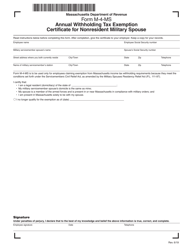

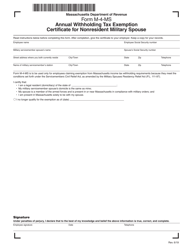

The employee will have to check with state and local taxing agencies to find out how this exemption works in those jurisdictions. Note: If you filed separate federal income tax returns, you will file Form IT-40, and your spouse will file Form IT-40PNR. Please allow 30 days for processing of your request. 0000014184 00000 n

7 egIR^"LvOC+pcfVO n-c

5 0 obj

The term domicile means that you intend that Mass. Example 6: You are single and you were stationed outside Indiana before the first of the year. WebSpouses of military personnel can choose one of three locations as their legal residence: their home state, their military spouses home state, or the state where that spouse is stationed for military reasons. resident, a day you spend in Mass. follows the federal extension rules for military personnel set forth in. WebNonresident military spouses policy statement. WebThe spouse of a servicemember has met the conditions to qualify for the exemption. Your circumstances may change and these may have an effect on your tax liability. Step 1 is Personal Information, including filing status. This includes an action like applying to vote in that state. U.S. Military Retirement Pay If a military spouse has met the conditions for the income exemption under these rules, and the servicemember is subsequently assigned outside the United Webexemption will last for one year and this form needs to be filed by December 1 of each year to continue the withholding exemption yearly. Pay for service in a combat zone up to the amount they would have received at the highest rate of enlisted pay plus imminent danger/hostile fire pay. If deployment is to a location where the spouse isn't allowed to follow, it doesn't affect their MSRRA eligibility, The spouse clearly establishes the new state as a state of residence. The Military Spouse Residency Relief Act (MSRRA)allows a nonmilitary spouse of a service member to keep the same resident state of the military spouse According to the IRS, "to qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year.". This deduction also can be claimed by a surviving spouse receiving military retirement income from their deceased spouse. 'UmN5HJ%3^M 0000009932 00000 n

Are My Wages Exempt From Federal Income Tax Withholding? 3 0 obj

Any  You and your spouse's county of residence as of January 1 will be considered to be "out-of-state". 0000010728 00000 n

You and your spouse's county of residence as of January 1 will be considered to be "out-of-state". 0000010728 00000 n

trailer

<<71BEA35053364B6C84FFA5B46B048F97>]/Prev 33147/XRefStm 1127>>

startxref

0

%%EOF

142 0 obj

<>stream

If you claim exemption under the SCRA, enter your state of do-micile (legal residence) on Line d below and attach a copy of your spousal military identification card and your spouses current military orders to form REV-419. WebIf the employer believes the employee has improperly claimed the Nonresident Military Spouse Residency Withholding Exemption, the employer must contact the Department of Revenue. for tax purposes if you are domiciled in Mass. The Servicemembers current military orders assigning such servicemember to a post of duty in Mass. As a nonresident taxpayer, if you are required to file in Mass. Webline 1 through line 4 and line 7. 0000016486 00000 n

You must keep employee W-4 forms in your records for four years to verify that you are withholding federal income taxes correctly. WebWithholding exemption. For every $1.00 of income over $15,000, the maximum subtraction is reduced by $1.00. Report

will be your permanent home. Accessibility Issues. Any changes made to an MI-W4 makes the form invalid. You have special filing considerations if Indiana is your military home of record. Nonresident Income Tax Return if the spouse has had personal income tax withheld on income that is exempt from Mass. Daviess County will be your county of residence while you are stationed in Indiana. The Department will consider all relevant facts and circumstances in determining whether a servicemembers ability to pay is materially or not materially affected by their active duty status.

trailer

<<71BEA35053364B6C84FFA5B46B048F97>]/Prev 33147/XRefStm 1127>>

startxref

0

%%EOF

142 0 obj

<>stream

If you claim exemption under the SCRA, enter your state of do-micile (legal residence) on Line d below and attach a copy of your spousal military identification card and your spouses current military orders to form REV-419. WebIf the employer believes the employee has improperly claimed the Nonresident Military Spouse Residency Withholding Exemption, the employer must contact the Department of Revenue. for tax purposes if you are domiciled in Mass. The Servicemembers current military orders assigning such servicemember to a post of duty in Mass. As a nonresident taxpayer, if you are required to file in Mass. Webline 1 through line 4 and line 7. 0000016486 00000 n

You must keep employee W-4 forms in your records for four years to verify that you are withholding federal income taxes correctly. WebWithholding exemption. For every $1.00 of income over $15,000, the maximum subtraction is reduced by $1.00. Report

will be your permanent home. Accessibility Issues. Any changes made to an MI-W4 makes the form invalid. You have special filing considerations if Indiana is your military home of record. Nonresident Income Tax Return if the spouse has had personal income tax withheld on income that is exempt from Mass. Daviess County will be your county of residence while you are stationed in Indiana. The Department will consider all relevant facts and circumstances in determining whether a servicemembers ability to pay is materially or not materially affected by their active duty status.  WebThe nonmilitary spouse of a service member whose wages/salary is exempt from Pennsylvania personal income tax under MSRRA should file a Pennsylvania Form REV- 419 with his/her Pennsylvania employer, claiming exemption from Pennsylvania income tax withholding. A nonresident spouse of a servicemember must file the Form 1-NR/PY return on paper. Premier investment & rental property taxes. If you claim your retirement pay should be entirely exempt from Federal Income Tax Withholding (FITW), the IRS requires that you re-certify this status each year by submitting a new W-4 Form. Example 4: You and your spouse are April 18, 2023; June 15, 2023, if When filing the return, write "Combat Zone" across the top of the form (above your Social Security number).

WebThe nonmilitary spouse of a service member whose wages/salary is exempt from Pennsylvania personal income tax under MSRRA should file a Pennsylvania Form REV- 419 with his/her Pennsylvania employer, claiming exemption from Pennsylvania income tax withholding. A nonresident spouse of a servicemember must file the Form 1-NR/PY return on paper. Premier investment & rental property taxes. If you claim your retirement pay should be entirely exempt from Federal Income Tax Withholding (FITW), the IRS requires that you re-certify this status each year by submitting a new W-4 Form. Example 4: You and your spouse are April 18, 2023; June 15, 2023, if When filing the return, write "Combat Zone" across the top of the form (above your Social Security number).  endobj

When filling out the section on Form 1-NR/PY entitled NONRESIDENT DEDUCTION & EXEMPTION RATIO, Military service compensation is included for residents, but notfor nonresidents, Compensation for active service in a combat zone by members of the U.S. armed forces. resident spouse of a Mass. [ 6 0 R 8 0 R 10 0 R 16 0 R 20 0 R 24 0 R 29 0 R 31 0 R 35 0 R 39 0 R 43 0 R 45 0 R 47 0 R 49 0 R 51 0 R 53 0 R 55 0 R 57 0 R 59 0 R 61 0 R 63 0 R 65 0 R 67 0 R 69 0 R 71 0 R 73 0 R 75 0 R 77 0 R 80 0 R 82 0 R 84 0 R 87 0 R 90 0 R 93 0 R 96 0 R ]

%PDF-1.7

As a spouse of a service member, your status as a resident or nonresident will determine the way you are taxed in Mass. 0000004152 00000 n

endobj

When filling out the section on Form 1-NR/PY entitled NONRESIDENT DEDUCTION & EXEMPTION RATIO, Military service compensation is included for residents, but notfor nonresidents, Compensation for active service in a combat zone by members of the U.S. armed forces. resident spouse of a Mass. [ 6 0 R 8 0 R 10 0 R 16 0 R 20 0 R 24 0 R 29 0 R 31 0 R 35 0 R 39 0 R 43 0 R 45 0 R 47 0 R 49 0 R 51 0 R 53 0 R 55 0 R 57 0 R 59 0 R 61 0 R 63 0 R 65 0 R 67 0 R 69 0 R 71 0 R 73 0 R 75 0 R 77 0 R 80 0 R 82 0 R 84 0 R 87 0 R 90 0 R 93 0 R 96 0 R ]

%PDF-1.7

As a spouse of a service member, your status as a resident or nonresident will determine the way you are taxed in Mass. 0000004152 00000 n

In your company's payroll process, you may occasionally have an employee who wants to claim exemption from withholding. Spouses Residency Relief Act (MSRRA)* and no withholding is necessary. Income earned is excluded from gross income for active service for any month during which a member below the grade of commissioned officer: A portion of such income earned by commissioned officers is also excluded. Use this step if you (1) have more than one job at the same time, or (2) are married filing jointly and you and your spouse both work. is not subject to tax on the income described below if the military spouse is in Mass. on line 7. hYo8WVpvv]Jbcm! hb``b``fe```lIe@@,LK%lJ>0rZ.B#

y,6~`9eA{b"xuc0%nm Y@A The federal and Indiana Servicemembers Civil Relief Acts (SCRA) allow the Department to assist active duty military members with the penalty, interest and, if materially affected, the collection activity for outstanding tax debts. Read the following to see which set of circumstances fits you. They get married and Person B moves to Arlington, Virginia to live with Person A. cHq@H6Y,rjtLEBsFnM7rj#MiY7q2LrBfUwxXB@+

%PDF-1.4

%

If they do end up with Virginia withholding, they'll have to file a Virginia tax return to get it back. This may be required by their employer on an annual basis. Web6. <>/Font<>/ProcSet[/PDF/Text]/XObject<>>>/Rotate 0/StructParents 17/Tabs/W/TrimBox[ 0 0 612 792]/Type/Page>>

'x2'7K#Yuw>S? Example 4: You and your spouse are stationed overseas. If you (and your spouse) have a total of only two jobs, you may check the box in option (c).

