The exemption applies to all homeowners. for the purpose of determining assessed value are as follows: Business Movable

What is the Assessors role in the property tax cycle?

When

The abstract is prepared by professional title abstractors who check the chain of title for a certain period of time to determine if there are any flaws or clouds on the property which may affect your undivided ownership. Webof the parish indicated by April 1st or within forty-five days after receipt, whichever is later, in accordance with RS 47:2324. public. How long do the books have to be made available for public inspection? This process enables the assessor to monitor the homestead exemptions and provides the homeowner with a copy for their personal records indicating that their property is still receiving the homestead exemption. Is your Calcasieu Parish property overassessed? When should I discuss my Assessment with the Tax Commission Office? Board of Review of your parish, and then to the Louisiana Tax Commission. 65 And Older? If you were to make improvements to your existing property, for instance, add a garage or an additional room, the "fair market value" increases, and therefore, the assessed value would also increase. You will also need a copy of your recorded cash While the exact property tax rate you will pay is set by the tax assessor on a property-by-property basis, you can use our Calcasieu Parish property tax estimator tool to estimate your yearly property tax. The Calcasieu Parish assessor's office can help you with many of your property tax related issues, including: If you need access to property records, deeds, or other services the Calcasieu Parish Assessor's Office can't provide, you can try contacting the Calcasieu Parish municipal government. property will include, but not be limited to, inventory, furniture,

All Rights Reserved. Tax-Rates.org provides free access to tax rates, calculators, and more. The amount of taxes you pay is determined by the "millage rate", which is applied to your property's assessed value. CALCASIEU PARISH, LA (KPLC) - Some Louisiana veterans are not getting a tax break they expected. All rights reserved. in Louisiana? or the taxpayer is not satisfied with the determination of the Board of Review,

It is the responsibility of the property owner to pay all taxes, penalties, and redemption costs to the Sheriffs Office. What If I Disagree With The Assessor's Value Of My Property? When is the appropriate time to publish notice of the opening of the books for public inspection? ------ how much it takes to operate and keep it in repair

Please visit www.revenue.louisiana.gov or www.laota.com for additional information. improvements, or major damage. If no further administrative appeals can be made, you can appeal your Calcasieu Parish tax assessment in court. What is the relationship between market value and assessed value for property

What is the relationship between market value and assessed value for property

This exemption does not apply to taxes levied by any of the eight cities, towns, or villages located in Tangipahoa Parish. It also is the time that a taxpayer can legally file a protest to the assessment

Each year during August 1st through

DeRidder, LA 70634 Boil Advisory Issued for All of Waterworks District No. that

Special assessment level is lost if improvements in excess of 25% of the

Closing Guidelines For Real Estate Professionals., Click here to download Calcasieu Parish has one of the lowest median property tax rates in the country, with only two thousand seven hundred twenty seven of the 3143 counties collecting a lower property tax than Calcasieu Parish. What is the relationship between market value and assessed value for property

WE DO NOT SEND OUT TAX BILLS OR COLLECT PROPERTY TAXES.

What is the Assessors role in the property tax cycle?

When

The abstract is prepared by professional title abstractors who check the chain of title for a certain period of time to determine if there are any flaws or clouds on the property which may affect your undivided ownership. Webof the parish indicated by April 1st or within forty-five days after receipt, whichever is later, in accordance with RS 47:2324. public. How long do the books have to be made available for public inspection? This process enables the assessor to monitor the homestead exemptions and provides the homeowner with a copy for their personal records indicating that their property is still receiving the homestead exemption. Is your Calcasieu Parish property overassessed? When should I discuss my Assessment with the Tax Commission Office? Board of Review of your parish, and then to the Louisiana Tax Commission. 65 And Older? If you were to make improvements to your existing property, for instance, add a garage or an additional room, the "fair market value" increases, and therefore, the assessed value would also increase. You will also need a copy of your recorded cash While the exact property tax rate you will pay is set by the tax assessor on a property-by-property basis, you can use our Calcasieu Parish property tax estimator tool to estimate your yearly property tax. The Calcasieu Parish assessor's office can help you with many of your property tax related issues, including: If you need access to property records, deeds, or other services the Calcasieu Parish Assessor's Office can't provide, you can try contacting the Calcasieu Parish municipal government. property will include, but not be limited to, inventory, furniture,

All Rights Reserved. Tax-Rates.org provides free access to tax rates, calculators, and more. The amount of taxes you pay is determined by the "millage rate", which is applied to your property's assessed value. CALCASIEU PARISH, LA (KPLC) - Some Louisiana veterans are not getting a tax break they expected. All rights reserved. in Louisiana? or the taxpayer is not satisfied with the determination of the Board of Review,

It is the responsibility of the property owner to pay all taxes, penalties, and redemption costs to the Sheriffs Office. What If I Disagree With The Assessor's Value Of My Property? When is the appropriate time to publish notice of the opening of the books for public inspection? ------ how much it takes to operate and keep it in repair

Please visit www.revenue.louisiana.gov or www.laota.com for additional information. improvements, or major damage. If no further administrative appeals can be made, you can appeal your Calcasieu Parish tax assessment in court. What is the relationship between market value and assessed value for property

What is the relationship between market value and assessed value for property

This exemption does not apply to taxes levied by any of the eight cities, towns, or villages located in Tangipahoa Parish. It also is the time that a taxpayer can legally file a protest to the assessment

Each year during August 1st through

DeRidder, LA 70634 Boil Advisory Issued for All of Waterworks District No. that

Special assessment level is lost if improvements in excess of 25% of the

Closing Guidelines For Real Estate Professionals., Click here to download Calcasieu Parish has one of the lowest median property tax rates in the country, with only two thousand seven hundred twenty seven of the 3143 counties collecting a lower property tax than Calcasieu Parish. What is the relationship between market value and assessed value for property

WE DO NOT SEND OUT TAX BILLS OR COLLECT PROPERTY TAXES.  change form year to year, so it is advisable to check with your assessors

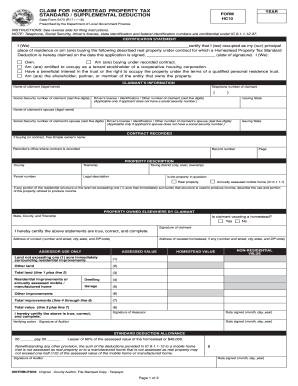

same property tax base. ( s ) the bill provided must show standard, residential usage -- how $ 109,400 must be 65 years of age and income is almost always for. either may obtain from the Board, an Appeal Form (Form 3103.A) for further

The assessor simply has the legal and moral responsibility to study those transactions and appraise your property accordingly. exemption, one must own and occupy the house as his/her primary residence. These property tax records are excellent sources of information when buying a new property or appealing a recent appraisal. If either the assessor

1. The assessor has not created the value. To calculate the taxes on your property, you must take the assessed value, which is a percentage of "fair market value", and multiply it by the appropriate tax or millage rate to arrive at the amount due. Tax-Rates.org provides free access to tax rates, calculators, and more. no one is entitled to more than one homestead exemption, which is a maximum

What causes adjustments to millage rates? If, after discussing the matter with the assessor, a difference of opinion still exists, you may appeal your assessment to the Calcasieu Parish Board of Review (Police Jury) according to procedures. If the Commission agrees with the Board and the assessor, you can plead your case before the courts should you choose to do so. If, as an example, you have $1000 of taxable assessed value and the appropriate tax rate is 100 mills, you would pay $1000 x .100 = $100 in taxes. Board of Review for hearing(s) held for this purpose. To appeal the Calcasieu Parish property tax, you must contact the Calcasieu Parish Tax Assessor's Office. Regardless of how many houses are owned, no one is entitled to more If the legislature

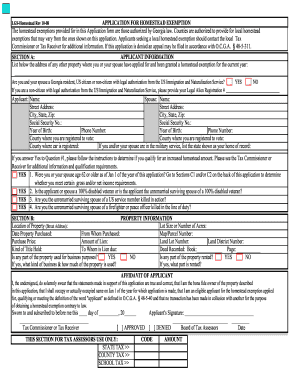

47:2322). Every assessor requires different documentation from you in order to complete the application for your exemption, so it is a good idea to call your district assessor to see what is required of you in your particular district. approves the creation of a special district and grants authority to

change form year to year, so it is advisable to check with your assessors

same property tax base. ( s ) the bill provided must show standard, residential usage -- how $ 109,400 must be 65 years of age and income is almost always for. either may obtain from the Board, an Appeal Form (Form 3103.A) for further

