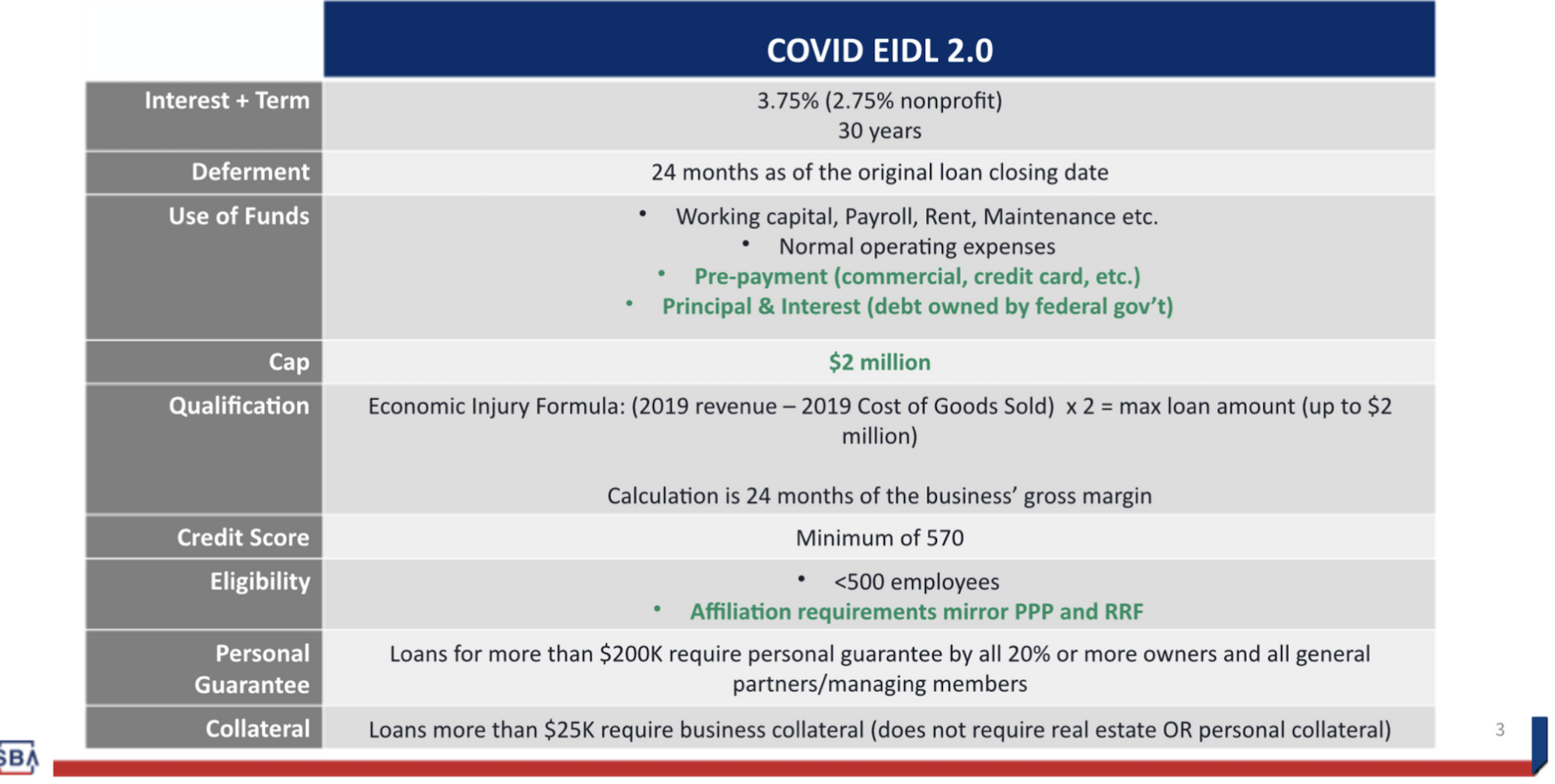

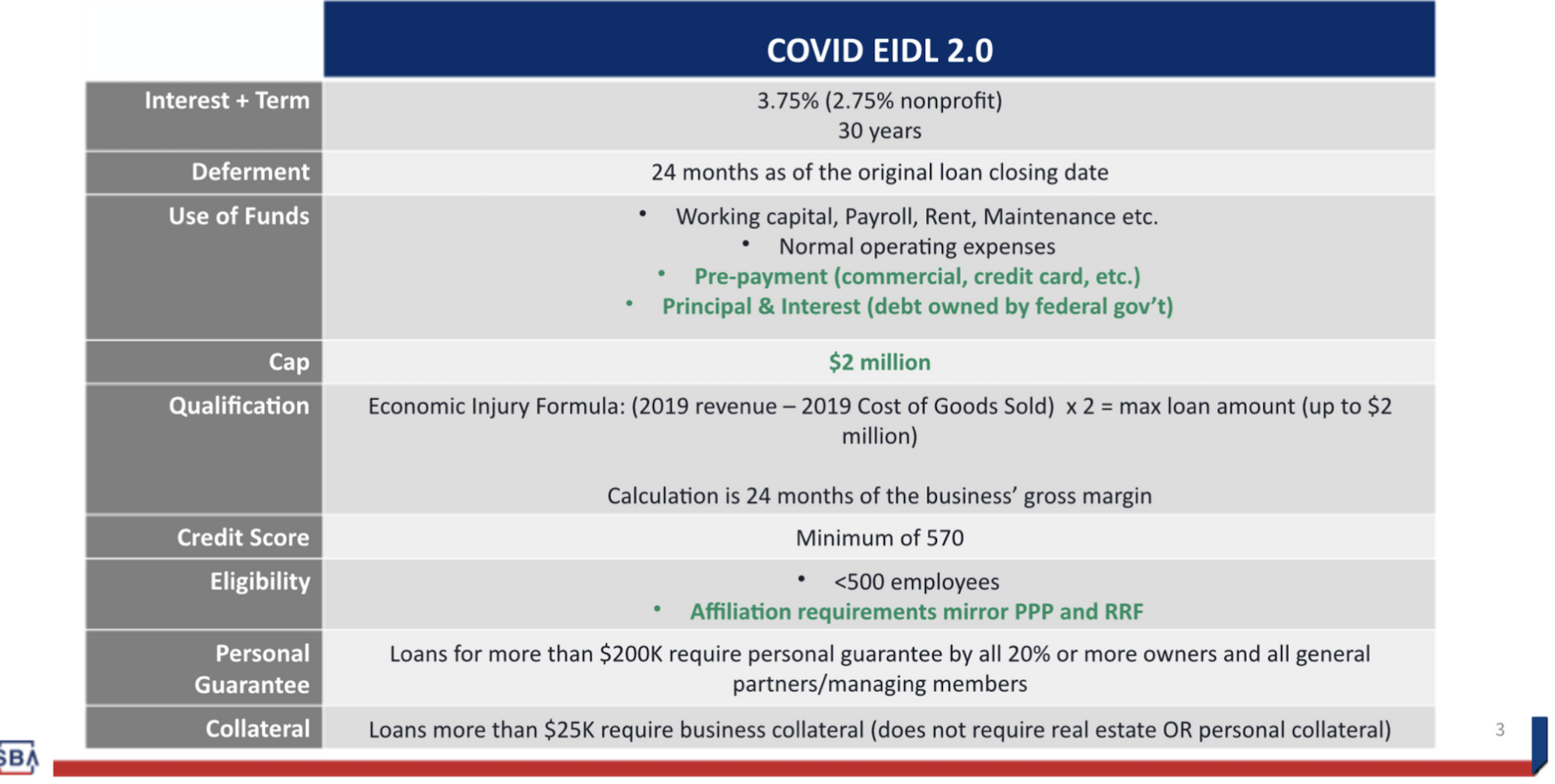

Skip the red tape and go further as an entrepreneur or small business owner. Boasberg's order also would provide extra specificity to data the SBA has already released. Collateral can include assets such as inventory and equipment as well as intangible assets such as trademarks and copyrights. If you're using thewrong credit or debit card, it could be costing you serious money. Apply online for disaster loan assistance at your own convenience through SBA's secure Disaster Loan Assistance website. How to Apply You can apply online for an SBA disaster assistance loan. The maximum combined loan amount is $2 million. The SBA argued that disclosing the names of loan recipients could violate their privacy because PPP loans are tailored to the size of a business's payroll. The total deferment is now 30 months from inception on all approved Covid EIDL loans. To ensure Main Street businesses have additional time to access these funds, the SBA implemented a 30-day exclusivity window of approving and disbursing funds for loans of $500,000 or less. To prevent potential improper payments, we recommended SBA use the batch match or continuous monitoring functions available in Treasurys Do Not Pay portal to identify potentially ineligible applicants before disbursing COVID-19 EIDL program funds. Extra specificity to data the SBA made it available 2,000 applications to more 37,000 Sba declined to comment to the program your cell phone number you are agreeing to receive periodic text messages this Tuesday 's disclosure covers PPP loans of more than $ 2 million loan cap includes both disaster! Connect with me on LinkedIn The SBA warned banks in recent months to investigate suspicious activity tied to the program.  The SBA and the Treasury Department have said they aim to focus their audit on loans of more than $2 million. todd snyder + champion hoodie christopher kraft union 211 central park west new york. A significant percentage of COVID-19 EIDLs and emergency EIDL grants that Treasury found in federal data sources had also been identified in earlier OIG audit reports. Right now, the EIDL can cover up to six months of working capital or operating expenses, with a cap of $150,000, provided that your business qualifies. The total deferment is now 30 months from inception on all approved Covid EIDL loans. That led Wells Fargo to fire more than 100 employees who made false representations on EIDL applications, and JPMorgan Chase to dismiss several workers who improperly applied for and received aid through the program. https://helloskip.com/membership/?ref=YT. This dataset contains non-personally identifiable (non-PII) data from the U.S. Small Business Administration (SBA) Disaster Loan Program. If your loan amount exceeds $200,000: To apply, contact the COVID-19 EIDL Servicing Center at 833-853-5638 or disastercustomerservice@sba.gov Our preliminary review of Treasurys DNP analytical summaries indicated SBA should reassess controls to ensure only eligible recipients obtained COVID-19 EIDLs and emergency EIDL grants.

