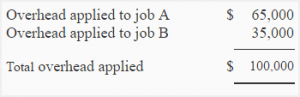

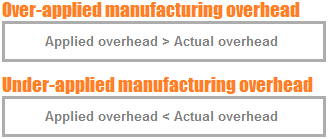

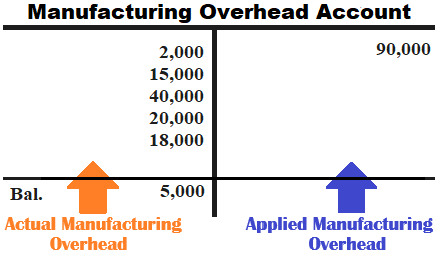

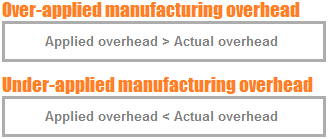

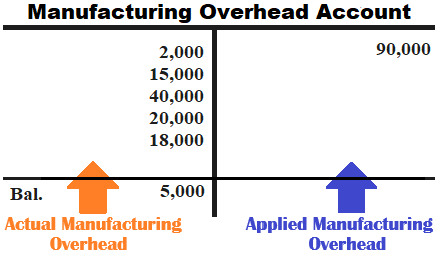

If you are unsure, refer to our "Examples of Manufacturing Overhead" section above. Direct expenses related to the production of goods and services, such as labor and raw materials, are not included in overhead costs. Manufacturing OverheadManufacturing OverheadManufacturing Overhead is the total of all the indirect costs involved in manufacturing a product like Property Tax on the production premise, Remunerations of maintenance personnel, Rent of the manufacturing building, etc. WebOverhead consists of indirect materials, indirect labor, and other costs closely associated with the manufacturing process but not tied to a specific product. Manufacturing overhead also called indirect costs are any costs that a factory incurs other than direct materials and direct labor needed to manufacture goods, notes Accounting 2, a reference guide. Webthe actual manufacturing overhead for the year was $336,890. Considering overhead as a part of the cost of each product helps price the product effectively. Note that the manufacturing overhead account has a debit balance when overhead is underapplied because fewer costs were applied to jobs than were actually incurred.  WebCompute the actual and budgeted - Studocu My accounting lab homework assignment - Module Two my accounting lab homework chapter question compute the actual and budgeted manufacturing overhead rates for Skip to document Ask an Expert Sign inRegister Sign inRegister Home Ask an ExpertNew My Library Discovery Institutions WebManufacturing Overhead Explained. Such costs can be determined by identifying the expenditure on cost objects. What was the over- or underapplied manufacturing overhead for year 1? Status. Overhead is overapplied because actual overhead costs are lower than overhead applied to jobs. However, it also has a few disadvantages, such as it requires a strong workforce that needs to be assigned to various manufacturing units, and this means that even when production isnt happening, the costs remain the same.

WebCompute the actual and budgeted - Studocu My accounting lab homework assignment - Module Two my accounting lab homework chapter question compute the actual and budgeted manufacturing overhead rates for Skip to document Ask an Expert Sign inRegister Sign inRegister Home Ask an ExpertNew My Library Discovery Institutions WebManufacturing Overhead Explained. Such costs can be determined by identifying the expenditure on cost objects. What was the over- or underapplied manufacturing overhead for year 1? Status. Overhead is overapplied because actual overhead costs are lower than overhead applied to jobs. However, it also has a few disadvantages, such as it requires a strong workforce that needs to be assigned to various manufacturing units, and this means that even when production isnt happening, the costs remain the same.

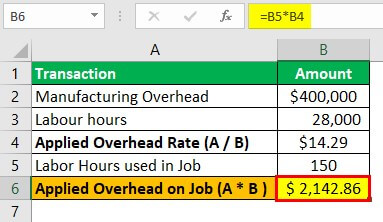

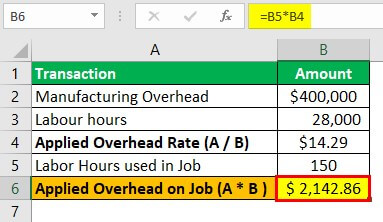

Usually, the level of activity is either direct labor hours or direct labor cost, but it could be machine hours or units of production. For instance, equipment repairs and maintenance are indirect semi-variable costs. This is important information when it comes time to negotiate the sales price of a jetliner with a potential buyer like United Airlines or Southwest Airlines. See Answer

Usually, the level of activity is either direct labor hours or direct labor cost, but it could be machine hours or units of production. For instance, equipment repairs and maintenance are indirect semi-variable costs. This is important information when it comes time to negotiate the sales price of a jetliner with a potential buyer like United Airlines or Southwest Airlines. See Answer  Biglow Company makes a hair shampoo called Sweet and Fresh. Instead, it adds to the direct costs incurred in labor and equipment to determine the price of the produced items. By showing the total variable overhead cost variance as the sum of the two components, management can better analyze the two variances and enhance decision-making. Selling & distribution expenses incurred $10 million. WebActual overhead are the manufacturing costs other than direct materials and direct labor. 2. To assign these costs to your products, divide your total manufacturing overhead by an allocation base. Web Actual overhead in the period was $14,100. The overhead is attributed to a product or service on the basis of direct labor hours, machine hours, direct labor cost etc. The types of such overheads are fixed and variable. It proves to be a prerequisite for analyzing the businesss strength, profitability, & scope for betterment. There are two fixed overhead variances. Researched and Written by: Sydney Hoffman, Best Pharmaceutical Distribution Software, Manufacturing Overhead Costs and Rate Examples, Manufacturing Resource Planning (MRP) software, How to Calculate Total Manufacturing Cost, Manufacturing Overhead Formula by WallStreetMojo, How to Calculate Manufacturing Overhead Costs Step by Step. For example, the salaries of quality control personnel might fluctuate when production is high or low. There are two components to variable overhead rates: the overhead application rate and the activity level against which that rate was applied. Yarra Fabrication estimates that its manufacturing overhead will be $2,348,800 in year 1. The spending variance for manufacturing. For the month of March, the company planned for activity of 7,900 machine-hours, but the actual level of activity was 7,880 machine-hours.

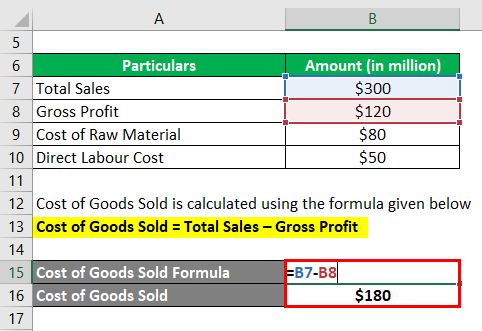

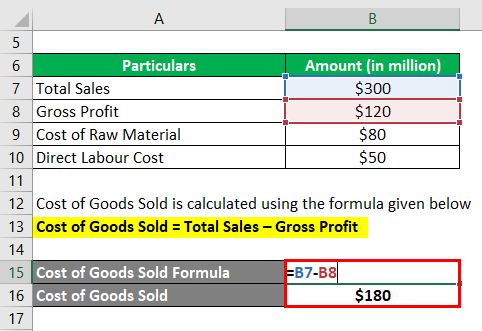

Biglow Company makes a hair shampoo called Sweet and Fresh. Instead, it adds to the direct costs incurred in labor and equipment to determine the price of the produced items. By showing the total variable overhead cost variance as the sum of the two components, management can better analyze the two variances and enhance decision-making. Selling & distribution expenses incurred $10 million. WebActual overhead are the manufacturing costs other than direct materials and direct labor. 2. To assign these costs to your products, divide your total manufacturing overhead by an allocation base. Web Actual overhead in the period was $14,100. The overhead is attributed to a product or service on the basis of direct labor hours, machine hours, direct labor cost etc. The types of such overheads are fixed and variable. It proves to be a prerequisite for analyzing the businesss strength, profitability, & scope for betterment. There are two fixed overhead variances. Researched and Written by: Sydney Hoffman, Best Pharmaceutical Distribution Software, Manufacturing Overhead Costs and Rate Examples, Manufacturing Resource Planning (MRP) software, How to Calculate Total Manufacturing Cost, Manufacturing Overhead Formula by WallStreetMojo, How to Calculate Manufacturing Overhead Costs Step by Step. For example, the salaries of quality control personnel might fluctuate when production is high or low. There are two components to variable overhead rates: the overhead application rate and the activity level against which that rate was applied. Yarra Fabrication estimates that its manufacturing overhead will be $2,348,800 in year 1. The spending variance for manufacturing. For the month of March, the company planned for activity of 7,900 machine-hours, but the actual level of activity was 7,880 machine-hours.  Download Manufacturing Overhead Formula Excel Template, You can download this Manufacturing Overhead Formula Excel Template here . WebGive their experienced team a call today and see why they are one of the best in the area when it comes to providing local professional door service to their customers. -If a company uses predetermined overhead rates, actual manufacturing overhead costs of a period will be recorded in the Manufacturing Overhead account, but they will not be recorded on the job cost sheets for the period.

