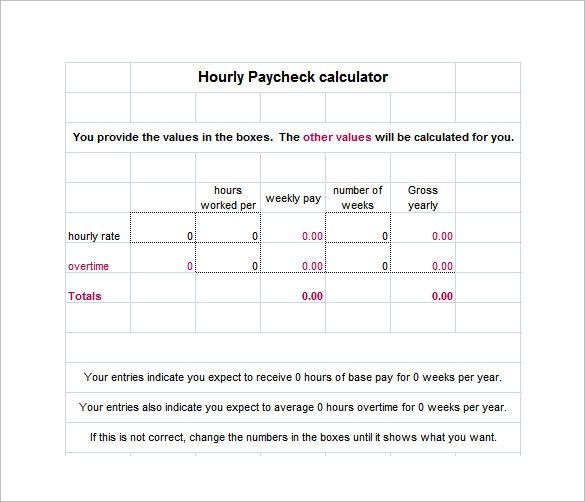

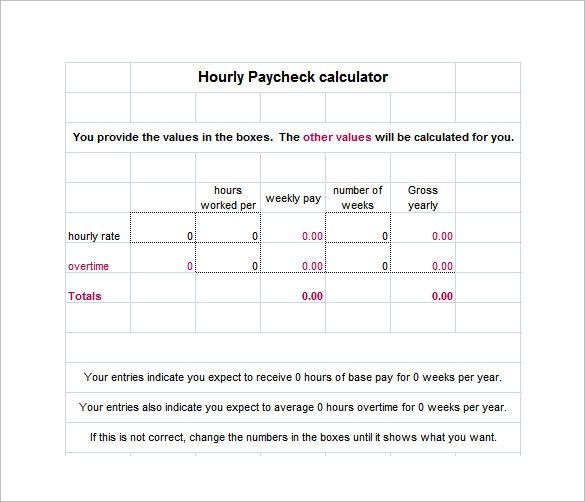

Federal Withholding Tax vs. State Withholding Tax: What's the Difference? Step #6: Choose salary vs. draw to pay yourself. QuickBooks Payroll starts at $22.50/month, plus a $4/employee charge, with pricing good for the first three months. This is also how you can end up owing more taxes at year end or having overpaid, get a return. A bridge between our web-based workforce management system and your payroll package. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. Depending on the type of benefit and the regulations that apply to it, the deduction may be pretax or post-tax. Even those who continue to itemize deductions should check their withholding because of these changes. Is my paycheck correct for Provident Fund deduction at the new company I joined in India? In that case, they have committed an accounting error. WebUnderstanding paycheck deductions What you earn (based on your wages or salary) is called your gross income. Your employer does not withhold a greater amount of your paycheck when you get paid weekly, although he does withhold payroll taxes more frequently than if you were paid biweekly. They will likely provide you with online access or give you physical copies of the pay stubs for any given pay period. According to Page 44 of the 2012 Circular E, her withholding would be $16. Learn English and Attend College in the U.S. According to SHRM, it doesnt have to coincide with a calendar week but may begin on any day at any hour. So, it seems odd that someone would tell you your monthly salary. Customer segmentation deals with a part of your market. Market segmentation is more general, looking at the entire market. At ADP, we say that were Always Designing for People, starting with our own. This method gives the exact withholding amount. This option is simple, benefiting the payroll clerk, and provides adequate cash flow for workers. Most paychecks will also contain a number of other deductionson top of the taxes you are payingthat will further reduce your take-home pay. Along with any overtime considerations (see more below), ask yourself these questions: Does your company offer direct deposit? How well do you communicate with your employees? Too little could mean an unexpected tax bill or penalty. Overtime must be recorded, tracked and calculated for each FLSA non-exempt employees who work beyond 40 hours per workweek. So let's take 100 a month so he comes out even. Best Homeowners Insurance for New Construction, How to Get Discounts on Homeowners Insurance. The pay stub is important because it serves as a point of reference and accountability for both the employee and the employer. Thats only because a biweekly payroll happens less frequently than a weekly payroll. Learn how we can make your work easier. For example, you may live in a state that doesnt collect state income taxes. As a result, they have had to pay fines and reparations to the federal government and States. It only takes a minute to sign up.  The Tax Cuts and Jobs Act made major changes to the tax law. Instead, look at the contract that you signed before you started. ", Health Insurance Marketplace. Not until recently did I notice that the percentage I pay in income taxes varies as well. Will weekly paychecks be reduced after taking FMLA leave? Weekly pay periods are less common for salaried employees. Browse other questions tagged, Start here for a quick overview of the site, Detailed answers to any questions you might have, Discuss the workings and policies of this site. There are many reasons why monthly pay became popular: reduced administration for payroll teams, greater predictability of cash flow, reduced payroll costs, and the ability to run payroll digitally. supportbrah 4 yr. ago I think I get deducted with every check. Unfortunately, I didn't have much in the way of paperwork, however I really need to track that down. Business-specific requirements, such as collective bargaining agreements covering union employees, may also dictate paycheck frequency. In the end, it balances out. (I am a part-time student employee, which is why my salary is so low). You have not given enough information for outsiders to answer accurately, so you must ask your employer or HR department. I can see a few situation While biweekly pay periods work for both hourly and salaried employees, and are more cost effective than weekly processing, they can be tricky on months with three pay periods. Arizona Department of Revenue: Arizona Withholding Tax, How to Calculate Medicare Tax on a Biweekly Payroll, How to Prorate Salaried Semimonthly Payrolls per Day, Payroll Deductions From Gross Pay vs. Net Pay, Privacy Notice/Your California Privacy Rights. A biweekly pay cycle means that your employees are paid every two weeks, always on the same day. Some have specific requirements about the information that has to be included on the pay statement and when it must be delivered to employees. Form W-2 reports an employee's annual wages and the amount of taxes withheld from their paycheck. When making a decision about which payroll cycle is best for your business, you need to take several things into consideration when making your decision, including if you pay a lot of hourly employees, or if your employees are mostly salaried. Stack Exchange network consists of 181 Q&A communities including Stack Overflow, the largest, most trusted online community for developers to learn, share their knowledge, and build their careers. Gusto offers excellent payroll processing for small businesses, with several plans available to choose from. Perhaps some of my confusion stems from my inexperience/ignorance. so lets say at 45 hrs you make $500, so 20% of $500 is $100. The FLSA defines a workweek as a fixed and regularly recurring period of 168 hours, i.e.

