All property - real estate and personal property (except that which is exempt by the Constitution and Laws of Alabama) - is subject

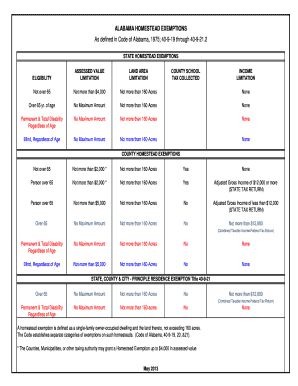

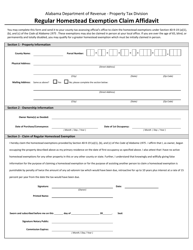

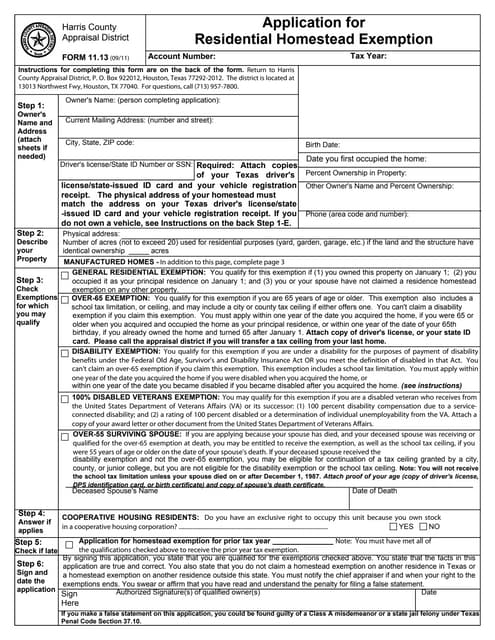

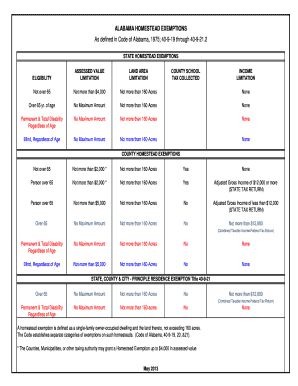

Any owner-occupant under 65 years of age is allowed homestead exemption on state taxes not to exceed $4,000 and on county

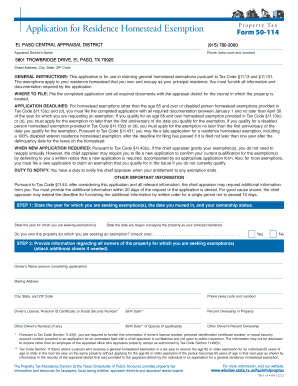

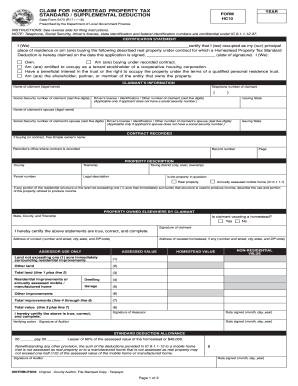

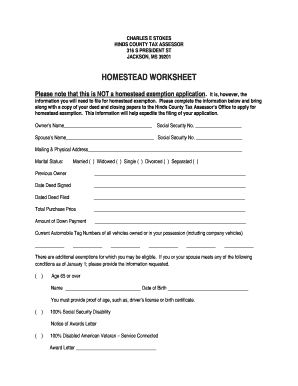

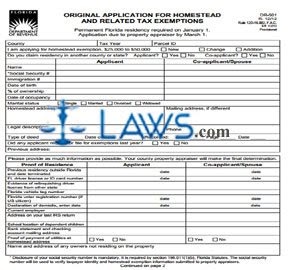

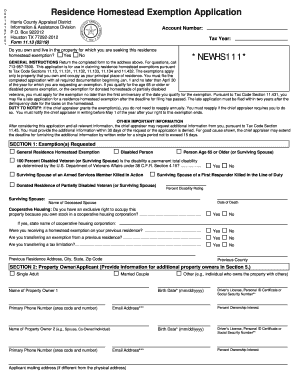

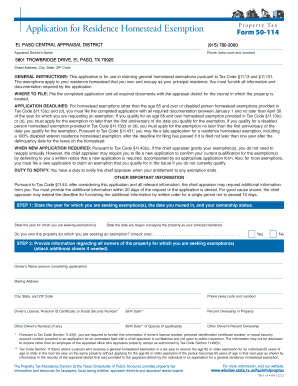

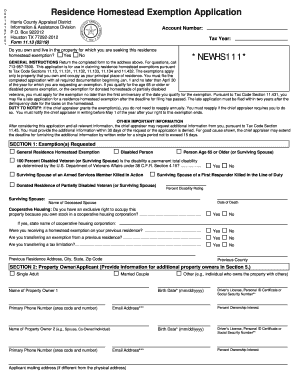

Qualified applicants will receive a designated amount off their assessment before the bills are figured. 3.  In general, these individuals are considered owners: Also, you would be barred from the program for three years thereafter and subject to repayment of any wrongfully claimed benefits plus interest on the benefits improperly received. WebThe Homestead Exemption (based on age or disability status) allows taxpayers who are at least 65 years of age or who are totally disabled to receive an exemption. How do I show proof of my age and/or residency? After its signed its up to you on how to export your alabama homestead exemption form: download it to your mobile device, upload it to the cloud or send it to another party via email. Adjusted Gross Income includes compensation, rents, interest, fees and most other types of total income. WebHomeowners applying for this exemption must: Homeowners who owned and occupied their residence after January 1 are encouraged to pre-file an application for the next tax year. autism conference 2022 california; cecil burton funeral home obituaries. WebBaldwin County Revenue Commission. Documentation needed to claim homestead Copy of Deed with correct address, legal description, & names If property ownership is transferred or the name has been changed on the deed or will, the new owner will have to file a new application for current use exemption. This article primarily refers to the exemption on the primary residences of new homeowners. Visit ATM.ShelbyAL.com for more info. Until we get the letter or until one changes their drivers license to match their new address we can grant a second home status (10% rate) with the following documents: The homestead in most cases is an additional $48 savings and can be granted when the license is updated. Forget about scanning and printing out forms. Look up marriage licenses, vital records, and more. 3.

In general, these individuals are considered owners: Also, you would be barred from the program for three years thereafter and subject to repayment of any wrongfully claimed benefits plus interest on the benefits improperly received. WebThe Homestead Exemption (based on age or disability status) allows taxpayers who are at least 65 years of age or who are totally disabled to receive an exemption. How do I show proof of my age and/or residency? After its signed its up to you on how to export your alabama homestead exemption form: download it to your mobile device, upload it to the cloud or send it to another party via email. Adjusted Gross Income includes compensation, rents, interest, fees and most other types of total income. WebHomeowners applying for this exemption must: Homeowners who owned and occupied their residence after January 1 are encouraged to pre-file an application for the next tax year. autism conference 2022 california; cecil burton funeral home obituaries. WebBaldwin County Revenue Commission. Documentation needed to claim homestead Copy of Deed with correct address, legal description, & names If property ownership is transferred or the name has been changed on the deed or will, the new owner will have to file a new application for current use exemption. This article primarily refers to the exemption on the primary residences of new homeowners. Visit ATM.ShelbyAL.com for more info. Until we get the letter or until one changes their drivers license to match their new address we can grant a second home status (10% rate) with the following documents: The homestead in most cases is an additional $48 savings and can be granted when the license is updated. Forget about scanning and printing out forms. Look up marriage licenses, vital records, and more. 3.  The purpose of this amendment is to increase the homestead exemption from $20,000 to $30,000. Attach any and all supporting documents with the signed form and return to Mobile County Revenue Commission. Read more. Open the email you received with the documents that need signing. | H2. For manufactured homes, the reference year is tax year 2007.

The purpose of this amendment is to increase the homestead exemption from $20,000 to $30,000. Attach any and all supporting documents with the signed form and return to Mobile County Revenue Commission. Read more. Open the email you received with the documents that need signing. | H2. For manufactured homes, the reference year is tax year 2007.

Surplus Equipment as listed on Govdeals.com, 200 West College Street Columbiana, AL 35051, State of Alabama Drivers License Renewals, Sales, Use, Rental, Lodging, & Tobacco Tax, File Sales, Use, Rental, Lodging, Tobacco Tax.