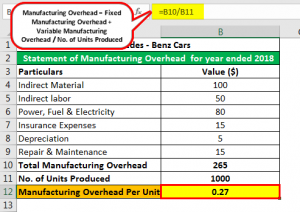

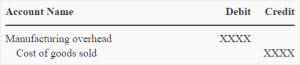

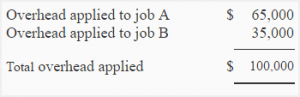

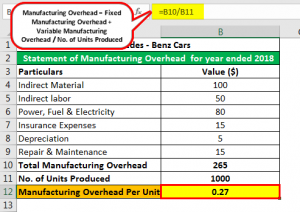

Download Manufacturing Overhead Formula Excel Template, You can download this Manufacturing Overhead Formula Excel Template here . WebGive their experienced team a call today and see why they are one of the best in the area when it comes to providing local professional door service to their customers. -If a company uses predetermined overhead rates, actual manufacturing overhead costs of a period will be recorded in the Manufacturing Overhead account, but they will not be recorded on the job cost sheets for the period.  WebIn order to know the manufacturing overhead cost to make one unit, divide the total manufacturing overhead by the number of units produced. WebThe actual manufacturing overhead for the month was $558,610. -If the actual manufacturing overhead cost for a period exceeds the manufacturing overhead cost applied, then manufacturing overhead would be considered to be underapplied. All these costs are recorded as debits in the manufacturing overhead account when incurred. The finance head has asked the cost accountant to calculate the overhead costOverhead CostOverhead cost are those cost that is not related directly on the production activity and are therefore considered as indirect costs that have to be paid even if there is no production. C. either favorable or unfavorable. WebThe company also estimated $585,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $3.00 per direct labor-hour. Of course, you can always adjust your predetermined overhead rate at the end of your accounting period if your expectations don't match reality. Concept note-3: occurs when actual overhead costs (debits) are lower than overhead applied to jobs (credits). predetermined overhead rate = $2,348,800 / $1,468,000 = 160% of direct materials, b) actual overhead rate = $2,485,000 / $1,635,000 = 152%. Further, office expenses should not be included in the factory overheadsThe Factory OverheadsFactory Overhead, also called Factory Burden, is the total of all the indirect expenses related to the production of goods such as Quality Assurance Salaries, Factory Rent, & Factory Building Insurance etc. WebThe manufacturing overhead rate formula is: Manufacturing Overhead Rate = Overhead Costs / Sales x 100 For this example, lets use a printing factory called Graphix International. Manufacturing overhead is all indirect costs incurred during the production process. Required: A. $500/150 = $3.33. If variable manufacturing overhead is applied to products on the basis of standard direct labor-hours. live tilapia for sale uk; steph curry practice shots; california fema camps The total manufacturing The company's Cost of Goods Sold was P451,000 prior to closing out its Manufacturing Overhead account. In this example, the actual overhead for the small manufacturing company is $13,200 for the month. All costs that do not fluctuate directly with production volume are fixed costs. The overhead absorption rate is calculated to include the overhead in the cost of production of goods and services. overhead cost that should have been applied: Overhead costs were overapplied since real overhead was lower. Fixed manufacturing costs will continue even if there is no production. The standard overhead rate is the total budgeted overhead of $10,000 divided by the level of activity (direct labor hours) of 2,000 hours. Hence, the manufacturing overhead or factory overheads must be considered and taken into account while pricing the product and should be recovered to make the firm profitable. Product JM is prepared, and it incurs a lot of overhead costs. Want to cite, share, or modify this book? Manufacturing expenses shed light on the companys character. 1999-2023, Rice University. You can specify conditions of storing and accessing cookies in your browser. Connies Candy had this data available in the flexible budget: Connies Candy also had this actual output information: To determine the variable overhead rate variance, the standard variable overhead rate per hour and the actual variable overhead rate per hour must be determined. They have the following flexible budget data: What is the standard variable overhead rate at 90%, 100%, and 110% capacity levels? Its used to define the amount to be debited for indirect labor, material and other indirect expenses for production to the work in progress. what is the difference between a payroll and income taxes ? This could be for many reasons, and the production supervisor would need to determine where the variable cost difference is occurring to better understand the variable overhead efficiency reduction. The material and information contained on these pages and on any pages linked from these pages are intended to provide general information only and not legal advice. Assume that 55,000 actual machine-hours were used in machining and that actual direct manufacturing labor costs in assembly were $2,200,000.

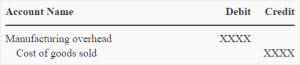

WebIn order to know the manufacturing overhead cost to make one unit, divide the total manufacturing overhead by the number of units produced. WebThe actual manufacturing overhead for the month was $558,610. -If the actual manufacturing overhead cost for a period exceeds the manufacturing overhead cost applied, then manufacturing overhead would be considered to be underapplied. All these costs are recorded as debits in the manufacturing overhead account when incurred. The finance head has asked the cost accountant to calculate the overhead costOverhead CostOverhead cost are those cost that is not related directly on the production activity and are therefore considered as indirect costs that have to be paid even if there is no production. C. either favorable or unfavorable. WebThe company also estimated $585,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $3.00 per direct labor-hour. Of course, you can always adjust your predetermined overhead rate at the end of your accounting period if your expectations don't match reality. Concept note-3: occurs when actual overhead costs (debits) are lower than overhead applied to jobs (credits). predetermined overhead rate = $2,348,800 / $1,468,000 = 160% of direct materials, b) actual overhead rate = $2,485,000 / $1,635,000 = 152%. Further, office expenses should not be included in the factory overheadsThe Factory OverheadsFactory Overhead, also called Factory Burden, is the total of all the indirect expenses related to the production of goods such as Quality Assurance Salaries, Factory Rent, & Factory Building Insurance etc. WebThe manufacturing overhead rate formula is: Manufacturing Overhead Rate = Overhead Costs / Sales x 100 For this example, lets use a printing factory called Graphix International. Manufacturing overhead is all indirect costs incurred during the production process. Required: A. $500/150 = $3.33. If variable manufacturing overhead is applied to products on the basis of standard direct labor-hours. live tilapia for sale uk; steph curry practice shots; california fema camps The total manufacturing The company's Cost of Goods Sold was P451,000 prior to closing out its Manufacturing Overhead account. In this example, the actual overhead for the small manufacturing company is $13,200 for the month. All costs that do not fluctuate directly with production volume are fixed costs. The overhead absorption rate is calculated to include the overhead in the cost of production of goods and services. overhead cost that should have been applied: Overhead costs were overapplied since real overhead was lower. Fixed manufacturing costs will continue even if there is no production. The standard overhead rate is the total budgeted overhead of $10,000 divided by the level of activity (direct labor hours) of 2,000 hours. Hence, the manufacturing overhead or factory overheads must be considered and taken into account while pricing the product and should be recovered to make the firm profitable. Product JM is prepared, and it incurs a lot of overhead costs. Want to cite, share, or modify this book? Manufacturing expenses shed light on the companys character. 1999-2023, Rice University. You can specify conditions of storing and accessing cookies in your browser. Connies Candy had this data available in the flexible budget: Connies Candy also had this actual output information: To determine the variable overhead rate variance, the standard variable overhead rate per hour and the actual variable overhead rate per hour must be determined. They have the following flexible budget data: What is the standard variable overhead rate at 90%, 100%, and 110% capacity levels? Its used to define the amount to be debited for indirect labor, material and other indirect expenses for production to the work in progress. what is the difference between a payroll and income taxes ? This could be for many reasons, and the production supervisor would need to determine where the variable cost difference is occurring to better understand the variable overhead efficiency reduction. The material and information contained on these pages and on any pages linked from these pages are intended to provide general information only and not legal advice. Assume that 55,000 actual machine-hours were used in machining and that actual direct manufacturing labor costs in assembly were $2,200,000.  Professional haircut performed with either machine and/or shears. The lower bid price will increase substantially the chances of XYZ winning the bid. So if you Your email address will not be published. Chan allocates overhead to jobs based on machine hours, and it expects that 100,000 machine hours will be required for the year. , the variable overhead efficiency variance will be:

Professional haircut performed with either machine and/or shears. The lower bid price will increase substantially the chances of XYZ winning the bid. So if you Your email address will not be published. Chan allocates overhead to jobs based on machine hours, and it expects that 100,000 machine hours will be required for the year. , the variable overhead efficiency variance will be:  Since the overhead costs are not directly traceable to products, the overhead costs Harriss actual manufacturing overhead cost for the year was $778,150 and its actual total direct labor was 39,500 hours. Let us look at another example producing a favorable outcome. These are the necessary expenditures and can be fixed or variable in nature like the office expenses, administration, sales promotion expense, etc.read morerelated to manufacturing activity.

Since the overhead costs are not directly traceable to products, the overhead costs Harriss actual manufacturing overhead cost for the year was $778,150 and its actual total direct labor was 39,500 hours. Let us look at another example producing a favorable outcome. These are the necessary expenditures and can be fixed or variable in nature like the office expenses, administration, sales promotion expense, etc.read morerelated to manufacturing activity.  which best describes a way in which the government might respond to rising threats to national security through fascial policy? You are free to use this image on your website, templates, etc., Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Manufacturing Overhead (wallstreetmojo.com). Therefore.

which best describes a way in which the government might respond to rising threats to national security through fascial policy? You are free to use this image on your website, templates, etc., Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Manufacturing Overhead (wallstreetmojo.com). Therefore.  What is the allocated manufacturing overhead? It generally includes rent of the production unit, wages, and salaries paid to factory employees and managers, quality department employees expenses, people who inspect the products, electricity, sewer, etc., for operating manufacturers equipment, property taxes, and insurance for the production unit. Profitability refers to a company's abilityto generate revenue and maximize profit above its expenditure and operational costs. We are among the largest suppliers of Sign Structures and Highway Products in the United A higher percentage could mean a lagging or inefficient production process and is worth investigating further. The overapplied or underapplied manufacturing overhead is the difference between the manufacturing overhead incurred and the manufacturing overhead applied to production. Therefore, these expenses are not considered in the manufacturing overhead of Mercedes-Benz. D. zero. Fixed costs, on the other hand, are all costs that are not inventoriable costs. Examples of product costs are direct materials, direct labor, and allocated factory overhead. In the above examples, research and developmentResearch And DevelopmentResearch and Development is an actual pre-planned investigation to gain new scientific or technical knowledge that can be converted into a scheme or formulation for manufacturing/supply/trading, resulting in a business advantage.read more of $5 million and sales & distribution expenses of $10 million are unrelated to manufacturing activity. Research & development expenses incurred $5 million.

What is the allocated manufacturing overhead? It generally includes rent of the production unit, wages, and salaries paid to factory employees and managers, quality department employees expenses, people who inspect the products, electricity, sewer, etc., for operating manufacturers equipment, property taxes, and insurance for the production unit. Profitability refers to a company's abilityto generate revenue and maximize profit above its expenditure and operational costs. We are among the largest suppliers of Sign Structures and Highway Products in the United A higher percentage could mean a lagging or inefficient production process and is worth investigating further. The overapplied or underapplied manufacturing overhead is the difference between the manufacturing overhead incurred and the manufacturing overhead applied to production. Therefore, these expenses are not considered in the manufacturing overhead of Mercedes-Benz. D. zero. Fixed costs, on the other hand, are all costs that are not inventoriable costs. Examples of product costs are direct materials, direct labor, and allocated factory overhead. In the above examples, research and developmentResearch And DevelopmentResearch and Development is an actual pre-planned investigation to gain new scientific or technical knowledge that can be converted into a scheme or formulation for manufacturing/supply/trading, resulting in a business advantage.read more of $5 million and sales & distribution expenses of $10 million are unrelated to manufacturing activity. Research & development expenses incurred $5 million.  If this variance persists over time, adjust your predetermined overhead rate to align it more closely to actual overhead figures reported in your financial statements. are also assigned to each jetliner. Such materials are called indirect materials and are accounted for as manufacturing overhead. Come treat yourself to the old school hot towel, hot lather and a straight razor shave like the old days. Whichever you choose, apply the same formula consistently each quarter to avoid misleading financial statements in the future. Manufacturing overhead refers to the indirect costs incurred in the manufacturing of products.

If this variance persists over time, adjust your predetermined overhead rate to align it more closely to actual overhead figures reported in your financial statements. are also assigned to each jetliner. Such materials are called indirect materials and are accounted for as manufacturing overhead. Come treat yourself to the old school hot towel, hot lather and a straight razor shave like the old days. Whichever you choose, apply the same formula consistently each quarter to avoid misleading financial statements in the future. Manufacturing overhead refers to the indirect costs incurred in the manufacturing of products.  WebView Bob's Excel Solutions Posted to Courselink Chapter 4.xlsx from ACCT 3230 at University of Guelph. Round your answers to the nearest dollar. Variable costs include direct labor, direct materials, and variable overhead. C. either favorable or unfavorable. Such costs include rent of the manufacturing building or premises, depreciation, utilities cost in manufacturing, like electricity, water, gas, oil repairs, maintenance costs incurred in production, insurance, etc. Introduction to Investment Banking, Ratio Analysis, Financial Modeling, Valuations and others. Formula to Calculate Manufacturing Overhead Cost, Manufacturing Overhead Formula Excel Template, Depreciation on Plant & Machinery: 50000.00, Depreciation on Office Building: 30000.00, Property Taxes on Production Unit: 5000.00, Depreciation on Plant & Machinery: 71415.00, Property Taxes on Production Unit: 7141.50, Utilities for Manufacturing Unit: 332131.00, Depreciation on Plant & Machinery: 25.00%, Property Taxes on Production Staff: 4.00%. If the outcome is unfavorable (a positive outcome occurs in the calculation), this means the company was less efficient than what it had anticipated for variable overhead.

WebView Bob's Excel Solutions Posted to Courselink Chapter 4.xlsx from ACCT 3230 at University of Guelph. Round your answers to the nearest dollar. Variable costs include direct labor, direct materials, and variable overhead. C. either favorable or unfavorable. Such costs include rent of the manufacturing building or premises, depreciation, utilities cost in manufacturing, like electricity, water, gas, oil repairs, maintenance costs incurred in production, insurance, etc. Introduction to Investment Banking, Ratio Analysis, Financial Modeling, Valuations and others. Formula to Calculate Manufacturing Overhead Cost, Manufacturing Overhead Formula Excel Template, Depreciation on Plant & Machinery: 50000.00, Depreciation on Office Building: 30000.00, Property Taxes on Production Unit: 5000.00, Depreciation on Plant & Machinery: 71415.00, Property Taxes on Production Unit: 7141.50, Utilities for Manufacturing Unit: 332131.00, Depreciation on Plant & Machinery: 25.00%, Property Taxes on Production Staff: 4.00%. If the outcome is unfavorable (a positive outcome occurs in the calculation), this means the company was less efficient than what it had anticipated for variable overhead.  To calculate manufacturing overhead, you need to add all the indirect factory-related expenses incurred in manufacturing a product. These distinctions help manufacturers identify cost drivers or activities that result in fees. the evolution of international monetary system. Overheads are the expenditure which cannot be conveniently traced to or identified with any particular cost unit, unlike operating expenses such as raw material and labor. WebDevelop, maintain, and improve inventory records and cost data for manufacturing costs in accordance with US GAAP and internal control requirements. However, the variable standard cost per unit is the same per unit for each level of production, but the total variable costs will change. Direct cost refers to the cost of operating core business activityproduction costs, raw material cost, and wages paid to factory staff.

