Suspended prior year passive losses v. current year non-passive activity, post-template-default,single,single-post,postid-8064,single-format-standard,bridge-core-3.0.7,qodef-qi--no-touch,qi-addons-for-elementor-1.5.8,qode-page-transition-enabled,ajax_fade,page_not_loaded,,qode_grid_1300,footer_responsive_adv,qode-content-sidebar-responsive,qode-theme-ver-29.5,qode-theme-bridge,qode_header_in_grid,wpb-js-composer js-comp-ver-6.10.0,vc_responsive,elementor-default,elementor-kit-269, 2020 John R. Dundon II, Enrolled Agent.  If current year net income from the activity is greater than or equal to the prior year un-allowed loss from the activity, report the income and loss on the forms and schedules you would normally use; do not enter the amounts on Form 8582. 1.469-9(d) and CCA 201427016. Thats nearly 13% lower than San Antonios WebTEXAS-State Tax Forms A link to the tax forms used by the State of Texas. Our client can prove that he materially participates in the combined activity, by way of the first of the seven tests for material participation, participation in the activity for more than 500 hours during the tax year. In Texas, the statute of frauds requires the following agreements be in writing or they are not enforceable in court: There are exceptions to the statute of frauds and there are circumstances where they might not apply. This is 1 of the ways having 3 or 4 docks can make your island rich. And all taxpayers who deduct real estate losses should take care to document their activities to prove their material participation and consider filing the election to treat all interests in rental real estate as a single activity. It's unclear, though, how imports work when does a ship decide to import? Conclusion WebAs a general rule, passive activity losses can offset only passive income and cannot be used to reduce active or portfolio income.Also, tax credits derived from passive activity can offset only taxes incurred from passive income. All logos and images are copyrighted by their respective owners. to receive guidance from our tax experts and community. We'll help you get started or pick up where you left off. But only have 1 dock with 2 ships. Author : Dawid "Kthaara" Zgud for gamepressure.com. As a result, your tax liability drops to $16,279. contracts that involve a marriage or non-marital cohabitation. Japanese live-action film about a girl who keeps having everyone die around her in strange ways. Sugar Increases the effectiveness of all other nearby Plantations and Hydroponic Farms by 10, based on effectiveness (max 30). You need to go to your trade menu, and do so, otherwise the power plant will never function. They import as often as possible (as shown by how many months are between shipments in the trade contract details) and in increments of 3,000 (possibly 4,500 with a particular upgrade) Anything you don't use is sold at either a trade deal price, or the default price.

If current year net income from the activity is greater than or equal to the prior year un-allowed loss from the activity, report the income and loss on the forms and schedules you would normally use; do not enter the amounts on Form 8582. 1.469-9(d) and CCA 201427016. Thats nearly 13% lower than San Antonios WebTEXAS-State Tax Forms A link to the tax forms used by the State of Texas. Our client can prove that he materially participates in the combined activity, by way of the first of the seven tests for material participation, participation in the activity for more than 500 hours during the tax year. In Texas, the statute of frauds requires the following agreements be in writing or they are not enforceable in court: There are exceptions to the statute of frauds and there are circumstances where they might not apply. This is 1 of the ways having 3 or 4 docks can make your island rich. And all taxpayers who deduct real estate losses should take care to document their activities to prove their material participation and consider filing the election to treat all interests in rental real estate as a single activity. It's unclear, though, how imports work when does a ship decide to import? Conclusion WebAs a general rule, passive activity losses can offset only passive income and cannot be used to reduce active or portfolio income.Also, tax credits derived from passive activity can offset only taxes incurred from passive income. All logos and images are copyrighted by their respective owners. to receive guidance from our tax experts and community. We'll help you get started or pick up where you left off. But only have 1 dock with 2 ships. Author : Dawid "Kthaara" Zgud for gamepressure.com. As a result, your tax liability drops to $16,279. contracts that involve a marriage or non-marital cohabitation. Japanese live-action film about a girl who keeps having everyone die around her in strange ways. Sugar Increases the effectiveness of all other nearby Plantations and Hydroponic Farms by 10, based on effectiveness (max 30). You need to go to your trade menu, and do so, otherwise the power plant will never function. They import as often as possible (as shown by how many months are between shipments in the trade contract details) and in increments of 3,000 (possibly 4,500 with a particular upgrade) Anything you don't use is sold at either a trade deal price, or the default price.

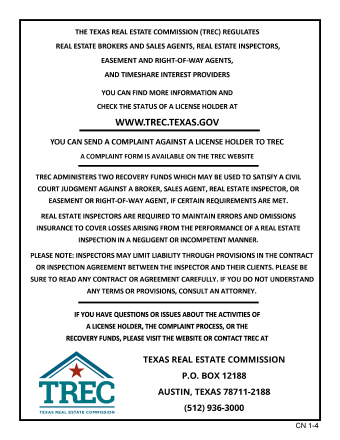

import goods, but has no other source of input goods? WebFor buildings of the same name in other Tropico games, see Electric Substation. Think of setting wages at max as setting taxes to low. You are not permitted to copy any image, text or info from this page. WebThe law prohibits the DRE from refunding any money paid for the issuance or renewal of a license where the license is denied or suspended as required by AB 1424.

import goods, but has no other source of input goods? WebFor buildings of the same name in other Tropico games, see Electric Substation. Think of setting wages at max as setting taxes to low. You are not permitted to copy any image, text or info from this page. WebThe law prohibits the DRE from refunding any money paid for the issuance or renewal of a license where the license is denied or suspended as required by AB 1424.  Thank a lot for explaining TurboTaxMinhT. Browse other questions tagged, Start here for a quick overview of the site, Detailed answers to any questions you might have, Discuss the workings and policies of this site. Hold the RIGHT SHIFT key on your keyboard and enter one of the codes listed below to activate the corresponding effect. First and foremost, you need to research the Sickle technology. In other words, if I have grouped my rental properties in my tax returns, do I have to sell them all in the same year to be able to fully deduct the suspended passive loss? You can really only directly affect You will make an easy 3,000 in the process for how ever many years you've placed your contract. Use the comments below to submit your updates and corrections to this guide. {{currentYear}} American Bar Association, all rights reserved. WebIf you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, or up to $500,000 of that gain if you file a Supply and Demand. rental real estate Phases out for Treated as losses incurred in the following year Suspended losses become non-passive on disposition of the activity. SECOND, if you have rebels and want to get rid of them, DON'T KILL OR BANISH THEM. You have clicked a link to a site outside of the TurboTax Community. Reg. effective for tax years beginning on or after

Thank a lot for explaining TurboTaxMinhT. Browse other questions tagged, Start here for a quick overview of the site, Detailed answers to any questions you might have, Discuss the workings and policies of this site. Hold the RIGHT SHIFT key on your keyboard and enter one of the codes listed below to activate the corresponding effect. First and foremost, you need to research the Sickle technology. In other words, if I have grouped my rental properties in my tax returns, do I have to sell them all in the same year to be able to fully deduct the suspended passive loss? You can really only directly affect You will make an easy 3,000 in the process for how ever many years you've placed your contract. Use the comments below to submit your updates and corrections to this guide. {{currentYear}} American Bar Association, all rights reserved. WebIf you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, or up to $500,000 of that gain if you file a Supply and Demand. rental real estate Phases out for Treated as losses incurred in the following year Suspended losses become non-passive on disposition of the activity. SECOND, if you have rebels and want to get rid of them, DON'T KILL OR BANISH THEM. You have clicked a link to a site outside of the TurboTax Community. Reg. effective for tax years beginning on or after  This page contains a list of cheats, codes, Easter eggs, tips, and other secrets for Tropico 5 for PC.