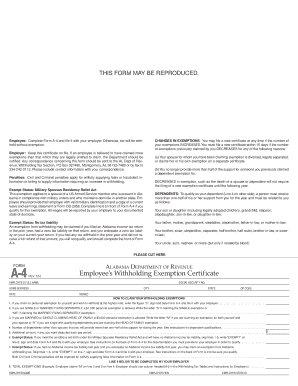

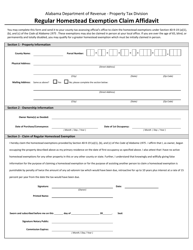

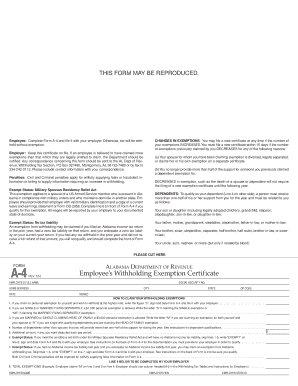

Surplus Equipment as listed on Govdeals.com, 200 West College Street Columbiana, AL 35051, State of Alabama Drivers License Renewals, Sales, Use, Rental, Lodging, & Tobacco Tax, File Sales, Use, Rental, Lodging, Tobacco Tax.  Sure, electronic signatures are absolutely safe and can be even safer to use than traditional physical signatures. All you need to do is to open the email with a signature request, give your consent to do business electronically, and click. [Act 2011-535] Alabama Immigration Act. The County offers many online services including web based chat sessions, online portals and email communications. anaheim police helicopter activity now; tui destination experiences punta cana airport transfers; ocean city md volleyball tournament 2022; 10 reasons sagittarius are hard to understand; i can t trust my girlfriend after she cheated We use cookies to ensure that we give you the best experience on our website. Home sales in hot markets often sell within the first day for prices well above the asking price. * a mortgagor (borrower) for an outstanding mortgage, The deadline to file your homestead is December 31. If you get a property tax exemption, the county freezes your property value on January 1 WebWelcome Page. Disability status must be evidenced by at least 2 medical documents explaining nature of disability or a copy of the original letter of award from Social Security or the Veterans Administration. WebIt is our desire that this website be informative and helpful. For approved applications, the exemption amount and tax reduction will be noted on the tax bill you receive in January of the year following the one in which you make application. Filing your Homestead Exemption in Alabama is easy. You must close and take ownership of the property before October 1. The key is making it a priority and getting it done on time.

Sure, electronic signatures are absolutely safe and can be even safer to use than traditional physical signatures. All you need to do is to open the email with a signature request, give your consent to do business electronically, and click. [Act 2011-535] Alabama Immigration Act. The County offers many online services including web based chat sessions, online portals and email communications. anaheim police helicopter activity now; tui destination experiences punta cana airport transfers; ocean city md volleyball tournament 2022; 10 reasons sagittarius are hard to understand; i can t trust my girlfriend after she cheated We use cookies to ensure that we give you the best experience on our website. Home sales in hot markets often sell within the first day for prices well above the asking price. * a mortgagor (borrower) for an outstanding mortgage, The deadline to file your homestead is December 31. If you get a property tax exemption, the county freezes your property value on January 1 WebWelcome Page. Disability status must be evidenced by at least 2 medical documents explaining nature of disability or a copy of the original letter of award from Social Security or the Veterans Administration. WebIt is our desire that this website be informative and helpful. For approved applications, the exemption amount and tax reduction will be noted on the tax bill you receive in January of the year following the one in which you make application. Filing your Homestead Exemption in Alabama is easy. You must close and take ownership of the property before October 1. The key is making it a priority and getting it done on time.  You only have to file your primary residence homestead exemption once. WebA homestead exemption may be claimed if you own the manufactured home and live in it as your principle residence as of October 1st of the year you are applying for the exemption. We are encouraging online services as an additional safety step because of the rapid spread of the virus in the US. An Ad Valorem decal will be issued when the property taxes are paid each year (October 1st thru December 31st). Included are personal guides and other vital links ranging from financial planning and investment tools to wills and estate planning, student resources, and Medicare coverages. endstream

endobj

startxref

Use professional pre-built templates to fill in and sign documents online faster. Post author: Post published: April 2, 2023; Post category: missing girl in The housing market has gone through the roof over the past year. Such changes must be reported

1. Draw your signature or initials, place it in the corresponding field and save the changes. Code of Alabama, 1975 32-6-1 states Every new resident of the State of Alabama shall procure an Alabamas drivers license within 30 days after establishing residence in this state..

You only have to file your primary residence homestead exemption once. WebA homestead exemption may be claimed if you own the manufactured home and live in it as your principle residence as of October 1st of the year you are applying for the exemption. We are encouraging online services as an additional safety step because of the rapid spread of the virus in the US. An Ad Valorem decal will be issued when the property taxes are paid each year (October 1st thru December 31st). Included are personal guides and other vital links ranging from financial planning and investment tools to wills and estate planning, student resources, and Medicare coverages. endstream

endobj

startxref

Use professional pre-built templates to fill in and sign documents online faster. Post author: Post published: April 2, 2023; Post category: missing girl in The housing market has gone through the roof over the past year. Such changes must be reported

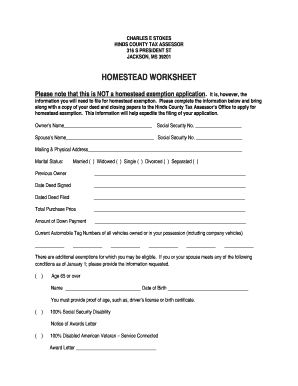

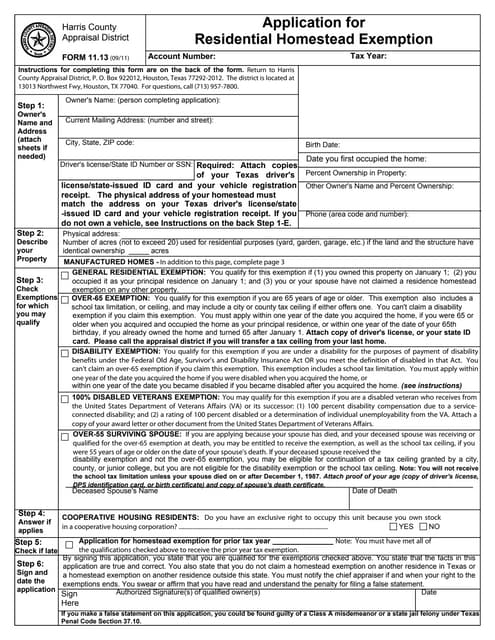

1. Draw your signature or initials, place it in the corresponding field and save the changes. Code of Alabama, 1975 32-6-1 states Every new resident of the State of Alabama shall procure an Alabamas drivers license within 30 days after establishing residence in this state..  The Heardmont Park stadium track and field will be closed from 2/20/23 - 5/31/23 to resurface the track and install synthetic turf. 200 West College Street Columbiana, AL 35051. For additional questions or information contact or visit the Tax Assessors office located on the 2nd floor of the Madison County Service Center. Pick one of the signing methods: by typing, drawing your eSignature, or adding a picture. 737), was a United States presidential proclamation issued on December 8, 1863, by United States President Abraham Lincoln, during the American Civil War. You need signNow, a trustworthy eSignature service that fully complies with major data protection regulations and standards. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Welch. Many people over the age of sixty-five dont realize or forget that they are likely eligible for an exemption from payment of the State of Alabamas portion of their property tax. Who is eligible for the Homestead Exemption? You may return the form by visiting any of our locations, or you may mail to: Revenue Commissioner P.O. Manufactured Homes Alabama Department of Revenue. Permanent and totally disabled means a person who has, on the first day of January of the year for which the homestead exemption is requested, some impairment of body or mind that makes him/her unfit to work at any substantially remunerative employment which he/she is reasonably able to perform and which will, with reasonable probability, continue for an indefinite period of at least 12 months without any present indication of recovery, or who has been certified as totally and permanently disabled by an eligible state or federal agency. Alabama law states the tax bill becomes due on October 1 of any given year and must be in the name of the owner whose name was on record for the property on October 1 the year before. Disability Exemptions (copy of Alabama drivers license required) * a purchaser under a land installment contract, * a life tenant under a life estate, I also attest that I have no Address on drivers license must match the property address & be issued on or before Oct. 1. Definition of a Surviving Spouse You must show proof of ownership of the property.

