Middle English pensel "an artist's brush, pencil," from early French pincel (same meaning), derived from Latin penicillus, literally, "little tail" related to penicillin see Word History at 3pen, Thesaurus: All synonyms and antonyms for pencil, Nglish: Translation of pencil for Spanish Speakers, Britannica English: Translation of pencil for Arabic Speakers, Britannica.com: Encyclopedia article about pencil. To meet the criteria for the partial exemption from the Loan Estimate and Closing Disclosure requirements under the BUILD Act, the transaction must meet all of the following criteria: 15 U.S.C. Because many disclosure items for the construction financing would otherwise be based on the best information reasonably available at the time of disclosure, Appendix D provides special procedures and assumptions creditors may use to provide consistent and compliant disclosures. Among others, special disclosure provisions in Regulation Z are contained in: Note that 1026.17(c)(6) and Appendix D existed prior to the TRID Rule. The TRID Rule does not prohibit a creditor from requesting and collecting additional information (beyond the six pieces of information that constitute an application under the TRID Rule) or verifying documents it deems necessary in connection with a request for a mortgage loan, including a request for a pre-approval or a pre-qualification letter. The Tax Implications of Home Equity Loan Interest. Those partial exemptions are either 1) the regulatory partial exemption in Regulation Z, 12 CFR 1026.3(h) (Regulation Z Partial Exemption), or 2) the statutory partial exemption in the TILA and RESPA statutes, provided through amendments made by the Building Up Independent Lives and Dreams Act (BUILD Act) (BUILD Act Partial Exemption). Specifically, the total amount of lender credits (specific and general) actually provided to the consumer is compared to the amount of the lender credits identified in Section J: Total Closing Costs on page 2 of the Loan Estimate. You know what it looks like but what is it called? 1. These examples are programmatically compiled from various online sources to illustrate current usage of the word 'pencil.' One goose, two geese. Does a creditors use of a model form provide a safe harbor if the model form does not reflect a TRID Rule change finalized in 2017? As discussed below, there are three types of changes that require a creditor to ensure that the consumer receives a corrected Closing Disclosure at least three business days before consummation. Property address Estimated property value Name of borrower LD Acronyms. For more information about general coverage requirements of the TRID Rule, see Section 4 of the TILA-RESPA Rule Small Entity Compliance Guide . The basic of objective of these (and other federal laws) is the protection of homebuyers, homeowners and renters from unfair lending practices and discrimination. Photo: monkeybusinessimages / Getty Images. A new construction loan is a loan for the purchase of a home that is not yet constructed or the purchase of a new home where construction is currently underway, not a loan for financing home improvement, remodeling, or adding to an existing structure. The Mortgage Reform and Anti-Predatory Lending Act is known as which title under Dodd-Frank? If a consumer submits the six pieces of information that constitute an application for purposes of the TRID Rule to obtain a pre-approval or pre-qualification letter for a mortgage loan subject to the TRID Rule, the creditor is responsible for ensuring that a Loan Estimate is provided to the consumer within three business days of receipt of the last of the six pieces of information. (as modifier) a pencil drawing. WebAcceptance Capital Mortgage Corporation: Rate it: ACMC: American Church Mortgage Company: Rate it: ACMF: Angas Contributory Mortgage Fund: Rate it: ADDTL: Additional: Rate it: ADR: American Depositary Receipt: Rate it: AHMC: Acceptance Home Mortgage Corporation: Rate it: AHMC: Absolute Home Mortgage Corporation: Rate it: AHMC: As the Bureau noted in finalizing the 2017 changes to the TRID Rule, a creditor is deemed to be in compliance with the disclosure requirements associated with the Loan Estimate and Closing Disclosure if the creditor uses the appropriate model form and properly completes it with accurate content. Comment 2(a)(3)-1. 1604(b). Any opinions expressed in the examples do not represent those of Merriam-Webster or its editors. Required Information to trigger a Loan Estimate: (1) The consumers name. WebMilton Friedman uses a pencil to illustrate how the free market price system promotes cooperation and harmony among those with no common interest. PITI is an acronym that stands for "principal, interest, taxes, and insurance." Assets. hTk0*~ZmMXhH

lukd'qs{w{l 32ZS(iX|X09=eE.y0crfK6Yv?-,!"TKlsy[c;D 12 CFR 1026.37(n), 38(s). Your lender will ask you to provide a short statement as to why that occurred. No. 1) Federal Mortgage Related Laws. 12 CFR 1026.19(e)(3). TRID also establishes the fees that lenders can charge. Regardless of which set of disclosures the creditor chooses to providethe Loan Estimate and Closing Disclosure or, alternatively, the GFE, HUD-1, and TIL disclosuresthe creditor must comply with all applicable disclosure requirements pertaining to those disclosures. Our calculator includes 1 ABS. 12 CFR 1026.37(g)(6)(ii). 35,000 worksheets, games,and lesson plans, Marketplace for millions ofeducator-created resources, Spanish-English dictionary,translator, and learning. For example, if after receiving the pre-qualification letter, the consumer submits the property address (i.e., the sixth of the six pieces of information that constitute an application under the TRID Rule), the creditor is obligated to ensure the Loan Estimate is provided to the consumer by the third business day after submission of the property address. Subjects. 12 CFR 1026.38(h)(3). See also, discussion of the Regulation Z Partial Exemption, discussed in TRID Housing Assistance Loan Question 2, above. PITI typically refers to your total monthly mortgage payment, including principal, interest, taxes and insurance. Both construction-only loans (i.e., usually shorter term loans with several fund disbursements where the consumer pays only accrued interest until construction is completed) and also construction-permanent loans (i.e., construction loans that convert to permanent financing once construction is completed in which the loan amount is amortized just as in a standard mortgage transaction) can be covered by the TRID rule if the coverage requirements are met. Estimated Value of Property. The list of 31 Pencil acronyms and abbreviations (March 2023): 50 Categories. Public Education Needs Civic Involvement in Learning. PENCIL Meaning 2. 9 popular forms of Abbreviation for Mortgage updated in 2023. There is your acronym ALIENS. More information on disclosing the Total of Payments is available in Section 3.6.1 of the TILA-RESPA Rule Guide to Forms . 12 CFR 1026.38(f) and 1026.38(g). PENCIL Meaning. Comments 17(c)(1)-19, 19(e)(3)(i)-5, 37(g)(6)(ii)-1, and 38(h)(3)-1. %%EOF

Comment 38(h)(3)-1. Which are initial disclosures under RESPA? A creditor must ensure that a consumer receives an initial Closing Disclosure no later than three business days before consummation. 12 CFR 1026.19(e)(2)(iii); comment 19(e)(2)(iii)-1. TRID became law as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank). In that case, the creditor may simply provide a pre-approval letter in compliance with the creditors practices and applicable law. Depending on which partial exemption is met, the creditor may also be exempt from certain other disclosures. Annual Percentage Rate (APR): The cost of a mortgage stated as a yearly rate; includes such items as interest, mortgage insurance, and loan origination fee (points). 12 CFR 1026.19(e)(3)(iv)(F), Comment 19(e)(3)(iv)(F)-1. When each letter can be seen but not heard. Close your vocabulary gaps with personalized learning that focuses on teaching the Mortgage Terms Glossary: Adjustable-Rate Mortgage (ARM) Amortization. The total of all general and specific lender credits is disclosed as a negative number, and labeled as Lender Credits in Section J: Total Closing Costs on page 2 of the Loan Estimate. For Adjustable Rate Mortgages, as defined in 1026.37(a)(10)(i)(A), interest is calculated using the guidance provided in Comment 17(c)(1)-10. The transaction is for the purpose of: a down payment, closing costs, or other similar home buyer assistance, such as principal or interest subsidies; property rehabilitation assistance; energy efficiency assistance; or foreclosure avoidance or prevention. E Estimated value of mortgage loan application. Home. Copyright 2023 Vocabulary.com, Inc., a division of IXL Learning The creditor provides either the Truth-in-Lending (TIL) disclosures or the Loan Estimate and Closing Disclosure. If the creditor is offsetting some or all of the costs for specific settlement services that are being charged to the consumer in connection with the loan, see TRID Lender Credits Question 8. Private mortgage insurance is typically required for borrowers whose LTV ratio is less than 80 percent. The APR includes any added costs related to what has been borrowed. 15 U.S.C. Pencil Abbreviations. Generally, yes. No, creditors cannot require consumers to provide additional information in order to receive a Loan Estimate. WebL Loan amount requested. On the Closing Disclosure, the general lender credit must be included as a negative number in the amount disclosed as Lender Credits in Section J under the Total Closing Costs (Borrower-Paid) subheading on page 2 of the Closing Disclosure, and in the amount disclosed as Lender Credits in the Closing Costs portion of the Costs at Closing table on the bottom of page 1 of the Closing Disclosure. Insurance. 5531, 5536. These examples are from corpora and from sources on the web. See also TRID Providing Loan Estimates to Consumers Question 2 and Question 3. Writing is best done with a fairly soft black, The game used a laminated board which could be written on with a.