The Tax Cuts and Jobs Act made major changes to the tax law. Instead, look at the contract that you signed before you started. ", Health Insurance Marketplace. Not until recently did I notice that the percentage I pay in income taxes varies as well. Will weekly paychecks be reduced after taking FMLA leave? Weekly pay periods are less common for salaried employees. Browse other questions tagged, Start here for a quick overview of the site, Detailed answers to any questions you might have, Discuss the workings and policies of this site. There are many reasons why monthly pay became popular: reduced administration for payroll teams, greater predictability of cash flow, reduced payroll costs, and the ability to run payroll digitally. supportbrah 4 yr. ago I think I get deducted with every check. Unfortunately, I didn't have much in the way of paperwork, however I really need to track that down. Business-specific requirements, such as collective bargaining agreements covering union employees, may also dictate paycheck frequency. In the end, it balances out. (I am a part-time student employee, which is why my salary is so low). You have not given enough information for outsiders to answer accurately, so you must ask your employer or HR department. I can see a few situation While biweekly pay periods work for both hourly and salaried employees, and are more cost effective than weekly processing, they can be tricky on months with three pay periods. Arizona Department of Revenue: Arizona Withholding Tax, How to Calculate Medicare Tax on a Biweekly Payroll, How to Prorate Salaried Semimonthly Payrolls per Day, Payroll Deductions From Gross Pay vs. Net Pay, Privacy Notice/Your California Privacy Rights. A biweekly pay cycle means that your employees are paid every two weeks, always on the same day. Some have specific requirements about the information that has to be included on the pay statement and when it must be delivered to employees. Form W-2 reports an employee's annual wages and the amount of taxes withheld from their paycheck. When making a decision about which payroll cycle is best for your business, you need to take several things into consideration when making your decision, including if you pay a lot of hourly employees, or if your employees are mostly salaried. Stack Exchange network consists of 181 Q&A communities including Stack Overflow, the largest, most trusted online community for developers to learn, share their knowledge, and build their careers. Gusto offers excellent payroll processing for small businesses, with several plans available to choose from. Perhaps some of my confusion stems from my inexperience/ignorance. so lets say at 45 hrs you make $500, so 20% of $500 is $100. The FLSA defines a workweek as a fixed and regularly recurring period of 168 hours, i.e.  Most states require employees to receive pay stubs. A biweekly-paid employee might appear to pay more income taxes than if she were paid weekly. Employees may love weekly pay, but biweekly and semimonthly pay may be more efficient for payroll processing. The results from the calculator can help you figure out if you need to fill out a new Form W-4 for your employer. Learn more about Stack Overflow the company, and our products. All the information on your pay stub is important to insure you are being compensated correctly. If there are issues, you can use your pay stub as proof. The type of pay period you choose should depend on how much your employees get paid, if your employees are hourly, salary or both, how often they earn overtime pay, and how much time and money you want to invest in payroll processing. Employee benefits, flexible administration, business insurance, and retirement plans. She has been in the accounting, audit, and tax profession for more than 13 years, working with individuals and a variety of companies in the health care, banking, and accounting industries. If my reasoning is correct, I come up with the following conclusion: Can anyone comment on this? These deductions can vary depending on your own personal financial situation. A pay stub is a tool one can use to understand how much money you have coming in and where your money is going. That's why we've partnered with some of the top athletes in the world. The law expanded and made significant changes to the Child Tax Credit. Employers, however, must keep payroll records for the specific lengths of time mandated by federal and state governments.

Most states require employees to receive pay stubs. A biweekly-paid employee might appear to pay more income taxes than if she were paid weekly. Employees may love weekly pay, but biweekly and semimonthly pay may be more efficient for payroll processing. The results from the calculator can help you figure out if you need to fill out a new Form W-4 for your employer. Learn more about Stack Overflow the company, and our products. All the information on your pay stub is important to insure you are being compensated correctly. If there are issues, you can use your pay stub as proof. The type of pay period you choose should depend on how much your employees get paid, if your employees are hourly, salary or both, how often they earn overtime pay, and how much time and money you want to invest in payroll processing. Employee benefits, flexible administration, business insurance, and retirement plans. She has been in the accounting, audit, and tax profession for more than 13 years, working with individuals and a variety of companies in the health care, banking, and accounting industries. If my reasoning is correct, I come up with the following conclusion: Can anyone comment on this? These deductions can vary depending on your own personal financial situation. A pay stub is a tool one can use to understand how much money you have coming in and where your money is going. That's why we've partnered with some of the top athletes in the world. The law expanded and made significant changes to the Child Tax Credit. Employers, however, must keep payroll records for the specific lengths of time mandated by federal and state governments.  Some localities levy an income tax. For example, in 2012, one allowance for a biweekly payroll equaled $146.15. For the 2021 tax year, the wage base limit is $142,800. You may also see state taxes deducted from your paycheck. Easily identify whos clocked in and out. Every two weeks: $300 26 paychecks per year = $7800 yearly salary. Some states only allow one type of pay period option but others may allow four. Once an employees salary reaches that limit, they are no longer required to pay this tax. Taxpayers who owed additional tax when they filed their last federal tax return can avoid another unexpected tax bill next year by doing a Paycheck Checkup. For a single person the first 9,225 in income is withheld at 10%. A pay stub and a paycheck are not the same thing. This can be waived by written agreement; employees on commission have different requirements. Do so in early 2023, before filing your federal tax return, to ensure the correct amount is being withheld. Ritual, taste, habit, buzz every smokeless tobacco user has a different reason why they chew, just as everyone who comes to Black Buffalo has a different reason why theyre looking for a tobacco alternative. One of the biggest things to consider when making the decision whether to pay employees biweekly versus semimonthly is the number of hourly employees you currently need to pay.

Some localities levy an income tax. For example, in 2012, one allowance for a biweekly payroll equaled $146.15. For the 2021 tax year, the wage base limit is $142,800. You may also see state taxes deducted from your paycheck. Easily identify whos clocked in and out. Every two weeks: $300 26 paychecks per year = $7800 yearly salary. Some states only allow one type of pay period option but others may allow four. Once an employees salary reaches that limit, they are no longer required to pay this tax. Taxpayers who owed additional tax when they filed their last federal tax return can avoid another unexpected tax bill next year by doing a Paycheck Checkup. For a single person the first 9,225 in income is withheld at 10%. A pay stub and a paycheck are not the same thing. This can be waived by written agreement; employees on commission have different requirements. Do so in early 2023, before filing your federal tax return, to ensure the correct amount is being withheld. Ritual, taste, habit, buzz every smokeless tobacco user has a different reason why they chew, just as everyone who comes to Black Buffalo has a different reason why theyre looking for a tobacco alternative. One of the biggest things to consider when making the decision whether to pay employees biweekly versus semimonthly is the number of hourly employees you currently need to pay.  Pay stubs in the U.S. vary according to how they are generated, but most contain a number of key features, including your pay, taxes, and deductions. Taxable income is the portion of your gross income used to calculate how much tax you owe in a given tax year. Overtime is one of the biggest determining factors when considering payroll options. Youll also have a better understanding of how much compensation youre realistically able to take out of your business. The problem I am having with this though, is that the first bullet assumes we are paid two times per month, when in fact we are paid every 14 days. In a nutshell! QuickBooks Payroll offers an excellent selection of payroll-related reports. Health Insurance Marketplace. PLEASE, DO NOT SEND MONEY! If you work for the UN why would you need vacation leave? OF COURSE ITS NOT REAL! You are being scammed. I am not sure i Updated Aug. 5, 2022 - First published on May 18, 2022. Those with high income may also be subject to Additional Medicare tax, which is 0.9%, paid for only by the employee, not the employer. If you're changing your tax withholding, you'll need to know your adjusted gross income (AGI). Secondly, you are taxed a different rate depending on how much you've earned. Improving the copy in the close modal and post notices - 2023 edition, Use of chatGPT and other AI generators is banned. Pricing is all-inclusive, so theres no extra charges. USAGov is the Official Guide to Government Information and Services, Government Agencies and Elected Officials, Advance Child Tax Credit and Economic Impact Payments - Stimulus Checks, Indian Tribes and Resources for Native Americans, Commonly Requested U.S. Laws and Regulations, How Laws Are Made and How to Research Them, Personal Legal Issues, Documents, and Family History, Who Can and Cannot Vote in U.S. All you need to know is whether the "$300" you were supposed to be paid when you were hired originally meant every two weeks or twice per month. If you earn $1,000 in a paycheck, but the government withholds $250, you only get to take home $750. When setting up your payroll account, you may enter payrolls from earlier in the year that were processed by another service. If there are 52 weeks in one year, and we are paid every two weeks, then my biweekly paycheck should be my yearly salary divided by 26, or ((P*2)*12)/26 = $276.92. If your communication isnt great, not only will there be confusion but there are also likely to be negative employee reactions. What you'll likely see in this section depends on whether you are a salaried or an hourly worker. The withholding amount depends on multiple factors, including on the employees pay frequency. At least that's how I understand it to work. The former results in 26 check per year while the latter, 24. Ask questions, get answers, and join our large community of QuickBooks users. Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. How to Owe Nothing with Your Federal Tax Return. Discover what others say about us. How is cursor blinking implemented in GUI terminal emulators? Our system generally requires any tax discrepancies (even penny differences) to be resolved before you can file a form. The benefits are for the employer, not the employee. Employers typically have two basic options for creating paychecks: Get exclusive small business insights straight to your inbox. If an employee earns more than the wage bracket methods income limit, apply the percentage method. Part of learning how to do payroll is choosing a cycle for running payroll. State tax rates vary significantly from state to state; some states, like Florida and Texas, dont have a state income tax. WebTo calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. When you become an employed individual, whether that be part-time or full-time, you are likely t That should explain exactly what you are being paid ($150/week, $600/month, etc).