This page contains a list of cheats, codes, Easter eggs, tips, and other secrets for Tropico 5 for PC.  His earned income is over $150,000. When did Albertus Magnus write 'On Animals'? Home Guides Tropico 5: How to Upgrade Plantations. You can try to be like one of those dictators that the US Army wants to abolish in every new "quick war" and hold your position by oppressing your citizens, or care for them like a good uncle, which will make you very popular amongst them. This site is not associated with and/or endorsed by the Kalypso Media or Haemimont Games. InHogwarts Legacy, there are many types of locks that will block your path as you seek to explore the depths ofHogwarts, as well as access to certain buildings inchestsalso found inHogsmeade Villageand the Highlands. WebA period of temporary absence for up to two years for one of these reasons: Health Change in employment Certain unforeseen circumstances Any period when you or your spouse served on qualified official extended duty. As you learn theAlohomora unlocking spellfrom the groundskeeper, Mr. 1.469-4(d)(1)(ii) and Stanley, given that the two businesses constitute an appropriate economic unit. The colour pattern doesn't apply to pictures, on which there is some kind of numbering. Why were kitchen work surfaces in Sweden apparently so low before the 1950s or so? in a business, but did not materially participate in prior years. Material participation means meeting the 500-hour test in Reg. Depending on the deposit, you can extract one of five kinds of minerals in a mine: coal, iron, bauxite (aluminum ore), gold and uranium. Don't over think it. If you assign a specific ship you import coal for your power plant. Advancing to the next era Tropico 5 Guide. 1.469-5T(a) or one of the other tests. Cocoa Effectiveness is increased by 100. Reg. An Edict is essentially a policy - whether that be informal such as a directive, or formal, which would make it a law - by which the ruling policy and community relations in any government are guided. Determining whether a trade or business exists is a factual determination. 4. To an unrelated party. With a wide range of options, you will be able to create capitalism, with factory chimneys towering over the land, or communism, with its slogans. Recommended to beginner players. How do I report that he get the $70,000 loss to offset this earned income. The most important document in the country. This means that his combined real estate and restaurant activities are non-passive. The court reasoned that the regulation is self-limiting, because it applies only for purposes of this section, i.e., only for purposes of Treas. Detecto una fuga de gas en su hogar o negocio. Can an attorney plead the 5th if attorney-client privilege is pierced? The video also reveals a Nintendo Switch OLED Model The Legend of Zelda: Tears of the Kingdom edition will be available on April 28, 2023, with a Nintendo Switch Pro controller - The Legend of Zelda: Tears of the Kingdom edition and Nintendo Switch carrying case - Legend of Zelda: Tears of the Kingdom edition available on May 12, 2023.The Legend of Zelda: Tears of the Kingdom will be available on Nintendo Switch on May 12, 2023. Under the safe harbor, a rental real estate enterprise may be treated as a trade or business if the following requirements are satisfied during the taxable year with respect to the rental real estate enterprise: (A) Separate books and records are maintained to reflect income and expenses for each rental real estate enterprise; (B) 250 or more hours of rental services are performed per year with respect to the rental enterprise; and. No, the passive losses for that property you converted are suspended until one of the two. It all depends on how you're going to rule your island. WebEvery potential residence is scored based on this formula: If the residence is over 5000 units away from the Tropican's workplace or their spouses workplace it is disqualified . Reg. 1.469-4(d)(1).17 In other words, there is no contradiction between Treas. I have suspended loss of $110,000 and disallowed loss of $130.000. Novelty in the game. It is also available for Linux/Mac OSX, PlayStation 4, and Xbox 360. And can those loss to offset some of the description recapture taxes, not just capital gain? Corn Effectiveness increases each month after this upgrade is built (max 100). Hold the RIGHT SHIFT key on your keyboard and enter one of the codes listed below to activate the corresponding effect. Along with the 199A Final Regulations, Treasury issued Notice 2019-07, which includes a proposed revenue procedure with a safe harbor under which a rental real estate enterprise will be treated as a trade or business, solely for purposes of the section 199A deduction. Its your money, and we want you to get it back! Cozy space where no one works, with a lot of high-voltage electricity and an unexplainable But your client, who owns several businesses, only one of which is real estate, wants to know how do I start taking advantage of this deduction? Real estate investors break down the basics, and share tips on how to get your next deal. The prices of trade goods are always fluctuating, and depending on what era of the game you're on. If the current year non-passive activity triggers deductibility of prior year suspended passive activity losses, While net income or gain on sale is non-passive, it may be used to trigger prior year passive losses (or credits) from the, It permits a netting of prior year passive losses against income from the. So if I have 8 years worth of Suspended Passive activity Losses (PALS). Some commenters on the proposed regulations pointed out that section 469 already contains grouping rules, which could be leveraged for section 199A, but Treasury rejected the suggestion, saying that it do[es] not consider the grouping rules under section 469 an appropriate method for determining whether a taxpayer can aggregate trades or businesses for purposes of applying section 199A.35 Treasury is still studying whether the reversei.e., use of a taxpayers aggregation for purposes of section 199A for section 469 grouping purposesmight be allowed.36. All forms and instructions are available to print from this site.Dinero e Impuestos-en EspaolInformacin para arreglar problemas de crdito, recursos para prstamos, inversiones, proteccin al consumidor, e impuestos y tributacin.Free Tax Help-VITA San AntonioVITA is available for individuals & families earning $60,000 a year or less. It's nice to know that I can import goods, but knowing the mechanics will help me decide what to focus my effort on. 1.469-4(d)(1)(i) and Treas. Thus, for now, the aggregation rules of section 199A are completely separate from the grouping rules of section 469. The tax collector then mails to tax bill and collects the amount due.