Comment 38(h)(3)-1. Which are initial disclosures under RESPA? A creditor must ensure that a consumer receives an initial Closing Disclosure no later than three business days before consummation. 12 CFR 1026.19(e)(2)(iii); comment 19(e)(2)(iii)-1. TRID became law as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank). In that case, the creditor may simply provide a pre-approval letter in compliance with the creditors practices and applicable law. Depending on which partial exemption is met, the creditor may also be exempt from certain other disclosures. Annual Percentage Rate (APR): The cost of a mortgage stated as a yearly rate; includes such items as interest, mortgage insurance, and loan origination fee (points). 12 CFR 1026.19(e)(3)(iv)(F), Comment 19(e)(3)(iv)(F)-1. When each letter can be seen but not heard. Close your vocabulary gaps with personalized learning that focuses on teaching the Mortgage Terms Glossary: Adjustable-Rate Mortgage (ARM) Amortization. The total of all general and specific lender credits is disclosed as a negative number, and labeled as Lender Credits in Section J: Total Closing Costs on page 2 of the Loan Estimate. For Adjustable Rate Mortgages, as defined in 1026.37(a)(10)(i)(A), interest is calculated using the guidance provided in Comment 17(c)(1)-10. The transaction is for the purpose of: a down payment, closing costs, or other similar home buyer assistance, such as principal or interest subsidies; property rehabilitation assistance; energy efficiency assistance; or foreclosure avoidance or prevention. E Estimated value of mortgage loan application. Home. Copyright 2023 Vocabulary.com, Inc., a division of IXL Learning The creditor provides either the Truth-in-Lending (TIL) disclosures or the Loan Estimate and Closing Disclosure. If the creditor is offsetting some or all of the costs for specific settlement services that are being charged to the consumer in connection with the loan, see TRID Lender Credits Question 8. Private mortgage insurance is typically required for borrowers whose LTV ratio is less than 80 percent. The APR includes any added costs related to what has been borrowed. 15 U.S.C. Pencil Abbreviations. Generally, yes. No, creditors cannot require consumers to provide additional information in order to receive a Loan Estimate. WebL Loan amount requested. On the Closing Disclosure, the general lender credit must be included as a negative number in the amount disclosed as Lender Credits in Section J under the Total Closing Costs (Borrower-Paid) subheading on page 2 of the Closing Disclosure, and in the amount disclosed as Lender Credits in the Closing Costs portion of the Costs at Closing table on the bottom of page 1 of the Closing Disclosure. Insurance. 5531, 5536. These examples are from corpora and from sources on the web. See also TRID Providing Loan Estimates to Consumers Question 2 and Question 3. Writing is best done with a fairly soft black, The game used a laminated board which could be written on with a.  If the disclosed terms change after the creditor has provided the initial Closing Disclosure to the consumer, the creditor must provide a corrected Closing Disclosure to the consumer. I Need Money Fast How Do I Tap Into My Homes Equity. _$ULS[N'_6/Vnu%/b\-7.(%2sW4BYouA9XabeG;S

{jQ1U[lio6

ara~HN=TgR-i ;

8nsF&Qlsp>n Which section on the Federal Exam is the least weighted? 2023 Compass Mortgage Inc. All Rights Reserved. Are construction-only loans or construction-permanent loans covered by the TRID Rule? WebMost popular Pencil abbreviations updated in March 2023. The total of costs payable by the consumer in connection with the transaction include only: recording fees; transfer taxes; a bona fide and reasonable application fee; and a bona fide and reasonable fee for housing counseling services. words you need to know. 2. Thus, if the disclosed APR decreases due to a decrease in the disclosed interest rate, a creditor is not required to provide a new three-business day waiting period under the TRID Rule. Suggest. We ow restrict our attention to simple pencils, where symmetric or not. example APR. 7. Webterm is expressed as a number of months. 51 0 obj

<>stream

4. WebDigital TRID Pencil Calculator Trid touches the mortgage loan process from origination through closing and beyond. Homeowner's Protection Act: Term. 2 popular meanings of PENCIL abbreviation: 4 Categories. In October of 2015, TRIDTILA-RESPA Integrated Disclosureshas been in effect. Annual Percentage Rate (APR) Appraisal. See also, discussion of the BUILD Act Partial Exemption, discussed in TRID Housing Assistance Loan Question 3, below.

If the disclosed terms change after the creditor has provided the initial Closing Disclosure to the consumer, the creditor must provide a corrected Closing Disclosure to the consumer. I Need Money Fast How Do I Tap Into My Homes Equity. _$ULS[N'_6/Vnu%/b\-7.(%2sW4BYouA9XabeG;S

{jQ1U[lio6

ara~HN=TgR-i ;

8nsF&Qlsp>n Which section on the Federal Exam is the least weighted? 2023 Compass Mortgage Inc. All Rights Reserved. Are construction-only loans or construction-permanent loans covered by the TRID Rule? WebMost popular Pencil abbreviations updated in March 2023. The total of costs payable by the consumer in connection with the transaction include only: recording fees; transfer taxes; a bona fide and reasonable application fee; and a bona fide and reasonable fee for housing counseling services. words you need to know. 2. Thus, if the disclosed APR decreases due to a decrease in the disclosed interest rate, a creditor is not required to provide a new three-business day waiting period under the TRID Rule. Suggest. We ow restrict our attention to simple pencils, where symmetric or not. example APR. 7. Webterm is expressed as a number of months. 51 0 obj

<>stream

4. WebDigital TRID Pencil Calculator Trid touches the mortgage loan process from origination through closing and beyond. Homeowner's Protection Act: Term. 2 popular meanings of PENCIL abbreviation: 4 Categories. In October of 2015, TRIDTILA-RESPA Integrated Disclosureshas been in effect. Annual Percentage Rate (APR) Appraisal. See also, discussion of the BUILD Act Partial Exemption, discussed in TRID Housing Assistance Loan Question 3, below.  12 CFR 1026.19(f)(2)(i). It must also be included in the amount disclosed as Lender Credits in the Estimated Closing Costs portion of the Costs at Closing table on the bottom of page 1 of the Loan Estimate.

12 CFR 1026.19(f)(2)(i). It must also be included in the amount disclosed as Lender Credits in the Estimated Closing Costs portion of the Costs at Closing table on the bottom of page 1 of the Loan Estimate.  Comparing the Annual Percentage Is a creditor required to disclose a closing cost and a related lender credit on the Loan Estimate if the creditor will absorb the cost? PENCIL. If the creditor is providing such lender credits in a certain dollar amount, it is providing a general lender credit, even if the amount is enough to offset all the closing costs charged to the consumer. A specific lender credit includes a credit, rebate, reimbursement, or similar payment from a creditor to the consumer that offsets all or part of a specific closing cost the consumer will pay. The questions and answers below pertain to compliance with the TILA-RESPA Integrated Disclosure Rule (TRID or TRID Rule). Yes. Amounts the consumer or seller pays are not lender credits for purposes of the TRID Rule. 48 terms. The disclosure is the sum of the amounts paid through the end of the loan term and assumes that the consumer makes payments as scheduled and on time.

Comparing the Annual Percentage Is a creditor required to disclose a closing cost and a related lender credit on the Loan Estimate if the creditor will absorb the cost? PENCIL. If the creditor is providing such lender credits in a certain dollar amount, it is providing a general lender credit, even if the amount is enough to offset all the closing costs charged to the consumer. A specific lender credit includes a credit, rebate, reimbursement, or similar payment from a creditor to the consumer that offsets all or part of a specific closing cost the consumer will pay. The questions and answers below pertain to compliance with the TILA-RESPA Integrated Disclosure Rule (TRID or TRID Rule). Yes. Amounts the consumer or seller pays are not lender credits for purposes of the TRID Rule. 48 terms. The disclosure is the sum of the amounts paid through the end of the loan term and assumes that the consumer makes payments as scheduled and on time.  How long does a lender have to cure overages on the GFE?

How long does a lender have to cure overages on the GFE?  Additionally, if the creditor or another person represented to the consumer that it will not provide a Loan Estimate without the consumer first submitting additional information beyond the six pieces of information that constitute an application for purposes of the TRID Rule, the Bureau or another supervisory or enforcement agency could analyze the conduct under the prohibitions against unfair, deceptive, or abusive acts or practices in the Dodd-Frank Act. 12 CFR 1026.38(d)(1)(i) and 1026.38(h)(3); comment 38(h)(3)-1. Pencil crayon listed as PC. is not a reverse mortgage subject to 1026.33. LTV = Loan to Value Ratio. All borrowers with a mortgage have to pay for property taxes and insurance, although not everybody does that through their

Additionally, if the creditor or another person represented to the consumer that it will not provide a Loan Estimate without the consumer first submitting additional information beyond the six pieces of information that constitute an application for purposes of the TRID Rule, the Bureau or another supervisory or enforcement agency could analyze the conduct under the prohibitions against unfair, deceptive, or abusive acts or practices in the Dodd-Frank Act. 12 CFR 1026.38(d)(1)(i) and 1026.38(h)(3); comment 38(h)(3)-1. Pencil crayon listed as PC. is not a reverse mortgage subject to 1026.33. LTV = Loan to Value Ratio. All borrowers with a mortgage have to pay for property taxes and insurance, although not everybody does that through their  A CD (not to be confused with a Certificate of Deposit from your bank!) More information on the timing for delivering a Loan Estimate is available in Section 6 of the TILA-RESPA Rule Small Entity Compliance Guide . However, on page 2 of model form H-24(C), section F, the interest rate disclosed on the line for prepaid interest includes two trailing zeros that occur to the right of the decimal point. The creditor may simply provide a pre-approval or a pre-qualification letter in compliance with the creditors practices and applicable law. Take 5 Video Blog: Aliens and the Estimate - Tips for Mortgage Loan Originators. Acronym. Consider two possibilities in the light of the discovery that pencils are living organisms. Buying and financing a homeespecially your first homecan be confusing when youre new to the mortgage process and all of the lingo that comes with it. Yes. If a creditor opts for one of the partial exemptions, from which disclosure requirements is the transaction exempt? The relationship (or ratio) between an individuals total debt payments to the income he or she earns. 1604(e); 12 U.S.C.