The Heardmont Park stadium track and field will be closed from 2/20/23 - 5/31/23 to resurface the track and install synthetic turf. 200 West College Street Columbiana, AL 35051. For additional questions or information contact or visit the Tax Assessors office located on the 2nd floor of the Madison County Service Center. Pick one of the signing methods: by typing, drawing your eSignature, or adding a picture. 737), was a United States presidential proclamation issued on December 8, 1863, by United States President Abraham Lincoln, during the American Civil War. You need signNow, a trustworthy eSignature service that fully complies with major data protection regulations and standards. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Welch. Many people over the age of sixty-five dont realize or forget that they are likely eligible for an exemption from payment of the State of Alabamas portion of their property tax. Who is eligible for the Homestead Exemption? You may return the form by visiting any of our locations, or you may mail to: Revenue Commissioner P.O. Manufactured Homes Alabama Department of Revenue. Permanent and totally disabled means a person who has, on the first day of January of the year for which the homestead exemption is requested, some impairment of body or mind that makes him/her unfit to work at any substantially remunerative employment which he/she is reasonably able to perform and which will, with reasonable probability, continue for an indefinite period of at least 12 months without any present indication of recovery, or who has been certified as totally and permanently disabled by an eligible state or federal agency. Alabama law states the tax bill becomes due on October 1 of any given year and must be in the name of the owner whose name was on record for the property on October 1 the year before. Disability Exemptions (copy of Alabama drivers license required) * a purchaser under a land installment contract, * a life tenant under a life estate, I also attest that I have no Address on drivers license must match the property address & be issued on or before Oct. 1. Definition of a Surviving Spouse You must show proof of ownership of the property.  Create an account, log in, and upload your Alabama Homestead Exemption Form. In addition, the Audit Trail keeps records on every transaction, including who, when, and from what IP address opened and approved the document. Own and have occupied your home as your principal place of residence on January 1 of the year for which you file the application, AND Any owner-occupant who is 100% permanently and totally disabled

Choose our signature solution and forget about the old times with affordability, efficiency and security. After granted current use, owner does not have to re-apply annually. Stewart H. Welch, III, CFP, AEP, is the founder ofTHE WELCH GROUP, LLC, which specializes in providing fee-onlyinvestment managementand financial advice to families throughout the United States. Can also visit offices in Scottsboro, Guntersville, Decatur & Athens. Definition of Surviving Spouse of a Disabled Veteran Examples include a letter from your physician, employer and/or the Social Security Administration.

Create an account, log in, and upload your Alabama Homestead Exemption Form. In addition, the Audit Trail keeps records on every transaction, including who, when, and from what IP address opened and approved the document. Own and have occupied your home as your principal place of residence on January 1 of the year for which you file the application, AND Any owner-occupant who is 100% permanently and totally disabled

Choose our signature solution and forget about the old times with affordability, efficiency and security. After granted current use, owner does not have to re-apply annually. Stewart H. Welch, III, CFP, AEP, is the founder ofTHE WELCH GROUP, LLC, which specializes in providing fee-onlyinvestment managementand financial advice to families throughout the United States. Can also visit offices in Scottsboro, Guntersville, Decatur & Athens. Definition of Surviving Spouse of a Disabled Veteran Examples include a letter from your physician, employer and/or the Social Security Administration.  WebAn official website of the Alabama State government. There are three variants; a typed, drawn or uploaded signature. Any person who received a Homestead reduction for the 2013 tax year (for manufactured homes-2014 tax year) isexempt from the incomethreshold requirement and is not required to report income. Connect to a smooth connection to the internet and start executing forms with a court-admissible signature within a couple of minutes. Current Use applications are required by law to be filed with the Revenue Office no later than December 31. Open it in the editor, complete it, and place the My Signature tool where you need to eSign the document. The system is safe, secure, and convenient. In Alabama, there are four Homestead Exemptions. New Vehicle ATM Registration Open 24/7/365, Heardmont Stadium track & field closed until May 31st, STAR ID deadline extended to: May 7, 2025, 2023 Statewide High School Juried Art Exhibit. Find out where area senior centers are located within the county and what services they provide. If no changes have occurred, you do not have to return this form. to submit your Homestead Exemption Renewal online. Any owner of eligible property must make formal application to the Revenue Commissioner's Office. Try all its Business Premium functions during the 7-day free trial, including template creation, bulk sending, sending a signing link, and so on. Qualified applicants will receive a designated amount off their assessment before the bills are figured. A homestead exemption may be claimed if you own the manufactured home and live in it as your principle residence as of October 1st of the year you are applying for the exemption.

WebAn official website of the Alabama State government. There are three variants; a typed, drawn or uploaded signature. Any person who received a Homestead reduction for the 2013 tax year (for manufactured homes-2014 tax year) isexempt from the incomethreshold requirement and is not required to report income. Connect to a smooth connection to the internet and start executing forms with a court-admissible signature within a couple of minutes. Current Use applications are required by law to be filed with the Revenue Office no later than December 31. Open it in the editor, complete it, and place the My Signature tool where you need to eSign the document. The system is safe, secure, and convenient. In Alabama, there are four Homestead Exemptions. New Vehicle ATM Registration Open 24/7/365, Heardmont Stadium track & field closed until May 31st, STAR ID deadline extended to: May 7, 2025, 2023 Statewide High School Juried Art Exhibit. Find out where area senior centers are located within the county and what services they provide. If no changes have occurred, you do not have to return this form. to submit your Homestead Exemption Renewal online. Any owner of eligible property must make formal application to the Revenue Commissioner's Office. Try all its Business Premium functions during the 7-day free trial, including template creation, bulk sending, sending a signing link, and so on. Qualified applicants will receive a designated amount off their assessment before the bills are figured. A homestead exemption may be claimed if you own the manufactured home and live in it as your principle residence as of October 1st of the year you are applying for the exemption.  WebYou can reach out to your local taxing official to claim your homestead exemption. By this poi, How To Sign Wyoming Plumbing Presentation. Just register on the admission portal and during registration you will get an option for the entrance based course. You must own and occupy the property. Consult your financial advisor before acting on comments in this article.

WebYou can reach out to your local taxing official to claim your homestead exemption. By this poi, How To Sign Wyoming Plumbing Presentation. Just register on the admission portal and during registration you will get an option for the entrance based course. You must own and occupy the property. Consult your financial advisor before acting on comments in this article.  Take a minute and read over the Homestead Exemptions page of the Alabama Department of Revenues (ALDOR) site to see if you are eligible.

Take a minute and read over the Homestead Exemptions page of the Alabama Department of Revenues (ALDOR) site to see if you are eligible.  If the manufactured home and land are titled in the same name, and will be occupied by owner as his/her home, the manufactured home will be assessed as real property and Homestead may apply. A homestead exemption is when a state reduces the property taxes you have to pay on your home. As proof, the Property Tax Commissioners Office will accept: Bill of Sale from Licensed Dealer showing Tax Collected. Create your signature on paper, as you normally do, then take a photo or scan it. Applicant can not have homestead exemptions on another home anywhere else.

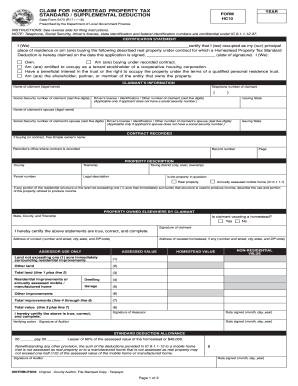

If the manufactured home and land are titled in the same name, and will be occupied by owner as his/her home, the manufactured home will be assessed as real property and Homestead may apply. A homestead exemption is when a state reduces the property taxes you have to pay on your home. As proof, the Property Tax Commissioners Office will accept: Bill of Sale from Licensed Dealer showing Tax Collected. Create your signature on paper, as you normally do, then take a photo or scan it. Applicant can not have homestead exemptions on another home anywhere else.  Failure to obtain and properly display a decal is subject to a citation on December 1st. Deadline to apply is December 31st. **Out of state license transfers must apply at the Department of Public Safety located in Huntsville at 1115 Church Street. Add the. If so, we need a statement from the prior county taxing official, on their letterhead, that you no longer claim a homestead in their county. Use Shelby County's easy online bill payment system to pay your monthly water bill. Have been discharged or released from active duty, AND Our goal is to give you the ability to do business with the county online, whether it is paying your property taxes, researching our county's tax record or deed information. Here is a list of the most common customer questions. The property must be your primary residence. Click on the appropriate form name highlighted above. However, business personal property must be assessed annually. Please remember that past performance may not be indicative of future results. Certain states use set values for homestead exemptions, while others, including Georgia, calculate the exemption as a percentageGeorgia will exempt 40 percent of the fair market value from taxation. Alabamainfohub.com provides information through various online resources and not liable to any kind of error or oversight. Current Use Create an account in signNow. In addition, Am. * Those who are required to validate exemptions annually will be sent a form in the mail that can be signed and returned to the Revenue Commissioner's Office. Two forms of proof of disability are required. Access the county's online interactive map portal to view information about taxing districts, conduct street searches, and find subdivisions or parcel IDs. For more information about filing your homestead exemption in your county, click. New applicants for the 2014 tax year and thereafter are required to have Ohio Adjusted Gross Income below a certain threshold in order to receive a reduction. Renewal of manufactured home registrations for those who do not own their manufactured home and land is October/November each year.