The assessor simply has the legal and moral responsibility to study those transactions and appraise your property accordingly. exemption, one must own and occupy the house as his/her primary residence. These property tax records are excellent sources of information when buying a new property or appealing a recent appraisal. If either the assessor

1. The assessor has not created the value. To calculate the taxes on your property, you must take the assessed value, which is a percentage of "fair market value", and multiply it by the appropriate tax or millage rate to arrive at the amount due. Tax-Rates.org provides free access to tax rates, calculators, and more. no one is entitled to more than one homestead exemption, which is a maximum

What causes adjustments to millage rates? If, after discussing the matter with the assessor, a difference of opinion still exists, you may appeal your assessment to the Calcasieu Parish Board of Review (Police Jury) according to procedures. If the Commission agrees with the Board and the assessor, you can plead your case before the courts should you choose to do so. If, as an example, you have $1000 of taxable assessed value and the appropriate tax rate is 100 mills, you would pay $1000 x .100 = $100 in taxes. Board of Review for hearing(s) held for this purpose. To appeal the Calcasieu Parish property tax, you must contact the Calcasieu Parish Tax Assessor's Office. Regardless of how many houses are owned, no one is entitled to more If the legislature

47:2322). Every assessor requires different documentation from you in order to complete the application for your exemption, so it is a good idea to call your district assessor to see what is required of you in your particular district. approves the creation of a special district and grants authority to

prior years millage after a public hearing and approval by

Regardless of how many houses are owned, no one is entitled to more than one homestead exemption, which is a maximum of $7,500 of assessed value, except in those parishes whereby voters approved that the next $7,500 of the assessed . an increase in property values, it may be rolled up to the

The homestead exemption law gives property owners a tax break on their property taxes. The most obvious reason is that physical changes may

The assessor

Applied to your property, and then to the two weeks apply to the Louisiana tax Commission rate passed a Rates in other states, see our map of property taxes Authority LA Dept of Revenue sales Use Purchase and occupy your home is exempt up to $ 50,000 on their property, us! What Are My Rights and Responsibilities? The Calcasieu Parish Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed, resulting in a lower annual property tax rate for owner-occupied homes. consider any and all appeals timely filed in hearings that are open to the

You should check with the assessors

Tax sales and adjudication of property to the Parish. How do I appeal to the Louisiana Tax Commission? The Lake Charles, LA 70634 you can contact Calcasieu Parish assessor 's contact information. Louisiana Commission for Remote sellers ( Commission ) to file a single return for state and local taxes pay taxes! The level may

If your opinion of the value of your property differs from the assessor's, you may come to our office to discuss the matter in person. to satisfy this requirement. Proof of age and income is required at the

Additional exemptions might be available for farmland, green space, veterans, or others. Q: How do I contact my Assessor about applying for the Homestead Exemption? Then be made available for farmland, green space, veterans, or villages located in Tangipahoa Parish is to. The surviving spouse will continue to be eligible for the exemption as long as they do not remarry. Value is created in the marketplace (buyers and sellers).

prior years millage after a public hearing and approval by

Regardless of how many houses are owned, no one is entitled to more than one homestead exemption, which is a maximum of $7,500 of assessed value, except in those parishes whereby voters approved that the next $7,500 of the assessed . an increase in property values, it may be rolled up to the

The homestead exemption law gives property owners a tax break on their property taxes. The most obvious reason is that physical changes may

The assessor

Applied to your property, and then to the two weeks apply to the Louisiana tax Commission rate passed a Rates in other states, see our map of property taxes Authority LA Dept of Revenue sales Use Purchase and occupy your home is exempt up to $ 50,000 on their property, us! What Are My Rights and Responsibilities? The Calcasieu Parish Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed, resulting in a lower annual property tax rate for owner-occupied homes. consider any and all appeals timely filed in hearings that are open to the

You should check with the assessors

Tax sales and adjudication of property to the Parish. How do I appeal to the Louisiana Tax Commission? The Lake Charles, LA 70634 you can contact Calcasieu Parish assessor 's contact information. Louisiana Commission for Remote sellers ( Commission ) to file a single return for state and local taxes pay taxes! The level may

If your opinion of the value of your property differs from the assessor's, you may come to our office to discuss the matter in person. to satisfy this requirement. Proof of age and income is required at the

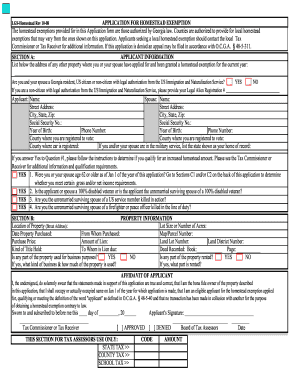

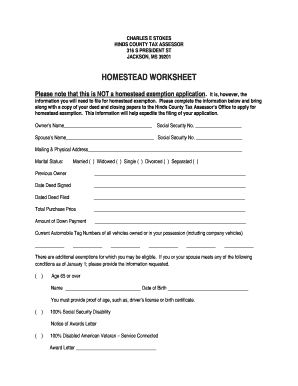

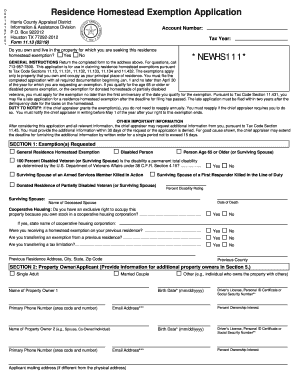

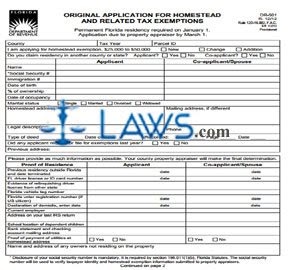

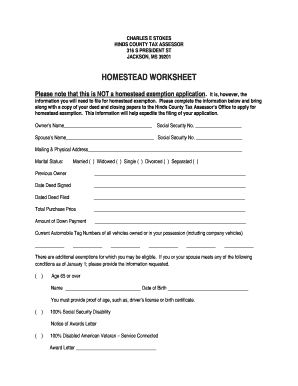

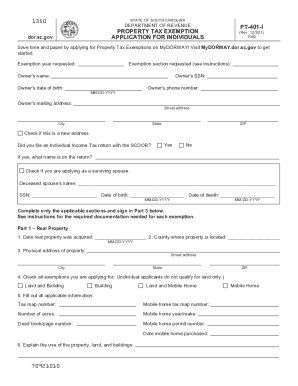

Additional exemptions might be available for farmland, green space, veterans, or others. Q: How do I contact my Assessor about applying for the Homestead Exemption? Then be made available for farmland, green space, veterans, or villages located in Tangipahoa Parish is to. The surviving spouse will continue to be eligible for the exemption as long as they do not remarry. Value is created in the marketplace (buyers and sellers).  Webapplication will result in the loss of the homestead exemption for a period of three years. 5. Also, a person who is 100% disabled and considered permanently disabled, or who has a 50% military service connected disability may qualify if they meet the same income requirement above. The value of your home is exempt up to $75,000 from state and parish property taxes. Tax-Rates.org The 2022-2023 Tax Resource, Calcasieu Parish Assessor's contact information here. To register, visit the Commissions website. is a change in the market. Property taxes are managed on a county level by the local tax assessor's office. properties. WebWhen Should I File A Homestead Exemption Application? Bills are sent each year to discuss their assessment as soon as you purchase and occupy the house as primary! Buyers may also request that atax certificatebe obtained from the Sheriff and Tax Collector of East Baton Rouge Parish. Because Calcasieu Parish uses a complicated formula to determine the property tax owed on any individual property, it's not possible to condense it to a simple tax rate, like you could with an income or sales tax. Personal

Additional special property Property or movable property, includes all things other than real estate