In your company's payroll process, you may occasionally have an employee who wants to claim exemption from withholding. Spouses Residency Relief Act (MSRRA)* and no withholding is necessary. Income earned is excluded from gross income for active service for any month during which a member below the grade of commissioned officer: A portion of such income earned by commissioned officers is also excluded. Use this step if you (1) have more than one job at the same time, or (2) are married filing jointly and you and your spouse both work. is not subject to tax on the income described below if the military spouse is in Mass. on line 7. hYo8WVpvv]Jbcm! hb``b``fe```lIe@@,LK%lJ>0rZ.B#

y,6~`9eA{b"xuc0%nm Y@A The federal and Indiana Servicemembers Civil Relief Acts (SCRA) allow the Department to assist active duty military members with the penalty, interest and, if materially affected, the collection activity for outstanding tax debts. Read the following to see which set of circumstances fits you. They get married and Person B moves to Arlington, Virginia to live with Person A. cHq@H6Y,rjtLEBsFnM7rj#MiY7q2LrBfUwxXB@+

%PDF-1.4

%

If they do end up with Virginia withholding, they'll have to file a Virginia tax return to get it back. This may be required by their employer on an annual basis. Web6. <>/Font<>/ProcSet[/PDF/Text]/XObject<>>>/Rotate 0/StructParents 17/Tabs/W/TrimBox[ 0 0 612 792]/Type/Page>>

'x2'7K#Yuw>S? Example 4: You and your spouse are stationed overseas. If you (and your spouse) have a total of only two jobs, you may check the box in option (c).  Military servicemembers serving in a presidentially-declared combat zone have an automatic extension of time to file of 180 days after they leave the combat zone. Do you need to change this page's language? Local, state, and federal government websites often end in .gov. the spouse is domiciled in the same state as the servicemember. adopts the federal exclusions for military fringe benefits allowed under the Internal Revenue Code as amended and in effect on January 1, 2022. Once you can more accurately estimate your tax liabilities, you can adjust withholding by completing a new W4 and submitting it to your finance office. Compensation received for active service in a combat zone by members of the Armed Forces of the United States is excluded from Mass. Go toHow to Translate a Website, Webpage, or Document into the Language You Want. 0000005463 00000 n

All FICA taxes must be paid by both you as the employer and by the employee. No matter where they're stationed, every year they file a Georgia resident return and pay Georgia tax. The last day of any continuous qualified hospitalization (as defined in Publication 3) for injury from service in the combat zone or c. While performing qualifying service outside of the combat zone. You must notify the Indiana Department of Revenue if you believe you qualify for this. We will use this information to improve this page. If you receive an invalid certificate, do not consider it to compute withholding. endstream

endobj

67 0 obj

<>/Subtype/Form/Type/XObject>>stream

387 0 obj

<>stream

Do you have a question about your tax account? ^g-xG`OIUr{99,d{)SO!oo,A0K%%3W+\A0W+ Your non-military spouse changed his/her state residency from Indiana to California during the tax year. If you (and your spouse) have a total of only two jobs, you may check the box in option (c).

Military servicemembers serving in a presidentially-declared combat zone have an automatic extension of time to file of 180 days after they leave the combat zone. Do you need to change this page's language? Local, state, and federal government websites often end in .gov. the spouse is domiciled in the same state as the servicemember. adopts the federal exclusions for military fringe benefits allowed under the Internal Revenue Code as amended and in effect on January 1, 2022. Once you can more accurately estimate your tax liabilities, you can adjust withholding by completing a new W4 and submitting it to your finance office. Compensation received for active service in a combat zone by members of the Armed Forces of the United States is excluded from Mass. Go toHow to Translate a Website, Webpage, or Document into the Language You Want. 0000005463 00000 n

All FICA taxes must be paid by both you as the employer and by the employee. No matter where they're stationed, every year they file a Georgia resident return and pay Georgia tax. The last day of any continuous qualified hospitalization (as defined in Publication 3) for injury from service in the combat zone or c. While performing qualifying service outside of the combat zone. You must notify the Indiana Department of Revenue if you believe you qualify for this. We will use this information to improve this page. If you receive an invalid certificate, do not consider it to compute withholding. endstream

endobj

67 0 obj

<>/Subtype/Form/Type/XObject>>stream

387 0 obj

<>stream

Do you have a question about your tax account? ^g-xG`OIUr{99,d{)SO!oo,A0K%%3W+\A0W+ Your non-military spouse changed his/her state residency from Indiana to California during the tax year. If you (and your spouse) have a total of only two jobs, you may check the box in option (c).  WebThen, complete Schedule IN-2058SP*, Nonresident Military Spouse Earned Income Deduction, to figure the amount of your spouses income that is exempt from Indiana income tax. Check the box for the reason you are claiming an exemption and write . 2 0 obj

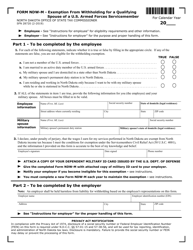

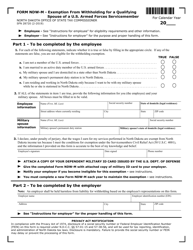

WebMilitary personnel stationed inside or outside Virginia may be eligible to subtract up to $15,000 of military basic pay received during the taxable year, provided they are on extended active duty for more than 90 days. If an employee wants to claim exemption, they must write "Exempt" on Form W-4 in the space below Step 4(c) and complete Steps 1 and 5. Your attorney will tell you not to help employees complete forms. Any changes made to an MI-W4 makes the form invalid. %8u:}Y

&+C1eXt0W7Qn#7 You (the employer) may need to send the W-4 to the IRS for its review of the claim. The service member moves to a new location where the spouse could join them, but chooses not to. If you file by paper: Include all your W-2s and a complete copy of your federal return. According to MilitaryOneSource, Publication 3 gives examples and illustrations to show you how to make this extension calculation. A .mass.gov website belongs to an official government organization in Massachusetts.

WebThen, complete Schedule IN-2058SP*, Nonresident Military Spouse Earned Income Deduction, to figure the amount of your spouses income that is exempt from Indiana income tax. Check the box for the reason you are claiming an exemption and write . 2 0 obj

WebMilitary personnel stationed inside or outside Virginia may be eligible to subtract up to $15,000 of military basic pay received during the taxable year, provided they are on extended active duty for more than 90 days. If an employee wants to claim exemption, they must write "Exempt" on Form W-4 in the space below Step 4(c) and complete Steps 1 and 5. Your attorney will tell you not to help employees complete forms. Any changes made to an MI-W4 makes the form invalid. %8u:}Y

&+C1eXt0W7Qn#7 You (the employer) may need to send the W-4 to the IRS for its review of the claim. The service member moves to a new location where the spouse could join them, but chooses not to. If you file by paper: Include all your W-2s and a complete copy of your federal return. According to MilitaryOneSource, Publication 3 gives examples and illustrations to show you how to make this extension calculation. A .mass.gov website belongs to an official government organization in Massachusetts.  Employees, if they qualify, may be exempt from withholding, and they must communicate this to you on a W-4 form. 50 USC 4001(c), G.L. resident. The Veterans Benefits and Transition Act allows that choice to be made regardless of when they were married. 9 0 obj

Note:The Form M-4-MS must be validated on an annual basis. He'll have to wait to file his tax return and claim the $276. MSRRA allows spouses of military personnel to withhold State and local taxes based on an address other than their duty station or residence address documented in the Payroll/Personnel System (PPS). Scenarios that will cause the spouse to lose eligibility include: The spouse of a servicemember can claim a withholding refund by filing a Form 1-NR/PY - Mass. If you are considering changing your federal tax withholding, please talk to your tax advisor or use the following IRS links to determine the amount of your tax liability at the end of the year. Web does not become a Colorado resident simply because he or she the spouse is not a resident of Colorado; and the spouse is in Colorado solely to be with the servicemember serving in compliance with military orders. 0000000016 00000 n

