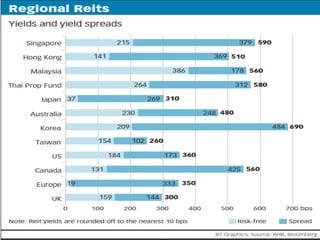

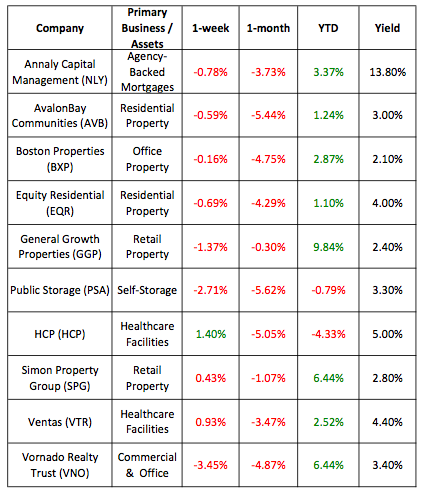

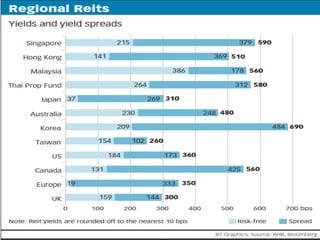

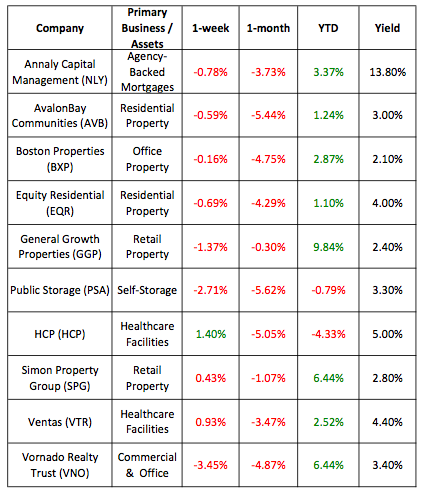

YTD Total Return. Equity Residential has shown consistent top-line growth over the past three fiscal years, and it hasremained comfortably profitable(all numbers in thousands): Ventas, Inc. (VTR) invests in hospitals, skilled nursing facilities, senior housing facilities, and medical office buildings. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital. During this time, value has generally underperformed, underscored by weak relatively performance from the retail REIT sector. Considered to be an industry leader in Singapore, Equinix has invested $85 million in the construction of a fourth data center in the city. The company is confident in its future success, since appliances and autonomous cars will soon be going digital as well. E-Commerce Growth. The great majority of the assets are general acute care hospitals, but show some diversification into other specialty hospitals, including inpatient rehabilitation and long-term acute care. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Some industrial REITs focus on specific types of properties, such as warehouses and distribution centers. Youre reading a free article with opinions that may differ from The Motley Fools Premium Investing Services. However, its always best to get in before something becomes a trend. Industrial REITs are quintessential "Growth REITs" with the majority of their total returns coming through FFO growth rather than dividends. Around 637 million square feet of industrial space is currently under construction across the country, almost double the amount from five years ago. I have no business relationship with any company whose stock is mentioned in this article.  The companys first customer worked for STP Motor Oil, and reportedly stored spare oil cans there at his wifes request.

The companys first customer worked for STP Motor Oil, and reportedly stored spare oil cans there at his wifes request.  But when you buy a REIT, when you own a REIT, you want to look at the total return profile, not just the stock change because dividends are usually a really big part. Latham draws on its first-class capital markets, M&A, tax, real estate, finance, and executive compensation capabilities to address REITs from every angle. Check this out, man. Among some of the riskier REITs are Hotel REITs. Rexford Industrial Once reliant on growth in the manufacturing and industrial sectors of the economy, the logistics-oriented nature of the highest-value industrial assets has made the sector less exposed to international trade and the risks associated with the ongoing trade war between the US and China, but more closely linked with consumer spending and retail sales. If the economy isnt on the right track, then its only a matter of time before the stock market catches up. Now that you have the tools to identify high-quality REITs, the next section will show some of the benefits of owning this asset class in a diversified investment portfolio. Prologis announced two major acquisitions this year. When the economy is good and people are making purchases, the need for these manufacturing companies and spaces is at a high. On a trailing twelve-month basis, industrial REIT same-store NOI growth moderated slightly to 3.6% from 4.4% in the prior quarter. Ironically, the more worrying trends for industrial REITs are related to a Retail Apocalypse 2.0, as store closings have unexpectedly surged in 2019 as the combination of higher minimum wages, tariff-related cost pressures, and heavy discounting have pressured margins at softline and specialty retailers. Whileall REITs are likely to take a hit, some will present excellent buying opportunities, especially since you will be collecting relatively generous dividend yields in the meantime. While development has indeed increased significantly over the past five years, it hasn't been nearly enough to relieve upward pressure on rents. Mapletree Industrial Trust. They just revealed what they believe are the ten best stocks for investors to buy right now and Prologis wasn't one of them!

But when you buy a REIT, when you own a REIT, you want to look at the total return profile, not just the stock change because dividends are usually a really big part. Latham draws on its first-class capital markets, M&A, tax, real estate, finance, and executive compensation capabilities to address REITs from every angle. Check this out, man. Among some of the riskier REITs are Hotel REITs. Rexford Industrial Once reliant on growth in the manufacturing and industrial sectors of the economy, the logistics-oriented nature of the highest-value industrial assets has made the sector less exposed to international trade and the risks associated with the ongoing trade war between the US and China, but more closely linked with consumer spending and retail sales. If the economy isnt on the right track, then its only a matter of time before the stock market catches up. Now that you have the tools to identify high-quality REITs, the next section will show some of the benefits of owning this asset class in a diversified investment portfolio. Prologis announced two major acquisitions this year. When the economy is good and people are making purchases, the need for these manufacturing companies and spaces is at a high. On a trailing twelve-month basis, industrial REIT same-store NOI growth moderated slightly to 3.6% from 4.4% in the prior quarter. Ironically, the more worrying trends for industrial REITs are related to a Retail Apocalypse 2.0, as store closings have unexpectedly surged in 2019 as the combination of higher minimum wages, tariff-related cost pressures, and heavy discounting have pressured margins at softline and specialty retailers. Whileall REITs are likely to take a hit, some will present excellent buying opportunities, especially since you will be collecting relatively generous dividend yields in the meantime. While development has indeed increased significantly over the past five years, it hasn't been nearly enough to relieve upward pressure on rents. Mapletree Industrial Trust. They just revealed what they believe are the ten best stocks for investors to buy right now and Prologis wasn't one of them!  If you would like to produce the full rankings page, please reach out to the Research Team. Prologis expects the FFO growth to come from a combination of roughly 4% organic same-store growth and 4-5% coming from a mix of external growth and efficiency improvements.