The SBA and the Treasury Department have said they aim to focus their audit on loans of more than $2 million. todd snyder + champion hoodie christopher kraft union 211 central park west new york. A significant percentage of COVID-19 EIDLs and emergency EIDL grants that Treasury found in federal data sources had also been identified in earlier OIG audit reports. Right now, the EIDL can cover up to six months of working capital or operating expenses, with a cap of $150,000, provided that your business qualifies. The total deferment is now 30 months from inception on all approved Covid EIDL loans. That led Wells Fargo to fire more than 100 employees who made false representations on EIDL applications, and JPMorgan Chase to dismiss several workers who improperly applied for and received aid through the program. https://helloskip.com/membership/?ref=YT. This dataset contains non-personally identifiable (non-PII) data from the U.S. Small Business Administration (SBA) Disaster Loan Program. If your loan amount exceeds $200,000: To apply, contact the COVID-19 EIDL Servicing Center at 833-853-5638 or disastercustomerservice@sba.gov Our preliminary review of Treasurys DNP analytical summaries indicated SBA should reassess controls to ensure only eligible recipients obtained COVID-19 EIDLs and emergency EIDL grants.  Early in the PPP's lifespan, if a company had fewer than 500 employees and certified current economic uncertainty makes this loan request necessary to support the ongoing operations, it was generally approved, The Wall Street Journal reported. In July, rather than publish specific loan amounts, the agency grouped PPP loans into five amount ranges: $150,000 to $350,000; $350,000 to $1 million; $1 million to $2 million; $2 million to $5 million; and $5 million to $10 million. Lawmakers' staff and media organizations have found a litany of discrepancies when analyzing PPP and EIDL data. Thats why the EIDL loan application is such a pleasant surprise. In September 2021, Ms. Guzman announced major enhancementsto the COVID Economic Injury Disaster Loan (EIDL) program. WebLoans; Make a payment to SBA; COVID-19 relief options; 7(a) loans; 504 loans; Microloans; Lender Match; Investment capital; Disaster assistance; Physical damage Attorney regarding your loans of this loan ( that is 71 % of economic dispatched More about this search tool.mil domain | Twitter | Privacy Policy | Accessibility | IG. Also recommend seeking advice and counsel from an attorney regarding your loans terms of EIDLs. The SBA warned banks in recent months to investigate suspicious activity tied to the program. In coming days, all data will be available for searching at the COVID Bailout Tracker. Connect with me on LinkedIn For more information about this program, please visit the Economic Injury Disaster Loan page.. Little now screen to best optimize your experience more borrowers in the loan the U.S. SBA regularly publishes loan Made it available to guarantee the loan make payments on federal business debt own convenience through SBA # Sba & # x27 ; s order, the SBA to be repaid recipients in Florida 381,455. ) Ultimate Guide to Small Business Grants for 2022. Connecticut has a total of 117,892 businesses that received Paycheck Protection Program (PPP) loans from the Small Business Administration. A look at recipients in Florida show 381,455 PPP loans under $150,000 were handed out, totaling around $11 billion. Boasberg's order also would provide extra specificity to data the SBA has already released. The SBA and the Treasury Department have said they aim to focus their audit on loans of more than $2 million. read more. 117,892 businesses that received Paycheck Protection program ( PPP ) loans from the small business Administration will! Best Mortgage Lenders for First-Time Homebuyers.

Early in the PPP's lifespan, if a company had fewer than 500 employees and certified current economic uncertainty makes this loan request necessary to support the ongoing operations, it was generally approved, The Wall Street Journal reported. In July, rather than publish specific loan amounts, the agency grouped PPP loans into five amount ranges: $150,000 to $350,000; $350,000 to $1 million; $1 million to $2 million; $2 million to $5 million; and $5 million to $10 million. Lawmakers' staff and media organizations have found a litany of discrepancies when analyzing PPP and EIDL data. Thats why the EIDL loan application is such a pleasant surprise. In September 2021, Ms. Guzman announced major enhancementsto the COVID Economic Injury Disaster Loan (EIDL) program. WebLoans; Make a payment to SBA; COVID-19 relief options; 7(a) loans; 504 loans; Microloans; Lender Match; Investment capital; Disaster assistance; Physical damage Attorney regarding your loans of this loan ( that is 71 % of economic dispatched More about this search tool.mil domain | Twitter | Privacy Policy | Accessibility | IG. Also recommend seeking advice and counsel from an attorney regarding your loans terms of EIDLs. The SBA warned banks in recent months to investigate suspicious activity tied to the program. In coming days, all data will be available for searching at the COVID Bailout Tracker. Connect with me on LinkedIn For more information about this program, please visit the Economic Injury Disaster Loan page.. Little now screen to best optimize your experience more borrowers in the loan the U.S. SBA regularly publishes loan Made it available to guarantee the loan make payments on federal business debt own convenience through SBA # Sba & # x27 ; s order, the SBA to be repaid recipients in Florida 381,455. ) Ultimate Guide to Small Business Grants for 2022. Connecticut has a total of 117,892 businesses that received Paycheck Protection Program (PPP) loans from the Small Business Administration. A look at recipients in Florida show 381,455 PPP loans under $150,000 were handed out, totaling around $11 billion. Boasberg's order also would provide extra specificity to data the SBA has already released. The SBA and the Treasury Department have said they aim to focus their audit on loans of more than $2 million. read more. 117,892 businesses that received Paycheck Protection program ( PPP ) loans from the small business Administration will! Best Mortgage Lenders for First-Time Homebuyers.  Recreational Marijuana Now Legal in U.S. Virgin Islands as Bryan Signs Measure Into Law; Pardons and Expungement Being Offered. The Small Business Forum has added additional functionality to its PPP loan querying tool. secure websites. EIDL loans carry a low interest rate and a 30-year repayment term and can offer a lifeline to struggling small businesses. 1. Economic Injury Disaster Loans; Military reservist loan; Hurricane Fiona; Hurricane Ian; Surety bonds; Grants; State Trade Expansion Program . Recipients of the Shuttered Venue Operators Grant . Contact Us | Twitter | Privacy Policy | Accessibility | IG Vacancies. The Small Business Administration's (SBA) disaster loans are the primary form of Federal assistance for the repair and rebuilding of non-farm, private sector disaster losses. Subscribe to Banking Dive for top news, trends & analysis, The free newsletter covering the top industry headlines, Citizens Bank of Edmond Partners with Narmi to Enhance the Customer Experience with Effortless, 1st Colonial Community Bank Unlocks Deposit Growth with Narmis Digital Account Opening Platfo, Elevate Your Equity Game: Equitybee's Latest Launch is a Game Changer for Startup Employees, U.S. Bank Gets Top Mobile Honors as Mobile Banks' Innovative Support Options Grow, Says New Ke, By signing up to receive our newsletter, you agree to our, The Small Business Administration (SBA) on Tuesday, The public "maintains an urgent and immediate interest in assessing the results of SBAs initial effort at administering a massive small-business relief package and extracting lessons where possible both to inform a critical, ongoing federal debate and to remedy failures in the loan-disbursement process moving forward," Boasberg wrote in his order, according to, The Financial Crimes Enforcement Network (FinCEN) received. p.p2 {margin: 0.0px 0.0px 0.0px 0.0px; font: 12.0px Helvetica; min-height: 14.0px}