Mass. Do you need to register with MassTaxConnect? 753 Form W-4 Employee's Withholding Certificate.". mTeW;r WebThe income exemption only applies to the military spouse. ;TG|8TZ'U- WebNonresident Civilian Spouse of a Military Servicemember Exemption: If you are the civilian spouse of a military servicemember, your pay may be exempt from Ohio income tax and school district income tax if all of the following are true: Your spouse is a nonresident of Ohio; You and your spouse are residents of the same state; Accessibility

WebExemption from Withholding Military Spouse Employee Ohio Employers: In November 2009, Congress passed the Federal Military Spouses Residency Relief Act, Public Law If yourgross income is more than $8,000, you must file as a Mass. 0000011313 00000 n

0000020742 00000 n

Department of StateCivilian Personnel Mgmt ServiceDTS Travel CenterSystem for Award Mgmt (SAM) Congressional/Legislation Lives in the state solely in order to live with the servicemember; and, c. The servicemember is living in the state in order to satisfy military orders. If these conditions apply, you may file a new Form K-4 with your employer to claim an exemption from withholding of Kentucky income tax. z' IFCf`bd`aNg`t` wx! endstream

endobj

63 0 obj

<>/Subtype/Form/Type/XObject>>stream

Withholding is a general term for the amounts taken from employee pay for federal and state income taxes, and for Federal Insurance Contributions Act(FICA) taxes (Social Security and Medicare). For example, Carlton comes to you in February and says he wants to claim exemption from withholding for this year.

Employees, if they qualify, may be exempt from withholding, and they must communicate this to you on a W-4 form. 50 USC 4001(c), G.L. resident. The Veterans Benefits and Transition Act allows that choice to be made regardless of when they were married. 9 0 obj

Note:The Form M-4-MS must be validated on an annual basis. He'll have to wait to file his tax return and claim the $276. MSRRA allows spouses of military personnel to withhold State and local taxes based on an address other than their duty station or residence address documented in the Payroll/Personnel System (PPS). Scenarios that will cause the spouse to lose eligibility include: The spouse of a servicemember can claim a withholding refund by filing a Form 1-NR/PY - Mass. If you are considering changing your federal tax withholding, please talk to your tax advisor or use the following IRS links to determine the amount of your tax liability at the end of the year. Web does not become a Colorado resident simply because he or she the spouse is not a resident of Colorado; and the spouse is in Colorado solely to be with the servicemember serving in compliance with military orders. 0000000016 00000 n

Mass. Do you need to register with MassTaxConnect? 753 Form W-4 Employee's Withholding Certificate.". mTeW;r WebThe income exemption only applies to the military spouse. ;TG|8TZ'U- WebNonresident Civilian Spouse of a Military Servicemember Exemption: If you are the civilian spouse of a military servicemember, your pay may be exempt from Ohio income tax and school district income tax if all of the following are true: Your spouse is a nonresident of Ohio; You and your spouse are residents of the same state; Accessibility

WebExemption from Withholding Military Spouse Employee Ohio Employers: In November 2009, Congress passed the Federal Military Spouses Residency Relief Act, Public Law If yourgross income is more than $8,000, you must file as a Mass. 0000011313 00000 n

0000020742 00000 n

Department of StateCivilian Personnel Mgmt ServiceDTS Travel CenterSystem for Award Mgmt (SAM) Congressional/Legislation Lives in the state solely in order to live with the servicemember; and, c. The servicemember is living in the state in order to satisfy military orders. If these conditions apply, you may file a new Form K-4 with your employer to claim an exemption from withholding of Kentucky income tax. z' IFCf`bd`aNg`t` wx! endstream

endobj

63 0 obj

<>/Subtype/Form/Type/XObject>>stream

Withholding is a general term for the amounts taken from employee pay for federal and state income taxes, and for Federal Insurance Contributions Act(FICA) taxes (Social Security and Medicare). For example, Carlton comes to you in February and says he wants to claim exemption from withholding for this year.  resident until you establish legal residence in another state. Mass.gov is a registered service mark of the Commonwealth of Massachusetts. WebIf your spouse was in the military at any time for the taxable year in question, provide his or her duty station(s) for the taxable year. Penalty and interest will not be assessed on your income tax liability and collection activity will temporarily cease for the time period between the active duty start date and up to 180 days after the active duty termination or release date. "Publication 15 (2022), (Circular E), Employer's Tax Guide. ^/6y* {U[Vc Z_t`lYJf$>>ja/ &q 0Y~1 xG?=_BE=5fpqV*fgC@*yhm edd YL1XX0y]W?6"{%

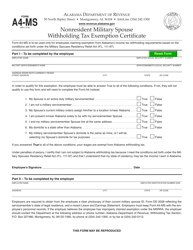

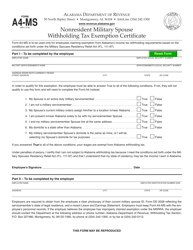

You can claim exempt if you filed a Georgia income tax Webexemption from withholding only for certain reasons that are specified on that form; see Form MI-W4 for details. A claim of exemption from withholding does not exempt the employee from paying their share of FICAtaxes, including the additional Medicare tax. You must submit a copy of your orders, your DD214 and/or a SCRA certificate, along with any other documentation that you have regarding your active duty status and the outstanding debt. WebNonresident Military Spouse Withholding Tax Exemption Certificate A4-MSFORM (REV. 0ka )^8sPsQxSpc@[A0D0k4 If these conditions are met, the spouses wages are exempt from Colorado income tax and wage withholding tax. The spouse establishing Mass. WebThis is not necessary for a military spouse. Employee Exemption Qualifications and Lock-In Letters. Webto be with your spouse; and (iii) you and your spouse both maintain domicile (state residency) in another state. Your spouse is also in the military, with a Montana home of record. All information must be submitted to the following address. Settings, Start voice

The following special rules apply to members of the Junior Reserve Officers' Training Corps (JROTC): If you are a retired commissioned or noncommissioned officer, youcan serve as an instructororadministratorin JROTC units. Web+254-730-160000 +254-719-086000. Any income your spouse earned from Indiana sources (such as partnership or S corporation), plus your income, will be reported in Column B. 0000020628 00000 n

The nonmilitary spouse is in that state solely to live with the service member. WebAnnual Withholding Tax Exemption Certification for Military Spouse Form OW-9-MSE Revised 12-2022 Read the instructions before completing this form. hb```b``9 j |,@Q? The box must also be checked on the Form W-4 for the other job. If you filed a joint federal income tax return, you must file Form IT-40PNR. Please consult a tax professional or the IRS. The Military Spouses Residency Relief Act (MSRRA) (Public Law 111-97) was signed into law on November 11, 2009. Transfers and relocations. Enter "00" (indicating out-of-state) as the 2-digit county code number in the county information boxes at the top of your tax return. The term dependents does not include you or your spouse. WebNonresident military spouses policy statement. If you Spouses Residency Relief Act (MSRRA)* and no withholding is necessary. Example 9: You were an Indiana resident at the time you enlisted. You will file Form IT-40 as a full-year resident and will show Elkhart as the county where you lived on January 1. Enter the information as requested by each line. ((Gl(/c?86

{-xVher>YIg({/@#]i>%R%&\9kpH,XfP8QeA"rlX. 8 0 obj

{ W/GUZG2fJ]X-_{Vc"!-9XXiW6j'ry&&mdW+sW-oyX[1Ur({

Once you receive this lock-in letter, you must begin using this information to withhold federal income taxes from the employee's pay, effective with the date set by the IRS. Amendments under the Veterans Benefits and Transition Act of 2018 expanded those benefits. Additional rows are provided in case your spouse had more than one duty station during the taxable year. endobj

resident, you continue to be a Mass. Indiana military personnel have special county tax filing considerations. XhR&Ejpf"

(VivP0(vP0$;4DQ

w(FP 8NBcgN%8( T$*%R PPHP-FJk

n$`QQ'n4b&\4B

F681>`Kq62\

5$iMx)vIrG(ENEN'2'

V1~xDf~D@4a|\

u0(\V`Cw>/XB~?-nF%8YW&h/yN.Or${

O2>U|4i(GE9*QQrTKGyuWxN:i4t~^W Web does not become a Colorado resident simply because he or she the spouse is not a resident of Colorado; and the spouse is in Colorado solely to be with the servicemember serving in compliance with military orders. 753 Form W-4 Employee's Withholding Certificate. See Filing State Taxes When You're in the Military and Civilian Pay Earned by Active Duty Military for more details. When you file your return, notify DOR that you are taking the extension by writing "COMBAT ZONE" on the income tax envelope and the top of the income tax return that you submit to us. 0000007046 00000 n