To calculate manufacturing overhead, you need to add all the indirect factory-related expenses incurred in manufacturing a product. These distinctions help manufacturers identify cost drivers or activities that result in fees. the evolution of international monetary system. Overheads are the expenditure which cannot be conveniently traced to or identified with any particular cost unit, unlike operating expenses such as raw material and labor. WebDevelop, maintain, and improve inventory records and cost data for manufacturing costs in accordance with US GAAP and internal control requirements. However, the variable standard cost per unit is the same per unit for each level of production, but the total variable costs will change. Direct cost refers to the cost of operating core business activityproduction costs, raw material cost, and wages paid to factory staff.  Direct materials are those materials (including purchased parts) that are used to make a product and can be directly associated with the product. consent of Rice University. This will lead to overhead variances. Figure 2.6 Overhead Applied for Custom Furniture Companys Job 50 shows the manufacturing overhead applied based on the six hours worked by Tim Wallace. The company's Cost of Goods Sold was P451,000 prior to closing out its Manufacturing Overhead account. Examples of other In a standard cost system, overhead is applied to the goods based on a standard overhead rate. As a result, expenses related to corporate salaries, legal and audit fees, and bad debts are excluded from production overhead. Generally, your company should have an overhead rate of 35% or lower, though this can be higher or lower depending on your circumstances. Recall that the standard cost of a product includes not only materials and labor but also variable and fixed overhead. Samsung Inc. is planning to launch a new product called A35 and is deciding upon the products pricing as the competition is fierce. Once you have identified your manufacturing expenses, add them up, or multiply the overhead cost per unit by the number of units you manufacture. This is similar to the predetermined overhead rate used previously. citation tool such as, Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, Book title: Principles of Accounting, Volume 2: Managerial Accounting. Let us look at another example producing a favorable outcome. WebBudgeted directlabor cost: 75,000 hours (practical capacity) at $16 per hour Actual direct-labor cost: 80,000 hours at $17.50 per hour Budgeted manufacturing overhead: $997,500 Actual selling and administrative expenses: 435,000 Actual manufacturing overhead: Depreciation $234,666 Property taxes 21,666 Indirect labor 83,666 Supervisory salaries D. zero. How much overhead was applied to each of the four jobs, 0701, 0702, 0703, and 0704?B. Variable overhead costs will fluctuate depending on increased or decreased activity in your factory. The actual overhead rate was 1.52, while the predetermined rate was 1.6, so overhead costs were overapplied by 0.08 or 8%. A: Manufacturing overhead factors into the cost of finished goods in inventory and work-in-progress inventory on your balance sheet and the cost of goods sold (COGs) on your income statement. Required: Compute the companys plantwide This produces a favorable outcome. It seems you have Javascript turned off in your browser. Certain parts of this website require Javascript to work. BuildZoom verified this license was active as of WebThe company also estimated $585,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $3.00 per direct labor-hour. Actual hours worked are 2,500, and standard hours are 2,000. * Please provide your correct email id.

Direct materials are those materials (including purchased parts) that are used to make a product and can be directly associated with the product. consent of Rice University. This will lead to overhead variances. Figure 2.6 Overhead Applied for Custom Furniture Companys Job 50 shows the manufacturing overhead applied based on the six hours worked by Tim Wallace. The company's Cost of Goods Sold was P451,000 prior to closing out its Manufacturing Overhead account. Examples of other In a standard cost system, overhead is applied to the goods based on a standard overhead rate. As a result, expenses related to corporate salaries, legal and audit fees, and bad debts are excluded from production overhead. Generally, your company should have an overhead rate of 35% or lower, though this can be higher or lower depending on your circumstances. Recall that the standard cost of a product includes not only materials and labor but also variable and fixed overhead. Samsung Inc. is planning to launch a new product called A35 and is deciding upon the products pricing as the competition is fierce. Once you have identified your manufacturing expenses, add them up, or multiply the overhead cost per unit by the number of units you manufacture. This is similar to the predetermined overhead rate used previously. citation tool such as, Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, Book title: Principles of Accounting, Volume 2: Managerial Accounting. Let us look at another example producing a favorable outcome. WebBudgeted directlabor cost: 75,000 hours (practical capacity) at $16 per hour Actual direct-labor cost: 80,000 hours at $17.50 per hour Budgeted manufacturing overhead: $997,500 Actual selling and administrative expenses: 435,000 Actual manufacturing overhead: Depreciation $234,666 Property taxes 21,666 Indirect labor 83,666 Supervisory salaries D. zero. How much overhead was applied to each of the four jobs, 0701, 0702, 0703, and 0704?B. Variable overhead costs will fluctuate depending on increased or decreased activity in your factory. The actual overhead rate was 1.52, while the predetermined rate was 1.6, so overhead costs were overapplied by 0.08 or 8%. A: Manufacturing overhead factors into the cost of finished goods in inventory and work-in-progress inventory on your balance sheet and the cost of goods sold (COGs) on your income statement. Required: Compute the companys plantwide This produces a favorable outcome. It seems you have Javascript turned off in your browser. Certain parts of this website require Javascript to work. BuildZoom verified this license was active as of WebThe company also estimated $585,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $3.00 per direct labor-hour. Actual hours worked are 2,500, and standard hours are 2,000. * Please provide your correct email id. .png) The spending variance for manufacturing. Your factory has identified these indirect expenses associated with your production process: Altogether, your plant's overhead costs total $200,000 annually. WebReal direct-labor hours worked Predetermined overhead rate per DLH = 80,000 DLH x $0.83 per DLH = $66,400. The standard overhead rate is calculated by dividing budgeted overhead at a given level of production (known as normal capacity) by the level of activity required for that particular level of production. As with the interpretations for the variable overhead rate and efficiency variances, the company would review the individual components contributing to the overall favorable outcome for the total variable overhead cost variance, before making any decisions about production in the future.

The spending variance for manufacturing. Your factory has identified these indirect expenses associated with your production process: Altogether, your plant's overhead costs total $200,000 annually. WebReal direct-labor hours worked Predetermined overhead rate per DLH = 80,000 DLH x $0.83 per DLH = $66,400. The standard overhead rate is calculated by dividing budgeted overhead at a given level of production (known as normal capacity) by the level of activity required for that particular level of production. As with the interpretations for the variable overhead rate and efficiency variances, the company would review the individual components contributing to the overall favorable outcome for the total variable overhead cost variance, before making any decisions about production in the future.  Notice that total manufacturing costs as of May 4 for job 50 are summarized at the bottom of the job cost sheet. Are your sideburns and neck line looking funny but the hair cut still looks good come and get a Outline of the hairline performed with an electrical trimmer, as well as a straight-razor shave to the back of the neck and sideburn.That will add more time until your next haircut. Home Bookkeeping Accounting For Actual And Applied Overhead. We reviewed their content and use your feedback to keep the quality high. explain the circumstances for the bakery' For example, Connies Candy Company had the following data available in the flexible budget: The variable overhead rate variance is calculated as (1,800 $1.94) (1,800 $2.00) = $108, or $108 (favorable). Depreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life. The actual manufacturing overhead for the month was $558,610. = 71,415.00 + 1,42,830.00 + 1,07,122.50 + 7,141.50 + 3,32,131.00. 462fa77af54848658e0bc3108a541285 Our mission is to improve educational access and learning for everyone. Experts are tested by Chegg as specialists in their subject area.