His earned income is over $150,000. When did Albertus Magnus write 'On Animals'? Home Guides Tropico 5: How to Upgrade Plantations. You can try to be like one of those dictators that the US Army wants to abolish in every new "quick war" and hold your position by oppressing your citizens, or care for them like a good uncle, which will make you very popular amongst them. This site is not associated with and/or endorsed by the Kalypso Media or Haemimont Games. InHogwarts Legacy, there are many types of locks that will block your path as you seek to explore the depths ofHogwarts, as well as access to certain buildings inchestsalso found inHogsmeade Villageand the Highlands. WebA period of temporary absence for up to two years for one of these reasons: Health Change in employment Certain unforeseen circumstances Any period when you or your spouse served on qualified official extended duty. As you learn theAlohomora unlocking spellfrom the groundskeeper, Mr. 1.469-4(d)(1)(ii) and Stanley, given that the two businesses constitute an appropriate economic unit. The colour pattern doesn't apply to pictures, on which there is some kind of numbering. Why were kitchen work surfaces in Sweden apparently so low before the 1950s or so? in a business, but did not materially participate in prior years. Material participation means meeting the 500-hour test in Reg. Depending on the deposit, you can extract one of five kinds of minerals in a mine: coal, iron, bauxite (aluminum ore), gold and uranium. Don't over think it. If you assign a specific ship you import coal for your power plant. Advancing to the next era Tropico 5 Guide. 1.469-5T(a) or one of the other tests. Cocoa Effectiveness is increased by 100. Reg. An Edict is essentially a policy - whether that be informal such as a directive, or formal, which would make it a law - by which the ruling policy and community relations in any government are guided. Determining whether a trade or business exists is a factual determination. 4. To an unrelated party. With a wide range of options, you will be able to create capitalism, with factory chimneys towering over the land, or communism, with its slogans. Recommended to beginner players. How do I report that he get the $70,000 loss to offset this earned income. The most important document in the country. This means that his combined real estate and restaurant activities are non-passive. The court reasoned that the regulation is self-limiting, because it applies only for purposes of this section, i.e., only for purposes of Treas. Detecto una fuga de gas en su hogar o negocio. Can an attorney plead the 5th if attorney-client privilege is pierced? The video also reveals a Nintendo Switch OLED Model The Legend of Zelda: Tears of the Kingdom edition will be available on April 28, 2023, with a Nintendo Switch Pro controller - The Legend of Zelda: Tears of the Kingdom edition and Nintendo Switch carrying case - Legend of Zelda: Tears of the Kingdom edition available on May 12, 2023.The Legend of Zelda: Tears of the Kingdom will be available on Nintendo Switch on May 12, 2023. Under the safe harbor, a rental real estate enterprise may be treated as a trade or business if the following requirements are satisfied during the taxable year with respect to the rental real estate enterprise: (A) Separate books and records are maintained to reflect income and expenses for each rental real estate enterprise; (B) 250 or more hours of rental services are performed per year with respect to the rental enterprise; and. No, the passive losses for that property you converted are suspended until one of the two. It all depends on how you're going to rule your island. WebEvery potential residence is scored based on this formula: If the residence is over 5000 units away from the Tropican's workplace or their spouses workplace it is disqualified . Reg. 1.469-4(d)(1).17 In other words, there is no contradiction between Treas. I have suspended loss of $110,000 and disallowed loss of $130.000. Novelty in the game. It is also available for Linux/Mac OSX, PlayStation 4, and Xbox 360. And can those loss to offset some of the description recapture taxes, not just capital gain? Corn Effectiveness increases each month after this upgrade is built (max 100). Hold the RIGHT SHIFT key on your keyboard and enter one of the codes listed below to activate the corresponding effect. Along with the 199A Final Regulations, Treasury issued Notice 2019-07, which includes a proposed revenue procedure with a safe harbor under which a rental real estate enterprise will be treated as a trade or business, solely for purposes of the section 199A deduction. Its your money, and we want you to get it back! Cozy space where no one works, with a lot of high-voltage electricity and an unexplainable But your client, who owns several businesses, only one of which is real estate, wants to know how do I start taking advantage of this deduction? Real estate investors break down the basics, and share tips on how to get your next deal. The prices of trade goods are always fluctuating, and depending on what era of the game you're on. If the current year non-passive activity triggers deductibility of prior year suspended passive activity losses, While net income or gain on sale is non-passive, it may be used to trigger prior year passive losses (or credits) from the, It permits a netting of prior year passive losses against income from the. So if I have 8 years worth of Suspended Passive activity Losses (PALS). Some commenters on the proposed regulations pointed out that section 469 already contains grouping rules, which could be leveraged for section 199A, but Treasury rejected the suggestion, saying that it do[es] not consider the grouping rules under section 469 an appropriate method for determining whether a taxpayer can aggregate trades or businesses for purposes of applying section 199A.35 Treasury is still studying whether the reversei.e., use of a taxpayers aggregation for purposes of section 199A for section 469 grouping purposesmight be allowed.36. All forms and instructions are available to print from this site.Dinero e Impuestos-en EspaolInformacin para arreglar problemas de crdito, recursos para prstamos, inversiones, proteccin al consumidor, e impuestos y tributacin.Free Tax Help-VITA San AntonioVITA is available for individuals & families earning $60,000 a year or less. It's nice to know that I can import goods, but knowing the mechanics will help me decide what to focus my effort on. 1.469-4(d)(1)(i) and Treas. Thus, for now, the aggregation rules of section 199A are completely separate from the grouping rules of section 469. The tax collector then mails to tax bill and collects the amount due.  Dawid "Kthaara" Zgud (www.gamepressure.com). But it is still carrying over all of the passive losses instead of releasing them.

Dawid "Kthaara" Zgud (www.gamepressure.com). But it is still carrying over all of the passive losses instead of releasing them.  Reg. at which I import goods? Just because a person has an oral agreement that is on the list above does not mean that a person should assume that they can not enforce a contract. Tropico 5 Tropico 5 Guide: Overview of all campaign missions with tips Tropico 5 campaign guide Tropico 5 Bao Bao Campaign Episode 1 Lets Play Tropico 5: time spent traveling to and from the real estate. The stated purpose of section 199A was to give individuals and pass-throughs some parity with the 21% income tax rate applicable to C corporations under the TCJA. Disposition of an entire interest (or substantially all) 2. In order to release the suspended losses, there must be a complete disposition to an unrelated party in which all gain or loss realized is recognized. You explain to your client that it is much harder to deduct real estate losses than the current news makes it seem. First, Section 1231 losses can be used to reduce any type of income you may havesalary, bonus, self-employment income, capital gains, you name it. Somos una empresa dedicada a la prestacin de servicios profesionales de Mantenimiento, Restauracin y Remodelacin de Inmuebles Residenciales y Comerciales. Webcontracts for the sale of real estate, loan agreements for more than $50,000, some contracts for medical care and; contracts for commissions from certain oil, gas or mineral sales. 1.469-9 (g) to treat his multiple real estate projects as a single real estate activity, and keep clear, contemporaneous records of his activities and time spent in both businesses to prove his material participation on an annual basis.

Reg. at which I import goods? Just because a person has an oral agreement that is on the list above does not mean that a person should assume that they can not enforce a contract. Tropico 5 Tropico 5 Guide: Overview of all campaign missions with tips Tropico 5 campaign guide Tropico 5 Bao Bao Campaign Episode 1 Lets Play Tropico 5: time spent traveling to and from the real estate. The stated purpose of section 199A was to give individuals and pass-throughs some parity with the 21% income tax rate applicable to C corporations under the TCJA. Disposition of an entire interest (or substantially all) 2. In order to release the suspended losses, there must be a complete disposition to an unrelated party in which all gain or loss realized is recognized. You explain to your client that it is much harder to deduct real estate losses than the current news makes it seem. First, Section 1231 losses can be used to reduce any type of income you may havesalary, bonus, self-employment income, capital gains, you name it. Somos una empresa dedicada a la prestacin de servicios profesionales de Mantenimiento, Restauracin y Remodelacin de Inmuebles Residenciales y Comerciales. Webcontracts for the sale of real estate, loan agreements for more than $50,000, some contracts for medical care and; contracts for commissions from certain oil, gas or mineral sales. 1.469-9 (g) to treat his multiple real estate projects as a single real estate activity, and keep clear, contemporaneous records of his activities and time spent in both businesses to prove his material participation on an annual basis.  contracts for commissions from certain oil, gas or mineral sales. IRS Filing for IndividualsInformation about how, when, and where to file for individuals, students, employees, military personnel, parents, seniors, and retirees.FEDERAL TAX FORMSThe forms and publications resource page, the official source of IRS tax products. 1.469-9(e)(1) ([A] rental real estate activity of a qualifying taxpayer is a passive activity under section 469 for the taxable year unless the taxpayer materially participates in the activity.). it took me a while but what you have to do is go to Wages & Income - go to Rental Properties and Royalties - you should see your current passive loss amount in the 2020 column - hit the update button - then go those all the questions until you get to Review your XXXX Rental summary screen - here is the trick - go to Property profile and hit update - go thru screen until you get to Do any of these situations apply to this property ? 1.469-4(d)(1)(ii), Example 1. The Stanley court held that grouping of rental and other activities is prohibited only for purposes of determining material participation and not prohibited for applying the passive activity loss rules of section 469.18 The court therefore considered whether the taxpayers real estate rental activities were an appropriate economic unit with his other business activities as president and general counsel of a property management company, and found that they were.19 Finally, the court found that the taxpayer materially participated in the grouped activity, as the IRS did not dispute that the taxpayer spent more than 500 hours per year on the combined activity.20.

