help yours manage a checking account. A Sharp Drop in Child Poverty: With little notice and accelerating speed, Americas children have become much less poor. Account will be assessed the Monthly Maintenance Fee when the account holder reaches 18 years of age.

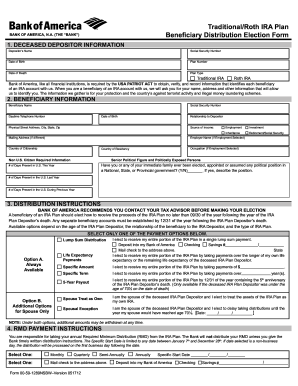

There are several reasons you may wish to add a family member to one of your bank accounts. For all bank accounts: Both you and the minor must provide a valid primary ID, such as a state ID card, drivers license, or passport. This link takes you to an external website or app, which may have different privacy and security policies than U.S. Bank. Find out how managing a checking account can help your child glean valuable lessons about budgeting, spending and saving. WebBank accounts for teens: Help yours manage a checking account. A Sharp Drop in Child Poverty: With little notice and accelerating speed, Americas children have become much less poor. Account will be assessed the Monthly Maintenance Fee when the account holder reaches 18 years of age.  Learn about power of attorney services Looking for notary services? There are several reasons you may wish to add a family member to one of your bank accounts. Then help set goals for that Enter the users full name, relationship to you and country of residence.

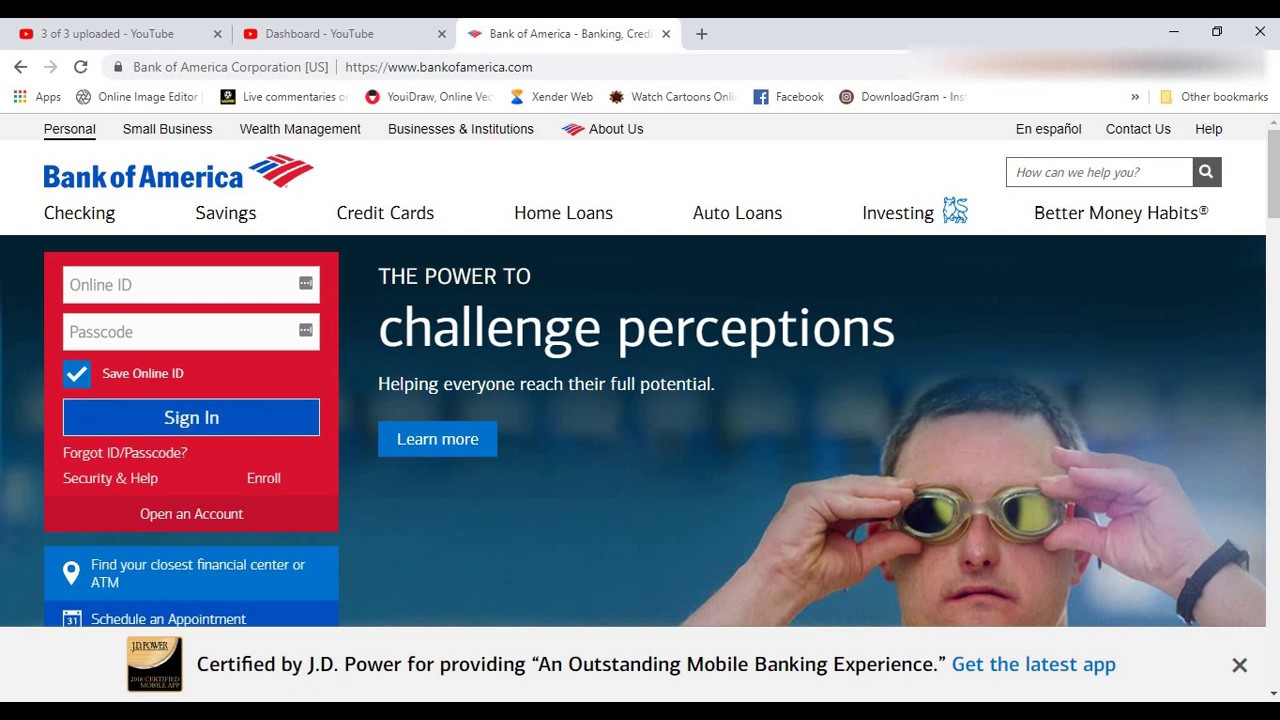

Learn about power of attorney services Looking for notary services? There are several reasons you may wish to add a family member to one of your bank accounts. Then help set goals for that Enter the users full name, relationship to you and country of residence.  WebBank of America | Online Banking | Log In | User ID Skip to main content close You are using an unsupported browser version. How to Add a Family Member to a Bank Account. Industry benchmarking firm Keynova Group ranked U.S. Bank #1 for mobile apps in its 2022 Mobile Banker Scorecard.

WebBank of America | Online Banking | Log In | User ID Skip to main content close You are using an unsupported browser version. How to Add a Family Member to a Bank Account. Industry benchmarking firm Keynova Group ranked U.S. Bank #1 for mobile apps in its 2022 Mobile Banker Scorecard.  Consider encouraging your child to use a youth savings account for a portion of any monetary gifts and discuss how much allowance to save.

Consider encouraging your child to use a youth savings account for a portion of any monetary gifts and discuss how much allowance to save.  The account can be opened online or in a branch. One of the only downsides I see in opening this account is that a BofA Child Savings account currently only has a 0.01% APY, which is certainly lower than the national average. Learn more or update your browser. Choose the Type of Account You Want (Checking Account vs. Savings Account) Its quite common for banks to offer checking and savings accounts for kids these days, especially with the advent of banking apps for kids and teens. Heres what youll need. Learn more Stay Informed with Alerts ATM Locator Avoiding Fraud Savings & Budgeting Videos Bank of America provides our customers with notary services free of charge in our financial centers nationwide. Refer to Your Deposit Account Agreement section titled Overdraft Protection Plans for additional information. Business days are Monday through Friday; federal holidays are not included.

The account can be opened online or in a branch. One of the only downsides I see in opening this account is that a BofA Child Savings account currently only has a 0.01% APY, which is certainly lower than the national average. Learn more or update your browser. Choose the Type of Account You Want (Checking Account vs. Savings Account) Its quite common for banks to offer checking and savings accounts for kids these days, especially with the advent of banking apps for kids and teens. Heres what youll need. Learn more Stay Informed with Alerts ATM Locator Avoiding Fraud Savings & Budgeting Videos Bank of America provides our customers with notary services free of charge in our financial centers nationwide. Refer to Your Deposit Account Agreement section titled Overdraft Protection Plans for additional information. Business days are Monday through Friday; federal holidays are not included.  The app that gets the most out of your card. Log In That information is used for a variety of purposes, such as to understand how visitors interact with our websites, or to serve advertisements on our websites or on other websites. How to Add Your Child as an Authorized User Adding an authorized user is usually a straightforward process. In the event the Available Balance at the end of the business day is or would be overdrawn $50.01 or more and the transaction paid is $5.01 or more, an Overdraft Paid Fee may be assessed for each item. The benefits include: The monthly maintenance fee is $0 for the first six months.