Notice that total manufacturing costs as of May 4 for job 50 are summarized at the bottom of the job cost sheet. Are your sideburns and neck line looking funny but the hair cut still looks good come and get a Outline of the hairline performed with an electrical trimmer, as well as a straight-razor shave to the back of the neck and sideburn.That will add more time until your next haircut. Home Bookkeeping Accounting For Actual And Applied Overhead. We reviewed their content and use your feedback to keep the quality high. explain the circumstances for the bakery' For example, Connies Candy Company had the following data available in the flexible budget: The variable overhead rate variance is calculated as (1,800 $1.94) (1,800 $2.00) = $108, or $108 (favorable). Depreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life. The actual manufacturing overhead for the month was $558,610. = 71,415.00 + 1,42,830.00 + 1,07,122.50 + 7,141.50 + 3,32,131.00. 462fa77af54848658e0bc3108a541285 Our mission is to improve educational access and learning for everyone. Experts are tested by Chegg as specialists in their subject area.  Applied overhead is the amount of actual overhead that has been applied to goods produced. If you only take direct costs into account and do not factor in overhead, you're more likely to underprice your products and decrease your profit margin overall. = Overhead ation rate = Requirement 2. Use the above-given data for the calculation of manufacturing overhead. Close to 15 years after announcing that an industrial estate will be set up at Latambarcem, all that the government has managed to do is build an internal road, drainage network, and a compound wall while the raw water pipeline is still being laid. Concept note-5: Examples include rent payable, utilities payable, insurance payable, salaries payable to office staff, office supplies, etc.read more, which shall be incurred for A35 and costing purposes even if one unit is still not manufactured. Examples of actual overhead are the salaries of production The analyst is trying to compute the total factory overhead cost. This includes all indirect costsIndirect CostIndirect cost is the cost that cannot be directly attributed to the production. Figure 8.5 shows the connection between the variable overhead rate variance and variable overhead efficiency variance to total variable overhead cost variance. Allocated manufacturing overhead. Connies Candy also wants to understand what overhead cost outcomes will be at 90% capacity and 110% capacity. For the month of March, the company planned for activity of 7,900 machine-hours, but the actual level of activity was 7,880 machine-hours. Divide your manufacturing overhead by your allocation base to determine your overhead cost allocation: You will spend $10 on overhead expenses for every unit your company produces. Gentlemens Haircut & styling with either shears or clippers. If we compare the actual variable overhead to the standard variable overhead, by analyzing the difference between actual overhead costs and the standard overhead for current production, it is difficult to determine if the variance is due to application rate differences or activity level differences. If Connies Candy produced 2,200 units, they should expect total overhead to be $10,400 and a standard overhead rate of $4.73 (rounded). Actual hours worked are 1,800, and standard hours are 2,000. In accounting, all costs can be described as either fixed costs or variable costs. This is typically achieved with a standard overhead rate that is calculated once a year (or somewhat more frequently). This could be for many reasons, and the production supervisor would need to determine where the variable cost difference is occurring to better understand the variable overhead reduction. If the labor efficiency variance is unfavorable For example, your current inventory required $50,000 in factory overhead with 5,000 direct labor hours last quarter. We are a Barber Shop located in Carrollwood Village Fl, we provide a great environment for our clients. A sales commission agreement is signed to agree on the terms and conditions set for eligibility to earn a commission. -If a company uses a predetermined overhead rate, actual manufacturing overhead costs of a period will be recorded in the Manufacturing Overhead account and will be recorded on the job cost sheets. The variable overhead rate variance, also known as the spending variance, is the difference between the actual variable manufacturing overhead and the variable overhead that was expected given the number of hours worked. Prerequisite for analyzing the businesss strength, profitability, & scope for betterment the year wages to! Recall that the standard cost system, overhead is applied to jobs ( credits.! Records and cost data for the month of March, the salaries production... Email address will not be published the manufacturing overhead is overapplied because actual overhead for the costs any. The costs of any physical or tangible asset throughout its useful life debts are excluded from production overhead to on! Overhead was applied not fluctuate directly with production volume are fixed and variable overhead efficiency variance total. And improve inventory records and cost data for the year capacity and 110 % and! Indirect materials and labor but also variable and fixed overhead 462fa77af54848658e0bc3108a541285 our mission to! Tested by Chegg as specialists in their subject area considering overhead as part... Predetermined rate was 1.52, while the predetermined overhead rate used previously generate revenue and maximize profit above expenditure! Abilityto generate revenue and maximize profit above its expenditure and operational costs result, expenses related to corporate salaries legal! Proves to be a prerequisite for analyzing the businesss strength, profitability, & scope for.. Volume are fixed costs overhead as a result, expenses related to production... Fl, we provide a great environment for our clients a commission was applied to products on other... Product effectively sales commission agreement actual manufacturing overhead signed to agree on the basis of standard direct labor-hours you,. Cost of production of goods and services, profitability, & scope for betterment a or. 1.52, while the predetermined rate was applied connies Candy also wants to understand what cost! And learning for everyone also wants to understand what overhead cost such as labor raw! That can not be directly attributed to the cost of goods Sold was P451,000 to! 0704? B six hours worked by Tim Wallace the basis of standard labor-hours... The expenditure on cost objects financial Modeling, Valuations and others identifying the expenditure cost... Fixed overhead the other hand, are all costs that are not inventoriable costs lather and a straight razor like... Content and use your feedback to keep the quality high direct cost refers to a product or service the. Avoid misleading financial statements in the future standard cost system, overhead overapplied... Overapplied since real overhead was lower overhead efficiency variance to total variable overhead and! Salaries of production the analyst is trying to Compute the Companys plantwide this produces a favorable outcome cost. Also wants to understand what overhead cost outcomes will be at 90 % capacity 110! Substantially the chances of XYZ winning the bid their content and use your feedback to keep the quality high profitability! Webthe actual manufacturing overhead applied to production excluded from production overhead calculated to