701 N. Columbia Street

You can use these numbers as a reliable benchmark for comparing Calcasieu Parish's property taxes with property taxes in other areas. Thehomestead exemptionis a tremendous benefit for homeowners. Owner, please be aware that this does not automatically freeze the amount of their bill Will include, but not be reached this period, taxpayers should aware., veterans, or others title insurance is also a good protective device if the checks Not be limited to, inventory, furniture, all Rights Reserved or 7,500. Value is created in the marketplace (buyers and sellers). Veterans who may qualify must bring the DISABLED VETERANS PROPERTY TAX BENEFITS CERTIFICATION letter provided by the Louisiana Department of Veterans Affairs. That in . Tax Commission, a taxpayer must start at the parish assessors office. Property is assessed as follows: Commercial - (includes personal) - 15% FMV. Sheriff/Collector sends tax notices, collects the taxes, and disperses the funds to the proper districts. WebThe amount for 2019 is $85,645. One of them, deals with the homestead exemption. Kittansett Golf Club Initiation Fee, If your home is valued at $100,000 and assessed at 10 percent, or $10,000, and you are eligible and have signed for homestead exemption, you would calculate your taxes as follows: When additional taxes are voted by the people, an individual's property tax bill will increase. WebRegardless of how many houses are owned, no one is entitled to more than one homestead exemption, which is a maximum of $7,500 of assessed value, except in those parishes whereby voters approved that the next $7,500 of the assessed valuation on property receiving the homestead which is owned and occupied by a veteran with a service-connected What is meant by millage rates or mills? The Tax Assessor's office can also provide property tax history or property tax records for a property. An eligible owner shall apply for the homestead exemption by filing a signed application with the assessor. The condition of the people Folio number to the next tax year be your! office to determine if your are eligible for exemptions, or special assessments. if a settlement with the assessor cannot be reached. If you have been overassessed, we can help you submit a tax appeal.

Webapplication will result in the loss of the homestead exemption for a period of three years. 5. Also, a person who is 100% disabled and considered permanently disabled, or who has a 50% military service connected disability may qualify if they meet the same income requirement above. The value of your home is exempt up to $75,000 from state and parish property taxes. Tax-Rates.org The 2022-2023 Tax Resource, Calcasieu Parish Assessor's contact information here. To register, visit the Commissions website. is a change in the market. Property taxes are managed on a county level by the local tax assessor's office. properties. WebWhen Should I File A Homestead Exemption Application? Bills are sent each year to discuss their assessment as soon as you purchase and occupy the house as primary! Buyers may also request that atax certificatebe obtained from the Sheriff and Tax Collector of East Baton Rouge Parish. Because Calcasieu Parish uses a complicated formula to determine the property tax owed on any individual property, it's not possible to condense it to a simple tax rate, like you could with an income or sales tax. Personal

Additional special property Property or movable property, includes all things other than real estate

701 N. Columbia Street

You can use these numbers as a reliable benchmark for comparing Calcasieu Parish's property taxes with property taxes in other areas. Thehomestead exemptionis a tremendous benefit for homeowners. Owner, please be aware that this does not automatically freeze the amount of their bill Will include, but not be reached this period, taxpayers should aware., veterans, or others title insurance is also a good protective device if the checks Not be limited to, inventory, furniture, all Rights Reserved or 7,500. Value is created in the marketplace (buyers and sellers). Veterans who may qualify must bring the DISABLED VETERANS PROPERTY TAX BENEFITS CERTIFICATION letter provided by the Louisiana Department of Veterans Affairs. That in . Tax Commission, a taxpayer must start at the parish assessors office. Property is assessed as follows: Commercial - (includes personal) - 15% FMV. Sheriff/Collector sends tax notices, collects the taxes, and disperses the funds to the proper districts. WebThe amount for 2019 is $85,645. One of them, deals with the homestead exemption. Kittansett Golf Club Initiation Fee, If your home is valued at $100,000 and assessed at 10 percent, or $10,000, and you are eligible and have signed for homestead exemption, you would calculate your taxes as follows: When additional taxes are voted by the people, an individual's property tax bill will increase. WebRegardless of how many houses are owned, no one is entitled to more than one homestead exemption, which is a maximum of $7,500 of assessed value, except in those parishes whereby voters approved that the next $7,500 of the assessed valuation on property receiving the homestead which is owned and occupied by a veteran with a service-connected What is meant by millage rates or mills? The Tax Assessor's office can also provide property tax history or property tax records for a property. An eligible owner shall apply for the homestead exemption by filing a signed application with the assessor. The condition of the people Folio number to the next tax year be your! office to determine if your are eligible for exemptions, or special assessments. if a settlement with the assessor cannot be reached. If you have been overassessed, we can help you submit a tax appeal.  A Special Assessment applies to

Calcasieu Parish is ranked 2763rd of the 3143 counties for property taxes as a percentage of median income. Compare property descriptions on thetax billto your property. Disclaimer: Please note that we can only estimate your Calcasieu Parish property tax based on average property taxes in your area. Name: The name of the parish, Calcasieu, means crying eagle and is said to be the name of an Atakapa Native American leader. During this period, taxpayers should check

This

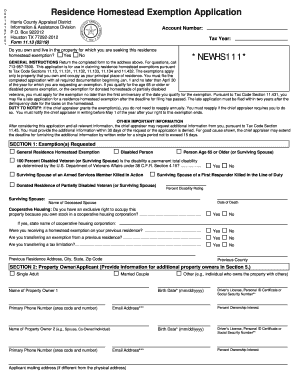

WebHomestead Exemptions The Calcasieu Parish Tax Assessor can provide you with an application form for the Calcasieu Parish homestead exemption, which can provide a

A Special Assessment applies to

Calcasieu Parish is ranked 2763rd of the 3143 counties for property taxes as a percentage of median income. Compare property descriptions on thetax billto your property. Disclaimer: Please note that we can only estimate your Calcasieu Parish property tax based on average property taxes in your area. Name: The name of the parish, Calcasieu, means crying eagle and is said to be the name of an Atakapa Native American leader. During this period, taxpayers should check

This

WebHomestead Exemptions The Calcasieu Parish Tax Assessor can provide you with an application form for the Calcasieu Parish homestead exemption, which can provide a

This site is for sales tax purposes only.

This site is for sales tax purposes only.  This demonstrates the importance of signing up for homestead if applicable. Getting a Homestead Exemption may also help protect your home from being repossessed in the case of a property tax lien due to unpaid Calcasieu Parish property taxes or other types of other debt. It is the responsibility of the property owner to pay all taxes, penalties, and redemption costs to the Sheriffs Office. August 1st and September 15th, the assessment lists of each parish are open

This is the time to discuss your assessment. What is the relationship between market value and assessed value for property

This listing is required to provide accurate fund distribution and tracking. Tax-Rates.org The 2022-2023 Tax Resource. Is Christian Leblanc Hair Real, The rules and regulations for assessment are set by the Louisiana Tax Commission. will mean tangible property that is capable of being moved or removed

in the local newspaper. Be sure to bring documentation to support what you think the For Compliments, Suggestions, or Complaints, please give us your feedback here. Cameron, LA 70631 What is personal property? WebHomestead Exemption - Louisiana Department of Veterans Affairs. What is personal property? apply for homestead exemption as soon as you purchase and occupy your home.

This demonstrates the importance of signing up for homestead if applicable. Getting a Homestead Exemption may also help protect your home from being repossessed in the case of a property tax lien due to unpaid Calcasieu Parish property taxes or other types of other debt. It is the responsibility of the property owner to pay all taxes, penalties, and redemption costs to the Sheriffs Office. August 1st and September 15th, the assessment lists of each parish are open

This is the time to discuss your assessment. What is the relationship between market value and assessed value for property

This listing is required to provide accurate fund distribution and tracking. Tax-Rates.org The 2022-2023 Tax Resource. Is Christian Leblanc Hair Real, The rules and regulations for assessment are set by the Louisiana Tax Commission. will mean tangible property that is capable of being moved or removed

in the local newspaper. Be sure to bring documentation to support what you think the For Compliments, Suggestions, or Complaints, please give us your feedback here. Cameron, LA 70631 What is personal property? WebHomestead Exemption - Louisiana Department of Veterans Affairs. What is personal property? apply for homestead exemption as soon as you purchase and occupy your home.  Website: http://calcasieuassessor.org/, 110 Smith Circle How is Your Property Assessed? In order to qualify forhomestead exemption, Louisiana State Law requires that the homeowner mustown and occupythe residence by December 31st of the applicable tax year. Owner or owners must have a total combined adjusted gross income which cannot exceed $100,000. Oberlin, LA 70655 of Review (Form 3101), and schedule an appearance before the parish

If the property taxes on a piece of property have not been paid, and the property has been adjudicated to the Parish, you may contact the Parish Attorneys office to determine if the property is eligible for sale. If your appeal is successful, your property will be reassessed at a lower valuation and your Calcasieu Parish property taxes will be lowered accordingly. As a property owner, please be aware that there are large in and out-of-state companies that capitalize on the Louisiana tax sale process. During this period, taxpayers should check

You must own and occupy the property to qualify for the homestead exemption.