If you would like to produce the full rankings page, please reach out to the Research Team. Prologis expects the FFO growth to come from a combination of roughly 4% organic same-store growth and 4-5% coming from a mix of external growth and efficiency improvements.  Jason Hall: They're not. The REIT Spreadsheet list in this article contains a list of publicly-traded Real Estate Investment Trusts. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes. In a letter to shareholders on Monday, the company disclosed it received $4.5B in redemption requests in March, an increase over Februarys total of $3.9B. SEGRO (ISIN GB00B5ZN1N88, $ SEGXF ), is a real estate investment trust focused on industrial real estate. Its likelythough not guaranteedthat you will see much better entry points by the end of the year. In this case, blame prolonged record-low interest rates. Riding the e-commerce wave, industrial REIT performance has been relentless over the past half-decade as retailers and logistics providers have invested heavily in supply chain densification and physical distribution networks in a relentless "need for speed" arms race. Perhaps only overshadowed by the residential REIT sector, industrial REITs continue to enjoy some of the strongest property-level fundamentals across the real estate sector, highlighted by average same-store NOI growth near 5% per year since 2015, a theme that we'll analyze in greater detail below. Year-over-year, it implies an increase of 20%. Made, I think $900 million in acquisitions last year. Buy These 2 Discounted Stocks, Buying $1,000 of This 5.6%-Yielding Dividend Stock Would Be a Brilliant Move, 1 FAANG Stock to Buy Hand Over Fist in April and 1 to Avoid Like the Plague, Prediction: This Will Be the Largest AI Stock in 2030, A Big Change May Be Coming to Social Security -- and It's Not a Good One, Join Over Half a Million Premium Members And Get More In-Depth Stock Guidance and Research, Jeremy Bowman, Jason Hall, and Brian Withers, Copyright, Trademark and Patent Information. However, the REIT is now on firmer footing and is pursuing growth opportunities. This shows the profound effect that depreciation and amortization can have on the GAAP financial performance of real estate investment trusts. Not too bad. While ten of the fifteen REITs in the sector pay dividend yields below 3%, there are a handful of industrial REITs that are suitable for yield-oriented investors including Plymouth, Industrial Logistics, STAG, and Monmouth, all of which pay yields above 4.6%. Its also the third largest WebA REIT is a company that owns and typically operates income-producing real estate or related assets. Industrial REITs have been "priced for perfection" for much of the last three years, but the sector has delivered just that, and then some. Best performing sectors for the month were industrial large caps (up 2.4% m-o-m), office (down 1.4% m-o-m) and retail (down 3.2% m-o-m). Choice Properties is Canadas largest REIT, with 702 properties and 63.9 million square feet of gross leasable area. Industrial REITs: Buy the Best Cash Flows Ive always liked Industrial REITs thanks to the strength of their cash flows. I am not receiving compensation for it (other than from Seeking Alpha). Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. The list of REIT companies sorted by market cap is updated daily. Outside of Amazon, we think that industrial REITs are perhaps best positioned to capitalize on the continued growth of e-commerce, enjoying better competitive dynamics than third-party logistics providers like that face a higher potential disintermediation risk from Amazon itself. It's come down over the past month or so. Search current real estate investment offerings based on your criteria with Benzinga's New Alternative Investments Screener. In addition to the downloadable Excel sheet of all REITs, this article discusses why income investors should pay particularly close attention to this asset class. SWFI is a minority-owned organization. 3Q19 was another strong "Beat-And-Raise" quarter. Click here to download our most recent Sure Analysis report on CLPR (preview of page 1 of 3 shown below): Brandywine Realty owns, develops, leases and manages an urban town center and transit-oriented portfolio which includes 163 properties in Philadelphia, Austin and Washington, D.C. It has ownership interests in high-quality offices in North America comprising more than 40 million square feet. In this list, well be ranking each REIT according to its market capitalization, or market cap, which is the market value of its outstanding shares. Since the start of 2015, industrial REITs are tied with residential REITs for the strongest average annual same-store NOI growth at 4.8% per year. Due to this headwind and its high debt load, the stock has plunged 47% over the last 12 months, to a 13-year low. Some highlights. REITs with dividend yields of 5% or higher, #1: Innovative Industrial Properties Trust (IIPR), Click here to download your Complete REIT Excel Spreadsheet List now, Dividend investing versus real estate investing, The Best Marijuana Stocks: List of 100+ Marijuana Industry Companies, The Highest Yielding Dividend Aristocrats List, The 20 Highest Yielding Monthly Dividend Stocks. I think as a long-term investment, five-plus, 10-plus years, investors can do OK. Best performing stocks for March were Keppel DC REIT (up 4.0% m-o-m) and CapitaLand Ascendas REIT (up 3.2% m-o-m). 1.90%. Real Estate and Housing Index definitions and holdings are available at HoyaCapital.com. Its also riding current trends, like aging baby boomers.. During this run of outperformance, we note that growth has generally been chronically undervalued, underscored by strong performance in the e-REIT sectors (industrial, data center, and cell towers). Analysts Disclosure: I am/we are long PLD, VNQ. Hall: That's important. You can learn more about the standards we follow in producing accurate, unbiased content in our. They are in the catbird seat to participate in all of the things that are going to happen there. During the quarter, Uniti Leasing deployed capital expenditures of $71.9 million, primarily related to the construction of approximately 2,250 new route miles of valuable fiber infrastructure. In exchange for listing as a REIT, these trusts must pay out at least 90% of their net income as dividend payments to their unitholders (REITs trade as units, not shares).