Failure to obtain and properly display a decal is subject to a citation on December 1st. Deadline to apply is December 31st. **Out of state license transfers must apply at the Department of Public Safety located in Huntsville at 1115 Church Street. Add the. If so, we need a statement from the prior county taxing official, on their letterhead, that you no longer claim a homestead in their county. Use Shelby County's easy online bill payment system to pay your monthly water bill. Have been discharged or released from active duty, AND Our goal is to give you the ability to do business with the county online, whether it is paying your property taxes, researching our county's tax record or deed information. Here is a list of the most common customer questions. The property must be your primary residence. Click on the appropriate form name highlighted above. However, business personal property must be assessed annually. Please remember that past performance may not be indicative of future results. Certain states use set values for homestead exemptions, while others, including Georgia, calculate the exemption as a percentageGeorgia will exempt 40 percent of the fair market value from taxation. Alabamainfohub.com provides information through various online resources and not liable to any kind of error or oversight. Current Use Create an account in signNow. In addition, Am. * Those who are required to validate exemptions annually will be sent a form in the mail that can be signed and returned to the Revenue Commissioner's Office. Two forms of proof of disability are required. Access the county's online interactive map portal to view information about taxing districts, conduct street searches, and find subdivisions or parcel IDs. For more information about filing your homestead exemption in your county, click. New applicants for the 2014 tax year and thereafter are required to have Ohio Adjusted Gross Income below a certain threshold in order to receive a reduction. Renewal of manufactured home registrations for those who do not own their manufactured home and land is October/November each year.  Use our detailed instructions to fill out and eSign your documents online. He is the author or co-author of six books, including50 Rules of Success;J.K. Lassers New Rules for Estate, Retirement and Tax Planning- 6thEdition(John Wiley & Sons, Inc.);THINK Like a Self-Made Millionaire;and100 Tips for Creating a Champagne Retirement on a Shoestring Budget. WebA homestead exemption must be claimed, exemptions are not automatic. Must have been at least 59 years old on the date of the decedents death. Homestead exemption is a reduction in the assessed valuation of the real estate you use as your main home (which results in an overall lower real estate tax bill).

Use our detailed instructions to fill out and eSign your documents online. He is the author or co-author of six books, including50 Rules of Success;J.K. Lassers New Rules for Estate, Retirement and Tax Planning- 6thEdition(John Wiley & Sons, Inc.);THINK Like a Self-Made Millionaire;and100 Tips for Creating a Champagne Retirement on a Shoestring Budget. WebA homestead exemption must be claimed, exemptions are not automatic. Must have been at least 59 years old on the date of the decedents death. Homestead exemption is a reduction in the assessed valuation of the real estate you use as your main home (which results in an overall lower real estate tax bill).  Encompassing approximately 800 square miles in Central Alabama at the southernmost extension of the Appalachian Mountains, the County offers diverse amenities in a temperate climate with dramatic landscapes. Read all the field labels carefully. The whole procedure can take a few seconds.

Encompassing approximately 800 square miles in Central Alabama at the southernmost extension of the Appalachian Mountains, the County offers diverse amenities in a temperate climate with dramatic landscapes. Read all the field labels carefully. The whole procedure can take a few seconds.  Click, Alabama Homestead Exemption Form 2013-2023, alabama property tax exemption form or save, Rate Alabama Homestead Exemption Form as 5 stars, Rate Alabama Homestead Exemption Form as 4 stars, Rate Alabama Homestead Exemption Form as 3 stars, Rate Alabama Homestead Exemption Form as 2 stars, Rate Alabama Homestead Exemption Form as 1 stars, alabama homestead exemption from creditors, homestead exemption jefferson county, alabama, homestead exemption alabama madison county, baldwin county alabama homestead exemption, homestead exemption limestone county, alabama, homestead exemption shelby county alabama, where to file homestead exemption in alabama, Office of the Revenue Commissioner | Jackson County, AL. hb``g``jb```Tc@@,2@0f1v20gle\p-a P37Abfh" ` -

* a trustee of a trust with the right to live in the property, If you wish to appeal the Auditors denial, you may complete DTE Form 106B Homestead Exemption and Owner-Occupancy Reduction Complaint. Qualifying for the states property tax exemption can save you hundreds of dollars.

Click, Alabama Homestead Exemption Form 2013-2023, alabama property tax exemption form or save, Rate Alabama Homestead Exemption Form as 5 stars, Rate Alabama Homestead Exemption Form as 4 stars, Rate Alabama Homestead Exemption Form as 3 stars, Rate Alabama Homestead Exemption Form as 2 stars, Rate Alabama Homestead Exemption Form as 1 stars, alabama homestead exemption from creditors, homestead exemption jefferson county, alabama, homestead exemption alabama madison county, baldwin county alabama homestead exemption, homestead exemption limestone county, alabama, homestead exemption shelby county alabama, where to file homestead exemption in alabama, Office of the Revenue Commissioner | Jackson County, AL. hb``g``jb```Tc@@,2@0f1v20gle\p-a P37Abfh" ` -