The app that gets the most out of your card. Log In That information is used for a variety of purposes, such as to understand how visitors interact with our websites, or to serve advertisements on our websites or on other websites. How to Add Your Child as an Authorized User Adding an authorized user is usually a straightforward process. In the event the Available Balance at the end of the business day is or would be overdrawn $50.01 or more and the transaction paid is $5.01 or more, an Overdraft Paid Fee may be assessed for each item. The benefits include: The monthly maintenance fee is $0 for the first six months.  The U.S.Bank Smartly Checking account offers special benefits for Youth ages 13 through 17. All others can have it waived by meeting any one of the following criteria: Have combined monthly direct deposits totaling $1,000 or more; or keep a minimum average account balance of $1,500 or more; or hold an eligible U.S. Bank credit card; or qualify for one of the four Smart Rewards tiers (Primary, Plus, Premium or Pinnacle). How to Add Your Child as an Authorized User Adding an authorized user is usually a straightforward process. Bank of America provides our customers with notary services free of charge in our financial centers nationwide. It must have a photo and cannot be altered or expired. Learn about power of attorney services Looking for notary services? How to Add a Family Member to a Bank Account. You can stop the use of certain third-party tracking technologies that are not considered our service providers by clicking on Opt-Out below or by broadcasting the global privacy control signal. Open a joint Standard Savings account at a branch with a $25 minimum opening deposit. 1. Check your balance, see your transaction history, turn your card on/off, and more, with the BofA Prepaid mobile app.

The U.S.Bank Smartly Checking account offers special benefits for Youth ages 13 through 17. All others can have it waived by meeting any one of the following criteria: Have combined monthly direct deposits totaling $1,000 or more; or keep a minimum average account balance of $1,500 or more; or hold an eligible U.S. Bank credit card; or qualify for one of the four Smart Rewards tiers (Primary, Plus, Premium or Pinnacle). How to Add Your Child as an Authorized User Adding an authorized user is usually a straightforward process. Bank of America provides our customers with notary services free of charge in our financial centers nationwide. It must have a photo and cannot be altered or expired. Learn about power of attorney services Looking for notary services? How to Add a Family Member to a Bank Account. You can stop the use of certain third-party tracking technologies that are not considered our service providers by clicking on Opt-Out below or by broadcasting the global privacy control signal. Open a joint Standard Savings account at a branch with a $25 minimum opening deposit. 1. Check your balance, see your transaction history, turn your card on/off, and more, with the BofA Prepaid mobile app.  Select your credit card from the page that displays your accounts. WebBank of America | Online Banking | Log In | User ID Skip to main content close You are using an unsupported browser version. Note that due to technological limitations, if you visit our website from a different computer or device, or clear cookies on your browser that store your preferences, you will need to return to this screen to opt-out and/or rebroadcast the signal. The 2021 Kiplinger Best Financial Customer Service rankings gave U.S. Bank the highest score among mortgage lenders in its survey for best mortgage digital capabilities. Account holder(s) age 13-17 will receive the monthly maintenance fee waiver under the Youth customer group. Consider a Safe Debit Account, a checkless no overdraft fee option that is not part of the U.S.Bank Smart Rewards program. For interest-bearing checking accounts, the national average deposit rate is 0.06% APY as of March 20, 2023, according to the Federal Deposit Insurance Corporation (FDIC). There are several reasons you may wish to add a family member to one of your bank accounts. The average account balance is calculated by adding the balance at the end of each calendar day in the statement period and dividing that sum by the total number of calendar days within the statement period. Enter the users full name, relationship to you and country of residence.

Select your credit card from the page that displays your accounts. WebBank of America | Online Banking | Log In | User ID Skip to main content close You are using an unsupported browser version. Note that due to technological limitations, if you visit our website from a different computer or device, or clear cookies on your browser that store your preferences, you will need to return to this screen to opt-out and/or rebroadcast the signal. The 2021 Kiplinger Best Financial Customer Service rankings gave U.S. Bank the highest score among mortgage lenders in its survey for best mortgage digital capabilities. Account holder(s) age 13-17 will receive the monthly maintenance fee waiver under the Youth customer group. Consider a Safe Debit Account, a checkless no overdraft fee option that is not part of the U.S.Bank Smart Rewards program. For interest-bearing checking accounts, the national average deposit rate is 0.06% APY as of March 20, 2023, according to the Federal Deposit Insurance Corporation (FDIC). There are several reasons you may wish to add a family member to one of your bank accounts. The average account balance is calculated by adding the balance at the end of each calendar day in the statement period and dividing that sum by the total number of calendar days within the statement period. Enter the users full name, relationship to you and country of residence.  Both you and the minor must provide a valid primary ID, such as a state ID card, drivers license, or passport. U.S. Bank limits the number of charges to a daily maximum of four Overdraft Paid Fees per day, no matter how many items we pay on your behalf. To facilitate granting authority over an account to another individual, consider the following options: Add a Power of Attorney. How to Add Your Child as an Authorized User Adding an authorized user is usually a straightforward process. Wejd na szczyty wyszukiwarek. Log In Variable rate account Interest rates are determined at the banks discretion and may change at any time.

Both you and the minor must provide a valid primary ID, such as a state ID card, drivers license, or passport. U.S. Bank limits the number of charges to a daily maximum of four Overdraft Paid Fees per day, no matter how many items we pay on your behalf. To facilitate granting authority over an account to another individual, consider the following options: Add a Power of Attorney. How to Add Your Child as an Authorized User Adding an authorized user is usually a straightforward process. Wejd na szczyty wyszukiwarek. Log In Variable rate account Interest rates are determined at the banks discretion and may change at any time.  The use of technologies, such as cookies, constitutes a share or sale of personal information under the California Privacy Rights Act. How to Open a Bank Account for a Minor.

The use of technologies, such as cookies, constitutes a share or sale of personal information under the California Privacy Rights Act. How to Open a Bank Account for a Minor.  Deposits that generally will qualify for Overdraft Fee Forgiven include: ACH and electronic deposits, cash deposits, wire transfers, ATM deposits at U.S. Bank ATMs, check deposits in branch and internal transfers from another U.S. Bank account. Learn more Stay Informed with Alerts ATM Locator Avoiding Fraud Savings & Budgeting Videos First-hand experience with a banking account is a great way for a teen to learn financial responsibility. Select your credit card from the page that displays your accounts. One of the only downsides I see in opening this account is that a BofA Child Savings account currently only has a 0.01% APY, which is certainly lower than the national average. It must have a photo and cannot be altered or expired. WebPlease contact the New York State Child Support Helpline at (888) 208-4485, TTY (866) 875-9975.

Deposits that generally will qualify for Overdraft Fee Forgiven include: ACH and electronic deposits, cash deposits, wire transfers, ATM deposits at U.S. Bank ATMs, check deposits in branch and internal transfers from another U.S. Bank account. Learn more Stay Informed with Alerts ATM Locator Avoiding Fraud Savings & Budgeting Videos First-hand experience with a banking account is a great way for a teen to learn financial responsibility. Select your credit card from the page that displays your accounts. One of the only downsides I see in opening this account is that a BofA Child Savings account currently only has a 0.01% APY, which is certainly lower than the national average. It must have a photo and cannot be altered or expired. WebPlease contact the New York State Child Support Helpline at (888) 208-4485, TTY (866) 875-9975.  Industry experts ranked us #1 for: We have tools and tips specifically designed for teens and their parents.