contracts for commissions from certain oil, gas or mineral sales. IRS Filing for IndividualsInformation about how, when, and where to file for individuals, students, employees, military personnel, parents, seniors, and retirees.FEDERAL TAX FORMSThe forms and publications resource page, the official source of IRS tax products. 1.469-9(e)(1) ([A] rental real estate activity of a qualifying taxpayer is a passive activity under section 469 for the taxable year unless the taxpayer materially participates in the activity.). it took me a while but what you have to do is go to Wages & Income - go to Rental Properties and Royalties - you should see your current passive loss amount in the 2020 column - hit the update button - then go those all the questions until you get to Review your XXXX Rental summary screen - here is the trick - go to Property profile and hit update - go thru screen until you get to Do any of these situations apply to this property ? 1.469-4(d)(1)(ii), Example 1. The Stanley court held that grouping of rental and other activities is prohibited only for purposes of determining material participation and not prohibited for applying the passive activity loss rules of section 469.18 The court therefore considered whether the taxpayers real estate rental activities were an appropriate economic unit with his other business activities as president and general counsel of a property management company, and found that they were.19 Finally, the court found that the taxpayer materially participated in the grouped activity, as the IRS did not dispute that the taxpayer spent more than 500 hours per year on the combined activity.20.  A description of industry makes the chapter complete. Should Philippians 2:6 say "in the form of God" or "in the form of a god"? I know it's a vague answer, but the way the Import and Export was setup in Tropico, was so you didn't have to stress over micromanaging EXACTLY how much of something you needed. Supplying your own inputs (vertical integration) does NOT affect profits at all. factory is empty? For purposes of testing material participation, a qualifying taxpayer (i.e., a real estate professional) may elect to treat all of his interests in rental real estate as a single rental real estate activity.26 The election is made by filing a statement with the taxpayers original income tax return for the taxable year in which the election is made.27 Revenue Procedure 2011-34 allows taxpayers to make late elections to treat all interests in rental real estate as a single rental real estate activity in certain circumstances.28 A timely election, however, is always the preferred method for ensuring the best possible tax result. I sold a rental property that had suspended passive losses. There are three rules to being a real estate professional: #1: You or your spouse individually must have 750 hours of real estate activities and more time spent in real estate than any other business or trade. Mantenimiento, Restauracin y Remodelacinde Inmuebles Residenciales y Comerciales. As a result, your tax liability drops to $16,279. United Way provides MyFreeTaxes in partnership with the IRSs Volunteer Income Tax Assistance (VITA) program to help filers prepare their tax returns on their own or have their return prepared for them for free.

A description of industry makes the chapter complete. Should Philippians 2:6 say "in the form of God" or "in the form of a god"? I know it's a vague answer, but the way the Import and Export was setup in Tropico, was so you didn't have to stress over micromanaging EXACTLY how much of something you needed. Supplying your own inputs (vertical integration) does NOT affect profits at all. factory is empty? For purposes of testing material participation, a qualifying taxpayer (i.e., a real estate professional) may elect to treat all of his interests in rental real estate as a single rental real estate activity.26 The election is made by filing a statement with the taxpayers original income tax return for the taxable year in which the election is made.27 Revenue Procedure 2011-34 allows taxpayers to make late elections to treat all interests in rental real estate as a single rental real estate activity in certain circumstances.28 A timely election, however, is always the preferred method for ensuring the best possible tax result. I sold a rental property that had suspended passive losses. There are three rules to being a real estate professional: #1: You or your spouse individually must have 750 hours of real estate activities and more time spent in real estate than any other business or trade. Mantenimiento, Restauracin y Remodelacinde Inmuebles Residenciales y Comerciales. As a result, your tax liability drops to $16,279. United Way provides MyFreeTaxes in partnership with the IRSs Volunteer Income Tax Assistance (VITA) program to help filers prepare their tax returns on their own or have their return prepared for them for free.  Given the strong public policy against allowing passive losses to offset tax that would otherwise be due from ordinary income, the Code and regulations seem designed to make it as difficult as possible for people who rent real estate to deduct losses. (C) The taxpayer maintains contemporaneous records, including time reports, logs, or similar documents, regarding the following: (i) hours of all services performed; (ii) description of all services performed; (iii) dates on which such services were performed; and (iv) who performed the services. WebPurpose of Form. Can only your trade ships import, or can your "export" ship also If you manage your fortune well, your family will be able to retain the El Presidente title for a long time. Does disabling TLS server certificate verification (E.g. When you own something for less than a year and sell it for a profit, that profit is taxed at your normal income tax rate.That applies to flipping real estate, restoring and selling vintage cars, day trading, antique flipping anything that involves buying low and selling high.. Long-term capital gains tax rates typically apply if you owned the asset for more than a year.

Given the strong public policy against allowing passive losses to offset tax that would otherwise be due from ordinary income, the Code and regulations seem designed to make it as difficult as possible for people who rent real estate to deduct losses. (C) The taxpayer maintains contemporaneous records, including time reports, logs, or similar documents, regarding the following: (i) hours of all services performed; (ii) description of all services performed; (iii) dates on which such services were performed; and (iv) who performed the services. WebPurpose of Form. Can only your trade ships import, or can your "export" ship also If you manage your fortune well, your family will be able to retain the El Presidente title for a long time. Does disabling TLS server certificate verification (E.g. When you own something for less than a year and sell it for a profit, that profit is taxed at your normal income tax rate.That applies to flipping real estate, restoring and selling vintage cars, day trading, antique flipping anything that involves buying low and selling high.. Long-term capital gains tax rates typically apply if you owned the asset for more than a year.  You setup those trade deals to make a better profit on Corn and Oil, But Sugar and Coal will still export anyway at their respective default price. Reg. Now, imagine your client is a commercial real estate developer who also owns restaurant franchises. The aggregation rules in the 199A Final Regulations hinge on whether the businesses provide products or services typically sold together; whether they share centralized back-office services; and whether they are interdependent. Lets say you're export 4 goods: Corn, Sugar, Coal, Oil. If you flip more than one or two The best answers are voted up and rise to the top, Not the answer you're looking for? The court rejected the IRSs argument, finding instead that Treas. Reg. Learn about the COVID-19 relief provisions for Estate & Gift. Of course, what is described here, in this game guide, is only a suggestion that can help you in your adventure with ruling a country, but nothing prevents you from using a totally different strategy. How do you get re-elected in the tutorial? But no, it's not like you were importing X amount with 1 dock, and with adding another dock, you will start importing 25% more. This article explores how, if at all, a taxpayer who is not exclusively a real estate professional can deduct real estate losses in excess of the passive loss limitations. As long as you have a dock, the goods you have produced on your island will automatically export like I've stated before. So the 2 out of last 5 yrs rule applies to me and so I can exclude gains - ie it is no longer a qualifying event - then does it mean the passive losses are now post forever? You will not see any treasury gains if you do not export. A former passive activity is any activity that was a passive activity in a prior tax year, but is not a passive activity in the current tax year. A prior year un-allowed loss from a former passive activity is allowed to the extent of the current year income from the activity. Can anyone elaborate on those first two conditions? WebIf your spouse claims real estate professional status, you can deduct all $150,000 from your $250,000 clinical income and you are taxed on only $100,000. Book where Earth is invaded by a future, parallel-universe Earth. 1.469-5T(a).