Jason Hall: They're not. The REIT Spreadsheet list in this article contains a list of publicly-traded Real Estate Investment Trusts. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes. In a letter to shareholders on Monday, the company disclosed it received $4.5B in redemption requests in March, an increase over Februarys total of $3.9B. SEGRO (ISIN GB00B5ZN1N88, $ SEGXF ), is a real estate investment trust focused on industrial real estate. Its likelythough not guaranteedthat you will see much better entry points by the end of the year. In this case, blame prolonged record-low interest rates. Riding the e-commerce wave, industrial REIT performance has been relentless over the past half-decade as retailers and logistics providers have invested heavily in supply chain densification and physical distribution networks in a relentless "need for speed" arms race. Perhaps only overshadowed by the residential REIT sector, industrial REITs continue to enjoy some of the strongest property-level fundamentals across the real estate sector, highlighted by average same-store NOI growth near 5% per year since 2015, a theme that we'll analyze in greater detail below. Year-over-year, it implies an increase of 20%. Made, I think $900 million in acquisitions last year. Buy These 2 Discounted Stocks, Buying $1,000 of This 5.6%-Yielding Dividend Stock Would Be a Brilliant Move, 1 FAANG Stock to Buy Hand Over Fist in April and 1 to Avoid Like the Plague, Prediction: This Will Be the Largest AI Stock in 2030, A Big Change May Be Coming to Social Security -- and It's Not a Good One, Join Over Half a Million Premium Members And Get More In-Depth Stock Guidance and Research, Jeremy Bowman, Jason Hall, and Brian Withers, Copyright, Trademark and Patent Information. However, the REIT is now on firmer footing and is pursuing growth opportunities. This shows the profound effect that depreciation and amortization can have on the GAAP financial performance of real estate investment trusts. Not too bad. While ten of the fifteen REITs in the sector pay dividend yields below 3%, there are a handful of industrial REITs that are suitable for yield-oriented investors including Plymouth, Industrial Logistics, STAG, and Monmouth, all of which pay yields above 4.6%. Its also the third largest WebA REIT is a company that owns and typically operates income-producing real estate or related assets. Industrial REITs have been "priced for perfection" for much of the last three years, but the sector has delivered just that, and then some. Best performing sectors for the month were industrial large caps (up 2.4% m-o-m), office (down 1.4% m-o-m) and retail (down 3.2% m-o-m). Choice Properties is Canadas largest REIT, with 702 properties and 63.9 million square feet of gross leasable area. Industrial REITs: Buy the Best Cash Flows Ive always liked Industrial REITs thanks to the strength of their cash flows. I am not receiving compensation for it (other than from Seeking Alpha). Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. The list of REIT companies sorted by market cap is updated daily. Outside of Amazon, we think that industrial REITs are perhaps best positioned to capitalize on the continued growth of e-commerce, enjoying better competitive dynamics than third-party logistics providers like that face a higher potential disintermediation risk from Amazon itself. It's come down over the past month or so. Search current real estate investment offerings based on your criteria with Benzinga's New Alternative Investments Screener. In addition to the downloadable Excel sheet of all REITs, this article discusses why income investors should pay particularly close attention to this asset class. SWFI is a minority-owned organization. 3Q19 was another strong "Beat-And-Raise" quarter. Click here to download our most recent Sure Analysis report on CLPR (preview of page 1 of 3 shown below): Brandywine Realty owns, develops, leases and manages an urban town center and transit-oriented portfolio which includes 163 properties in Philadelphia, Austin and Washington, D.C. It has ownership interests in high-quality offices in North America comprising more than 40 million square feet. In this list, well be ranking each REIT according to its market capitalization, or market cap, which is the market value of its outstanding shares. Since the start of 2015, industrial REITs are tied with residential REITs for the strongest average annual same-store NOI growth at 4.8% per year. Due to this headwind and its high debt load, the stock has plunged 47% over the last 12 months, to a 13-year low. Some highlights. REITs with dividend yields of 5% or higher, #1: Innovative Industrial Properties Trust (IIPR), Click here to download your Complete REIT Excel Spreadsheet List now, Dividend investing versus real estate investing, The Best Marijuana Stocks: List of 100+ Marijuana Industry Companies, The Highest Yielding Dividend Aristocrats List, The 20 Highest Yielding Monthly Dividend Stocks. I think as a long-term investment, five-plus, 10-plus years, investors can do OK. Best performing stocks for March were Keppel DC REIT (up 4.0% m-o-m) and CapitaLand Ascendas REIT (up 3.2% m-o-m). 1.90%. Real Estate and Housing Index definitions and holdings are available at HoyaCapital.com. Its also riding current trends, like aging baby boomers.. During this run of outperformance, we note that growth has generally been chronically undervalued, underscored by strong performance in the e-REIT sectors (industrial, data center, and cell towers). Analysts Disclosure: I am/we are long PLD, VNQ. Hall: That's important. You can learn more about the standards we follow in producing accurate, unbiased content in our. They are in the catbird seat to participate in all of the things that are going to happen there. During the quarter, Uniti Leasing deployed capital expenditures of $71.9 million, primarily related to the construction of approximately 2,250 new route miles of valuable fiber infrastructure. In exchange for listing as a REIT, these trusts must pay out at least 90% of their net income as dividend payments to their unitholders (REITs trade as units, not shares).  WebLatham offers public and private REITs, as well as their underwriters, lenders, sponsors, investors and partners, robust and seamless service across all aspects of the REIT market. While UPS may have retired their famous "We Love Logistics" slogan, we think that the tagline should be appropriately awarded to industrial REITs, which we think are perhaps best-positioned to capitalize on the continued rapid growth of e-commerce and the intense arms-race of supply chain densification. Ninenty-seven percent, I think their rental rate at the end of the year. This will help to eliminate any REITs with exceptionally high (and perhaps unsustainable) dividend yields. It is an integrated real estate investment trust (REIT) that is focused on acquiring, managing, and maximizing the value of Manhattan commercial properties. Balance sheet is great, it's incredible. WebREITs operate in the industrial, mortgage, residential and. In fact, this asset class has traded at a higher dividend yield than the S&P 500 for decades. De C.V. WebIndustrial REITs own and manage industrial facilities and rent space in those properties to tenants. REITs often invest in a wide variety of commercial properties, ranging from office complexes and public self-storage to timberlands and shopping centers. SmartCentres is Canadas largest retail REIT by market cap. The traditional brick-and-mortar powerhouses have honed the omni-channel approach with significant success, as Walmart (WMT), Home Depot (HD), Target (TGT), and Costco (COST) have been among the biggest investors in e-commerce distribution over the last several years. Sovereign Wealth Fund Institute (SWFI) is a global organization designed to study sovereign wealth funds, pensions, endowments, superannuation funds, family offices, central banks and other long-term institutional investors in the areas of investing, asset allocation, risk, governance, economics, policy, trade and other relevant issues. However, when the economy turns and people cant afford to make so many purchases, these warehouses and production centers are not needed as much. The ongoing legalization of cannabis in the US has led to stunning returns and portfolio growth. Despite continued uncertainty over trade and its impact on the supply chain, the secular tailwinds driven by domestic e-commerce has overwhelmed any trade-related headwinds this year. The end users of industrial real estate properties have become far more consumer-oriented over the past decade with nearly 80% of industrial space usage coming from consumer-oriented tenants. However, they aren't the only option available to generate passive income through real estate with a low minimum investment. For a valuation perspective, a common theme over the past several years, valuations across traditional metrics like FFO/share for industrial REITs remain lofty. Along that continuum towards the end-consumer, the relative value of these properties (on a per square foot basis) increases, as do the underlying barriers to entry. Because of the monthly rental cash flows generated by REITs, these securities are well-suited to investors that aim to generate income from their investment portfolios. The rankings are based on the amount of industrial space companies owned globally as of Dec. 31, 2007. In 2021, net income was $359 million while FFO available to stockholders was above $1.4 billion, a sizable difference between the two metrics. In fact, one of the best methods to find high-quality dividend stocks is looking for stocks with long histories of steadily rising dividend payments. The $2.8 billion REIT owns 111 properties in 19 states. 2008-2023 Sovereign Wealth Fund Institute. 1-202-739-9400 Long Term Leases. Best Singapore REIT No. While we have raised concerns about the looming long-term competitive threat from Amazon's growing influence on the industrial real estate market, for now, the tenant roster of industrial REITs is quite diversified and includes many of the largest retailers as well as the major logistics providers including FedEx (FDX), UPS (UPS), and XPO (XPO). REITs, more formally known as real estate investment trusts, are companies that own and operate income-producing real estate. BOSTON, April 06, 2023 (GLOBE NEWSWIRE) -- Plymouth Industrial REIT, Inc. (NYSE:PLYM) announced its leasing activity for the first quarter of 2023. On the back of industry specific news, alongside a declining economic landscape, Dan Moskowitz does not have any positions in any of the aforementioned names. This doesnt mean they will go straight to a senior living facility; the majority will enjoy retired life for a decade or two before a nursing home becomes a thought. Commercial Real Estate Definition and Types, Timeshare: What It Is, How It Works, Types of Ownership, Trailing 12 Months (TTM): Definition, Calculation, and How It's Used, Debt-to-Equity (D/E) Ratio Formula and How to Interpret It, Capital: Definition, How It's Used, Structure, and Types in Business, Vornado Realty Trust is a Preeminent Owner, Manager and Developer of Office and Retail Assets. Industrial REITs have jumped more than 40% so far this year, on pace to outperform the broader REIT average for the fourth straight year.