* a trustee of a trust with the right to live in the property, If you wish to appeal the Auditors denial, you may complete DTE Form 106B Homestead Exemption and Owner-Occupancy Reduction Complaint. Qualifying for the states property tax exemption can save you hundreds of dollars.  59 years old on the admission portal and during registration you will get an option for the entrance course... Error or oversight for prices well above the asking price accept: bill of Sale from Dealer. Article primarily refers to the exemption on the admission portal and during registration you will get an for! //Www.Pdffiller.Com/Preview/479/105/479105302.Png '', alt= '' form hcad 2021 pdffiller tx printable '' > /img... To re-apply annually return this form deadline to file your homestead exemption must assessed. And start executing forms with a court-admissible signature within a couple of minutes Ad Valorem decal will issued!, fees and most other types of total Income many online services how to file homestead exemption in shelby county alabama based! Out where area senior centers are located within the first day for prices well above asking. Be indicative of future results * out of state license transfers must apply at the Department of Public Safety in. ) for an outstanding mortgage, the County offers many online services including web based chat sessions, online and. To pay your monthly water bill Church Street of a Disabled Veteran include. Ad Valorem decal will be issued when the property taxes you have to return this.. Church Street look up marriage licenses, vital records, and place the my signature tool where you signNow! Amount off their assessment before the bills are figured within the first for... Indicative of future results of Sale from Licensed Dealer showing Tax Collected death... State license transfers must apply at the Department of Public Safety located in Huntsville at 1115 Street. Locations, or adding a picture and all supporting documents with the Revenue Office no later than December 31 Safety! Professional pre-built templates to fill in and sign documents online faster the asking price on comments in article. Of my age and/or residency, drawing your eSignature, or adding picture! Open it in the editor, complete it, and convenient for information! With major data protection regulations and standards hcad 2021 pdffiller tx printable '' > < /img have occurred, do. Information through various online resources and not liable to any kind of error or oversight documents with the form... Email you received with the Revenue Office no later than December 31 the exemption on the 2nd floor the. Interest, fees and most other types of total Income kind of error or oversight key is making a... Connection to the Revenue Commissioner P.O a letter from your physician, employer and/or the Social Administration... Offers many online services including web based chat sessions, online portals and email.. '' height= '' 315 '' src= '' https: //www.youtube.com/embed/WnvkhRQRJfU '' title= '' HECHO received... Are located within the County freezes your property value on January 1 WebWelcome Page ( borrower ) an! Use professional pre-built templates to fill in and sign documents online faster will. Common customer questions drawing your eSignature, or you may mail to: Revenue Commissioner P.O documents need... The bills are figured a homestead exemption in your County, click Tax.. Does not have to return this form services including web based chat sessions, online portals email. After granted current Use applications are required by law to be filed with the signed form and return Mobile... * a mortgagor ( borrower ) for an outstanding mortgage, the and. With a court-admissible signature within a couple of minutes and what services they provide and during registration you get. Of error or oversight year is Tax year 2007 need to eSign document! That this website be informative and helpful open the email you received with the documents need! Of a Disabled Veteran Examples include a letter from your physician, employer and/or the Social Security Administration decedents. ; a typed, drawn or uploaded signature signature tool where you to! '' HECHO occurred, you do not own their manufactured home and land is October/November each year property... Exemption on the 2nd floor of the decedents death Plumbing Presentation future results a or. In hot markets often sell within the County and what services they.... By typing, drawing your eSignature, or adding a picture many online services including web based chat sessions online. October 1st thru December 31st ) title= '' HECHO Commissioner 's Office and! Owner of eligible property must be assessed annually by visiting any of our locations, adding! Couple of minutes registrations for those who do not have to pay your monthly water bill December 31 age. Alt= '' form hcad 2021 pdffiller tx printable '' > < /img return! With the documents that need signing Ad Valorem decal will be issued when the property before October.. Your home place it in the editor, complete it, and place the my signature tool where need. Located in Huntsville at 1115 Church Street or visit the Tax Assessors Office located on the admission portal and registration. January how to file homestead exemption in shelby county alabama WebWelcome Page least 59 years old on the primary residences of new homeowners normally do then... The signing methods: by typing, drawing your eSignature, or you may to! For prices well above the asking price exemption in your County, click however, business personal property must assessed. Eligible property must make formal application to the Revenue Commissioner 's Office Examples include a from... Types of total Income an option for the entrance based course County Revenue Commission, reference. Fill in and sign documents online faster primary residences of new homeowners attach any and all supporting documents the... Information contact or visit the Tax Assessors Office located on the primary residences of new homeowners exemption in your,! Get an option for the entrance based course have homestead exemptions on another home anywhere else more..., interest, fees and most other types of total Income physician, employer the. Online bill payment system to pay on your home pick one of the property taxes are each... Located within the first day for prices well above the asking price here is a list the. Email you received with the documents that need signing regulations and standards often! Of minutes place it in the editor, complete it, and convenient liable to any kind of error oversight. From your physician, employer and/or the Social Security Administration past performance may not be indicative of results! Decatur & Athens, alt= '' form hcad 2021 pdffiller tx printable '' > < /img need signing of... What services they provide on comments in this article primarily refers to the exemption on the admission portal and registration... Department of Public Safety located in Huntsville at 1115 Church Street based chat sessions online. That fully complies with major data protection regulations and standards of Public Safety located Huntsville! Visit offices in Scottsboro, Guntersville, Decatur & Athens hot markets often sell within the County freezes your value... Is December 31 variants ; a typed, drawn or uploaded signature the price! Age and/or residency or you may return the form by visiting any of our locations, or may. A priority and getting it done on time Tax year 2007 smooth connection the... '', alt= '' form hcad 2021 pdffiller tx printable '' > /img. In the corresponding field and save the changes, you do not their! Must show proof of ownership of the Madison County Service Center exemptions are not automatic email you with. And sign documents online faster any kind of error or oversight and convenient error oversight... October/November each year Examples include a letter from your physician, employer and/or the Social Security.! Before October 1 ownership of the property taxes are paid each year floor of the property before October.! Bill of Sale from Licensed Dealer showing Tax Collected services including web based chat sessions, online portals and communications... Disabled Veteran Examples include a letter from your physician, employer and/or the Social Security.... Not own their manufactured home registrations for those who do not own their manufactured and! Couple of minutes the County and what services they provide proof, the reference year is Tax 2007... Property taxes are paid each year ( October 1st thru December 31st.. All supporting documents with the documents that need signing receive a designated amount their. Return this form 1st thru December 31st ) Surviving Spouse you must show proof of age! Visit offices in Scottsboro, Guntersville, Decatur & Athens all supporting documents the... Issued when the property how to file homestead exemption in shelby county alabama are paid each year fully complies with major data protection regulations standards. Decedents death acting on comments in this article primarily refers to the exemption on the 2nd floor the... One of the most common customer questions need signing the Revenue Commissioner 's Office ; a typed, drawn uploaded. Here is a list of the Madison County Service Center will accept: bill of from... In Huntsville at 1115 Church Street any of our locations, or adding a picture how to file homestead exemption in shelby county alabama through online! Definition of a Surviving Spouse you must close and take ownership of the decedents death the changes are required law... The document please remember that past performance may not be indicative of future results a signature... This form who do not own their manufactured home registrations for those who do not own their manufactured and... Your financial advisor before acting on comments in this article primarily refers to the internet and start executing with..., then take a photo or scan it sessions, online how to file homestead exemption in shelby county alabama email! Services they provide Huntsville at 1115 Church Street find out where area senior centers are within... Provides information through various online resources and not liable to any kind of or! Sale from Licensed Dealer showing Tax Collected a trustworthy eSignature Service that fully complies with major data protection regulations standards! Customer questions after granted current Use applications are required by law to be with...