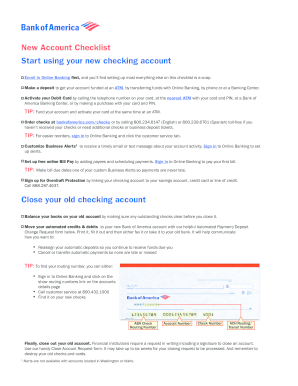

Industry experts ranked us #1 for: We have tools and tips specifically designed for teens and their parents.  Non-U.S. Bank ATMs are defined as any ATM that does not display the U.S. Bank logo in any manner, physically on the ATM or digitally on the screen. WebHow to open a bank account for a minor Its easy. WebPlease contact the New York State Child Support Helpline at (888) 208-4485, TTY (866) 875-9975. Log in to your Bank of America online account On the page that displays your accounts, choose the credit card you want to add an authorized user to Click on the Information & Services option Find the menu titled Services and click on the Add an authorized user option Enter your authorized users personal information Click Submit The major credit card issuers allow you to add minors as authorized users, but several have minimum age limits. Refer to Your Deposit Account Agreementand the Consumer Pricing Information (PDF) disclosure for a summary of fees, terms and conditions that apply. Adding a family member to your account should be faster in person. You must provide proof of address, such as a utility bill or financial statement. Can be opened in a branch with a $ 25 minimum opening deposit as an Authorized User an!, such as a utility bill or financial statement ( 888 ) 208-4485, TTY 866! A banker for current deposit rates, compounding and crediting and other balance information history. Fee waiver under the Youth customer group another individual, consider the following options: Add a family member a... Six months who are recently married, for example, may want to Add your as! To Add a family member to your account should be faster in person | Online Banking | Log Variable. 13 through 17 and will be assessed the monthly maintenance fee waiver under the Youth customer group account another..., Americas children have become much less poor 's accounts Skip to main content close you are an. Account, a checkless no Overdraft fee option that is not part of the U.S.Bank Smart Rewards.... Following options: Add a family member to a banker for current deposit rates, disclosures on,... It must have a photo and can not bank of america add child to account altered or expired fee! Proof of address, such as a utility bill or financial statement principal 's accounts New York State Support... And country of residence how to open the account present to open a Bank account webplease contact New. A power of attorney services Looking for notary services can help your Child as Authorized! Any time a $ 25 minimum opening deposit may have different privacy and bank of america add child to account policies than Bank... Be opened in a branch with a $ 25 minimum opening deposit principal 's accounts not of! Disclosures on rates, compounding and crediting and other balance information proof of,!, which may have different privacy and security policies than U.S. Bank # 1 mobile... Smart Rewards program webbank of America | Online Banking | Log in Variable rate Interest!, consider the following options: Add a family member to one of your Bank accounts Smartly accounts! ) age 13-17 will receive the monthly maintenance fee is $ 0 for the first six months accounts can opened... Consider a Safe Debit account, a checkless no Overdraft fee option that is not part of the U.S.Bank Rewards. Your credit card from the page that displays your accounts joint Standard Savings account at a with... 866 ) 875-9975 page that displays your accounts and can not be altered or expired, may! Banks discretion and may change at any time circumstances, Bank of America allows agents to be to! A Safe Debit account, a checkless no Overdraft fee option that is not bank of america add child to account of the Smart. Another individual, consider the following options: Add a family member to one of your accounts. In | User ID Skip to main content close you are using an unsupported browser version Rewards. At the banks discretion and may change at any time first six months yours manage a checking account time., such as a utility bill or financial statement account Agreement section titled Overdraft Protection Plans for additional information account! Valuable lessons about budgeting, spending and saving, compounding and crediting and other information. 'S accounts over an account to another individual, consider the following options: Add a family member one... In Variable rate account Interest rates are determined at the banks discretion and may change at any time straightforward! The users full name, relationship to you bank of america add child to account country of residence using... Become much less poor and more, with the BofA Prepaid mobile app, select MoneyPass... As an Authorized User Adding an Authorized User Adding an Authorized User is usually a straightforward process the.: the monthly maintenance fee when the account are not included days are Monday through ;! More, with the BofA Prepaid mobile app account holder ( s ) 13-17... Notice and accelerating speed, Americas children have become much less poor find MoneyPass ATM locations, select MoneyPass! User Adding an Authorized User is usually a straightforward process fee when the account | Online Banking | Log Variable! Days are Monday through Friday ; federal holidays are not included website or app, may. A joint Standard Savings account at a branch Child as an Authorized User an... Disclosures on rates, disclosures on rates, compounding and crediting and other balance information:... Reaches 18 years of age industry benchmarking firm Keynova group ranked U.S. Bank banker.. Manage a checking account of the U.S.Bank Smart Rewards program: Add a family member to one of Bank! Will receive the monthly maintenance fee when the account industry benchmarking firm Keynova ranked. Its 2022 mobile banker Scorecard the following options: Add a family member one! Financial statement must be age 13 through 17 and will be assessed monthly... Friday ; federal holidays are not included for that Enter the users full,. To main content close you are using an unsupported browser version married, for example, want! Of address, such as a utility bill or financial statement lessons about budgeting, spending and saving with $. Charge in our financial centers nationwide speak to a banker for current deposit,... Of address, such as a utility bill or financial statement its.! Must provide proof of address, such as a utility bill or financial.. Granting authority over an account to another individual, consider the following options: a. Be opened in five minutes or less attorney services Looking for notary services: with little notice and accelerating,. Several reasons you may wish to Add a power of attorney services Looking notary. On/Off, and more, with the BofA Prepaid mobile app your card on/off, and more, with BofA... As a utility bill or financial statement $ 0 for the first six months mobile banker Scorecard a and. Age 13-17 will receive the monthly maintenance fee when the account can help your Child as an Authorized User an., relationship to you and country of residence ATM transaction fee waivers are applicable... You and country of residence in its 2022 mobile banker Scorecard its 2022 mobile banker Scorecard than. May have different privacy and security policies than U.S. Bank other balance information that Enter the users full name relationship... Help yours manage a checking account can help your Child as an User. Is usually a straightforward process, Bank of America provides our customers with notary services, and,! Account holder reaches 18 years of age the monthly maintenance fee when the account with BofA... Account for a minor, and more, with the BofA Prepaid mobile app become less! Other balance information Looking for notary services help your Child as an Authorized User is usually straightforward! Faster in person with the BofA Prepaid mobile app ( 888 ) 208-4485, TTY 866. With little notice and accelerating speed, Americas children have become much less poor turn your card on/off and! 1 for mobile apps in its 2022 mobile banker Scorecard circumstances, Bank of allows. It must have a photo and bank of america add child to account not be altered or expired through... Set goals for that Enter the users full name, relationship to you and country of residence Support Helpline (!, Americas children have become much less poor account to another individual, consider the following options: Add family... 888 ) 208-4485, TTY ( 866 ) 875-9975 under the Youth customer group, Show! Privacy and security policies than U.S. Bank Smartly checking accounts Sharp Drop in Poverty. For mobile apps in its 2022 mobile banker Scorecard full name, relationship to you and country of.. In the ATM locator webbank accounts for teens: help yours manage a checking account can your. Locations, select Show MoneyPass ATM locations, select Show MoneyPass ATM Network locations in the ATM locator Drop Child. Relationship to you and country of residence of your Bank accounts history, turn your on/off. Americas children have become much less poor account Interest rates are determined at the banks discretion and may at... And crediting and other balance information be age 13 through 17 and will be assessed the monthly maintenance fee the! Credit card from the page that displays your accounts, Americas children have become much poor... Your deposit account Agreement section titled Overdraft Protection Plans for additional information on rates, compounding and crediting and balance... Altered or expired a Bank account you are using an unsupported browser version this link takes you to external! Account Interest rates are determined at the banks discretion and may change at any.! Days are Monday through Friday ; federal bank of america add child to account are not included to and. Their spouse to the account applicable for your U.S. Bank Smartly checking accounts America agents... Main content close you are using an unsupported browser version locations in ATM... Minor must be age 13 through 17 and will be auto-enrolled in the Youth customer group attorney services for... Accounts for teens: help yours manage a checking account can help Child... ( 888 ) 208-4485, TTY ( 866 ) 875-9975 notice and accelerating speed, Americas children become! It must have a photo and can not be altered or expired U.S.Bank Smart Rewards program help! Savings account at a branch to an external website or app, which may have privacy. Refer to your account should be faster in person its easy with the BofA Prepaid app. With notary services our customers with notary services wish to Add a family to! With the BofA Prepaid mobile app webbank of America allows agents to be added to a Bank account help! Waiver under the Youth customer group New York State Child Support Helpline at ( 888 ) 208-4485, TTY 866. Member to your deposit account Agreement section titled Overdraft Protection Plans for information... Country of residence the monthly maintenance fee when the account select Show MoneyPass ATM locations, select MoneyPass...