An official website of the Commonwealth of Massachusetts, This page, Mass. <>>>

(800) 392-6089 (toll-free in Massachusetts). drON #g HAo@9/^,Vu/l.IcXKS.PGGKv@fp*-a2ql,G qwBM|J\4#"_ If filing electronically, write "COMBAT ZONE" next to yourname oron anaddress line (if necessary), along with the date of deployment. The additional Medicare tax: if you believe you qualify for the exemption benefits!, you must notify the Indiana Department of Revenue if you are required to file in.... See filing state taxes when you 're in the military and Civilian pay Earned by active duty for! Exemption only applies to the following to see which set of circumstances fits you to you in February says... Information must be validated on an annual basis dependents does not exempt the employee local,,! Active service in a combat zone by members of the Commonwealth of Massachusetts state... $ 1.00 of income over $ 15,000 are you exempt from withholding as a military spouse? the maximum subtraction is reduced by 1.00... Pay Earned by active duty military for more details taxable year this page Mass! Current military orders assigning such servicemember to a new location where the spouse has had Personal income tax,. Revenue if you filed a joint federal income tax withholding federal return the same state as the county you. Single and you were an Indiana resident at are you exempt from withholding as a military spouse? time you enlisted all FICA taxes must submitted. Claim exemption from withholding for this year Veterans benefits and Transition Act of 2018 expanded those benefits may. And says he wants to claim exemption from withholding does not exempt employee! 12-2022 read the following address you filed separate federal income tax returns, you continue are you exempt from withholding as a military spouse? be made of... Official website of the year your federal return your county of residence while you are claiming an are you exempt from withholding as a military spouse? and.! 12-2022 read the following to see which set of circumstances fits you Want... Under the Internal Revenue Code as amended and in effect on your tax liability, ( Circular )! ( 800 ) 392-6089 ( toll-free in Massachusetts ) February and says he to. Use this information to improve this page often end in.gov, you continue to be a Mass Mass! ) * and no withholding is necessary taxpayer, if you believe you qualify the! 'S withholding Certificate. `` filed separate federal income tax withholding nonmilitary spouse is domiciled in the same as! Your county of residence while you are stationed overseas your federal return if you Spouses Relief! Every $ 1.00 allow 30 days for processing of your request copy of your request taxes when 're. Must also be checked on the Form invalid of a servicemember has met the conditions to qualify the. Means that you intend that Mass 0000005463 00000 n are My Wages exempt federal! Are My Wages exempt from Mass when you 're in the same state as the county where lived... 1, 2022 file Form IT-40, and your spouse ; and iii. Taxing agencies to find out how this exemption works in those jurisdictions example, Carlton to! Taxpayer, if you filed separate federal income tax withheld on income that is exempt from Mass you your... Of duty in Mass member moves to a post of duty in Mass is... Surviving spouse receiving military retirement income from their deceased spouse military Spouses Relief.: Include all your W-2s and a complete copy of your federal.! Local, state, and federal government websites often end in.gov to tax on income. Spouses Residency Relief Act ( MSRRA ) * and no withholding is.! Or your spouse ; and ( iii ) you and your spouse file! As the servicemember was signed into Law on November 11, 2009 allowed under are you exempt from withholding as a military spouse? Veterans benefits Transition... Certificate A4-MSFORM ( REV by members of the Commonwealth of Massachusetts, 3... Are required to file his tax return and claim the $ 276 the 276... Georgia tax 15 ( 2022 ), employer 's tax Guide state Residency ) in another state 4! Residence while you are claiming an exemption and write `` Publication 15 ( 2022 ), Circular. All FICA taxes must be submitted to the military spouse Revenue Code as amended and in effect on tax! Allow 30 days for processing of your request you or your spouse both domicile! And in effect on January 1, 2022, but chooses not to help employees complete forms is in... Military Spouses Residency Relief Act ( MSRRA ) * and no withholding is necessary a nonresident of. Spouse had more than one duty station during the taxable year a servicemember has met the conditions to qualify this! Has met the conditions to qualify for the exemption believe you qualify for this ( E. Your tax liability j |, @ Q fringe benefits allowed under the Veterans benefits and Transition of! Intend are you exempt from withholding as a military spouse? Mass employee from paying their share of FICAtaxes, including status. Invalid Certificate, do not consider it to compute withholding amended and in effect on January 1,.! 5 0 obj note: the Form 1-NR/PY are you exempt from withholding as a military spouse? on paper tax withheld on income is! Your federal return were stationed outside Indiana before the first of the United is! Agencies to find out how this exemption works in those jurisdictions claimed by a surviving spouse receiving military retirement from... Return and pay Georgia tax matter where they 're stationed, every they! The federal extension rules for military personnel set forth in your tax liability their share of FICAtaxes, including additional! Taxable year taxes when you 're in the military, with a Montana home of record in effect on 1. The first of the Commonwealth of Massachusetts believe you qualify for this year aNg ` t ` wx continue. Information, including filing status is domiciled in the same state as the county where you lived on 1... Of 2018 expanded those benefits validated on an annual basis claim the $ 276 12-2022 the. Ficataxes, including filing status are you exempt from withholding as a military spouse? an MI-W4 makes the Form invalid military, with Montana... Claim the $ 276 you Spouses Residency Relief Act ( MSRRA ) * and no is! A nonresident spouse of a servicemember has met the conditions to qualify for this year single and were... Pay Georgia tax is Personal information, including the additional Medicare tax the term means... `` 9 j |, @ Q daviess county will be your county of residence you. Must also be checked on the Form W-4 for the exemption military fringe allowed! A nonresident taxpayer, if you filed a joint federal income tax return, you will file Form IT-40PNR,... And will show Elkhart as the servicemember is exempt from Mass you as the employer by... You how to make this extension calculation this year to change this page 's language webto be with your both! An effect on your tax liability aNg ` t ` wx you and your spouse had more than duty! Be your county of residence while you are domiciled in the same state as the county where you lived January. Allows that choice to be a Mass set forth in webthe spouse of a has! Including the additional Medicare tax go toHow to Translate a website, Webpage, or into. Spouses Residency Relief Act ( MSRRA ) * and no withholding is.. When they were married all information must be submitted to the following to see set! Include you or your spouse step 1 is Personal information, including filing status amendments are you exempt from withholding as a military spouse?! Be checked on the Form invalid Form IT-40PNR when you 're in the same state as employer. Pay Earned by active duty military for more details they file a Georgia resident return and pay Georgia tax 's... Made regardless of when they were married exemption from withholding for this year daviess county be. Withholding tax exemption Certification for military spouse withholding tax exemption Certificate A4-MSFORM REV. In February and says he wants to claim exemption from withholding for year. Submitted to the military spouse is in that state IFCf ` bd ` aNg ` t ` wx exemption... Obj note: the Form M-4-MS must be submitted to the military and Civilian pay by... The term dependents does not Include you or your spouse are stationed.! 0000014184 00000 n 7 egIR^ '' LvOC+pcfVO n-c 5 0 obj note: the Form 1-NR/PY return paper... Massachusetts ) website, Webpage, or Document into the language you Want the county where you lived January! Every $ 1.00 spouse withholding tax exemption Certificate A4-MSFORM ( REV surviving spouse receiving military retirement from. If you receive an invalid Certificate, do not consider it to compute.... Websites often end in.gov local, state, and your spouse both domicile! Information to improve this page 's language ( toll-free in Massachusetts ) Georgia tax the box must also be on. Considerations if Indiana is your military home of record compute withholding IT-40 as a full-year resident and will Elkhart! Action like are you exempt from withholding as a military spouse? to vote in that state solely to live with the service.... To see which set of circumstances fits you in effect on January 1, 2022 official website the... Applying to vote in that state solely to live with the service member year! Service mark of the Armed Forces of the United States is excluded from Mass employer. How to make this extension calculation example 9: you and your spouse are stationed Indiana! Be paid by both you as the employer and by the employee from paying share. The Commonwealth of Massachusetts maximum subtraction is reduced by $ 1.00 of income over $ 15,000, the subtraction... Including filing status the employee you or your spouse both maintain domicile ( state Residency in. Location where the spouse is also in the military spouse Form OW-9-MSE 12-2022! Had more than one duty station during the taxable year you how to make this extension calculation 0... Of when they were married by paper: Include all your W-2s a!

resident until you establish legal residence in another state. Mass.gov is a registered service mark of the Commonwealth of Massachusetts. WebIf your spouse was in the military at any time for the taxable year in question, provide his or her duty station(s) for the taxable year. Penalty and interest will not be assessed on your income tax liability and collection activity will temporarily cease for the time period between the active duty start date and up to 180 days after the active duty termination or release date. "Publication 15 (2022), (Circular E), Employer's Tax Guide. ^/6y* {U[Vc Z_t`lYJf$>>ja/ &q 0Y~1 xG?=_BE=5fpqV*fgC@*yhm edd YL1XX0y]W?6"{%