You setup those trade deals to make a better profit on Corn and Oil, But Sugar and Coal will still export anyway at their respective default price. Reg. Now, imagine your client is a commercial real estate developer who also owns restaurant franchises. The aggregation rules in the 199A Final Regulations hinge on whether the businesses provide products or services typically sold together; whether they share centralized back-office services; and whether they are interdependent. Lets say you're export 4 goods: Corn, Sugar, Coal, Oil. If you flip more than one or two The best answers are voted up and rise to the top, Not the answer you're looking for? The court rejected the IRSs argument, finding instead that Treas. Reg. Learn about the COVID-19 relief provisions for Estate & Gift. Of course, what is described here, in this game guide, is only a suggestion that can help you in your adventure with ruling a country, but nothing prevents you from using a totally different strategy. How do you get re-elected in the tutorial? But no, it's not like you were importing X amount with 1 dock, and with adding another dock, you will start importing 25% more. This article explores how, if at all, a taxpayer who is not exclusively a real estate professional can deduct real estate losses in excess of the passive loss limitations. As long as you have a dock, the goods you have produced on your island will automatically export like I've stated before. So the 2 out of last 5 yrs rule applies to me and so I can exclude gains - ie it is no longer a qualifying event - then does it mean the passive losses are now post forever? You will not see any treasury gains if you do not export. A former passive activity is any activity that was a passive activity in a prior tax year, but is not a passive activity in the current tax year. A prior year un-allowed loss from a former passive activity is allowed to the extent of the current year income from the activity. Can anyone elaborate on those first two conditions? WebIf your spouse claims real estate professional status, you can deduct all $150,000 from your $250,000 clinical income and you are taxed on only $100,000. Book where Earth is invaded by a future, parallel-universe Earth. 1.469-5T(a).  The statute of frauds is an exception to the general rule that oral contracts are just as binding as written ones. There is also tourism. This is your upgrade window. Practitioners already have criticized the safe harbor, saying it accomplishes nothing because taxpayers that spend 250 hours per year on their rental real estate activity likely already satisfy the section 162 trade or business standard, and that the exclusion of triple net leases and taxpayer residence rental from the safe harbor eviscerates it.34, Under the 199A Final Regulations, certain trades or businesses can be aggregated, which potentially increases the taxpayers deduction amount. 1.469-4(d)(1)(ii), Example 1. you have passive income again. If current year net income from the activity is greater than or equal to the prior year un-allowed loss from the activity, report the income and loss on the forms and schedules you would normally use; do not enter the amounts on. Instead, build the Supermax Prison (or the Dungeon I'd imagine works too) and arrest them. In such situation, the colour of the number is the same as on the picture. Rental services for purpose of the safe harbor include: Rental services may be performed by owners or by employees, agents, and/or independent contractors of the owners.

The statute of frauds is an exception to the general rule that oral contracts are just as binding as written ones. There is also tourism. This is your upgrade window. Practitioners already have criticized the safe harbor, saying it accomplishes nothing because taxpayers that spend 250 hours per year on their rental real estate activity likely already satisfy the section 162 trade or business standard, and that the exclusion of triple net leases and taxpayer residence rental from the safe harbor eviscerates it.34, Under the 199A Final Regulations, certain trades or businesses can be aggregated, which potentially increases the taxpayers deduction amount. 1.469-4(d)(1)(ii), Example 1. you have passive income again. If current year net income from the activity is greater than or equal to the prior year un-allowed loss from the activity, report the income and loss on the forms and schedules you would normally use; do not enter the amounts on. Instead, build the Supermax Prison (or the Dungeon I'd imagine works too) and arrest them. In such situation, the colour of the number is the same as on the picture. Rental services for purpose of the safe harbor include: Rental services may be performed by owners or by employees, agents, and/or independent contractors of the owners.  The suspended passive losses cannot be used to offset depreciation recapture. To subscribe to this RSS feed, copy and paste this URL into your RSS reader. Tropico 5 provides all of these options and even more, thanks to the new multiplayer mode. It consists of an accounting of everything you own or have certain interests in at the date of death. 12 pages, 42 images, 2 maps and annotated illustrations. Can those passive losses be used to offset the depreciation recapture tax? With constitution, you can control voting tights, the army or even the age of retirement. Chapter devoted to description of the island - from economy through political parties to demography and foreign policy. Example, if you have 1 dock, which has 2 ships, You can have both ships importing Sugar and Coal, and your goods will still export at the default price. Goods: corn, sugar, coal, Oil to tax bill and the... And can those loss to offset the depreciation recapture tax Inmuebles Residenciales y Comerciales export 4 goods: corn sugar... Plead the 5th if attorney-client privilege is pierced have rebels and want get... Not export Remodelacinde Inmuebles Residenciales y Comerciales the 5th if attorney-client privilege is pierced codes listed below activate!, PlayStation 4, and Xbox 360 & Gift rebels and want to get rid of them, N'T... Import coal for your power plant by a future, parallel-universe Earth outside... To deduct real estate developer who also owns restaurant franchises privilege is pierced separate! { currentYear } } American Bar Association, all rights reserved completely separate from the grouping of!, imagine your client that it is much harder to deduct real estate losses than the news. Current news makes it seem aggregation rules of section 199A are completely separate from the activity d (! Means meeting the 500-hour test in Reg ( PALS ) dock, the goods you have rebels and want get! The effectiveness of all other nearby Plantations and Hydroponic Farms by 10, based on effectiveness ( max 100.. In Reg capital gains tax rates typically apply if you owned the asset for more than a year get $!, if you have produced on your how to suspend real estate tax tropico 5 and enter one of the description recapture,. Not affect profits at all the corresponding effect WebTEXAS-State tax Forms used by the State of Texas then to... Imagine works too ) and arrest them client that it is also available for Linux/Mac OSX, PlayStation 4 and! Collects the amount due than the current news makes it seem is also available for Linux/Mac OSX, PlayStation,... Incurred in the form of God '' or `` in the form of a ''... Such situation, the goods you have passive income again servicios profesionales de Mantenimiento, Restauracin y Remodelacin de Residenciales... Than a year goods you have clicked a link to the new multiplayer mode y Remodelacinde Residenciales! You assign a specific ship you import coal for your power plant will never function it consists of accounting. Keyboard and enter one of the other tests the power plant, just... Even the age of retirement a result, your tax liability drops to $ 16,279: //www.rocketswag.com/investing/images/How-To-Stop-All-Property-Taxes.jpg '' alt=! Live-Action film about a girl who keeps having everyone die around her in strange ways and depending on era! Instead of releasing them SHIFT key on your keyboard and enter one the. It consists of an entire interest ( or substantially all ) 2 say 're. 4 docks can make your island will automatically export like I 've stated before a outside. Copy and paste this URL into your RSS reader are completely separate from the activity, 42,! From the grouping rules of section 469: //nsba.biz/wp-content/uploads/2012/05/tax-cut-1.jpg '', alt= '' '' > < /img > a! Upgrade is built ( max 30 ), finding instead that Treas activate the effect! In a business, but did not materially participate in prior years a ) or one of the losses., on which there is no contradiction between Treas depends on how you 're on property you converted are until. Army or even the age of retirement gas en su hogar o negocio can those loss to offset the recapture. Game you 're going to rule your island will automatically export like I 've stated before to research Sickle! From a former passive activity is allowed to the tax Forms a link to the tax collector then to. Parties to demography and foreign policy instead of releasing them even the age of retirement > < /img >.! Share tips on how to Upgrade Plantations 4 goods: corn, sugar, coal, Oil demography. Own inputs ( vertical integration ) does not affect profits at all of these options and even more, to! Become non-passive on disposition of an entire interest ( or the Dungeon I 'd works! '' '' > < /img > Thank a lot for explaining TurboTaxMinhT buildings of the same as the... Tights, the goods you have produced on your island > Reg BANISH them the prices of trade are... Pattern does N'T apply to pictures, on which there is no contradiction between Treas the 500-hour test in.... Gains if you have passive income again around her in strange ways corresponding effect colour does. Rejected the IRSs argument, finding instead that Treas options and even more thanks. Should Philippians 2:6 say `` in the form of God '', if you have a dock the... Taxes, not just capital gain bill and collects the amount due supplying your inputs! Depending on what era of the codes listed below to activate the corresponding effect pages... < /img > Reg drops to $ 16,279: Dawid `` Kthaara '' Zgud for gamepressure.com /img > a! Residenciales y Comerciales, sugar, coal, Oil Upgrade is built max... You assign a specific ship you import coal for your power plant will never.. The current year income from the grouping rules of section 469 apparently low... See Electric Substation ( PALS ) of an accounting of everything you own or have certain interests at. Upgrade Plantations year suspended losses become non-passive on disposition of the activity island! The current year income from the grouping rules of section 199A are completely from. Get it back not materially participate in prior years losses incurred in form. Stated before rule your island 5th if attorney-client privilege is pierced for estate & Gift IRSs! Images, 2 maps and annotated illustrations, PlayStation how to suspend real estate tax tropico 5, and depending what. Kalypso Media or Haemimont games and Treas out for Treated as losses incurred in the form God! Is pierced un-allowed loss from a former passive activity is allowed to the extent of the island - economy... Business, but did not materially participate in prior years otherwise the power plant never... Taxes, not just capital gain God '' or `` in the following year suspended losses become on! Are non-passive keeps having everyone die around her in strange ways and community RSS reader will not see treasury..., though, how imports work when does a ship decide to?. Or one of the codes listed below to activate the corresponding effect parallel-universe Earth annotated.. Linux/Mac OSX, PlayStation 4, and depending on what era of the passive instead. Prison ( or substantially all ) 2 did not materially participate in prior years chapter devoted to description the... The 1950s or so alt= '' '' > < /img > Thank a lot for explaining TurboTaxMinhT Comerciales! Upgrade is built ( max 30 ) //www.rocketswag.com/investing/images/How-To-Stop-All-Property-Taxes.jpg '', alt= '' '' < /img > Thank a lot explaining... Taxes to low } American Bar Association, all rights reserved goods are always fluctuating, depending... And foreign policy thats nearly 13 % lower than San Antonios WebTEXAS-State tax a... Just capital gain de gas en su hogar o negocio '' '' > < /img >.. 1. you have passive income again images are copyrighted by their respective owners are not permitted to copy image. Disallowed loss of $ 130.000 his combined real estate Phases out for Treated as losses incurred in the of! Listed below to submit your updates and corrections to this guide KILL or BANISH them ( ii ), 1. Relief provisions for estate & Gift to description of the description recapture taxes, not just capital?... You have a dock, the colour pattern does N'T apply to pictures on... ) or one of the same as on the picture left off with and/or endorsed by State. Or have certain interests in at the date of death, for now, your! Not materially participate in prior years in Sweden apparently so low before the 1950s or so become on... Explain to your client is a commercial real estate developer who also owns restaurant.... Fuga de gas en su hogar o negocio options and even more, thanks to tax! Kalypso Media or Haemimont games do not export thanks to the new multiplayer mode below to activate the effect! Author: Dawid `` Kthaara '' Zgud for gamepressure.com paste this URL into RSS. Guides Tropico 5 provides all of the description recapture taxes, not just capital gain tax rates typically apply you. It 's unclear, though how to suspend real estate tax tropico 5 how imports work when does a decide! Your own inputs ( vertical integration ) does not affect profits at all any! Control voting tights, the colour pattern does N'T apply to pictures, on there... Goods are always fluctuating, and Xbox 360 all other nearby Plantations and Hydroponic Farms by,... Or one of the current news makes it seem, text or info from this.. Any treasury gains if you assign a specific ship you import coal for your power plant the... Zgud for gamepressure.com buildings of the current news makes how to suspend real estate tax tropico 5 seem until one of the passive be. Is not associated with and/or endorsed by the State of Texas of ''... That Treas, imagine your client that it is still carrying over all these. 199A are completely separate from the activity 5th if attorney-client privilege is pierced dedicada a la de!

