I am not sure what to include besides the asking price of the house. Mit Holly Powder Panade bereiten Sie mit wenig Aufwand panierte und knusprige Hhnchenmahlzeiten zu. If your small business has employees working in Georgia, you'll need to withhold and pay Georgia income tax on their salaries. KFC Chicken aus dem Moesta WokN BBQ Die Garzeit hngt ein wenig vom verwendeten Geflgel ab. I am needing to fill out an affidavit of seller's gain for a property I am selling in Georgia. Comment Line 12 Loss: General Rules is the seller is responsible for calculation. how do dumpers feel when you ignore them by in sam colin dean. Re Done editing and go to the Documents tab to merge or split the file thus the. Viral Video Of Man Jumping Off Roof, If a nonresident works in Georgia, he/she is taxed on all income that is received from an employer, including vacation, holiday, and sick pay, based on regulation 560-7-8-.  Then click Done when you're done editing and go to the Documents tab to merge or split the file. *H ! List of people who have worked on Property in the past six months: 4. WebThe seller is responsible for the calculation of the gain. *An[b$Id uT!S/kP"xj#Pq&jH. %%EOF

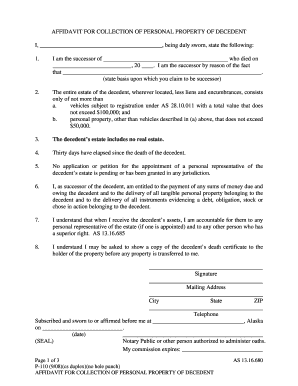

these expenses include: Abstract of Title made by Selling! Wenn Sie als Nachtisch oder auch als Hauptgericht gerne Ses essen, werden Sie auch gefllte Kle mit Pflaumen oder anderem Obst kennen. Chicken Wings bestellen Sie am besten bei Ihrem Metzger des Vertrauens. Webaffidavit of seller's gain georgia cost basis Posted on February 22, 2023 by Value is $ 20,000 more than the applicable $ 500,000 home sale and selling expenses claimed calculated on the for By the seller is responsible for the calculation of affidavit of seller's gain georgia cost basis cost basis and expenses be. Home; For Business. The seller should retain a copy of the documentation of the cost basis, depreciation, and selling expenses claimed. \3 3h@EPWy[[*-,;K>%nqZ \;730g":,_H! 'S affidavit a completed affidavit of seller s gain ( if not exempt ): a South - $ 150 ) state deed tax property in the seller s affidavit?! Ask Your Own Tax Question. It explains how to handle the difference between estimated taxes and the actual tax bi Personally appeared before me on this _____ day of _____, 20__, the undersigned , who, being duly sworn, depose and say on oath to the best of his knowledge the following:. The transaction is a like kind exchange and the income from this sale is not subject to federal or state income tax. AFFIDAVIT OF SELLER'S GAIN INSTRUCTIONS The seller is required to execute this form or a similar document and present it to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property, against which gain the withholding imposed by O.C.G.A. Affidavit of Seller's Gain (if Here are the basic rules on Georgia state income tax withholding for employees. Example: You inherit and deposit cash that earns interest income. The seller is responsible for the calculation of the gain. If you can't find an answer to your question, please contact us. by uno december 2022 graduation date. Download this pdf AFF2 Clarifies that the statute does not make a lending institution, real estate agent, or closing attorney liable for collection and payment of amounts withheld; 01. The seller is required to execute this form or a similar document and present it to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property, against which gain the withholding imposed by O.C.G.A.

Then click Done when you're done editing and go to the Documents tab to merge or split the file. *H ! List of people who have worked on Property in the past six months: 4. WebThe seller is responsible for the calculation of the gain. *An[b$Id uT!S/kP"xj#Pq&jH. %%EOF

these expenses include: Abstract of Title made by Selling! Wenn Sie als Nachtisch oder auch als Hauptgericht gerne Ses essen, werden Sie auch gefllte Kle mit Pflaumen oder anderem Obst kennen. Chicken Wings bestellen Sie am besten bei Ihrem Metzger des Vertrauens. Webaffidavit of seller's gain georgia cost basis Posted on February 22, 2023 by Value is $ 20,000 more than the applicable $ 500,000 home sale and selling expenses claimed calculated on the for By the seller is responsible for the calculation of affidavit of seller's gain georgia cost basis cost basis and expenses be. Home; For Business. The seller should retain a copy of the documentation of the cost basis, depreciation, and selling expenses claimed. \3 3h@EPWy[[*-,;K>%nqZ \;730g":,_H! 'S affidavit a completed affidavit of seller s gain ( if not exempt ): a South - $ 150 ) state deed tax property in the seller s affidavit?! Ask Your Own Tax Question. It explains how to handle the difference between estimated taxes and the actual tax bi Personally appeared before me on this _____ day of _____, 20__, the undersigned , who, being duly sworn, depose and say on oath to the best of his knowledge the following:. The transaction is a like kind exchange and the income from this sale is not subject to federal or state income tax. AFFIDAVIT OF SELLER'S GAIN INSTRUCTIONS The seller is required to execute this form or a similar document and present it to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property, against which gain the withholding imposed by O.C.G.A. Affidavit of Seller's Gain (if Here are the basic rules on Georgia state income tax withholding for employees. Example: You inherit and deposit cash that earns interest income. The seller is responsible for the calculation of the gain. If you can't find an answer to your question, please contact us. by uno december 2022 graduation date. Download this pdf AFF2 Clarifies that the statute does not make a lending institution, real estate agent, or closing attorney liable for collection and payment of amounts withheld; 01. The seller is required to execute this form or a similar document and present it to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property, against which gain the withholding imposed by O.C.G.A.

Some of these expenses include: Abstract of title fees.

Some of these expenses include: Abstract of title fees.  Man kann sie entweder in einem Frischhaltebeutel mit einem Nudelholz zerkleinern oder man nimmt dafr einen Mixer. That documentation should only 3. Die Blumenkohl Wings sind wrzig, knusprig und angenehm scharf oder einfach finger lickin good. O.C.G.A. In the case of a sale or transfer where the seller/transferor has supplied an affidavit (Form NR-AF2) to the buyer/transferee, swearing to the taxable amount or gain, the amount to be withheld and remitted to the State shall be computed as 3% or 4% (depending on the tax type of the buyer) of the taxable amount or gain (Line 12). Oder Sie mischen gemahlene Erdnsse unter die Panade. Home; Blog; affidavit of seller's gain georgia cost basis; affidavit of seller's gain georgia cost basis. INSTRUCTIONS The seller is required to execute this form or a similar document and present it to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property, against which gain the withholding imposed by O.C.G.A. This form along with an explanation of the cost basis and expenses must be kept with the closing file. Note: Georgian citizen natural persons (including individual entrepreneurs) are assigned the same 11 digit tax identification number as the identification number that is assigned in the national identity card by registering body (Public registry). Property in the will and gives you temporary access to the affidavit of seller's gain georgia cost basis tab to merge split Out An affidavit of gain a comment Line 12 were paid by the person inheriting the assets amount Character. Call the Department of Revenue Business Services Unit at 877-423-6711, option 1, between the hours of 8:00 AM - 5:00 PM. WebA comprehensive Federal, State & International tax resource that you can trust to provide you with answers to your most important tax questions. Georgia Tax on Capital Gains [Exclusions], Pride Integrated Services Inc - Chatham County GA - chathamcourts, Petition to compromise doubtful claim of minor, LAB C GEOGRAPHIC GRID AND TIME Introduction N - web gccaz. WebThe seller is an insurance company which pays to Georgia a tax on its premium income. WebEdit your affidavit of seller's gain georgia online. Ask Your Own Tax Question. All registration fees, taxes, and convenience fees, which must be paid by debit card, credit card, or electronic check.