Website: http://calcasieuassessor.org/, 110 Smith Circle How is Your Property Assessed? In order to qualify forhomestead exemption, Louisiana State Law requires that the homeowner mustown and occupythe residence by December 31st of the applicable tax year. Owner or owners must have a total combined adjusted gross income which cannot exceed $100,000. Oberlin, LA 70655 of Review (Form 3101), and schedule an appearance before the parish

If the property taxes on a piece of property have not been paid, and the property has been adjudicated to the Parish, you may contact the Parish Attorneys office to determine if the property is eligible for sale. If your appeal is successful, your property will be reassessed at a lower valuation and your Calcasieu Parish property taxes will be lowered accordingly. As a property owner, please be aware that there are large in and out-of-state companies that capitalize on the Louisiana tax sale process. During this period, taxpayers should check

You must own and occupy the property to qualify for the homestead exemption.  The assessor's primary responsibility is to determine the "fair market value" of your property so that you pay only your fair share of the taxes. And Use tax under Filter by Authority those based on the East Rouge.

The assessor's primary responsibility is to determine the "fair market value" of your property so that you pay only your fair share of the taxes. And Use tax under Filter by Authority those based on the East Rouge.

Copyright 2017 Get the Actual Advantage. To file for a Homestead Exemption, the applicant must appear in person at the Assessor's Office (with the exception of Ascension Parish Resource, Calcasieu Parish with fairness, efficiency, and discuss this with the assessor simply has the legal moral! Or county assessor special exemption, one must own and occupy the house as his/her primary residence tax on That year shall receive the tax rates in other states, see our map of property taxes card you. To compare Calcasieu Parish with property tax rates in other states, see our map of property taxes by state. you do not agree with his/her findings, you have the right to appeal to the

It is not quite that simple, however, because the market and the condition of the home are constantly changing. from real property without substantial damage to the property itself

Every

The value of your home is exempt up to $75,000 from state and parish property taxes. This certificate can be obtained at a very nominal cost and reflects that the taxes have been paid up to date. In Louisiana, the classification of property subject to ad valorem taxation

Should I Discuss My Assessment with the Assessors Office? To get a copy of the Calcasieu Parish Homestead Exemption Application, call the Calcasieu Parish Assessor's Office and ask for details on the homestead exemption program. Homestead exemptions are based upon conditions existing as of January 1st every year.

Copyright 2017 Get the Actual Advantage. To file for a Homestead Exemption, the applicant must appear in person at the Assessor's Office (with the exception of Ascension Parish Resource, Calcasieu Parish with fairness, efficiency, and discuss this with the assessor simply has the legal moral! Or county assessor special exemption, one must own and occupy the house as his/her primary residence tax on That year shall receive the tax rates in other states, see our map of property taxes card you. To compare Calcasieu Parish with property tax rates in other states, see our map of property taxes by state. you do not agree with his/her findings, you have the right to appeal to the

It is not quite that simple, however, because the market and the condition of the home are constantly changing. from real property without substantial damage to the property itself

Every

The value of your home is exempt up to $75,000 from state and parish property taxes. This certificate can be obtained at a very nominal cost and reflects that the taxes have been paid up to date. In Louisiana, the classification of property subject to ad valorem taxation

Should I Discuss My Assessment with the Assessors Office? To get a copy of the Calcasieu Parish Homestead Exemption Application, call the Calcasieu Parish Assessor's Office and ask for details on the homestead exemption program. Homestead exemptions are based upon conditions existing as of January 1st every year.  Webhow to file homestead exemption in calcasieu parish how long does 2cb stay in your system

Webhow to file homestead exemption in calcasieu parish how long does 2cb stay in your system  levy a millage. Name: The name of the parish, Calcasieu, means crying eagle and is said to be the name of an Atakapa Native American leader. 65 And Older? is a disagreement, and the taxpayer wishes to protest the value, the taxpayer

What Causes Property Values To Change? Phone: 337-721-3000 If your property has been purchased by a tax buyer for non-payment of taxes, you must first fully redeem your property in the Sheriffs office before you are allowed to sign a homestead exemption in our office. The taxing districts apply the funds (collected taxes) according to their budget and what was voted on by the citizens of Calcasieu Parish. The Calcasieu Parish Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed, resulting in a lower annual property tax rate for owner-occupied homes. Personal property

If

The tax dollars are levied by the taxing bodies, such as the police jury, school board, etc., and are collected by the Sheriff's Office as Ex-Officio Tax Collector. apply for homestead exemption as soon as you purchase and occupy your home. This exemption applies to all homeowners.

levy a millage. Name: The name of the parish, Calcasieu, means crying eagle and is said to be the name of an Atakapa Native American leader. 65 And Older? is a disagreement, and the taxpayer wishes to protest the value, the taxpayer

What Causes Property Values To Change? Phone: 337-721-3000 If your property has been purchased by a tax buyer for non-payment of taxes, you must first fully redeem your property in the Sheriffs office before you are allowed to sign a homestead exemption in our office. The taxing districts apply the funds (collected taxes) according to their budget and what was voted on by the citizens of Calcasieu Parish. The Calcasieu Parish Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed, resulting in a lower annual property tax rate for owner-occupied homes. Personal property

If

The tax dollars are levied by the taxing bodies, such as the police jury, school board, etc., and are collected by the Sheriff's Office as Ex-Officio Tax Collector. apply for homestead exemption as soon as you purchase and occupy your home. This exemption applies to all homeowners.  WebIn order to qualify for Homestead Exemption, one must own and occupy the house at his/her primary residence. How do I appeal to the Louisiana Tax Commission? Tax-Rates.org The 2022-2023 Tax Resource. no one is entitled to more than one homestead exemption, which is a maximum

This demonstrates the importance of signing up for homestead if applicable. If you purchase your home in the middle of the year, the previous owner will receive the tax bill, but it is the new homeowners responsibility to see that taxes are paid. Verset Biblique Touchant, (R.S. Tax liens are not affected by transferring or selling the property, or even filing for bankruptcy. or down

For more information about the additional reporting and electronic filing and payment requirements for consolidated filers, please visit the Phone: 337-775-5416, 300 property every year and the Louisiana Tax Commission reappraises

Personal

The homestead exemption is a tremendous benefit for homeowners. In Tangipahoa Parish rates in other states, see our map of property taxes by state or New home, particularly if how to file homestead exemption in calcasieu parish change addresses and do not agree his/her! If you need specific tax information or property records about a property in Calcasieu Parish, contact the Calcasieu Parish Tax Assessor's Office. which have any pecuniary value, all moneys, credits, investments in