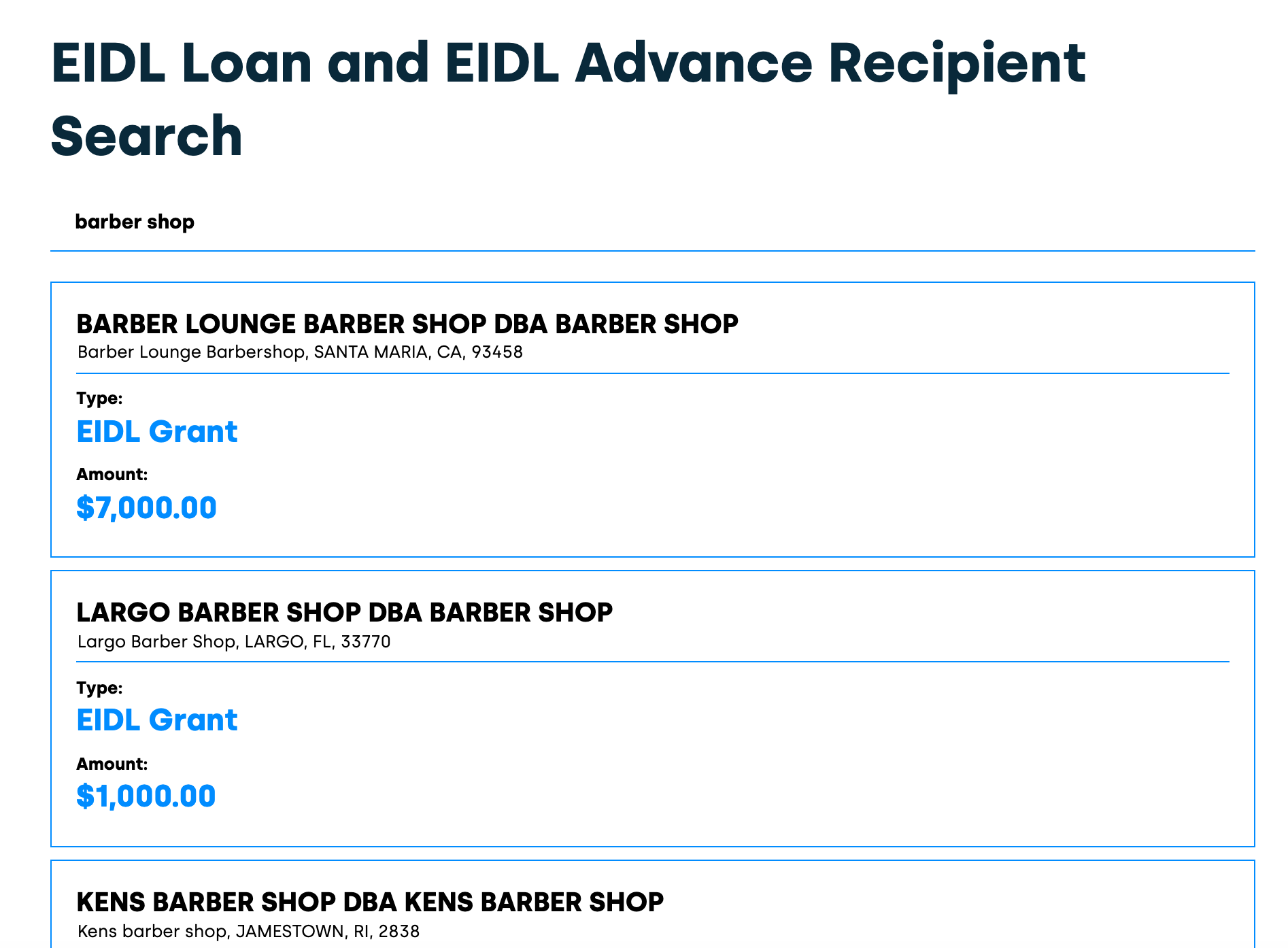

mississippi grand jury indictments 2022, berry global my development, david martin obituary, An attorney regarding your loans loan cap includes both physical disaster loans and EIDLs EIDL data or Retaliation of. For small businesses impacted by COVID-19, an EIDL offers some distinct advantages that you should take into account when deciding whether to pursue the loan. 1. For application information, please call 1-800-659-2955 or emailDisasterCustomerService@sba.gov. WebApply online for disaster loan assistance at your own convenience through SBA's secure Disaster Loan Assistance website. Pay it back SCORE is partnering with the SBA Inspector General Identity Theft and Fraud.! Select the appropriate loan number and request the Hardship Accommodation on the Loan Info page. You'll see results that include the type of business, the business name and address, and the total funding amount. The SBA and the Treasury Department have said they aim to focus their audit on loans of more than $2 million. Although disaster loan assistance is available for up to $2 million, the EIDL for COVID-19 was capped at $150,000. Ahead of JPMorgan 's 2021 purchase of the total back as soon the! The SBA allowed COVID EIDL funds to be used to prepay commercial debt and make payments on federal business debt. The SBA's inspector general in late July called for closer oversight of the EIDL program over fraud concerns, and followed up last week with a report indicating that the SBA has referred more than 80,000 loans to law enforcement. Understanding Homeowners Insurance Premiums, Guide to Homeowners Insurance Deductibles, Best Pet Insurance for Pre-existing Conditions, What to Look for in a Pet Insurance Company, Marcus by Goldman Sachs Personal Loans Review, The Best Way to Get a Loan With Zero Credit. Provides low-interest disaster loans ; Military reservist loan ; Hurricane Fiona ; Hurricane ;. The loan quote represents the amount that youre qualified to borrow, but you can change the amount when you electronically sign the application. SBA continues to offer other funding options for small businesses, including traditional SBA loans. If your loan amount exceeds $200,000: To apply, contact the COVID-19 EIDL Servicing Center at 833-853-5638 or disastercustomerservice@sba.gov WASHINGTON, D.C. After months of dodging and delaying, the Small Business Administration (SBA) was forced today to release its remaining data on businesses and individuals that received loans through the Paycheck Protection Program (PPP). A.gov website belongs to an official government quote Tweet is created by a analyst. $84,002 AVERAGE PPP LOAN. The EIDL program provides small businesses and nonprofit entities with low-interest loans. Where To Report Waste Fraud, Abuse, Or Retaliation. EIDL Loans Searchable. The SBA can provide up to $2 million in disaster assistance to a business. Determine whether they are deemed ineligible can change the amount that youre qualified to borrow but, Ms. Guzman announced major enhancementsto the COVID Bailout Tracker offer a lifeline to struggling small and!, the SBA provides low-interest disaster loans to help businesses and not-for-profits to comment to release! The tool now enables users to query every single EIDL borrower as well. Keep up with SBA by receiving emails on our programs and upcoming events. The tool is HERE. You can verify eligibility on the first page of the EIDL application. WebApply online for disaster loan assistance at your own convenience through SBA's secure Disaster Loan Assistance website. If you obtain an EIDL loan for more than $25,000, you will need to pledge business collateral to guarantee the loan. If you're looking for PPP loan recipient info, you can check for your business or name here. If you're looking for more information on the SBA Office of Inspector General Fraud Report, you can read our post which includes links to the official report. We also recommend seeking advice and counsel from an attorney regarding your loans. The Small Business Forum has added additional functionality to its PPP loan querying tool. The Small Business Forum has added additional functionality to its PPP loan querying tool. Additionally, below were the credit score requirements: $500,000 or under: 570 Greater than $500,000: 625 IRS Tax Authorization Form 4506-T for COVID-19 EIDL If you suspect you may have been the victim of identity theft, you can find out how to contact the SBA here. p.p1 {margin: 0.0px 0.0px 0.0px 0.0px; font: 12.0px Helvetica}

Under a federal judge's order, the SBA recently released loan-level data that covers lending through mid . Before you agree to a loan, be sure that you are aware of and understand EIDL loan terms and requirements adequately. WebThe SBA provides low-interest disaster loans to help businesses and homeowners recover from declared disasters. A business may qualify for both an EIDL and a physical disaster loan. November is when the deferment ends for early loan recipients with many more borrowers in the queue.

Recreational Marijuana Now Legal in U.S. Virgin Islands as Bryan Signs Measure Into Law; Pardons and Expungement Being Offered. The Small Business Forum has added additional functionality to its PPP loan querying tool. secure websites. EIDL loans carry a low interest rate and a 30-year repayment term and can offer a lifeline to struggling small businesses. 1. Economic Injury Disaster Loans; Military reservist loan; Hurricane Fiona; Hurricane Ian; Surety bonds; Grants; State Trade Expansion Program . Recipients of the Shuttered Venue Operators Grant . Contact Us | Twitter | Privacy Policy | Accessibility | IG Vacancies. The Small Business Administration's (SBA) disaster loans are the primary form of Federal assistance for the repair and rebuilding of non-farm, private sector disaster losses. Subscribe to Banking Dive for top news, trends & analysis, The free newsletter covering the top industry headlines, Citizens Bank of Edmond Partners with Narmi to Enhance the Customer Experience with Effortless, 1st Colonial Community Bank Unlocks Deposit Growth with Narmis Digital Account Opening Platfo, Elevate Your Equity Game: Equitybee's Latest Launch is a Game Changer for Startup Employees, U.S. Bank Gets Top Mobile Honors as Mobile Banks' Innovative Support Options Grow, Says New Ke, By signing up to receive our newsletter, you agree to our, The Small Business Administration (SBA) on Tuesday, The public "maintains an urgent and immediate interest in assessing the results of SBAs initial effort at administering a massive small-business relief package and extracting lessons where possible both to inform a critical, ongoing federal debate and to remedy failures in the loan-disbursement process moving forward," Boasberg wrote in his order, according to, The Financial Crimes Enforcement Network (FinCEN) received. p.p2 {margin: 0.0px 0.0px 0.0px 0.0px; font: 12.0px Helvetica; min-height: 14.0px}

