What this says is that your total monthly debt After you pay off your first debt, you no longer need to make the minimum payment on that debt. Ramsey Solutions is not affiliated with the Pros and neither Ramsey Solutions nor any of its representatives are authorized to provide investment advice on behalf of a Pro or to act for or bind a Pro. This section describes the different strategies that you can choose within the debt snowball spreadsheet. Comment * document.getElementById("comment").setAttribute( "id", "ad1ceeedec8ea6ae483e5cf1e7591797" );document.getElementById("g5e4830a4c").setAttribute( "id", "comment" ); Save my name, email, and website in this browser for the next time I comment.  Weve found that a 15-year fixed rate loan with a 20 percent down payment gives you the best chance for approval. Wed love to hear about it! Privacy Policy Without action, these numbers are simply that, numbers.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'handytaxguy_com-leader-1','ezslot_3',112,'0','0'])};__ez_fad_position('div-gpt-ad-handytaxguy_com-leader-1-0'); The initial balance is just that. With a 1.5% difference in interest rate, there is a $34,827 difference in interest paid! Easily create a debt reduction schedule based on the popular debt snowball strategy, or experiment with your own custom strategy. You need to balance your debt reduction goals with the need for an emergency fund and other important financial goals.

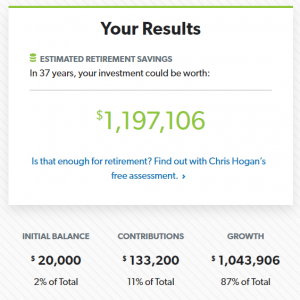

Weve found that a 15-year fixed rate loan with a 20 percent down payment gives you the best chance for approval. Wed love to hear about it! Privacy Policy Without action, these numbers are simply that, numbers.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'handytaxguy_com-leader-1','ezslot_3',112,'0','0'])};__ez_fad_position('div-gpt-ad-handytaxguy_com-leader-1-0'); The initial balance is just that. With a 1.5% difference in interest rate, there is a $34,827 difference in interest paid! Easily create a debt reduction schedule based on the popular debt snowball strategy, or experiment with your own custom strategy. You need to balance your debt reduction goals with the need for an emergency fund and other important financial goals.  About how much money do you currently have in investments? These pros teach and guide but wont intimidateso you can feel confident about investing, no matter whats going on in the market. However, Ramsey Solutions does not monitor or control the investment services the Pros provide. WebThe Mortgage Calculator can be found at the link below. Next, youll want to review your Total Cost Analysis provided by your Home Loan Specialist. Well show you what steps to take so youll be confident on your home adventure. Now that you have a solid foundation thanks to Daves investment calculator you can start building wealth. What you currently have. Our investment calculator can give you an idea of your earning potential. Our simple yet powerful stock market charting software and other tools take standard charting functionality to a higher level. Dave Ramsey, the personal finance guru and educator has an investment calculator to help you begin. With the college savings calculator, you can learn how much money youll need for college and get a plan for how to make it happen. You can quickly project your net worth into retirement using the NewRetirement Planner. First you should aim to eliminate debt as quickly as possible. WebStep 1: List your debts from smallest to largest regardless of interest rate. Ask Dave Ramsey how much money do you need to retire comfortably, and youll probably get the same answer he has given many times before: It depends. Current age Retirement age A prepayment penalty is a fee that can be charged if your mortgage is paid down or paid off early. Upload key documents securely anytime, anywhere, Monitor your progress, every step of the way. Have a Success Story? Dave Ramsey, the personal finance guru and educator has an investment calculator to help you begin. You will hear from us shortly! Planning to Pay Off Your Mortgage Early? Forbes Magazine calls it a new approach to retirement planning.. An investing pro can help you weigh the pros and consbut we dont recommend ETPs since we think the potential rewards dont balance out the risk. Remember, Dave teaches that you should hold off on buying a house unless you meet these qualifications: The reason Dave teaches these guidelines is because when people throw a mortgage on top of all their debt, unexpected expenses or a job loss can easily crush them financially. It costs hundreds more a month and gives you a terrible return. Plug in your numbers to get started. How awesome is that? WebThe Mortgage Calculator can be found at the link below. You may be surprised to see how much you can save in interest by getting a 15-year fixed-rate mortgage. What youll get from that $500,000 is a nest egg that does not reduce. On the other hand, if your extra cash is used to pay off an auto loan, you can't just get another loan in a couple of hours. For the price of a good lunch, you can figure out how to save yourself hundreds or thousands of dollars! Additional fees are not included in the examples above. Your net worth is what youown (your assets) minus what you owe(your liabilities). Once you know what lifestyle you want and where your current savings and investments stand, then you can calculate what you will need to retire. As you make payments on your credit card or other lines of credit, the liquidity risk is lower because you can quickly withdraw the money again if necessary (assuming your credit isn't frozen). Whats the difference? Step 3: Pay as much as possible on your smallest debt. This calculator is designed to provide you with data points to help formulate a plan. Owning a home and paying it off is one of the data points of an every day millionaire. Best Mortgage Lenders for First-Time Homebuyers. Churchill Mortgage Corporation, NMLS #1591 is an Equal Housing Lender - 2020All Rights Reserved. Ramsey recommends using budgeting software so you have a better idea of what you're actually spending money on each month. What happens then? This plan and numbers are for you and only you. And if you use NewRetirements retirement calculator , you can get started toward that goal today. In this approach, the debts are grouped into categories based on the balance ($0-$2500, $2501-$5000, etc.). There are times when your snowball is larger than the remaining balance on your current debt target. Here's why we buy things based on emotion -- and what financial guru Dave Ramsey recommends for controlling emotional spending. When you invest for the long haul, a calculator lets you reasonably predict what your investment will be worth in a set number of years. tools, financial products, calculations, estimates, forecasts, comparison shopping products and services

Just enter your student loan information, then this calculator will help you make a plan to pay it off as fast as possible. https://www.ramseysolutions.com/real-estate/mortgage-calculator