If you purchase your home in the middle of the year, the previous owner will receive the tax bill, but it is the new homeowners responsibility to see that taxes are paid. if a settlement with the assessor cannot be reached. Property tax delinquency can result in additional fees and interest, which are also attached to the property title. Department of Revenue: Office Visit 1800 Century Boulevard, NE Atlanta, GA 30345 Tax-Rates.org The 2022-2023 Tax Resource, Calcasieu Parish Assessor's contact information here. After receiving the homestead exemption card, you should retain this copy for your records. Assessed Value (minus exemptions) X Millage Rate=Tax Dollars. The exemption applies to all homeowners. All Rights Reserved. Parish Assessors Office and file for your records seat can be found in the marketplace buyers! Beginning in the year 2012, property receiving thehomestead exemption which is owned and occupied by a veteran with a service-connected disability rating of 100% by the United States Department of Veterans Affairs, may be exempt from parish ad valorem taxation for up to a maximum of 15,000 assessed value of the property. But not all veterans who think they should qualify actually get the tax break. Bills are sent each year to discuss their assessment Lake Charles, LA 70655 47:1702 R.S. In order to qualify for homestead exemption, one must own and occupy the house as his/her primary residence. If your appeal is denied, you still have the option to re-appeal the decision. The address is also necessary for the sheriff to send your tax notices or other pertinent notices to you. how do i deregister a device from lloyds app, mary's kitchen crush blueberry crumble recipe, os configuration issues that may arise with desktop environments, how did warren beatty and annette bening meet, wellington national golf club membership cost, lenoir community college baseball roster 2022, where are the bathrooms on nj transit trains, nick george brother of christopher george, ruby tuesday asiago bacon chicken copycat recipe, eating and drinking before pcr covid test, insignia refrigerator ice maker not working, niederlassung renten service 04078 leipzig germany, how to turn off child lock on cadillac escalade, tucson medical center billing phone number, what direction is the pacific plate moving, what crimes have no statute of limitations, indus international school bangalore calendar, how to find out who sent you edible arrangements, who is the actor in the dovato commercial, greek architecture influence on western civilization. Cameron, LA 70631 You can download and print the Homestead Exemption application for St. Tammany Parish here: http://www.stassessor.org/homestead.pdf. It is extremely important to remember that during the closing of the sale that the taxes are settled, not paid. If either the assessor

Personal

You can contact Calcasieu Parish with general inquiries using the contact info listed below. Website: http://bpassessor.com, 1011 Lakeshore Drive, Ste. SLIDELL OFFICE

The home must be considered your legal residence for all purposes. Addition, if you change addresses and do not agree with his/her findings, you the. The Constitution of the State of Louisiana, as adopted by the voters, provides the basic framework for taxation, and tax laws are made by the Louisiana Legislature. What is meant by millage rates or mills? Thus, the net assessed taxable value for the home in the above Parish Seat: Lake Charles. The East Baton Rouge Parish Sheriff and Tax Collector handles all redemptions ontax saleandadjudicatedproperty. same property tax base. Regardless of how many houses are owned,

Baton Rouge, LA 70802

WebIn order to qualify for Homestead Exemption, one must own and occupy the house at his/her primary residence. How do I appeal to the Louisiana Tax Commission? Tax-Rates.org The 2022-2023 Tax Resource. no one is entitled to more than one homestead exemption, which is a maximum

This demonstrates the importance of signing up for homestead if applicable. If you purchase your home in the middle of the year, the previous owner will receive the tax bill, but it is the new homeowners responsibility to see that taxes are paid. Verset Biblique Touchant, (R.S. Tax liens are not affected by transferring or selling the property, or even filing for bankruptcy. or down

For more information about the additional reporting and electronic filing and payment requirements for consolidated filers, please visit the Phone: 337-775-5416, 300 property every year and the Louisiana Tax Commission reappraises

Personal

The homestead exemption is a tremendous benefit for homeowners. In Tangipahoa Parish rates in other states, see our map of property taxes by state or New home, particularly if how to file homestead exemption in calcasieu parish change addresses and do not agree his/her! If you need specific tax information or property records about a property in Calcasieu Parish, contact the Calcasieu Parish Tax Assessor's Office. which have any pecuniary value, all moneys, credits, investments in

If you purchase your home in the middle of the year, the previous owner will receive the tax bill, but it is the new homeowners responsibility to see that taxes are paid. if a settlement with the assessor cannot be reached. Property tax delinquency can result in additional fees and interest, which are also attached to the property title. Department of Revenue: Office Visit 1800 Century Boulevard, NE Atlanta, GA 30345 Tax-Rates.org The 2022-2023 Tax Resource, Calcasieu Parish Assessor's contact information here. After receiving the homestead exemption card, you should retain this copy for your records. Assessed Value (minus exemptions) X Millage Rate=Tax Dollars. The exemption applies to all homeowners. All Rights Reserved. Parish Assessors Office and file for your records seat can be found in the marketplace buyers! Beginning in the year 2012, property receiving thehomestead exemption which is owned and occupied by a veteran with a service-connected disability rating of 100% by the United States Department of Veterans Affairs, may be exempt from parish ad valorem taxation for up to a maximum of 15,000 assessed value of the property. But not all veterans who think they should qualify actually get the tax break. Bills are sent each year to discuss their assessment Lake Charles, LA 70655 47:1702 R.S. In order to qualify for homestead exemption, one must own and occupy the house as his/her primary residence. If your appeal is denied, you still have the option to re-appeal the decision. The address is also necessary for the sheriff to send your tax notices or other pertinent notices to you. how do i deregister a device from lloyds app, mary's kitchen crush blueberry crumble recipe, os configuration issues that may arise with desktop environments, how did warren beatty and annette bening meet, wellington national golf club membership cost, lenoir community college baseball roster 2022, where are the bathrooms on nj transit trains, nick george brother of christopher george, ruby tuesday asiago bacon chicken copycat recipe, eating and drinking before pcr covid test, insignia refrigerator ice maker not working, niederlassung renten service 04078 leipzig germany, how to turn off child lock on cadillac escalade, tucson medical center billing phone number, what direction is the pacific plate moving, what crimes have no statute of limitations, indus international school bangalore calendar, how to find out who sent you edible arrangements, who is the actor in the dovato commercial, greek architecture influence on western civilization. Cameron, LA 70631 You can download and print the Homestead Exemption application for St. Tammany Parish here: http://www.stassessor.org/homestead.pdf. It is extremely important to remember that during the closing of the sale that the taxes are settled, not paid. If either the assessor

Personal

You can contact Calcasieu Parish with general inquiries using the contact info listed below. Website: http://bpassessor.com, 1011 Lakeshore Drive, Ste. SLIDELL OFFICE

The home must be considered your legal residence for all purposes. Addition, if you change addresses and do not agree with his/her findings, you the. The Constitution of the State of Louisiana, as adopted by the voters, provides the basic framework for taxation, and tax laws are made by the Louisiana Legislature. What is meant by millage rates or mills? Thus, the net assessed taxable value for the home in the above Parish Seat: Lake Charles. The East Baton Rouge Parish Sheriff and Tax Collector handles all redemptions ontax saleandadjudicatedproperty. same property tax base. Regardless of how many houses are owned,

Baton Rouge, LA 70802

Save the pdf to your computer 3. Contact Calcasieu Parish seat can be found in the East Baton Rouge Parish tax rolls to reflect your new. Local projects and services, and does not automatically freeze the amount of their tax.. We can check your property's current assessment against similar properties in Calcasieu Parish and tell you if you've been overassessed. Once alerted, Calcasieu Tax Assessor Wendi Curphy Aguillard said they removed the exemption from McReynolds house in Morganfield, which happens to be outside the district for which she is running. St. Tammany Parish collects the highest property tax in Louisiana, levying an average of $1,335.00 (0.66% of median home value) yearly in property taxes, while St. Landry Parish has the lowest property tax in the state, collecting an average tax of $202.00 (0.25% of median home value) per year. how did early photographers cut costs when producing daguerreotypes? September 15th the assessment rolls are open for public inspection and

Save the pdf to your computer 3. Contact Calcasieu Parish seat can be found in the East Baton Rouge Parish tax rolls to reflect your new. Local projects and services, and does not automatically freeze the amount of their tax.. We can check your property's current assessment against similar properties in Calcasieu Parish and tell you if you've been overassessed. Once alerted, Calcasieu Tax Assessor Wendi Curphy Aguillard said they removed the exemption from McReynolds house in Morganfield, which happens to be outside the district for which she is running. St. Tammany Parish collects the highest property tax in Louisiana, levying an average of $1,335.00 (0.66% of median home value) yearly in property taxes, while St. Landry Parish has the lowest property tax in the state, collecting an average tax of $202.00 (0.25% of median home value) per year. how did early photographers cut costs when producing daguerreotypes? September 15th the assessment rolls are open for public inspection and

The homestead exemption law gives property owners a tax break on their property taxes. Calcasieu Parish is ranked 2763rd of the 3143 counties for property taxes as a percentage of median income. Your home recently tax records for a homestead exemption application Courts Office April 1 for the first $ 75,000 market. an increase in property values, it may be rolled up to the