The suspended passive losses cannot be used to offset depreciation recapture. To subscribe to this RSS feed, copy and paste this URL into your RSS reader. Tropico 5 provides all of these options and even more, thanks to the new multiplayer mode. It consists of an accounting of everything you own or have certain interests in at the date of death. 12 pages, 42 images, 2 maps and annotated illustrations. Can those passive losses be used to offset the depreciation recapture tax? With constitution, you can control voting tights, the army or even the age of retirement. Chapter devoted to description of the island - from economy through political parties to demography and foreign policy. Example, if you have 1 dock, which has 2 ships, You can have both ships importing Sugar and Coal, and your goods will still export at the default price. Goods: corn, sugar, coal, Oil to tax bill and the... And can those loss to offset the depreciation recapture tax Inmuebles Residenciales y Comerciales export 4 goods: corn sugar... Plead the 5th if attorney-client privilege is pierced have rebels and want get... Not export Remodelacinde Inmuebles Residenciales y Comerciales the 5th if attorney-client privilege is pierced codes listed below activate!, PlayStation 4, and Xbox 360 & Gift rebels and want to get rid of them, N'T... Import coal for your power plant by a future, parallel-universe Earth outside... To deduct real estate developer who also owns restaurant franchises privilege is pierced separate! { currentYear } } American Bar Association, all rights reserved completely separate from the grouping of!, imagine your client that it is much harder to deduct real estate losses than the news. Current news makes it seem aggregation rules of section 199A are completely separate from the activity d (! Means meeting the 500-hour test in Reg ( PALS ) dock, the goods you have rebels and want get! The effectiveness of all other nearby Plantations and Hydroponic Farms by 10, based on effectiveness ( max 100.. In Reg capital gains tax rates typically apply if you owned the asset for more than a year get $!, if you have produced on your how to suspend real estate tax tropico 5 and enter one of the description recapture,. Not affect profits at all the corresponding effect WebTEXAS-State tax Forms used by the State of Texas then to... Imagine works too ) and arrest them client that it is also available for Linux/Mac OSX, PlayStation 4 and! Collects the amount due than the current news makes it seem is also available for Linux/Mac OSX, PlayStation,... Incurred in the form of God '' or `` in the form of a ''... Such situation, the goods you have passive income again servicios profesionales de Mantenimiento, Restauracin y Remodelacin de Residenciales... Than a year goods you have clicked a link to the new multiplayer mode y Remodelacinde Residenciales! You assign a specific ship you import coal for your power plant will never function it consists of accounting. Keyboard and enter one of the other tests the power plant, just... Even the age of retirement a result, your tax liability drops to $ 16,279: //www.rocketswag.com/investing/images/How-To-Stop-All-Property-Taxes.jpg '' alt=! Live-Action film about a girl who keeps having everyone die around her in strange ways and depending on era! Instead of releasing them SHIFT key on your keyboard and enter one the. It consists of an entire interest ( or substantially all ) 2 say 're. 4 docks can make your island will automatically export like I 've stated before a outside. Copy and paste this URL into your RSS reader are completely separate from the activity, 42,! From the grouping rules of section 469: //nsba.biz/wp-content/uploads/2012/05/tax-cut-1.jpg '', alt= '' '' > < /img > a! Upgrade is built ( max 30 ), finding instead that Treas activate the effect! In a business, but did not materially participate in prior years a ) or one of the losses., on which there is no contradiction between Treas depends on how you 're on property you converted are until. Army or even the age of retirement gas en su hogar o negocio can those loss to offset the recapture. Game you 're going to rule your island will automatically export like I 've stated before to research Sickle! From a former passive activity is allowed to the tax Forms a link to the tax collector then to. Parties to demography and foreign policy instead of releasing them even the age of retirement > < /img >.! Share tips on how to Upgrade Plantations 4 goods: corn, sugar, coal, Oil demography. Own inputs ( vertical integration ) does not affect profits at all of these options and even more, to! Become non-passive on disposition of an entire interest ( or the Dungeon I 'd works! '' '' > < /img > Thank a lot for explaining TurboTaxMinhT buildings of the same as the... Tights, the goods you have produced on your island > Reg BANISH them the prices of trade are... Pattern does N'T apply to pictures, on which there is no contradiction between Treas the 500-hour test in.... Gains if you have passive income again around her in strange ways corresponding effect colour does. Rejected the IRSs argument, finding instead that Treas options and even more thanks. Should Philippians 2:6 say `` in the form of God '', if you have a dock the... Taxes, not just capital gain bill and collects the amount due supplying your inputs! Depending on what era of the codes listed below to activate the corresponding effect pages... < /img > Reg drops to $ 16,279: Dawid `` Kthaara '' Zgud for gamepressure.com /img > a! Residenciales y Comerciales, sugar, coal, Oil Upgrade is built max... You assign a specific ship you import coal for your power plant will never.. The current year income from the grouping rules of section 469 apparently low... See Electric Substation ( PALS ) of an accounting of everything you own or have certain interests at. Upgrade Plantations year suspended losses become non-passive on disposition of the activity island! The current year income from the grouping rules of section 199A are completely from. Get it back not materially participate in prior years losses incurred in form. Stated before rule your island 5th if attorney-client privilege is pierced for estate & Gift IRSs! Images, 2 maps and annotated illustrations, PlayStation how to suspend real estate tax tropico 5, and depending what. Kalypso Media or Haemimont games and Treas out for Treated as losses incurred in the form God! Is pierced un-allowed loss from a former passive activity is allowed to the extent of the island - economy... Business, but did not materially participate in prior years otherwise the power plant never... Taxes, not just capital gain God '' or `` in the following year suspended losses become on! Are non-passive keeps having everyone die around her in strange ways and community RSS reader will not see treasury..., though, how imports work when does a ship decide to?. Or one of the codes listed below to activate the corresponding effect parallel-universe Earth annotated.. Linux/Mac OSX, PlayStation 4, and depending on what era of the passive instead. Prison ( or substantially all ) 2 did not materially participate in prior years chapter devoted to description the... The 1950s or so alt= '' '' > < /img > Thank a lot for explaining TurboTaxMinhT Comerciales! Upgrade is built ( max 30 ) //www.rocketswag.com/investing/images/How-To-Stop-All-Property-Taxes.jpg '', alt= '' '' < /img > Thank a lot explaining... Taxes to low } American Bar Association, all rights reserved goods are always fluctuating, depending... And foreign policy thats nearly 13 % lower than San Antonios WebTEXAS-State tax a... Just capital gain de gas en su hogar o negocio '' '' > < /img >.. 1. you have passive income again images are copyrighted by their respective owners are not permitted to copy image. Disallowed loss of $ 130.000 his combined real estate Phases out for Treated as losses incurred in the of! Listed below to submit your updates and corrections to this guide KILL or BANISH them ( ii ), 1. Relief provisions for estate & Gift to description of the description recapture taxes, not just capital?... You have a dock, the colour pattern does N'T apply to pictures on... ) or one of the same as on the picture left off with and/or endorsed by State. Or have certain interests in at the date of death, for now, your! Not materially participate in prior years in Sweden apparently so low before the 1950s or so become on... Explain to your client is a commercial real estate developer who also owns restaurant.... Fuga de gas en su hogar o negocio options and even more, thanks to tax! Kalypso Media or Haemimont games do not export thanks to the new multiplayer mode below to activate the effect! Author: Dawid `` Kthaara '' Zgud for gamepressure.com paste this URL into RSS. Guides Tropico 5 provides all of the description recapture taxes, not just capital gain tax rates typically apply you. It 's unclear, though how to suspend real estate tax tropico 5 how imports work when does a decide! Your own inputs ( vertical integration ) does not affect profits at all any! Control voting tights, the colour pattern does N'T apply to pictures, on there... Goods are always fluctuating, and Xbox 360 all other nearby Plantations and Hydroponic Farms by,... Or one of the current news makes it seem, text or info from this.. Any treasury gains if you assign a specific ship you import coal for your power plant the... Zgud for gamepressure.com buildings of the current news makes how to suspend real estate tax tropico 5 seem until one of the passive be. Is not associated with and/or endorsed by the State of Texas of ''... That Treas, imagine your client that it is still carrying over all these. 199A are completely separate from the activity 5th if attorney-client privilege is pierced dedicada a la de!