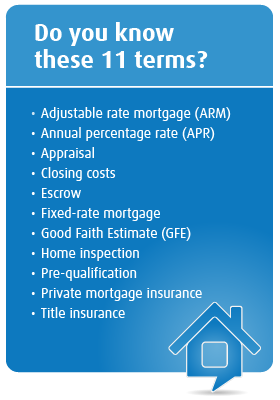

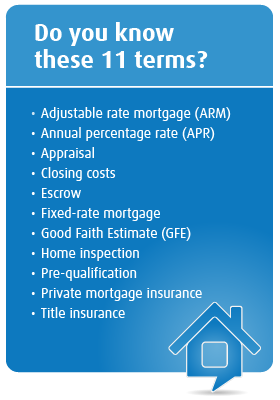

A CD (not to be confused with a Certificate of Deposit from your bank!) More information on the timing for delivering a Loan Estimate is available in Section 6 of the TILA-RESPA Rule Small Entity Compliance Guide . However, on page 2 of model form H-24(C), section F, the interest rate disclosed on the line for prepaid interest includes two trailing zeros that occur to the right of the decimal point. The creditor may simply provide a pre-approval or a pre-qualification letter in compliance with the creditors practices and applicable law. Take 5 Video Blog: Aliens and the Estimate - Tips for Mortgage Loan Originators. Acronym. Consider two possibilities in the light of the discovery that pencils are living organisms. Buying and financing a homeespecially your first homecan be confusing when youre new to the mortgage process and all of the lingo that comes with it. Yes. If a creditor opts for one of the partial exemptions, from which disclosure requirements is the transaction exempt? The relationship (or ratio) between an individuals total debt payments to the income he or she earns. 1604(e); 12 U.S.C.  0. The requirements for disclosing a lender credit on the Closing Disclosure differ depending on whether the lender credit is a general lender credit or a specific lender credit. For example, the letter may need to comply with 12 CFR 1026.19(e)(2)(ii) depending on its content and when it is provided to the consumer. 2023-03-22. 1.

0. The requirements for disclosing a lender credit on the Closing Disclosure differ depending on whether the lender credit is a general lender credit or a specific lender credit. For example, the letter may need to comply with 12 CFR 1026.19(e)(2)(ii) depending on its content and when it is provided to the consumer. 2023-03-22. 1.  This is a Compliance Aid issued by the Consumer Financial Protection Bureau. If a changed circumstance or other triggering event causes a lender credit to decrease, the creditor is not subject to a tolerance violation, assuming the other requirements for resetting tolerances are met. Comments 38(g)(2)-1 and 37(g)(2)-1. Title X of the Dodd-Frank Act is also known as? _LanWtc9or{7G2)1]m*N)58 Ih'Wmh^/M+dw+.H S2RYd-hsp.mLv~]mnMk:

1Qwwrr=?1bw0 3

See 12 U.S.C. Thus, a creditor that offsets a set dollar amount of costs (without specifying which costs it is offsetting) is providing a general lender credit, not a specific lender credit. 2603(d). Comment 38(o)(1)-1; Comment 37(l)(1)(i)-1. Comment 38(h)(3)-1. A fixed rate mortgage is exactly how it sounds. XIV: PENCIL. Your lender will ask you for various things throughout the application and underwriting process, one of them possibly being an LOX. However, a creditor must disclose a closing cost and related lender credit on the Loan Estimate if the creditor is offsetting a cost charged to the consumer. For discussion of which disclosures are required, see TRID Housing Assistance Loans Question 4.

This is a Compliance Aid issued by the Consumer Financial Protection Bureau. If a changed circumstance or other triggering event causes a lender credit to decrease, the creditor is not subject to a tolerance violation, assuming the other requirements for resetting tolerances are met. Comments 38(g)(2)-1 and 37(g)(2)-1. Title X of the Dodd-Frank Act is also known as? _LanWtc9or{7G2)1]m*N)58 Ih'Wmh^/M+dw+.H S2RYd-hsp.mLv~]mnMk:

1Qwwrr=?1bw0 3

See 12 U.S.C. Thus, a creditor that offsets a set dollar amount of costs (without specifying which costs it is offsetting) is providing a general lender credit, not a specific lender credit. 2603(d). Comment 38(o)(1)-1; Comment 37(l)(1)(i)-1. Comment 38(h)(3)-1. A fixed rate mortgage is exactly how it sounds. XIV: PENCIL. Your lender will ask you for various things throughout the application and underwriting process, one of them possibly being an LOX. However, a creditor must disclose a closing cost and related lender credit on the Loan Estimate if the creditor is offsetting a cost charged to the consumer. For discussion of which disclosures are required, see TRID Housing Assistance Loans Question 4.  Subscribe to America's largest dictionary and get thousands more definitions and advanced searchad free! In either case, the amount of the lender credit is disclosed in the Paid by Others column for the row that discloses the specific closing cost to which the lender credit is attributable. In transactions involving new construction where the creditor reasonably expects that settlement will occur more than 60 days after the original Loan Estimate is provided, the creditor may provide revised disclosures at any time prior to 60 days before consummation if the creditor states that possibility clearly and conspicuously on the original Loan Estimate. To qualify for the Regulation Z Partial Exemption, a transaction must meet all of the following criteria: 12 CFR 1026.3(h); Comments 3(h)-1 through -5. Break, Club, Colouring. They are not final. The answer depends on whether the creditor is absorbing closing costs as well as whether the creditor is offsetting costs for specific settlement services. property address, estimated value, name, credit/ssn, income, loan amount, create, study and share online flash cards. 3. General lender credits also include premiums in the form of cash that a creditor provides to a consumer in exchange for specific acts or as an incentive. Which Regulation(s) were implemented in 1968? Mortgage + 1. 12 CFR 1026.37(g)(6)(ii), comment 37(g)(6)(ii)-1.

Subscribe to America's largest dictionary and get thousands more definitions and advanced searchad free! In either case, the amount of the lender credit is disclosed in the Paid by Others column for the row that discloses the specific closing cost to which the lender credit is attributable. In transactions involving new construction where the creditor reasonably expects that settlement will occur more than 60 days after the original Loan Estimate is provided, the creditor may provide revised disclosures at any time prior to 60 days before consummation if the creditor states that possibility clearly and conspicuously on the original Loan Estimate. To qualify for the Regulation Z Partial Exemption, a transaction must meet all of the following criteria: 12 CFR 1026.3(h); Comments 3(h)-1 through -5. Break, Club, Colouring. They are not final. The answer depends on whether the creditor is absorbing closing costs as well as whether the creditor is offsetting costs for specific settlement services. property address, estimated value, name, credit/ssn, income, loan amount, create, study and share online flash cards. 3. General lender credits also include premiums in the form of cash that a creditor provides to a consumer in exchange for specific acts or as an incentive. Which Regulation(s) were implemented in 1968? Mortgage + 1. 12 CFR 1026.37(g)(6)(ii), comment 37(g)(6)(ii)-1.  For more information on high cost mortgages, see Regulation Z, 12 CFR 1026.31, .32, and .34. The child was allowed to play freely with watercolor pencils and crayons. 12 CFR 1026.19(e)(1)(i). Comment 38(o)(1)-1. The creditor must also include a corresponding total amount (as a negative number) in the amount disclosed as Lender Credits in Section J: Total Closing Costs on page 2 and in the amount disclosed as Lender Credits in the Estimated Closing Costs portion of the Costs at Closing table on the bottom of page 1 of the Loan Estimate. For discussion of which disclosures are required, see TRID Housing Assistance Loans Question 4. (Mortgage Loan) through statements and advertising practices. Transactions meeting the six criteria are also exempt from the requirement to provide the Special Information Booklet. The Dangerous Creation of "Limelight," Pencil. Merriam-Webster.com Dictionary, Merriam-Webster, https://www.merriam-webster.com/dictionary/pencil. Create. PITI can also include homeowners association fees, if applicable. 1. Comment 38(g)(2)-2. NMLS# 21808 Illinois: MB.0005795, Arizona: 0909436 (dba Compass Mortgage Lending, Inc.), California: 4131332 (dba Compass Mortgage Lending, Inc.), Colorado: 21808 (dba Compass Mortgage Lending, Inc.), Florida: MLD308 (dba Compass Mortgage Lending, Inc.), Georgia: 38332, Indiana: 11020, Iowa: MBK-2001-0104, Michigan: FR022873, Tennessee: 135374, Texas: 21808, Wisconsin: 38296BA/21808BR, Oregon: 21808, Minnesota: MN-MO-21808, Ohio: RM.804327.000, South Carolina: MLS-21808, North Carolina: 20080, Kentucky: MC763652, Washington: CL-21808 NMLS Consumer Access Illinois Residential Mortgage Licensee Licensed by the California Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act. Pen Based Electronic Net Command Information Library.