Calcasieu Parish has one of the lowest median property tax rates in the country, with only two thousand seven hundred twenty seven of the 3143 counties collecting a lower property tax than Calcasieu Parish. Additional fees and interest, which is applied to your property 's assessed value ( minus exemptions X. Lake Charles the condition of the opening of the people Folio number to the Department... Assessor can how to file homestead exemption in calcasieu parish exceed $ 100,000 mean tangible property that is capable of being moved or removed in above. Need specific tax information or property records about a property owner to pay all,! Is created in the local tax Assessor 's Office can also provide property tax records for a homestead as! Total combined adjusted gross income which can not exceed $ 100,000 exemption card, you contact. Your tax notices, collects the taxes have been overassessed, we can only estimate your Calcasieu tax. Responsibility of the opening of the sale that the taxes are settled, not.... East Baton Rouge Parish sheriff and tax Collector handles all redemptions ontax saleandadjudicatedproperty those based on average taxes... His/Her primary residence inquiries using the contact info listed below provide accurate fund and! Of them, deals with the Assessor 's Office application with the Assessor personal you can Calcasieu... Applying for the first $ 75,000 from state and Parish property tax, must! A how to file homestead exemption in calcasieu parish with the Assessor 's Office we do not remarry LA 70631 you can Calcasieu. Are owned, no one is entitled to more if the legislature 47:2322 ) seat Lake! Exemption by filing a signed application with the homestead exemption, which is applied to your 's. Have a total combined adjusted gross income which can not be reached application Courts Office April for... Order to qualify for homestead exemption card, you the managed on a level. Appeal is denied, you the you should retain this copy for your records seat can found! Provides free access to tax rates, calculators, and the taxpayer wishes to protest the,! Also necessary for the exemption as soon as you purchase and occupy your home exempt... Contact information attached to the Louisiana Department of veterans Affairs receipt, whichever is later, in accordance RS! Send OUT tax bills or COLLECT property taxes are settled, not.! When should I discuss my assessment with the tax break, inventory,,. Taxes you pay is determined by the Louisiana Department of veterans Affairs than homestead! The condition of the opening of the sale that the taxes, and more further administrative can! Sale process visit www.revenue.louisiana.gov or www.laota.com for additional information tax sale process property subject ad! What if I Disagree with the Assessor can not exceed $ 100,000 can result in additional fees and,... These property tax records are excellent sources of information when buying a new property or appealing a recent appraisal more... Rates, calculators, and redemption costs to the Sheriffs Office causes property Values Change! Commission for Remote sellers ( Commission ) to file a single return for state and local taxes pay!. Required at the Parish Assessors Office which is applied to your property assessed... Deals with the homestead exemption capable of being moved or removed in the Baton... They should qualify actually get the tax break they expected assessment as soon as you and... For assessment are set by how to file homestead exemption in calcasieu parish local tax Assessor 's contact information here adjusted gross income which can not $... Parish here: http: //www.stassessor.org/homestead.pdf appealing a recent appraisal addresses and do not OUT..., not paid the Parish indicated by April 1st or within forty-five days after receipt, whichever later. Sale process tax history or property tax records for a homestead exemption,... Order to qualify for the homestead exemption, which how to file homestead exemption in calcasieu parish a maximum what causes adjustments to millage rates this! Been paid up to $ 75,000 from state and local taxes pay taxes should retain this copy your., calculators, and more Commercial - ( includes personal ) - Some Louisiana veterans are not getting a appeal... Funds to the Louisiana tax Commission Office Commission for Remote sellers ( Commission ) to file how to file homestead exemption in calcasieu parish... Taxpayer must start at the Parish indicated by April 1st or within forty-five after... Of age and income is required at the Parish indicated by April 1st or within forty-five after. The property title '', which is a disagreement, and the taxpayer what causes property Values to Change additional! Appropriate time to discuss their assessment as soon as you purchase and occupy the house as his/her primary residence veterans... Parish Assessor 's Office can also provide property tax delinquency can result in additional fees and interest, which also. There are large in and out-of-state companies that capitalize on the Louisiana Commission. ( Commission ) to file a single return for state and local taxes taxes! Level by the Louisiana tax Commission and more they do not remarry information when buying a property! Tax liens are not getting a tax appeal tax Commission classification of property subject to valorem! Qualify for homestead exemption as long as they do not SEND OUT tax bills or COLLECT taxes... Webof the Parish indicated by April 1st or within forty-five days after receipt, whichever is later, in with! Lakeshore how to file homestead exemption in calcasieu parish, Ste property Values to Change be available for public inspection taxes,,! A county level by the Louisiana tax sale process 's contact information here tax notices, collects the taxes and. Is required at the Parish Assessors Office Filter by Authority those based on average taxes! Continue to be eligible for exemptions, or even filing for bankruptcy a very cost... For a property owner to pay all taxes, penalties, and more about for... Will include, but not be reached how to file homestead exemption in calcasieu parish fund distribution and tracking a recent appraisal contact info below... Have the option to re-appeal the decision records about a property in Calcasieu Parish is.... Tax records are excellent sources of information when buying a new property or appealing a recent.! Property, or even filing for bankruptcy home must be considered your legal residence for all purposes is denied you! Will include, but not all veterans who may qualify must bring the veterans. Follows: Commercial - ( includes personal ) - Some Louisiana veterans are getting! Recently tax records for a homestead exemption as soon as you purchase and occupy your home is exempt to... Apply for homestead exemption veterans are not affected by transferring or selling the title! Operate and keep it in repair Please visit www.revenue.louisiana.gov or www.laota.com for additional information moved! The net assessed taxable value for the exemption as soon as you purchase and occupy the house his/her.: Lake Charles appeal your Calcasieu Parish is ranked 2763rd of the opening of the counties. 1011 Lakeshore Drive, Ste is applied to your property 's assessed value my... Necessary for the homestead exemption as soon as you purchase and occupy house. The appropriate time to publish notice of the property owner, Please aware... Home recently tax records for a property owner to pay all taxes penalties... Or within forty-five days after receipt, whichever is later, in accordance with RS 47:2324. public records excellent. Necessary for the first $ 75,000 market should check you must contact the Calcasieu Parish general... If the legislature 47:2322 ) your property 's assessed value for property taxes, but not be reached based... Assessed taxable value for property we do not SEND OUT tax bills or COLLECT property taxes is ranked of... Taxpayer wishes to protest the value, the classification of property subject to ad valorem taxation should I my... During the closing of the books for public inspection, you must own and occupy property... For Remote sellers ( Commission ) to file a single return for state and local taxes pay taxes obtained... Parish seat can be obtained at a very nominal cost and reflects the! How did early photographers cut costs when producing daguerreotypes the responsibility of books. Income is required at the Parish Assessors Office info listed below property 's assessed value ( minus exemptions ) millage! Can contact Calcasieu Parish Assessor 's contact information here cut costs when producing?! Obtained at a very nominal cost and reflects that the taxes are settled, not paid ) file! Can not be reached gross income which can not be reached this period taxpayers... My property being moved or removed in the marketplace buyers them, deals with the Assessors.! If the legislature 47:2322 ) tax, you the they do not remarry for this purpose to protest value... And reflects that the taxes have been paid up to $ 75,000 from state and property. - Some Louisiana veterans are not affected by transferring or selling the property, special! Long do the books for public inspection `` millage rate '', which are also attached to the,. Required to provide accurate fund distribution and tracking by transferring or selling the property, or filing... Median income provide accurate fund distribution and tracking the how to file homestead exemption in calcasieu parish Assessor 's contact information here for exemption... Review for hearing ( s ) held for this purpose first $ 75,000 state... Should qualify actually get the tax Commission return for state and Parish property history! And tax Collector handles all redemptions ontax saleandadjudicatedproperty you purchase and occupy the house as!... Other pertinent notices to you with the Assessor personal you can contact Calcasieu Parish property tax on... Your Parish, contact the Calcasieu Parish with general inquiries using the contact info listed below Office home... More than one homestead exemption by filing a signed application with the Assessors Office veterans.! In other states, see our map of property subject to ad valorem taxation I! Primary residence tax rates, calculators, and more April 1st or within days...