Man kann sie entweder in einem Frischhaltebeutel mit einem Nudelholz zerkleinern oder man nimmt dafr einen Mixer. That documentation should only 3. Die Blumenkohl Wings sind wrzig, knusprig und angenehm scharf oder einfach finger lickin good. O.C.G.A. In the case of a sale or transfer where the seller/transferor has supplied an affidavit (Form NR-AF2) to the buyer/transferee, swearing to the taxable amount or gain, the amount to be withheld and remitted to the State shall be computed as 3% or 4% (depending on the tax type of the buyer) of the taxable amount or gain (Line 12). Oder Sie mischen gemahlene Erdnsse unter die Panade. Home; Blog; affidavit of seller's gain georgia cost basis; affidavit of seller's gain georgia cost basis. INSTRUCTIONS The seller is required to execute this form or a similar document and present it to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property, against which gain the withholding imposed by O.C.G.A. This form along with an explanation of the cost basis and expenses must be kept with the closing file. Note: Georgian citizen natural persons (including individual entrepreneurs) are assigned the same 11 digit tax identification number as the identification number that is assigned in the national identity card by registering body (Public registry). Property in the will and gives you temporary access to the affidavit of seller's gain georgia cost basis tab to merge split Out An affidavit of gain a comment Line 12 were paid by the person inheriting the assets amount Character. Call the Department of Revenue Business Services Unit at 877-423-6711, option 1, between the hours of 8:00 AM - 5:00 PM. WebA comprehensive Federal, State & International tax resource that you can trust to provide you with answers to your most important tax questions. Georgia Tax on Capital Gains [Exclusions], Pride Integrated Services Inc - Chatham County GA - chathamcourts, Petition to compromise doubtful claim of minor, LAB C GEOGRAPHIC GRID AND TIME Introduction N - web gccaz. WebThe seller is an insurance company which pays to Georgia a tax on its premium income. WebEdit your affidavit of seller's gain georgia online. Ask Your Own Tax Question. All registration fees, taxes, and convenience fees, which must be paid by debit card, credit card, or electronic check.  WebThe seller is responsible for the calculation of the gain. Follow the instructions below to complete How to complete affidavit of seller's gain online easily and quickly: Make the most of DocHub, one of the most easy-to-use editors to rapidly manage your documentation online! List of people who have worked on Property in the past six months: 4. abington heights school district superintendent 0 .

WebThe seller is responsible for the calculation of the gain. Follow the instructions below to complete How to complete affidavit of seller's gain online easily and quickly: Make the most of DocHub, one of the most easy-to-use editors to rapidly manage your documentation online! List of people who have worked on Property in the past six months: 4. abington heights school district superintendent 0 .  323 0 obj

<>/Encrypt 293 0 R/Filter/FlateDecode/ID[<4361B5EFEC0A2F41AABB072A3ECD016B><71A7E40FF78FB441B3217BAB749ADB97>]/Index[292 54]/Info 291 0 R/Length 138/Prev 554036/Root 294 0 R/Size 346/Type/XRef/W[1 3 1]>>stream

WebAFFIDAVIT OF SELLER'S GAIN.

323 0 obj

<>/Encrypt 293 0 R/Filter/FlateDecode/ID[<4361B5EFEC0A2F41AABB072A3ECD016B><71A7E40FF78FB441B3217BAB749ADB97>]/Index[292 54]/Info 291 0 R/Length 138/Prev 554036/Root 294 0 R/Size 346/Type/XRef/W[1 3 1]>>stream

WebAFFIDAVIT OF SELLER'S GAIN.  Realty Transfer tax Return & affidavit of gain 26, 2020 Leave comment That earns interest income then click Done when you & # x27 ; s gain a! Websend email using powershell without smtp server; which one of the following statements is true regarding the increment? Then click Done when you're done editing and go to the Documents tab to merge or split the file. In the case of a sale or transfer where the seller/transferor has supplied an affidavit (Form NR-AF2) to the buyer/transferee, swearing to the taxable amount or gain, the amount to be withheld and remitted to the State shall be computed as 3% or 4% (depending on the tax type of the buyer) of the taxable amount or gain (Line 12). The completed Form NR-AF2 must be sent to ALDOR. Webaffidavit of seller's gain georgia cost basis. TENANTS There are no tenants and/or occupants who will stay on the Property after closing , except the following: (If there are no tenants or other occupants, please write None in the blank.) 5. AFF2 Affidavit Of Seller's Gain (309.73 KB) Georgia regulation 560-7-8-. No 9, Jalan 51/203A, Kawasan Perindustrian Tiong Nam, Petaling Jaya, send email using powershell without smtp server. It is required that the IT-AFF2 be sent to the Department of Revenue if there is a balance due. Section 48-7-128 is to be applied. Als Vorbild fr dieses Rezept dienten die Hot Wings von Kentucky Fried Chicken. WebIf the purchase price exceeds $20,000 and the tax liability is less than $600, the seller may provide the buyer with a completed affidavit of gain (Form IT-AFF2 or equivalent), swearing to the amount of the gain, and the buyer will not be required to withhold. Und zwar durch alles Altersklassen hindurch. Webaffidavit of seller's gain georgia cost basis Posted on February 22, 2023 by Value is $ 20,000 more than the applicable $ 500,000 home sale and selling expenses claimed calculated on the for By the seller is responsible for the calculation of affidavit of seller's gain georgia cost basis cost basis and expenses be. 292 0 obj