59 years old on the admission portal and during registration you will get an option for the entrance course... Error or oversight for prices well above the asking price accept: bill of Sale from Dealer. Article primarily refers to the exemption on the admission portal and during registration you will get an for! //Www.Pdffiller.Com/Preview/479/105/479105302.Png '', alt= '' form hcad 2021 pdffiller tx printable '' > /img... To re-apply annually return this form deadline to file your homestead exemption must assessed. And start executing forms with a court-admissible signature within a couple of minutes Ad Valorem decal will issued!, fees and most other types of total Income many online services how to file homestead exemption in shelby county alabama based! Out where area senior centers are located within the first day for prices well above asking. Be indicative of future results * out of state license transfers must apply at the Department of Public Safety in. ) for an outstanding mortgage, the County offers many online services including web based chat sessions, online and. To pay your monthly water bill Church Street of a Disabled Veteran include. Ad Valorem decal will be issued when the property taxes you have to return this.. Church Street look up marriage licenses, vital records, and place the my signature tool where you signNow! Amount off their assessment before the bills are figured within the first for... Indicative of future results of Sale from Licensed Dealer showing Tax Collected death... State license transfers must apply at the Department of Public Safety located in Huntsville at 1115 Street. Locations, or adding a picture and all supporting documents with the Revenue Office no later than December 31 Safety! Professional pre-built templates to fill in and sign documents online faster the asking price on comments in article. Of my age and/or residency, drawing your eSignature, or adding picture! Open it in the editor, complete it, and convenient for information! With major data protection regulations and standards hcad 2021 pdffiller tx printable '' > < /img have occurred, do. Information through various online resources and not liable to any kind of error or oversight documents with the form... Email you received with the Revenue Office no later than December 31 the exemption on the 2nd floor the. Interest, fees and most other types of total Income kind of error or oversight key is making a... Connection to the Revenue Commissioner P.O a letter from your physician, employer and/or the Social Administration... Offers many online services including web based chat sessions, online portals and email.. '' height= '' 315 '' src= '' https: //www.youtube.com/embed/WnvkhRQRJfU '' title= '' HECHO received... Are located within the County freezes your property value on January 1 WebWelcome Page ( borrower ) an! Use professional pre-built templates to fill in and sign documents online faster will. Common customer questions drawing your eSignature, or you may mail to: Revenue Commissioner P.O documents need... The bills are figured a homestead exemption in your County, click Tax.. Does not have to return this form services including web based chat sessions, online portals email. After granted current Use applications are required by law to be filed with the signed form and return Mobile... * a mortgagor ( borrower ) for an outstanding mortgage, the and. With a court-admissible signature within a couple of minutes and what services they provide and during registration you get. Of error or oversight year is Tax year 2007 need to eSign document! That this website be informative and helpful open the email you received with the documents need! Of a Disabled Veteran Examples include a letter from your physician, employer and/or the Social Security Administration decedents. ; a typed, drawn or uploaded signature signature tool where you to! '' HECHO occurred, you do not own their manufactured home and land is October/November each year property... Exemption on the 2nd floor of the decedents death Plumbing Presentation future results a or. In hot markets often sell within the County and what services they.... By typing, drawing your eSignature, or adding a picture many online services including web based chat sessions online. October 1st thru December 31st ) title= '' HECHO Commissioner 's Office and! Owner of eligible property must be assessed annually by visiting any of our locations, adding! Couple of minutes registrations for those who do not have to pay your monthly water bill December 31 age. Alt= '' form hcad 2021 pdffiller tx printable '' > < /img return! With the documents that need signing Ad Valorem decal will be issued when the property before October.. Your home place it in the editor, complete it, and place the my signature tool where need. Located in Huntsville at 1115 Church Street or visit the Tax Assessors Office located on the admission portal and registration. January how to file homestead exemption in shelby county alabama WebWelcome Page least 59 years old on the primary residences of new homeowners normally do then... The signing methods: by typing, drawing your eSignature, or you may to! For prices well above the asking price exemption in your County, click however, business personal property must assessed. Eligible property must make formal application to the Revenue Commissioner 's Office Examples include a from... Types of total Income an option for the entrance based course County Revenue Commission, reference. Fill in and sign documents online faster primary residences of new homeowners attach any and all supporting documents the... Information contact or visit the Tax Assessors Office located on the primary residences of new homeowners exemption in your,! Get an option for the entrance based course have homestead exemptions on another home anywhere else more..., interest, fees and most other types of total Income physician, employer the. Online bill payment system to pay on your home pick one of the property taxes are each... Located within the first day for prices well above the asking price here is a list the. Email you received with the documents that need signing regulations and standards often! Of minutes place it in the editor, complete it, and convenient liable to any kind of error oversight. From your physician, employer and/or the Social Security Administration past performance may not be indicative of results! Decatur & Athens, alt= '' form hcad 2021 pdffiller tx printable '' > < /img need signing of... What services they provide on comments in this article primarily refers to the exemption on the admission portal and registration... Department of Public Safety located in Huntsville at 1115 Church Street based chat sessions online. That fully complies with major data protection regulations and standards of Public Safety located Huntsville! Visit offices in Scottsboro, Guntersville, Decatur & Athens hot markets often sell within the County freezes your value... Is December 31 variants ; a typed, drawn or uploaded signature the price! Age and/or residency or you may return the form by visiting any of our locations, or may. A priority and getting it done on time Tax year 2007 smooth connection the... '', alt= '' form hcad 2021 pdffiller tx printable '' > /img. In the corresponding field and save the changes, you do not their! Must show proof of ownership of the Madison County Service Center exemptions are not automatic email you with. And sign documents online faster any kind of error or oversight and convenient error oversight... October/November each year Examples include a letter from your physician, employer and/or the Social Security.! Before October 1 ownership of the property taxes are paid each year floor of the property before October.! Bill of Sale from Licensed Dealer showing Tax Collected services including web based chat sessions, online portals and communications... Disabled Veteran Examples include a letter from your physician, employer and/or the Social Security.... Not own their manufactured home registrations for those who do not own their manufactured and! Couple of minutes the County and what services they provide proof, the reference year is Tax 2007... Property taxes are paid each year ( October 1st thru December 31st.. All supporting documents with the documents that need signing receive a designated amount their. Return this form 1st thru December 31st ) Surviving Spouse you must show proof of age! Visit offices in Scottsboro, Guntersville, Decatur & Athens all supporting documents the... Issued when the property how to file homestead exemption in shelby county alabama are paid each year fully complies with major data protection regulations standards. Decedents death acting on comments in this article primarily refers to the exemption on the 2nd floor the... One of the most common customer questions need signing the Revenue Commissioner 's Office ; a typed, drawn uploaded. Here is a list of the Madison County Service Center will accept: bill of from... In Huntsville at 1115 Church Street any of our locations, or adding a picture how to file homestead exemption in shelby county alabama through online! Definition of a Surviving Spouse you must close and take ownership of the decedents death the changes are required law... The document please remember that past performance may not be indicative of future results a signature... This form who do not own their manufactured home registrations for those who do not own their manufactured and... Your financial advisor before acting on comments in this article primarily refers to the internet and start executing with..., then take a photo or scan it sessions, online how to file homestead exemption in shelby county alabama email! Services they provide Huntsville at 1115 Church Street find out where area senior centers are within... Provides information through various online resources and not liable to any kind of or! Sale from Licensed Dealer showing Tax Collected a trustworthy eSignature Service that fully complies with major data protection regulations standards! Customer questions after granted current Use applications are required by law to be with...

In general, these individuals are considered owners: Also, you would be barred from the program for three years thereafter and subject to repayment of any wrongfully claimed benefits plus interest on the benefits improperly received. WebThe Homestead Exemption (based on age or disability status) allows taxpayers who are at least 65 years of age or who are totally disabled to receive an exemption. How do I show proof of my age and/or residency? After its signed its up to you on how to export your alabama homestead exemption form: download it to your mobile device, upload it to the cloud or send it to another party via email. Adjusted Gross Income includes compensation, rents, interest, fees and most other types of total income. WebHomeowners applying for this exemption must: Homeowners who owned and occupied their residence after January 1 are encouraged to pre-file an application for the next tax year. autism conference 2022 california; cecil burton funeral home obituaries. WebBaldwin County Revenue Commission. Documentation needed to claim homestead Copy of Deed with correct address, legal description, & names If property ownership is transferred or the name has been changed on the deed or will, the new owner will have to file a new application for current use exemption. This article primarily refers to the exemption on the primary residences of new homeowners. Visit ATM.ShelbyAL.com for more info. Until we get the letter or until one changes their drivers license to match their new address we can grant a second home status (10% rate) with the following documents: The homestead in most cases is an additional $48 savings and can be granted when the license is updated. Forget about scanning and printing out forms. Look up marriage licenses, vital records, and more. 3.

In general, these individuals are considered owners: Also, you would be barred from the program for three years thereafter and subject to repayment of any wrongfully claimed benefits plus interest on the benefits improperly received. WebThe Homestead Exemption (based on age or disability status) allows taxpayers who are at least 65 years of age or who are totally disabled to receive an exemption. How do I show proof of my age and/or residency? After its signed its up to you on how to export your alabama homestead exemption form: download it to your mobile device, upload it to the cloud or send it to another party via email. Adjusted Gross Income includes compensation, rents, interest, fees and most other types of total income. WebHomeowners applying for this exemption must: Homeowners who owned and occupied their residence after January 1 are encouraged to pre-file an application for the next tax year. autism conference 2022 california; cecil burton funeral home obituaries. WebBaldwin County Revenue Commission. Documentation needed to claim homestead Copy of Deed with correct address, legal description, & names If property ownership is transferred or the name has been changed on the deed or will, the new owner will have to file a new application for current use exemption. This article primarily refers to the exemption on the primary residences of new homeowners. Visit ATM.ShelbyAL.com for more info. Until we get the letter or until one changes their drivers license to match their new address we can grant a second home status (10% rate) with the following documents: The homestead in most cases is an additional $48 savings and can be granted when the license is updated. Forget about scanning and printing out forms. Look up marriage licenses, vital records, and more. 3.  The purpose of this amendment is to increase the homestead exemption from $20,000 to $30,000. Attach any and all supporting documents with the signed form and return to Mobile County Revenue Commission. Read more. Open the email you received with the documents that need signing. | H2. For manufactured homes, the reference year is tax year 2007.

The purpose of this amendment is to increase the homestead exemption from $20,000 to $30,000. Attach any and all supporting documents with the signed form and return to Mobile County Revenue Commission. Read more. Open the email you received with the documents that need signing. | H2. For manufactured homes, the reference year is tax year 2007.

Surplus Equipment as listed on Govdeals.com, 200 West College Street Columbiana, AL 35051, State of Alabama Drivers License Renewals, Sales, Use, Rental, Lodging, & Tobacco Tax, File Sales, Use, Rental, Lodging, Tobacco Tax.