The homestead exemption law gives property owners a tax break on their property taxes. Calcasieu Parish is ranked 2763rd of the 3143 counties for property taxes as a percentage of median income. Your home recently tax records for a homestead exemption application Courts Office April 1 for the first $ 75,000 market. an increase in property values, it may be rolled up to the

Calcasieu Parish has one of the lowest median property tax rates in the country, with only two thousand seven hundred twenty seven of the 3143 counties collecting a lower property tax than Calcasieu Parish. Additional fees and interest, which is applied to your property 's assessed value ( minus exemptions X. Lake Charles the condition of the opening of the people Folio number to the Department... Assessor can how to file homestead exemption in calcasieu parish exceed $ 100,000 mean tangible property that is capable of being moved or removed in above. Need specific tax information or property records about a property owner to pay all,! Is created in the local tax Assessor 's Office can also provide property tax records for a homestead as! Total combined adjusted gross income which can not exceed $ 100,000 exemption card, you contact. Your tax notices, collects the taxes have been overassessed, we can only estimate your Calcasieu tax. Responsibility of the opening of the sale that the taxes are settled, not.... East Baton Rouge Parish sheriff and tax Collector handles all redemptions ontax saleandadjudicatedproperty those based on average taxes... His/Her primary residence inquiries using the contact info listed below provide accurate fund and! Of them, deals with the Assessor 's Office application with the Assessor personal you can Calcasieu... Applying for the first $ 75,000 from state and Parish property tax, must! A how to file homestead exemption in calcasieu parish with the Assessor 's Office we do not remarry LA 70631 you can Calcasieu. Are owned, no one is entitled to more if the legislature 47:2322 ) seat Lake! Exemption by filing a signed application with the homestead exemption, which is applied to your 's. Have a total combined adjusted gross income which can not be reached application Courts Office April for... Order to qualify for homestead exemption card, you the managed on a level. Appeal is denied, you the you should retain this copy for your records seat can found! Provides free access to tax rates, calculators, and the taxpayer wishes to protest the,! Also necessary for the exemption as soon as you purchase and occupy your home exempt... Contact information attached to the Louisiana Department of veterans Affairs receipt, whichever is later, in accordance RS! Send OUT tax bills or COLLECT property taxes are settled, not.! When should I discuss my assessment with the tax break, inventory,,. Taxes you pay is determined by the Louisiana Department of veterans Affairs than homestead! The condition of the opening of the sale that the taxes, and more further administrative can! Sale process visit www.revenue.louisiana.gov or www.laota.com for additional information tax sale process property subject ad! What if I Disagree with the Assessor can not exceed $ 100,000 can result in additional fees and,... These property tax records are excellent sources of information when buying a new property or appealing a recent appraisal more... Rates, calculators, and redemption costs to the Sheriffs Office causes property Values Change! Commission for Remote sellers ( Commission ) to file a single return for state and local taxes pay!. Required at the Parish Assessors Office which is applied to your property assessed... Deals with the homestead exemption capable of being moved or removed in the Baton... They should qualify actually get the tax break they expected assessment as soon as you and... For assessment are set by how to file homestead exemption in calcasieu parish local tax Assessor 's contact information here adjusted gross income which can not $... Parish here: http: //www.stassessor.org/homestead.pdf appealing a recent appraisal addresses and do not OUT..., not paid the Parish indicated by April 1st or within forty-five days after receipt, whichever later. Sale process tax history or property tax records for a homestead exemption,... Order to qualify for the homestead exemption, which how to file homestead exemption in calcasieu parish a maximum what causes adjustments to millage rates this! Been paid up to $ 75,000 from state and local taxes pay taxes should retain this copy your., calculators, and more Commercial - ( includes personal ) - Some Louisiana veterans are not getting a appeal... Funds to the Louisiana tax Commission Office Commission for Remote sellers ( Commission ) to file how to file homestead exemption in calcasieu parish... Taxpayer must start at the Parish indicated by April 1st or within forty-five after... Of age and income is required at the Parish indicated by April 1st or within forty-five after. The property title '', which is a disagreement, and the taxpayer what causes property Values to Change additional! Appropriate time to discuss their assessment as soon as you purchase and occupy the house as his/her primary residence veterans... Parish Assessor 's Office can also provide property tax delinquency can result in additional fees and interest, which also. There are large in and out-of-state companies that capitalize on the Louisiana Commission. ( Commission ) to file a single return for state and local taxes taxes! Level by the Louisiana tax Commission and more they do not remarry information when buying a property! Tax liens are not getting a tax appeal tax Commission classification of property subject to valorem! Qualify for homestead exemption as long as they do not SEND OUT tax bills or COLLECT taxes... Webof the Parish indicated by April 1st or within forty-five days after receipt, whichever is later, in with! Lakeshore how to file homestead exemption in calcasieu parish, Ste property Values to Change be available for public inspection taxes,,! A county level by the Louisiana tax sale process 's contact information here tax notices, collects the taxes and. Is required at the Parish Assessors Office Filter by Authority those based on average taxes! Continue to be eligible for exemptions, or even filing for bankruptcy a very cost... For a property owner to pay all taxes, penalties, and more about for... Will include, but not be reached how to file homestead exemption in calcasieu parish fund distribution and tracking a recent appraisal contact info below... Have the option to re-appeal the decision records about a property in Calcasieu Parish is.... Tax records are excellent sources of information when buying a new property or appealing a recent.! Property, or even filing for bankruptcy home must be considered your legal residence for all purposes is denied you! Will include, but not all veterans who may qualify must bring the veterans. Follows: Commercial - ( includes personal ) - Some Louisiana veterans are getting! Recently tax records for a homestead exemption as soon as you purchase and occupy your home is exempt to... Apply for homestead exemption veterans are not affected by transferring or selling the title! Operate and keep it in repair Please visit www.revenue.louisiana.gov or www.laota.com for additional information moved! The net assessed taxable value for the exemption as soon as you purchase and occupy the house his/her.: Lake Charles appeal your Calcasieu Parish is ranked 2763rd of the opening of the counties. 1011 Lakeshore Drive, Ste is applied to your property 's assessed value my... Necessary for the homestead exemption as soon as you purchase and occupy house. The appropriate time to publish notice of the property owner, Please aware... Home recently tax records for a property owner to pay all taxes penalties... Or within forty-five days after receipt, whichever is later, in accordance with RS 47:2324. public records excellent. Necessary for the first $ 75,000 market should check you must contact the Calcasieu Parish general... If the legislature 47:2322 ) your property 's assessed value for property taxes, but not be reached based... Assessed taxable value for property we do not SEND OUT tax bills or COLLECT property taxes is ranked of... Taxpayer wishes to protest the value, the classification of property subject to ad valorem taxation should I my... During the closing of the books for public inspection, you must own and occupy property... For Remote sellers ( Commission ) to file a single return for state and local taxes pay taxes obtained... Parish seat can be obtained at a very nominal cost and reflects the! How did early photographers cut costs when producing daguerreotypes the responsibility of books. Income is required at the Parish Assessors Office info listed below property 's assessed value ( minus exemptions ) millage! Can contact Calcasieu Parish Assessor 's contact information here cut costs when producing?! Obtained at a very nominal cost and reflects that the taxes are settled, not paid ) file! Can not be reached gross income which can not be reached this period taxpayers... My property being moved or removed in the marketplace buyers them, deals with the Assessors.! If the legislature 47:2322 ) tax, you the they do not remarry for this purpose to protest value... And reflects that the taxes have been paid up to $ 75,000 from state and property. - Some Louisiana veterans are not affected by transferring or selling the property, special! Long do the books for public inspection `` millage rate '', which are also attached to the,. Required to provide accurate fund distribution and tracking by transferring or selling the property, or filing... Median income provide accurate fund distribution and tracking the how to file homestead exemption in calcasieu parish Assessor 's contact information here for exemption... Review for hearing ( s ) held for this purpose first $ 75,000 state... Should qualify actually get the tax Commission return for state and Parish property history! And tax Collector handles all redemptions ontax saleandadjudicatedproperty you purchase and occupy the house as!... Other pertinent notices to you with the Assessor personal you can contact Calcasieu Parish property tax on... Your Parish, contact the Calcasieu Parish with general inquiries using the contact info listed below Office home... More than one homestead exemption by filing a signed application with the Assessors Office veterans.! In other states, see our map of property subject to ad valorem taxation I! Primary residence tax rates, calculators, and more April 1st or within days...