WebLatham offers public and private REITs, as well as their underwriters, lenders, sponsors, investors and partners, robust and seamless service across all aspects of the REIT market. While UPS may have retired their famous "We Love Logistics" slogan, we think that the tagline should be appropriately awarded to industrial REITs, which we think are perhaps best-positioned to capitalize on the continued rapid growth of e-commerce and the intense arms-race of supply chain densification. Ninenty-seven percent, I think their rental rate at the end of the year. This will help to eliminate any REITs with exceptionally high (and perhaps unsustainable) dividend yields. It is an integrated real estate investment trust (REIT) that is focused on acquiring, managing, and maximizing the value of Manhattan commercial properties. Balance sheet is great, it's incredible. WebREITs operate in the industrial, mortgage, residential and. In fact, this asset class has traded at a higher dividend yield than the S&P 500 for decades. De C.V. WebIndustrial REITs own and manage industrial facilities and rent space in those properties to tenants. REITs often invest in a wide variety of commercial properties, ranging from office complexes and public self-storage to timberlands and shopping centers. SmartCentres is Canadas largest retail REIT by market cap. The traditional brick-and-mortar powerhouses have honed the omni-channel approach with significant success, as Walmart (WMT), Home Depot (HD), Target (TGT), and Costco (COST) have been among the biggest investors in e-commerce distribution over the last several years. Sovereign Wealth Fund Institute (SWFI) is a global organization designed to study sovereign wealth funds, pensions, endowments, superannuation funds, family offices, central banks and other long-term institutional investors in the areas of investing, asset allocation, risk, governance, economics, policy, trade and other relevant issues. However, when the economy turns and people cant afford to make so many purchases, these warehouses and production centers are not needed as much. The ongoing legalization of cannabis in the US has led to stunning returns and portfolio growth. Despite continued uncertainty over trade and its impact on the supply chain, the secular tailwinds driven by domestic e-commerce has overwhelmed any trade-related headwinds this year. The end users of industrial real estate properties have become far more consumer-oriented over the past decade with nearly 80% of industrial space usage coming from consumer-oriented tenants. However, they aren't the only option available to generate passive income through real estate with a low minimum investment. For a valuation perspective, a common theme over the past several years, valuations across traditional metrics like FFO/share for industrial REITs remain lofty. Along that continuum towards the end-consumer, the relative value of these properties (on a per square foot basis) increases, as do the underlying barriers to entry. Because of the monthly rental cash flows generated by REITs, these securities are well-suited to investors that aim to generate income from their investment portfolios. The rankings are based on the amount of industrial space companies owned globally as of Dec. 31, 2007. In 2021, net income was $359 million while FFO available to stockholders was above $1.4 billion, a sizable difference between the two metrics. In fact, one of the best methods to find high-quality dividend stocks is looking for stocks with long histories of steadily rising dividend payments. The $2.8 billion REIT owns 111 properties in 19 states. 2008-2023 Sovereign Wealth Fund Institute. 1-202-739-9400 Long Term Leases. Best Singapore REIT No. While we have raised concerns about the looming long-term competitive threat from Amazon's growing influence on the industrial real estate market, for now, the tenant roster of industrial REITs is quite diversified and includes many of the largest retailers as well as the major logistics providers including FedEx (FDX), UPS (UPS), and XPO (XPO). REITs, more formally known as real estate investment trusts, are companies that own and operate income-producing real estate. BOSTON, April 06, 2023 (GLOBE NEWSWIRE) -- Plymouth Industrial REIT, Inc. (NYSE:PLYM) announced its leasing activity for the first quarter of 2023. On the back of industry specific news, alongside a declining economic landscape, Dan Moskowitz does not have any positions in any of the aforementioned names. This doesnt mean they will go straight to a senior living facility; the majority will enjoy retired life for a decade or two before a nursing home becomes a thought. Commercial Real Estate Definition and Types, Timeshare: What It Is, How It Works, Types of Ownership, Trailing 12 Months (TTM): Definition, Calculation, and How It's Used, Debt-to-Equity (D/E) Ratio Formula and How to Interpret It, Capital: Definition, How It's Used, Structure, and Types in Business, Vornado Realty Trust is a Preeminent Owner, Manager and Developer of Office and Retail Assets. Industrial REITs have jumped more than 40% so far this year, on pace to outperform the broader REIT average for the fourth straight year.  For those unfamiliar with Microsoft Excel, the following images show how to filter for REITs with dividend yields between 5% and 7% using the filter function of Excel. WebThe five largest REITs in the United States in 2021 are: American Tower Corporation, Prologis, Crown Castle International, Simon Property Group and Weyerhaeuser. Their average interest rate on their entire debt book is 1.7%. Sovereign Wealth Fund Institute and SWFI are registered trademarks of the Sovereign Wealth Fund Institute. Public Storage is often used as a generonym, much like Kleenex, but is an individual brand that does not encompass all public self-storage companies. That's even though it's come down. They now have a billion. Hall: Yeah.

For those unfamiliar with Microsoft Excel, the following images show how to filter for REITs with dividend yields between 5% and 7% using the filter function of Excel. WebThe five largest REITs in the United States in 2021 are: American Tower Corporation, Prologis, Crown Castle International, Simon Property Group and Weyerhaeuser. Their average interest rate on their entire debt book is 1.7%. Sovereign Wealth Fund Institute and SWFI are registered trademarks of the Sovereign Wealth Fund Institute. Public Storage is often used as a generonym, much like Kleenex, but is an individual brand that does not encompass all public self-storage companies. That's even though it's come down. They now have a billion. Hall: Yeah.  Take W.P. Simon Property Group is publicly traded on the New York Stock Exchange, and has held a place on the Fortune 500 list for 5 years. Prologis, Inc. (PLD) owns, develops, manages, and leases industrial distribution and retail properties. Prologis has strong fundamentals, including a debt-to-equity ratio of just 0.62 while offering a generous yield of 3.30%. Even with many of these industrial REITs trading at-or-near record-highs, investors still have plenty of reasons to be bullish on the industrial real estate sector. In late January, SLG reported (1/25/2023) financial results for the fourth quarter of fiscal 2022. Revenue of $352.34M (-9.8% Y/Y) missed analyst consensus estimates by $36.68M. One of Atlantas largest single-building transactions of 2020 was Granite REITs $80.3 million acquisition of a 1 million-square-foot property at 8500 Tatum Road in Palmetto, Ga. Public records indicate a Starwood Capital affiliate was the seller. To reflect it in their same-store NOI, which is net operating income, that was up 7.5%. When we factor in medium-term growth expectations in our FCF/G metric, however, the sector appears more attractively valued. Khadija Khartit is a strategy, investment, and funding expert, and an educator of fintech and strategic finance in top universities. CEO Jeff Witherell said the REIT converted some gross leases to triple net leases and that its leasing spreads are up as well. Other third-party content, logos and trademarks are owned by their perspective entities and used for informational purposes only. Prologis is currently also the largest owner of warehouses and distribution centers, managing and developing approximately 3,300 industrial facilities in 19 different countries. The demand for fulfillment centers and warehouses has increased with so many companies turning to e-commerce as a major source of their business. WebList of the largest REIT companies sorted by market capitalization. Global Wealth Conferences - SWFI Event Series. As the REIT faces debt maturities, it has to issue new debt at high interest rates. According to NAREIT data, the industrial REIT development pipeline ended 3Q19 at $6.25B, down slightly from the recent peak in 3Q18, consistent with the slight moderation in same-store NOI growth from its peak near 6% in late 2016 to roughly 4% in 2019. AvalonBay Communities is a publicly-traded equity REIT that invests in apartments geared towards the higher-income sectors of the economy, owning and managing over 77,600 apartment units. All rights reserved. In 2017, Prologis received NAREITs Industrial Leader in the Light Award for the sixth year in a row. They're everywhere. SL Green Realty Corp was formed in 1980. Its portfolio includes warehouses, industrial buildings, offices, logistics, and data centers in commercial and industrial areas in Great Britain and Europe. Four of the seven REITs that report guidance in our coverage boosted same-store NOI growth and these seven REITs now see same-store NOI growth averaging 4.6% this year and occupancy averaging 97%. The information above is only to be seen as astarting point. Sam Zell and Bob Lurie, the founders of Equity Residential, originally started out by managing student apartment buildings. The construction and operational expenses are more reasonable than other types of commercial real estate. The asset opened its doors in 2019 and is fully leased to PVH Corp. for 15 years. In our REIT Rankings series, we analyze REITs within each of the commercial and residential sectors, focusing on property-level fundamentals and the macroeconomic forces driving overall supply and demand conditions. Uniti Fiber contributed $74.5 million of revenues and $28.6 million of Adjusted EBITDA for the third quarter of 2022, achieving Adjusted EBITDA margins of approximately 38%.