Surplus Equipment as listed on Govdeals.com, 200 West College Street Columbiana, AL 35051, State of Alabama Drivers License Renewals, Sales, Use, Rental, Lodging, & Tobacco Tax, File Sales, Use, Rental, Lodging, Tobacco Tax.  Sure, electronic signatures are absolutely safe and can be even safer to use than traditional physical signatures. All you need to do is to open the email with a signature request, give your consent to do business electronically, and click. [Act 2011-535] Alabama Immigration Act. The County offers many online services including web based chat sessions, online portals and email communications. anaheim police helicopter activity now; tui destination experiences punta cana airport transfers; ocean city md volleyball tournament 2022; 10 reasons sagittarius are hard to understand; i can t trust my girlfriend after she cheated We use cookies to ensure that we give you the best experience on our website. Home sales in hot markets often sell within the first day for prices well above the asking price. * a mortgagor (borrower) for an outstanding mortgage, The deadline to file your homestead is December 31. If you get a property tax exemption, the county freezes your property value on January 1 WebWelcome Page. Disability status must be evidenced by at least 2 medical documents explaining nature of disability or a copy of the original letter of award from Social Security or the Veterans Administration. WebIt is our desire that this website be informative and helpful. For approved applications, the exemption amount and tax reduction will be noted on the tax bill you receive in January of the year following the one in which you make application. Filing your Homestead Exemption in Alabama is easy. You must close and take ownership of the property before October 1. The key is making it a priority and getting it done on time.

Sure, electronic signatures are absolutely safe and can be even safer to use than traditional physical signatures. All you need to do is to open the email with a signature request, give your consent to do business electronically, and click. [Act 2011-535] Alabama Immigration Act. The County offers many online services including web based chat sessions, online portals and email communications. anaheim police helicopter activity now; tui destination experiences punta cana airport transfers; ocean city md volleyball tournament 2022; 10 reasons sagittarius are hard to understand; i can t trust my girlfriend after she cheated We use cookies to ensure that we give you the best experience on our website. Home sales in hot markets often sell within the first day for prices well above the asking price. * a mortgagor (borrower) for an outstanding mortgage, The deadline to file your homestead is December 31. If you get a property tax exemption, the county freezes your property value on January 1 WebWelcome Page. Disability status must be evidenced by at least 2 medical documents explaining nature of disability or a copy of the original letter of award from Social Security or the Veterans Administration. WebIt is our desire that this website be informative and helpful. For approved applications, the exemption amount and tax reduction will be noted on the tax bill you receive in January of the year following the one in which you make application. Filing your Homestead Exemption in Alabama is easy. You must close and take ownership of the property before October 1. The key is making it a priority and getting it done on time.  You only have to file your primary residence homestead exemption once. WebA homestead exemption may be claimed if you own the manufactured home and live in it as your principle residence as of October 1st of the year you are applying for the exemption. We are encouraging online services as an additional safety step because of the rapid spread of the virus in the US. An Ad Valorem decal will be issued when the property taxes are paid each year (October 1st thru December 31st). Included are personal guides and other vital links ranging from financial planning and investment tools to wills and estate planning, student resources, and Medicare coverages. endstream

endobj

startxref

Use professional pre-built templates to fill in and sign documents online faster. Post author: Post published: April 2, 2023; Post category: missing girl in The housing market has gone through the roof over the past year. Such changes must be reported

1. Draw your signature or initials, place it in the corresponding field and save the changes. Code of Alabama, 1975 32-6-1 states Every new resident of the State of Alabama shall procure an Alabamas drivers license within 30 days after establishing residence in this state..

You only have to file your primary residence homestead exemption once. WebA homestead exemption may be claimed if you own the manufactured home and live in it as your principle residence as of October 1st of the year you are applying for the exemption. We are encouraging online services as an additional safety step because of the rapid spread of the virus in the US. An Ad Valorem decal will be issued when the property taxes are paid each year (October 1st thru December 31st). Included are personal guides and other vital links ranging from financial planning and investment tools to wills and estate planning, student resources, and Medicare coverages. endstream

endobj

startxref

Use professional pre-built templates to fill in and sign documents online faster. Post author: Post published: April 2, 2023; Post category: missing girl in The housing market has gone through the roof over the past year. Such changes must be reported

1. Draw your signature or initials, place it in the corresponding field and save the changes. Code of Alabama, 1975 32-6-1 states Every new resident of the State of Alabama shall procure an Alabamas drivers license within 30 days after establishing residence in this state..  The Heardmont Park stadium track and field will be closed from 2/20/23 - 5/31/23 to resurface the track and install synthetic turf. 200 West College Street Columbiana, AL 35051. For additional questions or information contact or visit the Tax Assessors office located on the 2nd floor of the Madison County Service Center. Pick one of the signing methods: by typing, drawing your eSignature, or adding a picture. 737), was a United States presidential proclamation issued on December 8, 1863, by United States President Abraham Lincoln, during the American Civil War. You need signNow, a trustworthy eSignature service that fully complies with major data protection regulations and standards. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Welch. Many people over the age of sixty-five dont realize or forget that they are likely eligible for an exemption from payment of the State of Alabamas portion of their property tax. Who is eligible for the Homestead Exemption? You may return the form by visiting any of our locations, or you may mail to: Revenue Commissioner P.O. Manufactured Homes Alabama Department of Revenue. Permanent and totally disabled means a person who has, on the first day of January of the year for which the homestead exemption is requested, some impairment of body or mind that makes him/her unfit to work at any substantially remunerative employment which he/she is reasonably able to perform and which will, with reasonable probability, continue for an indefinite period of at least 12 months without any present indication of recovery, or who has been certified as totally and permanently disabled by an eligible state or federal agency. Alabama law states the tax bill becomes due on October 1 of any given year and must be in the name of the owner whose name was on record for the property on October 1 the year before. Disability Exemptions (copy of Alabama drivers license required) * a purchaser under a land installment contract, * a life tenant under a life estate, I also attest that I have no Address on drivers license must match the property address & be issued on or before Oct. 1. Definition of a Surviving Spouse You must show proof of ownership of the property.

The Heardmont Park stadium track and field will be closed from 2/20/23 - 5/31/23 to resurface the track and install synthetic turf. 200 West College Street Columbiana, AL 35051. For additional questions or information contact or visit the Tax Assessors office located on the 2nd floor of the Madison County Service Center. Pick one of the signing methods: by typing, drawing your eSignature, or adding a picture. 737), was a United States presidential proclamation issued on December 8, 1863, by United States President Abraham Lincoln, during the American Civil War. You need signNow, a trustworthy eSignature service that fully complies with major data protection regulations and standards. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Welch. Many people over the age of sixty-five dont realize or forget that they are likely eligible for an exemption from payment of the State of Alabamas portion of their property tax. Who is eligible for the Homestead Exemption? You may return the form by visiting any of our locations, or you may mail to: Revenue Commissioner P.O. Manufactured Homes Alabama Department of Revenue. Permanent and totally disabled means a person who has, on the first day of January of the year for which the homestead exemption is requested, some impairment of body or mind that makes him/her unfit to work at any substantially remunerative employment which he/she is reasonably able to perform and which will, with reasonable probability, continue for an indefinite period of at least 12 months without any present indication of recovery, or who has been certified as totally and permanently disabled by an eligible state or federal agency. Alabama law states the tax bill becomes due on October 1 of any given year and must be in the name of the owner whose name was on record for the property on October 1 the year before. Disability Exemptions (copy of Alabama drivers license required) * a purchaser under a land installment contract, * a life tenant under a life estate, I also attest that I have no Address on drivers license must match the property address & be issued on or before Oct. 1. Definition of a Surviving Spouse You must show proof of ownership of the property.  Create an account, log in, and upload your Alabama Homestead Exemption Form. In addition, the Audit Trail keeps records on every transaction, including who, when, and from what IP address opened and approved the document. Own and have occupied your home as your principal place of residence on January 1 of the year for which you file the application, AND Any owner-occupant who is 100% permanently and totally disabled

Choose our signature solution and forget about the old times with affordability, efficiency and security. After granted current use, owner does not have to re-apply annually. Stewart H. Welch, III, CFP, AEP, is the founder ofTHE WELCH GROUP, LLC, which specializes in providing fee-onlyinvestment managementand financial advice to families throughout the United States. Can also visit offices in Scottsboro, Guntersville, Decatur & Athens. Definition of Surviving Spouse of a Disabled Veteran Examples include a letter from your physician, employer and/or the Social Security Administration.

Create an account, log in, and upload your Alabama Homestead Exemption Form. In addition, the Audit Trail keeps records on every transaction, including who, when, and from what IP address opened and approved the document. Own and have occupied your home as your principal place of residence on January 1 of the year for which you file the application, AND Any owner-occupant who is 100% permanently and totally disabled

Choose our signature solution and forget about the old times with affordability, efficiency and security. After granted current use, owner does not have to re-apply annually. Stewart H. Welch, III, CFP, AEP, is the founder ofTHE WELCH GROUP, LLC, which specializes in providing fee-onlyinvestment managementand financial advice to families throughout the United States. Can also visit offices in Scottsboro, Guntersville, Decatur & Athens. Definition of Surviving Spouse of a Disabled Veteran Examples include a letter from your physician, employer and/or the Social Security Administration.  WebYou can reach out to your local taxing official to claim your homestead exemption. By this poi, How To Sign Wyoming Plumbing Presentation. Just register on the admission portal and during registration you will get an option for the entrance based course. You must own and occupy the property. Consult your financial advisor before acting on comments in this article.