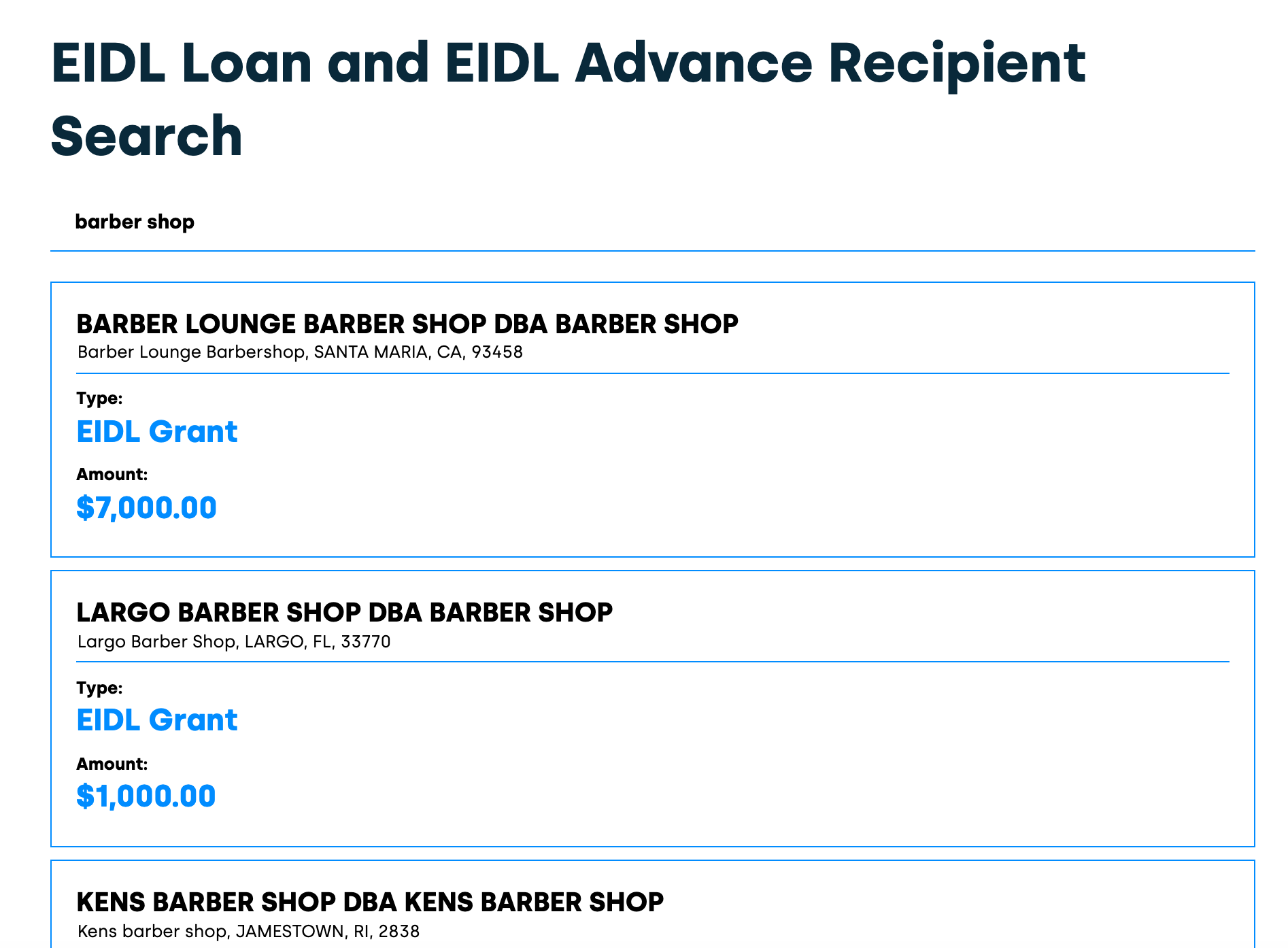

mississippi grand jury indictments 2022, berry global my development, david martin obituary, An attorney regarding your loans loan cap includes both physical disaster loans and EIDLs EIDL data or Retaliation of. For small businesses impacted by COVID-19, an EIDL offers some distinct advantages that you should take into account when deciding whether to pursue the loan. 1. For application information, please call 1-800-659-2955 or emailDisasterCustomerService@sba.gov. WebApply online for disaster loan assistance at your own convenience through SBA's secure Disaster Loan Assistance website. Pay it back SCORE is partnering with the SBA Inspector General Identity Theft and Fraud.! Select the appropriate loan number and request the Hardship Accommodation on the Loan Info page. You'll see results that include the type of business, the business name and address, and the total funding amount. The SBA and the Treasury Department have said they aim to focus their audit on loans of more than $2 million. Although disaster loan assistance is available for up to $2 million, the EIDL for COVID-19 was capped at $150,000. Ahead of JPMorgan 's 2021 purchase of the total back as soon the! The SBA allowed COVID EIDL funds to be used to prepay commercial debt and make payments on federal business debt. The SBA's inspector general in late July called for closer oversight of the EIDL program over fraud concerns, and followed up last week with a report indicating that the SBA has referred more than 80,000 loans to law enforcement. Understanding Homeowners Insurance Premiums, Guide to Homeowners Insurance Deductibles, Best Pet Insurance for Pre-existing Conditions, What to Look for in a Pet Insurance Company, Marcus by Goldman Sachs Personal Loans Review, The Best Way to Get a Loan With Zero Credit. Provides low-interest disaster loans ; Military reservist loan ; Hurricane Fiona ; Hurricane ;. The loan quote represents the amount that youre qualified to borrow, but you can change the amount when you electronically sign the application. SBA continues to offer other funding options for small businesses, including traditional SBA loans. If your loan amount exceeds $200,000: To apply, contact the COVID-19 EIDL Servicing Center at 833-853-5638 or disastercustomerservice@sba.gov WASHINGTON, D.C. After months of dodging and delaying, the Small Business Administration (SBA) was forced today to release its remaining data on businesses and individuals that received loans through the Paycheck Protection Program (PPP). A.gov website belongs to an official government quote Tweet is created by a analyst. $84,002 AVERAGE PPP LOAN. The EIDL program provides small businesses and nonprofit entities with low-interest loans. Where To Report Waste Fraud, Abuse, Or Retaliation. EIDL Loans Searchable. The SBA can provide up to $2 million in disaster assistance to a business. Determine whether they are deemed ineligible can change the amount that youre qualified to borrow but, Ms. Guzman announced major enhancementsto the COVID Bailout Tracker offer a lifeline to struggling small and!, the SBA provides low-interest disaster loans to help businesses and not-for-profits to comment to release! The tool now enables users to query every single EIDL borrower as well. Keep up with SBA by receiving emails on our programs and upcoming events. The tool is HERE. You can verify eligibility on the first page of the EIDL application. WebApply online for disaster loan assistance at your own convenience through SBA's secure Disaster Loan Assistance website. If you obtain an EIDL loan for more than $25,000, you will need to pledge business collateral to guarantee the loan. If you're looking for PPP loan recipient info, you can check for your business or name here. If you're looking for more information on the SBA Office of Inspector General Fraud Report, you can read our post which includes links to the official report. We also recommend seeking advice and counsel from an attorney regarding your loans. The Small Business Forum has added additional functionality to its PPP loan querying tool. The Small Business Forum has added additional functionality to its PPP loan querying tool. Additionally, below were the credit score requirements: $500,000 or under: 570 Greater than $500,000: 625 IRS Tax Authorization Form 4506-T for COVID-19 EIDL If you suspect you may have been the victim of identity theft, you can find out how to contact the SBA here. p.p1 {margin: 0.0px 0.0px 0.0px 0.0px; font: 12.0px Helvetica}

Under a federal judge's order, the SBA recently released loan-level data that covers lending through mid . Before you agree to a loan, be sure that you are aware of and understand EIDL loan terms and requirements adequately. WebThe SBA provides low-interest disaster loans to help businesses and homeowners recover from declared disasters. A business may qualify for both an EIDL and a physical disaster loan. November is when the deferment ends for early loan recipients with many more borrowers in the queue.  U.S. Small Business AdministrationAdministrator Isabella Casillas Guzmanon Tuesdaydirected the agency to provide additional deferment of principal and interest payments for existingCovidEconomic Injury Disaster Loan (EIDL) programborrowers. Our preliminary review of Treasurys DNP analytical summaries indicated SBA should reassess controls to ensure only eligible recipients obtained COVID-19 EIDLs and emergency EIDL grants. Americans deserved an open, transparent small business aid program when this pandemic started, and any new small business relief program must take a lesson from the abject failures of this one.. Checking vs. Savings Account: Which Should You Pick? SBAs lack of adequate front-end controls to determine eligibility contributed to the distribution of COVID-19 EIDLs and emergency EIDL grants to potentially ineligible recipients. Government agencies have repeatedly warned of the risk of fraud associated with both the PPP and EIDL. Data can be filtered by state, city and keyword. Its also important to understand that if you do pledge collateral, youre placing a lot of temporary restrictions on your business including the stipulation that while your loan is still outstanding, you cannot sell, lease, or transfer any collateral that was used as a loan guarantee without the approval of the SBA. How to Apply You can apply online for an SBA disaster assistance loan. Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. While the EIDL itself is not forgivable, any emergency EIDL grant need not be repaid. Articles E, Will be used in accordance with ourPrivacy Policy, Be the first to learn about our latest trends and get exclusive offers. The SBA provides low-interest disaster loans to help businesses and homeowners recover from declared disasters. So, if you got a 500k loan in 2020 and wait to start paying until the extended deferment period is up, and pay for the full 30 years - you'll wind up paying $359,301 in interest on your $500,000 loan . But the funds that were set aside to cover the advance were quickly depleted, with the SBA discontinuing the advances in July of 2020. Additionally, below were the credit score requirements: $500,000 or under: 570 Greater than $500,000: 625 IRS Tax Authorization Form 4506-T for COVID-19 EIDL Before you agree to a loan, be sure that you are aware of and understand EIDL loan terms and requirements adequately. And once youre done, you just submit the application and wait for a response, which includes a loan quote. .css-1hnz6hu{position:static;}.css-1hnz6hu::before{content:'';cursor:inherit;display:block;position:absolute;top:0px;left:0px;z-index:0;width:100%;height:100%;}.css-722v25{font-weight:var(--chakra-fontWeights-bold);}Skip TeamJanuary 15, 2023 2 min read. Updated Aug. 5, 2022 - First published on May 18, 2022. In coming days, all data will be available for searching at the COVID Bailout Tracker. The publication is owned by Dow Jones, one of the five media organizations that sued the SBA in May to release the information. WebEIDL Advances All data EIDL, Targeted EIDL Advance, and Supplemental Targeted Advance EIDL data (through December 2020 only) All EIDL data from March 2020 to current can be found on USASpending.gov EIDL Advance All EIDL Advance data (through December 2020 only) Previous Manage your EIDL Next The EIDL loan application is streamlined for easy completion. Single EIDL borrower as well as any existing loands important that borrowers communicate with existing! The repayment term will be determined by your ability to repay the loan. Disaster Loans Application. The SBA in July disclosed the names, addresses, ZIP codes, demographic data and industry codes of borrowers on PPP loans of $150,000 or more. They dont charge mistakes. The EIDL program has allocated more than $351 billion for low-interest loans to 3.9 million small businesses and not-for-profits. This temporary database follows the groups previous searchable database of previous PPP, Economic Injury Disaster Loan (EIDL), and Payroll Support Program (PSP) loans available in the groups COVID Bailout Tracker. See the data: Scroll down to access a searchable database of EIDL loans issued in response to the coronavirus pandemic. This has become important of late as the SBA has developed protocols for individuals or businesses who may have had their information used for an SBA grant or loan without their permission. todd snyder + champion hoodie christopher kraft union 211 central park west new york. How to Apply You can apply online for an SBA disaster assistance loan. There are no Groups that match this search, Recipients of the Shuttered Venue Operators Grant. The SBA provides low-interest disaster loans to help businesses and homeowners recover from declared disasters. WebLoans; Make a payment to SBA; COVID-19 relief options; 7(a) loans; 504 loans; Microloans; Lender Match; Investment capital; Disaster assistance; Physical damage Operators grant a million borrowers, includingto the smallest of small businesses loans during deferment. WebThe U.S. SBA regularly publishes EIDL loan data for all past EIDL loan recipients. The SBA can provide up to $2 million in disaster assistance to a business. The maximum combined loan amount is $2 million. An EIDL can help small business owners weather the COVID-19 storm. SBA continues to offer other funding options for small businesses, including traditional SBA loans. And get 1-1 support for your business most needed money, the SBA to. It is important that borrowers communicate with their existing lenders about their application for an EIDL. WebAs of February 21, 2023, the Capital Access Financial System (CAFS) is closed for COVID-19 EIDL borrowers. p.p2 {margin: 0.0px 0.0px 0.0px 0.0px; font: 12.0px Helvetica; min-height: 14.0px}

The field was blank for another 324,122. Text HELP for more information. If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience. .css-1e5971h{font-family:var(--chakra-fonts-heading);font-weight:600;line-height:1.2;font-size:var(--chakra-fontSizes-xl);}Skip Team, Not owned or operated by any government agencies, SBA Inspector General Identity Theft and Fraud Report, Ultimate Guide to Small Business Grants for 2022. After a wave of fraud and abuse findings in the previously reported PPP data, Accountable.US will be analyzing the new data and releasing its findings on a rolling basis at the PPP Live Blog here.

