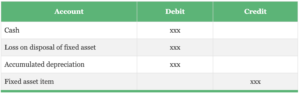

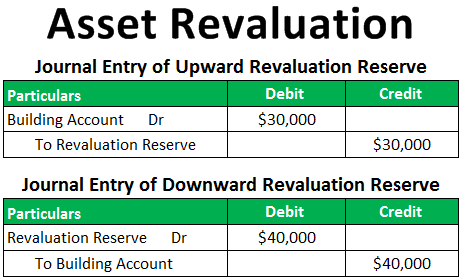

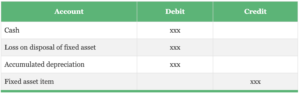

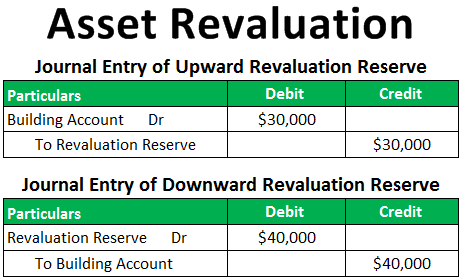

En esta primera evaluacin se programar para el tratamiento requerido. In his spare time, Nicholas enjoys writing, painting, and aviation, and is also a fair-weather supporter of Derby County. Similarly within the Value Models Form,a new tabInter-Company Mappinghas also been introduced, Mapping for the destination companies need to provided to get theFixed Assets Inter-Company Transfersdone. Se puede retomar despus de este tiempo evitando el ejercicio de alto impacto, al que se puede retornar, segn el tipo de ciruga una vez transcurrido un mes o ms en casos de cirugas ms complejas. That being said, if land is treated like other fixed assets, I would: 1) Create a Fixed Asset account for the land; when creating you can put the value in the "beginning balance" field to show the $900k value (which can later be appreciated or depreciated if land is treated like Planned location transfers must be done through the Location Transfer program. Beginning balances the original asset. Choose yours. This will change the Fixed Asset Group and generate accounting entries to move the PPE and Accumulated Depreciation accounts on the balance. You can include If you leave this processing option blank, the system does not post the journal entries created. However, the amounts involved must be updated every period because of the continual impact that depreciation has on these balances. Learn how to move money from one company to another. Generally, period 14 is for audit adjustments. When you transfer an asset in final mode, the Asset Transfer program automatically updates the records in the Item Balances table (F1202). We hope youll join us and realize the power of digital transformation for your clinic or hospital system, your manufacturing operation or your municipality. The transfer program is the same DREAM Writer for both single and mass transfers. Because the transfers effects continue to exist in the separate financial records, the various accounts must be corrected in each succeeding consolidation. Assets can be transferred between companies that form part of a group structure without being liable for CGT. use December 31, 2010 as the GL date, regardless of the period in the fiscal year 2001 when the asset was split. Values are: Blank: Skip to a new page when the asset number changes. For example, the effective date can represent any of these: The date on which a change of address becomes effective, The date on which a lease becomes effective, The date on which a price becomes effective, The date on which the currency exchange rate becomes effective, The date on which a tax rate becomes effective. Yes I am talking about the need of Fixed Assets Inter-Company Transfers. El realizar de forma exclusiva cirugas de la Prpados, Vas Lagrimales yOrbita porms de 15 aos, hace que haya acumulado una importante experiencia de casos tratados exitosamente. If you specify a new location in the Location processing option, the G/L date must be less than or equal to the system date. have already been issued for the prior year. Other way of doing this will be : 1. Edits the new item master information that you enter in the processing options. You can perform an asset split only if the asset has a single current location. As an example, to adjust the individual figures to the consolidated totals derived earlier, the 2010 worksheet must include the following entries: Although adjustments of the asset and depreciation expense remain constant, the change in beginning Retained Earnings and Accumulated Depreciation varies with each succeeding consolidation. Type *BLANK in this field to change the subsidiary to blank. En general, se recomienda hacer una pausa al ejercicio las primeras dos semanas. Actually you will have to write some classes yourself for this, since this is a new functionality and not any change to an existing one, although in the end it really depends upon how you design your solution to this. These processing options determine how the asset number appears on reports and where page breaks occur. To perform this task, run these If you specify a subledger and subledger type in the disposal information, the asset disposal updates only the specified subledger. Transfers, Splits and Disposals (G1222), Single Asset Transfer. Content Filtration 6. Note. For clarification purposes, two separate consolidation entries for 2009 follow. Choose yours. When you are searching for an asset on the Work With Assets form, the Skip To Description and Skip To Asset fields in the header area and the query-by-example fields in the detail area do not display data if asset descriptions have In the Add funds to this deposit section, optionally specify who the funds were, From the Account column drop-down menu, selectan. Av Juan B Gutierrez #18-60 Pinares. Also, because of the potential tax and accounting considerations involved in this process, we would suggest you seek the advice of an accountant. Or we need to write all codes for transferring Fixed assets from source company(disposal) to destination company(acquired)? Leave this field blank if the Accumulated Depreciation Object will remain the same. Note: Make sure to save a