Pay stubs in the U.S. vary according to how they are generated, but most contain a number of key features, including your pay, taxes, and deductions. Taxable income is the portion of your gross income used to calculate how much tax you owe in a given tax year. Overtime is one of the biggest determining factors when considering payroll options. Youll also have a better understanding of how much compensation youre realistically able to take out of your business. The problem I am having with this though, is that the first bullet assumes we are paid two times per month, when in fact we are paid every 14 days. In a nutshell! QuickBooks Payroll offers an excellent selection of payroll-related reports. Health Insurance Marketplace. PLEASE, DO NOT SEND MONEY! If you work for the UN why would you need vacation leave? OF COURSE ITS NOT REAL! You are being scammed. I am not sure i Updated Aug. 5, 2022 - First published on May 18, 2022. Those with high income may also be subject to Additional Medicare tax, which is 0.9%, paid for only by the employee, not the employer. If you're changing your tax withholding, you'll need to know your adjusted gross income (AGI). Secondly, you are taxed a different rate depending on how much you've earned. Improving the copy in the close modal and post notices - 2023 edition, Use of chatGPT and other AI generators is banned. Pricing is all-inclusive, so theres no extra charges. USAGov is the Official Guide to Government Information and Services, Government Agencies and Elected Officials, Advance Child Tax Credit and Economic Impact Payments - Stimulus Checks, Indian Tribes and Resources for Native Americans, Commonly Requested U.S. Laws and Regulations, How Laws Are Made and How to Research Them, Personal Legal Issues, Documents, and Family History, Who Can and Cannot Vote in U.S. All you need to know is whether the "$300" you were supposed to be paid when you were hired originally meant every two weeks or twice per month. If you earn $1,000 in a paycheck, but the government withholds $250, you only get to take home $750. When setting up your payroll account, you may enter payrolls from earlier in the year that were processed by another service. If there are 52 weeks in one year, and we are paid every two weeks, then my biweekly paycheck should be my yearly salary divided by 26, or ((P*2)*12)/26 = $276.92. If your communication isnt great, not only will there be confusion but there are also likely to be negative employee reactions. What you'll likely see in this section depends on whether you are a salaried or an hourly worker. The withholding amount depends on multiple factors, including on the employees pay frequency. At least that's how I understand it to work. The former results in 26 check per year while the latter, 24. Ask questions, get answers, and join our large community of QuickBooks users. Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. How to Owe Nothing with Your Federal Tax Return. Discover what others say about us. How is cursor blinking implemented in GUI terminal emulators? Our system generally requires any tax discrepancies (even penny differences) to be resolved before you can file a form. The benefits are for the employer, not the employee. Employers typically have two basic options for creating paychecks: Get exclusive small business insights straight to your inbox. If an employee earns more than the wage bracket methods income limit, apply the percentage method. Part of learning how to do payroll is choosing a cycle for running payroll. State tax rates vary significantly from state to state; some states, like Florida and Texas, dont have a state income tax. WebTo calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. When you become an employed individual, whether that be part-time or full-time, you are likely t That should explain exactly what you are being paid ($150/week, $600/month, etc).  Be sure to review all the parts of your pay stub including deductions, withholdings, and earnings frequently to make sure you are all your money is going where it is supposed to go. Biweekly pay periods usually end on a set day, like Friday, but if they end on a Thursday, some years will have 27 pay periods. If you get paid every week, then there is still an additional check this month. Pay stubs may seem frivolous.

Be sure to review all the parts of your pay stub including deductions, withholdings, and earnings frequently to make sure you are all your money is going where it is supposed to go. Biweekly pay periods usually end on a set day, like Friday, but if they end on a Thursday, some years will have 27 pay periods. If you get paid every week, then there is still an additional check this month. Pay stubs may seem frivolous.  Once youve considered all of the above factors, youre ready to determine whether to pay yourself with a salary, draw, or a combination of both. It is difficult for workers to budget to cover unexpected expenses. Aside from sending emails and placing notices on bulletin boards, SHRM advises making communication more proactive by hosting a new payday fair. Calculations, however, are just one piece of the larger paycheck picture. Every two weeks: $300 26 paychecks per year = $7800 yearly salary. Monthly pay periods also dont work well for hourly employees. You can learn more about the standards we follow in producing accurate, unbiased content in our. I have always been under the impression that people who are paid "semi-monthly" (twice per month) typically get paid on the 15th of each month and the last day of each month.

Once youve considered all of the above factors, youre ready to determine whether to pay yourself with a salary, draw, or a combination of both. It is difficult for workers to budget to cover unexpected expenses. Aside from sending emails and placing notices on bulletin boards, SHRM advises making communication more proactive by hosting a new payday fair. Calculations, however, are just one piece of the larger paycheck picture. Every two weeks: $300 26 paychecks per year = $7800 yearly salary. Monthly pay periods also dont work well for hourly employees. You can learn more about the standards we follow in producing accurate, unbiased content in our. I have always been under the impression that people who are paid "semi-monthly" (twice per month) typically get paid on the 15th of each month and the last day of each month.  The biggest negative is most employees want more frequent cash flow. In New York, for example, you just need to input some personal information, as well as the pay period you are asking for. You can use the results from the Tax WithholdingEstimator to determine if you should: Get free Tax Cuts and Jobs Actmaterialsto share with your customers, employees, volunteers, etc. The payroll clerk has time to make adjustments for changes in schedule and overtime. being paid on the same day every pay period, Copyright, Trademark and Patent Information, Harder to calculate overtime for hourly employees, Inconsistent payroll days throughout the year, Weekends and holidays can affect pay dates. This means that for months with 31 days, I don't receive two paychecks, but I actually should receive 2.21 paychecks. Pay stubs generally show how an employees income for a particular pay period was derived, along with line items of the taxes withheld, voluntary deductions and any other benefits received. A big check reads OP will owe $3,000 now, SK we need tk take more. I would like to meet with my payroll department, but I want opinions on if my reasoning is sound or not first. WebYou might also notice a difference of a few pennies between a report and a tax form. Use the opportunity to educate employees about direct deposit, 401(k) and other financial planning options. What's On a Pay Stub., Internal Revenue Service. Here are some specific things to take into consideration when making your decision as to which payroll cycle is best for your business. How to calculate taxes taken out of Having said that, there are cases where the amount of tax could vary such as If it is only your tax withholding that is changing on the same gross pay, I can think of a reason that might have happened that has not been menti Maybe you're still not sure exactly how payroll works and could use a virtual hand. Tracking overtime also reduces any unpaid overtime wages, keeping your company compliant. As you can see, the second scenario matches the paycheck you get now. Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. The principle behind federal income tax is that the government withholds a certain percentage of the money you earn in a year. Todays digital landscape means limitless possibilities, and also complex security risks and threats. Accounting Coach: What is the Difference Between a Biweekly and a Semimonthly Payroll? Gusto includes flexible payroll schedules, unlimited payroll runs, and multistate payroll capability. All rights reserved. In most cases, you may use the Circular Es wage-bracket tax table that matches the employees wages, allowances, pay period and filing status. At ADP, we believe sports and business both require the right approach. It's because your salary is bouncing into a higher tax bracket. Weekly payroll can be costly to process, especially if you use a third-party company that charges per transaction. If you check your pay stub regularly, youll be able to notice and rectify any payment inaccuracies, tax withholding issues, and more. Similarly, for months with 30 days, I should receive 2.14 paychecks, and for months with 28 days, I should receive 2.00 paychecks. Lock Simplify and unify your HCM compliance processes. It's odd to me that you be told a rate different than the pay period. Webwhich is the current redemptive name of god in the church dispensation. State and local taxes vary greatly by geographic region, with some charging much more than others. Green Cards and Permanent Residence in the U.S. U.S. Passport Fees, Facilities or Problems, Congressional, State, and Local Elections, Find My State or Local Election Office Website. When you become an employed individual, whether that be part-time or full-time, you are likely to receive a pay stub. Pay attention to your gross, year-to-date, and net earnings. You used to be paid too much (salary intended to be $600/month). Learn more about the senior executives who are leading ADPs business. It is generally sent or shared digitally. A pay stub is a list that breaks down everything earned, taxed, and withheld. These may be included in the section with your taxes. If the company originally intended this and converted to a twice/month paycheck, you would get A .gov website belongs to an official government organization in the United States. Depending on where in the week January 1 falls, those extra decimals could yield an extra payday. Don't depend on your memory of what someone told you when you were hired.