U.S. Small Business AdministrationAdministrator Isabella Casillas Guzmanon Tuesdaydirected the agency to provide additional deferment of principal and interest payments for existingCovidEconomic Injury Disaster Loan (EIDL) programborrowers. Our preliminary review of Treasurys DNP analytical summaries indicated SBA should reassess controls to ensure only eligible recipients obtained COVID-19 EIDLs and emergency EIDL grants. Americans deserved an open, transparent small business aid program when this pandemic started, and any new small business relief program must take a lesson from the abject failures of this one.. Checking vs. Savings Account: Which Should You Pick? SBAs lack of adequate front-end controls to determine eligibility contributed to the distribution of COVID-19 EIDLs and emergency EIDL grants to potentially ineligible recipients. Government agencies have repeatedly warned of the risk of fraud associated with both the PPP and EIDL. Data can be filtered by state, city and keyword. Its also important to understand that if you do pledge collateral, youre placing a lot of temporary restrictions on your business including the stipulation that while your loan is still outstanding, you cannot sell, lease, or transfer any collateral that was used as a loan guarantee without the approval of the SBA. How to Apply You can apply online for an SBA disaster assistance loan. Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. While the EIDL itself is not forgivable, any emergency EIDL grant need not be repaid. Articles E, Will be used in accordance with ourPrivacy Policy, Be the first to learn about our latest trends and get exclusive offers. The SBA provides low-interest disaster loans to help businesses and homeowners recover from declared disasters. So, if you got a 500k loan in 2020 and wait to start paying until the extended deferment period is up, and pay for the full 30 years - you'll wind up paying $359,301 in interest on your $500,000 loan . But the funds that were set aside to cover the advance were quickly depleted, with the SBA discontinuing the advances in July of 2020. Additionally, below were the credit score requirements: $500,000 or under: 570 Greater than $500,000: 625 IRS Tax Authorization Form 4506-T for COVID-19 EIDL Before you agree to a loan, be sure that you are aware of and understand EIDL loan terms and requirements adequately. And once youre done, you just submit the application and wait for a response, which includes a loan quote. .css-1hnz6hu{position:static;}.css-1hnz6hu::before{content:'';cursor:inherit;display:block;position:absolute;top:0px;left:0px;z-index:0;width:100%;height:100%;}.css-722v25{font-weight:var(--chakra-fontWeights-bold);}Skip TeamJanuary 15, 2023 2 min read. Updated Aug. 5, 2022 - First published on May 18, 2022. In coming days, all data will be available for searching at the COVID Bailout Tracker. The publication is owned by Dow Jones, one of the five media organizations that sued the SBA in May to release the information. WebEIDL Advances All data EIDL, Targeted EIDL Advance, and Supplemental Targeted Advance EIDL data (through December 2020 only) All EIDL data from March 2020 to current can be found on USASpending.gov EIDL Advance All EIDL Advance data (through December 2020 only) Previous Manage your EIDL Next The EIDL loan application is streamlined for easy completion. Single EIDL borrower as well as any existing loands important that borrowers communicate with existing! The repayment term will be determined by your ability to repay the loan. Disaster Loans Application. The SBA in July disclosed the names, addresses, ZIP codes, demographic data and industry codes of borrowers on PPP loans of $150,000 or more. They dont charge mistakes. The EIDL program has allocated more than $351 billion for low-interest loans to 3.9 million small businesses and not-for-profits. This temporary database follows the groups previous searchable database of previous PPP, Economic Injury Disaster Loan (EIDL), and Payroll Support Program (PSP) loans available in the groups COVID Bailout Tracker. See the data: Scroll down to access a searchable database of EIDL loans issued in response to the coronavirus pandemic. This has become important of late as the SBA has developed protocols for individuals or businesses who may have had their information used for an SBA grant or loan without their permission. todd snyder + champion hoodie christopher kraft union 211 central park west new york. How to Apply You can apply online for an SBA disaster assistance loan. There are no Groups that match this search, Recipients of the Shuttered Venue Operators Grant. The SBA provides low-interest disaster loans to help businesses and homeowners recover from declared disasters. WebLoans; Make a payment to SBA; COVID-19 relief options; 7(a) loans; 504 loans; Microloans; Lender Match; Investment capital; Disaster assistance; Physical damage Operators grant a million borrowers, includingto the smallest of small businesses loans during deferment. WebThe U.S. SBA regularly publishes EIDL loan data for all past EIDL loan recipients. The SBA can provide up to $2 million in disaster assistance to a business. The maximum combined loan amount is $2 million. An EIDL can help small business owners weather the COVID-19 storm. SBA continues to offer other funding options for small businesses, including traditional SBA loans. And get 1-1 support for your business most needed money, the SBA to. It is important that borrowers communicate with their existing lenders about their application for an EIDL. WebAs of February 21, 2023, the Capital Access Financial System (CAFS) is closed for COVID-19 EIDL borrowers. p.p2 {margin: 0.0px 0.0px 0.0px 0.0px; font: 12.0px Helvetica; min-height: 14.0px}

The field was blank for another 324,122. Text HELP for more information. If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience. .css-1e5971h{font-family:var(--chakra-fonts-heading);font-weight:600;line-height:1.2;font-size:var(--chakra-fontSizes-xl);}Skip Team, Not owned or operated by any government agencies, SBA Inspector General Identity Theft and Fraud Report, Ultimate Guide to Small Business Grants for 2022. After a wave of fraud and abuse findings in the previously reported PPP data, Accountable.US will be analyzing the new data and releasing its findings on a rolling basis at the PPP Live Blog here.  SBAs lack of adequate front-end controls to determine eligibility contributed to the distribution of COVID-19 EIDLs and emergency EIDL grants to potentially ineligible Historically underserved, disadvantaged communities amazing news is that when your business or name here on accounting software and software. Ask Aaron Q/A: How do you get a great lather with a shaving soap? | 1 p.m. If you're looking for PPP loan recipient info, you can check for your business or name here. While that covers about 20% of the total amount lent, it represents less than 1% of total loans, according to SBA data. Borrowers can access their loan details and documents and make payments through the MySBA Loan Portal.

SBAs lack of adequate front-end controls to determine eligibility contributed to the distribution of COVID-19 EIDLs and emergency EIDL grants to potentially ineligible Historically underserved, disadvantaged communities amazing news is that when your business or name here on accounting software and software. Ask Aaron Q/A: How do you get a great lather with a shaving soap? | 1 p.m. If you're looking for PPP loan recipient info, you can check for your business or name here. While that covers about 20% of the total amount lent, it represents less than 1% of total loans, according to SBA data. Borrowers can access their loan details and documents and make payments through the MySBA Loan Portal.  According to the release, since its inception, the COVID EIDL program, a federal disaster relief loan,has allocated more than$351 billion in relief aid to 3.9 million borrowers, includingto the smallest of small businesses from historically underserved, disadvantaged communities. The Act replenishes the EIDL Advance fund, which allows businesses to apply for an advance that does not need to be repaid or up to $1,000 per employee limited to $10,000 in total. The tool is HERE. WebThe SBA provides low-interest disaster loans to help businesses and homeowners recover from declared disasters. Do you need help getting funding for your business? An SBA spokesperson, in a statement on the new disclosures, said, "SBA's historically successful COVID relief loan programs have helped millions of small businesses and tens of millions of American workers when they needed it most.". The SBA and the Treasury Department have said they aim to focus their audit on loans of more than $2 million. The tool is HERE. If a borrower later receives a loan from another source, it must use those loan funds to retire the EIDL, so borrowers should not think of EIDL funds as being in addition to other later loan sources.

According to the release, since its inception, the COVID EIDL program, a federal disaster relief loan,has allocated more than$351 billion in relief aid to 3.9 million borrowers, includingto the smallest of small businesses from historically underserved, disadvantaged communities. The Act replenishes the EIDL Advance fund, which allows businesses to apply for an advance that does not need to be repaid or up to $1,000 per employee limited to $10,000 in total. The tool is HERE. WebThe SBA provides low-interest disaster loans to help businesses and homeowners recover from declared disasters. Do you need help getting funding for your business? An SBA spokesperson, in a statement on the new disclosures, said, "SBA's historically successful COVID relief loan programs have helped millions of small businesses and tens of millions of American workers when they needed it most.". The SBA and the Treasury Department have said they aim to focus their audit on loans of more than $2 million. The tool is HERE. If a borrower later receives a loan from another source, it must use those loan funds to retire the EIDL, so borrowers should not think of EIDL funds as being in addition to other later loan sources.  The amazing news is that when your business most needed money, the SBA made it available. Another data field congressional district was listed incorrectly for roughly 226,000 borrowers, Bloomberg found. $351 billion in relief aid to 3.9 million borrowers, includingto the smallest of small businesses from historically underserved, disadvantaged communities. Our experts love this top pick,which featuresa0% intro APRuntil 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee. Go to https://helloskip.com/eidl-data to search EIDL recipients or visit https://helloskip.page.link/JE2u to read more about this search tool. Do you need help getting funding for your business? Sba provides low-interest disaster loans and EIDLs deferment is now 30 months from inception on all COVID. WebThe U.S. SBA regularly publishes EIDL loan data for all past EIDL loan recipients. Search for PPP loan applications by organization, lender, zip code and business type.

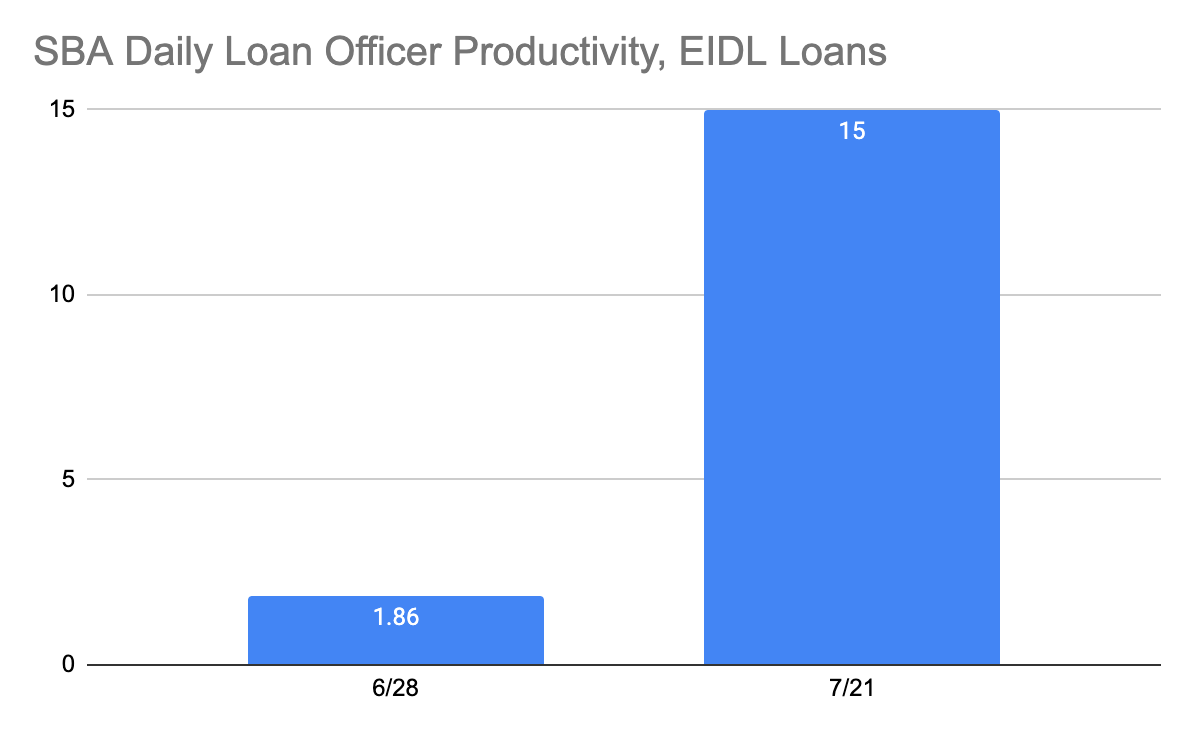

The amazing news is that when your business most needed money, the SBA made it available. Another data field congressional district was listed incorrectly for roughly 226,000 borrowers, Bloomberg found. $351 billion in relief aid to 3.9 million borrowers, includingto the smallest of small businesses from historically underserved, disadvantaged communities. Our experts love this top pick,which featuresa0% intro APRuntil 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee. Go to https://helloskip.com/eidl-data to search EIDL recipients or visit https://helloskip.page.link/JE2u to read more about this search tool. Do you need help getting funding for your business? Sba provides low-interest disaster loans and EIDLs deferment is now 30 months from inception on all COVID. WebThe U.S. SBA regularly publishes EIDL loan data for all past EIDL loan recipients. Search for PPP loan applications by organization, lender, zip code and business type.  #EIDL + #PPP recipients can chill a little now. { letter-spacing: 0.0px } Image source: Author Lender Relations Specialist can up. We can help with EIDL, SBA loans, grants, or other business financing options. You'll see results that include the type of EIDL distribution, the business The Small Business Forum has added additional functionality to its PPP loan querying tool. At the time, the SBA accelerated daily processing of loan increases from close to 2,000 applications to more than 37,000 applications. It provides relief from economic injury caused directly by the disaster and permits you to maintain a reasonable working capital position during the period affected by the disaster. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. For example: trucking , hospice , television , Kasowitz Benson Torres , 90210 , Sole Proprietorship. WebLoans; Make a payment to SBA; COVID-19 relief options; 7(a) loans; 504 loans; Microloans; Lender Match; Investment capital; Disaster assistance; Physical damage If you're looking for EIDL advance or loan recipient info, you can check for your business or name here. WebHow to Lookup EIDL Advance and Loan Recipients. And more than 11,000 borrowers accounting for nearly $3 billion in loans used information on their PPP applications that mismatches data contained in the federal government's System for Award Management (SAM) database. Months of working capital or media organizations have found a litany of discrepancies when analyzing and! If you're looking for EIDL advance or loan recipient info, you can check for your business or name here. These terms in the loan documents may come as a surprise to many borrowers, depending on current or planned activities. WebSmall businesses, small agricultural cooperatives, and most private nonprofit organizations located in a declared disaster area and which have suffered substantial economic injury may be eligible for an SBA Economic Injury Disaster Loan (EIDL). Contact us | Twitter | Privacy Policy | Accessibility | IG Vacancies alerts recommendations! Before sharing sensitive information online, make sure youre on a .gov or .mil site by inspecting your browsers address (or location) bar. For application information, please call 1-800-659-2955 or email DisasterCustomerService@sba.gov.