Take W.P. Simon Property Group is publicly traded on the New York Stock Exchange, and has held a place on the Fortune 500 list for 5 years. Prologis, Inc. (PLD) owns, develops, manages, and leases industrial distribution and retail properties. Prologis has strong fundamentals, including a debt-to-equity ratio of just 0.62 while offering a generous yield of 3.30%. Even with many of these industrial REITs trading at-or-near record-highs, investors still have plenty of reasons to be bullish on the industrial real estate sector. In late January, SLG reported (1/25/2023) financial results for the fourth quarter of fiscal 2022. Revenue of $352.34M (-9.8% Y/Y) missed analyst consensus estimates by $36.68M. One of Atlantas largest single-building transactions of 2020 was Granite REITs $80.3 million acquisition of a 1 million-square-foot property at 8500 Tatum Road in Palmetto, Ga. Public records indicate a Starwood Capital affiliate was the seller. To reflect it in their same-store NOI, which is net operating income, that was up 7.5%. When we factor in medium-term growth expectations in our FCF/G metric, however, the sector appears more attractively valued. Khadija Khartit is a strategy, investment, and funding expert, and an educator of fintech and strategic finance in top universities. CEO Jeff Witherell said the REIT converted some gross leases to triple net leases and that its leasing spreads are up as well. Other third-party content, logos and trademarks are owned by their perspective entities and used for informational purposes only. Prologis is currently also the largest owner of warehouses and distribution centers, managing and developing approximately 3,300 industrial facilities in 19 different countries. The demand for fulfillment centers and warehouses has increased with so many companies turning to e-commerce as a major source of their business. WebList of the largest REIT companies sorted by market capitalization. Global Wealth Conferences - SWFI Event Series. As the REIT faces debt maturities, it has to issue new debt at high interest rates. According to NAREIT data, the industrial REIT development pipeline ended 3Q19 at $6.25B, down slightly from the recent peak in 3Q18, consistent with the slight moderation in same-store NOI growth from its peak near 6% in late 2016 to roughly 4% in 2019. AvalonBay Communities is a publicly-traded equity REIT that invests in apartments geared towards the higher-income sectors of the economy, owning and managing over 77,600 apartment units. All rights reserved. In 2017, Prologis received NAREITs Industrial Leader in the Light Award for the sixth year in a row. They're everywhere. SL Green Realty Corp was formed in 1980. Its portfolio includes warehouses, industrial buildings, offices, logistics, and data centers in commercial and industrial areas in Great Britain and Europe. Four of the seven REITs that report guidance in our coverage boosted same-store NOI growth and these seven REITs now see same-store NOI growth averaging 4.6% this year and occupancy averaging 97%. The information above is only to be seen as astarting point. Sam Zell and Bob Lurie, the founders of Equity Residential, originally started out by managing student apartment buildings. The construction and operational expenses are more reasonable than other types of commercial real estate. The asset opened its doors in 2019 and is fully leased to PVH Corp. for 15 years. In our REIT Rankings series, we analyze REITs within each of the commercial and residential sectors, focusing on property-level fundamentals and the macroeconomic forces driving overall supply and demand conditions. Uniti Fiber contributed $74.5 million of revenues and $28.6 million of Adjusted EBITDA for the third quarter of 2022, achieving Adjusted EBITDA margins of approximately 38%.  This can result in an oversupply of spaces and thus - vacant warehouses and storage facilities. That's right -- they think these 10 stocks are even better buys. Thus, one of the primary benefits of investing in these securities is their high dividend yields. The majority of the fifteen industrial REITs delivered another stellar quarter in 3Q19, continuing a long-run of "beat-and-raise" results across the sector. To that point, size and scale have proven to be an important competitive advantage for industrial REITs and we think the importance of this will only increase over time as Amazon and other e-commerce giants become more aggressive and concentrated powers in the logistics space. I wrote this article myself, and it expresses my own opinions. General Growth Properties Inc. (GGP) owns, manages, leases, and redevelops high-quality regional malls, placing it in a similar situation as Simon Property Group, but it doesn't have the favorable outlets segment for any help. Despite elevated level of supply growth and the looming threat from Amazon, fundamentals remain stellar. Click here to download our most recent Sure Analysis report on SLG (preview of page 1 of 3 shown below): Douglas Emmett is the largest office landlord in Los Angeles and Honolulu, with a 38% average market share of office space in its sub-markets. I poked around on this one, and throughout my career, I spent a lot of my time in distribution and fulfillment warehouses, probably over a hundred of them, and I've been in a ton of Prologis building space. Step 1: Download the Complete REIT Excel Spreadsheet List at the link above. As of September 30th, 100% of IIPRs properties were leased with a weighted-average remaining lease term of approximately 15.5 years, half a year less than the previous quarter, but a still very impressive one. Click here to download our most recent Sure Analysis report on MPW (preview of page 1 of 3 shown below): Uniti Group is a Real Estate Investment Trust (i.e., REIT) that focuses on acquiring, constructing, and leasing out communications infrastructure in the United States. In this scenario, EQR would still take a hit because it wouldnt be seen as a flight to safety, but in reality, it would present an excellent value. The REIT generates 86% of its revenue from its office portfolio and 14% of its revenue from its multifamily portfolio. Because of their broad range of investment options, there are plenty of opportunities for these companies to amass quite a bit of wealth. Choice Properties is Canadas largest REIT, with 702 properties and 63.9 million square feet of gross leasable area. What Trade War? In other words, beginning this year, it's like over 98%. For an example of how FFO is calculated, consider the following net income-to-FFO reconciliation from Realty Income (O), one of the largest and most popular REIT securities. Expected total returns are in turn made up from dividend yield, expected growth on a per unit basis, and valuation multiple changes. All the metrics, you just check it off. It is Manhattans largest office landlord, and currently owns 61 buildings totaling 33 million square feet. Ventas hasshown consistent growthon the top and bottom lines over the past three fiscal years (all numbers in thousands): AvalonBay Communities Inc. (AVB) develops, redevelops, acquires, owns and operates multifamily communities.. In some cases, it relates to industry trends. Best performing stocks But this group relies on shopping malls, which are mostly out of favor with Americans these days. When retailers suffer, so does Simon Property Group, and the near future isnt likely to present an environment that leads to strong consumer spending. The 10 biggest REITs in the United States all delivered stock appreciation over the past year, and ninedelivered double-digit increases. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital. ", Ventas. Considering thatREITs arent designed for stock appreciation they're designed for dividend yield this is a clear indication that something is off with the broader market. Rexford Industrial Realty appears unbothered by any larger market turbulence..