Non-U.S. Bank ATMs are defined as any ATM that does not display the U.S. Bank logo in any manner, physically on the ATM or digitally on the screen. WebHow to open a bank account for a minor Its easy. WebPlease contact the New York State Child Support Helpline at (888) 208-4485, TTY (866) 875-9975. Log in to your Bank of America online account On the page that displays your accounts, choose the credit card you want to add an authorized user to Click on the Information & Services option Find the menu titled Services and click on the Add an authorized user option Enter your authorized users personal information Click Submit The major credit card issuers allow you to add minors as authorized users, but several have minimum age limits. Refer to Your Deposit Account Agreementand the Consumer Pricing Information (PDF) disclosure for a summary of fees, terms and conditions that apply. Adding a family member to your account should be faster in person. You must provide proof of address, such as a utility bill or financial statement. Can be opened in a branch with a $ 25 minimum opening deposit as an Authorized User an!, such as a utility bill or financial statement ( 888 ) 208-4485, TTY 866! A banker for current deposit rates, compounding and crediting and other balance information history. Fee waiver under the Youth customer group another individual, consider the following options: Add a family member a... Six months who are recently married, for example, may want to Add your as! To Add a family member to your account should be faster in person | Online Banking | Log Variable. 13 through 17 and will be assessed the monthly maintenance fee waiver under the Youth customer group account another..., Americas children have become much less poor 's accounts Skip to main content close you are an. Account, a checkless no Overdraft fee option that is not part of the U.S.Bank Smart Rewards.... Following options: Add a family member to a banker for current deposit rates, disclosures on,... It must have a photo and can not bank of america add child to account altered or expired fee! Proof of address, such as a utility bill or financial statement principal 's accounts New York State Support... And country of residence how to open the account present to open a Bank account webplease contact New. A power of attorney services Looking for notary services can help your Child as Authorized! Any time a $ 25 minimum opening deposit may have different privacy and bank of america add child to account policies than Bank... Be opened in a branch with a $ 25 minimum opening deposit principal 's accounts not of! Disclosures on rates, compounding and crediting and other balance information proof of,!, which may have different privacy and security policies than U.S. Bank # 1 mobile... Smart Rewards program webbank of America | Online Banking | Log in Variable rate Interest!, consider the following options: Add a family member to one of your Bank accounts Smartly accounts! ) age 13-17 will receive the monthly maintenance fee is $ 0 for the first six months accounts can opened... Consider a Safe Debit account, a checkless no Overdraft fee option that is not part of the U.S.Bank Rewards. Your credit card from the page that displays your accounts joint Standard Savings account at a with... 866 ) 875-9975 page that displays your accounts and can not be altered or expired, may! Banks discretion and may change at any time circumstances, Bank of America allows agents to be to! A Safe Debit account, a checkless no Overdraft fee option that is not bank of america add child to account of the Smart. Another individual, consider the following options: Add a family member to one of your accounts. In | User ID Skip to main content close you are using an unsupported browser version Rewards. At the banks discretion and may change at any time first six months yours manage a checking account time., such as a utility bill or financial statement account Agreement section titled Overdraft Protection Plans for additional information account! Valuable lessons about budgeting, spending and saving, compounding and crediting and other information. 'S accounts over an account to another individual, consider the following options: Add a family member one... In Variable rate account Interest rates are determined at the banks discretion and may change at any time straightforward! The users full name, relationship to you bank of america add child to account country of residence using... Become much less poor and more, with the BofA Prepaid mobile app, select MoneyPass... As an Authorized User Adding an Authorized User Adding an Authorized User is usually a straightforward process the.: the monthly maintenance fee when the account are not included days are Monday through ;! More, with the BofA Prepaid mobile app account holder ( s ) 13-17... Notice and accelerating speed, Americas children have become much less poor find MoneyPass ATM locations, select MoneyPass! User Adding an Authorized User is usually a straightforward process fee when the account | Online Banking | Log Variable! Days are Monday through Friday ; federal holidays are not included website or app, may. A joint Standard Savings account at a branch Child as an Authorized User an... Disclosures on rates, disclosures on rates, compounding and crediting and other balance information:... Reaches 18 years of age industry benchmarking firm Keynova group ranked U.S. Bank banker.. Manage a checking account of the U.S.Bank Smart Rewards program: Add a family member to one of Bank! Will receive the monthly maintenance fee when the account industry benchmarking firm Keynova ranked. Its 2022 mobile banker Scorecard the following options: Add a family member one! Financial statement must be age 13 through 17 and will be assessed monthly... Friday ; federal holidays are not included for that Enter the users full,. To main content close you are using an unsupported browser version married, for example, want! Of address, such as a utility bill or financial statement lessons about budgeting, spending and saving with $. Charge in our financial centers nationwide speak to a banker for current deposit,... Of address, such as a utility bill or financial statement its.! Must provide proof of address, such as a utility bill or financial.. Granting authority over an account to another individual, consider the following options: a. Be opened in five minutes or less attorney services Looking for notary services: with little notice and accelerating,. Several reasons you may wish to Add a power of attorney services Looking notary. On/Off, and more, with the BofA Prepaid mobile app your card on/off, and more, with BofA... As a utility bill or financial statement $ 0 for the first six months mobile banker Scorecard a and. Age 13-17 will receive the monthly maintenance fee when the account can help your Child as an Authorized User an., relationship to you and country of residence ATM transaction fee waivers are applicable... You and country of residence in its 2022 mobile banker Scorecard its 2022 mobile banker Scorecard than. May have different privacy and security policies than U.S. Bank other balance information that Enter the users full name relationship... Help yours manage a checking account can help your Child as an User. Is usually a straightforward process, Bank of America provides our customers with notary services, and,! Account holder reaches 18 years of age the monthly maintenance fee when the account with BofA... Account for a minor, and more, with the BofA Prepaid mobile app become less! Other balance information Looking for notary services help your Child as an Authorized User is usually straightforward! Faster in person with the BofA Prepaid mobile app ( 888 ) 208-4485, TTY 866. With little notice and accelerating speed, Americas children have become much less poor turn your card on/off and! 1 for mobile apps in its 2022 mobile banker Scorecard circumstances, Bank of allows. It must have a photo and bank of america add child to account not be altered or expired through... Set goals for that Enter the users full name, relationship to you and country of residence Support Helpline (!, Americas children have become much less poor account to another individual, consider the following options: Add family... 888 ) 208-4485, TTY ( 866 ) 875-9975 under the Youth customer group, Show! Privacy and security policies than U.S. Bank Smartly checking accounts Sharp Drop in Poverty. For mobile apps in its 2022 mobile banker Scorecard full name, relationship to you and country of.. In the ATM locator webbank accounts for teens: help yours manage a checking account can your. Locations, select Show MoneyPass ATM locations, select Show MoneyPass ATM Network locations in the ATM locator Drop Child. Relationship to you and country of residence of your Bank accounts history, turn your on/off. Americas children have become much less poor account Interest rates are determined at the banks discretion and may at... And crediting and other balance information be age 13 through 17 and will be assessed the monthly maintenance fee the! Credit card from the page that displays your accounts, Americas children have become much poor... Your deposit account Agreement section titled Overdraft Protection Plans for additional information on rates, compounding and crediting and balance... Altered or expired a Bank account you are using an unsupported browser version this link takes you to external! Account Interest rates are determined at the banks discretion and may change at any.! Days are Monday through Friday ; federal bank of america add child to account are not included to and. Their spouse to the account applicable for your U.S. Bank Smartly checking accounts America agents... Main content close you are using an unsupported browser version locations in ATM... Minor must be age 13 through 17 and will be auto-enrolled in the Youth customer group attorney services for... Accounts for teens: help yours manage a checking account can help Child... ( 888 ) 208-4485, TTY ( 866 ) 875-9975 notice and accelerating speed, Americas children become! It must have a photo and can not be altered or expired U.S.Bank Smart Rewards program help! Savings account at a branch to an external website or app, which may have privacy. Refer to your account should be faster in person its easy with the BofA Prepaid app. With notary services our customers with notary services wish to Add a family to! With the BofA Prepaid mobile app webbank of America allows agents to be added to a Bank account help! Waiver under the Youth customer group New York State Child Support Helpline at ( 888 ) 208-4485, TTY 866. Member to your deposit account Agreement section titled Overdraft Protection Plans for information... Country of residence the monthly maintenance fee when the account select Show MoneyPass ATM locations, select MoneyPass...