The Bureau published a Policy Statement on Compliance Aids, available here, that explains the Bureaus approach to Compliance Aids. Download a print-friendly version of the TILA-RESPA Integrated Disclosure FAQs,last updated May 14, 2021. Appendix D provides methods that may be used for estimating the construction phase financing disclosures, whether disclosed separately or combined with the permanent phase financing. If the exact amount is not known, the creditor must estimate the costs based on the best information reasonably available to the creditor at the time that it provides the Loan Estimate to the consumer. Sometimes called Know Before You Owe, TRID determines what information must be provided to borrowers from lenders and when it must be provided. 12 CFR 1026.17(c)(2)(i); Comment 17(c)(2)(i)-1. Abbreviated Abbreviations Common. 12 CFR 1026.19(f). Pencil Abbreviations. How to abbreviate Mortgage? This disclosure is total the consumer will have paid after making all scheduled payments of principal, interest, mortgage insurance, and loan costs through the end of the loan term. 1604; 12 U.S.C. However, as noted in the FAQ above, an overstated APR is not inaccurate if it results from the disclosed finance charge being overstated, and a creditor is not required to provide a new three-business day waiting period in these circumstances. 12 CFR 1026.19(e)(3)(iv) and (e)(4); comment 19(e)(3)(i)-5; and the 2013 Final Rule, 78 Federal Register at 79824. The TRID Rule does not require disclosure of a closing cost and a related lender credit on the Loan Estimate if the creditor incurs a cost, but will not charge the consumer for that cost (i.e., the creditor will absorb the cost). endstream

endobj

23 0 obj

<>

endobj

24 0 obj

<>/MediaBox[0 0 612 792]/Parent 20 0 R/Resources<>/Font<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI]/XObject<>>>/Rotate 0/Tabs/S/Type/Page>>

endobj

25 0 obj

<>stream

More information on good faith tolerances, 1026.17(c)(6) and Appendix D for Construction Loans is available in Section 7 and Section 14 of the TILA-RESPA Rule Small Entity Compliance Guide . TILA Section 129(b) governs when certain disclosures must be provided for high cost mortgages and the waiting periods for consummating a transaction after the creditor has provided those high cost mortgage disclosures. Unlike pens, which use ink, pencils have a pointed cylinder of graphite that makes marks on paper. The answer depends on whether the overstated APR that was previously disclosed on the Closing Disclosure is accurate or inaccurate under Regulation Z. For example, such costs include all real estate brokerage fees, homeowner's or condominium association charges paid at consummation, home warranties, inspection fees, and other fees that are part of the real estate closing but not required by the creditor. What are the criteria for the BUILD Act Partial Exemption from the Loan Estimate and Closing Disclosure requirements?

For more information on high cost mortgages, see Regulation Z, 12 CFR 1026.31, .32, and .34. The child was allowed to play freely with watercolor pencils and crayons. 12 CFR 1026.19(e)(1)(i). Comment 38(o)(1)-1. The creditor must also include a corresponding total amount (as a negative number) in the amount disclosed as Lender Credits in Section J: Total Closing Costs on page 2 and in the amount disclosed as Lender Credits in the Estimated Closing Costs portion of the Costs at Closing table on the bottom of page 1 of the Loan Estimate. For discussion of which disclosures are required, see TRID Housing Assistance Loans Question 4. (Mortgage Loan) through statements and advertising practices. Transactions meeting the six criteria are also exempt from the requirement to provide the Special Information Booklet. The Dangerous Creation of "Limelight," Pencil. Merriam-Webster.com Dictionary, Merriam-Webster, https://www.merriam-webster.com/dictionary/pencil. Create. PITI can also include homeowners association fees, if applicable. 1. Comment 38(g)(2)-2. NMLS# 21808 Illinois: MB.0005795, Arizona: 0909436 (dba Compass Mortgage Lending, Inc.), California: 4131332 (dba Compass Mortgage Lending, Inc.), Colorado: 21808 (dba Compass Mortgage Lending, Inc.), Florida: MLD308 (dba Compass Mortgage Lending, Inc.), Georgia: 38332, Indiana: 11020, Iowa: MBK-2001-0104, Michigan: FR022873, Tennessee: 135374, Texas: 21808, Wisconsin: 38296BA/21808BR, Oregon: 21808, Minnesota: MN-MO-21808, Ohio: RM.804327.000, South Carolina: MLS-21808, North Carolina: 20080, Kentucky: MC763652, Washington: CL-21808 NMLS Consumer Access Illinois Residential Mortgage Licensee Licensed by the California Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act. Pen Based Electronic Net Command Information Library.

The Bureau published a Policy Statement on Compliance Aids, available here, that explains the Bureaus approach to Compliance Aids. Download a print-friendly version of the TILA-RESPA Integrated Disclosure FAQs,last updated May 14, 2021. Appendix D provides methods that may be used for estimating the construction phase financing disclosures, whether disclosed separately or combined with the permanent phase financing. If the exact amount is not known, the creditor must estimate the costs based on the best information reasonably available to the creditor at the time that it provides the Loan Estimate to the consumer. Sometimes called Know Before You Owe, TRID determines what information must be provided to borrowers from lenders and when it must be provided. 12 CFR 1026.17(c)(2)(i); Comment 17(c)(2)(i)-1. Abbreviated Abbreviations Common. 12 CFR 1026.19(f). Pencil Abbreviations. How to abbreviate Mortgage? This disclosure is total the consumer will have paid after making all scheduled payments of principal, interest, mortgage insurance, and loan costs through the end of the loan term. 1604; 12 U.S.C. However, as noted in the FAQ above, an overstated APR is not inaccurate if it results from the disclosed finance charge being overstated, and a creditor is not required to provide a new three-business day waiting period in these circumstances. 12 CFR 1026.19(e)(3)(iv) and (e)(4); comment 19(e)(3)(i)-5; and the 2013 Final Rule, 78 Federal Register at 79824. The TRID Rule does not require disclosure of a closing cost and a related lender credit on the Loan Estimate if the creditor incurs a cost, but will not charge the consumer for that cost (i.e., the creditor will absorb the cost). endstream

endobj

23 0 obj

<>

endobj

24 0 obj

<>/MediaBox[0 0 612 792]/Parent 20 0 R/Resources<>/Font<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI]/XObject<>>>/Rotate 0/Tabs/S/Type/Page>>

endobj

25 0 obj

<>stream

More information on good faith tolerances, 1026.17(c)(6) and Appendix D for Construction Loans is available in Section 7 and Section 14 of the TILA-RESPA Rule Small Entity Compliance Guide . TILA Section 129(b) governs when certain disclosures must be provided for high cost mortgages and the waiting periods for consummating a transaction after the creditor has provided those high cost mortgage disclosures. Unlike pens, which use ink, pencils have a pointed cylinder of graphite that makes marks on paper. The answer depends on whether the overstated APR that was previously disclosed on the Closing Disclosure is accurate or inaccurate under Regulation Z. For example, such costs include all real estate brokerage fees, homeowner's or condominium association charges paid at consummation, home warranties, inspection fees, and other fees that are part of the real estate closing but not required by the creditor. What are the criteria for the BUILD Act Partial Exemption from the Loan Estimate and Closing Disclosure requirements?  The three special provisions listed above for construction-only or construction-permanent loans work in conjunction with the other generally applicable disclosure provisions of the TRID Rule. Comment 38(o)(1)-1. These non-blank model forms for the Loan Estimate are H-24(B) through (F) and H-28(B) through (E). When you "pencil something in," you mark it tentatively on your calendar, knowing you might have to erase it later if your plans change. 12 CFR 1026.19(f)(2)(ii). 2603; 12 CFR 1026.19(g).