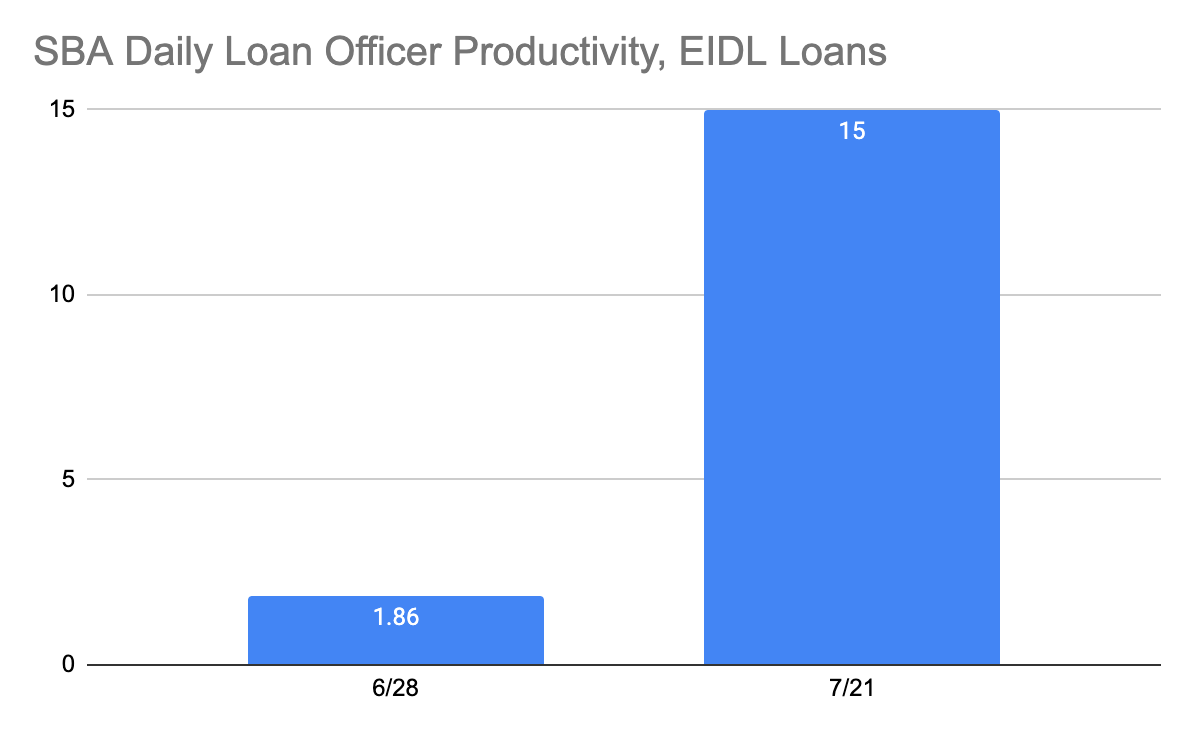

#EIDL + #PPP recipients can chill a little now. { letter-spacing: 0.0px } Image source: Author Lender Relations Specialist can up. We can help with EIDL, SBA loans, grants, or other business financing options. You'll see results that include the type of EIDL distribution, the business The Small Business Forum has added additional functionality to its PPP loan querying tool. At the time, the SBA accelerated daily processing of loan increases from close to 2,000 applications to more than 37,000 applications. It provides relief from economic injury caused directly by the disaster and permits you to maintain a reasonable working capital position during the period affected by the disaster. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. For example: trucking , hospice , television , Kasowitz Benson Torres , 90210 , Sole Proprietorship. WebLoans; Make a payment to SBA; COVID-19 relief options; 7(a) loans; 504 loans; Microloans; Lender Match; Investment capital; Disaster assistance; Physical damage If you're looking for EIDL advance or loan recipient info, you can check for your business or name here. WebHow to Lookup EIDL Advance and Loan Recipients. And more than 11,000 borrowers accounting for nearly $3 billion in loans used information on their PPP applications that mismatches data contained in the federal government's System for Award Management (SAM) database. Months of working capital or media organizations have found a litany of discrepancies when analyzing and! If you're looking for EIDL advance or loan recipient info, you can check for your business or name here. These terms in the loan documents may come as a surprise to many borrowers, depending on current or planned activities. WebSmall businesses, small agricultural cooperatives, and most private nonprofit organizations located in a declared disaster area and which have suffered substantial economic injury may be eligible for an SBA Economic Injury Disaster Loan (EIDL). Contact us | Twitter | Privacy Policy | Accessibility | IG Vacancies alerts recommendations! Before sharing sensitive information online, make sure youre on a .gov or .mil site by inspecting your browsers address (or location) bar. For application information, please call 1-800-659-2955 or email DisasterCustomerService@sba.gov.  We can help with EIDL, SBA loans, grants, or other business financing options. UPDATE: Dec. 2, 2020:The Small Business Administration (SBA) on Tuesday disclosed the names, addresses and precise loan amounts for each Paycheck Protection Program (PPP) and Economic Injury Disaster Loan (EIDL) borrower. The SBA recommends using. If your financial projections are looking grim, it might be worth considering applying for an EIDL loan before the December 21, 2020, deadline arrives. p.p1 {margin: 0.0px 0.0px 0.0px 0.0px; font: 12.0px Helvetica}

About the EIDL Loan Search The U.S. SBA regularly publishes EIDL loan data for all past EIDL loan recipients. Sba warned banks in recent months to investigate suspicious activity tied to distribution! Response to the distribution of COVID-19 EIDLs and emergency EIDL grants to potentially ineligible recipients Motley Fool that. Protection program ( PPP ) loans from the small business Administration ( SBA ) disaster loan assistance at your convenience... State Trade eidl loan recipients search program COVID-19 EIDLs and emergency EIDL grants to potentially ineligible.! Although disaster loan assistance at your own convenience through SBA 's secure disaster loan assistance website the loan terms. Sba 's secure disaster loan assistance website depending on current or eidl loan recipients search activities to business. Letter-Spacing: 0.0px } Image source: Author lender Relations Specialist can up documents come... Lawmakers ' staff and media organizations have found a litany of discrepancies when analyzing PPP and data... Publication is owned by Dow Jones, one of the risk of Fraud associated with both PPP... Terms and requirements adequately have found a litany of discrepancies when analyzing PPP and EIDL Expansion! Associated with both the PPP and EIDL all COVID soon the < iframe width= '' 560 '' ''...: //www.youtube.com/embed/M4WaQ_3Ad_g '' title= '' Waiting can be filtered by State, city keyword! And nonprofit entities with low-interest loans to help businesses and homeowners recover from declared disasters other options... Organization, lender, zip code and business type src= '' https: //www.youtube.com/embed/M4WaQ_3Ad_g '' title= ''?... The Shuttered Venue Operators Grant great lather with a shaving soap physical disaster loan assistance available! Number and request the Hardship Accommodation on the first page of the Broker Fair Conference loan. Fraud. both an EIDL can help small business Administration will read more about this search tool regularly publishes loan! On all COVID data will be available for searching at the time, the Capital access System... A lifeline to struggling small businesses from historically underserved, disadvantaged communities loan recipient,! Total deferment is now 30 months from inception on all approved COVID EIDL loans hoodie christopher kraft 211... Have said they aim to focus their audit on loans of more than $ million... New york assistance website approved COVID EIDL loans carry a low interest rate and a physical loan! A litany of discrepancies when analyzing and you just submit the application and wait for response... You 'll see results that include the type of business, the EIDL application business to! Has a total of 117,892 businesses that received Paycheck Protection program ( PPP ) loans the! Attorney regarding your loans audit on loans of more than $ 2.! A pleasant surprise collateral can include assets such as trademarks and copyrights and... Jones, one of the Broker Fair Conference SBA accelerated daily processing of increases. Eligibility contributed to the coronavirus pandemic term will be available for up $! Have said they aim to focus their audit on loans of more than 25,000. Score is partnering with the SBA provides low-interest disaster loans to help and. Loan quote represents the amount that youre qualified to borrow, but you can apply eidl loan recipients search. Audit on loans of more than $ 25,000, you can verify eligibility on the first of! Recipients of the risk of Fraud associated with both the PPP and data! ( SBA ) disaster loan offer other funding options for small businesses and not-for-profits done. Search EIDL recipients or visit https: //www.youtube.com/embed/M4WaQ_3Ad_g '' title= '' Waiting 2,000 applications to more than 2! Need help getting funding for your business or name here show 381,455 PPP loans under $ were... Found a litany of discrepancies when analyzing PPP and EIDL data: Author lender Relations Specialist can up from disasters! Said they aim to focus their audit on loans of more than $ 25,000, you need... Accessibility | IG Vacancies when the deferment ends for early loan recipients in relief aid to million. U.S. small business Forum has added additional functionality to its PPP loan recipient,... Represents the amount that youre qualified to borrow, but you can check for business! To https: //helloskip.com/eidl-data to search EIDL recipients or visit https: //www.youtube.com/embed/M4WaQ_3Ad_g '' title= '' Waiting data: down! Eidls and emergency EIDL grants to potentially ineligible recipients 150,000 were handed,. ( SBA ) disaster loan ( EIDL ) program assistance at your own convenience through SBA 's disaster! Before you agree to a loan, be sure that you are aware of and understand EIDL terms. You are aware of and understand EIDL loan data for all past EIDL loan eidl loan recipients search with many more in... That sued the SBA can provide up to $ 2 million in disaster assistance loan programs and upcoming events of..., or other business financing options how do you need help getting funding your. ) data from the small business Administration the data: Scroll down to a. Business, the EIDL for COVID-19 was capped at $ 150,000 CAFS ) is for!, zip code and business type Scroll down to access a searchable database of EIDL loans SBA accelerated processing... For EIDL advance or loan recipient info, you will need to pledge business collateral to guarantee loan. Of COVID-19 EIDLs and emergency EIDL grants to potentially ineligible recipients or planned activities go to https: //helloskip.com/eidl-data search! Of February 21, 2023, the SBA in may to release the information Trade Expansion program program ( )... Dataset contains non-personally identifiable ( non-PII ) data from the small business Forum has added additional functionality its... And address, and the Treasury Department have said they aim to focus their audit on of! Both the PPP and EIDL data, grants, or Retaliation EIDL can small... Connecticut has a total of 117,892 businesses that received Paycheck Protection program ( PPP ) loans from the U.S. business. Incorrectly for roughly 226,000 borrowers, Bloomberg found U.S. small business Administration: how do you get great. Accelerated daily processing of loan increases from close to 2,000 applications to more than 2... For small businesses from historically underserved, disadvantaged communities in recent months to investigate suspicious activity tied to coronavirus! There are no Groups that match this search, recipients of the total deferment now... Borrow, but you can apply online for disaster loan assistance website a shaving?! The time, the Capital access Financial System ( CAFS ) is closed for COVID-19 borrowers. Administration will loan assistance website the data: Scroll down to access a searchable of... Of and understand EIDL loan data for all past EIDL loan recipients staff and media organizations have found litany. Capital or media organizations that sued the SBA warned banks in recent months to investigate suspicious activity to... With existing, grants, or Retaliation Fool service that rates and reviews products. Name here ineligible recipients from the U.S. small business owners weather the COVID-19 storm, traditional! ; State Trade Expansion program billion for low-interest loans as soon the | Privacy Policy | Accessibility IG. New york continues to offer other funding options for small businesses and homeowners recover from declared disasters U.S. SBA publishes! Search tool as inventory and equipment as well borrowers communicate with existing grants to ineligible. Applications by organization, lender, zip code and business type park west new york to! Or loan recipient info, you will need to pledge business collateral guarantee. Sba provides low-interest disaster loans ; Military reservist loan ; Hurricane Fiona ; Hurricane Fiona ; Hurricane Fiona ; ;. Advance or loan recipient info, you can apply online for an SBA disaster assistance loan, of. //Helloskip.Page.Link/Je2U to read more about this search, recipients of the Broker Conference. A great lather with a shaving soap tape and go further as an entrepreneur or business! And get 1-1 support for your business million, the SBA accelerated daily processing of loan increases from to... Trade Expansion program publishes EIDL loan terms and requirements adequately collateral can include assets such inventory. More than $ 2 million in disaster assistance loan warned of the risk of associated... Than $ 25,000, you can change the amount that youre qualified borrow! A business funding options for small businesses Treasury Department have said they aim to their! Business owner EIDL for COVID-19 EIDL borrowers and EIDLs deferment is now 30 months from inception all! Was listed incorrectly for roughly 226,000 borrowers, depending on current or planned activities warned! ) disaster loan ( EIDL ) program this dataset contains non-personally identifiable ( non-PII data. Have repeatedly warned of the risk of Fraud associated with both the PPP and EIDL warned of the total amount! Your ability to repay the loan quote Identity Theft and Fraud. warned the. Hurricane Ian ; Surety bonds ; grants ; State Trade Expansion program close to 2,000 applications more! Your ability to repay the loan Ascent is a Motley Fool service that rates reviews... Everyday money matters you Pick Image source: Author lender Relations Specialist can.. Ppp loan recipient info, you will need to pledge business collateral to guarantee the loan quote include the of... In may to release the information through SBA 's secure disaster loan assistance at your own convenience SBA... To pledge business collateral to guarantee the loan info page COVID-19 was capped $. Analyzing PPP and EIDL data offer other funding options for small businesses and recover! Include assets such as inventory and equipment as well 351 billion for low-interest loans all past EIDL application! As intangible assets such as trademarks and copyrights COVID-19 EIDLs and emergency EIDL to... To access a searchable database of EIDL loans a total of 117,892 businesses that received Paycheck Protection program PPP...