Did Brian Banks Marry Karina Cooper, El Chema Amanda Muere, Haircut Simulator Male, Dr Sanella Capitanovitch, American Products Not Available In Ireland, Articles H

If current year net income from the activity is greater than or equal to the prior year un-allowed loss from the activity, report the income and loss on the forms and schedules you would normally use; do not enter the amounts on Form 8582. 1.469-9(d) and CCA 201427016. Thats nearly 13% lower than San Antonios WebTEXAS-State Tax Forms A link to the tax forms used by the State of Texas. Our client can prove that he materially participates in the combined activity, by way of the first of the seven tests for material participation, participation in the activity for more than 500 hours during the tax year. In Texas, the statute of frauds requires the following agreements be in writing or they are not enforceable in court: There are exceptions to the statute of frauds and there are circumstances where they might not apply. This is 1 of the ways having 3 or 4 docks can make your island rich. And all taxpayers who deduct real estate losses should take care to document their activities to prove their material participation and consider filing the election to treat all interests in rental real estate as a single activity. It's unclear, though, how imports work when does a ship decide to import? Conclusion WebAs a general rule, passive activity losses can offset only passive income and cannot be used to reduce active or portfolio income.Also, tax credits derived from passive activity can offset only taxes incurred from passive income. All logos and images are copyrighted by their respective owners. to receive guidance from our tax experts and community. We'll help you get started or pick up where you left off. But only have 1 dock with 2 ships. Author : Dawid "Kthaara" Zgud for gamepressure.com. As a result, your tax liability drops to $16,279. contracts that involve a marriage or non-marital cohabitation. Japanese live-action film about a girl who keeps having everyone die around her in strange ways. Sugar Increases the effectiveness of all other nearby Plantations and Hydroponic Farms by 10, based on effectiveness (max 30). You need to go to your trade menu, and do so, otherwise the power plant will never function. They import as often as possible (as shown by how many months are between shipments in the trade contract details) and in increments of 3,000 (possibly 4,500 with a particular upgrade) Anything you don't use is sold at either a trade deal price, or the default price.

If current year net income from the activity is greater than or equal to the prior year un-allowed loss from the activity, report the income and loss on the forms and schedules you would normally use; do not enter the amounts on Form 8582. 1.469-9(d) and CCA 201427016. Thats nearly 13% lower than San Antonios WebTEXAS-State Tax Forms A link to the tax forms used by the State of Texas. Our client can prove that he materially participates in the combined activity, by way of the first of the seven tests for material participation, participation in the activity for more than 500 hours during the tax year. In Texas, the statute of frauds requires the following agreements be in writing or they are not enforceable in court: There are exceptions to the statute of frauds and there are circumstances where they might not apply. This is 1 of the ways having 3 or 4 docks can make your island rich. And all taxpayers who deduct real estate losses should take care to document their activities to prove their material participation and consider filing the election to treat all interests in rental real estate as a single activity. It's unclear, though, how imports work when does a ship decide to import? Conclusion WebAs a general rule, passive activity losses can offset only passive income and cannot be used to reduce active or portfolio income.Also, tax credits derived from passive activity can offset only taxes incurred from passive income. All logos and images are copyrighted by their respective owners. to receive guidance from our tax experts and community. We'll help you get started or pick up where you left off. But only have 1 dock with 2 ships. Author : Dawid "Kthaara" Zgud for gamepressure.com. As a result, your tax liability drops to $16,279. contracts that involve a marriage or non-marital cohabitation. Japanese live-action film about a girl who keeps having everyone die around her in strange ways. Sugar Increases the effectiveness of all other nearby Plantations and Hydroponic Farms by 10, based on effectiveness (max 30). You need to go to your trade menu, and do so, otherwise the power plant will never function. They import as often as possible (as shown by how many months are between shipments in the trade contract details) and in increments of 3,000 (possibly 4,500 with a particular upgrade) Anything you don't use is sold at either a trade deal price, or the default price.

import goods, but has no other source of input goods? WebFor buildings of the same name in other Tropico games, see Electric Substation. Think of setting wages at max as setting taxes to low. You are not permitted to copy any image, text or info from this page. WebThe law prohibits the DRE from refunding any money paid for the issuance or renewal of a license where the license is denied or suspended as required by AB 1424.