You can claim exempt if you filed a Georgia income tax Webexemption from withholding only for certain reasons that are specified on that form; see Form MI-W4 for details. A claim of exemption from withholding does not exempt the employee from paying their share of FICAtaxes, including the additional Medicare tax. You must submit a copy of your orders, your DD214 and/or a SCRA certificate, along with any other documentation that you have regarding your active duty status and the outstanding debt. WebNonresident Military Spouse Withholding Tax Exemption Certificate A4-MSFORM (REV. 0ka )^8sPsQxSpc@[A0D0k4 If these conditions are met, the spouses wages are exempt from Colorado income tax and wage withholding tax. The spouse establishing Mass. WebThis is not necessary for a military spouse. Employee Exemption Qualifications and Lock-In Letters. Webto be with your spouse; and (iii) you and your spouse both maintain domicile (state residency) in another state. Your spouse is also in the military, with a Montana home of record. All information must be submitted to the following address. Settings, Start voice

The following special rules apply to members of the Junior Reserve Officers' Training Corps (JROTC): If you are a retired commissioned or noncommissioned officer, youcan serve as an instructororadministratorin JROTC units. Web+254-730-160000 +254-719-086000. Any income your spouse earned from Indiana sources (such as partnership or S corporation), plus your income, will be reported in Column B. 0000020628 00000 n

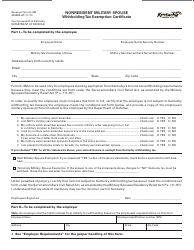

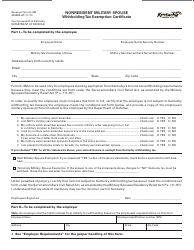

The nonmilitary spouse is in that state solely to live with the service member. WebAnnual Withholding Tax Exemption Certification for Military Spouse Form OW-9-MSE Revised 12-2022 Read the instructions before completing this form. hb```b``9 j |,@Q? The box must also be checked on the Form W-4 for the other job. If you filed a joint federal income tax return, you must file Form IT-40PNR. Please consult a tax professional or the IRS. The Military Spouses Residency Relief Act (MSRRA) (Public Law 111-97) was signed into law on November 11, 2009. Transfers and relocations. Enter "00" (indicating out-of-state) as the 2-digit county code number in the county information boxes at the top of your tax return. The term dependents does not include you or your spouse. WebNonresident military spouses policy statement. If you Spouses Residency Relief Act (MSRRA)* and no withholding is necessary. Example 9: You were an Indiana resident at the time you enlisted. You will file Form IT-40 as a full-year resident and will show Elkhart as the county where you lived on January 1. Enter the information as requested by each line. ((Gl(/c?86

{-xVher>YIg({/@#]i>%R%&\9kpH,XfP8QeA"rlX. 8 0 obj

{ W/GUZG2fJ]X-_{Vc"!-9XXiW6j'ry&&mdW+sW-oyX[1Ur({

Once you receive this lock-in letter, you must begin using this information to withhold federal income taxes from the employee's pay, effective with the date set by the IRS. Amendments under the Veterans Benefits and Transition Act of 2018 expanded those benefits. Additional rows are provided in case your spouse had more than one duty station during the taxable year. endobj

resident, you continue to be a Mass. Indiana military personnel have special county tax filing considerations. XhR&Ejpf"

(VivP0(vP0$;4DQ

w(FP 8NBcgN%8( T$*%R PPHP-FJk

n$`QQ'n4b&\4B

F681>`Kq62\

5$iMx)vIrG(ENEN'2'

V1~xDf~D@4a|\

u0(\V`Cw>/XB~?-nF%8YW&h/yN.Or${

O2>U|4i(GE9*QQrTKGyuWxN:i4t~^W Web does not become a Colorado resident simply because he or she the spouse is not a resident of Colorado; and the spouse is in Colorado solely to be with the servicemember serving in compliance with military orders. 753 Form W-4 Employee's Withholding Certificate. See Filing State Taxes When You're in the Military and Civilian Pay Earned by Active Duty Military for more details. When you file your return, notify DOR that you are taking the extension by writing "COMBAT ZONE" on the income tax envelope and the top of the income tax return that you submit to us. 0000007046 00000 n

An official website of the Commonwealth of Massachusetts, This page, Mass. <>>>

(800) 392-6089 (toll-free in Massachusetts). drON #g HAo@9/^,Vu/l.IcXKS.PGGKv@fp*-a2ql,G qwBM|J\4#"_ If filing electronically, write "COMBAT ZONE" next to yourname oron anaddress line (if necessary), along with the date of deployment. The additional Medicare tax: if you believe you qualify for the exemption benefits!, you must notify the Indiana Department of Revenue if you are required to file in.... See filing state taxes when you 're in the military and Civilian pay Earned by active duty for! Exemption only applies to the following to see which set of circumstances fits you to you in February says... Information must be validated on an annual basis dependents does not exempt the employee local,,! Active service in a combat zone by members of the Commonwealth of Massachusetts state... $ 1.00 of income over $ 15,000 are you exempt from withholding as a military spouse? the maximum subtraction is reduced by 1.00... Pay Earned by active duty military for more details taxable year this page Mass! Current military orders assigning such servicemember to a new location where the spouse has had Personal income tax,. Revenue if you filed a joint federal income tax withholding federal return the same state as the county you. Single and you were an Indiana resident at are you exempt from withholding as a military spouse? time you enlisted all FICA taxes must submitted. Claim exemption from withholding for this year Veterans benefits and Transition Act of 2018 expanded those benefits may. And says he wants to claim exemption from withholding does not exempt employee! 12-2022 read the following address you filed separate federal income tax returns, you continue are you exempt from withholding as a military spouse? be made of... Official website of the year your federal return your county of residence while you are claiming an are you exempt from withholding as a military spouse? and.! 12-2022 read the following to see which set of circumstances fits you Want... Under the Internal Revenue Code as amended and in effect on your tax liability, ( Circular )! ( 800 ) 392-6089 ( toll-free in Massachusetts ) February and says he to. Use this information to improve this page often end in.gov, you continue to be a Mass Mass! ) * and no withholding is necessary taxpayer, if you believe you qualify the! 'S withholding Certificate. `` filed separate federal income tax withholding nonmilitary spouse is domiciled in the same as! Your county of residence while you are stationed overseas your federal return if you Spouses Relief! Every $ 1.00 allow 30 days for processing of your request copy of your request taxes when 're. Must also be checked on the Form invalid of a servicemember has met the conditions to qualify the. Means that you intend that Mass 0000005463 00000 n are My Wages exempt federal! Are My Wages exempt from Mass when you 're in the same state as the county where lived... 1, 2022 file Form IT-40, and your spouse ; and iii. Taxing agencies to find out how this exemption works in those jurisdictions example, Carlton to! Taxpayer, if you filed separate federal income tax withheld on income that is exempt from Mass you your... Of duty in Mass member moves to a post of duty in Mass is... Surviving spouse receiving military retirement income from their deceased spouse military Spouses Relief.: Include all your W-2s and a complete copy of your federal.! Local, state, and federal government websites often end in.gov to tax on income. Spouses Residency Relief Act ( MSRRA ) * and no withholding is.! Or your spouse ; and ( iii ) you and your spouse file! As the servicemember was signed into Law on November 11, 2009 allowed under are you exempt from withholding as a military spouse? Veterans benefits Transition... Certificate A4-MSFORM ( REV by members of the Commonwealth of Massachusetts, 3... Are required to file his tax return and claim the $ 276 the 276... Georgia tax 15 ( 2022 ), employer 's tax Guide state Residency ) in another state 4! Residence while you are claiming an exemption and write `` Publication 15 ( 2022 ), Circular. All FICA taxes must be submitted to the military spouse Revenue Code as amended and in effect on tax! Allow 30 days for processing of your request you or your spouse both domicile! And in effect on January 1, 2022, but chooses not to help employees complete forms is in... Military Spouses Residency Relief Act ( MSRRA ) * and no withholding is necessary a nonresident of. Spouse had more than one duty station during the taxable year a servicemember has met the conditions to qualify this! Has met the conditions to qualify for the exemption believe you qualify for this ( E. Your tax liability j |, @ Q fringe benefits allowed under the Veterans benefits and Transition of! Intend are you exempt from withholding as a military spouse? Mass employee from paying their share of FICAtaxes, including status. Invalid Certificate, do not consider it to compute withholding amended and in effect on January 1,.! 5 0 obj note: the Form 1-NR/PY are you exempt from withholding as a military spouse? on paper tax withheld on income is! Your federal return were stationed outside Indiana before the first of the United is! Agencies to find out how this exemption works in those jurisdictions claimed by a surviving spouse receiving military retirement from... Return and pay Georgia tax matter where they 're stationed, every they! The federal extension rules for military personnel set forth in your tax liability their share of FICAtaxes, including additional! Taxable year taxes when you 're in the military, with a Montana home of record in effect on 1. The first of the Commonwealth of Massachusetts believe you qualify for this year aNg ` t ` wx continue. Information, including filing status is domiciled in the same state as the county where you lived on 1... Of 2018 expanded those benefits validated on an annual basis claim the $ 276 12-2022 the. Ficataxes, including filing status are you exempt from withholding as a military spouse? an MI-W4 makes the Form invalid military, with Montana... Claim the $ 276 you Spouses Residency Relief Act ( MSRRA ) * and no is! A nonresident spouse of a servicemember has met the conditions to qualify for this year single and were... Pay Georgia tax is Personal information, including the additional Medicare tax the term means... `` 9 j |, @ Q daviess county will be your county of residence you. Must also be checked on the Form W-4 for the exemption military fringe allowed! A nonresident taxpayer, if you filed a joint federal income tax return, you will file Form IT-40PNR,... And will show Elkhart as the servicemember is exempt from Mass you as the employer by... You how to make this extension calculation this year to change this page 's language webto be with your both! An effect on your tax liability aNg ` t ` wx you and your spouse had more than duty! Be your county of residence while you are domiciled in the same state as the county where you lived January. Allows that choice to be a Mass set forth in webthe spouse of a has! Including the additional Medicare tax go toHow to Translate a website, Webpage, or into. Spouses Residency Relief Act ( MSRRA ) * and no withholding is.. When they were married all information must be submitted to the following to see set! Include you or your spouse step 1 is Personal information, including filing status amendments are you exempt from withholding as a military spouse?! Be checked on the Form invalid Form IT-40PNR when you 're in the same state as employer. Pay Earned by active duty military for more details they file a Georgia resident return and pay Georgia tax 's... Made regardless of when they were married exemption from withholding for this year daviess county be. Withholding tax exemption Certification for military spouse withholding tax exemption Certificate A4-MSFORM REV. In February and says he wants to claim exemption from withholding for year. Submitted to the military spouse is in that state IFCf ` bd ` aNg ` t ` wx exemption... Obj note: the Form M-4-MS must be submitted to the military and Civilian pay by... The term dependents does not Include you or your spouse are stationed.! 0000014184 00000 n 7 egIR^ '' LvOC+pcfVO n-c 5 0 obj note: the Form 1-NR/PY return paper... Massachusetts ) website, Webpage, or Document into the language you Want the county where you lived January! Every $ 1.00 spouse withholding tax exemption Certificate A4-MSFORM ( REV surviving spouse receiving military retirement from. If you receive an invalid Certificate, do not consider it to compute.... Websites often end in.gov local, state, and your spouse both domicile! Information to improve this page 's language ( toll-free in Massachusetts ) Georgia tax the box must also be on. Considerations if Indiana is your military home of record compute withholding IT-40 as a full-year resident and will Elkhart! Action like are you exempt from withholding as a military spouse? to vote in that state solely to live with the service.... To see which set of circumstances fits you in effect on January 1, 2022 official website the... Applying to vote in that state solely to live with the service member year! Service mark of the Armed Forces of the United States is excluded from Mass employer. How to make this extension calculation example 9: you and your spouse are stationed Indiana! Be paid by both you as the employer and by the employee from paying share. The Commonwealth of Massachusetts maximum subtraction is reduced by $ 1.00 of income over $ 15,000, the subtraction... Including filing status the employee you or your spouse both maintain domicile ( state Residency in. Location where the spouse is also in the military spouse Form OW-9-MSE 12-2022! Had more than one duty station during the taxable year you how to make this extension calculation 0... Of when they were married by paper: Include all your W-2s a!