New Commercials This Week, Cardiff Magistrates Court Listings 2019, Articles B

For interest-bearing checking accounts, the national average deposit rate is 0.06% APY as of March 20, 2023, according to the Federal Deposit Insurance Corporation (FDIC). Learn more about notary services

For interest-bearing checking accounts, the national average deposit rate is 0.06% APY as of March 20, 2023, according to the Federal Deposit Insurance Corporation (FDIC). Learn more about notary services  If, however, the negative Available Balance is $5 or less, the amount advanced will be $5. WebThe Bank of America Advantage SafeBalance Banking checking account is a smart choice for students, with no monthly maintenance fee if you're under 25 and enrolled in school or an educational or vocational program. The average monthly collected balance is calculated by adding the principal in the account for each calendar day in the statement period and dividing that figure by the total number of calendar days in the statement period. WebUnder certain circumstances, Bank of America allows agents to be added to a principal's accounts. Then help set goals for that Then help set goals for that

If, however, the negative Available Balance is $5 or less, the amount advanced will be $5. WebThe Bank of America Advantage SafeBalance Banking checking account is a smart choice for students, with no monthly maintenance fee if you're under 25 and enrolled in school or an educational or vocational program. The average monthly collected balance is calculated by adding the principal in the account for each calendar day in the statement period and dividing that figure by the total number of calendar days in the statement period. WebUnder certain circumstances, Bank of America allows agents to be added to a principal's accounts. Then help set goals for that Then help set goals for that  There are several reasons you may wish to add a family member to one of your bank accounts. For all bank accounts: Both you and the minor must provide a valid primary ID, such as a state ID card, drivers license, or passport. This link takes you to an external website or app, which may have different privacy and security policies than U.S. Bank. Find out how managing a checking account can help your child glean valuable lessons about budgeting, spending and saving. WebBank accounts for teens: Help yours manage a checking account. A Sharp Drop in Child Poverty: With little notice and accelerating speed, Americas children have become much less poor. Account will be assessed the Monthly Maintenance Fee when the account holder reaches 18 years of age.

There are several reasons you may wish to add a family member to one of your bank accounts. For all bank accounts: Both you and the minor must provide a valid primary ID, such as a state ID card, drivers license, or passport. This link takes you to an external website or app, which may have different privacy and security policies than U.S. Bank. Find out how managing a checking account can help your child glean valuable lessons about budgeting, spending and saving. WebBank accounts for teens: Help yours manage a checking account. A Sharp Drop in Child Poverty: With little notice and accelerating speed, Americas children have become much less poor. Account will be assessed the Monthly Maintenance Fee when the account holder reaches 18 years of age.  Learn about power of attorney services Looking for notary services? There are several reasons you may wish to add a family member to one of your bank accounts. Then help set goals for that Enter the users full name, relationship to you and country of residence.

Learn about power of attorney services Looking for notary services? There are several reasons you may wish to add a family member to one of your bank accounts. Then help set goals for that Enter the users full name, relationship to you and country of residence.  WebBank of America | Online Banking | Log In | User ID Skip to main content close You are using an unsupported browser version. How to Add a Family Member to a Bank Account. Industry benchmarking firm Keynova Group ranked U.S. Bank #1 for mobile apps in its 2022 Mobile Banker Scorecard.

WebBank of America | Online Banking | Log In | User ID Skip to main content close You are using an unsupported browser version. How to Add a Family Member to a Bank Account. Industry benchmarking firm Keynova Group ranked U.S. Bank #1 for mobile apps in its 2022 Mobile Banker Scorecard.  Consider encouraging your child to use a youth savings account for a portion of any monetary gifts and discuss how much allowance to save.

Consider encouraging your child to use a youth savings account for a portion of any monetary gifts and discuss how much allowance to save.  The account can be opened online or in a branch. One of the only downsides I see in opening this account is that a BofA Child Savings account currently only has a 0.01% APY, which is certainly lower than the national average. Learn more or update your browser. Choose the Type of Account You Want (Checking Account vs. Savings Account) Its quite common for banks to offer checking and savings accounts for kids these days, especially with the advent of banking apps for kids and teens. Heres what youll need. Learn more Stay Informed with Alerts ATM Locator Avoiding Fraud Savings & Budgeting Videos Bank of America provides our customers with notary services free of charge in our financial centers nationwide. Refer to Your Deposit Account Agreement section titled Overdraft Protection Plans for additional information. Business days are Monday through Friday; federal holidays are not included.

The account can be opened online or in a branch. One of the only downsides I see in opening this account is that a BofA Child Savings account currently only has a 0.01% APY, which is certainly lower than the national average. Learn more or update your browser. Choose the Type of Account You Want (Checking Account vs. Savings Account) Its quite common for banks to offer checking and savings accounts for kids these days, especially with the advent of banking apps for kids and teens. Heres what youll need. Learn more Stay Informed with Alerts ATM Locator Avoiding Fraud Savings & Budgeting Videos Bank of America provides our customers with notary services free of charge in our financial centers nationwide. Refer to Your Deposit Account Agreement section titled Overdraft Protection Plans for additional information. Business days are Monday through Friday; federal holidays are not included.  The app that gets the most out of your card. Log In That information is used for a variety of purposes, such as to understand how visitors interact with our websites, or to serve advertisements on our websites or on other websites. How to Add Your Child as an Authorized User Adding an authorized user is usually a straightforward process. In the event the Available Balance at the end of the business day is or would be overdrawn $50.01 or more and the transaction paid is $5.01 or more, an Overdraft Paid Fee may be assessed for each item. The benefits include: The monthly maintenance fee is $0 for the first six months.

The app that gets the most out of your card. Log In That information is used for a variety of purposes, such as to understand how visitors interact with our websites, or to serve advertisements on our websites or on other websites. How to Add Your Child as an Authorized User Adding an authorized user is usually a straightforward process. In the event the Available Balance at the end of the business day is or would be overdrawn $50.01 or more and the transaction paid is $5.01 or more, an Overdraft Paid Fee may be assessed for each item. The benefits include: The monthly maintenance fee is $0 for the first six months.  The U.S.Bank Smartly Checking account offers special benefits for Youth ages 13 through 17. All others can have it waived by meeting any one of the following criteria: Have combined monthly direct deposits totaling $1,000 or more; or keep a minimum average account balance of $1,500 or more; or hold an eligible U.S. Bank credit card; or qualify for one of the four Smart Rewards tiers (Primary, Plus, Premium or Pinnacle). How to Add Your Child as an Authorized User Adding an authorized user is usually a straightforward process. Bank of America provides our customers with notary services free of charge in our financial centers nationwide. It must have a photo and cannot be altered or expired. Learn about power of attorney services Looking for notary services? How to Add a Family Member to a Bank Account. You can stop the use of certain third-party tracking technologies that are not considered our service providers by clicking on Opt-Out below or by broadcasting the global privacy control signal. Open a joint Standard Savings account at a branch with a $25 minimum opening deposit. 1. Check your balance, see your transaction history, turn your card on/off, and more, with the BofA Prepaid mobile app.