WebYou can reach out to your local taxing official to claim your homestead exemption. By this poi, How To Sign Wyoming Plumbing Presentation. Just register on the admission portal and during registration you will get an option for the entrance based course. You must own and occupy the property. Consult your financial advisor before acting on comments in this article.  Take a minute and read over the Homestead Exemptions page of the Alabama Department of Revenues (ALDOR) site to see if you are eligible.

Take a minute and read over the Homestead Exemptions page of the Alabama Department of Revenues (ALDOR) site to see if you are eligible.  If the manufactured home and land are titled in the same name, and will be occupied by owner as his/her home, the manufactured home will be assessed as real property and Homestead may apply. A homestead exemption is when a state reduces the property taxes you have to pay on your home. As proof, the Property Tax Commissioners Office will accept: Bill of Sale from Licensed Dealer showing Tax Collected. Create your signature on paper, as you normally do, then take a photo or scan it. Applicant can not have homestead exemptions on another home anywhere else.

If the manufactured home and land are titled in the same name, and will be occupied by owner as his/her home, the manufactured home will be assessed as real property and Homestead may apply. A homestead exemption is when a state reduces the property taxes you have to pay on your home. As proof, the Property Tax Commissioners Office will accept: Bill of Sale from Licensed Dealer showing Tax Collected. Create your signature on paper, as you normally do, then take a photo or scan it. Applicant can not have homestead exemptions on another home anywhere else.  Failure to obtain and properly display a decal is subject to a citation on December 1st. Deadline to apply is December 31st. **Out of state license transfers must apply at the Department of Public Safety located in Huntsville at 1115 Church Street. Add the. If so, we need a statement from the prior county taxing official, on their letterhead, that you no longer claim a homestead in their county. Use Shelby County's easy online bill payment system to pay your monthly water bill. Have been discharged or released from active duty, AND Our goal is to give you the ability to do business with the county online, whether it is paying your property taxes, researching our county's tax record or deed information. Here is a list of the most common customer questions. The property must be your primary residence. Click on the appropriate form name highlighted above. However, business personal property must be assessed annually. Please remember that past performance may not be indicative of future results. Certain states use set values for homestead exemptions, while others, including Georgia, calculate the exemption as a percentageGeorgia will exempt 40 percent of the fair market value from taxation. Alabamainfohub.com provides information through various online resources and not liable to any kind of error or oversight. Current Use Create an account in signNow. In addition, Am. * Those who are required to validate exemptions annually will be sent a form in the mail that can be signed and returned to the Revenue Commissioner's Office. Two forms of proof of disability are required. Access the county's online interactive map portal to view information about taxing districts, conduct street searches, and find subdivisions or parcel IDs. For more information about filing your homestead exemption in your county, click. New applicants for the 2014 tax year and thereafter are required to have Ohio Adjusted Gross Income below a certain threshold in order to receive a reduction. Renewal of manufactured home registrations for those who do not own their manufactured home and land is October/November each year.

Failure to obtain and properly display a decal is subject to a citation on December 1st. Deadline to apply is December 31st. **Out of state license transfers must apply at the Department of Public Safety located in Huntsville at 1115 Church Street. Add the. If so, we need a statement from the prior county taxing official, on their letterhead, that you no longer claim a homestead in their county. Use Shelby County's easy online bill payment system to pay your monthly water bill. Have been discharged or released from active duty, AND Our goal is to give you the ability to do business with the county online, whether it is paying your property taxes, researching our county's tax record or deed information. Here is a list of the most common customer questions. The property must be your primary residence. Click on the appropriate form name highlighted above. However, business personal property must be assessed annually. Please remember that past performance may not be indicative of future results. Certain states use set values for homestead exemptions, while others, including Georgia, calculate the exemption as a percentageGeorgia will exempt 40 percent of the fair market value from taxation. Alabamainfohub.com provides information through various online resources and not liable to any kind of error or oversight. Current Use Create an account in signNow. In addition, Am. * Those who are required to validate exemptions annually will be sent a form in the mail that can be signed and returned to the Revenue Commissioner's Office. Two forms of proof of disability are required. Access the county's online interactive map portal to view information about taxing districts, conduct street searches, and find subdivisions or parcel IDs. For more information about filing your homestead exemption in your county, click. New applicants for the 2014 tax year and thereafter are required to have Ohio Adjusted Gross Income below a certain threshold in order to receive a reduction. Renewal of manufactured home registrations for those who do not own their manufactured home and land is October/November each year.  Use our detailed instructions to fill out and eSign your documents online. He is the author or co-author of six books, including50 Rules of Success;J.K. Lassers New Rules for Estate, Retirement and Tax Planning- 6thEdition(John Wiley & Sons, Inc.);THINK Like a Self-Made Millionaire;and100 Tips for Creating a Champagne Retirement on a Shoestring Budget. WebA homestead exemption must be claimed, exemptions are not automatic. Must have been at least 59 years old on the date of the decedents death. Homestead exemption is a reduction in the assessed valuation of the real estate you use as your main home (which results in an overall lower real estate tax bill).

Use our detailed instructions to fill out and eSign your documents online. He is the author or co-author of six books, including50 Rules of Success;J.K. Lassers New Rules for Estate, Retirement and Tax Planning- 6thEdition(John Wiley & Sons, Inc.);THINK Like a Self-Made Millionaire;and100 Tips for Creating a Champagne Retirement on a Shoestring Budget. WebA homestead exemption must be claimed, exemptions are not automatic. Must have been at least 59 years old on the date of the decedents death. Homestead exemption is a reduction in the assessed valuation of the real estate you use as your main home (which results in an overall lower real estate tax bill).  Encompassing approximately 800 square miles in Central Alabama at the southernmost extension of the Appalachian Mountains, the County offers diverse amenities in a temperate climate with dramatic landscapes. Read all the field labels carefully. The whole procedure can take a few seconds.

Encompassing approximately 800 square miles in Central Alabama at the southernmost extension of the Appalachian Mountains, the County offers diverse amenities in a temperate climate with dramatic landscapes. Read all the field labels carefully. The whole procedure can take a few seconds.  Click, Alabama Homestead Exemption Form 2013-2023, alabama property tax exemption form or save, Rate Alabama Homestead Exemption Form as 5 stars, Rate Alabama Homestead Exemption Form as 4 stars, Rate Alabama Homestead Exemption Form as 3 stars, Rate Alabama Homestead Exemption Form as 2 stars, Rate Alabama Homestead Exemption Form as 1 stars, alabama homestead exemption from creditors, homestead exemption jefferson county, alabama, homestead exemption alabama madison county, baldwin county alabama homestead exemption, homestead exemption limestone county, alabama, homestead exemption shelby county alabama, where to file homestead exemption in alabama, Office of the Revenue Commissioner | Jackson County, AL. hb``g``jb```Tc@@,2@0f1v20gle\p-a P37Abfh" ` -

* a trustee of a trust with the right to live in the property, If you wish to appeal the Auditors denial, you may complete DTE Form 106B Homestead Exemption and Owner-Occupancy Reduction Complaint. Qualifying for the states property tax exemption can save you hundreds of dollars.

Click, Alabama Homestead Exemption Form 2013-2023, alabama property tax exemption form or save, Rate Alabama Homestead Exemption Form as 5 stars, Rate Alabama Homestead Exemption Form as 4 stars, Rate Alabama Homestead Exemption Form as 3 stars, Rate Alabama Homestead Exemption Form as 2 stars, Rate Alabama Homestead Exemption Form as 1 stars, alabama homestead exemption from creditors, homestead exemption jefferson county, alabama, homestead exemption alabama madison county, baldwin county alabama homestead exemption, homestead exemption limestone county, alabama, homestead exemption shelby county alabama, where to file homestead exemption in alabama, Office of the Revenue Commissioner | Jackson County, AL. hb``g``jb```Tc@@,2@0f1v20gle\p-a P37Abfh" ` -