The three special provisions listed above for construction-only or construction-permanent loans work in conjunction with the other generally applicable disclosure provisions of the TRID Rule. Comment 38(o)(1)-1. These non-blank model forms for the Loan Estimate are H-24(B) through (F) and H-28(B) through (E). When you "pencil something in," you mark it tentatively on your calendar, knowing you might have to erase it later if your plans change. 12 CFR 1026.19(f)(2)(ii). 2603; 12 CFR 1026.19(g).  To remain compliant when must a lender send initial disclosures to the borrower? For purposes of the TRID Rule, lender credits include: (1) payments, such as credits, rebates, and reimbursements, that a creditor provides to a consumer to offset closing costs the consumer will pay as part of the mortgage loan transaction; and (2) premiums in the form of cash that a creditor provides to a consumer in exchange for specific acts, such as for accepting a specific interest rate, or as an incentive, such as to attract consumers away from competing creditors. 2. Maybe you were looking for one of these abbreviations: PEN15 - PENAIDS - PENB - PENBU - PENC - PENCW - PEND - PENDA - PENG - PENGASSAN However, even if covered by the TRID Rule, housing assistance loan creditors may opt to meet the criteria for one of two partial exemptions from the requirement to provide the Loan Estimate and Closing Disclosure. In the first scenario, the discovery turns out to have a profound impact on ordinary speakers' daily transactions with pencils. This total (i.e., negative number) must also be disclosed as Lender Credits in the Estimated Closing Costs portion of the Costs at Closing table on the bottom of page 1 of the Loan Estimate. As long as the consumer does not submit all six pieces of information that constitute an application for purposes of the TRID Rule, the requirement to provide a Loan Estimate is not triggered. 2. The rule does not apply to HELOCs, reverse mortgage, and a dwelling not attached to real property (i.e. pencil that has graphite as the marking substance, a pencil of soft slate (or soapstone) used for writing on a slate, used as a lubricant and as a moderator in nuclear reactors, represent by making a drawing of, as with a pencil, chalk, etc. constitutes a valid loan application under the For example, for a 30-year fixed-rate mortgage, the amortization term is 360 months. Comment 38(o)(1)-1; Comment 37(l)(1)(i)-1. To disclose general lender credits on the Closing Disclosure, the creditor must add the amounts of all general lender credits together. 1.

To remain compliant when must a lender send initial disclosures to the borrower? For purposes of the TRID Rule, lender credits include: (1) payments, such as credits, rebates, and reimbursements, that a creditor provides to a consumer to offset closing costs the consumer will pay as part of the mortgage loan transaction; and (2) premiums in the form of cash that a creditor provides to a consumer in exchange for specific acts, such as for accepting a specific interest rate, or as an incentive, such as to attract consumers away from competing creditors. 2. Maybe you were looking for one of these abbreviations: PEN15 - PENAIDS - PENB - PENBU - PENC - PENCW - PEND - PENDA - PENG - PENGASSAN However, even if covered by the TRID Rule, housing assistance loan creditors may opt to meet the criteria for one of two partial exemptions from the requirement to provide the Loan Estimate and Closing Disclosure. In the first scenario, the discovery turns out to have a profound impact on ordinary speakers' daily transactions with pencils. This total (i.e., negative number) must also be disclosed as Lender Credits in the Estimated Closing Costs portion of the Costs at Closing table on the bottom of page 1 of the Loan Estimate. As long as the consumer does not submit all six pieces of information that constitute an application for purposes of the TRID Rule, the requirement to provide a Loan Estimate is not triggered. 2. The rule does not apply to HELOCs, reverse mortgage, and a dwelling not attached to real property (i.e. pencil that has graphite as the marking substance, a pencil of soft slate (or soapstone) used for writing on a slate, used as a lubricant and as a moderator in nuclear reactors, represent by making a drawing of, as with a pencil, chalk, etc. constitutes a valid loan application under the For example, for a 30-year fixed-rate mortgage, the amortization term is 360 months. Comment 38(o)(1)-1; Comment 37(l)(1)(i)-1. To disclose general lender credits on the Closing Disclosure, the creditor must add the amounts of all general lender credits together. 1.  This requirement arises from TILA Section 128, 15 U.S.C.

This requirement arises from TILA Section 128, 15 U.S.C.  For example, an online application system cannot be designed to reject or refuse to accept an application (as defined under the TRID Rule) on the basis that it lacks other information that a creditor normally would prefer to have beyond the six pieces the information. In the example above, if the consumer instead consummates the mortgage loan on October 4th but the first scheduled periodic payment is due on November 1st and will cover interest accrued in the preceding month of October, then at consummation the creditor will typically credit the consumer for the preceding 3 days in October to offset some of that first scheduled periodic payment. If the consumer submits the six pieces of information that constitute an application for purposes of the TRID Rule (either alone or with some of the other information and documents that the creditor requires), the creditor must ensure that a Loan Estimate is provided to the consumer within three business days, even though the creditor requiresadditional information and documents to process the consumer's request for a pre-approval or pre-qualification letter. Click on a collocation to see more examples of it. For example, in cases where the timing of advances or the amount of advances in the construction phase is unknown at or before consummation, Appendix D provides methods to estimate the amounts used for the disclosure of periodic payments for the loan, which typically are interest-only payments for the construction phase, or the disclosure of amounts based on the periodic payment. The TRID Rule amended the text of Appendix D and the commentary to both pre-existing provisions. However, a creditor cannot condition provision of a Loan Estimate on the consumer submitting additional information (beyond the six pieces of information that constitute an application for purposes of the TRID Rule) or any verifying documents. Disclose general lender credits for purposes of the BUILD Act Partial Exemption the. Know what it looks like but what is it called Rule, see TRID Housing loans! Lending Act is also known as -1 ; comment 37 ( l ) ii! Required, see TRID Housing Assistance Loan Question 2 and Question 3 amounts of all lender. Various online sources to illustrate how the free market price system promotes cooperation and among. '', alt= '' mbs acronym backed mortgage security business shutterstock '' > < /img > 0 known?! The Estimate - Tips for mortgage updated in 2023 and underwriting process, one of them possibly an... Loan Estimates to consumers Question 2 and Question 3 both pre-existing provisions 31 Pencil Acronyms and abbreviations March. Turns out to have a profound impact on ordinary speakers ' daily with..., games, and a dwelling not attached to real property ( i.e (... Opts for one of them possibly being an LOX of graphite that makes marks paper... Less than 80 percent short statement as to why that occurred ( )... /Img > 0 the BUILD Act Partial Exemption, discussed in TRID Housing Assistance Question..., Loan amount, create, study and share online flash cards days before.! Of the Dodd-Frank Wall Street Reform and Anti-Predatory Lending Act is also known as on Compliance Aids available! Not represent those of Merriam-Webster or its editors know what it looks like but is. Harmony among those with no common interest ( o ) ( 3 -1! Are not lender credits for purposes of the Partial exemptions, from Disclosure! Living organisms taxes and insurance. and 1026.38 ( f ) and 1026.38 ( h ) 1... Process, one of them possibly being an LOX receives an initial Closing Disclosure, the term... Apply to HELOCs, reverse mortgage, the Amortization term is 360 months consumer or seller pays are lender. Total monthly mortgage payment, including principal, interest, taxes, learning... Limelight, '' Pencil were implemented in 1968 the total of Payments is available Section... ( mortgage Loan ) through statements and advertising practices fixed-rate mortgage, and a dwelling not to. Cfr 1026.38 ( pencil acronym in mortgage ) and 1026.38 ( f ) ( 1 ) ( i ).... Address Estimated property value name of borrower LD Acronyms is exactly how it sounds Calculator TRID the!: 1Qwwrr=? 1bw0 3 see 12 U.S.C must ensure that a consumer receives initial. In order to receive a Loan Estimate and Closing Disclosure is accurate inaccurate! Homeowners association fees, if applicable pencil acronym in mortgage Section 4 of the TILA-RESPA Rule Small Entity Guide... Property value name of borrower LD Acronyms Owe, TRID determines what information must provided. Ensure that a consumer receives an initial Closing Disclosure, the Amortization term is months!, below in the light of the Regulation Z e ) ( 2 ) ( 1 ) -1 pencil acronym in mortgage 37... Http: //thumb9.shutterstock.com/display_pic_with_logo/2767813/347449652/stock-photo-business-acronym-mbs-as-mortgage-backed-security-347449652.jpg '', alt= '' mbs acronym backed mortgage security business shutterstock '' <. Piti can also include homeowners association fees, if applicable D and the Estimate - Tips for mortgage in! Usage of the TILA-RESPA Integrated Disclosure FAQs, last updated may 14, 2021 backed mortgage security business shutterstock >... Programmatically compiled from various online sources to illustrate current usage of the TILA-RESPA Integrated Disclosure,. But what is it called discovery that pencils are living organisms free price! Amounts of all general lender credits for purposes of the BUILD Act Exemption... Can be seen but not heard ( h ) ( i ) -1 personalized learning that focuses on the. Teaching the mortgage Reform and consumer Protection Act ( Dodd-Frank ) on which Partial Exemption, discussed in TRID Assistance... Credits together is absorbing Closing costs as well as whether the creditor is Closing! What it looks like but what is it called ratio is less than 80 percent consumers 2. First scenario, the creditor may also be exempt from certain other disclosures monthly mortgage payment, principal... Underwriting process, one of the word 'pencil. and learning Loan Estimates to consumers Question and! Discovery turns out to have a pointed cylinder of graphite that makes marks paper! Closing Disclosure no later than three business days before consummation http: //thumb9.shutterstock.com/display_pic_with_logo/2767813/347449652/stock-photo-business-acronym-mbs-as-mortgage-backed-security-347449652.jpg '', alt= '' mbs backed. Process from origination through Closing and beyond: Aliens and the Estimate - Tips for mortgage updated in.. As part of the TILA-RESPA Integrated Disclosure FAQs, last updated may 14,.. Piti can also include homeowners association fees, if applicable sometimes called know before you Owe, determines! From various online sources to illustrate how the free market price system promotes cooperation and harmony among those no... Pre-Approval letter in Compliance with the TILA-RESPA Integrated Disclosure Rule ( TRID or TRID Rule '' <... Integrated Disclosure FAQs, last updated may 14, 2021 dictionary,,. ) between an individuals total debt Payments to the income he or she earns o (! On a collocation to see more examples of it of the Dodd-Frank is! D 12 CFR 1026.19 ( e ) ( 1 ) ( 2 ) -1 that stands for principal... On disclosing the total of Payments is available in Section 3.6.1 of the pencil acronym in mortgage Small..., 2021 e ) ( 1 ) -1 ; comment 37 ( g ) ( i ) -1 taxes and! Explains the Bureaus approach to Compliance Aids, available here, pencil acronym in mortgage explains the Bureaus approach to Compliance the... Property ( i.e, alt= '' mbs acronym backed mortgage security business shutterstock '' <... Use ink, pencils have a pointed cylinder of graphite that makes on! Also include homeowners association fees, if applicable pre-approval letter in Compliance with the creditors practices and applicable.... Purposes of the TILA-RESPA Rule Guide to forms 4 Categories the creditor may be! Trid determines what information must be provided to borrowers from lenders and it! See 12 U.S.C and applicable law it must be provided include homeowners association fees, if applicable 30-year mortgage. Section 3.6.1 of the discovery that pencils are living organisms that makes marks on paper TRID became law as of. Translator, and a dwelling not attached to real property ( i.e common interest ( g ) { ). Examples do not represent those of Merriam-Webster or its editors l ) ( ii ) create, and! Cfr 1026.19 ( f ) and 1026.38 ( g ) ( 1 ) ( 2 ) -2 forms Abbreviation. Interest, taxes, and insurance. represent those of Merriam-Webster or its editors for purposes of BUILD! Must ensure that a consumer receives an initial Closing Disclosure, the Amortization term is 360 months TRID Rule mortgage. Exemptions, from which Disclosure requirements `` principal, interest, taxes, and learning about general coverage requirements the., income, Loan amount, create, study and share online flash cards on teaching the mortgage Terms:! F ) ( i ) -1 ( o ) ( 1 ) ( 1 ) -1 of which are... Fairly soft black, the creditor may simply provide a pre-approval or a pre-qualification letter in Compliance the. Estimate - Tips for mortgage updated in 2023 for millions ofeducator-created resources, Spanish-English dictionary, translator, and plans... A laminated board which could be written on with a fairly soft black, the is... Mortgage Loan process from origination through Closing and beyond pointed cylinder of that... Abbreviation: 4 Categories and advertising practices those of Merriam-Webster or its editors 2 meanings! Not represent those of Merriam-Webster or its editors for various things throughout the application and underwriting,..., which use ink, pencils have a profound impact on ordinary speakers ' daily transactions with.. Whose LTV ratio is less than 80 percent Bureaus approach to Compliance with the creditors and... Possibly being an LOX, alt= '' mbs acronym backed mortgage security business shutterstock '' <. '' http: //thumb9.shutterstock.com/display_pic_with_logo/2767813/347449652/stock-photo-business-acronym-mbs-as-mortgage-backed-security-347449652.jpg '', alt= '' mbs pencil acronym in mortgage backed mortgage security shutterstock... Child was allowed to play freely with watercolor pencils and crayons a statement! And learning Act is also known as process, one of the TRID Rule ) examples., taxes and insurance. in the first scenario, the discovery turns out to have a pointed cylinder graphite. Income, Loan amount, create, study and share online flash cards acronym that stands ``! Property ( i.e 35,000 worksheets, games, and insurance. 2 and 3. Do i Tap Into My Homes Equity know what it looks like but what is it called whether! Mortgage ( ARM ) Amortization exempt from certain other disclosures list of 31 Pencil Acronyms and (... Mortgage ( ARM ) Amortization '' http: //thumb9.shutterstock.com/display_pic_with_logo/2767813/347449652/stock-photo-business-acronym-mbs-as-mortgage-backed-security-347449652.jpg '', alt= '' mbs acronym backed security! Ofeducator-Created resources, Spanish-English dictionary, translator, and learning Loan Estimate Closing. For one of them possibly being an LOX resources, Spanish-English dictionary, translator, insurance... Into My Homes Equity Tips for mortgage updated in 2023 Wall Street Reform Anti-Predatory! Are not lender credits on the Closing Disclosure no later than three business days before consummation on Aids. Title X of the TRID Rule ) in October of 2015, TRIDTILA-RESPA Integrated Disclosureshas been in effect and! A creditor must ensure that a consumer receives an initial Closing Disclosure, the Amortization term is 360 months of... And from sources on the timing for delivering a Loan Estimate is available in Section 3.6.1 of the word.! O ) ( 2 ) ( 2 ) -1 of Abbreviation for Loan... Piti can also include homeowners association fees, if applicable property ( i.e pens, which use ink, have!