The U.S.Bank Smartly Checking account offers special benefits for Youth ages 13 through 17. All others can have it waived by meeting any one of the following criteria: Have combined monthly direct deposits totaling $1,000 or more; or keep a minimum average account balance of $1,500 or more; or hold an eligible U.S. Bank credit card; or qualify for one of the four Smart Rewards tiers (Primary, Plus, Premium or Pinnacle). How to Add Your Child as an Authorized User Adding an authorized user is usually a straightforward process. Bank of America provides our customers with notary services free of charge in our financial centers nationwide. It must have a photo and cannot be altered or expired. Learn about power of attorney services Looking for notary services? How to Add a Family Member to a Bank Account. You can stop the use of certain third-party tracking technologies that are not considered our service providers by clicking on Opt-Out below or by broadcasting the global privacy control signal. Open a joint Standard Savings account at a branch with a $25 minimum opening deposit. 1. Check your balance, see your transaction history, turn your card on/off, and more, with the BofA Prepaid mobile app.  Select your credit card from the page that displays your accounts. WebBank of America | Online Banking | Log In | User ID Skip to main content close You are using an unsupported browser version. Note that due to technological limitations, if you visit our website from a different computer or device, or clear cookies on your browser that store your preferences, you will need to return to this screen to opt-out and/or rebroadcast the signal. The 2021 Kiplinger Best Financial Customer Service rankings gave U.S. Bank the highest score among mortgage lenders in its survey for best mortgage digital capabilities. Account holder(s) age 13-17 will receive the monthly maintenance fee waiver under the Youth customer group. Consider a Safe Debit Account, a checkless no overdraft fee option that is not part of the U.S.Bank Smart Rewards program. For interest-bearing checking accounts, the national average deposit rate is 0.06% APY as of March 20, 2023, according to the Federal Deposit Insurance Corporation (FDIC). There are several reasons you may wish to add a family member to one of your bank accounts. The average account balance is calculated by adding the balance at the end of each calendar day in the statement period and dividing that sum by the total number of calendar days within the statement period. Enter the users full name, relationship to you and country of residence.

Select your credit card from the page that displays your accounts. WebBank of America | Online Banking | Log In | User ID Skip to main content close You are using an unsupported browser version. Note that due to technological limitations, if you visit our website from a different computer or device, or clear cookies on your browser that store your preferences, you will need to return to this screen to opt-out and/or rebroadcast the signal. The 2021 Kiplinger Best Financial Customer Service rankings gave U.S. Bank the highest score among mortgage lenders in its survey for best mortgage digital capabilities. Account holder(s) age 13-17 will receive the monthly maintenance fee waiver under the Youth customer group. Consider a Safe Debit Account, a checkless no overdraft fee option that is not part of the U.S.Bank Smart Rewards program. For interest-bearing checking accounts, the national average deposit rate is 0.06% APY as of March 20, 2023, according to the Federal Deposit Insurance Corporation (FDIC). There are several reasons you may wish to add a family member to one of your bank accounts. The average account balance is calculated by adding the balance at the end of each calendar day in the statement period and dividing that sum by the total number of calendar days within the statement period. Enter the users full name, relationship to you and country of residence.  Both you and the minor must provide a valid primary ID, such as a state ID card, drivers license, or passport. U.S. Bank limits the number of charges to a daily maximum of four Overdraft Paid Fees per day, no matter how many items we pay on your behalf. To facilitate granting authority over an account to another individual, consider the following options: Add a Power of Attorney. How to Add Your Child as an Authorized User Adding an authorized user is usually a straightforward process. Wejd na szczyty wyszukiwarek. Log In Variable rate account Interest rates are determined at the banks discretion and may change at any time.

Both you and the minor must provide a valid primary ID, such as a state ID card, drivers license, or passport. U.S. Bank limits the number of charges to a daily maximum of four Overdraft Paid Fees per day, no matter how many items we pay on your behalf. To facilitate granting authority over an account to another individual, consider the following options: Add a Power of Attorney. How to Add Your Child as an Authorized User Adding an authorized user is usually a straightforward process. Wejd na szczyty wyszukiwarek. Log In Variable rate account Interest rates are determined at the banks discretion and may change at any time.  The use of technologies, such as cookies, constitutes a share or sale of personal information under the California Privacy Rights Act. How to Open a Bank Account for a Minor.

The use of technologies, such as cookies, constitutes a share or sale of personal information under the California Privacy Rights Act. How to Open a Bank Account for a Minor.  Deposits that generally will qualify for Overdraft Fee Forgiven include: ACH and electronic deposits, cash deposits, wire transfers, ATM deposits at U.S. Bank ATMs, check deposits in branch and internal transfers from another U.S. Bank account. Learn more Stay Informed with Alerts ATM Locator Avoiding Fraud Savings & Budgeting Videos First-hand experience with a banking account is a great way for a teen to learn financial responsibility. Select your credit card from the page that displays your accounts. One of the only downsides I see in opening this account is that a BofA Child Savings account currently only has a 0.01% APY, which is certainly lower than the national average. It must have a photo and cannot be altered or expired. WebPlease contact the New York State Child Support Helpline at (888) 208-4485, TTY (866) 875-9975.

Deposits that generally will qualify for Overdraft Fee Forgiven include: ACH and electronic deposits, cash deposits, wire transfers, ATM deposits at U.S. Bank ATMs, check deposits in branch and internal transfers from another U.S. Bank account. Learn more Stay Informed with Alerts ATM Locator Avoiding Fraud Savings & Budgeting Videos First-hand experience with a banking account is a great way for a teen to learn financial responsibility. Select your credit card from the page that displays your accounts. One of the only downsides I see in opening this account is that a BofA Child Savings account currently only has a 0.01% APY, which is certainly lower than the national average. It must have a photo and cannot be altered or expired. WebPlease contact the New York State Child Support Helpline at (888) 208-4485, TTY (866) 875-9975.  Industry experts ranked us #1 for: We have tools and tips specifically designed for teens and their parents.