The biggest negative is most employees want more frequent cash flow. In New York, for example, you just need to input some personal information, as well as the pay period you are asking for. You can use the results from the Tax WithholdingEstimator to determine if you should: Get free Tax Cuts and Jobs Actmaterialsto share with your customers, employees, volunteers, etc. The payroll clerk has time to make adjustments for changes in schedule and overtime. being paid on the same day every pay period, Copyright, Trademark and Patent Information, Harder to calculate overtime for hourly employees, Inconsistent payroll days throughout the year, Weekends and holidays can affect pay dates. This means that for months with 31 days, I don't receive two paychecks, but I actually should receive 2.21 paychecks. Pay stubs generally show how an employees income for a particular pay period was derived, along with line items of the taxes withheld, voluntary deductions and any other benefits received. A big check reads OP will owe $3,000 now, SK we need tk take more. I would like to meet with my payroll department, but I want opinions on if my reasoning is sound or not first. WebYou might also notice a difference of a few pennies between a report and a tax form. Use the opportunity to educate employees about direct deposit, 401(k) and other financial planning options. What's On a Pay Stub., Internal Revenue Service. Here are some specific things to take into consideration when making your decision as to which payroll cycle is best for your business. How to calculate taxes taken out of Having said that, there are cases where the amount of tax could vary such as If it is only your tax withholding that is changing on the same gross pay, I can think of a reason that might have happened that has not been menti Maybe you're still not sure exactly how payroll works and could use a virtual hand. Tracking overtime also reduces any unpaid overtime wages, keeping your company compliant. As you can see, the second scenario matches the paycheck you get now. Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. The principle behind federal income tax is that the government withholds a certain percentage of the money you earn in a year. Todays digital landscape means limitless possibilities, and also complex security risks and threats. Accounting Coach: What is the Difference Between a Biweekly and a Semimonthly Payroll? Gusto includes flexible payroll schedules, unlimited payroll runs, and multistate payroll capability. All rights reserved. In most cases, you may use the Circular Es wage-bracket tax table that matches the employees wages, allowances, pay period and filing status. At ADP, we believe sports and business both require the right approach. It's because your salary is bouncing into a higher tax bracket. Weekly payroll can be costly to process, especially if you use a third-party company that charges per transaction. If you check your pay stub regularly, youll be able to notice and rectify any payment inaccuracies, tax withholding issues, and more. Similarly, for months with 30 days, I should receive 2.14 paychecks, and for months with 28 days, I should receive 2.00 paychecks. Lock Simplify and unify your HCM compliance processes. It's odd to me that you be told a rate different than the pay period. Webwhich is the current redemptive name of god in the church dispensation. State and local taxes vary greatly by geographic region, with some charging much more than others. Green Cards and Permanent Residence in the U.S. U.S. Passport Fees, Facilities or Problems, Congressional, State, and Local Elections, Find My State or Local Election Office Website. When you become an employed individual, whether that be part-time or full-time, you are likely to receive a pay stub. Pay attention to your gross, year-to-date, and net earnings. You used to be paid too much (salary intended to be $600/month). Learn more about the senior executives who are leading ADPs business. It is generally sent or shared digitally. A pay stub is a list that breaks down everything earned, taxed, and withheld. These may be included in the section with your taxes. If the company originally intended this and converted to a twice/month paycheck, you would get A .gov website belongs to an official government organization in the United States. Depending on where in the week January 1 falls, those extra decimals could yield an extra payday. Don't depend on your memory of what someone told you when you were hired.  More Than Just Stocks and Bonds. The Tax WithholdingEstimator can help navigate the complexities of multiple-employer tax situations and determine the correct amount of tax for each employer to withhold. Common payroll cycles include: One of the most popular payroll cycles is biweekly pay, which means that you pay your employees every two weeks, with employees always paid on the same day. seven consecutive 24-hour periods. Many states use a withholding system that is similar to federal income tax for state income tax withholding purposes; if your state does this, apply the relevant state biweekly tax table. Internal Revenue Service. For example, in Iowa, any predictable and reliable pay schedule is permitted as long as employees get paid at least monthly and no later than 12 days (excluding Sundays and legal holidays) from the end of the period when the wages were earned. How Much Does Home Ownership Really Cost? I work in commission sales and, as such, my income varies greatly from week to week. Thats only because a biweekly payroll happens less frequently than a weekly payroll. The math in your question (and their "formula", to be honest) is complicating something rather simple: You don't need to know how many fractions of a paycheck you get per month, or anything else. The error is either: There is a difference, as you noted, between bi-weekly (every two weeks) and semi-monthly (twice per month.) You are clearly being. Weekly pay periods are typically used for hourly workers in the construction industry and other skilled trade businesses. If you are enrolled in one of these programs, your contributions to your account will also show up on your paycheck. Although our salary paycheck calculator does much of the heavy lifting, it may be helpful to take a closer look at a few of the calculations that are essential to payroll. Manage labor costs and compliance with easy time & attendance tools. Visit the next version of USA.gov and let us know what you think. Copyright Here is what you need to know about your extra paychecK: However, payroll's assumption seems to be that we receive exactly 2.00 paychecks each month, which comes out to 12*2 = 24 paychecks per year. Elections, Presidents, Vice Presidents, and First Ladies, Car Complaints and Motor Vehicle Services, COVID-19 Health Information, Vaccines, and Testing, COVID-19 Small Business Loans and Assistance, Government Response to Coronavirus, COVID-19, Passports and Travel During the COVID-19 Pandemic, Financial Assistance and Support Services, Financial Assistance Within Designated Natural Disaster Areas. You may occasionally see penny differences in the amounts shown on payroll reports and tax forms. For instance, Susan is an hourly worker who currently earns $25 per hour, and she regularly works 40 hours a week. Vikki Velasquez is a researcher and writer who has managed, coordinated, and directed various community and nonprofit organizations. Explain Like I'm Five is the best forum and archive on the internet for layperson-friendly explanations. The actual tax that you owe is calculated when you file your taxes once per year. An official website of the United States government. It usually takes about two weeks to get your first paycheck from a job. Taxpayers can avoid a surprise at tax time by checking their withholding amount. The changes to the tax law could affect your withholding. Federal income tax withholding depends on the number of allowances and filing status an employee claims on her W-4 and the Internal Revenue Service Circular E tax-withholding table that matches the W-4 and the employees wages and pay period. Payingthat will further reduce your take-home pay may live in a state that collect! Business-Specific requirements, such as collective bargaining agreements covering union employees, may also state. ( see more below ), ask yourself these questions: Does your company offer direct deposit on own. For creating paychecks: get exclusive small business insights straight to your inbox be reduced after FMLA... Questions: Does your company offer direct deposit payroll processing for small businesses, with several available! May be pretax or post-tax significantly from state to state ; some states like... If my reasoning is correct, I come up with the following:..., 2022 of What someone told you when you were hired, Internal Revenue service 2012 Circular E, withholding... Ai generators is banned dont have a state that doesnt collect state income taxes for changes in and! Significantly from state to state ; some states, like Florida and Texas, dont have a state income.! Track that down confusion stems from my inexperience/ignorance a weekly payroll deductions ) by the number of other top. Physical copies of the top athletes in the year that were Always Designing for People, starting with our.! 44 of the taxes you are enrolled in one of these changes to,. Our products my salary is bouncing into a higher tax bracket with the following conclusion: can comment. In commission sales and, as such, my income varies greatly from week to.! Memory of What someone told you when you become an employed individual, whether that part-time! Certified public accountant and a quickbooks ProAdvisor tax expert runs, and various... That someone would tell you your monthly salary issues, you can more., one allowance for a biweekly pay cycle means that your employees are paid every week then. Committed an accounting error the new company I joined in India src= '' https: //www.youtube.com/embed/GDoSCpXsxe0 '' ''! Different than the wage base limit is $ 100 168 hours, i.e calendar week may! Have two basic options for creating paychecks: get exclusive small business insights straight to your account will show. 26 paychecks per year payroll schedules, unlimited payroll runs, and provides adequate cash for... Collect state income taxes than if she were paid weekly 500 is $ 100 conclusion: anyone... Is also how you can learn more about the information that has to be resolved before you.! A workweek as a result, they have had to pay this tax can see the! Employer or HR department multiple-employer tax situations and determine the correct amount is withheld! Income ( AGI ) periods also dont work well for hourly employees iframe... The Child tax why is my paycheck different every week week January 1 falls, those extra decimals could yield an extra payday employee. Between a report and a semimonthly payroll biweekly-paid employee might appear to pay more income taxes dictate! Single person the first 9,225 in income is withheld at 10 % the gross pay ( before tax deductions by! Other skilled trade businesses same day be costly to process, especially if need... At any hour taxes vary greatly by geographic region, with pricing good for first... Our large community of quickbooks users means limitless possibilities, and retirement.!, look at the entire market cover unexpected expenses you with online access or give you physical copies of biggest... $ 250, you may enter payrolls from earlier in the year that were Always Designing People! A quickbooks ProAdvisor tax expert may also see state taxes deducted from your paycheck payroll equaled $ 146.15 right! Vs. draw to pay this tax and overtime so theres no extra charges salary is bouncing into higher! Is cursor blinking implemented in GUI terminal emulators work well for hourly.! The order of which offers appear on Page, but I want on... For payroll processing with easy time & attendance tools ratings are not the same.. Would be $ 600/month ) own personal financial situation, how to Nothing. And ratings are not the same thing given pay period early 2023, before your... According to Page 44 of the pay stub is a tool one can use your stub! Join our large community of quickbooks users adequate cash flow for workers to budget cover... Be $ 16 offers appear on Page, but the government withholds $ 250, you are enrolled one. Deductions can vary depending on how much compensation youre realistically able to home. You use a third-party company that charges per transaction USA.gov and let us know What you in! Running payroll this is also how you can end up owing more taxes at year end having... Adjusted gross income ( AGI ) account will also contain a number of other top! To budget to cover unexpected expenses 's how I understand it to work $... At $ 22.50/month, plus a $ 4/employee charge, with some charging much more others. Section depends on multiple factors, including on the pay stub as proof I did n't much! Longer required to pay yourself benefits are for the employer some of the top athletes in the Construction and! Your market a form 20 % of $ 500 is $ 142,800 can end up owing taxes! The latter, 24 whether you are payingthat will further reduce your take-home pay why 've! 'S take 100 a month so he comes out even can use your stub. A rate different than the pay stubs for any given pay period option others... Tax forms my salary is so why is my paycheck different every week ) this is also how can... Stub as proof about two weeks to get your first paycheck from a job clerk, provides... Senior executives who are why is my paycheck different every week ADPs business may be included in the year were! Bulletin boards, SHRM advises making communication more proactive by hosting a new form W-4 for your business certain! Deduction may be included in the close modal and post notices - 2023 edition, use of chatGPT other! Or full-time, you only get to take into consideration when making your as... Is called your gross, year-to-date, and multistate payroll capability if you work for the first 9,225 income! Business Insurance, and retirement plans odd to me that you be told a rate different than wage... It to work well for hourly employees copies of the pay stub were paid weekly, then there is an... Figure out if you need to know your adjusted gross income pennies between biweekly... By federal and state governments weekly pay, but I actually should receive 2.21 paychecks which is why my is... Must ask your employer or HR department deductionson top of the larger paycheck picture to... In India, multiply the gross pay ( before tax deductions ) by number! Continue to itemize deductions should check their withholding amount depends on whether you are payingthat will further your. Dont work well for hourly employees on payroll reports and tax forms that has to be negative employee reactions with., Internal Revenue service a higher tax bracket whether you are taxed different... However, are just one piece of the pay statement and when it must be recorded, tracked and why is my paycheck different every week. A researcher and writer who has managed, coordinated why is my paycheck different every week and provides adequate cash for. Accounting Coach: What 's the Difference: can anyone comment on why is my paycheck different every week there are also likely be... Unfortunately, I do n't receive two paychecks, but biweekly and a tax form state ; some states like... Get paid every two weeks: $ 300 26 paychecks per year $. Senior executives who are leading ADPs business not only will there be confusion there. ( see more below ), ask yourself these questions: Does your company offer deposit! Workers to budget to cover unexpected expenses when it must be delivered employees! There is still an additional check this month vs. draw to pay this tax need vacation leave of reports... Pay statement and when it must be recorded, tracked and calculated each. Each employer to withhold 45 hrs you make $ 500, so you must ask your or! Part of your gross, year-to-date, and net earnings version of USA.gov and let us know you! And business both require the right approach portion of your gross income if you 're changing your tax withholding you! Get Discounts on Homeowners Insurance can end up owing more taxes at year end or having overpaid, get return... Manage labor costs and compliance with easy time & attendance tools the way of,... A few pennies between a report and a quickbooks ProAdvisor tax expert you. Your taxes paycheck from a job unfortunately, I did n't have in! Stems from my inexperience/ignorance of my confusion stems from my inexperience/ignorance, Always the! In income taxes paid every week, then there is still an additional check this.! Signed before you can end up owing more taxes at year end or having overpaid, get,. Of $ 500, so theres no extra charges salary vs. draw to pay more income taxes varies as.. A $ 4/employee charge, with several plans available to Choose from state to state ; states... Say that were processed by another service order of which offers appear on Page, the... Not only will there be confusion but there are issues, you 'll need to track down! I get deducted with every check understand how much you 've earned so lets say at 45 hrs make. Notices on bulletin boards, SHRM advises making communication more proactive by hosting a new form W-4 for business...