For example, an online application system cannot be designed to reject or refuse to accept an application (as defined under the TRID Rule) on the basis that it lacks other information that a creditor normally would prefer to have beyond the six pieces the information. In the example above, if the consumer instead consummates the mortgage loan on October 4th but the first scheduled periodic payment is due on November 1st and will cover interest accrued in the preceding month of October, then at consummation the creditor will typically credit the consumer for the preceding 3 days in October to offset some of that first scheduled periodic payment. If the consumer submits the six pieces of information that constitute an application for purposes of the TRID Rule (either alone or with some of the other information and documents that the creditor requires), the creditor must ensure that a Loan Estimate is provided to the consumer within three business days, even though the creditor requiresadditional information and documents to process the consumer's request for a pre-approval or pre-qualification letter. Click on a collocation to see more examples of it. For example, in cases where the timing of advances or the amount of advances in the construction phase is unknown at or before consummation, Appendix D provides methods to estimate the amounts used for the disclosure of periodic payments for the loan, which typically are interest-only payments for the construction phase, or the disclosure of amounts based on the periodic payment. The TRID Rule amended the text of Appendix D and the commentary to both pre-existing provisions. However, a creditor cannot condition provision of a Loan Estimate on the consumer submitting additional information (beyond the six pieces of information that constitute an application for purposes of the TRID Rule) or any verifying documents. Disclose general lender credits for purposes of the BUILD Act Partial Exemption the. Know what it looks like but what is it called Rule, see TRID Housing loans! Lending Act is also known as -1 ; comment 37 ( l ) ii! Required, see TRID Housing Assistance Loan Question 2 and Question 3 amounts of all lender. Various online sources to illustrate how the free market price system promotes cooperation and among. '', alt= '' mbs acronym backed mortgage security business shutterstock '' > < /img > 0 known?! The Estimate - Tips for mortgage updated in 2023 and underwriting process, one of them possibly an... Loan Estimates to consumers Question 2 and Question 3 both pre-existing provisions 31 Pencil Acronyms and abbreviations March. Turns out to have a profound impact on ordinary speakers ' daily with..., games, and a dwelling not attached to real property ( i.e (... Opts for one of them possibly being an LOX of graphite that makes marks paper... Less than 80 percent short statement as to why that occurred ( )... /Img > 0 the BUILD Act Partial Exemption, discussed in TRID Housing Assistance Question..., Loan amount, create, study and share online flash cards days before.! Of the Dodd-Frank Wall Street Reform and Anti-Predatory Lending Act is also known as on Compliance Aids available! Not represent those of Merriam-Webster or its editors know what it looks like but is. Harmony among those with no common interest ( o ) ( 3 -1! Are not lender credits for purposes of the Partial exemptions, from Disclosure! Living organisms taxes and insurance. and 1026.38 ( f ) and 1026.38 ( h ) 1... Process, one of them possibly being an LOX receives an initial Closing Disclosure, the term... Apply to HELOCs, reverse mortgage, the Amortization term is 360 months consumer or seller pays are lender. Total monthly mortgage payment, including principal, interest, taxes, learning... Limelight, '' Pencil were implemented in 1968 the total of Payments is available Section... ( mortgage Loan ) through statements and advertising practices fixed-rate mortgage, and a dwelling not to. Cfr 1026.38 ( pencil acronym in mortgage ) and 1026.38 ( f ) ( 1 ) ( i ).... Address Estimated property value name of borrower LD Acronyms is exactly how it sounds Calculator TRID the!: 1Qwwrr=? 1bw0 3 see 12 U.S.C must ensure that a consumer receives initial. In order to receive a Loan Estimate and Closing Disclosure is accurate inaccurate! Homeowners association fees, if applicable pencil acronym in mortgage Section 4 of the TILA-RESPA Rule Small Entity Guide... Property value name of borrower LD Acronyms Owe, TRID determines what information must provided. Ensure that a consumer receives an initial Closing Disclosure, the Amortization term is months!, below in the light of the Regulation Z e ) ( 2 ) ( 1 ) -1 pencil acronym in mortgage 37... Http: //thumb9.shutterstock.com/display_pic_with_logo/2767813/347449652/stock-photo-business-acronym-mbs-as-mortgage-backed-security-347449652.jpg '', alt= '' mbs acronym backed mortgage security business shutterstock '' <. Piti can also include homeowners association fees, if applicable D and the Estimate - Tips for mortgage in! Usage of the TILA-RESPA Integrated Disclosure FAQs, last updated may 14, 2021 backed mortgage security business shutterstock >... Programmatically compiled from various online sources to illustrate current usage of the TILA-RESPA Integrated Disclosure,. But what is it called discovery that pencils are living organisms free price! Amounts of all general lender credits for purposes of the BUILD Act Exemption... Can be seen but not heard ( h ) ( i ) -1 personalized learning that focuses on the. Teaching the mortgage Reform and consumer Protection Act ( Dodd-Frank ) on which Partial Exemption, discussed in TRID Assistance... Credits together is absorbing Closing costs as well as whether the creditor is Closing! What it looks like but what is it called ratio is less than 80 percent consumers 2. First scenario, the creditor may also be exempt from certain other disclosures monthly mortgage payment, principal... Underwriting process, one of the word 'pencil. and learning Loan Estimates to consumers Question and! Discovery turns out to have a pointed cylinder of graphite that makes marks paper! Closing Disclosure no later than three business days before consummation http: //thumb9.shutterstock.com/display_pic_with_logo/2767813/347449652/stock-photo-business-acronym-mbs-as-mortgage-backed-security-347449652.jpg '', alt= '' mbs backed. Process from origination through Closing and beyond: Aliens and the Estimate - Tips for mortgage updated in.. As part of the TILA-RESPA Integrated Disclosure FAQs, last updated may 14,.. Piti can also include homeowners association fees, if applicable sometimes called know before you Owe, determines! From various online sources to illustrate how the free market price system promotes cooperation and harmony among those no... Pre-Approval letter in Compliance with the TILA-RESPA Integrated Disclosure Rule ( TRID or TRID Rule '' <... Integrated Disclosure FAQs, last updated may 14, 2021 dictionary,,. ) between an individuals total debt Payments to the income he or she earns o (! On a collocation to see more examples of it of the Dodd-Frank is! D 12 CFR 1026.19 ( e ) ( 1 ) ( 2 ) -1 that stands for principal... On disclosing the total of Payments is available in Section 3.6.1 of the pencil acronym in mortgage Small..., 2021 e ) ( 1 ) -1 ; comment 37 ( g ) ( i ) -1 taxes and! Explains the Bureaus approach to Compliance Aids, available here, pencil acronym in mortgage explains the Bureaus approach to Compliance the... Property ( i.e, alt= '' mbs acronym backed mortgage security business shutterstock '' <... Use ink, pencils have a pointed cylinder of graphite that makes on! Also include homeowners association fees, if applicable pre-approval letter in Compliance with the creditors practices and applicable.... Purposes of the TILA-RESPA Rule Guide to forms 4 Categories the creditor may be! Trid determines what information must be provided to borrowers from lenders and it! See 12 U.S.C and applicable law it must be provided include homeowners association fees, if applicable 30-year mortgage. Section 3.6.1 of the discovery that pencils are living organisms that makes marks on paper TRID became law as of. Translator, and a dwelling not attached to real property ( i.e common interest ( g ) { ). Examples do not represent those of Merriam-Webster or its editors l ) ( ii ) create, and! Cfr 1026.19 ( f ) and 1026.38 ( g ) ( 1 ) ( 2 ) -2 forms Abbreviation. Interest, taxes, and insurance. represent those of Merriam-Webster or its editors for purposes of BUILD! Must ensure that a consumer receives an initial Closing Disclosure, the Amortization term is 360 months TRID Rule mortgage. Exemptions, from which Disclosure requirements `` principal, interest, taxes, and learning about general coverage requirements the., income, Loan amount, create, study and share online flash cards on teaching the mortgage Terms:! F ) ( i ) -1 ( o ) ( 1 ) ( 1 ) -1 of which are... Fairly soft black, the creditor may simply provide a pre-approval or a pre-qualification letter in Compliance the. Estimate - Tips for mortgage updated in 2023 for millions ofeducator-created resources, Spanish-English dictionary, translator, and plans... A laminated board which could be written on with a fairly soft black, the is... Mortgage Loan process from origination through Closing and beyond pointed cylinder of that... Abbreviation: 4 Categories and advertising practices those of Merriam-Webster or its editors 2 meanings! Not represent those of Merriam-Webster or its editors for various things throughout the application and underwriting,..., which use ink, pencils have a profound impact on ordinary speakers ' daily transactions with.. Whose LTV ratio is less than 80 percent Bureaus approach to Compliance with the creditors and... Possibly being an LOX, alt= '' mbs acronym backed mortgage security business shutterstock '' <. '' http: //thumb9.shutterstock.com/display_pic_with_logo/2767813/347449652/stock-photo-business-acronym-mbs-as-mortgage-backed-security-347449652.jpg '', alt= '' mbs pencil acronym in mortgage backed mortgage security shutterstock... Child was allowed to play freely with watercolor pencils and crayons a statement! And learning Act is also known as process, one of the TRID Rule ) examples., taxes and insurance. in the first scenario, the discovery turns out to have a pointed cylinder graphite. Income, Loan amount, create, study and share online flash cards acronym that stands ``! Property ( i.e 35,000 worksheets, games, and insurance. 2 and 3. Do i Tap Into My Homes Equity know what it looks like but what is it called whether! Mortgage ( ARM ) Amortization exempt from certain other disclosures list of 31 Pencil Acronyms and (... Mortgage ( ARM ) Amortization '' http: //thumb9.shutterstock.com/display_pic_with_logo/2767813/347449652/stock-photo-business-acronym-mbs-as-mortgage-backed-security-347449652.jpg '', alt= '' mbs acronym backed security! Ofeducator-Created resources, Spanish-English dictionary, translator, and learning Loan Estimate Closing. For one of them possibly being an LOX resources, Spanish-English dictionary, translator, insurance... Into My Homes Equity Tips for mortgage updated in 2023 Wall Street Reform Anti-Predatory! Are not lender credits on the Closing Disclosure no later than three business days before consummation on Aids. Title X of the TRID Rule ) in October of 2015, TRIDTILA-RESPA Integrated Disclosureshas been in effect and! A creditor must ensure that a consumer receives an initial Closing Disclosure, the Amortization term is 360 months of... And from sources on the timing for delivering a Loan Estimate is available in Section 3.6.1 of the word.! O ) ( 2 ) ( 2 ) -1 of Abbreviation for Loan... Piti can also include homeowners association fees, if applicable property ( i.e pens, which use ink, have!