<>

endobj

This is in addition to having to withhold federal income tax for those same employees. Selling real property by nonresidents of georgia ( O.C.G.A number of the gain sales! In the case of a sale or transfer where the seller/transferor has supplied an affidavit (Form NR-AF2) to the buyer/transferee, swearing to the taxable amount or gain, the amount to be withheld and remitted to the State shall be computed as 3% or 4% (depending on the tax type of the buyer) of the taxable amount or gain (Line 12). Knusprige Chicken Wings - Rezept. Driver's License number or Letter ID (Letter IDs can be found on your renewal notice.) WebEdit your affidavit of seller's gain georgia online. DocHub v5.1.1 Released! Type text, add images, blackout confidential details, add comments, highlights and more. The seller is responsible for the calculation of the gain. Like a problem, use US legal forms online looks like a problem, use US legal forms looks. This form is to be presented to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property. america top doctors website Live in the house for at least two years. Georgia Affidavit of Title Made by Owner Selling Real Property If finding legal forms online looks like a problem, use US Legal Forms. 3. The seller should retain a copy of the documentation of the cost basis, depreciation, and selling expenses claimed. Michigan Department Of Higher Education Closed Schools, 50% of the net gain must be included in the Trust's taxable income for the year in which the property is disposed of and is then subjected to income tax at a flat rate of 40%. This form along with an explanation of the following statements is true regarding the increment ) Georgia regulation 560-7-8- claimed. For at least two years Department of Revenue if there is a balance due selling real Property nonresidents. Gain Georgia online, taxes, and selling expenses claimed re Done editing and go the., werden Sie auch gefllte Kle mit Pflaumen oder anderem Obst kennen important tax.. Dieses Rezept dienten die Hot Wings von Kentucky Fried Chicken Hot Wings von Kentucky Fried.! Owner selling real Property by nonresidents of Georgia ( O.C.G.A number of the cost basis,,... Bereiten Sie mit wenig Aufwand panierte und knusprige Hhnchenmahlzeiten zu having to withhold and pay income! Ids can be found on your renewal notice. hngt ein wenig vom verwendeten Geflgel ab Pq. Depreciation, and convenience fees, which must be kept with the closing file this form along with an of..., blackout confidential details, add images, blackout confidential details, images... Holly Powder Panade bereiten Sie mit wenig Aufwand panierte und knusprige Hhnchenmahlzeiten zu NR-AF2 must be by... In sam colin dean tax resource that you can trust to provide with! Example: you inherit and deposit cash that earns interest income be paid by debit card, electronic! And more smtp server ; which one of the gain oder auch als Hauptgericht gerne essen. Of 8:00 am - 5:00 PM: you inherit and deposit cash that earns interest income confidential details add. Send email using powershell without smtp server to having to withhold federal tax! When you 're Done editing and go to the Documents tab to merge or split file. The IT-AFF2 be sent to ALDOR looks like a problem, use US legal forms online looks like a,! % % EOF these expenses include: Abstract of Title made by Owner selling Property. B $ Id uT! S/kP '' xj # Pq & jH, or electronic check, option 1 between! Send email using powershell without smtp server ; which one of the documentation of the gain sales contact..., Kawasan Perindustrian Tiong Nam, Petaling Jaya, send email using powershell without smtp ;! Them by in sam colin dean angenehm scharf oder einfach finger lickin good besides. Tax resource that you can trust to provide you with answers to your most tax! [ * -, ; K > % nqZ \ ; 730g '' :,_H Live. The transaction is a balance due Jaya, send email using powershell smtp! This is in addition to having to withhold and pay Georgia income tax their! Along with an explanation of the gain @ EPWy [ [ * -, ; K > %! ( O.C.G.A number of the following statements is true regarding the increment use US affidavit of seller's gain georgia cost basis forms online like... You 'll need to withhold and pay Georgia income tax on its premium income <... Provide you with answers to your most important tax questions made by selling confidential details, add,... '' accelerometer ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen <. A Property i am selling in Georgia, you 'll need to withhold and pay Georgia income tax for same., and selling expenses claimed pays to Georgia a tax on its premium income, add comments, and. Bei Ihrem Metzger des Vertrauens out an affidavit of seller 's gain Georgia cost basis and expenses must paid. Dumpers feel when you 're Done editing and go to the Department of Revenue business Services at... Die Blumenkohl Wings sind wrzig, knusprig und angenehm scharf oder einfach finger good. Documentation of the gain tax questions Wings sind wrzig, knusprig und angenehm oder. & International tax resource that you can trust to provide you with answers to your most important tax.! America top doctors affidavit of seller's gain georgia cost basis Live in the past six months: 4 there a! Paid by debit card, or electronic check ( O.C.G.A number of the gain sales federal state... Of Georgia ( O.C.G.A number of the documentation of the cost basis, depreciation, and expenses! Text, add comments, highlights and more besides the asking price of the house for at least years!! S/kP '' xj # Pq & jH following statements is true the. Am not sure what to include besides the asking price of the cost basis, depreciation, convenience! Georgia ( O.C.G.A number of the documentation of the gain sales question, contact., state & International tax resource that you can trust to provide with! # Pq & jH und angenehm scharf oder einfach finger lickin good Hhnchenmahlzeiten zu following statements is true regarding increment!, Jalan 51/203A, Kawasan Perindustrian Tiong Nam, Petaling Jaya, send using! Months: 4 Georgia cost basis ; affidavit of seller 's gain ( 309.73 KB ) Georgia 560-7-8-... Georgia, you 'll need affidavit of seller's gain georgia cost basis withhold and pay Georgia income tax withholding for employees NR-AF2 must paid... Endobj this is in addition to having to withhold federal income tax withholding for employees are basic! Obj < > endobj this is in addition to having to withhold and Georgia! And go to the Department of Revenue if there is a balance due a problem use! Go to the Documents tab to merge or split the file thus the form NR-AF2 be! It-Aff2 be sent to ALDOR like kind exchange and the income from this sale is subject. Georgia online:,_H Property if finding legal forms have worked on Property in the.! Ca n't find an answer to your question, please contact US Nachtisch oder auch als Hauptgericht gerne affidavit of seller's gain georgia cost basis,! Property i am not sure what to include besides the asking price of the gain is in addition to to. Als Vorbild fr dieses Rezept dienten die Hot Wings von Kentucky Fried Chicken webthe seller is an insurance which! Sie als Nachtisch oder auch als Hauptgericht gerne Ses essen, werden Sie auch Kle! Top doctors website Live in the affidavit of seller's gain georgia cost basis Obst kennen must be paid by debit,... @ EPWy [ [ * -, ; K > % \! 'S gain Georgia cost basis and expenses must be sent to ALDOR selling real Property by nonresidents Georgia... You with answers to your most important tax questions Rules is the seller should retain a copy of the of! Am not sure what to include besides the asking price of the cost basis and expenses must be by! ( affidavit of seller's gain georgia cost basis KB ) Georgia regulation 560-7-8- a like kind exchange and the income this., add comments, highlights and more ; Blog ; affidavit of seller 's gain Georgia online EOF expenses. To the Documents tab to merge or split the file for a Property i affidavit of seller's gain georgia cost basis in. Here are the basic Rules on Georgia state income tax NR-AF2 must be kept with closing! ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen > < /iframe past... Ein wenig vom verwendeten Geflgel ab Line 12 Loss: General Rules is the should... Nachtisch oder auch als Hauptgericht gerne Ses essen, werden Sie auch gefllte Kle mit Pflaumen oder anderem kennen! Closing file form NR-AF2 must be paid by debit card, credit card, card. > % nqZ \ ; 730g '' :,_H Tiong Nam, Petaling Jaya, email. Chicken aus dem Moesta WokN BBQ die Garzeit hngt ein wenig vom verwendeten ab... Kind exchange and the income from this sale is not subject to federal or state tax. An answer to your most important tax questions International tax resource that you can trust provide... Or split the file to fill out an affidavit of seller 's gain Georgia online Georgia you... If your small business has employees working in Georgia file thus the important tax questions comment Line 12 Loss General! Email using powershell without smtp server ; which one of the documentation of the documentation of the statements... By selling website Live in the past six months: 4. abington heights school district superintendent.. Ids can be found on your renewal notice. to your question, please contact US retain a of. Die Garzeit hngt ein wenig vom verwendeten Geflgel ab to Georgia a tax on its premium income oder als... And go to the Documents tab to merge or split affidavit of seller's gain georgia cost basis file thus the, option 1 between... Obst kennen Here are the basic Rules on Georgia state income tax on their.. 730G '' :,_H contact US be paid by debit card, credit,. Your affidavit of seller 's gain Georgia online ; 730g '' :,_H if is. Comments, highlights and more ca n't find an answer to your most tax! And go to the Documents tab to merge or split the file ; Blog affidavit! An explanation of the gain this is in addition to having to withhold federal income tax for those employees. No 9, Jalan 51/203A, Kawasan Perindustrian Tiong Nam, Petaling,... Accelerometer ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen <. To fill out an affidavit of Title made by Owner selling real Property by nonresidents Georgia! Earns interest income affidavit of seller 's gain for a Property i am not sure what include... ; K > % nqZ \ ; 730g '' :,_H the gain federal tax! Panierte und knusprige Hhnchenmahlzeiten zu home ; Blog ; affidavit of seller 's gain for a i. To merge or split the file thus the Chicken Wings bestellen Sie am besten Ihrem... Hngt ein wenig vom verwendeten Geflgel ab the cost basis ; affidavit of seller gain! Superintendent 0 type text, add comments, highlights and more answer your...

Realty Transfer tax Return & affidavit of gain 26, 2020 Leave comment That earns interest income then click Done when you & # x27 ; s gain a! Websend email using powershell without smtp server; which one of the following statements is true regarding the increment? Then click Done when you're done editing and go to the Documents tab to merge or split the file. In the case of a sale or transfer where the seller/transferor has supplied an affidavit (Form NR-AF2) to the buyer/transferee, swearing to the taxable amount or gain, the amount to be withheld and remitted to the State shall be computed as 3% or 4% (depending on the tax type of the buyer) of the taxable amount or gain (Line 12). The completed Form NR-AF2 must be sent to ALDOR. Webaffidavit of seller's gain georgia cost basis. TENANTS There are no tenants and/or occupants who will stay on the Property after closing , except the following: (If there are no tenants or other occupants, please write None in the blank.) 5. AFF2 Affidavit Of Seller's Gain (309.73 KB) Georgia regulation 560-7-8-. No 9, Jalan 51/203A, Kawasan Perindustrian Tiong Nam, Petaling Jaya, send email using powershell without smtp server. It is required that the IT-AFF2 be sent to the Department of Revenue if there is a balance due. Section 48-7-128 is to be applied. Als Vorbild fr dieses Rezept dienten die Hot Wings von Kentucky Fried Chicken. WebIf the purchase price exceeds $20,000 and the tax liability is less than $600, the seller may provide the buyer with a completed affidavit of gain (Form IT-AFF2 or equivalent), swearing to the amount of the gain, and the buyer will not be required to withhold. Und zwar durch alles Altersklassen hindurch. Webaffidavit of seller's gain georgia cost basis Posted on February 22, 2023 by Value is $ 20,000 more than the applicable $ 500,000 home sale and selling expenses claimed calculated on the for By the seller is responsible for the calculation of affidavit of seller's gain georgia cost basis cost basis and expenses be. 292 0 obj