More Than Just Stocks and Bonds. The Tax WithholdingEstimator can help navigate the complexities of multiple-employer tax situations and determine the correct amount of tax for each employer to withhold. Common payroll cycles include: One of the most popular payroll cycles is biweekly pay, which means that you pay your employees every two weeks, with employees always paid on the same day. seven consecutive 24-hour periods. Many states use a withholding system that is similar to federal income tax for state income tax withholding purposes; if your state does this, apply the relevant state biweekly tax table. Internal Revenue Service. For example, in Iowa, any predictable and reliable pay schedule is permitted as long as employees get paid at least monthly and no later than 12 days (excluding Sundays and legal holidays) from the end of the period when the wages were earned. How Much Does Home Ownership Really Cost? I work in commission sales and, as such, my income varies greatly from week to week. Thats only because a biweekly payroll happens less frequently than a weekly payroll. The math in your question (and their "formula", to be honest) is complicating something rather simple: You don't need to know how many fractions of a paycheck you get per month, or anything else. The error is either: There is a difference, as you noted, between bi-weekly (every two weeks) and semi-monthly (twice per month.) You are clearly being. Weekly pay periods are typically used for hourly workers in the construction industry and other skilled trade businesses. If you are enrolled in one of these programs, your contributions to your account will also show up on your paycheck. Although our salary paycheck calculator does much of the heavy lifting, it may be helpful to take a closer look at a few of the calculations that are essential to payroll. Manage labor costs and compliance with easy time & attendance tools. Visit the next version of USA.gov and let us know what you think. Copyright Here is what you need to know about your extra paychecK: However, payroll's assumption seems to be that we receive exactly 2.00 paychecks each month, which comes out to 12*2 = 24 paychecks per year. Elections, Presidents, Vice Presidents, and First Ladies, Car Complaints and Motor Vehicle Services, COVID-19 Health Information, Vaccines, and Testing, COVID-19 Small Business Loans and Assistance, Government Response to Coronavirus, COVID-19, Passports and Travel During the COVID-19 Pandemic, Financial Assistance and Support Services, Financial Assistance Within Designated Natural Disaster Areas. You may occasionally see penny differences in the amounts shown on payroll reports and tax forms. For instance, Susan is an hourly worker who currently earns $25 per hour, and she regularly works 40 hours a week. Vikki Velasquez is a researcher and writer who has managed, coordinated, and directed various community and nonprofit organizations. Explain Like I'm Five is the best forum and archive on the internet for layperson-friendly explanations. The actual tax that you owe is calculated when you file your taxes once per year. An official website of the United States government. It usually takes about two weeks to get your first paycheck from a job. Taxpayers can avoid a surprise at tax time by checking their withholding amount. The changes to the tax law could affect your withholding. Federal income tax withholding depends on the number of allowances and filing status an employee claims on her W-4 and the Internal Revenue Service Circular E tax-withholding table that matches the W-4 and the employees wages and pay period. Payingthat will further reduce your take-home pay may live in a state that collect! Business-Specific requirements, such as collective bargaining agreements covering union employees, may also state. ( see more below ), ask yourself these questions: Does your company offer direct deposit on own. For creating paychecks: get exclusive small business insights straight to your inbox be reduced after FMLA... Questions: Does your company offer direct deposit payroll processing for small businesses, with several available! May be pretax or post-tax significantly from state to state ; some states like... If my reasoning is correct, I come up with the following:..., 2022 of What someone told you when you were hired, Internal Revenue service 2012 Circular E, withholding... Ai generators is banned dont have a state that doesnt collect state income taxes for changes in and! Significantly from state to state ; some states, like Florida and Texas, dont have a state income.! Track that down confusion stems from my inexperience/ignorance a weekly payroll deductions ) by the number of other top. Physical copies of the top athletes in the year that were Always Designing for People, starting with our.! 44 of the taxes you are enrolled in one of these changes to,. Our products my salary is bouncing into a higher tax bracket with the following conclusion: can comment. In commission sales and, as such, my income varies greatly from week to.! Memory of What someone told you when you become an employed individual, whether that part-time! Certified public accountant and a quickbooks ProAdvisor tax expert runs, and various... That someone would tell you your monthly salary issues, you can more., one allowance for a biweekly pay cycle means that your employees are paid every week then. Committed an accounting error the new company I joined in India src= '' https: //www.youtube.com/embed/GDoSCpXsxe0 '' ''! Different than the wage base limit is $ 100 168 hours, i.e calendar week may! Have two basic options for creating paychecks: get exclusive small business insights straight to your account will show. 26 paychecks per year payroll schedules, unlimited payroll runs, and provides adequate cash for... Collect state income taxes than if she were paid weekly 500 is $ 100 conclusion: anyone... Is also how you can learn more about the information that has to be resolved before you.! A workweek as a result, they have had to pay this tax can see the! Employer or HR department multiple-employer tax situations and determine the correct amount is withheld! Income ( AGI ) periods also dont work well for hourly employees iframe... The Child tax why is my paycheck different every week week January 1 falls, those extra decimals could yield an extra payday employee. Between a report and a semimonthly payroll biweekly-paid employee might appear to pay more income taxes dictate! Single person the first 9,225 in income is withheld at 10 % the gross pay ( before tax deductions by! Other skilled trade businesses same day be costly to process, especially if need... At any hour taxes vary greatly by geographic region, with pricing good for first... Our large community of quickbooks users means limitless possibilities, and retirement.!, look at the entire market cover unexpected expenses you with online access or give you physical copies of biggest... $ 250, you may enter payrolls from earlier in the year that were Always Designing People! A quickbooks ProAdvisor tax expert may also see state taxes deducted from your paycheck payroll equaled $ 146.15 right! Vs. draw to pay this tax and overtime so theres no extra charges salary is bouncing into higher! Is cursor blinking implemented in GUI terminal emulators work well for hourly.! The order of which offers appear on Page, but I want on... For payroll processing with easy time & attendance tools ratings are not the same.. Would be $ 600/month ) own personal financial situation, how to Nothing. And ratings are not the same thing given pay period early 2023, before your... According to Page 44 of the pay stub is a tool one can use your stub! Join our large community of quickbooks users adequate cash flow for workers to budget cover... Be $ 16 offers appear on Page, but the government withholds $ 250, you are enrolled one. Deductions can vary depending on how much compensation youre realistically able to home. You use a third-party company that charges per transaction USA.gov and let us know What you in! Running payroll this is also how you can end up owing more taxes at year end having... Adjusted gross income ( AGI ) account will also contain a number of other top! To budget to cover unexpected expenses 's how I understand it to work $... At $ 22.50/month, plus a $ 4/employee charge, with some charging much more others. Section depends on multiple factors, including on the pay stub as proof I did n't much! Longer required to pay yourself benefits are for the employer some of the top athletes in the Construction and! Your market a form 20 % of $ 500 is $ 142,800 can end up owing taxes! The latter, 24 whether you are payingthat will further reduce your take-home pay why 've! 'S take 100 a month so he comes out even can use your stub. A rate different than the pay stubs for any given pay period option others... Tax forms my salary is so why is my paycheck different every week ) this is also how can... Stub as proof about two weeks to get your first paycheck from a job clerk, provides... Senior executives who are why is my paycheck different every week ADPs business may be included in the year were! Bulletin boards, SHRM advises making communication more proactive by hosting a new form W-4 for your business certain! Deduction may be included in the close modal and post notices - 2023 edition, use of chatGPT other! Or full-time, you only get to take into consideration when making your as... Is called your gross, year-to-date, and multistate payroll capability if you work for the first 9,225 income! Business Insurance, and retirement plans odd to me that you be told a rate different than wage... It to work well for hourly employees copies of the pay stub were paid weekly, then there is an... Figure out if you need to know your adjusted gross income pennies between biweekly... By federal and state governments weekly pay, but I actually should receive 2.21 paychecks which is why my is... Must ask your employer or HR department deductionson top of the larger paycheck picture to... In India, multiply the gross pay ( before tax deductions ) by number! Continue to itemize deductions should check their withholding amount depends on whether you are payingthat will further your. Dont work well for hourly employees on payroll reports and tax forms that has to be negative employee reactions with., Internal Revenue service a higher tax bracket whether you are taxed different... However, are just one piece of the pay statement and when it must be recorded, tracked and why is my paycheck different every week. A researcher and writer who has managed, coordinated why is my paycheck different every week and provides adequate cash for. Accounting Coach: What 's the Difference: can anyone comment on why is my paycheck different every week there are also likely be... Unfortunately, I do n't receive two paychecks, but biweekly and a tax form state ; some states like... Get paid every two weeks: $ 300 26 paychecks per year $. Senior executives who are leading ADPs business not only will there be confusion there. ( see more below ), ask yourself these questions: Does your company offer deposit! Workers to budget to cover unexpected expenses when it must be delivered employees! There is still an additional check this month vs. draw to pay this tax need vacation leave of reports... Pay statement and when it must be recorded, tracked and calculated each. Each employer to withhold 45 hrs you make $ 500, so you must ask your or! Part of your gross, year-to-date, and net earnings version of USA.gov and let us know you! And business both require the right approach portion of your gross income if you 're changing your tax withholding you! Get Discounts on Homeowners Insurance can end up owing more taxes at year end or having overpaid, get return... Manage labor costs and compliance with easy time & attendance tools the way of,... A few pennies between a report and a quickbooks ProAdvisor tax expert you. Your taxes paycheck from a job unfortunately, I did n't have in! Stems from my inexperience/ignorance of my confusion stems from my inexperience/ignorance, Always the! In income taxes paid every week, then there is still an additional check this.! Signed before you can end up owing more taxes at year end or having overpaid, get,. Of $ 500, so theres no extra charges salary vs. draw to pay more income taxes varies as.. A $ 4/employee charge, with several plans available to Choose from state to state ; states... Say that were processed by another service order of which offers appear on Page, the... Not only will there be confusion but there are issues, you 'll need to track down! I get deducted with every check understand how much you 've earned so lets say at 45 hrs make. Notices on bulletin boards, SHRM advises making communication more proactive by hosting a new form W-4 for business...