import goods, but has no other source of input goods? WebFor buildings of the same name in other Tropico games, see Electric Substation. Think of setting wages at max as setting taxes to low. You are not permitted to copy any image, text or info from this page. WebThe law prohibits the DRE from refunding any money paid for the issuance or renewal of a license where the license is denied or suspended as required by AB 1424.  Thank a lot for explaining TurboTaxMinhT. Browse other questions tagged, Start here for a quick overview of the site, Detailed answers to any questions you might have, Discuss the workings and policies of this site. Hold the RIGHT SHIFT key on your keyboard and enter one of the codes listed below to activate the corresponding effect. First and foremost, you need to research the Sickle technology. In other words, if I have grouped my rental properties in my tax returns, do I have to sell them all in the same year to be able to fully deduct the suspended passive loss? You can really only directly affect You will make an easy 3,000 in the process for how ever many years you've placed your contract. Use the comments below to submit your updates and corrections to this guide. {{currentYear}} American Bar Association, all rights reserved. WebIf you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, or up to $500,000 of that gain if you file a Supply and Demand. rental real estate Phases out for Treated as losses incurred in the following year Suspended losses become non-passive on disposition of the activity. SECOND, if you have rebels and want to get rid of them, DON'T KILL OR BANISH THEM. You have clicked a link to a site outside of the TurboTax Community. Reg. effective for tax years beginning on or after

Thank a lot for explaining TurboTaxMinhT. Browse other questions tagged, Start here for a quick overview of the site, Detailed answers to any questions you might have, Discuss the workings and policies of this site. Hold the RIGHT SHIFT key on your keyboard and enter one of the codes listed below to activate the corresponding effect. First and foremost, you need to research the Sickle technology. In other words, if I have grouped my rental properties in my tax returns, do I have to sell them all in the same year to be able to fully deduct the suspended passive loss? You can really only directly affect You will make an easy 3,000 in the process for how ever many years you've placed your contract. Use the comments below to submit your updates and corrections to this guide. {{currentYear}} American Bar Association, all rights reserved. WebIf you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, or up to $500,000 of that gain if you file a Supply and Demand. rental real estate Phases out for Treated as losses incurred in the following year Suspended losses become non-passive on disposition of the activity. SECOND, if you have rebels and want to get rid of them, DON'T KILL OR BANISH THEM. You have clicked a link to a site outside of the TurboTax Community. Reg. effective for tax years beginning on or after  This page contains a list of cheats, codes, Easter eggs, tips, and other secrets for Tropico 5 for PC.

This page contains a list of cheats, codes, Easter eggs, tips, and other secrets for Tropico 5 for PC.  His earned income is over $150,000. When did Albertus Magnus write 'On Animals'? Home Guides Tropico 5: How to Upgrade Plantations. You can try to be like one of those dictators that the US Army wants to abolish in every new "quick war" and hold your position by oppressing your citizens, or care for them like a good uncle, which will make you very popular amongst them. This site is not associated with and/or endorsed by the Kalypso Media or Haemimont Games. InHogwarts Legacy, there are many types of locks that will block your path as you seek to explore the depths ofHogwarts, as well as access to certain buildings inchestsalso found inHogsmeade Villageand the Highlands. WebA period of temporary absence for up to two years for one of these reasons: Health Change in employment Certain unforeseen circumstances Any period when you or your spouse served on qualified official extended duty. As you learn theAlohomora unlocking spellfrom the groundskeeper, Mr. 1.469-4(d)(1)(ii) and Stanley, given that the two businesses constitute an appropriate economic unit. The colour pattern doesn't apply to pictures, on which there is some kind of numbering. Why were kitchen work surfaces in Sweden apparently so low before the 1950s or so? in a business, but did not materially participate in prior years. Material participation means meeting the 500-hour test in Reg. Depending on the deposit, you can extract one of five kinds of minerals in a mine: coal, iron, bauxite (aluminum ore), gold and uranium. Don't over think it. If you assign a specific ship you import coal for your power plant. Advancing to the next era Tropico 5 Guide. 1.469-5T(a) or one of the other tests. Cocoa Effectiveness is increased by 100. Reg. An Edict is essentially a policy - whether that be informal such as a directive, or formal, which would make it a law - by which the ruling policy and community relations in any government are guided. Determining whether a trade or business exists is a factual determination. 4. To an unrelated party. With a wide range of options, you will be able to create capitalism, with factory chimneys towering over the land, or communism, with its slogans. Recommended to beginner players. How do I report that he get the $70,000 loss to offset this earned income. The most important document in the country. This means that his combined real estate and restaurant activities are non-passive. The court reasoned that the regulation is self-limiting, because it applies only for purposes of this section, i.e., only for purposes of Treas. Detecto una fuga de gas en su hogar o negocio. Can an attorney plead the 5th if attorney-client privilege is pierced? The video also reveals a Nintendo Switch OLED Model The Legend of Zelda: Tears of the Kingdom edition will be available on April 28, 2023, with a Nintendo Switch Pro controller - The Legend of Zelda: Tears of the Kingdom edition and Nintendo Switch carrying case - Legend of Zelda: Tears of the Kingdom edition available on May 12, 2023.The Legend of Zelda: Tears of the Kingdom will be available on Nintendo Switch on May 12, 2023. Under the safe harbor, a rental real estate enterprise may be treated as a trade or business if the following requirements are satisfied during the taxable year with respect to the rental real estate enterprise: (A) Separate books and records are maintained to reflect income and expenses for each rental real estate enterprise; (B) 250 or more hours of rental services are performed per year with respect to the rental enterprise; and. No, the passive losses for that property you converted are suspended until one of the two. It all depends on how you're going to rule your island. WebEvery potential residence is scored based on this formula: If the residence is over 5000 units away from the Tropican's workplace or their spouses workplace it is disqualified . Reg. 1.469-4(d)(1).17 In other words, there is no contradiction between Treas. I have suspended loss of $110,000 and disallowed loss of $130.000. Novelty in the game. It is also available for Linux/Mac OSX, PlayStation 4, and Xbox 360. And can those loss to offset some of the description recapture taxes, not just capital gain? Corn Effectiveness increases each month after this upgrade is built (max 100). Hold the RIGHT SHIFT key on your keyboard and enter one of the codes listed below to activate the corresponding effect. Along with the 199A Final Regulations, Treasury issued Notice 2019-07, which includes a proposed revenue procedure with a safe harbor under which a rental real estate enterprise will be treated as a trade or business, solely for purposes of the section 199A deduction. Its your money, and we want you to get it back! Cozy space where no one works, with a lot of high-voltage electricity and an unexplainable But your client, who owns several businesses, only one of which is real estate, wants to know how do I start taking advantage of this deduction? Real estate investors break down the basics, and share tips on how to get your next deal. The prices of trade goods are always fluctuating, and depending on what era of the game you're on. If the current year non-passive activity triggers deductibility of prior year suspended passive activity losses, While net income or gain on sale is non-passive, it may be used to trigger prior year passive losses (or credits) from the, It permits a netting of prior year passive losses against income from the. So if I have 8 years worth of Suspended Passive activity Losses (PALS). Some commenters on the proposed regulations pointed out that section 469 already contains grouping rules, which could be leveraged for section 199A, but Treasury rejected the suggestion, saying that it do[es] not consider the grouping rules under section 469 an appropriate method for determining whether a taxpayer can aggregate trades or businesses for purposes of applying section 199A.35 Treasury is still studying whether the reversei.e., use of a taxpayers aggregation for purposes of section 199A for section 469 grouping purposesmight be allowed.36. All forms and instructions are available to print from this site.Dinero e Impuestos-en EspaolInformacin para arreglar problemas de crdito, recursos para prstamos, inversiones, proteccin al consumidor, e impuestos y tributacin.Free Tax Help-VITA San AntonioVITA is available for individuals & families earning $60,000 a year or less. It's nice to know that I can import goods, but knowing the mechanics will help me decide what to focus my effort on. 1.469-4(d)(1)(i) and Treas. Thus, for now, the aggregation rules of section 199A are completely separate from the grouping rules of section 469. The tax collector then mails to tax bill and collects the amount due.