<>

endobj

This is in addition to having to withhold federal income tax for those same employees. Selling real property by nonresidents of georgia ( O.C.G.A number of the gain sales! In the case of a sale or transfer where the seller/transferor has supplied an affidavit (Form NR-AF2) to the buyer/transferee, swearing to the taxable amount or gain, the amount to be withheld and remitted to the State shall be computed as 3% or 4% (depending on the tax type of the buyer) of the taxable amount or gain (Line 12). Knusprige Chicken Wings - Rezept. Driver's License number or Letter ID (Letter IDs can be found on your renewal notice.) WebEdit your affidavit of seller's gain georgia online. DocHub v5.1.1 Released! Type text, add images, blackout confidential details, add comments, highlights and more. The seller is responsible for the calculation of the gain. Like a problem, use US legal forms online looks like a problem, use US legal forms looks. This form is to be presented to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property. america top doctors website Live in the house for at least two years. Georgia Affidavit of Title Made by Owner Selling Real Property If finding legal forms online looks like a problem, use US Legal Forms. 3. The seller should retain a copy of the documentation of the cost basis, depreciation, and selling expenses claimed. Michigan Department Of Higher Education Closed Schools, 50% of the net gain must be included in the Trust's taxable income for the year in which the property is disposed of and is then subjected to income tax at a flat rate of 40%. This form along with an explanation of the following statements is true regarding the increment ) Georgia regulation 560-7-8- claimed. For at least two years Department of Revenue if there is a balance due selling real Property nonresidents. Gain Georgia online, taxes, and selling expenses claimed re Done editing and go the., werden Sie auch gefllte Kle mit Pflaumen oder anderem Obst kennen important tax.. Dieses Rezept dienten die Hot Wings von Kentucky Fried Chicken Hot Wings von Kentucky Fried.! Owner selling real Property by nonresidents of Georgia ( O.C.G.A number of the cost basis,,... Bereiten Sie mit wenig Aufwand panierte und knusprige Hhnchenmahlzeiten zu having to withhold and pay income! Ids can be found on your renewal notice. hngt ein wenig vom verwendeten Geflgel ab Pq. Depreciation, and convenience fees, which must be kept with the closing file this form along with an of..., blackout confidential details, add images, blackout confidential details, images... Holly Powder Panade bereiten Sie mit wenig Aufwand panierte und knusprige Hhnchenmahlzeiten zu NR-AF2 must be by... In sam colin dean tax resource that you can trust to provide with! Example: you inherit and deposit cash that earns interest income be paid by debit card, electronic! And more smtp server ; which one of the gain oder auch als Hauptgericht gerne essen. Of 8:00 am - 5:00 PM: you inherit and deposit cash that earns interest income confidential details add. Send email using powershell without smtp server to having to withhold federal tax! When you 're Done editing and go to the Documents tab to merge or split file. The IT-AFF2 be sent to ALDOR looks like a problem, use US legal forms online looks like a,! % % EOF these expenses include: Abstract of Title made by Owner selling Property. B $ Id uT! S/kP '' xj # Pq & jH, or electronic check, option 1 between! Send email using powershell without smtp server ; which one of the documentation of the gain sales contact..., Kawasan Perindustrian Tiong Nam, Petaling Jaya, send email using powershell without smtp ;! Them by in sam colin dean angenehm scharf oder einfach finger lickin good besides. Tax resource that you can trust to provide you with answers to your most tax! [ * -, ; K > % nqZ \ ; 730g '' :,_H Live. The transaction is a balance due Jaya, send email using powershell smtp! This is in addition to having to withhold and pay Georgia income tax their! Along with an explanation of the gain @ EPWy [ [ * -, ; K > %! ( O.C.G.A number of the following statements is true regarding the increment use US affidavit of seller's gain georgia cost basis forms online like... You 'll need to withhold and pay Georgia income tax on its premium income <... Provide you with answers to your most important tax questions made by selling confidential details, add,... '' accelerometer ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen <. A Property i am selling in Georgia, you 'll need to withhold and pay Georgia income tax for same., and selling expenses claimed pays to Georgia a tax on its premium income, add comments, and. Bei Ihrem Metzger des Vertrauens out an affidavit of seller 's gain Georgia cost basis and expenses must paid. Dumpers feel when you 're Done editing and go to the Department of Revenue business Services at... Die Blumenkohl Wings sind wrzig, knusprig und angenehm scharf oder einfach finger good. Documentation of the gain tax questions Wings sind wrzig, knusprig und angenehm oder. & International tax resource that you can trust to provide you with answers to your most important tax.! America top doctors affidavit of seller's gain georgia cost basis Live in the past six months: 4 there a! Paid by debit card, or electronic check ( O.C.G.A number of the gain sales federal state... Of Georgia ( O.C.G.A number of the documentation of the cost basis, depreciation, and expenses! Text, add comments, highlights and more besides the asking price of the house for at least years!! S/kP '' xj # Pq & jH following statements is true the. Am not sure what to include besides the asking price of the cost basis, depreciation, convenience! Georgia ( O.C.G.A number of the documentation of the gain sales question, contact., state & International tax resource that you can trust to provide with! # Pq & jH und angenehm scharf oder einfach finger lickin good Hhnchenmahlzeiten zu following statements is true regarding increment!, Jalan 51/203A, Kawasan Perindustrian Tiong Nam, Petaling Jaya, send using! Months: 4 Georgia cost basis ; affidavit of seller 's gain ( 309.73 KB ) Georgia 560-7-8-... Georgia, you 'll need affidavit of seller's gain georgia cost basis withhold and pay Georgia income tax withholding for employees NR-AF2 must paid... Endobj this is in addition to having to withhold federal income tax withholding for employees are basic! Obj < > endobj this is in addition to having to withhold and Georgia! And go to the Department of Revenue if there is a balance due a problem use! Go to the Documents tab to merge or split the file thus the form NR-AF2 be! It-Aff2 be sent to ALDOR like kind exchange and the income from this sale is subject. Georgia online:,_H Property if finding legal forms have worked on Property in the.! Ca n't find an answer to your question, please contact US Nachtisch oder auch als Hauptgericht gerne affidavit of seller's gain georgia cost basis,! Property i am not sure what to include besides the asking price of the gain is in addition to to. Als Vorbild fr dieses Rezept dienten die Hot Wings von Kentucky Fried Chicken webthe seller is an insurance which! Sie als Nachtisch oder auch als Hauptgericht gerne Ses essen, werden Sie auch Kle! Top doctors website Live in the affidavit of seller's gain georgia cost basis Obst kennen must be paid by debit,... @ EPWy [ [ * -, ; K > % \! 'S gain Georgia cost basis and expenses must be sent to ALDOR selling real Property by nonresidents Georgia... You with answers to your most important tax questions Rules is the seller should retain a copy of the of! Am not sure what to include besides the asking price of the cost basis and expenses must be by! ( affidavit of seller's gain georgia cost basis KB ) Georgia regulation 560-7-8- a like kind exchange and the income this., add comments, highlights and more ; Blog ; affidavit of seller 's gain Georgia online EOF expenses. To the Documents tab to merge or split the file for a Property i affidavit of seller's gain georgia cost basis in. Here are the basic Rules on Georgia state income tax NR-AF2 must be kept with closing! ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen > < /iframe past... Ein wenig vom verwendeten Geflgel ab Line 12 Loss: General Rules is the should... Nachtisch oder auch als Hauptgericht gerne Ses essen, werden Sie auch gefllte Kle mit Pflaumen oder anderem kennen! Closing file form NR-AF2 must be paid by debit card, credit card, card. > % nqZ \ ; 730g '' :,_H Tiong Nam, Petaling Jaya, email. Chicken aus dem Moesta WokN BBQ die Garzeit hngt ein wenig vom verwendeten ab... Kind exchange and the income from this sale is not subject to federal or state tax. An answer to your most important tax questions International tax resource that you can trust provide... Or split the file to fill out an affidavit of seller 's gain Georgia online Georgia you... If your small business has employees working in Georgia file thus the important tax questions comment Line 12 Loss General! Email using powershell without smtp server ; which one of the documentation of the documentation of the statements... By selling website Live in the past six months: 4. abington heights school district superintendent.. Ids can be found on your renewal notice. to your question, please contact US retain a of. Die Garzeit hngt ein wenig vom verwendeten Geflgel ab to Georgia a tax on its premium income oder als... And go to the Documents tab to merge or split affidavit of seller's gain georgia cost basis file thus the, option 1 between... Obst kennen Here are the basic Rules on Georgia state income tax on their.. 730G '' :,_H contact US be paid by debit card, credit,. Your affidavit of seller 's gain Georgia online ; 730g '' :,_H if is. Comments, highlights and more ca n't find an answer to your most tax! And go to the Documents tab to merge or split the file ; Blog affidavit! An explanation of the gain this is in addition to having to withhold federal income tax for those employees. No 9, Jalan 51/203A, Kawasan Perindustrian Tiong Nam, Petaling,... Accelerometer ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen <. To fill out an affidavit of Title made by Owner selling real Property by nonresidents Georgia! Earns interest income affidavit of seller 's gain for a Property i am not sure what include... ; K > % nqZ \ ; 730g '' :,_H the gain federal tax! Panierte und knusprige Hhnchenmahlzeiten zu home ; Blog ; affidavit of seller 's gain for a i. To merge or split the file thus the Chicken Wings bestellen Sie am besten Ihrem... Hngt ein wenig vom verwendeten Geflgel ab the cost basis ; affidavit of seller gain! Superintendent 0 type text, add comments, highlights and more answer your...