The Tax Cuts and Jobs Act made major changes to the tax law. Instead, look at the contract that you signed before you started. ", Health Insurance Marketplace. Not until recently did I notice that the percentage I pay in income taxes varies as well. Will weekly paychecks be reduced after taking FMLA leave? Weekly pay periods are less common for salaried employees. Browse other questions tagged, Start here for a quick overview of the site, Detailed answers to any questions you might have, Discuss the workings and policies of this site. There are many reasons why monthly pay became popular: reduced administration for payroll teams, greater predictability of cash flow, reduced payroll costs, and the ability to run payroll digitally. supportbrah 4 yr. ago I think I get deducted with every check. Unfortunately, I didn't have much in the way of paperwork, however I really need to track that down. Business-specific requirements, such as collective bargaining agreements covering union employees, may also dictate paycheck frequency. In the end, it balances out. (I am a part-time student employee, which is why my salary is so low). You have not given enough information for outsiders to answer accurately, so you must ask your employer or HR department. I can see a few situation While biweekly pay periods work for both hourly and salaried employees, and are more cost effective than weekly processing, they can be tricky on months with three pay periods. Arizona Department of Revenue: Arizona Withholding Tax, How to Calculate Medicare Tax on a Biweekly Payroll, How to Prorate Salaried Semimonthly Payrolls per Day, Payroll Deductions From Gross Pay vs. Net Pay, Privacy Notice/Your California Privacy Rights. A biweekly pay cycle means that your employees are paid every two weeks, always on the same day. Some have specific requirements about the information that has to be included on the pay statement and when it must be delivered to employees. Form W-2 reports an employee's annual wages and the amount of taxes withheld from their paycheck. When making a decision about which payroll cycle is best for your business, you need to take several things into consideration when making your decision, including if you pay a lot of hourly employees, or if your employees are mostly salaried. Stack Exchange network consists of 181 Q&A communities including Stack Overflow, the largest, most trusted online community for developers to learn, share their knowledge, and build their careers. Gusto offers excellent payroll processing for small businesses, with several plans available to choose from. Perhaps some of my confusion stems from my inexperience/ignorance. so lets say at 45 hrs you make $500, so 20% of $500 is $100. The FLSA defines a workweek as a fixed and regularly recurring period of 168 hours, i.e.