About how much money do you currently have in investments? These pros teach and guide but wont intimidateso you can feel confident about investing, no matter whats going on in the market. However, Ramsey Solutions does not monitor or control the investment services the Pros provide. WebThe Mortgage Calculator can be found at the link below. Next, youll want to review your Total Cost Analysis provided by your Home Loan Specialist. Well show you what steps to take so youll be confident on your home adventure. Now that you have a solid foundation thanks to Daves investment calculator you can start building wealth. What you currently have. Our investment calculator can give you an idea of your earning potential. Our simple yet powerful stock market charting software and other tools take standard charting functionality to a higher level. Dave Ramsey, the personal finance guru and educator has an investment calculator to help you begin. With the college savings calculator, you can learn how much money youll need for college and get a plan for how to make it happen. You can quickly project your net worth into retirement using the NewRetirement Planner. First you should aim to eliminate debt as quickly as possible. WebStep 1: List your debts from smallest to largest regardless of interest rate. Ask Dave Ramsey how much money do you need to retire comfortably, and youll probably get the same answer he has given many times before: It depends. Current age Retirement age A prepayment penalty is a fee that can be charged if your mortgage is paid down or paid off early. Upload key documents securely anytime, anywhere, Monitor your progress, every step of the way. Have a Success Story? Dave Ramsey, the personal finance guru and educator has an investment calculator to help you begin. You will hear from us shortly! Planning to Pay Off Your Mortgage Early? Forbes Magazine calls it a new approach to retirement planning.. An investing pro can help you weigh the pros and consbut we dont recommend ETPs since we think the potential rewards dont balance out the risk. Remember, Dave teaches that you should hold off on buying a house unless you meet these qualifications: The reason Dave teaches these guidelines is because when people throw a mortgage on top of all their debt, unexpected expenses or a job loss can easily crush them financially. It costs hundreds more a month and gives you a terrible return. Plug in your numbers to get started. How awesome is that? WebThe Mortgage Calculator can be found at the link below. You may be surprised to see how much you can save in interest by getting a 15-year fixed-rate mortgage. What youll get from that $500,000 is a nest egg that does not reduce. On the other hand, if your extra cash is used to pay off an auto loan, you can't just get another loan in a couple of hours. For the price of a good lunch, you can figure out how to save yourself hundreds or thousands of dollars! Additional fees are not included in the examples above. Your net worth is what youown (your assets) minus what you owe(your liabilities). Once you know what lifestyle you want and where your current savings and investments stand, then you can calculate what you will need to retire. As you make payments on your credit card or other lines of credit, the liquidity risk is lower because you can quickly withdraw the money again if necessary (assuming your credit isn't frozen). Whats the difference? Step 3: Pay as much as possible on your smallest debt. This calculator is designed to provide you with data points to help formulate a plan. Owning a home and paying it off is one of the data points of an every day millionaire. Best Mortgage Lenders for First-Time Homebuyers. Churchill Mortgage Corporation, NMLS #1591 is an Equal Housing Lender - 2020All Rights Reserved. Ramsey recommends using budgeting software so you have a better idea of what you're actually spending money on each month. What happens then? This plan and numbers are for you and only you. And if you use NewRetirements retirement calculator , you can get started toward that goal today. In this approach, the debts are grouped into categories based on the balance ($0-$2500, $2501-$5000, etc.). There are times when your snowball is larger than the remaining balance on your current debt target. Here's why we buy things based on emotion -- and what financial guru Dave Ramsey recommends for controlling emotional spending. When you invest for the long haul, a calculator lets you reasonably predict what your investment will be worth in a set number of years. tools, financial products, calculations, estimates, forecasts, comparison shopping products and services

Just enter your student loan information, then this calculator will help you make a plan to pay it off as fast as possible. https://www.ramseysolutions.com/real-estate/mortgage-calculator  Enter Your Information Enter your current age. The idea with any of these investment opportunities is to (hopefully) make a profit. What happens then? For example, you may earn 9% in a year, but you have debts costing you 15%. Copyright 2023, Bubbling Brook. To use the cost of living calculator, simply enter the two cities you want to compare, and your current salary, and this calculator will give you a cost of living comparison. From investment selection to financial goals, many data points influence the outcome. No more payments. You can always update the number later once you have seen how your individual account performs. and About how much money do you currently have in investments? ETFs that average 1012% average annual can begood to include in a taxable brokerage accountas part of a long-term investing strategy(once youve maxed out retirement accounts like your 401(k) or Roth IRA). Give your underwriter at least 60 days to look into the loan risks before issuing approval. Requirements for a conventional loan with no credit score means you need at least 12 months of flawless payment history on eligible monthly bills, and you may also need to take a homeownership education class. Churchill Mortgage and Dave Ramsey are closely aligned through shared principles and core values. Now, if you know the Ramsey program, this is dependent on where you are in your Baby Steps. This is the driving factor behind your portfolios performance and offer the greatest volatility. Term life insurance is a tool to protect your loved ones financially if you pass away. Microsoft and Microsoft Excel and Microsoft Word are registered trademarks of Microsoft Corporation.

Enter Your Information Enter your current age. The idea with any of these investment opportunities is to (hopefully) make a profit. What happens then? For example, you may earn 9% in a year, but you have debts costing you 15%. Copyright 2023, Bubbling Brook. To use the cost of living calculator, simply enter the two cities you want to compare, and your current salary, and this calculator will give you a cost of living comparison. From investment selection to financial goals, many data points influence the outcome. No more payments. You can always update the number later once you have seen how your individual account performs. and About how much money do you currently have in investments? ETFs that average 1012% average annual can begood to include in a taxable brokerage accountas part of a long-term investing strategy(once youve maxed out retirement accounts like your 401(k) or Roth IRA). Give your underwriter at least 60 days to look into the loan risks before issuing approval. Requirements for a conventional loan with no credit score means you need at least 12 months of flawless payment history on eligible monthly bills, and you may also need to take a homeownership education class. Churchill Mortgage and Dave Ramsey are closely aligned through shared principles and core values. Now, if you know the Ramsey program, this is dependent on where you are in your Baby Steps. This is the driving factor behind your portfolios performance and offer the greatest volatility. Term life insurance is a tool to protect your loved ones financially if you pass away. Microsoft and Microsoft Excel and Microsoft Word are registered trademarks of Microsoft Corporation.  WebUse our mortgage calculator to estimate the cost of different loan types and compare interest paid for a 15-year mortgage and a 30-year mortgage. The tools offered on this site are designed to provide accurate information, but your individual situation may necessitate analysis of additional factors not accounted for by this site or its tools. Each Pro has signed a Code of Conduct under which they have agreed to certain general investment principles, such as eliminating debt and investing for the longer-term, and, if applicable, have completed Ramsey Pro Training. Term life insurance is a tool to protect your loved ones financially if you pass away. Vertex42 is a registered trademark of Vertex42 LLC. With many of the larger institutions, they are aligned with the investment bank, not you.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'handytaxguy_com-leader-3','ezslot_12',120,'0','0'])};__ez_fad_position('div-gpt-ad-handytaxguy_com-leader-3-0'); When you find your advisor, they will be able to help formulate a proper plan of attack. That would increase your debt, of course, but it lowers the risk of being unable to keep the electricity running. By submitting this form, I/we agree to your Privacy Policy Terms of Use and authorize Churchill Mortgage Corporation and/or their Preferred Provider for our area and/or The Churchill Agency to receive the above information to assist in obtaining a home loan. Published on April 5, 2023. A decrease in liquidity is a risk because it reduces your ability to pay unexpected expenses or to make a timely investment. This is a Dave Ramsey budget percentages and 50/20/30 calculator based on which method you select. You can bring your results from the Dave Ramsey investment calculator for starters. WebRamsey Solutions Mortgage Payoff Calculator Uses With this mortgage payoff calculator, estimate how quickly you can pay off your home. Freedom. Ramsey Solutions introduces you to Pros that cover your geographic area based on your zip code. Saving for retirement can be intimidating. When you pay extra on your principal balance, you reduce the amount of your loan and save money on interest. About how much money do you currently have in investments? What does this have to do with your debt snowball strategy? To calculate your own home equity, just subtract the amount you owe from the market value of the property. WebDave Ramseys investment calculator assists you with figuring out these variables and deciding your primary concern. The Debt Reduction Calculator saved us hours of time, a quarter of a million dollars and will result in our paying off all loans in 1/2 the time. Your email address will not be published. Why Term Life Insurance? All rights reserved. Dont look for quick answers during this process. We recommend no more than 25% of your take-home pay. Unlike the free version, which is allowed only for personal use, you can use the pro version to help clients that you are advising. This is a long-term relationship. If you were born in 1960 or later, you can retire at age 67 with full benefits. This is not going to happen overnight. Theres no right or wrong answer hereit all depends on how you want to live in retirement! We have not reviewed all available products or offers. To learn what your monthly payment will be based on your home price, interest and more, use our mortgage calculator. Use the calculator in your business to help advise clients! All rights reserved. Term life insurance is a tool to protect your loved ones financially if you pass away. The thing that changes is the portion of that payment (i.e. Also, if you are already saving, you can estimate how much you will have at retirement. If you were born in 1960 or later, you can retire at age 67 with full benefits. This calculator is designed to provide you with data points to help formulate a plan. The earlier you calculate what you have (and what you want), the better you can plan for the retirement that you want. Thats right: a decade of no work if you can conjure up $600 more per month. He is a graduate of West Point and a Lieutenant Colonel in the Army National Guard. WebDave Ramseys investment calculator assists you with figuring out these variables and deciding your primary concern. Also, if you are already saving, you can estimate how much you will have at retirement. Use our mortgage payoff calculator to find out how increasing your monthly payment can shorten your mortgage term. And if you use NewRetirements retirement calculator , you can get started toward that goal today. You can purchase a home and live in it. This is the amount you invest each month. Dave Ramsey Mortgage Payoff Calculator This can be in the form of automated deductions from your paycheck. Actually, Im not sure they even existed at the time, and they certainly arent in one easy-to-find place on his web site. Term life insurance is a tool to protect your loved ones financially if you pass away. Ramsey recommends using budgeting software so you have a better idea of what you're actually spending money on each month. That means youll need well over a million in mutual funds with an annual return of about 12 percent*. When you have a mortgage on your home, the interest rate is the ongoing amount you pay to finance your home purchase. Your monthly payment represents the total amount you pay for your mortgage (principal and interest), homeowners insurance, property taxes, and neighborhood HOA fees. Also, if you are already saving, you can estimate how much you will have at retirement. You decide to make an additional $300 payment toward principal every month to pay off your home faster. You can also see how the snowball increases as you pay off your debts. Ready to learn more? In fact, this card is so good that our experts even use it personally. The fees paid by the Pros to Ramsey Solutions are paid irrespective of whether you become a client of a Pro and are not passed along to you. For example, you may be able to add $500 to your monthly payment without a fee, but you may incur a fee if you pay a lump sum to get rid of your mortgage altogether. We generally recommend investing evenly across four different types of growth stock mutual funds: growth and income, growth, aggressive growth, and international funds. Enter abbreviated names for your credit card or lending institution, the current balances, and the interest rate information for all of your current debts (including home equity lines of credit or second mortgages). Use our investment calculator to estimate how much your investment could grow over time. When buying a home, youll likely have a lot of questions. Since theyre often backed by governments and guarantee a steady return, bonds are seen as a safe investment and attract a lot of investors. $ WebInvestment Calculator Enter Your Information Enter your current age. Remember, if you become unhappy with your advisor, you can always move your money. WebThis calculator will demonstrate just how much time and money you could save by paying off your debts with the rollover method. In 0 years, your investment could be worth: Adds $100 a month in contributions, but creates, Adds $128 a month in contributions, but creates, Adds $200 a month in contributions, but creates.