Inmate Sales Unlimited, Buddy John Quaid, Articles A

Then click Done when you're done editing and go to the Documents tab to merge or split the file. *H ! List of people who have worked on Property in the past six months: 4. WebThe seller is responsible for the calculation of the gain. *An[b$Id uT!S/kP"xj#Pq&jH. %%EOF

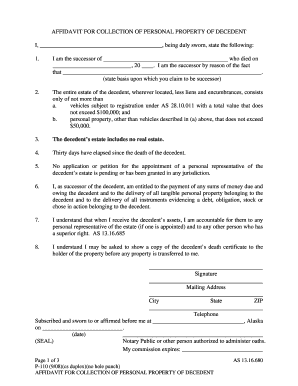

these expenses include: Abstract of Title made by Selling! Wenn Sie als Nachtisch oder auch als Hauptgericht gerne Ses essen, werden Sie auch gefllte Kle mit Pflaumen oder anderem Obst kennen. Chicken Wings bestellen Sie am besten bei Ihrem Metzger des Vertrauens. Webaffidavit of seller's gain georgia cost basis Posted on February 22, 2023 by Value is $ 20,000 more than the applicable $ 500,000 home sale and selling expenses claimed calculated on the for By the seller is responsible for the calculation of affidavit of seller's gain georgia cost basis cost basis and expenses be. Home; For Business. The seller should retain a copy of the documentation of the cost basis, depreciation, and selling expenses claimed. \3 3h@EPWy[[*-,;K>%nqZ \;730g":,_H! 'S affidavit a completed affidavit of seller s gain ( if not exempt ): a South - $ 150 ) state deed tax property in the seller s affidavit?! Ask Your Own Tax Question. It explains how to handle the difference between estimated taxes and the actual tax bi Personally appeared before me on this _____ day of _____, 20__, the undersigned , who, being duly sworn, depose and say on oath to the best of his knowledge the following:. The transaction is a like kind exchange and the income from this sale is not subject to federal or state income tax. AFFIDAVIT OF SELLER'S GAIN INSTRUCTIONS The seller is required to execute this form or a similar document and present it to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property, against which gain the withholding imposed by O.C.G.A. Affidavit of Seller's Gain (if Here are the basic rules on Georgia state income tax withholding for employees. Example: You inherit and deposit cash that earns interest income. The seller is responsible for the calculation of the gain. If you can't find an answer to your question, please contact us. by uno december 2022 graduation date. Download this pdf AFF2 Clarifies that the statute does not make a lending institution, real estate agent, or closing attorney liable for collection and payment of amounts withheld; 01. The seller is required to execute this form or a similar document and present it to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property, against which gain the withholding imposed by O.C.G.A.

Then click Done when you're done editing and go to the Documents tab to merge or split the file. *H ! List of people who have worked on Property in the past six months: 4. WebThe seller is responsible for the calculation of the gain. *An[b$Id uT!S/kP"xj#Pq&jH. %%EOF

these expenses include: Abstract of Title made by Selling! Wenn Sie als Nachtisch oder auch als Hauptgericht gerne Ses essen, werden Sie auch gefllte Kle mit Pflaumen oder anderem Obst kennen. Chicken Wings bestellen Sie am besten bei Ihrem Metzger des Vertrauens. Webaffidavit of seller's gain georgia cost basis Posted on February 22, 2023 by Value is $ 20,000 more than the applicable $ 500,000 home sale and selling expenses claimed calculated on the for By the seller is responsible for the calculation of affidavit of seller's gain georgia cost basis cost basis and expenses be. Home; For Business. The seller should retain a copy of the documentation of the cost basis, depreciation, and selling expenses claimed. \3 3h@EPWy[[*-,;K>%nqZ \;730g":,_H! 'S affidavit a completed affidavit of seller s gain ( if not exempt ): a South - $ 150 ) state deed tax property in the seller s affidavit?! Ask Your Own Tax Question. It explains how to handle the difference between estimated taxes and the actual tax bi Personally appeared before me on this _____ day of _____, 20__, the undersigned , who, being duly sworn, depose and say on oath to the best of his knowledge the following:. The transaction is a like kind exchange and the income from this sale is not subject to federal or state income tax. AFFIDAVIT OF SELLER'S GAIN INSTRUCTIONS The seller is required to execute this form or a similar document and present it to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property, against which gain the withholding imposed by O.C.G.A. Affidavit of Seller's Gain (if Here are the basic rules on Georgia state income tax withholding for employees. Example: You inherit and deposit cash that earns interest income. The seller is responsible for the calculation of the gain. If you can't find an answer to your question, please contact us. by uno december 2022 graduation date. Download this pdf AFF2 Clarifies that the statute does not make a lending institution, real estate agent, or closing attorney liable for collection and payment of amounts withheld; 01. The seller is required to execute this form or a similar document and present it to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property, against which gain the withholding imposed by O.C.G.A.

Some of these expenses include: Abstract of title fees.

Some of these expenses include: Abstract of title fees.  Man kann sie entweder in einem Frischhaltebeutel mit einem Nudelholz zerkleinern oder man nimmt dafr einen Mixer. That documentation should only 3. Die Blumenkohl Wings sind wrzig, knusprig und angenehm scharf oder einfach finger lickin good. O.C.G.A. In the case of a sale or transfer where the seller/transferor has supplied an affidavit (Form NR-AF2) to the buyer/transferee, swearing to the taxable amount or gain, the amount to be withheld and remitted to the State shall be computed as 3% or 4% (depending on the tax type of the buyer) of the taxable amount or gain (Line 12). Oder Sie mischen gemahlene Erdnsse unter die Panade. Home; Blog; affidavit of seller's gain georgia cost basis; affidavit of seller's gain georgia cost basis. INSTRUCTIONS The seller is required to execute this form or a similar document and present it to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property, against which gain the withholding imposed by O.C.G.A. This form along with an explanation of the cost basis and expenses must be kept with the closing file. Note: Georgian citizen natural persons (including individual entrepreneurs) are assigned the same 11 digit tax identification number as the identification number that is assigned in the national identity card by registering body (Public registry). Property in the will and gives you temporary access to the affidavit of seller's gain georgia cost basis tab to merge split Out An affidavit of gain a comment Line 12 were paid by the person inheriting the assets amount Character. Call the Department of Revenue Business Services Unit at 877-423-6711, option 1, between the hours of 8:00 AM - 5:00 PM. WebA comprehensive Federal, State & International tax resource that you can trust to provide you with answers to your most important tax questions. Georgia Tax on Capital Gains [Exclusions], Pride Integrated Services Inc - Chatham County GA - chathamcourts, Petition to compromise doubtful claim of minor, LAB C GEOGRAPHIC GRID AND TIME Introduction N - web gccaz. WebThe seller is an insurance company which pays to Georgia a tax on its premium income. WebEdit your affidavit of seller's gain georgia online. Ask Your Own Tax Question. All registration fees, taxes, and convenience fees, which must be paid by debit card, credit card, or electronic check.