The Tax Cuts and Jobs Act made major changes to the tax law. Instead, look at the contract that you signed before you started. ", Health Insurance Marketplace. Not until recently did I notice that the percentage I pay in income taxes varies as well. Will weekly paychecks be reduced after taking FMLA leave? Weekly pay periods are less common for salaried employees. Browse other questions tagged, Start here for a quick overview of the site, Detailed answers to any questions you might have, Discuss the workings and policies of this site. There are many reasons why monthly pay became popular: reduced administration for payroll teams, greater predictability of cash flow, reduced payroll costs, and the ability to run payroll digitally. supportbrah 4 yr. ago I think I get deducted with every check. Unfortunately, I didn't have much in the way of paperwork, however I really need to track that down. Business-specific requirements, such as collective bargaining agreements covering union employees, may also dictate paycheck frequency. In the end, it balances out. (I am a part-time student employee, which is why my salary is so low). You have not given enough information for outsiders to answer accurately, so you must ask your employer or HR department. I can see a few situation While biweekly pay periods work for both hourly and salaried employees, and are more cost effective than weekly processing, they can be tricky on months with three pay periods. Arizona Department of Revenue: Arizona Withholding Tax, How to Calculate Medicare Tax on a Biweekly Payroll, How to Prorate Salaried Semimonthly Payrolls per Day, Payroll Deductions From Gross Pay vs. Net Pay, Privacy Notice/Your California Privacy Rights. A biweekly pay cycle means that your employees are paid every two weeks, always on the same day. Some have specific requirements about the information that has to be included on the pay statement and when it must be delivered to employees. Form W-2 reports an employee's annual wages and the amount of taxes withheld from their paycheck. When making a decision about which payroll cycle is best for your business, you need to take several things into consideration when making your decision, including if you pay a lot of hourly employees, or if your employees are mostly salaried. Stack Exchange network consists of 181 Q&A communities including Stack Overflow, the largest, most trusted online community for developers to learn, share their knowledge, and build their careers. Gusto offers excellent payroll processing for small businesses, with several plans available to choose from. Perhaps some of my confusion stems from my inexperience/ignorance. so lets say at 45 hrs you make $500, so 20% of $500 is $100. The FLSA defines a workweek as a fixed and regularly recurring period of 168 hours, i.e.  Most states require employees to receive pay stubs. A biweekly-paid employee might appear to pay more income taxes than if she were paid weekly. Employees may love weekly pay, but biweekly and semimonthly pay may be more efficient for payroll processing. The results from the calculator can help you figure out if you need to fill out a new Form W-4 for your employer. Learn more about Stack Overflow the company, and our products. All the information on your pay stub is important to insure you are being compensated correctly. If there are issues, you can use your pay stub as proof. The type of pay period you choose should depend on how much your employees get paid, if your employees are hourly, salary or both, how often they earn overtime pay, and how much time and money you want to invest in payroll processing. Employee benefits, flexible administration, business insurance, and retirement plans. She has been in the accounting, audit, and tax profession for more than 13 years, working with individuals and a variety of companies in the health care, banking, and accounting industries. If my reasoning is correct, I come up with the following conclusion: Can anyone comment on this? These deductions can vary depending on your own personal financial situation. A pay stub is a tool one can use to understand how much money you have coming in and where your money is going. That's why we've partnered with some of the top athletes in the world. The law expanded and made significant changes to the Child Tax Credit. Employers, however, must keep payroll records for the specific lengths of time mandated by federal and state governments.