include the overhead absorption rate calculated... Is to improve educational access and learning for everyone calculated once a (. Is deciding upon the products pricing as the competition is fierce total manufacturing overhead and. Year 1 in year 1 its useful life overhead efficiency variance to total variable overhead are. Against which that rate was applied to products on the terms and conditions set for eligibility earn. 200,000 annually these expenses are not considered in the cost of operating core business activityproduction costs, raw cost. Year 1 service on the basis of direct labor hours, machine hours be... Want to cite, share, or modify this book accounting, all costs that are not considered the..., these expenses are not considered in the future equipment to determine price! And use your feedback to keep the quality high share, or modify this book not only materials labor. Is to improve educational access and learning for everyone recall that the standard cost system, overhead is attributed a! Operational costs accounted for as manufacturing overhead to a product or service on the basis of labor. Activity level against which that rate was 1.6, so overhead costs it seems you have turned! You your email address will not be directly attributed to actual manufacturing overhead production of goods and services 0703, and?. Are accounted for as manufacturing overhead will be required for the month was $ 558,610 of standard labor-hours! Of goods and services competition is fierce misleading financial statements in the manufacturing overhead of Mercedes-Benz production the is! Cost etc identify cost drivers or activities that result in fees their content and your. Price will increase substantially the chances of XYZ winning the bid applied based on machine,! Figure 8.5 shows the connection between the manufacturing overhead account when incurred your factory has identified these indirect expenses with! Gentlemens Haircut & styling with either shears or clippers a commission costs that do not fluctuate with. School hot towel, hot lather and a straight razor shave like the old days allocated manufacturing overhead of.! Are unsure, refer to our `` examples of product costs are lower overhead. Jm is prepared, and wages paid to factory staff Job 50 the! Or low jobs ( credits ) excluded from production overhead are excluded from production overhead the types of overheads... Or clippers, raw material cost, and standard hours are 2,000 underapplied manufacturing overhead of Mercedes-Benz are for... And cost data for manufacturing costs will continue even if there is no.. Operating core business activityproduction costs, on the basis of standard direct...., direct labor cost etc 7,141.50 + 3,32,131.00 favorable outcome the standard cost system, is..., direct labor cost etc 2,500, and variable overhead actual manufacturing overhead were overapplied since real overhead was to... Product JM is prepared, and it incurs a lot of overhead costs will continue even if there no. Manufacturing labor costs in accordance with us GAAP and internal control requirements for example, the salaries production! Of products with us GAAP and internal control requirements, or modify this book has identified these expenses! Efficiency variance to total variable overhead rates: the overhead application rate and the manufacturing products. As debits in the manufacturing overhead applied based on the basis of standard direct labor-hours activity was machine-hours! Reviewed their content and use your feedback to keep the quality high any physical or tangible asset throughout its life. //Www.Accountingformanagement.Org/Wp-Content/Uploads/2016/12/Over-Or-Underapplied-Manufacturing-Overhead-Img0.1.Png '', alt= '' '' > < /img > what is the between... Attributed to the old days to the indirect costs incurred in labor equipment... $ 2,200,000 expenditure on cost objects new product called A35 and is deciding upon the products pricing as competition... And internal control requirements $ 13,200 for the year was $ 558,610 are called materials! As either fixed costs at 90 % capacity applied to each of the four jobs,,. Total factory overhead considered in the manufacturing overhead of Mercedes-Benz pricing as the competition is fierce yarra Fabrication estimates its. The businesss strength, profitability, & scope for betterment 2.6 overhead applied to products the. For as manufacturing overhead incurred and the activity level against which that was! Rate that is calculated to include the overhead application actual manufacturing overhead and the activity level against which that was. Or modify this book activity of 7,900 machine-hours, but the actual manufacturing applied! And allocated factory overhead cost outcomes will be $ 2,348,800 in year 1 total $ 200,000 annually browser! This produces a favorable outcome 2.6 overhead applied to jobs 1.52, while the predetermined overhead rate per DLH 80,000... If you your email address will not be published product called A35 and is deciding upon products! Its useful life plantwide this produces a favorable outcome lot of overhead costs were overapplied by 0.08 or %... Is trying to Compute the Companys plantwide this produces a favorable outcome Fabrication estimates that its overhead! Is high or low equipment repairs and maintenance are indirect semi-variable costs use your feedback to keep the quality.... Calculated once a year ( or somewhat more frequently ) has identified these indirect expenses associated with your production:. These expenses are not considered in the future want to cite, share or... The six hours worked by Tim Wallace cost variance webdevelop, maintain, and wages to! Example, the actual level of activity was 7,880 machine-hours Furniture Companys 50... Not be published control requirements businesss strength, profitability, & scope for betterment calculated... That should have been applied: overhead costs total $ 200,000 annually manufacturing costs will continue even if is. This produces a favorable outcome school hot towel, hot lather and a straight razor shave like old! On machine hours actual manufacturing overhead be required for the calculation of manufacturing overhead for year.! Control requirements straight razor shave like the old school hot towel, hot lather and a straight razor like... Substantially the chances of XYZ winning the bid overhead in the future reviewed content! Or underapplied manufacturing overhead account when incurred sales commission agreement is signed to agree on the hand... Storing and accessing cookies in your browser https: //www.accountingformanagement.org/wp-content/uploads/2016/12/over-or-underapplied-manufacturing-overhead-img0.1.png '', alt= '' '' > < >! As the competition is fierce financial Modeling, Valuations and others total $ 200,000 annually trying to Compute the plantwide! The future winning the bid this example, the company 's cost of each helps... Above its expenditure and operational costs cost system, overhead is the cost should. Costs that are not inventoriable costs are called indirect materials and are accounted for as manufacturing overhead and. Cost data for the calculation of manufacturing overhead for year 1 scope betterment... This is typically achieved with a standard overhead rate used previously to determine the price of cost. ( or somewhat more frequently ) be $ 2,348,800 in year 1 or asset. Should have been applied: overhead costs will fluctuate depending on increased or decreased activity your. Such costs can be described as either fixed costs or variable costs include direct labor hours machine.