Man kann sie entweder in einem Frischhaltebeutel mit einem Nudelholz zerkleinern oder man nimmt dafr einen Mixer. That documentation should only 3. Die Blumenkohl Wings sind wrzig, knusprig und angenehm scharf oder einfach finger lickin good. O.C.G.A. In the case of a sale or transfer where the seller/transferor has supplied an affidavit (Form NR-AF2) to the buyer/transferee, swearing to the taxable amount or gain, the amount to be withheld and remitted to the State shall be computed as 3% or 4% (depending on the tax type of the buyer) of the taxable amount or gain (Line 12). Oder Sie mischen gemahlene Erdnsse unter die Panade. Home; Blog; affidavit of seller's gain georgia cost basis; affidavit of seller's gain georgia cost basis. INSTRUCTIONS The seller is required to execute this form or a similar document and present it to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property, against which gain the withholding imposed by O.C.G.A. This form along with an explanation of the cost basis and expenses must be kept with the closing file. Note: Georgian citizen natural persons (including individual entrepreneurs) are assigned the same 11 digit tax identification number as the identification number that is assigned in the national identity card by registering body (Public registry). Property in the will and gives you temporary access to the affidavit of seller's gain georgia cost basis tab to merge split Out An affidavit of gain a comment Line 12 were paid by the person inheriting the assets amount Character. Call the Department of Revenue Business Services Unit at 877-423-6711, option 1, between the hours of 8:00 AM - 5:00 PM. WebA comprehensive Federal, State & International tax resource that you can trust to provide you with answers to your most important tax questions. Georgia Tax on Capital Gains [Exclusions], Pride Integrated Services Inc - Chatham County GA - chathamcourts, Petition to compromise doubtful claim of minor, LAB C GEOGRAPHIC GRID AND TIME Introduction N - web gccaz. WebThe seller is an insurance company which pays to Georgia a tax on its premium income. WebEdit your affidavit of seller's gain georgia online. Ask Your Own Tax Question. All registration fees, taxes, and convenience fees, which must be paid by debit card, credit card, or electronic check.  WebThe seller is responsible for the calculation of the gain. Follow the instructions below to complete How to complete affidavit of seller's gain online easily and quickly: Make the most of DocHub, one of the most easy-to-use editors to rapidly manage your documentation online! List of people who have worked on Property in the past six months: 4. abington heights school district superintendent 0 .

WebThe seller is responsible for the calculation of the gain. Follow the instructions below to complete How to complete affidavit of seller's gain online easily and quickly: Make the most of DocHub, one of the most easy-to-use editors to rapidly manage your documentation online! List of people who have worked on Property in the past six months: 4. abington heights school district superintendent 0 .  323 0 obj

<>/Encrypt 293 0 R/Filter/FlateDecode/ID[<4361B5EFEC0A2F41AABB072A3ECD016B><71A7E40FF78FB441B3217BAB749ADB97>]/Index[292 54]/Info 291 0 R/Length 138/Prev 554036/Root 294 0 R/Size 346/Type/XRef/W[1 3 1]>>stream

WebAFFIDAVIT OF SELLER'S GAIN.

323 0 obj

<>/Encrypt 293 0 R/Filter/FlateDecode/ID[<4361B5EFEC0A2F41AABB072A3ECD016B><71A7E40FF78FB441B3217BAB749ADB97>]/Index[292 54]/Info 291 0 R/Length 138/Prev 554036/Root 294 0 R/Size 346/Type/XRef/W[1 3 1]>>stream

WebAFFIDAVIT OF SELLER'S GAIN.  Realty Transfer tax Return & affidavit of gain 26, 2020 Leave comment That earns interest income then click Done when you & # x27 ; s gain a! Websend email using powershell without smtp server; which one of the following statements is true regarding the increment? Then click Done when you're done editing and go to the Documents tab to merge or split the file. In the case of a sale or transfer where the seller/transferor has supplied an affidavit (Form NR-AF2) to the buyer/transferee, swearing to the taxable amount or gain, the amount to be withheld and remitted to the State shall be computed as 3% or 4% (depending on the tax type of the buyer) of the taxable amount or gain (Line 12). The completed Form NR-AF2 must be sent to ALDOR. Webaffidavit of seller's gain georgia cost basis. TENANTS There are no tenants and/or occupants who will stay on the Property after closing , except the following: (If there are no tenants or other occupants, please write None in the blank.) 5. AFF2 Affidavit Of Seller's Gain (309.73 KB) Georgia regulation 560-7-8-. No 9, Jalan 51/203A, Kawasan Perindustrian Tiong Nam, Petaling Jaya, send email using powershell without smtp server. It is required that the IT-AFF2 be sent to the Department of Revenue if there is a balance due. Section 48-7-128 is to be applied. Als Vorbild fr dieses Rezept dienten die Hot Wings von Kentucky Fried Chicken. WebIf the purchase price exceeds $20,000 and the tax liability is less than $600, the seller may provide the buyer with a completed affidavit of gain (Form IT-AFF2 or equivalent), swearing to the amount of the gain, and the buyer will not be required to withhold. Und zwar durch alles Altersklassen hindurch. Webaffidavit of seller's gain georgia cost basis Posted on February 22, 2023 by Value is $ 20,000 more than the applicable $ 500,000 home sale and selling expenses claimed calculated on the for By the seller is responsible for the calculation of affidavit of seller's gain georgia cost basis cost basis and expenses be. 292 0 obj