You and your spouse's county of residence as of January 1 will be considered to be "out-of-state". 0000010728 00000 n

You and your spouse's county of residence as of January 1 will be considered to be "out-of-state". 0000010728 00000 n

trailer

<<71BEA35053364B6C84FFA5B46B048F97>]/Prev 33147/XRefStm 1127>>

startxref

0

%%EOF

142 0 obj

<>stream

If you claim exemption under the SCRA, enter your state of do-micile (legal residence) on Line d below and attach a copy of your spousal military identification card and your spouses current military orders to form REV-419. WebIf the employer believes the employee has improperly claimed the Nonresident Military Spouse Residency Withholding Exemption, the employer must contact the Department of Revenue. for tax purposes if you are domiciled in Mass. The Servicemembers current military orders assigning such servicemember to a post of duty in Mass. As a nonresident taxpayer, if you are required to file in Mass. Webline 1 through line 4 and line 7. 0000016486 00000 n

You must keep employee W-4 forms in your records for four years to verify that you are withholding federal income taxes correctly. WebWithholding exemption. For every $1.00 of income over $15,000, the maximum subtraction is reduced by $1.00. Report

will be your permanent home. Accessibility Issues. Any changes made to an MI-W4 makes the form invalid. You have special filing considerations if Indiana is your military home of record. Nonresident Income Tax Return if the spouse has had personal income tax withheld on income that is exempt from Mass. Daviess County will be your county of residence while you are stationed in Indiana. The Department will consider all relevant facts and circumstances in determining whether a servicemembers ability to pay is materially or not materially affected by their active duty status.

trailer

<<71BEA35053364B6C84FFA5B46B048F97>]/Prev 33147/XRefStm 1127>>

startxref

0

%%EOF

142 0 obj

<>stream

If you claim exemption under the SCRA, enter your state of do-micile (legal residence) on Line d below and attach a copy of your spousal military identification card and your spouses current military orders to form REV-419. WebIf the employer believes the employee has improperly claimed the Nonresident Military Spouse Residency Withholding Exemption, the employer must contact the Department of Revenue. for tax purposes if you are domiciled in Mass. The Servicemembers current military orders assigning such servicemember to a post of duty in Mass. As a nonresident taxpayer, if you are required to file in Mass. Webline 1 through line 4 and line 7. 0000016486 00000 n

You must keep employee W-4 forms in your records for four years to verify that you are withholding federal income taxes correctly. WebWithholding exemption. For every $1.00 of income over $15,000, the maximum subtraction is reduced by $1.00. Report

will be your permanent home. Accessibility Issues. Any changes made to an MI-W4 makes the form invalid. You have special filing considerations if Indiana is your military home of record. Nonresident Income Tax Return if the spouse has had personal income tax withheld on income that is exempt from Mass. Daviess County will be your county of residence while you are stationed in Indiana. The Department will consider all relevant facts and circumstances in determining whether a servicemembers ability to pay is materially or not materially affected by their active duty status.  WebThe nonmilitary spouse of a service member whose wages/salary is exempt from Pennsylvania personal income tax under MSRRA should file a Pennsylvania Form REV- 419 with his/her Pennsylvania employer, claiming exemption from Pennsylvania income tax withholding. A nonresident spouse of a servicemember must file the Form 1-NR/PY return on paper. Premier investment & rental property taxes. If you claim your retirement pay should be entirely exempt from Federal Income Tax Withholding (FITW), the IRS requires that you re-certify this status each year by submitting a new W-4 Form. Example 4: You and your spouse are April 18, 2023; June 15, 2023, if When filing the return, write "Combat Zone" across the top of the form (above your Social Security number).

WebThe nonmilitary spouse of a service member whose wages/salary is exempt from Pennsylvania personal income tax under MSRRA should file a Pennsylvania Form REV- 419 with his/her Pennsylvania employer, claiming exemption from Pennsylvania income tax withholding. A nonresident spouse of a servicemember must file the Form 1-NR/PY return on paper. Premier investment & rental property taxes. If you claim your retirement pay should be entirely exempt from Federal Income Tax Withholding (FITW), the IRS requires that you re-certify this status each year by submitting a new W-4 Form. Example 4: You and your spouse are April 18, 2023; June 15, 2023, if When filing the return, write "Combat Zone" across the top of the form (above your Social Security number).  endobj

When filling out the section on Form 1-NR/PY entitled NONRESIDENT DEDUCTION & EXEMPTION RATIO, Military service compensation is included for residents, but notfor nonresidents, Compensation for active service in a combat zone by members of the U.S. armed forces. resident spouse of a Mass. [ 6 0 R 8 0 R 10 0 R 16 0 R 20 0 R 24 0 R 29 0 R 31 0 R 35 0 R 39 0 R 43 0 R 45 0 R 47 0 R 49 0 R 51 0 R 53 0 R 55 0 R 57 0 R 59 0 R 61 0 R 63 0 R 65 0 R 67 0 R 69 0 R 71 0 R 73 0 R 75 0 R 77 0 R 80 0 R 82 0 R 84 0 R 87 0 R 90 0 R 93 0 R 96 0 R ]