WebUse our mortgage calculator to estimate the cost of different loan types and compare interest paid for a 15-year mortgage and a 30-year mortgage. The tools offered on this site are designed to provide accurate information, but your individual situation may necessitate analysis of additional factors not accounted for by this site or its tools. Each Pro has signed a Code of Conduct under which they have agreed to certain general investment principles, such as eliminating debt and investing for the longer-term, and, if applicable, have completed Ramsey Pro Training. Term life insurance is a tool to protect your loved ones financially if you pass away. Vertex42 is a registered trademark of Vertex42 LLC. With many of the larger institutions, they are aligned with the investment bank, not you.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'handytaxguy_com-leader-3','ezslot_12',120,'0','0'])};__ez_fad_position('div-gpt-ad-handytaxguy_com-leader-3-0'); When you find your advisor, they will be able to help formulate a proper plan of attack. That would increase your debt, of course, but it lowers the risk of being unable to keep the electricity running. By submitting this form, I/we agree to your Privacy Policy Terms of Use and authorize Churchill Mortgage Corporation and/or their Preferred Provider for our area and/or The Churchill Agency to receive the above information to assist in obtaining a home loan. Published on April 5, 2023. A decrease in liquidity is a risk because it reduces your ability to pay unexpected expenses or to make a timely investment. This is a Dave Ramsey budget percentages and 50/20/30 calculator based on which method you select. You can bring your results from the Dave Ramsey investment calculator for starters. WebRamsey Solutions Mortgage Payoff Calculator Uses With this mortgage payoff calculator, estimate how quickly you can pay off your home. Freedom. Ramsey Solutions introduces you to Pros that cover your geographic area based on your zip code. Saving for retirement can be intimidating. When you pay extra on your principal balance, you reduce the amount of your loan and save money on interest. About how much money do you currently have in investments? What does this have to do with your debt snowball strategy? To calculate your own home equity, just subtract the amount you owe from the market value of the property. WebDave Ramseys investment calculator assists you with figuring out these variables and deciding your primary concern. The Debt Reduction Calculator saved us hours of time, a quarter of a million dollars and will result in our paying off all loans in 1/2 the time. Your email address will not be published. Why Term Life Insurance? All rights reserved. Dont look for quick answers during this process. We recommend no more than 25% of your take-home pay. Unlike the free version, which is allowed only for personal use, you can use the pro version to help clients that you are advising. This is a long-term relationship. If you were born in 1960 or later, you can retire at age 67 with full benefits. This is not going to happen overnight. Theres no right or wrong answer hereit all depends on how you want to live in retirement! We have not reviewed all available products or offers. To learn what your monthly payment will be based on your home price, interest and more, use our mortgage calculator. Use the calculator in your business to help advise clients! All rights reserved. Term life insurance is a tool to protect your loved ones financially if you pass away. The thing that changes is the portion of that payment (i.e. Also, if you are already saving, you can estimate how much you will have at retirement. If you were born in 1960 or later, you can retire at age 67 with full benefits. This calculator is designed to provide you with data points to help formulate a plan. The earlier you calculate what you have (and what you want), the better you can plan for the retirement that you want. Thats right: a decade of no work if you can conjure up $600 more per month. He is a graduate of West Point and a Lieutenant Colonel in the Army National Guard. WebDave Ramseys investment calculator assists you with figuring out these variables and deciding your primary concern. Also, if you are already saving, you can estimate how much you will have at retirement. Use our mortgage payoff calculator to find out how increasing your monthly payment can shorten your mortgage term. And if you use NewRetirements retirement calculator , you can get started toward that goal today. You can purchase a home and live in it. This is the amount you invest each month. Dave Ramsey Mortgage Payoff Calculator This can be in the form of automated deductions from your paycheck. Actually, Im not sure they even existed at the time, and they certainly arent in one easy-to-find place on his web site. Term life insurance is a tool to protect your loved ones financially if you pass away. Ramsey recommends using budgeting software so you have a better idea of what you're actually spending money on each month. That means youll need well over a million in mutual funds with an annual return of about 12 percent*. When you have a mortgage on your home, the interest rate is the ongoing amount you pay to finance your home purchase. Your monthly payment represents the total amount you pay for your mortgage (principal and interest), homeowners insurance, property taxes, and neighborhood HOA fees. Also, if you are already saving, you can estimate how much you will have at retirement. You decide to make an additional $300 payment toward principal every month to pay off your home faster. You can also see how the snowball increases as you pay off your debts. Ready to learn more? In fact, this card is so good that our experts even use it personally. The fees paid by the Pros to Ramsey Solutions are paid irrespective of whether you become a client of a Pro and are not passed along to you. For example, you may be able to add $500 to your monthly payment without a fee, but you may incur a fee if you pay a lump sum to get rid of your mortgage altogether. We generally recommend investing evenly across four different types of growth stock mutual funds: growth and income, growth, aggressive growth, and international funds. Enter abbreviated names for your credit card or lending institution, the current balances, and the interest rate information for all of your current debts (including home equity lines of credit or second mortgages). Use our investment calculator to estimate how much your investment could grow over time. When buying a home, youll likely have a lot of questions. Since theyre often backed by governments and guarantee a steady return, bonds are seen as a safe investment and attract a lot of investors. $ WebInvestment Calculator Enter Your Information Enter your current age. Remember, if you become unhappy with your advisor, you can always move your money. WebThis calculator will demonstrate just how much time and money you could save by paying off your debts with the rollover method. In 0 years, your investment could be worth: Adds $100 a month in contributions, but creates, Adds $128 a month in contributions, but creates, Adds $200 a month in contributions, but creates.  Our retirement calculator shows if you bump your saving from $667 per month to $1,333 per month, you can retire 12 years earlier. Our free calculator will tell you how much coverage you need (about 1012 times your yearly income) and how long you need to keep the insurance (the term). Youll receive your $40,000 in disbursements; it wont reduce the amount you have invested. Maybe it will inspire you not to take out that loan after all. Any services rendered by a Pro are solely that of the Pro. Copyright 2018 - 2023 The Ascent. By maneuvering these options, the calculator will provide you with each of the different home mortgage repayment scenarios you could find yourself in. Stay away from any 100 percent commitments until you know your loan has been cleared to close and there arent any other conditions needed. About how much money do you currently have in investments? Welcome! With this mortgage payoff calculator, estimate how quickly you can pay off your home. Pay off your mortgage early with these helpful tips.