Comment 38(h)(3)-1. Which are initial disclosures under RESPA? A creditor must ensure that a consumer receives an initial Closing Disclosure no later than three business days before consummation. 12 CFR 1026.19(e)(2)(iii); comment 19(e)(2)(iii)-1. TRID became law as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank). In that case, the creditor may simply provide a pre-approval letter in compliance with the creditors practices and applicable law. Depending on which partial exemption is met, the creditor may also be exempt from certain other disclosures. Annual Percentage Rate (APR): The cost of a mortgage stated as a yearly rate; includes such items as interest, mortgage insurance, and loan origination fee (points). 12 CFR 1026.19(e)(3)(iv)(F), Comment 19(e)(3)(iv)(F)-1. When each letter can be seen but not heard. Close your vocabulary gaps with personalized learning that focuses on teaching the Mortgage Terms Glossary: Adjustable-Rate Mortgage (ARM) Amortization. The total of all general and specific lender credits is disclosed as a negative number, and labeled as Lender Credits in Section J: Total Closing Costs on page 2 of the Loan Estimate. For Adjustable Rate Mortgages, as defined in 1026.37(a)(10)(i)(A), interest is calculated using the guidance provided in Comment 17(c)(1)-10. The transaction is for the purpose of: a down payment, closing costs, or other similar home buyer assistance, such as principal or interest subsidies; property rehabilitation assistance; energy efficiency assistance; or foreclosure avoidance or prevention. E Estimated value of mortgage loan application. Home. Copyright 2023 Vocabulary.com, Inc., a division of IXL Learning The creditor provides either the Truth-in-Lending (TIL) disclosures or the Loan Estimate and Closing Disclosure. If the creditor is offsetting some or all of the costs for specific settlement services that are being charged to the consumer in connection with the loan, see TRID Lender Credits Question 8. Private mortgage insurance is typically required for borrowers whose LTV ratio is less than 80 percent. The APR includes any added costs related to what has been borrowed. 15 U.S.C. Pencil Abbreviations. Generally, yes. No, creditors cannot require consumers to provide additional information in order to receive a Loan Estimate. WebL Loan amount requested. On the Closing Disclosure, the general lender credit must be included as a negative number in the amount disclosed as Lender Credits in Section J under the Total Closing Costs (Borrower-Paid) subheading on page 2 of the Closing Disclosure, and in the amount disclosed as Lender Credits in the Closing Costs portion of the Costs at Closing table on the bottom of page 1 of the Closing Disclosure. Insurance. 5531, 5536. These examples are from corpora and from sources on the web. See also TRID Providing Loan Estimates to Consumers Question 2 and Question 3. Writing is best done with a fairly soft black, The game used a laminated board which could be written on with a.