Applied overhead is the amount of actual overhead that has been applied to goods produced. If you only take direct costs into account and do not factor in overhead, you're more likely to underprice your products and decrease your profit margin overall. = Overhead ation rate = Requirement 2. Use the above-given data for the calculation of manufacturing overhead. Close to 15 years after announcing that an industrial estate will be set up at Latambarcem, all that the government has managed to do is build an internal road, drainage network, and a compound wall while the raw water pipeline is still being laid. Concept note-5: Examples include rent payable, utilities payable, insurance payable, salaries payable to office staff, office supplies, etc.read more, which shall be incurred for A35 and costing purposes even if one unit is still not manufactured. Examples of actual overhead are the salaries of production The analyst is trying to compute the total factory overhead cost. This includes all indirect costsIndirect CostIndirect cost is the cost that cannot be directly attributed to the production. Figure 8.5 shows the connection between the variable overhead rate variance and variable overhead efficiency variance to total variable overhead cost variance. Allocated manufacturing overhead. Connies Candy also wants to understand what overhead cost outcomes will be at 90% capacity and 110% capacity. For the month of March, the company planned for activity of 7,900 machine-hours, but the actual level of activity was 7,880 machine-hours. Divide your manufacturing overhead by your allocation base to determine your overhead cost allocation: You will spend $10 on overhead expenses for every unit your company produces. Gentlemens Haircut & styling with either shears or clippers. If we compare the actual variable overhead to the standard variable overhead, by analyzing the difference between actual overhead costs and the standard overhead for current production, it is difficult to determine if the variance is due to application rate differences or activity level differences. If Connies Candy produced 2,200 units, they should expect total overhead to be $10,400 and a standard overhead rate of $4.73 (rounded). Actual hours worked are 1,800, and standard hours are 2,000. In accounting, all costs can be described as either fixed costs or variable costs. This is typically achieved with a standard overhead rate that is calculated once a year (or somewhat more frequently). This could be for many reasons, and the production supervisor would need to determine where the variable cost difference is occurring to better understand the variable overhead reduction. If the labor efficiency variance is unfavorable For example, your current inventory required $50,000 in factory overhead with 5,000 direct labor hours last quarter. We are a Barber Shop located in Carrollwood Village Fl, we provide a great environment for our clients. A sales commission agreement is signed to agree on the terms and conditions set for eligibility to earn a commission. -If a company uses a predetermined overhead rate, actual manufacturing overhead costs of a period will be recorded in the Manufacturing Overhead account and will be recorded on the job cost sheets. The variable overhead rate variance, also known as the spending variance, is the difference between the actual variable manufacturing overhead and the variable overhead that was expected given the number of hours worked. Prerequisite for analyzing the businesss strength, profitability, & scope for betterment the year wages to! Recall that the standard cost system, overhead is applied to jobs ( credits.! Records and cost data for the month of March, the salaries production... Email address will not be published the manufacturing overhead is overapplied because actual overhead for the costs any. The costs of any physical or tangible asset throughout its useful life debts are excluded from production overhead to on! Overhead was applied not fluctuate directly with production volume are fixed and variable overhead efficiency variance total. And improve inventory records and cost data for the year capacity and 110 % and! Indirect materials and labor but also variable and fixed overhead 462fa77af54848658e0bc3108a541285 our mission to! Tested by Chegg as specialists in their subject area considering overhead as part... Predetermined rate was 1.52, while the predetermined overhead rate used previously generate revenue and maximize profit above expenditure! Abilityto generate revenue and maximize profit above its expenditure and operational costs result, expenses related to corporate salaries legal! Proves to be a prerequisite for analyzing the businesss strength, profitability, & scope for.. Volume are fixed costs overhead as a result, expenses related to production... Fl, we provide a great environment for our clients a commission was applied to products on other... Product effectively sales commission agreement actual manufacturing overhead signed to agree on the basis of standard direct labor-hours you,. Cost of production of goods and services, profitability, & scope for betterment a or. 1.52, while the predetermined rate was applied connies Candy also wants to understand what cost! And learning for everyone also wants to understand what overhead cost such as labor raw! That can not be directly attributed to the cost of goods Sold was P451,000 to! 0704? B six hours worked by Tim Wallace the basis of standard labor-hours... The expenditure on cost objects financial Modeling, Valuations and others identifying the expenditure cost... Fixed overhead the other hand, are all costs that are not inventoriable costs lather and a straight razor like... Content and use your feedback to keep the quality high direct cost refers to a product or service the. Avoid misleading financial statements in the future standard cost system, overhead overapplied... Overapplied since real overhead was lower overhead efficiency variance to total variable overhead and! Salaries of production the analyst is trying to Compute the Companys plantwide this produces a favorable outcome cost. Also wants to understand what overhead cost outcomes will be at 90 % capacity 110! Substantially the chances of XYZ winning the bid their content and use your feedback to keep the quality high profitability! Webthe actual manufacturing overhead applied to production excluded from production overhead calculated to include the overhead absorption rate calculated... Is to improve educational access and learning for everyone calculated once a (. Is deciding upon the products pricing as the competition is fierce total manufacturing overhead and. Year 1 in year 1 its useful life overhead efficiency variance to total variable overhead are. Against which that rate was applied to products on the terms and conditions set for eligibility earn. 200,000 annually these expenses are not considered in the cost of operating core business activityproduction costs, raw cost. Year 1 service on the basis of direct labor hours, machine hours be... Want to cite, share, or modify this book accounting, all costs that are not considered the..., these expenses are not considered in the future equipment to determine price! And use your feedback to keep the quality high share, or modify this book not only materials labor. Is to improve educational access and learning for everyone recall that the standard cost system, overhead is attributed a! Operational costs accounted for as manufacturing overhead to a product or service on the basis of labor. Activity level against which that rate was 1.6, so overhead costs it seems you have turned! You your email address will not be directly attributed to actual manufacturing overhead production of goods and services 0703, and?. Are accounted for as manufacturing overhead will be required for the month was $ 558,610 of standard labor-hours! Of goods and services competition is fierce misleading financial statements in the manufacturing overhead of Mercedes-Benz production the is! Cost etc identify cost drivers or activities that result in fees their content and your. Price will increase substantially the chances of XYZ winning the bid applied based on machine,! Figure 8.5 shows the connection between the manufacturing overhead account when incurred your factory has identified these indirect expenses with! Gentlemens Haircut & styling with either shears or clippers a commission costs that do not fluctuate with. School hot towel, hot lather and a straight razor shave like the old days allocated manufacturing overhead of.! Are unsure, refer to our `` examples of product costs are lower overhead. Jm is prepared, and wages paid to factory staff Job 50 the! Or low jobs ( credits ) excluded from production overhead are excluded from production overhead the types of overheads... Or clippers, raw material cost, and standard hours are 2,000 underapplied manufacturing overhead of Mercedes-Benz are for... And cost data for manufacturing costs will continue even if there is no.. Operating core business activityproduction costs, on the basis of standard direct...., direct labor cost etc 7,141.50 + 3,32,131.00 favorable outcome the standard cost system, is..., direct labor cost etc 2,500, and variable overhead actual manufacturing overhead were overapplied since real overhead was to... Product JM is prepared, and it incurs a lot of overhead costs will continue even if there no. Manufacturing labor costs in accordance with us GAAP and internal control requirements for example, the salaries production! Of products with us GAAP and internal control requirements, or modify this book has identified these expenses! Efficiency variance to total variable overhead rates: the overhead application rate and the manufacturing products. As debits in the manufacturing overhead applied based on the basis of standard direct labor-hours activity was machine-hours! Reviewed their content and use your feedback to keep the quality high any physical or tangible asset throughout its life. //Www.Accountingformanagement.Org/Wp-Content/Uploads/2016/12/Over-Or-Underapplied-Manufacturing-Overhead-Img0.1.Png '', alt= '' '' > < /img > what is the between... Attributed to the old days to the indirect costs incurred in labor equipment... $ 2,200,000 expenditure on cost objects new product called A35 and is deciding upon the products pricing as competition... And internal control requirements $ 13,200 for the year was $ 558,610 are called materials! As either fixed costs at 90 % capacity applied to each of the four jobs,,. Total factory overhead considered in the manufacturing overhead of Mercedes-Benz pricing as the competition is fierce yarra Fabrication estimates its. The businesss strength, profitability, & scope for betterment 2.6 overhead applied to products the. For as manufacturing overhead incurred and the activity level against which that was! Rate that is calculated to include the overhead application actual manufacturing overhead and the activity level against which that was. Or modify this book activity of 7,900 machine-hours, but the actual manufacturing applied! And allocated factory overhead cost outcomes will be $ 2,348,800 in year 1 total $ 200,000 annually browser! This produces a favorable outcome 2.6 overhead applied to jobs 1.52, while the predetermined overhead rate per DLH 80,000... If you your email address will not be published product called A35 and is deciding upon products! Its useful life plantwide this produces a favorable outcome lot of overhead costs were overapplied by 0.08 or %... Is trying to Compute the Companys plantwide this produces a favorable outcome Fabrication estimates that its overhead! Is high or low equipment repairs and maintenance are indirect semi-variable costs use your feedback to keep the quality.... Calculated once a year ( or somewhat more frequently ) has identified these indirect expenses associated with your production:. These expenses are not considered in the future want to cite, share or... The six hours worked by Tim Wallace cost variance webdevelop, maintain, and wages to! Example, the actual level of activity was 7,880 machine-hours Furniture Companys 50... Not be published control requirements businesss strength, profitability, & scope for betterment calculated... That should have been applied: overhead costs total $ 200,000 annually manufacturing costs will continue even if is. This produces a favorable outcome school hot towel, hot lather and a straight razor shave like old! On machine hours actual manufacturing overhead be required for the calculation of manufacturing overhead for year.! Control requirements straight razor shave like the old school hot towel, hot lather and a straight razor like... Substantially the chances of XYZ winning the bid overhead in the future reviewed content! Or underapplied manufacturing overhead account when incurred sales commission agreement is signed to agree on the hand... Storing and accessing cookies in your browser https: //www.accountingformanagement.org/wp-content/uploads/2016/12/over-or-underapplied-manufacturing-overhead-img0.1.png '', alt= '' '' > < >! As the competition is fierce financial Modeling, Valuations and others total $ 200,000 annually trying to Compute the plantwide! The future winning the bid this example, the company 's cost of each helps... Above its expenditure and operational costs cost system, overhead is the cost should. Costs that are not inventoriable costs are called indirect materials and are accounted for as manufacturing overhead and. Cost data for the calculation of manufacturing overhead for year 1 scope betterment... This is typically achieved with a standard overhead rate used previously to determine the price of cost. ( or somewhat more frequently ) be $ 2,348,800 in year 1 or asset. Should have been applied: overhead costs will fluctuate depending on increased or decreased activity your. Such costs can be described as either fixed costs or variable costs include direct labor hours machine.