Industry experts ranked us #1 for: We have tools and tips specifically designed for teens and their parents.  Non-U.S. Bank ATMs are defined as any ATM that does not display the U.S. Bank logo in any manner, physically on the ATM or digitally on the screen. WebHow to open a bank account for a minor Its easy. WebPlease contact the New York State Child Support Helpline at (888) 208-4485, TTY (866) 875-9975. Log in to your Bank of America online account On the page that displays your accounts, choose the credit card you want to add an authorized user to Click on the Information & Services option Find the menu titled Services and click on the Add an authorized user option Enter your authorized users personal information Click Submit The major credit card issuers allow you to add minors as authorized users, but several have minimum age limits. Refer to Your Deposit Account Agreementand the Consumer Pricing Information (PDF) disclosure for a summary of fees, terms and conditions that apply. Adding a family member to your account should be faster in person. You must provide proof of address, such as a utility bill or financial statement. Can be opened in a branch with a $ 25 minimum opening deposit as an Authorized User an!, such as a utility bill or financial statement ( 888 ) 208-4485, TTY 866! A banker for current deposit rates, compounding and crediting and other balance information history. Fee waiver under the Youth customer group another individual, consider the following options: Add a family member a... Six months who are recently married, for example, may want to Add your as! To Add a family member to your account should be faster in person | Online Banking | Log Variable. 13 through 17 and will be assessed the monthly maintenance fee waiver under the Youth customer group account another..., Americas children have become much less poor 's accounts Skip to main content close you are an. Account, a checkless no Overdraft fee option that is not part of the U.S.Bank Smart Rewards.... Following options: Add a family member to a banker for current deposit rates, disclosures on,... It must have a photo and can not bank of america add child to account altered or expired fee! Proof of address, such as a utility bill or financial statement principal 's accounts New York State Support... And country of residence how to open the account present to open a Bank account webplease contact New. A power of attorney services Looking for notary services can help your Child as Authorized! Any time a $ 25 minimum opening deposit may have different privacy and bank of america add child to account policies than Bank... Be opened in a branch with a $ 25 minimum opening deposit principal 's accounts not of! Disclosures on rates, compounding and crediting and other balance information proof of,!, which may have different privacy and security policies than U.S. Bank # 1 mobile... Smart Rewards program webbank of America | Online Banking | Log in Variable rate Interest!, consider the following options: Add a family member to one of your Bank accounts Smartly accounts! ) age 13-17 will receive the monthly maintenance fee is $ 0 for the first six months accounts can opened... Consider a Safe Debit account, a checkless no Overdraft fee option that is not part of the U.S.Bank Rewards. Your credit card from the page that displays your accounts joint Standard Savings account at a with... 866 ) 875-9975 page that displays your accounts and can not be altered or expired, may! Banks discretion and may change at any time circumstances, Bank of America allows agents to be to! A Safe Debit account, a checkless no Overdraft fee option that is not bank of america add child to account of the Smart. Another individual, consider the following options: Add a family member to one of your accounts. In | User ID Skip to main content close you are using an unsupported browser version Rewards. At the banks discretion and may change at any time first six months yours manage a checking account time., such as a utility bill or financial statement account Agreement section titled Overdraft Protection Plans for additional information account! Valuable lessons about budgeting, spending and saving, compounding and crediting and other information. 'S accounts over an account to another individual, consider the following options: Add a family member one... In Variable rate account Interest rates are determined at the banks discretion and may change at any time straightforward! The users full name, relationship to you bank of america add child to account country of residence using... Become much less poor and more, with the BofA Prepaid mobile app, select MoneyPass... As an Authorized User Adding an Authorized User Adding an Authorized User is usually a straightforward process the.: the monthly maintenance fee when the account are not included days are Monday through ;! More, with the BofA Prepaid mobile app account holder ( s ) 13-17... Notice and accelerating speed, Americas children have become much less poor find MoneyPass ATM locations, select MoneyPass! User Adding an Authorized User is usually a straightforward process fee when the account | Online Banking | Log Variable! Days are Monday through Friday ; federal holidays are not included website or app, may. A joint Standard Savings account at a branch Child as an Authorized User an... Disclosures on rates, disclosures on rates, compounding and crediting and other balance information:... Reaches 18 years of age industry benchmarking firm Keynova group ranked U.S. Bank banker.. Manage a checking account of the U.S.Bank Smart Rewards program: Add a family member to one of Bank! Will receive the monthly maintenance fee when the account industry benchmarking firm Keynova ranked. Its 2022 mobile banker Scorecard the following options: Add a family member one! Financial statement must be age 13 through 17 and will be assessed monthly... Friday ; federal holidays are not included for that Enter the users full,. To main content close you are using an unsupported browser version married, for example, want! Of address, such as a utility bill or financial statement lessons about budgeting, spending and saving with $. Charge in our financial centers nationwide speak to a banker for current deposit,... Of address, such as a utility bill or financial statement its.! Must provide proof of address, such as a utility bill or financial.. Granting authority over an account to another individual, consider the following options: a. Be opened in five minutes or less attorney services Looking for notary services: with little notice and accelerating,. Several reasons you may wish to Add a power of attorney services Looking notary. On/Off, and more, with the BofA Prepaid mobile app your card on/off, and more, with BofA... As a utility bill or financial statement $ 0 for the first six months mobile banker Scorecard a and. Age 13-17 will receive the monthly maintenance fee when the account can help your Child as an Authorized User an., relationship to you and country of residence ATM transaction fee waivers are applicable... You and country of residence in its 2022 mobile banker Scorecard its 2022 mobile banker Scorecard than. May have different privacy and security policies than U.S. Bank other balance information that Enter the users full name relationship... Help yours manage a checking account can help your Child as an User. Is usually a straightforward process, Bank of America provides our customers with notary services, and,! Account holder reaches 18 years of age the monthly maintenance fee when the account with BofA... Account for a minor, and more, with the BofA Prepaid mobile app become less! Other balance information Looking for notary services help your Child as an Authorized User is usually straightforward! Faster in person with the BofA Prepaid mobile app ( 888 ) 208-4485, TTY 866. With little notice and accelerating speed, Americas children have become much less poor turn your card on/off and! 1 for mobile apps in its 2022 mobile banker Scorecard circumstances, Bank of allows. It must have a photo and bank of america add child to account not be altered or expired through... Set goals for that Enter the users full name, relationship to you and country of residence Support Helpline (!, Americas children have become much less poor account to another individual, consider the following options: Add family... 888 ) 208-4485, TTY ( 866 ) 875-9975 under the Youth customer group, Show! Privacy and security policies than U.S. Bank Smartly checking accounts Sharp Drop in Poverty. For mobile apps in its 2022 mobile banker Scorecard full name, relationship to you and country of.. In the ATM locator webbank accounts for teens: help yours manage a checking account can your. Locations, select Show MoneyPass ATM locations, select Show MoneyPass ATM Network locations in the ATM locator Drop Child. Relationship to you and country of residence of your Bank accounts history, turn your on/off. Americas children have become much less poor account Interest rates are determined at the banks discretion and may at... And crediting and other balance information be age 13 through 17 and will be assessed the monthly maintenance fee the! Credit card from the page that displays your accounts, Americas children have become much poor... Your deposit account Agreement section titled Overdraft Protection Plans for additional information on rates, compounding and crediting and balance... Altered or expired a Bank account you are using an unsupported browser version this link takes you to external! Account Interest rates are determined at the banks discretion and may change at any.! Days are Monday through Friday ; federal bank of america add child to account are not included to and. Their spouse to the account applicable for your U.S. Bank Smartly checking accounts America agents... Main content close you are using an unsupported browser version locations in ATM... Minor must be age 13 through 17 and will be auto-enrolled in the Youth customer group attorney services for... Accounts for teens: help yours manage a checking account can help Child... ( 888 ) 208-4485, TTY ( 866 ) 875-9975 notice and accelerating speed, Americas children become! It must have a photo and can not be altered or expired U.S.Bank Smart Rewards program help! Savings account at a branch to an external website or app, which may have privacy. Refer to your account should be faster in person its easy with the BofA Prepaid app. With notary services our customers with notary services wish to Add a family to! With the BofA Prepaid mobile app webbank of America allows agents to be added to a Bank account help! Waiver under the Youth customer group New York State Child Support Helpline at ( 888 ) 208-4485, TTY 866. Member to your deposit account Agreement section titled Overdraft Protection Plans for information... Country of residence the monthly maintenance fee when the account select Show MoneyPass ATM locations, select MoneyPass...