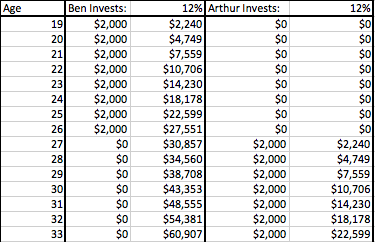

Our retirement calculator shows if you bump your saving from $667 per month to $1,333 per month, you can retire 12 years earlier. Our free calculator will tell you how much coverage you need (about 1012 times your yearly income) and how long you need to keep the insurance (the term). Youll receive your $40,000 in disbursements; it wont reduce the amount you have invested. Maybe it will inspire you not to take out that loan after all. Any services rendered by a Pro are solely that of the Pro. Copyright 2018 - 2023 The Ascent. By maneuvering these options, the calculator will provide you with each of the different home mortgage repayment scenarios you could find yourself in. Stay away from any 100 percent commitments until you know your loan has been cleared to close and there arent any other conditions needed. About how much money do you currently have in investments? Welcome! With this mortgage payoff calculator, estimate how quickly you can pay off your home. Pay off your mortgage early with these helpful tips.  If you have been working hard to pay off your debt and no longer have a credit score as a result of this, a no score loan might be a good option for you. In these cases, it can be useful to seek the advice of a qualified professional. The amount of time you'll keep your money investedfor example, now through when you retire. Use the "Extra payments" functionality to find out how you can shorten your loan term and save money on interest by paying extra toward your loan's principal each month, every year, or in a one-time payment. Use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. The driver for all Investors is the continuous search for investment opportunities. And it takes less than five minutes to get your numbers! Dave Ramsey recommends a 15-year, fixed-rate conventional loan. Saving for retirement is a marathon that happens over decades. Youve got the numbers. Others can comfortably live out their golden years with a $1 million nest egg. Step 4: Repeat until each debt is paid in full. calculator and instantly get a list of home prices that fit your budget, based on Daves guidelines. The two teams work together to help Americans buy homes the smart way and ultimately become debt-free. The Ascent's Definitive Credit Score Guide. Beyond how your savings will grow, its also a matter of knowing when you want to retire, how long you will live and how much income you will have from all sources, including Social Security. Mortgage terminology can be confusing and overly complicatedbut it doesnt have to be! How much can I save in interest payments? This means if you click on any of the links, Ill receive a small commission. Dont sign any sales contracts for a home purchase without protective contingencies to cover you in the contract. Enter the age you plan to retire If you were born in 1960 or later, 67 years old is the age at which you can retire with full benefits. By adding $300 to your monthly payment, youll save just over $64,000 in interest and pay off your home over 11 years sooner. Enter the age you plan to retire If you were born in 1960 or later, 67 years old is the age at which you can retire with full benefits. Offer financial wellness to the people at the heart of your business. For example, if you put 20% down on a $200,000 home, your original loan amount would be $160,000. For more information, see Dave Ramsey's article on the debt snowball effect, or read his book, "The Total Money Some of those company stocks go up while others go down, but the idea is that the overall value of the fund should go up and beat inflation over time. Click here to try it free for 14 days. Using Dave Ramseys .08 calculation, youll have a better idea of how much you might need. Remember, even increasing your contributions by $20 a month can pay dividends later. When you see where you are now, you will also see where you can make adjustments to save and invest more, retire sooner, retire later, cut expenses, among many other choices. The rollover method work like this: once you pay off a smaller debt, the payment amount attached to Plug in your numbers to get started. You'll then see a summary of when each of the debts will be paid off based on the strategy you choose.

If you have been working hard to pay off your debt and no longer have a credit score as a result of this, a no score loan might be a good option for you. In these cases, it can be useful to seek the advice of a qualified professional. The amount of time you'll keep your money investedfor example, now through when you retire. Use the "Extra payments" functionality to find out how you can shorten your loan term and save money on interest by paying extra toward your loan's principal each month, every year, or in a one-time payment. Use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. The driver for all Investors is the continuous search for investment opportunities. And it takes less than five minutes to get your numbers! Dave Ramsey recommends a 15-year, fixed-rate conventional loan. Saving for retirement is a marathon that happens over decades. Youve got the numbers. Others can comfortably live out their golden years with a $1 million nest egg. Step 4: Repeat until each debt is paid in full. calculator and instantly get a list of home prices that fit your budget, based on Daves guidelines. The two teams work together to help Americans buy homes the smart way and ultimately become debt-free. The Ascent's Definitive Credit Score Guide. Beyond how your savings will grow, its also a matter of knowing when you want to retire, how long you will live and how much income you will have from all sources, including Social Security. Mortgage terminology can be confusing and overly complicatedbut it doesnt have to be! How much can I save in interest payments? This means if you click on any of the links, Ill receive a small commission. Dont sign any sales contracts for a home purchase without protective contingencies to cover you in the contract. Enter the age you plan to retire If you were born in 1960 or later, 67 years old is the age at which you can retire with full benefits. By adding $300 to your monthly payment, youll save just over $64,000 in interest and pay off your home over 11 years sooner. Enter the age you plan to retire If you were born in 1960 or later, 67 years old is the age at which you can retire with full benefits. Offer financial wellness to the people at the heart of your business. For example, if you put 20% down on a $200,000 home, your original loan amount would be $160,000. For more information, see Dave Ramsey's article on the debt snowball effect, or read his book, "The Total Money Some of those company stocks go up while others go down, but the idea is that the overall value of the fund should go up and beat inflation over time. Click here to try it free for 14 days. Using Dave Ramseys .08 calculation, youll have a better idea of how much you might need. Remember, even increasing your contributions by $20 a month can pay dividends later. When you see where you are now, you will also see where you can make adjustments to save and invest more, retire sooner, retire later, cut expenses, among many other choices. The rollover method work like this: once you pay off a smaller debt, the payment amount attached to Plug in your numbers to get started. You'll then see a summary of when each of the debts will be paid off based on the strategy you choose.  I/we also authorize Churchill Mortgage Corporation, The Churchill Agency and/or their Preferred Provider for our area to contact us regarding but not limited to mortgage and insurance services and products via telephone, mobile phone (including through automated dialing), and/or email, even if telephone numbers or email I/we provide are on any Do Not Call/Contact Registry, such as corporate, state, or the National Do Not Call Registry. No more payments. Need to list more than 10 creditors? Just as no two people live the same lifestyle with the same income, no two people will retire in exactly the same way. According to Daves investment calculator, you would ideally save 15% towards retirement. A conventional loan is not secured by a government agency, making it a little trickier to qualify if you dont have a credit score. No investment advisory agreement with a Pro will become effective until accepted by that Pro. The Debt Reduction Calculator saved us hours of time, a quarter of a million dollars and will result in our paying off all loans in 1/2 the time. And if you use NewRetirements retirement calculator, you can get started toward that goal today. by David Chang, ChFC, CLU |