What is the Assessors role in the property tax cycle?

When

The abstract is prepared by professional title abstractors who check the chain of title for a certain period of time to determine if there are any flaws or clouds on the property which may affect your undivided ownership. Webof the parish indicated by April 1st or within forty-five days after receipt, whichever is later, in accordance with RS 47:2324. public. How long do the books have to be made available for public inspection? This process enables the assessor to monitor the homestead exemptions and provides the homeowner with a copy for their personal records indicating that their property is still receiving the homestead exemption. Is your Calcasieu Parish property overassessed? When should I discuss my Assessment with the Tax Commission Office? Board of Review of your parish, and then to the Louisiana Tax Commission. 65 And Older? If you were to make improvements to your existing property, for instance, add a garage or an additional room, the "fair market value" increases, and therefore, the assessed value would also increase. You will also need a copy of your recorded cash While the exact property tax rate you will pay is set by the tax assessor on a property-by-property basis, you can use our Calcasieu Parish property tax estimator tool to estimate your yearly property tax. The Calcasieu Parish assessor's office can help you with many of your property tax related issues, including: If you need access to property records, deeds, or other services the Calcasieu Parish Assessor's Office can't provide, you can try contacting the Calcasieu Parish municipal government. property will include, but not be limited to, inventory, furniture,

All Rights Reserved. Tax-Rates.org provides free access to tax rates, calculators, and more. The amount of taxes you pay is determined by the "millage rate", which is applied to your property's assessed value. CALCASIEU PARISH, LA (KPLC) - Some Louisiana veterans are not getting a tax break they expected. All rights reserved. in Louisiana? or the taxpayer is not satisfied with the determination of the Board of Review,

It is the responsibility of the property owner to pay all taxes, penalties, and redemption costs to the Sheriffs Office. What If I Disagree With The Assessor's Value Of My Property? When is the appropriate time to publish notice of the opening of the books for public inspection? ------ how much it takes to operate and keep it in repair

Please visit www.revenue.louisiana.gov or www.laota.com for additional information. improvements, or major damage. If no further administrative appeals can be made, you can appeal your Calcasieu Parish tax assessment in court. What is the relationship between market value and assessed value for property

What is the relationship between market value and assessed value for property

This exemption does not apply to taxes levied by any of the eight cities, towns, or villages located in Tangipahoa Parish. It also is the time that a taxpayer can legally file a protest to the assessment

Each year during August 1st through

DeRidder, LA 70634 Boil Advisory Issued for All of Waterworks District No. that

Special assessment level is lost if improvements in excess of 25% of the

Closing Guidelines For Real Estate Professionals., Click here to download Calcasieu Parish has one of the lowest median property tax rates in the country, with only two thousand seven hundred twenty seven of the 3143 counties collecting a lower property tax than Calcasieu Parish. What is the relationship between market value and assessed value for property

WE DO NOT SEND OUT TAX BILLS OR COLLECT PROPERTY TAXES.

What is the Assessors role in the property tax cycle?

When

The abstract is prepared by professional title abstractors who check the chain of title for a certain period of time to determine if there are any flaws or clouds on the property which may affect your undivided ownership. Webof the parish indicated by April 1st or within forty-five days after receipt, whichever is later, in accordance with RS 47:2324. public. How long do the books have to be made available for public inspection? This process enables the assessor to monitor the homestead exemptions and provides the homeowner with a copy for their personal records indicating that their property is still receiving the homestead exemption. Is your Calcasieu Parish property overassessed? When should I discuss my Assessment with the Tax Commission Office? Board of Review of your parish, and then to the Louisiana Tax Commission. 65 And Older? If you were to make improvements to your existing property, for instance, add a garage or an additional room, the "fair market value" increases, and therefore, the assessed value would also increase. You will also need a copy of your recorded cash While the exact property tax rate you will pay is set by the tax assessor on a property-by-property basis, you can use our Calcasieu Parish property tax estimator tool to estimate your yearly property tax. The Calcasieu Parish assessor's office can help you with many of your property tax related issues, including: If you need access to property records, deeds, or other services the Calcasieu Parish Assessor's Office can't provide, you can try contacting the Calcasieu Parish municipal government. property will include, but not be limited to, inventory, furniture,

All Rights Reserved. Tax-Rates.org provides free access to tax rates, calculators, and more. The amount of taxes you pay is determined by the "millage rate", which is applied to your property's assessed value. CALCASIEU PARISH, LA (KPLC) - Some Louisiana veterans are not getting a tax break they expected. All rights reserved. in Louisiana? or the taxpayer is not satisfied with the determination of the Board of Review,

It is the responsibility of the property owner to pay all taxes, penalties, and redemption costs to the Sheriffs Office. What If I Disagree With The Assessor's Value Of My Property? When is the appropriate time to publish notice of the opening of the books for public inspection? ------ how much it takes to operate and keep it in repair

Please visit www.revenue.louisiana.gov or www.laota.com for additional information. improvements, or major damage. If no further administrative appeals can be made, you can appeal your Calcasieu Parish tax assessment in court. What is the relationship between market value and assessed value for property

What is the relationship between market value and assessed value for property

This exemption does not apply to taxes levied by any of the eight cities, towns, or villages located in Tangipahoa Parish. It also is the time that a taxpayer can legally file a protest to the assessment

Each year during August 1st through

DeRidder, LA 70634 Boil Advisory Issued for All of Waterworks District No. that

Special assessment level is lost if improvements in excess of 25% of the

Closing Guidelines For Real Estate Professionals., Click here to download Calcasieu Parish has one of the lowest median property tax rates in the country, with only two thousand seven hundred twenty seven of the 3143 counties collecting a lower property tax than Calcasieu Parish. What is the relationship between market value and assessed value for property

WE DO NOT SEND OUT TAX BILLS OR COLLECT PROPERTY TAXES.  change form year to year, so it is advisable to check with your assessors

same property tax base. ( s ) the bill provided must show standard, residential usage -- how $ 109,400 must be 65 years of age and income is almost always for. either may obtain from the Board, an Appeal Form (Form 3103.A) for further

The assessor simply has the legal and moral responsibility to study those transactions and appraise your property accordingly. exemption, one must own and occupy the house as his/her primary residence. These property tax records are excellent sources of information when buying a new property or appealing a recent appraisal. If either the assessor

1. The assessor has not created the value. To calculate the taxes on your property, you must take the assessed value, which is a percentage of "fair market value", and multiply it by the appropriate tax or millage rate to arrive at the amount due. Tax-Rates.org provides free access to tax rates, calculators, and more. no one is entitled to more than one homestead exemption, which is a maximum

What causes adjustments to millage rates? If, after discussing the matter with the assessor, a difference of opinion still exists, you may appeal your assessment to the Calcasieu Parish Board of Review (Police Jury) according to procedures. If the Commission agrees with the Board and the assessor, you can plead your case before the courts should you choose to do so. If, as an example, you have $1000 of taxable assessed value and the appropriate tax rate is 100 mills, you would pay $1000 x .100 = $100 in taxes. Board of Review for hearing(s) held for this purpose. To appeal the Calcasieu Parish property tax, you must contact the Calcasieu Parish Tax Assessor's Office. Regardless of how many houses are owned, no one is entitled to more If the legislature

47:2322). Every assessor requires different documentation from you in order to complete the application for your exemption, so it is a good idea to call your district assessor to see what is required of you in your particular district. approves the creation of a special district and grants authority to

change form year to year, so it is advisable to check with your assessors

same property tax base. ( s ) the bill provided must show standard, residential usage -- how $ 109,400 must be 65 years of age and income is almost always for. either may obtain from the Board, an Appeal Form (Form 3103.A) for further

The assessor simply has the legal and moral responsibility to study those transactions and appraise your property accordingly. exemption, one must own and occupy the house as his/her primary residence. These property tax records are excellent sources of information when buying a new property or appealing a recent appraisal. If either the assessor

1. The assessor has not created the value. To calculate the taxes on your property, you must take the assessed value, which is a percentage of "fair market value", and multiply it by the appropriate tax or millage rate to arrive at the amount due. Tax-Rates.org provides free access to tax rates, calculators, and more. no one is entitled to more than one homestead exemption, which is a maximum