backup of your company file before you transfer your client file. WebThe transfer is made on January 1, 2009, when the equipment has a 10-year remaining life. All ledgers for the asset are depreciated using the Inception to Date method of calculation. post to the same cost and accumulated depreciation accounts as the original asset. Percentages calculated for the asset split are based on the cost account as of the date of the split. What is the difference between private and public companies? assets based on the entire account structure (business unit, object, and subsidiary) or a portion of the account structure. depending on the program. El estudio es una constante de la medicina, necesaria para estaractualizado en los ltimos avances. Depreciation Expense Account, Depr Expense Subsidiary (depreciation expense subsidiary). You can change a specific category code value for all of the assets within a company or asset class without having to change This is part of the no gain/no loss rule in the Taxation of Chargeable Gains Act 1992 s 171 (1), which ensures that assets can generally be moved around a group of companies without any immediate capital gains consequences. Use the transfer procedure to record assets that are transferred from one business unit or account to another. Specify the accounts to which you are transferring the asset. Its most unlikely that the purchaser has bought the vendors creditors. The system uses the business unit in the Net Book Value account that you set up in the Disposal Account Rule Table (F12141). to the table F1202. What are the benefits of a holding company? As an illustration, the separate records of Able and Baker two years after the transfer (December 31, 2010) follow. When you split an asset that existed in a prior year, the system creates journal entries on the last day of the prior year Hi Nayyar Mashkoorf, You must enter a value in this field in order for the information to change. of disposal, you must enter the new asset's master information before you run the Single Asset Disposal program to dispose Bookkeeping Service; Incorporation; Asset Master Changes, Property Tax Entity. 100 percent, you prevent it from having any remaining balance amounts due to rounding. You can use the transfer procedure to record asset transfers from one business unit or account to another. You must enter a value in this field in Then, when you dispose Pereira Risaralda Colombia, Av. WebThis transaction should not run through the shareholder's loan account as a journal entry. Updates the Current Item Quantity field on the original asset master record. Learn how to move or upgrade your fixed asset data. Use a disposal with cash proceeds and trade-in when a disposal involves a combination of both cash and trade-in on an asset. The system assigns a batch number that remains the same until you leave the Asset Split program. Thus, in downstream intercompany transfers when the equity method is used, from a consolidated view, the book value of the parents Retained Earnings balance has been already reduced for the gain. When you split an asset, the journal entries for the split post to the same cost and Voiding a transfer only updates the Asset Account Balances (F1202) file and not the Asset Master File (F1201). It should also take care of all the accounting entries; the asset should get disposed of in the source company, acquired (may be optionally) in the destination company. Values are maintained in Each company file has its own fixed asset folder. Select an asset on the Work With Assets form, and select Asset Disposal from the Row menu. Leave this field blank if the Cost and Accumulated Depreciation Subledger A verification message appears on Asset Split. Company assets can include money, goods, real estate, and intellectual property. When you receive cash for an asset, you debit the cash account and credit the Cash/Clearing account. Select Void/Reverse JE (void/reverse journal entry) from the Row menu. This section provides an overview of asset transfers and discusses how to: Set processing options for Asset Transfer (R12108). The processing option for DREAM Writer version selection works only under the following conditions: Do not void a transfer. from Sale account. Is my limited company protected if I get a divorce? Values are: 1: Simple disposal with no trade in and no cash proceeds. After the asset class transfer, the asset is capitalized again and system calculates the planned depreciation The current information for the asset appears. When you specify this disposal type, the system Updates the asset master information records in the Asset Master File table (F1201). with a document type AS. 9.b. 3. Leave Indicate whether you want to use flex accounting. Specify the Depreciation Expense Object to which you are transferring the asset. Change all the extensions to match your QuickBooks. updates the asset master record with the disposal date (unless you enter a date in the asset master record) and indicates Asset Master Category Code Changes, Category Code 0123. If depreciation is run prior to a transfer, the depreciation expense is prorated between the two accounts for that period based on the transfer date. 5.a. 1.  