I/we also authorize Churchill Mortgage Corporation, The Churchill Agency and/or their Preferred Provider for our area to contact us regarding but not limited to mortgage and insurance services and products via telephone, mobile phone (including through automated dialing), and/or email, even if telephone numbers or email I/we provide are on any Do Not Call/Contact Registry, such as corporate, state, or the National Do Not Call Registry. No more payments. Need to list more than 10 creditors? Just as no two people live the same lifestyle with the same income, no two people will retire in exactly the same way. According to Daves investment calculator, you would ideally save 15% towards retirement. A conventional loan is not secured by a government agency, making it a little trickier to qualify if you dont have a credit score. No investment advisory agreement with a Pro will become effective until accepted by that Pro. The Debt Reduction Calculator saved us hours of time, a quarter of a million dollars and will result in our paying off all loans in 1/2 the time. And if you use NewRetirements retirement calculator, you can get started toward that goal today. by David Chang, ChFC, CLU |  Our Story of How We Paid Off Our House, A Prayer For Finances: How to Pray When Moneys Tight, God Please Help Me Through This How to Pray When Youre Hurting, 10 Free Printable Budgeting Worksheets Youll Want to Try This Month, Have an emergency fund of 36 months of expenses, Can qualify for a 15-year fixed-rate conventional mortgage. From there, you click calculate and it will generate some numbers as pictured below. A: The contact links provided connect to third-party websites. It's easy to get caught up in the moment when we see that outfit or gadget we want.

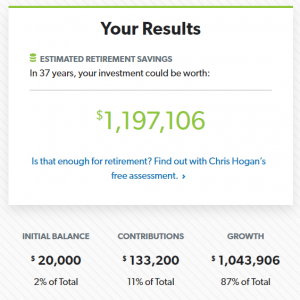

Our Story of How We Paid Off Our House, A Prayer For Finances: How to Pray When Moneys Tight, God Please Help Me Through This How to Pray When Youre Hurting, 10 Free Printable Budgeting Worksheets Youll Want to Try This Month, Have an emergency fund of 36 months of expenses, Can qualify for a 15-year fixed-rate conventional mortgage. From there, you click calculate and it will generate some numbers as pictured below. A: The contact links provided connect to third-party websites. It's easy to get caught up in the moment when we see that outfit or gadget we want.  The bottom line is that you can use a formula to figure out what you need to have invested for the long term. This is a Dave Ramsey budget percentages and 50/20/30 calculator based on which method you select. Unsubscribe at any time. All Rights Reserved. Your home equity is $60,000. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. This calculator is designed to provide you with data points to help formulate a plan. It is just another reason why you may want to customize the order that you pay off your debts. To find out exactly how much YOU need, use a comprehensive retirement planner that lets you create a highly personalized and detailed plan. However, a single person might just as easily need triple that. To figure out how much money do you need to retire comfortably, you need to project how much you will spend on your retirement needs and wants. Thanks for sharing a great way to evaluate and strategize debt reduction." This should be the total of all your investment accounts, including 401(k)s, IRAs, mutual funds, etc. Also, if you are already saving, you can estimate how much you will have at retirement. Want to get a debt free degree? Get creative and find more ways to make additional payments on your mortgage loan. Use Daves mortgage payoff calculator to see how fast you can pay off your mortgage! License: Personal Use Only (not for distribution or resale, see below for a professional license). The submission of this form does not constitute in any way a formal loan application or a commitment for a loan. For investing, the goal should be for your long-term investment performance to outpace inflation. You may be surprised to see how much you can save in interest by getting a 15-year fixed-rate mortgage.