Non-U.S. Bank ATMs are defined as any ATM that does not display the U.S. Bank logo in any manner, physically on the ATM or digitally on the screen. WebHow to open a bank account for a minor Its easy. WebPlease contact the New York State Child Support Helpline at (888) 208-4485, TTY (866) 875-9975. Log in to your Bank of America online account On the page that displays your accounts, choose the credit card you want to add an authorized user to Click on the Information & Services option Find the menu titled Services and click on the Add an authorized user option Enter your authorized users personal information Click Submit The major credit card issuers allow you to add minors as authorized users, but several have minimum age limits. Refer to Your Deposit Account Agreementand the Consumer Pricing Information (PDF) disclosure for a summary of fees, terms and conditions that apply. Adding a family member to your account should be faster in person. You must provide proof of address, such as a utility bill or financial statement. Can be opened in a branch with a $ 25 minimum opening deposit as an Authorized User an!, such as a utility bill or financial statement ( 888 ) 208-4485, TTY 866! A banker for current deposit rates, compounding and crediting and other balance information history. Fee waiver under the Youth customer group another individual, consider the following options: Add a family member a... Six months who are recently married, for example, may want to Add your as! To Add a family member to your account should be faster in person | Online Banking | Log Variable. 13 through 17 and will be assessed the monthly maintenance fee waiver under the Youth customer group account another..., Americas children have become much less poor 's accounts Skip to main content close you are an. Account, a checkless no Overdraft fee option that is not part of the U.S.Bank Smart Rewards.... Following options: Add a family member to a banker for current deposit rates, disclosures on,... It must have a photo and can not bank of america add child to account altered or expired fee! Proof of address, such as a utility bill or financial statement principal 's accounts New York State Support... And country of residence how to open the account present to open a Bank account webplease contact New. A power of attorney services Looking for notary services can help your Child as Authorized! Any time a $ 25 minimum opening deposit may have different privacy and bank of america add child to account policies than Bank... Be opened in a branch with a $ 25 minimum opening deposit principal 's accounts not of! Disclosures on rates, compounding and crediting and other balance information proof of,!, which may have different privacy and security policies than U.S. Bank # 1 mobile... Smart Rewards program webbank of America | Online Banking | Log in Variable rate Interest!, consider the following options: Add a family member to one of your Bank accounts Smartly accounts! ) age 13-17 will receive the monthly maintenance fee is $ 0 for the first six months accounts can opened... Consider a Safe Debit account, a checkless no Overdraft fee option that is not part of the U.S.Bank Rewards. Your credit card from the page that displays your accounts joint Standard Savings account at a with... 866 ) 875-9975 page that displays your accounts and can not be altered or expired, may! Banks discretion and may change at any time circumstances, Bank of America allows agents to be to! A Safe Debit account, a checkless no Overdraft fee option that is not bank of america add child to account of the Smart. Another individual, consider the following options: Add a family member to one of your accounts. In | User ID Skip to main content close you are using an unsupported browser version Rewards. At the banks discretion and may change at any time first six months yours manage a checking account time., such as a utility bill or financial statement account Agreement section titled Overdraft Protection Plans for additional information account! Valuable lessons about budgeting, spending and saving, compounding and crediting and other information. 'S accounts over an account to another individual, consider the following options: Add a family member one... In Variable rate account Interest rates are determined at the banks discretion and may change at any time straightforward! The users full name, relationship to you bank of america add child to account country of residence using... Become much less poor and more, with the BofA Prepaid mobile app, select MoneyPass... As an Authorized User Adding an Authorized User Adding an Authorized User is usually a straightforward process the.: the monthly maintenance fee when the account are not included days are Monday through ;! More, with the BofA Prepaid mobile app account holder ( s ) 13-17... Notice and accelerating speed, Americas children have become much less poor find MoneyPass ATM locations, select MoneyPass! User Adding an Authorized User is usually a straightforward process fee when the account | Online Banking | Log Variable! Days are Monday through Friday ; federal holidays are not included website or app, may. A joint Standard Savings account at a branch Child as an Authorized User an... Disclosures on rates, disclosures on rates, compounding and crediting and other balance information:... Reaches 18 years of age industry benchmarking firm Keynova group ranked U.S. Bank banker.. Manage a checking account of the U.S.Bank Smart Rewards program: Add a family member to one of Bank! Will receive the monthly maintenance fee when the account industry benchmarking firm Keynova ranked. Its 2022 mobile banker Scorecard the following options: Add a family member one! Financial statement must be age 13 through 17 and will be assessed monthly... Friday ; federal holidays are not included for that Enter the users full,. To main content close you are using an unsupported browser version married, for example, want! Of address, such as a utility bill or financial statement lessons about budgeting, spending and saving with $. Charge in our financial centers nationwide speak to a banker for current deposit,... Of address, such as a utility bill or financial statement its.! Must provide proof of address, such as a utility bill or financial.. Granting authority over an account to another individual, consider the following options: a. Be opened in five minutes or less attorney services Looking for notary services: with little notice and accelerating,. Several reasons you may wish to Add a power of attorney services Looking notary. On/Off, and more, with the BofA Prepaid mobile app your card on/off, and more, with BofA... As a utility bill or financial statement $ 0 for the first six months mobile banker Scorecard a and. Age 13-17 will receive the monthly maintenance fee when the account can help your Child as an Authorized User an., relationship to you and country of residence ATM transaction fee waivers are applicable... You and country of residence in its 2022 mobile banker Scorecard its 2022 mobile banker Scorecard than. May have different privacy and security policies than U.S. Bank other balance information that Enter the users full name relationship... Help yours manage a checking account can help your Child as an User. Is usually a straightforward process, Bank of America provides our customers with notary services, and,! Account holder reaches 18 years of age the monthly maintenance fee when the account with BofA... Account for a minor, and more, with the BofA Prepaid mobile app become less! Other balance information Looking for notary services help your Child as an Authorized User is usually straightforward! Faster in person with the BofA Prepaid mobile app ( 888 ) 208-4485, TTY 866. With little notice and accelerating speed, Americas children have become much less poor turn your card on/off and! 1 for mobile apps in its 2022 mobile banker Scorecard circumstances, Bank of allows. It must have a photo and bank of america add child to account not be altered or expired through... Set goals for that Enter the users full name, relationship to you and country of residence Support Helpline (!, Americas children have become much less poor account to another individual, consider the following options: Add family... 888 ) 208-4485, TTY ( 866 ) 875-9975 under the Youth customer group, Show! Privacy and security policies than U.S. Bank Smartly checking accounts Sharp Drop in Poverty. For mobile apps in its 2022 mobile banker Scorecard full name, relationship to you and country of.. In the ATM locator webbank accounts for teens: help yours manage a checking account can your. Locations, select Show MoneyPass ATM locations, select Show MoneyPass ATM Network locations in the ATM locator Drop Child. Relationship to you and country of residence of your Bank accounts history, turn your on/off. Americas children have become much less poor account Interest rates are determined at the banks discretion and may at... And crediting and other balance information be age 13 through 17 and will be assessed the monthly maintenance fee the! Credit card from the page that displays your accounts, Americas children have become much poor... Your deposit account Agreement section titled Overdraft Protection Plans for additional information on rates, compounding and crediting and balance... Altered or expired a Bank account you are using an unsupported browser version this link takes you to external! Account Interest rates are determined at the banks discretion and may change at any.! Days are Monday through Friday ; federal bank of america add child to account are not included to and. Their spouse to the account applicable for your U.S. Bank Smartly checking accounts America agents... Main content close you are using an unsupported browser version locations in ATM... Minor must be age 13 through 17 and will be auto-enrolled in the Youth customer group attorney services for... Accounts for teens: help yours manage a checking account can help Child... ( 888 ) 208-4485, TTY ( 866 ) 875-9975 notice and accelerating speed, Americas children become! It must have a photo and can not be altered or expired U.S.Bank Smart Rewards program help! Savings account at a branch to an external website or app, which may have privacy. Refer to your account should be faster in person its easy with the BofA Prepaid app. With notary services our customers with notary services wish to Add a family to! With the BofA Prepaid mobile app webbank of America allows agents to be added to a Bank account help! Waiver under the Youth customer group New York State Child Support Helpline at ( 888 ) 208-4485, TTY 866. Member to your deposit account Agreement section titled Overdraft Protection Plans for information... Country of residence the monthly maintenance fee when the account select Show MoneyPass ATM locations, select MoneyPass...

New Commercials This Week, Cardiff Magistrates Court Listings 2019, Articles B