%PDF-1.7

As a spouse of a service member, your status as a resident or nonresident will determine the way you are taxed in Mass. 0000004152 00000 n

endobj

When filling out the section on Form 1-NR/PY entitled NONRESIDENT DEDUCTION & EXEMPTION RATIO, Military service compensation is included for residents, but notfor nonresidents, Compensation for active service in a combat zone by members of the U.S. armed forces. resident spouse of a Mass. [ 6 0 R 8 0 R 10 0 R 16 0 R 20 0 R 24 0 R 29 0 R 31 0 R 35 0 R 39 0 R 43 0 R 45 0 R 47 0 R 49 0 R 51 0 R 53 0 R 55 0 R 57 0 R 59 0 R 61 0 R 63 0 R 65 0 R 67 0 R 69 0 R 71 0 R 73 0 R 75 0 R 77 0 R 80 0 R 82 0 R 84 0 R 87 0 R 90 0 R 93 0 R 96 0 R ]

%PDF-1.7

As a spouse of a service member, your status as a resident or nonresident will determine the way you are taxed in Mass. 0000004152 00000 n

In your company's payroll process, you may occasionally have an employee who wants to claim exemption from withholding. Spouses Residency Relief Act (MSRRA)* and no withholding is necessary. Income earned is excluded from gross income for active service for any month during which a member below the grade of commissioned officer: A portion of such income earned by commissioned officers is also excluded. Use this step if you (1) have more than one job at the same time, or (2) are married filing jointly and you and your spouse both work. is not subject to tax on the income described below if the military spouse is in Mass. on line 7. hYo8WVpvv]Jbcm! hb``b``fe```lIe@@,LK%lJ>0rZ.B#

y,6~`9eA{b"xuc0%nm Y@A The federal and Indiana Servicemembers Civil Relief Acts (SCRA) allow the Department to assist active duty military members with the penalty, interest and, if materially affected, the collection activity for outstanding tax debts. Read the following to see which set of circumstances fits you. They get married and Person B moves to Arlington, Virginia to live with Person A. cHq@H6Y,rjtLEBsFnM7rj#MiY7q2LrBfUwxXB@+

%PDF-1.4

%

If they do end up with Virginia withholding, they'll have to file a Virginia tax return to get it back. This may be required by their employer on an annual basis. Web6. <>/Font<>/ProcSet[/PDF/Text]/XObject<>>>/Rotate 0/StructParents 17/Tabs/W/TrimBox[ 0 0 612 792]/Type/Page>>

'x2'7K#Yuw>S? Example 4: You and your spouse are stationed overseas. If you (and your spouse) have a total of only two jobs, you may check the box in option (c).

In your company's payroll process, you may occasionally have an employee who wants to claim exemption from withholding. Spouses Residency Relief Act (MSRRA)* and no withholding is necessary. Income earned is excluded from gross income for active service for any month during which a member below the grade of commissioned officer: A portion of such income earned by commissioned officers is also excluded. Use this step if you (1) have more than one job at the same time, or (2) are married filing jointly and you and your spouse both work. is not subject to tax on the income described below if the military spouse is in Mass. on line 7. hYo8WVpvv]Jbcm! hb``b``fe```lIe@@,LK%lJ>0rZ.B#

y,6~`9eA{b"xuc0%nm Y@A The federal and Indiana Servicemembers Civil Relief Acts (SCRA) allow the Department to assist active duty military members with the penalty, interest and, if materially affected, the collection activity for outstanding tax debts. Read the following to see which set of circumstances fits you. They get married and Person B moves to Arlington, Virginia to live with Person A. cHq@H6Y,rjtLEBsFnM7rj#MiY7q2LrBfUwxXB@+

%PDF-1.4

%

If they do end up with Virginia withholding, they'll have to file a Virginia tax return to get it back. This may be required by their employer on an annual basis. Web6. <>/Font<>/ProcSet[/PDF/Text]/XObject<>>>/Rotate 0/StructParents 17/Tabs/W/TrimBox[ 0 0 612 792]/Type/Page>>

'x2'7K#Yuw>S? Example 4: You and your spouse are stationed overseas. If you (and your spouse) have a total of only two jobs, you may check the box in option (c).  Military servicemembers serving in a presidentially-declared combat zone have an automatic extension of time to file of 180 days after they leave the combat zone. Do you need to change this page's language? Local, state, and federal government websites often end in .gov. the spouse is domiciled in the same state as the servicemember. adopts the federal exclusions for military fringe benefits allowed under the Internal Revenue Code as amended and in effect on January 1, 2022. Once you can more accurately estimate your tax liabilities, you can adjust withholding by completing a new W4 and submitting it to your finance office. Compensation received for active service in a combat zone by members of the Armed Forces of the United States is excluded from Mass. Go toHow to Translate a Website, Webpage, or Document into the Language You Want. 0000005463 00000 n

All FICA taxes must be paid by both you as the employer and by the employee. No matter where they're stationed, every year they file a Georgia resident return and pay Georgia tax. The last day of any continuous qualified hospitalization (as defined in Publication 3) for injury from service in the combat zone or c. While performing qualifying service outside of the combat zone. You must notify the Indiana Department of Revenue if you believe you qualify for this. We will use this information to improve this page. If you receive an invalid certificate, do not consider it to compute withholding. endstream

endobj

67 0 obj

<>/Subtype/Form/Type/XObject>>stream

387 0 obj

<>stream

Do you have a question about your tax account? ^g-xG`OIUr{99,d{)SO!oo,A0K%%3W+\A0W+ Your non-military spouse changed his/her state residency from Indiana to California during the tax year. If you (and your spouse) have a total of only two jobs, you may check the box in option (c).

Military servicemembers serving in a presidentially-declared combat zone have an automatic extension of time to file of 180 days after they leave the combat zone. Do you need to change this page's language? Local, state, and federal government websites often end in .gov. the spouse is domiciled in the same state as the servicemember. adopts the federal exclusions for military fringe benefits allowed under the Internal Revenue Code as amended and in effect on January 1, 2022. Once you can more accurately estimate your tax liabilities, you can adjust withholding by completing a new W4 and submitting it to your finance office. Compensation received for active service in a combat zone by members of the Armed Forces of the United States is excluded from Mass. Go toHow to Translate a Website, Webpage, or Document into the Language You Want. 0000005463 00000 n

All FICA taxes must be paid by both you as the employer and by the employee. No matter where they're stationed, every year they file a Georgia resident return and pay Georgia tax. The last day of any continuous qualified hospitalization (as defined in Publication 3) for injury from service in the combat zone or c. While performing qualifying service outside of the combat zone. You must notify the Indiana Department of Revenue if you believe you qualify for this. We will use this information to improve this page. If you receive an invalid certificate, do not consider it to compute withholding. endstream

endobj

67 0 obj

<>/Subtype/Form/Type/XObject>>stream

387 0 obj

<>stream

Do you have a question about your tax account? ^g-xG`OIUr{99,d{)SO!oo,A0K%%3W+\A0W+ Your non-military spouse changed his/her state residency from Indiana to California during the tax year. If you (and your spouse) have a total of only two jobs, you may check the box in option (c).  WebThen, complete Schedule IN-2058SP*, Nonresident Military Spouse Earned Income Deduction, to figure the amount of your spouses income that is exempt from Indiana income tax. Check the box for the reason you are claiming an exemption and write . 2 0 obj

WebMilitary personnel stationed inside or outside Virginia may be eligible to subtract up to $15,000 of military basic pay received during the taxable year, provided they are on extended active duty for more than 90 days. If an employee wants to claim exemption, they must write "Exempt" on Form W-4 in the space below Step 4(c) and complete Steps 1 and 5. Your attorney will tell you not to help employees complete forms. Any changes made to an MI-W4 makes the form invalid. %8u:}Y

&+C1eXt0W7Qn#7 You (the employer) may need to send the W-4 to the IRS for its review of the claim. The service member moves to a new location where the spouse could join them, but chooses not to. If you file by paper: Include all your W-2s and a complete copy of your federal return. According to MilitaryOneSource, Publication 3 gives examples and illustrations to show you how to make this extension calculation. A .mass.gov website belongs to an official government organization in Massachusetts.