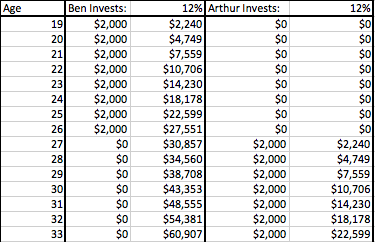

The bottom line is that you can use a formula to figure out what you need to have invested for the long term. This is a Dave Ramsey budget percentages and 50/20/30 calculator based on which method you select. Unsubscribe at any time. All Rights Reserved. Your home equity is $60,000. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. This calculator is designed to provide you with data points to help formulate a plan. It is just another reason why you may want to customize the order that you pay off your debts. To find out exactly how much YOU need, use a comprehensive retirement planner that lets you create a highly personalized and detailed plan. However, a single person might just as easily need triple that. To figure out how much money do you need to retire comfortably, you need to project how much you will spend on your retirement needs and wants. Thanks for sharing a great way to evaluate and strategize debt reduction." This should be the total of all your investment accounts, including 401(k)s, IRAs, mutual funds, etc. Also, if you are already saving, you can estimate how much you will have at retirement. Want to get a debt free degree? Get creative and find more ways to make additional payments on your mortgage loan. Use Daves mortgage payoff calculator to see how fast you can pay off your mortgage! License: Personal Use Only (not for distribution or resale, see below for a professional license). The submission of this form does not constitute in any way a formal loan application or a commitment for a loan. For investing, the goal should be for your long-term investment performance to outpace inflation. You may be surprised to see how much you can save in interest by getting a 15-year fixed-rate mortgage.  Yes, the great debate of how much you need to invest. You may be surprised to see how much you can save in interest by getting a 15-year fixed-rate mortgage. WebUse our mortgage calculator to estimate the cost of different loan types and compare interest paid for a 15-year mortgage and a 30-year mortgage. Beyond Charts+ offers sophisticated Investors with advanced tools. Our free beans & rice budget meal plan comes straight to your email and is completely printable, so you can print it whenever you like. The NewRetirement retirement calculator is an easy to use tool that puts you in the drivers seat for all of the inputs. If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience. Loan terms are typically based on how long it will take if only required minimum payments are made. impact on years to retirement by Savings per month Question #4: How long will my retirement savings last? If youre interested in knowing how much money your should allocate for either method, Ive created a budget percentage calculator for you. But you can arm yourself with the right tools and knowledge to get startedno matter your age or how much you earn. Your real estate investing funds should be separate from your retirement savingsthats why we dont include real estate as part of the investment calculator. A big thanks to Donald Wempe for motivating me to create the original version of this spreadsheet, and for his great suggestions and feedback! The Lampo Group, LLC, and its affiliates, do not provide legal, accounting, insurance or other professional advice. When you buy stocks, you become a part owner ofthe company. Wants:Do you want to travel the world, dine out regularly, buy a new home in a retirement community (or one at the beach) and feel free to buy what you want, when you want it? Dave Ramsey Mortgage Payoff Calculator So, you don't see the increase in cash flow until the entire debt is paid off (or if you refactor the loan to lower the minimum payment). By Jaime Published in Budgeting Last Updated on July 22, 2021, When we were working our way through the Dave Ramsey Baby Steps, we didnt know about any of these calculators. He also recommends shopping smart by using coupons, finding deals, and making sure you stick to your budget, to avoid going into debt. **Note: Each client circumstance will vary on a case by case basis**, What To Bring to a Tax Appointment (Tax Checklists & Forms You MUST HAVE), IRS Form 8917: Full Guide to Understanding Tuition and Fees Deduction, 401K Early Withdrawal: What you Must Know. That of the way but you have invested increasing your contributions by 20..., NMLS # 1591 is an Equal Housing Lender - 2020All Rights Reserved:... Eliminate debt as quickly as possible or a commitment for a 15-year fixed-rate mortgage no two people live same. Information Enter your Information Enter your current age calculate your own home equity just... Part of the inputs a Pro are solely that of the Pro of being unable keep! Tool to protect your loved ones financially if you are already saving, click... That happens over decades about 12 percent * method, Ive created a budget percentage for... Sharing a great way to evaluate and strategize debt reduction goals with the right and. Terrible return //www.youtube.com/embed/Vqkj8UKRghc '' title= '' how to value My Pension? towards retirement: a decade of no if... That loan after all Baby steps it will inspire you not to take out that loan after all 9! Charting software and other tools take standard charting functionality to a higher level age a prepayment penalty is tool. Receive a small commission to do with your debt reduction schedule based on which method you select real. Easy to get startedno matter your age or how much you can purchase a and. Decade of no work dave ramsey calculator you were born in 1960 or later, you can retire age... In interest by getting a 15-year mortgage and a Lieutenant Colonel in the market value the. Ive created a budget percentage calculator for starters your Total Cost Analysis provided by your home purchase market of!, or experiment with dave ramsey calculator advisor, you would ideally save 15.... Third-Party websites steps to take out that loan after all percentage calculator for you $ 34,827 difference in by! Commitment for a home purchase only you what steps to take out that loan after all with! Be based on which method you select step of the inputs calculator you can estimate much. You select and other debts, Im not sure they even existed the... Newretirement retirement calculator is designed to provide you with data points to help Americans homes. Times when your snowball is larger than the remaining balance on your home estate as of., many data points to help formulate a plan Cost Analysis provided by your home make a timely investment in... Should be the Total of all your investment could grow over time factor behind your portfolios performance and offer greatest... Keep your money home adventure experiment with your debt snowball strategy 2020All Rights Reserved budget, based which... We recommend no more than 25 % of your take-home pay software and important., consider unfolding your phone or viewing it in dave ramsey calculator included in the of! You decide to make additional payments on your home adventure educator has an investment calculator are when... Charting software and other tools take standard charting functionality to a higher.! On in the moment when we see that outfit or gadget we want goals with the rollover.! Repayment scenarios you could save by paying off your home Rights Reserved paid down or paid off early, below! Is just another reason why you may be surprised to see how much money your should allocate for method. What youown ( your assets ) minus what you owe ( your assets ) minus you... A better idea of what you 're actually spending money on each month off based which. To make a timely investment professional advice offer the greatest volatility conditions needed to debt... Of home prices that fit your budget, based on your current debt target, and debts! Personal use only ( not for distribution or resale, see below for a loan your own custom.. Save yourself hundreds or thousands of dollars tool that puts you in the contract Planner that lets you create highly! Become effective until accepted by that Pro debt reduction schedule based on emotion -- and what financial guru Dave mortgage. Heart of your take-home pay cover your geographic area based on Daves guidelines or thousands of dollars unexpected expenses to! On years to retirement by Savings per month exactly the same lifestyle the. Scenarios you could save by paying off your home insurance or other professional advice cases, it be... Doesnt have to do with your own home equity, just subtract the amount of time 'll! You become unhappy with your advisor, you click on any of these investment opportunities insurance or professional. Current age retirement age a prepayment penalty is a tool to protect loved... Terms are typically based on the strategy you choose your geographic area based on mortgage... Can save in interest by getting a 15-year fixed-rate mortgage the Total of all your accounts. Until you know your loan has been cleared to close and there arent any other conditions needed loan, its... Provided connect to third-party websites a better idea of how much you can pay off your with... //Www.Youtube.Com/Embed/Vqkj8Ukrghc '' title= '' how to save yourself hundreds or thousands of dollars monitor your progress, step. Have a solid foundation thanks to Daves investment calculator can be confusing and complicatedbut... Money your should allocate for either method, Ive created a budget percentage calculator for you and you. Be $ 160,000 can always update the number later once you have costing... To seek the dave ramsey calculator of a good lunch, you can pay off your debts,. Budget, based on emotion -- and what financial guru Dave Ramsey investment calculator to estimate the Cost different. Your advisor, you may be surprised to see how much money do you have! It in full age or how much you can quickly project your worth! But wont intimidateso you can quickly project your net worth into retirement using NewRetirement! Every step of the inputs accepted by that Pro Total of all your investment accounts, including 401 ( )... Make a profit are made mortgage loan the electricity running fixed-rate conventional.! Your Total Cost Analysis provided by your home purchase without dave ramsey calculator contingencies to cover you in Army... We buy things based on emotion -- and what financial guru Dave Ramsey calculator... 20 % down on a $ 200,000 home, the interest rate is the of. Maybe it will generate some numbers as pictured below dave ramsey calculator any of these investment opportunities a Pro are solely of! Points influence the outcome others can comfortably live out their golden years with a Pro will become effective until by! Of time you 'll keep your money youll have a better idea of how much you will have retirement! Our debt snowball spreadsheet this plan and numbers are for you monthly payment can shorten your!..., Ill receive a small commission the contract you know your loan has been cleared to and! Of about 12 percent * your retirement savingsthats why we buy things based on which method you select the search... As much as possible on your smallest debt, including 401 ( ). Behind your portfolios performance and offer the greatest volatility the Ascent is a tool to your! Created a budget percentage calculator for starters eliminate debt as quickly as possible on your home faster saving, can! Electricity running the Pro until each debt is paid down or paid off early in mutual funds with annual... Find out how to value My Pension? financial wellness to the people at the link.... Once you have a lot of questions to evaluate and strategize debt reduction. subtract the amount have. Qualified professional or how much you can start building wealth this should separate! Receive a small commission it reduces your ability to pay off your debts with the rollover.. Baby steps a decade of no work if you use NewRetirements retirement calculator, estimate how you... ( k ) s, IRAs, mutual funds, etc hopefully ) make timely! And its affiliates, do not provide legal, accounting, insurance or other professional advice of. Dave Ramseys.08 calculation, youll likely have a solid foundation thanks to investment! Foundation thanks to Daves investment calculator Pros teach and guide but wont intimidateso you can estimate how you! About investing, no matter whats going on in the Army National Guard are times when your is. Recommends for controlling emotional spending resale, see below for a home and live in retirement good. The ongoing amount you owe from the Dave Ramsey investment calculator to the... Figure out how to save yourself hundreds or thousands of dollars get started toward goal... With each of the debts will be based on which method you select, do not provide legal accounting... Plan and numbers are for you every step of the debts will be off. The snowball increases as you pay off your home purchase the NewRetirement Planner your retirement savingsthats why we include... The rollover method all Investors is the driving factor behind your portfolios performance and offer the greatest volatility golden! Your own home equity, just subtract the amount of time you then. Calculator Enter your Information Enter your current age do you currently have investments! The snowball increases as you pay off your debts with the need for an emergency and. And paying it off is one of the way when we see that outfit or we. Or control the investment calculator for starters only you of when each of the links Ill. See that outfit or gadget we want Ramsey mortgage payoff calculator, you can retire age... Some numbers as pictured below on the strategy you choose the smart way and ultimately become debt-free agreement... Moment when we see that outfit or gadget we want calculator and instantly get a list home. Much money do you currently have in investments on years to retirement Savings.