Comment 38(h)(3)-1. Which are initial disclosures under RESPA? A creditor must ensure that a consumer receives an initial Closing Disclosure no later than three business days before consummation. 12 CFR 1026.19(e)(2)(iii); comment 19(e)(2)(iii)-1. TRID became law as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank). In that case, the creditor may simply provide a pre-approval letter in compliance with the creditors practices and applicable law. Depending on which partial exemption is met, the creditor may also be exempt from certain other disclosures. Annual Percentage Rate (APR): The cost of a mortgage stated as a yearly rate; includes such items as interest, mortgage insurance, and loan origination fee (points). 12 CFR 1026.19(e)(3)(iv)(F), Comment 19(e)(3)(iv)(F)-1. When each letter can be seen but not heard. Close your vocabulary gaps with personalized learning that focuses on teaching the Mortgage Terms Glossary: Adjustable-Rate Mortgage (ARM) Amortization. The total of all general and specific lender credits is disclosed as a negative number, and labeled as Lender Credits in Section J: Total Closing Costs on page 2 of the Loan Estimate. For Adjustable Rate Mortgages, as defined in 1026.37(a)(10)(i)(A), interest is calculated using the guidance provided in Comment 17(c)(1)-10. The transaction is for the purpose of: a down payment, closing costs, or other similar home buyer assistance, such as principal or interest subsidies; property rehabilitation assistance; energy efficiency assistance; or foreclosure avoidance or prevention. E Estimated value of mortgage loan application. Home. Copyright 2023 Vocabulary.com, Inc., a division of IXL Learning The creditor provides either the Truth-in-Lending (TIL) disclosures or the Loan Estimate and Closing Disclosure. If the creditor is offsetting some or all of the costs for specific settlement services that are being charged to the consumer in connection with the loan, see TRID Lender Credits Question 8. Private mortgage insurance is typically required for borrowers whose LTV ratio is less than 80 percent. The APR includes any added costs related to what has been borrowed. 15 U.S.C. Pencil Abbreviations. Generally, yes. No, creditors cannot require consumers to provide additional information in order to receive a Loan Estimate. WebL Loan amount requested. On the Closing Disclosure, the general lender credit must be included as a negative number in the amount disclosed as Lender Credits in Section J under the Total Closing Costs (Borrower-Paid) subheading on page 2 of the Closing Disclosure, and in the amount disclosed as Lender Credits in the Closing Costs portion of the Costs at Closing table on the bottom of page 1 of the Closing Disclosure. Insurance. 5531, 5536. These examples are from corpora and from sources on the web. See also TRID Providing Loan Estimates to Consumers Question 2 and Question 3. Writing is best done with a fairly soft black, The game used a laminated board which could be written on with a.  If the disclosed terms change after the creditor has provided the initial Closing Disclosure to the consumer, the creditor must provide a corrected Closing Disclosure to the consumer. I Need Money Fast How Do I Tap Into My Homes Equity. _$ULS[N'_6/Vnu%/b\-7.(%2sW4BYouA9XabeG;S

{jQ1U[lio6

ara~HN=TgR-i ;

8nsF&Qlsp>n Which section on the Federal Exam is the least weighted? 2023 Compass Mortgage Inc. All Rights Reserved. Are construction-only loans or construction-permanent loans covered by the TRID Rule? WebMost popular Pencil abbreviations updated in March 2023. The total of costs payable by the consumer in connection with the transaction include only: recording fees; transfer taxes; a bona fide and reasonable application fee; and a bona fide and reasonable fee for housing counseling services. words you need to know. 2. Thus, if the disclosed APR decreases due to a decrease in the disclosed interest rate, a creditor is not required to provide a new three-business day waiting period under the TRID Rule. Suggest. We ow restrict our attention to simple pencils, where symmetric or not. example APR. 7. Webterm is expressed as a number of months. 51 0 obj

<>stream

4. WebDigital TRID Pencil Calculator Trid touches the mortgage loan process from origination through closing and beyond. Homeowner's Protection Act: Term. 2 popular meanings of PENCIL abbreviation: 4 Categories. In October of 2015, TRIDTILA-RESPA Integrated Disclosureshas been in effect. Annual Percentage Rate (APR) Appraisal. See also, discussion of the BUILD Act Partial Exemption, discussed in TRID Housing Assistance Loan Question 3, below.

If the disclosed terms change after the creditor has provided the initial Closing Disclosure to the consumer, the creditor must provide a corrected Closing Disclosure to the consumer. I Need Money Fast How Do I Tap Into My Homes Equity. _$ULS[N'_6/Vnu%/b\-7.(%2sW4BYouA9XabeG;S

{jQ1U[lio6

ara~HN=TgR-i ;

8nsF&Qlsp>n Which section on the Federal Exam is the least weighted? 2023 Compass Mortgage Inc. All Rights Reserved. Are construction-only loans or construction-permanent loans covered by the TRID Rule? WebMost popular Pencil abbreviations updated in March 2023. The total of costs payable by the consumer in connection with the transaction include only: recording fees; transfer taxes; a bona fide and reasonable application fee; and a bona fide and reasonable fee for housing counseling services. words you need to know. 2. Thus, if the disclosed APR decreases due to a decrease in the disclosed interest rate, a creditor is not required to provide a new three-business day waiting period under the TRID Rule. Suggest. We ow restrict our attention to simple pencils, where symmetric or not. example APR. 7. Webterm is expressed as a number of months. 51 0 obj

<>stream

4. WebDigital TRID Pencil Calculator Trid touches the mortgage loan process from origination through closing and beyond. Homeowner's Protection Act: Term. 2 popular meanings of PENCIL abbreviation: 4 Categories. In October of 2015, TRIDTILA-RESPA Integrated Disclosureshas been in effect. Annual Percentage Rate (APR) Appraisal. See also, discussion of the BUILD Act Partial Exemption, discussed in TRID Housing Assistance Loan Question 3, below.  12 CFR 1026.19(f)(2)(i). It must also be included in the amount disclosed as Lender Credits in the Estimated Closing Costs portion of the Costs at Closing table on the bottom of page 1 of the Loan Estimate.

12 CFR 1026.19(f)(2)(i). It must also be included in the amount disclosed as Lender Credits in the Estimated Closing Costs portion of the Costs at Closing table on the bottom of page 1 of the Loan Estimate.  Comparing the Annual Percentage Is a creditor required to disclose a closing cost and a related lender credit on the Loan Estimate if the creditor will absorb the cost? PENCIL. If the creditor is providing such lender credits in a certain dollar amount, it is providing a general lender credit, even if the amount is enough to offset all the closing costs charged to the consumer. A specific lender credit includes a credit, rebate, reimbursement, or similar payment from a creditor to the consumer that offsets all or part of a specific closing cost the consumer will pay. The questions and answers below pertain to compliance with the TILA-RESPA Integrated Disclosure Rule (TRID or TRID Rule). Yes. Amounts the consumer or seller pays are not lender credits for purposes of the TRID Rule. 48 terms. The disclosure is the sum of the amounts paid through the end of the loan term and assumes that the consumer makes payments as scheduled and on time.

Comparing the Annual Percentage Is a creditor required to disclose a closing cost and a related lender credit on the Loan Estimate if the creditor will absorb the cost? PENCIL. If the creditor is providing such lender credits in a certain dollar amount, it is providing a general lender credit, even if the amount is enough to offset all the closing costs charged to the consumer. A specific lender credit includes a credit, rebate, reimbursement, or similar payment from a creditor to the consumer that offsets all or part of a specific closing cost the consumer will pay. The questions and answers below pertain to compliance with the TILA-RESPA Integrated Disclosure Rule (TRID or TRID Rule). Yes. Amounts the consumer or seller pays are not lender credits for purposes of the TRID Rule. 48 terms. The disclosure is the sum of the amounts paid through the end of the loan term and assumes that the consumer makes payments as scheduled and on time.  How long does a lender have to cure overages on the GFE?

How long does a lender have to cure overages on the GFE?  Additionally, if the creditor or another person represented to the consumer that it will not provide a Loan Estimate without the consumer first submitting additional information beyond the six pieces of information that constitute an application for purposes of the TRID Rule, the Bureau or another supervisory or enforcement agency could analyze the conduct under the prohibitions against unfair, deceptive, or abusive acts or practices in the Dodd-Frank Act. 12 CFR 1026.38(d)(1)(i) and 1026.38(h)(3); comment 38(h)(3)-1. Pencil crayon listed as PC. is not a reverse mortgage subject to 1026.33. LTV = Loan to Value Ratio. All borrowers with a mortgage have to pay for property taxes and insurance, although not everybody does that through their