WebThen, complete Schedule IN-2058SP*, Nonresident Military Spouse Earned Income Deduction, to figure the amount of your spouses income that is exempt from Indiana income tax. Check the box for the reason you are claiming an exemption and write . 2 0 obj

WebMilitary personnel stationed inside or outside Virginia may be eligible to subtract up to $15,000 of military basic pay received during the taxable year, provided they are on extended active duty for more than 90 days. If an employee wants to claim exemption, they must write "Exempt" on Form W-4 in the space below Step 4(c) and complete Steps 1 and 5. Your attorney will tell you not to help employees complete forms. Any changes made to an MI-W4 makes the form invalid. %8u:}Y

&+C1eXt0W7Qn#7 You (the employer) may need to send the W-4 to the IRS for its review of the claim. The service member moves to a new location where the spouse could join them, but chooses not to. If you file by paper: Include all your W-2s and a complete copy of your federal return. According to MilitaryOneSource, Publication 3 gives examples and illustrations to show you how to make this extension calculation. A .mass.gov website belongs to an official government organization in Massachusetts.  Employees, if they qualify, may be exempt from withholding, and they must communicate this to you on a W-4 form. 50 USC 4001(c), G.L. resident. The Veterans Benefits and Transition Act allows that choice to be made regardless of when they were married. 9 0 obj

Note:The Form M-4-MS must be validated on an annual basis. He'll have to wait to file his tax return and claim the $276. MSRRA allows spouses of military personnel to withhold State and local taxes based on an address other than their duty station or residence address documented in the Payroll/Personnel System (PPS). Scenarios that will cause the spouse to lose eligibility include: The spouse of a servicemember can claim a withholding refund by filing a Form 1-NR/PY - Mass. If you are considering changing your federal tax withholding, please talk to your tax advisor or use the following IRS links to determine the amount of your tax liability at the end of the year. Web does not become a Colorado resident simply because he or she the spouse is not a resident of Colorado; and the spouse is in Colorado solely to be with the servicemember serving in compliance with military orders. 0000000016 00000 n

Mass. Do you need to register with MassTaxConnect? 753 Form W-4 Employee's Withholding Certificate.". mTeW;r WebThe income exemption only applies to the military spouse. ;TG|8TZ'U- WebNonresident Civilian Spouse of a Military Servicemember Exemption: If you are the civilian spouse of a military servicemember, your pay may be exempt from Ohio income tax and school district income tax if all of the following are true: Your spouse is a nonresident of Ohio; You and your spouse are residents of the same state; Accessibility

WebExemption from Withholding Military Spouse Employee Ohio Employers: In November 2009, Congress passed the Federal Military Spouses Residency Relief Act, Public Law If yourgross income is more than $8,000, you must file as a Mass. 0000011313 00000 n

0000020742 00000 n

Department of StateCivilian Personnel Mgmt ServiceDTS Travel CenterSystem for Award Mgmt (SAM) Congressional/Legislation Lives in the state solely in order to live with the servicemember; and, c. The servicemember is living in the state in order to satisfy military orders. If these conditions apply, you may file a new Form K-4 with your employer to claim an exemption from withholding of Kentucky income tax. z' IFCf`bd`aNg`t` wx! endstream

endobj

63 0 obj

<>/Subtype/Form/Type/XObject>>stream

Withholding is a general term for the amounts taken from employee pay for federal and state income taxes, and for Federal Insurance Contributions Act(FICA) taxes (Social Security and Medicare). For example, Carlton comes to you in February and says he wants to claim exemption from withholding for this year.

Employees, if they qualify, may be exempt from withholding, and they must communicate this to you on a W-4 form. 50 USC 4001(c), G.L. resident. The Veterans Benefits and Transition Act allows that choice to be made regardless of when they were married. 9 0 obj

Note:The Form M-4-MS must be validated on an annual basis. He'll have to wait to file his tax return and claim the $276. MSRRA allows spouses of military personnel to withhold State and local taxes based on an address other than their duty station or residence address documented in the Payroll/Personnel System (PPS). Scenarios that will cause the spouse to lose eligibility include: The spouse of a servicemember can claim a withholding refund by filing a Form 1-NR/PY - Mass. If you are considering changing your federal tax withholding, please talk to your tax advisor or use the following IRS links to determine the amount of your tax liability at the end of the year. Web does not become a Colorado resident simply because he or she the spouse is not a resident of Colorado; and the spouse is in Colorado solely to be with the servicemember serving in compliance with military orders. 0000000016 00000 n

Mass. Do you need to register with MassTaxConnect? 753 Form W-4 Employee's Withholding Certificate.". mTeW;r WebThe income exemption only applies to the military spouse. ;TG|8TZ'U- WebNonresident Civilian Spouse of a Military Servicemember Exemption: If you are the civilian spouse of a military servicemember, your pay may be exempt from Ohio income tax and school district income tax if all of the following are true: Your spouse is a nonresident of Ohio; You and your spouse are residents of the same state; Accessibility

WebExemption from Withholding Military Spouse Employee Ohio Employers: In November 2009, Congress passed the Federal Military Spouses Residency Relief Act, Public Law If yourgross income is more than $8,000, you must file as a Mass. 0000011313 00000 n

0000020742 00000 n

Department of StateCivilian Personnel Mgmt ServiceDTS Travel CenterSystem for Award Mgmt (SAM) Congressional/Legislation Lives in the state solely in order to live with the servicemember; and, c. The servicemember is living in the state in order to satisfy military orders. If these conditions apply, you may file a new Form K-4 with your employer to claim an exemption from withholding of Kentucky income tax. z' IFCf`bd`aNg`t` wx! endstream

endobj

63 0 obj

<>/Subtype/Form/Type/XObject>>stream

Withholding is a general term for the amounts taken from employee pay for federal and state income taxes, and for Federal Insurance Contributions Act(FICA) taxes (Social Security and Medicare). For example, Carlton comes to you in February and says he wants to claim exemption from withholding for this year.  resident until you establish legal residence in another state. Mass.gov is a registered service mark of the Commonwealth of Massachusetts. WebIf your spouse was in the military at any time for the taxable year in question, provide his or her duty station(s) for the taxable year. Penalty and interest will not be assessed on your income tax liability and collection activity will temporarily cease for the time period between the active duty start date and up to 180 days after the active duty termination or release date. "Publication 15 (2022), (Circular E), Employer's Tax Guide. ^/6y* {U[Vc Z_t`lYJf$>>ja/ &q 0Y~1 xG?=_BE=5fpqV*fgC@*yhm edd YL1XX0y]W?6"{%

You can claim exempt if you filed a Georgia income tax Webexemption from withholding only for certain reasons that are specified on that form; see Form MI-W4 for details. A claim of exemption from withholding does not exempt the employee from paying their share of FICAtaxes, including the additional Medicare tax. You must submit a copy of your orders, your DD214 and/or a SCRA certificate, along with any other documentation that you have regarding your active duty status and the outstanding debt. WebNonresident Military Spouse Withholding Tax Exemption Certificate A4-MSFORM (REV. 0ka )^8sPsQxSpc@[A0D0k4 If these conditions are met, the spouses wages are exempt from Colorado income tax and wage withholding tax. The spouse establishing Mass. WebThis is not necessary for a military spouse. Employee Exemption Qualifications and Lock-In Letters. Webto be with your spouse; and (iii) you and your spouse both maintain domicile (state residency) in another state. Your spouse is also in the military, with a Montana home of record. All information must be submitted to the following address. Settings, Start voice

The following special rules apply to members of the Junior Reserve Officers' Training Corps (JROTC): If you are a retired commissioned or noncommissioned officer, youcan serve as an instructororadministratorin JROTC units. Web+254-730-160000 +254-719-086000. Any income your spouse earned from Indiana sources (such as partnership or S corporation), plus your income, will be reported in Column B. 0000020628 00000 n

The nonmilitary spouse is in that state solely to live with the service member. WebAnnual Withholding Tax Exemption Certification for Military Spouse Form OW-9-MSE Revised 12-2022 Read the instructions before completing this form. hb```b``9 j |,@Q? The box must also be checked on the Form W-4 for the other job. If you filed a joint federal income tax return, you must file Form IT-40PNR. Please consult a tax professional or the IRS. The Military Spouses Residency Relief Act (MSRRA) (Public Law 111-97) was signed into law on November 11, 2009. Transfers and relocations. Enter "00" (indicating out-of-state) as the 2-digit county code number in the county information boxes at the top of your tax return. The term dependents does not include you or your spouse. WebNonresident military spouses policy statement. If you Spouses Residency Relief Act (MSRRA)* and no withholding is necessary. Example 9: You were an Indiana resident at the time you enlisted. You will file Form IT-40 as a full-year resident and will show Elkhart as the county where you lived on January 1. Enter the information as requested by each line. ((Gl(/c?86

{-xVher>YIg({/@#]i>%R%&\9kpH,XfP8QeA"rlX. 8 0 obj

{ W/GUZG2fJ]X-_{Vc"!-9XXiW6j'ry&&mdW+sW-oyX[1Ur({

Once you receive this lock-in letter, you must begin using this information to withhold federal income taxes from the employee's pay, effective with the date set by the IRS. Amendments under the Veterans Benefits and Transition Act of 2018 expanded those benefits. Additional rows are provided in case your spouse had more than one duty station during the taxable year. endobj

resident, you continue to be a Mass. Indiana military personnel have special county tax filing considerations. XhR&Ejpf"

(VivP0(vP0$;4DQ

w(FP 8NBcgN%8( T$*%R PPHP-FJk

n$`QQ'n4b&\4B

F681>`Kq62\

5$iMx)vIrG(ENEN'2'

V1~xDf~D@4a|\

u0(\V`Cw>/XB~?-nF%8YW&h/yN.Or${