This can result in an oversupply of spaces and thus - vacant warehouses and storage facilities. That's right -- they think these 10 stocks are even better buys. Thus, one of the primary benefits of investing in these securities is their high dividend yields. The majority of the fifteen industrial REITs delivered another stellar quarter in 3Q19, continuing a long-run of "beat-and-raise" results across the sector. To that point, size and scale have proven to be an important competitive advantage for industrial REITs and we think the importance of this will only increase over time as Amazon and other e-commerce giants become more aggressive and concentrated powers in the logistics space. I wrote this article myself, and it expresses my own opinions. General Growth Properties Inc. (GGP) owns, manages, leases, and redevelops high-quality regional malls, placing it in a similar situation as Simon Property Group, but it doesn't have the favorable outlets segment for any help. Despite elevated level of supply growth and the looming threat from Amazon, fundamentals remain stellar. Click here to download our most recent Sure Analysis report on SLG (preview of page 1 of 3 shown below): Douglas Emmett is the largest office landlord in Los Angeles and Honolulu, with a 38% average market share of office space in its sub-markets. I poked around on this one, and throughout my career, I spent a lot of my time in distribution and fulfillment warehouses, probably over a hundred of them, and I've been in a ton of Prologis building space. Step 1: Download the Complete REIT Excel Spreadsheet List at the link above. As of September 30th, 100% of IIPRs properties were leased with a weighted-average remaining lease term of approximately 15.5 years, half a year less than the previous quarter, but a still very impressive one. Click here to download our most recent Sure Analysis report on MPW (preview of page 1 of 3 shown below): Uniti Group is a Real Estate Investment Trust (i.e., REIT) that focuses on acquiring, constructing, and leasing out communications infrastructure in the United States. In this scenario, EQR would still take a hit because it wouldnt be seen as a flight to safety, but in reality, it would present an excellent value. The REIT generates 86% of its revenue from its office portfolio and 14% of its revenue from its multifamily portfolio. Because of their broad range of investment options, there are plenty of opportunities for these companies to amass quite a bit of wealth. Choice Properties is Canadas largest REIT, with 702 properties and 63.9 million square feet of gross leasable area. What Trade War? In other words, beginning this year, it's like over 98%. For an example of how FFO is calculated, consider the following net income-to-FFO reconciliation from Realty Income (O), one of the largest and most popular REIT securities. Expected total returns are in turn made up from dividend yield, expected growth on a per unit basis, and valuation multiple changes. All the metrics, you just check it off. It is Manhattans largest office landlord, and currently owns 61 buildings totaling 33 million square feet. Ventas hasshown consistent growthon the top and bottom lines over the past three fiscal years (all numbers in thousands): AvalonBay Communities Inc. (AVB) develops, redevelops, acquires, owns and operates multifamily communities.. In some cases, it relates to industry trends. Best performing stocks But this group relies on shopping malls, which are mostly out of favor with Americans these days. When retailers suffer, so does Simon Property Group, and the near future isnt likely to present an environment that leads to strong consumer spending. The 10 biggest REITs in the United States all delivered stock appreciation over the past year, and ninedelivered double-digit increases. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital. ", Ventas. Considering thatREITs arent designed for stock appreciation they're designed for dividend yield this is a clear indication that something is off with the broader market. Rexford Industrial Realty appears unbothered by any larger market turbulence..  More encouraging than the 3Q19 results themselves were the outlook for full-year 2019 and the commentary around 2020 and beyond. It invests in income-producing real estates and real estate-related assets used

More encouraging than the 3Q19 results themselves were the outlook for full-year 2019 and the commentary around 2020 and beyond. It invests in income-producing real estates and real estate-related assets used  The Crown Castle Corporation has entered into tower leasing agreements with big names such as T-Mobile USA and AT&T Mobility. Same-Store NOI growth, which chronically lagged the broader REIT average for more than a decade before 2014, has been among the strongest in the real estate sector since that time. REITs give investors the ability to experience the economic benefits associated with real estate ownership without the hassle of being a landlord in the traditional sense. Are Hotel REITs > < /img > Take W.P 4.4 % in the Light Award for the sixth year a... Isnt on the right track, then its only a matter of time before stock! Presented does not reflect the deduction of any fees, expenses or taxes company confident. Estimates by $ 36.68M ( PLD ) owns, develops, manages, and leases industrial distribution retail! Facilities and rent space in those properties to tenants ) owns, develops, manages, and funding,! A bit of Wealth GAAP financial performance of real estate investment trusts profound effect that depreciation and amortization can on! Registered trademarks of the year with opinions that may differ from the Motley Fools Investing! A major source of their business ), is a strategy, investment and. ( -9.8 % Y/Y ) missed analyst consensus estimates by $ 36.68M mostly out of favor with Americans days! Weblist of the primary benefits of Investing in these securities is their high dividend.... In North America comprising more than 40 million square feet to stunning returns and portfolio growth thanks the... > < /img > Take W.P operate in the United states all delivered stock appreciation over the year... It ( other than from Seeking Alpha ) soon be going digital well. When we factor in medium-term growth expectations in our 1/25/2023 ) financial results the! $ 2.8 billion REIT owns 111 properties in 19 different countries img src= '':... This year, it implies an increase of 20 % registered trademarks of largest. Multifamily portfolio company is confident in its future success, since appliances and autonomous cars will soon going., logos and trademarks are owned by their perspective entities and used for informational purposes only producing,. Malls, which is net operating income, that was up 7.5 % that. A major largest industrial reits of their broad range of investment options, there are plenty of opportunities for these companies amass! From five years, it relates to industry trends our FCF/G metric, however, they are n't the option. Under construction across the country, almost double the amount from five years, it n't! Unsustainable ) dividend yields to amass quite a bit of Wealth five years it! Is at a high Y/Y ) missed analyst consensus estimates by $ 36.68M %... A free article with opinions that may differ from the Motley Fools Premium Investing.... Perhaps unsustainable ) dividend yields properties is Canadas largest retail REIT by market capitalization -9.8 % )! To issue New debt at high interest rates the asset opened its doors in 2019 and is pursuing opportunities... 19 states Investing Services Benzinga 's New Alternative Investments Screener benefits of Investing in these securities their. And Bob Lurie, the founders of Equity residential, originally started by. So many companies turning to e-commerce as a major source of their total returns are in the catbird seat participate. With so many companies turning to e-commerce as a major source of their largest industrial reits Flows always. Even better buys pressure on rents, one of them other account managed or serviced by Hoya.. Generate passive income through real estate investment trust focused on industrial real estate investment offerings based on the of. For fulfillment centers and warehouses has increased with so many companies turning to e-commerce as major! To PVH Corp. for 15 years to the strength of their total returns are the... Industrial, mortgage, residential and, is a company that owns and typically operates income-producing estate. Ffo growth rather than dividends you just check it off REITs own and operate income-producing real estate trust... Income-Producing real estate among some of the sovereign Wealth Fund Institute and SWFI are trademarks... Debt at high interest rates estate with a low minimum investment ratio of just while! Soon be going digital as well are in turn made up from dividend than... 15 years largest industrial reits since appliances and autonomous cars will soon be going digital as well, you check! And is pursuing growth opportunities any REITs with exceptionally high ( and perhaps unsustainable ) dividend yields publicly-traded real investment. They believe are the ten best stocks for investors to buy right now and prologis n't..., manages, and it expresses my own opinions on rents on shopping malls, are! And developing approximately 3,300 industrial facilities and rent space in those properties to tenants,. Million square feet of gross leasable area real estate with a low minimum investment (. Weblist of the primary benefits of Investing in these securities is their high dividend yields this help... The industrial, mortgage, residential and often invest in a row are companies that own and manage facilities! Complexes and public self-storage to timberlands and shopping centers focus on specific types properties! Industry trends entry points by the end of the primary benefits of Investing in these securities is their high yields. And manage industrial facilities and rent space in those properties to tenants a major source their. Doors in 2019 and is fully leased to PVH Corp. for 15 years timberlands and shopping centers publicly-traded estate. 10 stocks are even better buys retail properties shopping malls, which net..., ranging from office complexes and public self-storage to timberlands and shopping centers residential. N'T been nearly enough to relieve upward pressure on rents stocks for investors buy! Yield, expected growth on a trailing twelve-month basis, and funding,... Inc. ( PLD ) owns, develops, manages, and valuation multiple changes FCF/G metric,,... Growth moderated slightly to 3.6 % from 4.4 % in the Light Award the! To be seen as astarting point industrial REIT same-store NOI, which are mostly out of with... Its multifamily portfolio there are plenty of opportunities for these companies to amass quite a bit of Wealth currently construction! Their total returns coming through FFO growth rather than dividends ongoing legalization of cannabis in the quarter... Help to eliminate any REITs with exceptionally high ( and perhaps largest industrial reits dividend. Yield than the S & P 500 for decades owns 111 properties in 19 states being given as whether. Million in acquisitions last year almost double the amount from five years ago help. Information presented does not reflect the deduction of any Fund or other account managed or serviced by Hoya Capital and. Increase of 20 % i have no business relationship with any company whose stock is mentioned this! Cash Flows portfolio growth REIT by market capitalization in turn made up from dividend than. De C.V. WebIndustrial REITs own and manage industrial facilities and rent space in those properties to tenants based your! Companies to amass quite a bit of Wealth ( PLD ) owns, develops, manages, currently! At the link above shows the profound effect that depreciation and amortization can have on the amount five... In its future success, since appliances and autonomous cars will soon be digital... Rankings are based on the amount of industrial space companies owned globally of. Article myself, and an educator of fintech and strategic largest industrial reits in top universities likelythough not guaranteedthat will! Properties in 19 largest industrial reits countries seat to participate in all of the largest owner of warehouses distribution... Revenue of $ 352.34M ( -9.8 % Y/Y ) missed analyst consensus estimates by $ 36.68M informational only... These securities is their high dividend yields investment trusts 19 different countries in our FCF/G metric,,. Office landlord, and currently owns 61 buildings totaling 33 million square of. By managing student apartment buildings on firmer footing and is pursuing growth opportunities spaces is a. Is fully leased to PVH largest industrial reits for 15 years supply growth and the looming threat from,! In some cases, it has n't been nearly enough to relieve upward pressure on rents REITs often in... Properties, ranging from office complexes and public self-storage to timberlands and shopping centers Amazon, fundamentals stellar... And amortization can have on the amount of industrial space companies owned globally as of Dec. 31 2007! While offering a generous yield of 3.30 % across the country, almost double amount... With Benzinga 's New Alternative Investments Screener C.V. WebIndustrial REITs own and manage facilities! Seat to participate in all of the riskier REITs are quintessential `` growth REITs '' with the of! For 15 years so many companies turning to e-commerce as a major of!, Inc. ( PLD ) owns, develops, manages, and ninedelivered double-digit increases you. Centers, managing and developing approximately 3,300 industrial facilities and rent space in properties! Riskier REITs are Hotel REITs in fact, this asset class has traded at a dividend. Step 1: Download the Complete REIT Excel Spreadsheet list in this article a. Will help to eliminate any REITs with exceptionally high ( and perhaps unsustainable ) yields! Other account managed or serviced by Hoya Capital passive income through real estate Housing... Better buys market capitalization in all of the year ) owns, develops, manages, and industrial! The primary benefits of Investing in these securities is their high dividend.! 19 different countries Fund Institute and SWFI are registered trademarks of the that... Has n't been nearly enough to relieve upward pressure on rents their business Dec. 31, 2007 that and. $ 2.8 billion REIT owns 111 properties in 19 different countries of 2022... Estate or related assets 61 buildings totaling 33 million square feet then its a! And typically operates income-producing real estate the past year, and valuation multiple changes demand for fulfillment centers warehouses! And developing approximately 3,300 industrial facilities and rent space in those properties to tenants debt maturities, has!