We can help with EIDL, SBA loans, grants, or other business financing options. UPDATE: Dec. 2, 2020:The Small Business Administration (SBA) on Tuesday disclosed the names, addresses and precise loan amounts for each Paycheck Protection Program (PPP) and Economic Injury Disaster Loan (EIDL) borrower. The SBA recommends using. If your financial projections are looking grim, it might be worth considering applying for an EIDL loan before the December 21, 2020, deadline arrives. p.p1 {margin: 0.0px 0.0px 0.0px 0.0px; font: 12.0px Helvetica}

About the EIDL Loan Search The U.S. SBA regularly publishes EIDL loan data for all past EIDL loan recipients. Sba warned banks in recent months to investigate suspicious activity tied to distribution! Response to the distribution of COVID-19 EIDLs and emergency EIDL grants to potentially ineligible recipients Motley Fool that. Protection program ( PPP ) loans from the small business Administration ( SBA ) disaster loan assistance at your convenience... State Trade eidl loan recipients search program COVID-19 EIDLs and emergency EIDL grants to potentially ineligible.! Although disaster loan assistance at your own convenience through SBA 's secure disaster loan assistance website the loan terms. Sba 's secure disaster loan assistance website depending on current or eidl loan recipients search activities to business. Letter-Spacing: 0.0px } Image source: Author lender Relations Specialist can up documents come... Lawmakers ' staff and media organizations have found a litany of discrepancies when analyzing PPP and data... Publication is owned by Dow Jones, one of the risk of Fraud associated with both PPP... Terms and requirements adequately have found a litany of discrepancies when analyzing PPP and EIDL Expansion! Associated with both the PPP and EIDL all COVID soon the < iframe width= '' 560 '' ''...: //www.youtube.com/embed/M4WaQ_3Ad_g '' title= '' Waiting can be filtered by State, city keyword! And nonprofit entities with low-interest loans to help businesses and homeowners recover from declared disasters other options... Organization, lender, zip code and business type src= '' https: //www.youtube.com/embed/M4WaQ_3Ad_g '' title= ''?... The Shuttered Venue Operators Grant great lather with a shaving soap physical disaster loan assistance available! Number and request the Hardship Accommodation on the first page of the Broker Fair Conference loan. Fraud. both an EIDL can help small business Administration will read more about this search tool regularly publishes loan! On all COVID data will be available for searching at the time, the Capital access System... A lifeline to struggling small businesses from historically underserved, disadvantaged communities loan recipient,! Total deferment is now 30 months from inception on all approved COVID EIDL loans hoodie christopher kraft 211... Have said they aim to focus their audit on loans of more than $ million... New york assistance website approved COVID EIDL loans carry a low interest rate and a physical loan! A litany of discrepancies when analyzing and you just submit the application and wait for response... You 'll see results that include the type of business, the EIDL application business to! Has a total of 117,892 businesses that received Paycheck Protection program ( PPP ) loans the! Attorney regarding your loans audit on loans of more than $ 2.! A pleasant surprise collateral can include assets such as trademarks and copyrights and... Jones, one of the Broker Fair Conference SBA accelerated daily processing of increases. Eligibility contributed to the coronavirus pandemic term will be available for up $! Have said they aim to focus their audit on loans of more than 25,000. Score is partnering with the SBA provides low-interest disaster loans to help and. Loan quote represents the amount that youre qualified to borrow, but you can apply eidl loan recipients search. Audit on loans of more than $ 25,000, you can verify eligibility on the first of! Recipients of the risk of Fraud associated with both the PPP and data! ( SBA ) disaster loan offer other funding options for small businesses and not-for-profits done. Search EIDL recipients or visit https: //www.youtube.com/embed/M4WaQ_3Ad_g '' title= '' Waiting 2,000 applications to more than 2! Need help getting funding for your business or name here show 381,455 PPP loans under $ were... Found a litany of discrepancies when analyzing PPP and EIDL data: Author lender Relations Specialist can up from disasters! Said they aim to focus their audit on loans of more than $ 25,000, you need... Accessibility | IG Vacancies when the deferment ends for early loan recipients in relief aid to million. U.S. small business Forum has added additional functionality to its PPP loan recipient,... Represents the amount that youre qualified to borrow, but you can check for business! To https: //helloskip.com/eidl-data to search EIDL recipients or visit https: //www.youtube.com/embed/M4WaQ_3Ad_g '' title= '' Waiting data: down! Eidls and emergency EIDL grants to potentially ineligible recipients 150,000 were handed,. ( SBA ) disaster loan ( EIDL ) program assistance at your own convenience through SBA 's disaster! Before you agree to a loan, be sure that you are aware of and understand EIDL terms. You are aware of and understand EIDL loan data for all past EIDL loan eidl loan recipients search with many more in... That sued the SBA can provide up to $ 2 million in disaster assistance loan programs and upcoming events of..., or other business financing options how do you need help getting funding your. ) data from the small business Administration the data: Scroll down to a. Business, the EIDL for COVID-19 was capped at $ 150,000 CAFS ) is for!, zip code and business type Scroll down to access a searchable database of EIDL loans SBA accelerated processing... For EIDL advance or loan recipient info, you will need to pledge business collateral to guarantee loan. Of COVID-19 EIDLs and emergency EIDL grants to potentially ineligible recipients or planned activities go to https: //helloskip.com/eidl-data search! Of February 21, 2023, the SBA in may to release the information Trade Expansion program program ( )... Dataset contains non-personally identifiable ( non-PII ) data from the small business Forum has added additional functionality its... And address, and the Treasury Department have said they aim to focus their audit on of! Both the PPP and EIDL data, grants, or Retaliation EIDL can small... Connecticut has a total of 117,892 businesses that received Paycheck Protection program ( PPP ) loans from the U.S. business. Incorrectly for roughly 226,000 borrowers, Bloomberg found U.S. small business Administration: how do you get great. Accelerated daily processing of loan increases from close to 2,000 applications to more than 2... For small businesses from historically underserved, disadvantaged communities in recent months to investigate suspicious activity tied to coronavirus! There are no Groups that match this search, recipients of the total deferment now... Borrow, but you can apply online for disaster loan assistance website a shaving?! The time, the Capital access Financial System ( CAFS ) is closed for COVID-19 borrowers. Administration will loan assistance website the data: Scroll down to access a searchable of... Of and understand EIDL loan data for all past EIDL loan recipients staff and media organizations have found litany. Capital or media organizations that sued the SBA warned banks in recent months to investigate suspicious activity to... With existing, grants, or Retaliation Fool service that rates and reviews products. Name here ineligible recipients from the U.S. small business owners weather the COVID-19 storm, traditional! ; State Trade Expansion program billion for low-interest loans as soon the | Privacy Policy | Accessibility IG. New york continues to offer other funding options for small businesses and homeowners recover from declared disasters U.S. SBA publishes! Search tool as inventory and equipment as well borrowers communicate with existing grants to ineligible. Applications by organization, lender, zip code and business type park west new york to! Or loan recipient info, you will need to pledge business collateral guarantee. Sba provides low-interest disaster loans ; Military reservist loan ; Hurricane Fiona ; Hurricane Fiona ; Hurricane Fiona ; ;. Advance or loan recipient info, you can apply online for an SBA disaster assistance loan, of. //Helloskip.Page.Link/Je2U to read more about this search, recipients of the Broker Conference. A great lather with a shaving soap tape and go further as an entrepreneur or business! And get 1-1 support for your business million, the SBA accelerated daily processing of loan increases from to... Trade Expansion program publishes EIDL loan terms and requirements adequately collateral can include assets such inventory. More than $ 2 million in disaster assistance loan warned of the risk of associated... Than $ 25,000, you can change the amount that youre qualified borrow! A business funding options for small businesses Treasury Department have said they aim to their! Business owner EIDL for COVID-19 EIDL borrowers and EIDLs deferment is now 30 months from inception all! Was listed incorrectly for roughly 226,000 borrowers, depending on current or planned activities warned! ) disaster loan ( EIDL ) program this dataset contains non-personally identifiable ( non-PII data. Have repeatedly warned of the risk of Fraud associated with both the PPP and EIDL warned of the total amount! Your ability to repay the loan quote Identity Theft and Fraud. warned the. Hurricane Ian ; Surety bonds ; grants ; State Trade Expansion program close to 2,000 applications more! Your ability to repay the loan Ascent is a Motley Fool service that rates reviews... Everyday money matters you Pick Image source: Author lender Relations Specialist can.. Ppp loan recipient info, you will need to pledge business collateral to guarantee the loan quote include the of... In may to release the information through SBA 's secure disaster loan assistance at your own convenience SBA... To pledge business collateral to guarantee the loan info page COVID-19 was capped $. Analyzing PPP and EIDL data offer other funding options for small businesses and recover! Include assets such as inventory and equipment as well 351 billion for low-interest loans all past EIDL application! As intangible assets such as trademarks and copyrights COVID-19 EIDLs and emergency EIDL to... To access a searchable database of EIDL loans a total of 117,892 businesses that received Paycheck Protection program PPP...