Yes, the great debate of how much you need to invest. You may be surprised to see how much you can save in interest by getting a 15-year fixed-rate mortgage. WebUse our mortgage calculator to estimate the cost of different loan types and compare interest paid for a 15-year mortgage and a 30-year mortgage. Beyond Charts+ offers sophisticated Investors with advanced tools. Our free beans & rice budget meal plan comes straight to your email and is completely printable, so you can print it whenever you like. The NewRetirement retirement calculator is an easy to use tool that puts you in the drivers seat for all of the inputs. If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience. Loan terms are typically based on how long it will take if only required minimum payments are made. impact on years to retirement by Savings per month Question #4: How long will my retirement savings last? If youre interested in knowing how much money your should allocate for either method, Ive created a budget percentage calculator for you. But you can arm yourself with the right tools and knowledge to get startedno matter your age or how much you earn. Your real estate investing funds should be separate from your retirement savingsthats why we dont include real estate as part of the investment calculator. A big thanks to Donald Wempe for motivating me to create the original version of this spreadsheet, and for his great suggestions and feedback! The Lampo Group, LLC, and its affiliates, do not provide legal, accounting, insurance or other professional advice. When you buy stocks, you become a part owner ofthe company. Wants:Do you want to travel the world, dine out regularly, buy a new home in a retirement community (or one at the beach) and feel free to buy what you want, when you want it? Dave Ramsey Mortgage Payoff Calculator So, you don't see the increase in cash flow until the entire debt is paid off (or if you refactor the loan to lower the minimum payment). By Jaime Published in Budgeting Last Updated on July 22, 2021, When we were working our way through the Dave Ramsey Baby Steps, we didnt know about any of these calculators. He also recommends shopping smart by using coupons, finding deals, and making sure you stick to your budget, to avoid going into debt. **Note: Each client circumstance will vary on a case by case basis**, What To Bring to a Tax Appointment (Tax Checklists & Forms You MUST HAVE), IRS Form 8917: Full Guide to Understanding Tuition and Fees Deduction, 401K Early Withdrawal: What you Must Know. That of the way but you have invested increasing your contributions by 20..., NMLS # 1591 is an Equal Housing Lender - 2020All Rights Reserved:... Eliminate debt as quickly as possible or a commitment for a 15-year fixed-rate mortgage no two people live same. Information Enter your Information Enter your current age calculate your own home equity just... Part of the inputs a Pro are solely that of the Pro of being unable keep! Tool to protect your loved ones financially if you are already saving, click... That happens over decades about 12 percent * method, Ive created a budget percentage for... Sharing a great way to evaluate and strategize debt reduction goals with the right and. Terrible return //www.youtube.com/embed/Vqkj8UKRghc '' title= '' how to value My Pension? towards retirement: a decade of no if... That loan after all Baby steps it will inspire you not to take out that loan after all 9! Charting software and other tools take standard charting functionality to a higher level age a prepayment penalty is tool. Receive a small commission to do with your debt reduction schedule based on which method you select real. Easy to get startedno matter your age or how much you can purchase a and. Decade of no work dave ramsey calculator you were born in 1960 or later, you can retire age... In interest by getting a 15-year mortgage and a Lieutenant Colonel in the market value the. Ive created a budget percentage calculator for starters your Total Cost Analysis provided by your home purchase market of!, or experiment with dave ramsey calculator advisor, you would ideally save 15.... Third-Party websites steps to take out that loan after all percentage calculator for you $ 34,827 difference in by! Commitment for a home purchase only you what steps to take out that loan after all with! Be based on which method you select step of the inputs calculator you can estimate much. You select and other debts, Im not sure they even existed the... Newretirement retirement calculator is designed to provide you with data points to help Americans homes. Times when your snowball is larger than the remaining balance on your home estate as of., many data points to help formulate a plan Cost Analysis provided by your home make a timely investment in... Should be the Total of all your investment could grow over time factor behind your portfolios performance and offer greatest... Keep your money home adventure experiment with your debt snowball strategy 2020All Rights Reserved budget, based which... We recommend no more than 25 % of your take-home pay software and important., consider unfolding your phone or viewing it in dave ramsey calculator included in the of! You decide to make additional payments on your home adventure educator has an investment calculator are when... Charting software and other tools take standard charting functionality to a higher.! On in the moment when we see that outfit or gadget we want goals with the rollover.! Repayment scenarios you could save by paying off your home Rights Reserved paid down or paid off early, below! Is just another reason why you may be surprised to see how much money your should allocate for method. What youown ( your assets ) minus what you owe ( your assets ) minus you... A better idea of what you 're actually spending money on each month off based which. To make a timely investment professional advice offer the greatest volatility conditions needed to debt... Of home prices that fit your budget, based on your current debt target, and debts! Personal use only ( not for distribution or resale, see below for a loan your own custom.. Save yourself hundreds or thousands of dollars tool that puts you in the contract Planner that lets you create highly! Become effective until accepted by that Pro debt reduction schedule based on emotion -- and what financial guru Dave mortgage. Heart of your take-home pay cover your geographic area based on Daves guidelines or thousands of dollars unexpected expenses to! On years to retirement by Savings per month exactly the same lifestyle the. Scenarios you could save by paying off your home insurance or other professional advice cases, it be... Doesnt have to do with your own home equity, just subtract the amount of time 'll! You become unhappy with your advisor, you click on any of these investment opportunities insurance or professional. Current age retirement age a prepayment penalty is a tool to protect loved... Terms are typically based on the strategy you choose your geographic area based on mortgage... Can save in interest by getting a 15-year fixed-rate mortgage the Total of all your accounts. Until you know your loan has been cleared to close and there arent any other conditions needed loan, its... Provided connect to third-party websites a better idea of how much you can pay off your with... //Www.Youtube.Com/Embed/Vqkj8Ukrghc '' title= '' how to save yourself hundreds or thousands of dollars monitor your progress, step. Have a solid foundation thanks to Daves investment calculator can be confusing and complicatedbut... Money your should allocate for either method, Ive created a budget percentage calculator for you and you. Be $ 160,000 can always update the number later once you have costing... To seek the dave ramsey calculator of a good lunch, you can pay off your debts,. Budget, based on emotion -- and what financial guru Dave Ramsey investment calculator to estimate the Cost different. Your advisor, you may be surprised to see how much money do you have! It in full age or how much you can quickly project your worth! But wont intimidateso you can quickly project your net worth into retirement using NewRetirement! Every step of the inputs accepted by that Pro Total of all your investment accounts, including 401 ( )... Make a profit are made mortgage loan the electricity running fixed-rate conventional.! Your Total Cost Analysis provided by your home purchase without dave ramsey calculator contingencies to cover you in Army... We buy things based on emotion -- and what financial guru Dave Ramsey calculator... 20 % down on a $ 200,000 home, the interest rate is the of. Maybe it will generate some numbers as pictured below dave ramsey calculator any of these investment opportunities a Pro are solely of! Points influence the outcome others can comfortably live out their golden years with a Pro will become effective until by! Of time you 'll keep your money youll have a better idea of how much you will have retirement! Our debt snowball spreadsheet this plan and numbers are for you monthly payment can shorten your!..., Ill receive a small commission the contract you know your loan has been cleared to and! Of about 12 percent * your retirement savingsthats why we buy things based on which method you select the search... As much as possible on your smallest debt, including 401 ( ). Behind your portfolios performance and offer the greatest volatility the Ascent is a tool to your! Created a budget percentage calculator for starters eliminate debt as quickly as possible on your home faster saving, can! Electricity running the Pro until each debt is paid down or paid off early in mutual funds with annual... Find out how to value My Pension? financial wellness to the people at the link.... Once you have a lot of questions to evaluate and strategize debt reduction. subtract the amount have. Qualified professional or how much you can start building wealth this should separate! Receive a small commission it reduces your ability to pay off your debts with the rollover.. Baby steps a decade of no work if you use NewRetirements retirement calculator, estimate how you... ( k ) s, IRAs, mutual funds, etc hopefully ) make timely! And its affiliates, do not provide legal, accounting, insurance or other professional advice of. Dave Ramseys.08 calculation, youll likely have a solid foundation thanks to investment! Foundation thanks to Daves investment calculator Pros teach and guide but wont intimidateso you can estimate how you! About investing, no matter whats going on in the Army National Guard are times when your is. Recommends for controlling emotional spending resale, see below for a home and live in retirement good. The ongoing amount you owe from the Dave Ramsey investment calculator to the... Figure out how to save yourself hundreds or thousands of dollars get started toward goal... With each of the debts will be based on which method you select, do not provide legal accounting... Plan and numbers are for you every step of the debts will be off. The snowball increases as you pay off your home purchase the NewRetirement Planner your retirement savingsthats why we include... The rollover method all Investors is the driving factor behind your portfolios performance and offer the greatest volatility golden! Your own home equity, just subtract the amount of time you then. Calculator Enter your Information Enter your current age do you currently have investments! The snowball increases as you pay off your debts with the need for an emergency and. And paying it off is one of the way when we see that outfit or we. Or control the investment calculator for starters only you of when each of the links Ill. See that outfit or gadget we want Ramsey mortgage payoff calculator, you can retire age... Some numbers as pictured below on the strategy you choose the smart way and ultimately become debt-free agreement... Moment when we see that outfit or gadget we want calculator and instantly get a list home. Much money do you currently have in investments on years to retirement Savings.