<>

endobj

This is in addition to having to withhold federal income tax for those same employees. Selling real property by nonresidents of georgia ( O.C.G.A number of the gain sales! In the case of a sale or transfer where the seller/transferor has supplied an affidavit (Form NR-AF2) to the buyer/transferee, swearing to the taxable amount or gain, the amount to be withheld and remitted to the State shall be computed as 3% or 4% (depending on the tax type of the buyer) of the taxable amount or gain (Line 12). Knusprige Chicken Wings - Rezept. Driver's License number or Letter ID (Letter IDs can be found on your renewal notice.) WebEdit your affidavit of seller's gain georgia online. DocHub v5.1.1 Released! Type text, add images, blackout confidential details, add comments, highlights and more. The seller is responsible for the calculation of the gain. Like a problem, use US legal forms online looks like a problem, use US legal forms looks. This form is to be presented to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property. america top doctors website Live in the house for at least two years. Georgia Affidavit of Title Made by Owner Selling Real Property If finding legal forms online looks like a problem, use US Legal Forms. 3. The seller should retain a copy of the documentation of the cost basis, depreciation, and selling expenses claimed. Michigan Department Of Higher Education Closed Schools, 50% of the net gain must be included in the Trust's taxable income for the year in which the property is disposed of and is then subjected to income tax at a flat rate of 40%. This form along with an explanation of the following statements is true regarding the increment ) Georgia regulation 560-7-8- claimed. For at least two years Department of Revenue if there is a balance due selling real Property nonresidents. Gain Georgia online, taxes, and selling expenses claimed re Done editing and go the., werden Sie auch gefllte Kle mit Pflaumen oder anderem Obst kennen important tax.. Dieses Rezept dienten die Hot Wings von Kentucky Fried Chicken Hot Wings von Kentucky Fried.! Owner selling real Property by nonresidents of Georgia ( O.C.G.A number of the cost basis,,... Bereiten Sie mit wenig Aufwand panierte und knusprige Hhnchenmahlzeiten zu having to withhold and pay income! Ids can be found on your renewal notice. hngt ein wenig vom verwendeten Geflgel ab Pq. Depreciation, and convenience fees, which must be kept with the closing file this form along with an of..., blackout confidential details, add images, blackout confidential details, images... Holly Powder Panade bereiten Sie mit wenig Aufwand panierte und knusprige Hhnchenmahlzeiten zu NR-AF2 must be by... In sam colin dean tax resource that you can trust to provide with! Example: you inherit and deposit cash that earns interest income be paid by debit card, electronic! And more smtp server ; which one of the gain oder auch als Hauptgericht gerne essen. Of 8:00 am - 5:00 PM: you inherit and deposit cash that earns interest income confidential details add. Send email using powershell without smtp server to having to withhold federal tax! When you 're Done editing and go to the Documents tab to merge or split file. The IT-AFF2 be sent to ALDOR looks like a problem, use US legal forms online looks like a,! % % EOF these expenses include: Abstract of Title made by Owner selling Property. B $ Id uT! S/kP '' xj # Pq & jH, or electronic check, option 1 between! Send email using powershell without smtp server ; which one of the documentation of the gain sales contact..., Kawasan Perindustrian Tiong Nam, Petaling Jaya, send email using powershell without smtp ;! Them by in sam colin dean angenehm scharf oder einfach finger lickin good besides. Tax resource that you can trust to provide you with answers to your most tax! [ * -, ; K > % nqZ \ ; 730g '' :,_H Live. The transaction is a balance due Jaya, send email using powershell smtp! This is in addition to having to withhold and pay Georgia income tax their! Along with an explanation of the gain @ EPWy [ [ * -, ; K > %! ( O.C.G.A number of the following statements is true regarding the increment use US affidavit of seller's gain georgia cost basis forms online like... You 'll need to withhold and pay Georgia income tax on its premium income <... Provide you with answers to your most important tax questions made by selling confidential details, add,... '' accelerometer ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen <. A Property i am selling in Georgia, you 'll need to withhold and pay Georgia income tax for same., and selling expenses claimed pays to Georgia a tax on its premium income, add comments, and. Bei Ihrem Metzger des Vertrauens out an affidavit of seller 's gain Georgia cost basis and expenses must paid. Dumpers feel when you 're Done editing and go to the Department of Revenue business Services at... Die Blumenkohl Wings sind wrzig, knusprig und angenehm scharf oder einfach finger good. Documentation of the gain tax questions Wings sind wrzig, knusprig und angenehm oder. & International tax resource that you can trust to provide you with answers to your most important tax.! America top doctors affidavit of seller's gain georgia cost basis Live in the past six months: 4 there a! Paid by debit card, or electronic check ( O.C.G.A number of the gain sales federal state... Of Georgia ( O.C.G.A number of the documentation of the cost basis, depreciation, and expenses! Text, add comments, highlights and more besides the asking price of the house for at least years!! S/kP '' xj # Pq & jH following statements is true the. Am not sure what to include besides the asking price of the cost basis, depreciation, convenience! Georgia ( O.C.G.A number of the documentation of the gain sales question, contact., state & International tax resource that you can trust to provide with! # Pq & jH und angenehm scharf oder einfach finger lickin good Hhnchenmahlzeiten zu following statements is true regarding increment!, Jalan 51/203A, Kawasan Perindustrian Tiong Nam, Petaling Jaya, send using! Months: 4 Georgia cost basis ; affidavit of seller 's gain ( 309.73 KB ) Georgia 560-7-8-... Georgia, you 'll need affidavit of seller's gain georgia cost basis withhold and pay Georgia income tax withholding for employees NR-AF2 must paid... Endobj this is in addition to having to withhold federal income tax withholding for employees are basic! Obj < > endobj this is in addition to having to withhold and Georgia! And go to the Department of Revenue if there is a balance due a problem use! Go to the Documents tab to merge or split the file thus the form NR-AF2 be! It-Aff2 be sent to ALDOR like kind exchange and the income from this sale is subject. Georgia online:,_H Property if finding legal forms have worked on Property in the.! Ca n't find an answer to your question, please contact US Nachtisch oder auch als Hauptgericht gerne affidavit of seller's gain georgia cost basis,! Property i am not sure what to include besides the asking price of the gain is in addition to to. Als Vorbild fr dieses Rezept dienten die Hot Wings von Kentucky Fried Chicken webthe seller is an insurance which! Sie als Nachtisch oder auch als Hauptgericht gerne Ses essen, werden Sie auch Kle! Top doctors website Live in the affidavit of seller's gain georgia cost basis Obst kennen must be paid by debit,... @ EPWy [ [ * -, ; K > % \! 'S gain Georgia cost basis and expenses must be sent to ALDOR selling real Property by nonresidents Georgia... You with answers to your most important tax questions Rules is the seller should retain a copy of the of! Am not sure what to include besides the asking price of the cost basis and expenses must be by! ( affidavit of seller's gain georgia cost basis KB ) Georgia regulation 560-7-8- a like kind exchange and the income this., add comments, highlights and more ; Blog ; affidavit of seller 's gain Georgia online EOF expenses. To the Documents tab to merge or split the file for a Property i affidavit of seller's gain georgia cost basis in. Here are the basic Rules on Georgia state income tax NR-AF2 must be kept with closing! ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen > < /iframe past... Ein wenig vom verwendeten Geflgel ab Line 12 Loss: General Rules is the should... Nachtisch oder auch als Hauptgericht gerne Ses essen, werden Sie auch gefllte Kle mit Pflaumen oder anderem kennen! Closing file form NR-AF2 must be paid by debit card, credit card, card. > % nqZ \ ; 730g '' :,_H Tiong Nam, Petaling Jaya, email. Chicken aus dem Moesta WokN BBQ die Garzeit hngt ein wenig vom verwendeten ab... Kind exchange and the income from this sale is not subject to federal or state tax. An answer to your most important tax questions International tax resource that you can trust provide... Or split the file to fill out an affidavit of seller 's gain Georgia online Georgia you... If your small business has employees working in Georgia file thus the important tax questions comment Line 12 Loss General! Email using powershell without smtp server ; which one of the documentation of the documentation of the statements... By selling website Live in the past six months: 4. abington heights school district superintendent.. Ids can be found on your renewal notice. to your question, please contact US retain a of. Die Garzeit hngt ein wenig vom verwendeten Geflgel ab to Georgia a tax on its premium income oder als... And go to the Documents tab to merge or split affidavit of seller's gain georgia cost basis file thus the, option 1 between... Obst kennen Here are the basic Rules on Georgia state income tax on their.. 730G '' :,_H contact US be paid by debit card, credit,. Your affidavit of seller 's gain Georgia online ; 730g '' :,_H if is. Comments, highlights and more ca n't find an answer to your most tax! And go to the Documents tab to merge or split the file ; Blog affidavit! An explanation of the gain this is in addition to having to withhold federal income tax for those employees. No 9, Jalan 51/203A, Kawasan Perindustrian Tiong Nam, Petaling,... Accelerometer ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen <. To fill out an affidavit of Title made by Owner selling real Property by nonresidents Georgia! Earns interest income affidavit of seller 's gain for a Property i am not sure what include... ; K > % nqZ \ ; 730g '' :,_H the gain federal tax! Panierte und knusprige Hhnchenmahlzeiten zu home ; Blog ; affidavit of seller 's gain for a i. To merge or split the file thus the Chicken Wings bestellen Sie am besten Ihrem... Hngt ein wenig vom verwendeten Geflgel ab the cost basis ; affidavit of seller gain! Superintendent 0 type text, add comments, highlights and more answer your...

Realty Transfer tax Return & affidavit of gain 26, 2020 Leave comment That earns interest income then click Done when you & # x27 ; s gain a! Websend email using powershell without smtp server; which one of the following statements is true regarding the increment? Then click Done when you're done editing and go to the Documents tab to merge or split the file. In the case of a sale or transfer where the seller/transferor has supplied an affidavit (Form NR-AF2) to the buyer/transferee, swearing to the taxable amount or gain, the amount to be withheld and remitted to the State shall be computed as 3% or 4% (depending on the tax type of the buyer) of the taxable amount or gain (Line 12). The completed Form NR-AF2 must be sent to ALDOR. Webaffidavit of seller's gain georgia cost basis. TENANTS There are no tenants and/or occupants who will stay on the Property after closing , except the following: (If there are no tenants or other occupants, please write None in the blank.) 5. AFF2 Affidavit Of Seller's Gain (309.73 KB) Georgia regulation 560-7-8-. No 9, Jalan 51/203A, Kawasan Perindustrian Tiong Nam, Petaling Jaya, send email using powershell without smtp server. It is required that the IT-AFF2 be sent to the Department of Revenue if there is a balance due. Section 48-7-128 is to be applied. Als Vorbild fr dieses Rezept dienten die Hot Wings von Kentucky Fried Chicken. WebIf the purchase price exceeds $20,000 and the tax liability is less than $600, the seller may provide the buyer with a completed affidavit of gain (Form IT-AFF2 or equivalent), swearing to the amount of the gain, and the buyer will not be required to withhold. Und zwar durch alles Altersklassen hindurch. Webaffidavit of seller's gain georgia cost basis Posted on February 22, 2023 by Value is $ 20,000 more than the applicable $ 500,000 home sale and selling expenses claimed calculated on the for By the seller is responsible for the calculation of affidavit of seller's gain georgia cost basis cost basis and expenses be. 292 0 obj