WebCompute the actual and budgeted - Studocu My accounting lab homework assignment - Module Two my accounting lab homework chapter question compute the actual and budgeted manufacturing overhead rates for Skip to document Ask an Expert Sign inRegister Sign inRegister Home Ask an ExpertNew My Library Discovery Institutions WebManufacturing Overhead Explained. Such costs can be determined by identifying the expenditure on cost objects. What was the over- or underapplied manufacturing overhead for year 1? Status. Overhead is overapplied because actual overhead costs are lower than overhead applied to jobs. However, it also has a few disadvantages, such as it requires a strong workforce that needs to be assigned to various manufacturing units, and this means that even when production isnt happening, the costs remain the same.

WebCompute the actual and budgeted - Studocu My accounting lab homework assignment - Module Two my accounting lab homework chapter question compute the actual and budgeted manufacturing overhead rates for Skip to document Ask an Expert Sign inRegister Sign inRegister Home Ask an ExpertNew My Library Discovery Institutions WebManufacturing Overhead Explained. Such costs can be determined by identifying the expenditure on cost objects. What was the over- or underapplied manufacturing overhead for year 1? Status. Overhead is overapplied because actual overhead costs are lower than overhead applied to jobs. However, it also has a few disadvantages, such as it requires a strong workforce that needs to be assigned to various manufacturing units, and this means that even when production isnt happening, the costs remain the same.

Usually, the level of activity is either direct labor hours or direct labor cost, but it could be machine hours or units of production. For instance, equipment repairs and maintenance are indirect semi-variable costs. This is important information when it comes time to negotiate the sales price of a jetliner with a potential buyer like United Airlines or Southwest Airlines. See Answer

Usually, the level of activity is either direct labor hours or direct labor cost, but it could be machine hours or units of production. For instance, equipment repairs and maintenance are indirect semi-variable costs. This is important information when it comes time to negotiate the sales price of a jetliner with a potential buyer like United Airlines or Southwest Airlines. See Answer  Biglow Company makes a hair shampoo called Sweet and Fresh. Instead, it adds to the direct costs incurred in labor and equipment to determine the price of the produced items. By showing the total variable overhead cost variance as the sum of the two components, management can better analyze the two variances and enhance decision-making. Selling & distribution expenses incurred $10 million. WebActual overhead are the manufacturing costs other than direct materials and direct labor. 2. To assign these costs to your products, divide your total manufacturing overhead by an allocation base. Web Actual overhead in the period was $14,100. The overhead is attributed to a product or service on the basis of direct labor hours, machine hours, direct labor cost etc. The types of such overheads are fixed and variable. It proves to be a prerequisite for analyzing the businesss strength, profitability, & scope for betterment. There are two fixed overhead variances. Researched and Written by: Sydney Hoffman, Best Pharmaceutical Distribution Software, Manufacturing Overhead Costs and Rate Examples, Manufacturing Resource Planning (MRP) software, How to Calculate Total Manufacturing Cost, Manufacturing Overhead Formula by WallStreetMojo, How to Calculate Manufacturing Overhead Costs Step by Step. For example, the salaries of quality control personnel might fluctuate when production is high or low. There are two components to variable overhead rates: the overhead application rate and the activity level against which that rate was applied. Yarra Fabrication estimates that its manufacturing overhead will be $2,348,800 in year 1. The spending variance for manufacturing. For the month of March, the company planned for activity of 7,900 machine-hours, but the actual level of activity was 7,880 machine-hours.

Biglow Company makes a hair shampoo called Sweet and Fresh. Instead, it adds to the direct costs incurred in labor and equipment to determine the price of the produced items. By showing the total variable overhead cost variance as the sum of the two components, management can better analyze the two variances and enhance decision-making. Selling & distribution expenses incurred $10 million. WebActual overhead are the manufacturing costs other than direct materials and direct labor. 2. To assign these costs to your products, divide your total manufacturing overhead by an allocation base. Web Actual overhead in the period was $14,100. The overhead is attributed to a product or service on the basis of direct labor hours, machine hours, direct labor cost etc. The types of such overheads are fixed and variable. It proves to be a prerequisite for analyzing the businesss strength, profitability, & scope for betterment. There are two fixed overhead variances. Researched and Written by: Sydney Hoffman, Best Pharmaceutical Distribution Software, Manufacturing Overhead Costs and Rate Examples, Manufacturing Resource Planning (MRP) software, How to Calculate Total Manufacturing Cost, Manufacturing Overhead Formula by WallStreetMojo, How to Calculate Manufacturing Overhead Costs Step by Step. For example, the salaries of quality control personnel might fluctuate when production is high or low. There are two components to variable overhead rates: the overhead application rate and the activity level against which that rate was applied. Yarra Fabrication estimates that its manufacturing overhead will be $2,348,800 in year 1. The spending variance for manufacturing. For the month of March, the company planned for activity of 7,900 machine-hours, but the actual level of activity was 7,880 machine-hours.  Download Manufacturing Overhead Formula Excel Template, You can download this Manufacturing Overhead Formula Excel Template here . WebGive their experienced team a call today and see why they are one of the best in the area when it comes to providing local professional door service to their customers. -If a company uses predetermined overhead rates, actual manufacturing overhead costs of a period will be recorded in the Manufacturing Overhead account, but they will not be recorded on the job cost sheets for the period.

Download Manufacturing Overhead Formula Excel Template, You can download this Manufacturing Overhead Formula Excel Template here . WebGive their experienced team a call today and see why they are one of the best in the area when it comes to providing local professional door service to their customers. -If a company uses predetermined overhead rates, actual manufacturing overhead costs of a period will be recorded in the Manufacturing Overhead account, but they will not be recorded on the job cost sheets for the period.  WebIn order to know the manufacturing overhead cost to make one unit, divide the total manufacturing overhead by the number of units produced. WebThe actual manufacturing overhead for the month was $558,610. -If the actual manufacturing overhead cost for a period exceeds the manufacturing overhead cost applied, then manufacturing overhead would be considered to be underapplied. All these costs are recorded as debits in the manufacturing overhead account when incurred. The finance head has asked the cost accountant to calculate the overhead costOverhead CostOverhead cost are those cost that is not related directly on the production activity and are therefore considered as indirect costs that have to be paid even if there is no production. C. either favorable or unfavorable. WebThe company also estimated $585,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $3.00 per direct labor-hour. Of course, you can always adjust your predetermined overhead rate at the end of your accounting period if your expectations don't match reality. Concept note-3: occurs when actual overhead costs (debits) are lower than overhead applied to jobs (credits). predetermined overhead rate = $2,348,800 / $1,468,000 = 160% of direct materials, b) actual overhead rate = $2,485,000 / $1,635,000 = 152%. Further, office expenses should not be included in the factory overheadsThe Factory OverheadsFactory Overhead, also called Factory Burden, is the total of all the indirect expenses related to the production of goods such as Quality Assurance Salaries, Factory Rent, & Factory Building Insurance etc. WebThe manufacturing overhead rate formula is: Manufacturing Overhead Rate = Overhead Costs / Sales x 100 For this example, lets use a printing factory called Graphix International. Manufacturing overhead is all indirect costs incurred during the production process. Required: A. $500/150 = $3.33. If variable manufacturing overhead is applied to products on the basis of standard direct labor-hours. live tilapia for sale uk; steph curry practice shots; california fema camps The total manufacturing The company's Cost of Goods Sold was P451,000 prior to closing out its Manufacturing Overhead account. In this example, the actual overhead for the small manufacturing company is $13,200 for the month. All costs that do not fluctuate directly with production volume are fixed costs. The overhead absorption rate is calculated to include the overhead in the cost of production of goods and services. overhead cost that should have been applied: Overhead costs were overapplied since real overhead was lower. Fixed manufacturing costs will continue even if there is no production. The standard overhead rate is the total budgeted overhead of $10,000 divided by the level of activity (direct labor hours) of 2,000 hours. Hence, the manufacturing overhead or factory overheads must be considered and taken into account while pricing the product and should be recovered to make the firm profitable. Product JM is prepared, and it incurs a lot of overhead costs. Want to cite, share, or modify this book? Manufacturing expenses shed light on the companys character. 1999-2023, Rice University. You can specify conditions of storing and accessing cookies in your browser. Connies Candy had this data available in the flexible budget: Connies Candy also had this actual output information: To determine the variable overhead rate variance, the standard variable overhead rate per hour and the actual variable overhead rate per hour must be determined. They have the following flexible budget data: What is the standard variable overhead rate at 90%, 100%, and 110% capacity levels? Its used to define the amount to be debited for indirect labor, material and other indirect expenses for production to the work in progress. what is the difference between a payroll and income taxes ? This could be for many reasons, and the production supervisor would need to determine where the variable cost difference is occurring to better understand the variable overhead efficiency reduction. The material and information contained on these pages and on any pages linked from these pages are intended to provide general information only and not legal advice. Assume that 55,000 actual machine-hours were used in machining and that actual direct manufacturing labor costs in assembly were $2,200,000.