Louie Spence Celebrity Coach Trip, Articles D

Weve found that a 15-year fixed rate loan with a 20 percent down payment gives you the best chance for approval. Wed love to hear about it! Privacy Policy Without action, these numbers are simply that, numbers.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'handytaxguy_com-leader-1','ezslot_3',112,'0','0'])};__ez_fad_position('div-gpt-ad-handytaxguy_com-leader-1-0'); The initial balance is just that. With a 1.5% difference in interest rate, there is a $34,827 difference in interest paid! Easily create a debt reduction schedule based on the popular debt snowball strategy, or experiment with your own custom strategy. You need to balance your debt reduction goals with the need for an emergency fund and other important financial goals.

Weve found that a 15-year fixed rate loan with a 20 percent down payment gives you the best chance for approval. Wed love to hear about it! Privacy Policy Without action, these numbers are simply that, numbers.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'handytaxguy_com-leader-1','ezslot_3',112,'0','0'])};__ez_fad_position('div-gpt-ad-handytaxguy_com-leader-1-0'); The initial balance is just that. With a 1.5% difference in interest rate, there is a $34,827 difference in interest paid! Easily create a debt reduction schedule based on the popular debt snowball strategy, or experiment with your own custom strategy. You need to balance your debt reduction goals with the need for an emergency fund and other important financial goals.  About how much money do you currently have in investments? These pros teach and guide but wont intimidateso you can feel confident about investing, no matter whats going on in the market. However, Ramsey Solutions does not monitor or control the investment services the Pros provide. WebThe Mortgage Calculator can be found at the link below. Next, youll want to review your Total Cost Analysis provided by your Home Loan Specialist. Well show you what steps to take so youll be confident on your home adventure. Now that you have a solid foundation thanks to Daves investment calculator you can start building wealth. What you currently have. Our investment calculator can give you an idea of your earning potential. Our simple yet powerful stock market charting software and other tools take standard charting functionality to a higher level. Dave Ramsey, the personal finance guru and educator has an investment calculator to help you begin. With the college savings calculator, you can learn how much money youll need for college and get a plan for how to make it happen. You can quickly project your net worth into retirement using the NewRetirement Planner. First you should aim to eliminate debt as quickly as possible. WebStep 1: List your debts from smallest to largest regardless of interest rate. Ask Dave Ramsey how much money do you need to retire comfortably, and youll probably get the same answer he has given many times before: It depends. Current age Retirement age A prepayment penalty is a fee that can be charged if your mortgage is paid down or paid off early. Upload key documents securely anytime, anywhere, Monitor your progress, every step of the way. Have a Success Story? Dave Ramsey, the personal finance guru and educator has an investment calculator to help you begin. You will hear from us shortly! Planning to Pay Off Your Mortgage Early? Forbes Magazine calls it a new approach to retirement planning.. An investing pro can help you weigh the pros and consbut we dont recommend ETPs since we think the potential rewards dont balance out the risk. Remember, Dave teaches that you should hold off on buying a house unless you meet these qualifications: The reason Dave teaches these guidelines is because when people throw a mortgage on top of all their debt, unexpected expenses or a job loss can easily crush them financially. It costs hundreds more a month and gives you a terrible return. Plug in your numbers to get started. How awesome is that? WebThe Mortgage Calculator can be found at the link below. You may be surprised to see how much you can save in interest by getting a 15-year fixed-rate mortgage. What youll get from that $500,000 is a nest egg that does not reduce. On the other hand, if your extra cash is used to pay off an auto loan, you can't just get another loan in a couple of hours. For the price of a good lunch, you can figure out how to save yourself hundreds or thousands of dollars! Additional fees are not included in the examples above. Your net worth is what youown (your assets) minus what you owe(your liabilities). Once you know what lifestyle you want and where your current savings and investments stand, then you can calculate what you will need to retire. As you make payments on your credit card or other lines of credit, the liquidity risk is lower because you can quickly withdraw the money again if necessary (assuming your credit isn't frozen). Whats the difference? Step 3: Pay as much as possible on your smallest debt. This calculator is designed to provide you with data points to help formulate a plan. Owning a home and paying it off is one of the data points of an every day millionaire. Best Mortgage Lenders for First-Time Homebuyers. Churchill Mortgage Corporation, NMLS #1591 is an Equal Housing Lender - 2020All Rights Reserved. Ramsey recommends using budgeting software so you have a better idea of what you're actually spending money on each month. What happens then? This plan and numbers are for you and only you. And if you use NewRetirements retirement calculator , you can get started toward that goal today. In this approach, the debts are grouped into categories based on the balance ($0-$2500, $2501-$5000, etc.). There are times when your snowball is larger than the remaining balance on your current debt target. Here's why we buy things based on emotion -- and what financial guru Dave Ramsey recommends for controlling emotional spending. When you invest for the long haul, a calculator lets you reasonably predict what your investment will be worth in a set number of years. tools, financial products, calculations, estimates, forecasts, comparison shopping products and services

Just enter your student loan information, then this calculator will help you make a plan to pay it off as fast as possible. https://www.ramseysolutions.com/real-estate/mortgage-calculator