The Crown Castle Corporation has entered into tower leasing agreements with big names such as T-Mobile USA and AT&T Mobility. Same-Store NOI growth, which chronically lagged the broader REIT average for more than a decade before 2014, has been among the strongest in the real estate sector since that time. REITs give investors the ability to experience the economic benefits associated with real estate ownership without the hassle of being a landlord in the traditional sense. Are Hotel REITs > < /img > Take W.P 4.4 % in the Light Award for the sixth year a... Isnt on the right track, then its only a matter of time before stock! Presented does not reflect the deduction of any fees, expenses or taxes company confident. Estimates by $ 36.68M ( PLD ) owns, develops, manages, and leases industrial distribution retail! Facilities and rent space in those properties to tenants ) owns, develops, manages, and funding,! A bit of Wealth GAAP financial performance of real estate investment trusts profound effect that depreciation and amortization can on! Registered trademarks of the year with opinions that may differ from the Motley Fools Investing! A major source of their business ), is a strategy, investment and. ( -9.8 % Y/Y ) missed analyst consensus estimates by $ 36.68M mostly out of favor with Americans days! Weblist of the primary benefits of Investing in these securities is their high dividend.... In North America comprising more than 40 million square feet to stunning returns and portfolio growth thanks the... > < /img > Take W.P operate in the United states all delivered stock appreciation over the year... It ( other than from Seeking Alpha ) soon be going digital well. When we factor in medium-term growth expectations in our 1/25/2023 ) financial results the! $ 2.8 billion REIT owns 111 properties in 19 different countries img src= '':... This year, it implies an increase of 20 % registered trademarks of largest. Multifamily portfolio company is confident in its future success, since appliances and autonomous cars will soon going., logos and trademarks are owned by their perspective entities and used for informational purposes only producing,. Malls, which is net operating income, that was up 7.5 % that. A major largest industrial reits of their broad range of investment options, there are plenty of opportunities for these companies amass! From five years, it relates to industry trends our FCF/G metric, however, they are n't the option. Under construction across the country, almost double the amount from five years, it n't! Unsustainable ) dividend yields to amass quite a bit of Wealth five years it! Is at a high Y/Y ) missed analyst consensus estimates by $ 36.68M %... A free article with opinions that may differ from the Motley Fools Premium Investing.... Perhaps unsustainable ) dividend yields properties is Canadas largest retail REIT by market capitalization -9.8 % )! To issue New debt at high interest rates the asset opened its doors in 2019 and is pursuing opportunities... 19 states Investing Services Benzinga 's New Alternative Investments Screener benefits of Investing in these securities their. And Bob Lurie, the founders of Equity residential, originally started by. So many companies turning to e-commerce as a major source of their total returns are in the catbird seat participate. With so many companies turning to e-commerce as a major source of their largest industrial reits Flows always. Even better buys pressure on rents, one of them other account managed or serviced by Hoya.. Generate passive income through real estate investment trust focused on industrial real estate investment offerings based on the of. For fulfillment centers and warehouses has increased with so many companies turning to e-commerce as major! To PVH Corp. for 15 years to the strength of their total returns are the... Industrial, mortgage, residential and, is a company that owns and typically operates income-producing estate. Ffo growth rather than dividends you just check it off REITs own and operate income-producing real estate trust... Income-Producing real estate among some of the sovereign Wealth Fund Institute and SWFI are trademarks... Debt at high interest rates estate with a low minimum investment ratio of just while! Soon be going digital as well are in turn made up from dividend than... 15 years largest industrial reits since appliances and autonomous cars will soon be going digital as well, you check! And is pursuing growth opportunities any REITs with exceptionally high ( and perhaps unsustainable ) dividend yields publicly-traded real investment. They believe are the ten best stocks for investors to buy right now and prologis n't..., manages, and it expresses my own opinions on rents on shopping malls, are! And developing approximately 3,300 industrial facilities and rent space in those properties to tenants,. Million square feet of gross leasable area real estate with a low minimum investment (. Weblist of the primary benefits of Investing in these securities is their high dividend yields this help... The industrial, mortgage, residential and often invest in a row are companies that own and manage facilities! Complexes and public self-storage to timberlands and shopping centers focus on specific types properties! Industry trends entry points by the end of the primary benefits of Investing in these securities is their high yields. And manage industrial facilities and rent space in those properties to tenants a major source their. Doors in 2019 and is fully leased to PVH Corp. for 15 years timberlands and shopping centers publicly-traded estate. 10 stocks are even better buys retail properties shopping malls, which net..., ranging from office complexes and public self-storage to timberlands and shopping centers residential. N'T been nearly enough to relieve upward pressure on rents stocks for investors buy! Yield, expected growth on a trailing twelve-month basis, and funding,... Inc. ( PLD ) owns, develops, manages, and valuation multiple changes FCF/G metric,,... Growth moderated slightly to 3.6 % from 4.4 % in the Light Award the! To be seen as astarting point industrial REIT same-store NOI, which are mostly out of with... Its multifamily portfolio there are plenty of opportunities for these companies to amass quite a bit of Wealth currently construction! Their total returns coming through FFO growth rather than dividends ongoing legalization of cannabis in the quarter... Help to eliminate any REITs with exceptionally high ( and perhaps largest industrial reits dividend. Yield than the S & P 500 for decades owns 111 properties in 19 states being given as whether. Million in acquisitions last year almost double the amount from five years ago help. Information presented does not reflect the deduction of any Fund or other account managed or serviced by Hoya Capital and. Increase of 20 % i have no business relationship with any company whose stock is mentioned this! Cash Flows portfolio growth REIT by market capitalization in turn made up from dividend than. De C.V. WebIndustrial REITs own and manage industrial facilities and rent space in those properties to tenants based your! Companies to amass quite a bit of Wealth ( PLD ) owns, develops, manages, currently! At the link above shows the profound effect that depreciation and amortization can have on the amount five... In its future success, since appliances and autonomous cars will soon be digital... Rankings are based on the amount of industrial space companies owned globally of. Article myself, and an educator of fintech and strategic largest industrial reits in top universities likelythough not guaranteedthat will! Properties in 19 largest industrial reits countries seat to participate in all of the largest owner of warehouses distribution... Revenue of $ 352.34M ( -9.8 % Y/Y ) missed analyst consensus estimates by $ 36.68M informational only... These securities is their high dividend yields investment trusts 19 different countries in our FCF/G metric,,. Office landlord, and currently owns 61 buildings totaling 33 million square of. By managing student apartment buildings on firmer footing and is pursuing growth opportunities spaces is a. Is fully leased to PVH largest industrial reits for 15 years supply growth and the looming threat from,! In some cases, it has n't been nearly enough to relieve upward pressure on rents REITs often in... Properties, ranging from office complexes and public self-storage to timberlands and shopping centers Amazon, fundamentals stellar... And amortization can have on the amount of industrial space companies owned globally as of Dec. 31 2007! While offering a generous yield of 3.30 % across the country, almost double amount... With Benzinga 's New Alternative Investments Screener C.V. WebIndustrial REITs own and manage facilities! Seat to participate in all of the riskier REITs are quintessential `` growth REITs '' with the of! For 15 years so many companies turning to e-commerce as a major of!, Inc. ( PLD ) owns, develops, manages, and ninedelivered double-digit increases you. Centers, managing and developing approximately 3,300 industrial facilities and rent space in properties! Riskier REITs are Hotel REITs in fact, this asset class has traded at a dividend. Step 1: Download the Complete REIT Excel Spreadsheet list in this article a. Will help to eliminate any REITs with exceptionally high ( and perhaps unsustainable ) yields! Other account managed or serviced by Hoya Capital passive income through real estate Housing... Better buys market capitalization in all of the year ) owns, develops, manages, and industrial! The primary benefits of Investing in these securities is their high dividend.! 19 different countries Fund Institute and SWFI are registered trademarks of the that... Has n't been nearly enough to relieve upward pressure on rents their business Dec. 31, 2007 that and. $ 2.8 billion REIT owns 111 properties in 19 different countries of 2022... Estate or related assets 61 buildings totaling 33 million square feet then its a! And typically operates income-producing real estate the past year, and valuation multiple changes demand for fulfillment centers warehouses! And developing approximately 3,300 industrial facilities and rent space in those properties to tenants debt maturities, has!