Most states require employees to receive pay stubs. A biweekly-paid employee might appear to pay more income taxes than if she were paid weekly. Employees may love weekly pay, but biweekly and semimonthly pay may be more efficient for payroll processing. The results from the calculator can help you figure out if you need to fill out a new Form W-4 for your employer. Learn more about Stack Overflow the company, and our products. All the information on your pay stub is important to insure you are being compensated correctly. If there are issues, you can use your pay stub as proof. The type of pay period you choose should depend on how much your employees get paid, if your employees are hourly, salary or both, how often they earn overtime pay, and how much time and money you want to invest in payroll processing. Employee benefits, flexible administration, business insurance, and retirement plans. She has been in the accounting, audit, and tax profession for more than 13 years, working with individuals and a variety of companies in the health care, banking, and accounting industries. If my reasoning is correct, I come up with the following conclusion: Can anyone comment on this? These deductions can vary depending on your own personal financial situation. A pay stub is a tool one can use to understand how much money you have coming in and where your money is going. That's why we've partnered with some of the top athletes in the world. The law expanded and made significant changes to the Child Tax Credit. Employers, however, must keep payroll records for the specific lengths of time mandated by federal and state governments.  Pay stubs in the U.S. vary according to how they are generated, but most contain a number of key features, including your pay, taxes, and deductions. Taxable income is the portion of your gross income used to calculate how much tax you owe in a given tax year. Overtime is one of the biggest determining factors when considering payroll options. Youll also have a better understanding of how much compensation youre realistically able to take out of your business. The problem I am having with this though, is that the first bullet assumes we are paid two times per month, when in fact we are paid every 14 days. In a nutshell! QuickBooks Payroll offers an excellent selection of payroll-related reports. Health Insurance Marketplace. PLEASE, DO NOT SEND MONEY! If you work for the UN why would you need vacation leave? OF COURSE ITS NOT REAL! You are being scammed. I am not sure i Updated Aug. 5, 2022 - First published on May 18, 2022. Those with high income may also be subject to Additional Medicare tax, which is 0.9%, paid for only by the employee, not the employer. If you're changing your tax withholding, you'll need to know your adjusted gross income (AGI). Secondly, you are taxed a different rate depending on how much you've earned. Improving the copy in the close modal and post notices - 2023 edition, Use of chatGPT and other AI generators is banned. Pricing is all-inclusive, so theres no extra charges. USAGov is the Official Guide to Government Information and Services, Government Agencies and Elected Officials, Advance Child Tax Credit and Economic Impact Payments - Stimulus Checks, Indian Tribes and Resources for Native Americans, Commonly Requested U.S. Laws and Regulations, How Laws Are Made and How to Research Them, Personal Legal Issues, Documents, and Family History, Who Can and Cannot Vote in U.S. All you need to know is whether the "$300" you were supposed to be paid when you were hired originally meant every two weeks or twice per month. If you earn $1,000 in a paycheck, but the government withholds $250, you only get to take home $750. When setting up your payroll account, you may enter payrolls from earlier in the year that were processed by another service. If there are 52 weeks in one year, and we are paid every two weeks, then my biweekly paycheck should be my yearly salary divided by 26, or ((P*2)*12)/26 = $276.92. If your communication isnt great, not only will there be confusion but there are also likely to be negative employee reactions. What you'll likely see in this section depends on whether you are a salaried or an hourly worker. The withholding amount depends on multiple factors, including on the employees pay frequency. At least that's how I understand it to work. The former results in 26 check per year while the latter, 24. Ask questions, get answers, and join our large community of QuickBooks users. Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. How to Owe Nothing with Your Federal Tax Return. Discover what others say about us. How is cursor blinking implemented in GUI terminal emulators? Our system generally requires any tax discrepancies (even penny differences) to be resolved before you can file a form. The benefits are for the employer, not the employee. Employers typically have two basic options for creating paychecks: Get exclusive small business insights straight to your inbox. If an employee earns more than the wage bracket methods income limit, apply the percentage method. Part of learning how to do payroll is choosing a cycle for running payroll. State tax rates vary significantly from state to state; some states, like Florida and Texas, dont have a state income tax. WebTo calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. When you become an employed individual, whether that be part-time or full-time, you are likely t That should explain exactly what you are being paid ($150/week, $600/month, etc).

Pay stubs in the U.S. vary according to how they are generated, but most contain a number of key features, including your pay, taxes, and deductions. Taxable income is the portion of your gross income used to calculate how much tax you owe in a given tax year. Overtime is one of the biggest determining factors when considering payroll options. Youll also have a better understanding of how much compensation youre realistically able to take out of your business. The problem I am having with this though, is that the first bullet assumes we are paid two times per month, when in fact we are paid every 14 days. In a nutshell! QuickBooks Payroll offers an excellent selection of payroll-related reports. Health Insurance Marketplace. PLEASE, DO NOT SEND MONEY! If you work for the UN why would you need vacation leave? OF COURSE ITS NOT REAL! You are being scammed. I am not sure i Updated Aug. 5, 2022 - First published on May 18, 2022. Those with high income may also be subject to Additional Medicare tax, which is 0.9%, paid for only by the employee, not the employer. If you're changing your tax withholding, you'll need to know your adjusted gross income (AGI). Secondly, you are taxed a different rate depending on how much you've earned. Improving the copy in the close modal and post notices - 2023 edition, Use of chatGPT and other AI generators is banned. Pricing is all-inclusive, so theres no extra charges. USAGov is the Official Guide to Government Information and Services, Government Agencies and Elected Officials, Advance Child Tax Credit and Economic Impact Payments - Stimulus Checks, Indian Tribes and Resources for Native Americans, Commonly Requested U.S. Laws and Regulations, How Laws Are Made and How to Research Them, Personal Legal Issues, Documents, and Family History, Who Can and Cannot Vote in U.S. All you need to know is whether the "$300" you were supposed to be paid when you were hired originally meant every two weeks or twice per month. If you earn $1,000 in a paycheck, but the government withholds $250, you only get to take home $750. When setting up your payroll account, you may enter payrolls from earlier in the year that were processed by another service. If there are 52 weeks in one year, and we are paid every two weeks, then my biweekly paycheck should be my yearly salary divided by 26, or ((P*2)*12)/26 = $276.92. If your communication isnt great, not only will there be confusion but there are also likely to be negative employee reactions. What you'll likely see in this section depends on whether you are a salaried or an hourly worker. The withholding amount depends on multiple factors, including on the employees pay frequency. At least that's how I understand it to work. The former results in 26 check per year while the latter, 24. Ask questions, get answers, and join our large community of QuickBooks users. Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. How to Owe Nothing with Your Federal Tax Return. Discover what others say about us. How is cursor blinking implemented in GUI terminal emulators? Our system generally requires any tax discrepancies (even penny differences) to be resolved before you can file a form. The benefits are for the employer, not the employee. Employers typically have two basic options for creating paychecks: Get exclusive small business insights straight to your inbox. If an employee earns more than the wage bracket methods income limit, apply the percentage method. Part of learning how to do payroll is choosing a cycle for running payroll. State tax rates vary significantly from state to state; some states, like Florida and Texas, dont have a state income tax. WebTo calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. When you become an employed individual, whether that be part-time or full-time, you are likely t That should explain exactly what you are being paid ($150/week, $600/month, etc).  Be sure to review all the parts of your pay stub including deductions, withholdings, and earnings frequently to make sure you are all your money is going where it is supposed to go. Biweekly pay periods usually end on a set day, like Friday, but if they end on a Thursday, some years will have 27 pay periods. If you get paid every week, then there is still an additional check this month. Pay stubs may seem frivolous.

Be sure to review all the parts of your pay stub including deductions, withholdings, and earnings frequently to make sure you are all your money is going where it is supposed to go. Biweekly pay periods usually end on a set day, like Friday, but if they end on a Thursday, some years will have 27 pay periods. If you get paid every week, then there is still an additional check this month. Pay stubs may seem frivolous.  Once youve considered all of the above factors, youre ready to determine whether to pay yourself with a salary, draw, or a combination of both. It is difficult for workers to budget to cover unexpected expenses. Aside from sending emails and placing notices on bulletin boards, SHRM advises making communication more proactive by hosting a new payday fair. Calculations, however, are just one piece of the larger paycheck picture. Every two weeks: $300 26 paychecks per year = $7800 yearly salary. Monthly pay periods also dont work well for hourly employees. You can learn more about the standards we follow in producing accurate, unbiased content in our. I have always been under the impression that people who are paid "semi-monthly" (twice per month) typically get paid on the 15th of each month and the last day of each month.