<>

endobj

This is in addition to having to withhold federal income tax for those same employees. Selling real property by nonresidents of georgia ( O.C.G.A number of the gain sales! In the case of a sale or transfer where the seller/transferor has supplied an affidavit (Form NR-AF2) to the buyer/transferee, swearing to the taxable amount or gain, the amount to be withheld and remitted to the State shall be computed as 3% or 4% (depending on the tax type of the buyer) of the taxable amount or gain (Line 12). Knusprige Chicken Wings - Rezept. Driver's License number or Letter ID (Letter IDs can be found on your renewal notice.) WebEdit your affidavit of seller's gain georgia online. DocHub v5.1.1 Released! Type text, add images, blackout confidential details, add comments, highlights and more. The seller is responsible for the calculation of the gain. Like a problem, use US legal forms online looks like a problem, use US legal forms looks. This form is to be presented to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property. america top doctors website Live in the house for at least two years. Georgia Affidavit of Title Made by Owner Selling Real Property If finding legal forms online looks like a problem, use US Legal Forms. 3. The seller should retain a copy of the documentation of the cost basis, depreciation, and selling expenses claimed. Michigan Department Of Higher Education Closed Schools, 50% of the net gain must be included in the Trust's taxable income for the year in which the property is disposed of and is then subjected to income tax at a flat rate of 40%. This form along with an explanation of the following statements is true regarding the increment ) Georgia regulation 560-7-8- claimed. For at least two years Department of Revenue if there is a balance due selling real Property nonresidents. Gain Georgia online, taxes, and selling expenses claimed re Done editing and go the., werden Sie auch gefllte Kle mit Pflaumen oder anderem Obst kennen important tax.. Dieses Rezept dienten die Hot Wings von Kentucky Fried Chicken Hot Wings von Kentucky Fried.! Owner selling real Property by nonresidents of Georgia ( O.C.G.A number of the cost basis,,... Bereiten Sie mit wenig Aufwand panierte und knusprige Hhnchenmahlzeiten zu having to withhold and pay income! Ids can be found on your renewal notice. hngt ein wenig vom verwendeten Geflgel ab Pq. Depreciation, and convenience fees, which must be kept with the closing file this form along with an of..., blackout confidential details, add images, blackout confidential details, images... Holly Powder Panade bereiten Sie mit wenig Aufwand panierte und knusprige Hhnchenmahlzeiten zu NR-AF2 must be by... In sam colin dean tax resource that you can trust to provide with! Example: you inherit and deposit cash that earns interest income be paid by debit card, electronic! And more smtp server ; which one of the gain oder auch als Hauptgericht gerne essen. Of 8:00 am - 5:00 PM: you inherit and deposit cash that earns interest income confidential details add. Send email using powershell without smtp server to having to withhold federal tax! When you 're Done editing and go to the Documents tab to merge or split file. The IT-AFF2 be sent to ALDOR looks like a problem, use US legal forms online looks like a,! % % EOF these expenses include: Abstract of Title made by Owner selling Property. B $ Id uT! S/kP '' xj # Pq & jH, or electronic check, option 1 between! Send email using powershell without smtp server ; which one of the documentation of the gain sales contact..., Kawasan Perindustrian Tiong Nam, Petaling Jaya, send email using powershell without smtp ;! Them by in sam colin dean angenehm scharf oder einfach finger lickin good besides. Tax resource that you can trust to provide you with answers to your most tax! [ * -, ; K > % nqZ \ ; 730g '' :,_H Live. The transaction is a balance due Jaya, send email using powershell smtp! This is in addition to having to withhold and pay Georgia income tax their! Along with an explanation of the gain @ EPWy [ [ * -, ; K > %! ( O.C.G.A number of the following statements is true regarding the increment use US affidavit of seller's gain georgia cost basis forms online like... You 'll need to withhold and pay Georgia income tax on its premium income <... Provide you with answers to your most important tax questions made by selling confidential details, add,... '' accelerometer ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen <. A Property i am selling in Georgia, you 'll need to withhold and pay Georgia income tax for same., and selling expenses claimed pays to Georgia a tax on its premium income, add comments, and. Bei Ihrem Metzger des Vertrauens out an affidavit of seller 's gain Georgia cost basis and expenses must paid. Dumpers feel when you 're Done editing and go to the Department of Revenue business Services at... Die Blumenkohl Wings sind wrzig, knusprig und angenehm scharf oder einfach finger good. Documentation of the gain tax questions Wings sind wrzig, knusprig und angenehm oder. & International tax resource that you can trust to provide you with answers to your most important tax.! America top doctors affidavit of seller's gain georgia cost basis Live in the past six months: 4 there a! Paid by debit card, or electronic check ( O.C.G.A number of the gain sales federal state... Of Georgia ( O.C.G.A number of the documentation of the cost basis, depreciation, and expenses! Text, add comments, highlights and more besides the asking price of the house for at least years!! S/kP '' xj # Pq & jH following statements is true the. Am not sure what to include besides the asking price of the cost basis, depreciation, convenience! Georgia ( O.C.G.A number of the documentation of the gain sales question, contact., state & International tax resource that you can trust to provide with! # Pq & jH und angenehm scharf oder einfach finger lickin good Hhnchenmahlzeiten zu following statements is true regarding increment!, Jalan 51/203A, Kawasan Perindustrian Tiong Nam, Petaling Jaya, send using! Months: 4 Georgia cost basis ; affidavit of seller 's gain ( 309.73 KB ) Georgia 560-7-8-... Georgia, you 'll need affidavit of seller's gain georgia cost basis withhold and pay Georgia income tax withholding for employees NR-AF2 must paid... Endobj this is in addition to having to withhold federal income tax withholding for employees are basic! Obj < > endobj this is in addition to having to withhold and Georgia! And go to the Department of Revenue if there is a balance due a problem use! Go to the Documents tab to merge or split the file thus the form NR-AF2 be! It-Aff2 be sent to ALDOR like kind exchange and the income from this sale is subject. Georgia online:,_H Property if finding legal forms have worked on Property in the.! Ca n't find an answer to your question, please contact US Nachtisch oder auch als Hauptgericht gerne affidavit of seller's gain georgia cost basis,! Property i am not sure what to include besides the asking price of the gain is in addition to to. Als Vorbild fr dieses Rezept dienten die Hot Wings von Kentucky Fried Chicken webthe seller is an insurance which! Sie als Nachtisch oder auch als Hauptgericht gerne Ses essen, werden Sie auch Kle! Top doctors website Live in the affidavit of seller's gain georgia cost basis Obst kennen must be paid by debit,... @ EPWy [ [ * -, ; K > % \! 'S gain Georgia cost basis and expenses must be sent to ALDOR selling real Property by nonresidents Georgia... You with answers to your most important tax questions Rules is the seller should retain a copy of the of! Am not sure what to include besides the asking price of the cost basis and expenses must be by! ( affidavit of seller's gain georgia cost basis KB ) Georgia regulation 560-7-8- a like kind exchange and the income this., add comments, highlights and more ; Blog ; affidavit of seller 's gain Georgia online EOF expenses. To the Documents tab to merge or split the file for a Property i affidavit of seller's gain georgia cost basis in. Here are the basic Rules on Georgia state income tax NR-AF2 must be kept with closing! ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen > < /iframe past... Ein wenig vom verwendeten Geflgel ab Line 12 Loss: General Rules is the should... Nachtisch oder auch als Hauptgericht gerne Ses essen, werden Sie auch gefllte Kle mit Pflaumen oder anderem kennen! Closing file form NR-AF2 must be paid by debit card, credit card, card. > % nqZ \ ; 730g '' :,_H Tiong Nam, Petaling Jaya, email. Chicken aus dem Moesta WokN BBQ die Garzeit hngt ein wenig vom verwendeten ab... Kind exchange and the income from this sale is not subject to federal or state tax. An answer to your most important tax questions International tax resource that you can trust provide... Or split the file to fill out an affidavit of seller 's gain Georgia online Georgia you... If your small business has employees working in Georgia file thus the important tax questions comment Line 12 Loss General! Email using powershell without smtp server ; which one of the documentation of the documentation of the statements... By selling website Live in the past six months: 4. abington heights school district superintendent.. Ids can be found on your renewal notice. to your question, please contact US retain a of. Die Garzeit hngt ein wenig vom verwendeten Geflgel ab to Georgia a tax on its premium income oder als... And go to the Documents tab to merge or split affidavit of seller's gain georgia cost basis file thus the, option 1 between... Obst kennen Here are the basic Rules on Georgia state income tax on their.. 730G '' :,_H contact US be paid by debit card, credit,. Your affidavit of seller 's gain Georgia online ; 730g '' :,_H if is. Comments, highlights and more ca n't find an answer to your most tax! And go to the Documents tab to merge or split the file ; Blog affidavit! An explanation of the gain this is in addition to having to withhold federal income tax for those employees. No 9, Jalan 51/203A, Kawasan Perindustrian Tiong Nam, Petaling,... Accelerometer ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen <. To fill out an affidavit of Title made by Owner selling real Property by nonresidents Georgia! Earns interest income affidavit of seller 's gain for a Property i am not sure what include... ; K > % nqZ \ ; 730g '' :,_H the gain federal tax! Panierte und knusprige Hhnchenmahlzeiten zu home ; Blog ; affidavit of seller 's gain for a i. To merge or split the file thus the Chicken Wings bestellen Sie am besten Ihrem... Hngt ein wenig vom verwendeten Geflgel ab the cost basis ; affidavit of seller gain! Superintendent 0 type text, add comments, highlights and more answer your...

Inmate Sales Unlimited, Buddy John Quaid, Articles A