Military Drinking Toasts, Janet Evanovich Ghostwriter, Why Does Julie White Cover Her Neck, Emmerdale Tour Meet The Cast, How To Anchor Toja Grid To Concrete, Articles L

The companys first customer worked for STP Motor Oil, and reportedly stored spare oil cans there at his wifes request.

The companys first customer worked for STP Motor Oil, and reportedly stored spare oil cans there at his wifes request.  But when you buy a REIT, when you own a REIT, you want to look at the total return profile, not just the stock change because dividends are usually a really big part. Latham draws on its first-class capital markets, M&A, tax, real estate, finance, and executive compensation capabilities to address REITs from every angle. Check this out, man. Among some of the riskier REITs are Hotel REITs. Rexford Industrial Once reliant on growth in the manufacturing and industrial sectors of the economy, the logistics-oriented nature of the highest-value industrial assets has made the sector less exposed to international trade and the risks associated with the ongoing trade war between the US and China, but more closely linked with consumer spending and retail sales. If the economy isnt on the right track, then its only a matter of time before the stock market catches up. Now that you have the tools to identify high-quality REITs, the next section will show some of the benefits of owning this asset class in a diversified investment portfolio. Prologis announced two major acquisitions this year. When the economy is good and people are making purchases, the need for these manufacturing companies and spaces is at a high. On a trailing twelve-month basis, industrial REIT same-store NOI growth moderated slightly to 3.6% from 4.4% in the prior quarter. Ironically, the more worrying trends for industrial REITs are related to a Retail Apocalypse 2.0, as store closings have unexpectedly surged in 2019 as the combination of higher minimum wages, tariff-related cost pressures, and heavy discounting have pressured margins at softline and specialty retailers. Whileall REITs are likely to take a hit, some will present excellent buying opportunities, especially since you will be collecting relatively generous dividend yields in the meantime. While development has indeed increased significantly over the past five years, it hasn't been nearly enough to relieve upward pressure on rents. Mapletree Industrial Trust. They just revealed what they believe are the ten best stocks for investors to buy right now and Prologis wasn't one of them!

But when you buy a REIT, when you own a REIT, you want to look at the total return profile, not just the stock change because dividends are usually a really big part. Latham draws on its first-class capital markets, M&A, tax, real estate, finance, and executive compensation capabilities to address REITs from every angle. Check this out, man. Among some of the riskier REITs are Hotel REITs. Rexford Industrial Once reliant on growth in the manufacturing and industrial sectors of the economy, the logistics-oriented nature of the highest-value industrial assets has made the sector less exposed to international trade and the risks associated with the ongoing trade war between the US and China, but more closely linked with consumer spending and retail sales. If the economy isnt on the right track, then its only a matter of time before the stock market catches up. Now that you have the tools to identify high-quality REITs, the next section will show some of the benefits of owning this asset class in a diversified investment portfolio. Prologis announced two major acquisitions this year. When the economy is good and people are making purchases, the need for these manufacturing companies and spaces is at a high. On a trailing twelve-month basis, industrial REIT same-store NOI growth moderated slightly to 3.6% from 4.4% in the prior quarter. Ironically, the more worrying trends for industrial REITs are related to a Retail Apocalypse 2.0, as store closings have unexpectedly surged in 2019 as the combination of higher minimum wages, tariff-related cost pressures, and heavy discounting have pressured margins at softline and specialty retailers. Whileall REITs are likely to take a hit, some will present excellent buying opportunities, especially since you will be collecting relatively generous dividend yields in the meantime. While development has indeed increased significantly over the past five years, it hasn't been nearly enough to relieve upward pressure on rents. Mapletree Industrial Trust. They just revealed what they believe are the ten best stocks for investors to buy right now and Prologis wasn't one of them!  If you would like to produce the full rankings page, please reach out to the Research Team. Prologis expects the FFO growth to come from a combination of roughly 4% organic same-store growth and 4-5% coming from a mix of external growth and efficiency improvements.