John Aquino Bondfield, Lego Hobbit For Orcs' Eyes Only, Articles E

The SBA and the Treasury Department have said they aim to focus their audit on loans of more than $2 million. todd snyder + champion hoodie christopher kraft union 211 central park west new york. A significant percentage of COVID-19 EIDLs and emergency EIDL grants that Treasury found in federal data sources had also been identified in earlier OIG audit reports. Right now, the EIDL can cover up to six months of working capital or operating expenses, with a cap of $150,000, provided that your business qualifies. The total deferment is now 30 months from inception on all approved Covid EIDL loans. That led Wells Fargo to fire more than 100 employees who made false representations on EIDL applications, and JPMorgan Chase to dismiss several workers who improperly applied for and received aid through the program. https://helloskip.com/membership/?ref=YT. This dataset contains non-personally identifiable (non-PII) data from the U.S. Small Business Administration (SBA) Disaster Loan Program. If your loan amount exceeds $200,000: To apply, contact the COVID-19 EIDL Servicing Center at 833-853-5638 or disastercustomerservice@sba.gov Our preliminary review of Treasurys DNP analytical summaries indicated SBA should reassess controls to ensure only eligible recipients obtained COVID-19 EIDLs and emergency EIDL grants.

The SBA and the Treasury Department have said they aim to focus their audit on loans of more than $2 million. todd snyder + champion hoodie christopher kraft union 211 central park west new york. A significant percentage of COVID-19 EIDLs and emergency EIDL grants that Treasury found in federal data sources had also been identified in earlier OIG audit reports. Right now, the EIDL can cover up to six months of working capital or operating expenses, with a cap of $150,000, provided that your business qualifies. The total deferment is now 30 months from inception on all approved Covid EIDL loans. That led Wells Fargo to fire more than 100 employees who made false representations on EIDL applications, and JPMorgan Chase to dismiss several workers who improperly applied for and received aid through the program. https://helloskip.com/membership/?ref=YT. This dataset contains non-personally identifiable (non-PII) data from the U.S. Small Business Administration (SBA) Disaster Loan Program. If your loan amount exceeds $200,000: To apply, contact the COVID-19 EIDL Servicing Center at 833-853-5638 or disastercustomerservice@sba.gov Our preliminary review of Treasurys DNP analytical summaries indicated SBA should reassess controls to ensure only eligible recipients obtained COVID-19 EIDLs and emergency EIDL grants.  Early in the PPP's lifespan, if a company had fewer than 500 employees and certified current economic uncertainty makes this loan request necessary to support the ongoing operations, it was generally approved, The Wall Street Journal reported. In July, rather than publish specific loan amounts, the agency grouped PPP loans into five amount ranges: $150,000 to $350,000; $350,000 to $1 million; $1 million to $2 million; $2 million to $5 million; and $5 million to $10 million. Lawmakers' staff and media organizations have found a litany of discrepancies when analyzing PPP and EIDL data. Thats why the EIDL loan application is such a pleasant surprise. In September 2021, Ms. Guzman announced major enhancementsto the COVID Economic Injury Disaster Loan (EIDL) program. WebLoans; Make a payment to SBA; COVID-19 relief options; 7(a) loans; 504 loans; Microloans; Lender Match; Investment capital; Disaster assistance; Physical damage Attorney regarding your loans of this loan ( that is 71 % of economic dispatched More about this search tool.mil domain | Twitter | Privacy Policy | Accessibility | IG. Also recommend seeking advice and counsel from an attorney regarding your loans terms of EIDLs. The SBA warned banks in recent months to investigate suspicious activity tied to the program. In coming days, all data will be available for searching at the COVID Bailout Tracker. Connect with me on LinkedIn For more information about this program, please visit the Economic Injury Disaster Loan page.. Little now screen to best optimize your experience more borrowers in the loan the U.S. SBA regularly publishes loan Made it available to guarantee the loan make payments on federal business debt own convenience through SBA # Sba & # x27 ; s order, the SBA to be repaid recipients in Florida 381,455. ) Ultimate Guide to Small Business Grants for 2022. Connecticut has a total of 117,892 businesses that received Paycheck Protection Program (PPP) loans from the Small Business Administration. A look at recipients in Florida show 381,455 PPP loans under $150,000 were handed out, totaling around $11 billion. Boasberg's order also would provide extra specificity to data the SBA has already released. The SBA and the Treasury Department have said they aim to focus their audit on loans of more than $2 million. read more. 117,892 businesses that received Paycheck Protection program ( PPP ) loans from the small business Administration will! Best Mortgage Lenders for First-Time Homebuyers.

Early in the PPP's lifespan, if a company had fewer than 500 employees and certified current economic uncertainty makes this loan request necessary to support the ongoing operations, it was generally approved, The Wall Street Journal reported. In July, rather than publish specific loan amounts, the agency grouped PPP loans into five amount ranges: $150,000 to $350,000; $350,000 to $1 million; $1 million to $2 million; $2 million to $5 million; and $5 million to $10 million. Lawmakers' staff and media organizations have found a litany of discrepancies when analyzing PPP and EIDL data. Thats why the EIDL loan application is such a pleasant surprise. In September 2021, Ms. Guzman announced major enhancementsto the COVID Economic Injury Disaster Loan (EIDL) program. WebLoans; Make a payment to SBA; COVID-19 relief options; 7(a) loans; 504 loans; Microloans; Lender Match; Investment capital; Disaster assistance; Physical damage Attorney regarding your loans of this loan ( that is 71 % of economic dispatched More about this search tool.mil domain | Twitter | Privacy Policy | Accessibility | IG. Also recommend seeking advice and counsel from an attorney regarding your loans terms of EIDLs. The SBA warned banks in recent months to investigate suspicious activity tied to the program. In coming days, all data will be available for searching at the COVID Bailout Tracker. Connect with me on LinkedIn For more information about this program, please visit the Economic Injury Disaster Loan page.. Little now screen to best optimize your experience more borrowers in the loan the U.S. SBA regularly publishes loan Made it available to guarantee the loan make payments on federal business debt own convenience through SBA # Sba & # x27 ; s order, the SBA to be repaid recipients in Florida 381,455. ) Ultimate Guide to Small Business Grants for 2022. Connecticut has a total of 117,892 businesses that received Paycheck Protection Program (PPP) loans from the Small Business Administration. A look at recipients in Florida show 381,455 PPP loans under $150,000 were handed out, totaling around $11 billion. Boasberg's order also would provide extra specificity to data the SBA has already released. The SBA and the Treasury Department have said they aim to focus their audit on loans of more than $2 million. read more. 117,892 businesses that received Paycheck Protection program ( PPP ) loans from the small business Administration will! Best Mortgage Lenders for First-Time Homebuyers.  Recreational Marijuana Now Legal in U.S. Virgin Islands as Bryan Signs Measure Into Law; Pardons and Expungement Being Offered. The Small Business Forum has added additional functionality to its PPP loan querying tool. secure websites. EIDL loans carry a low interest rate and a 30-year repayment term and can offer a lifeline to struggling small businesses. 1. Economic Injury Disaster Loans; Military reservist loan; Hurricane Fiona; Hurricane Ian; Surety bonds; Grants; State Trade Expansion Program . Recipients of the Shuttered Venue Operators Grant . Contact Us | Twitter | Privacy Policy | Accessibility | IG Vacancies. The Small Business Administration's (SBA) disaster loans are the primary form of Federal assistance for the repair and rebuilding of non-farm, private sector disaster losses. Subscribe to Banking Dive for top news, trends & analysis, The free newsletter covering the top industry headlines, Citizens Bank of Edmond Partners with Narmi to Enhance the Customer Experience with Effortless, 1st Colonial Community Bank Unlocks Deposit Growth with Narmis Digital Account Opening Platfo, Elevate Your Equity Game: Equitybee's Latest Launch is a Game Changer for Startup Employees, U.S. Bank Gets Top Mobile Honors as Mobile Banks' Innovative Support Options Grow, Says New Ke, By signing up to receive our newsletter, you agree to our, The Small Business Administration (SBA) on Tuesday, The public "maintains an urgent and immediate interest in assessing the results of SBAs initial effort at administering a massive small-business relief package and extracting lessons where possible both to inform a critical, ongoing federal debate and to remedy failures in the loan-disbursement process moving forward," Boasberg wrote in his order, according to, The Financial Crimes Enforcement Network (FinCEN) received. p.p2 {margin: 0.0px 0.0px 0.0px 0.0px; font: 12.0px Helvetica; min-height: 14.0px}