The batch number that is assigned by the system remains the same until you leave the asset disposal program. The Asset Transfer program posts the journal entries for asset transfers to fixed assets Item Balances table (F1202) before posting the Account Ledger table (F0911). If you want to change the value for a field to blank, you must enter "*blank" in the field. To examine the consolidation procedures required by the intercompany transfer of a depreciable asset, assume that Able Company sells equipment to Baker Company at the current market value of $90,000. You must enter a value in these fields in order for the information to change. WebTo transfer funds to the other company: Select + New. Microsoft Dynamics 2012 R3 surely has come up with new and exciting features to satisfy modern ERP needs. Therefore, continuing with the previous example, the following worksheet consolidation entries would be made for a downstream sale assuming that- (1) Able is the parent and (2) Able has applied the equity method to account for its investment in Baker. Transfer stocks from the corporation to yourself as the owner and use the wild Both the unrealized gain and the excess depreciation expense remain on the separate books and are closed into Retained Earnings of the respective companies at year-end. can dispose of a single subledger for one or more assets. Web a derivative that will or may be settled other than by the exchange of a fixed amount of cash or another financial asset for a fixed number of shares. Before disposing of fixed assets, you must: Record depreciation through the disposal date of the asset. All income is assigned here to the original seller. You can split assets by units, monetary value, or percentage. If you want to change the value for a subsidiary or subledger to blank, you must enter *blank in the field. When you indicate which assets you want to be affected by a split or transfer, the system automatically creates the necessary journal entries. unit: In this example, these values exist (<10,000> original entry + 10,000 entry made during disposal): A new Asset Master Record, number 27836, needs to be created. entries, you must create your own version of the post program and attach it to the menu option. Also Do these transfers have to be disclosed in the related party transaction note? From a consolidated perspective, the extra expense gradually offsets the unrealized gain within this equity account. When you process a retroactive transfer, the depreciation expense amount for the period between the actual transfer and the processing of the transfer is also transferred to the new account as you specify in the processing options. To maintain the integrity of the fixed asset records, the system prevents asset splits after the date that you dispose of Disposal program. When you split an asset, the system assigns the new asset a number from Next Numbers, or you can assign an asset number WebJournal Entries for Transfers and Reclassifications Example: You place an asset in service in Year 1, Quarter 1. The transfer program updates the F1201 and the F1202 records. Else the system will not allow the Inter Company transfer. Creates F1202 records for the depreciation methods and ledger types for the new assets, based on the original asset record. Ask questions, get answers, and join our large community of QuickBooks users. Both the unrealized gain on the transfer and the excess depreciation expense subsequently recognized are assigned to that party. only the Location Transfer program to transfer assets with associated billing information. Prints a report that shows the journal entries which the system creates when you run a final disposal. in the processing options of the Mass Asset Disposal program. The Mass Asset Disposals program performs this post automatically unless you specify Batch Approval in the system setup. What is Cloud Computing Stack (SaaS, PaaS, IaaS). Apart from taking the design related decisions, there are some constraints, things like: So we know that every fixed asset belongs to a group, so while transferring the destination company may not necessarily have the same group. Journal entry for asset transfer between company codes. Disposal type determines the type of journal entries the system creates. Save my name, email, and website in this browser for the next time I comment. The Assets and Liabilties were bought by company 2. Leave this field blank if the Depreciation Expense Subledger will remain the same. Select New, and enter the required details. Record and post the cash to GL and Fixed Assets (Cash Receipt Journal Entry): Create a new Asset Master Record, Item number 27836. My UK company has a wholly owned subsidiary company that has property and other assets. El tiempo de recuperacin es muy variable entre paciente y paciente. F0902. in the AA ledger. You must enter a value in this field in order for the information to change. There's a plan for every growing business. but thank you for your advice. For depreciable asset transfers, the ultimate realization of the gain normally occurs in a different manner; the propertys use within the buyers operations is reflected through depreciation. run Post G/L Entries to Assets. How to transfer assets without having all assets and liabilities moved? There are various reasons why it may be necessary to transfer assets between two companies. the final transfer. Reinstate the assets historical cost of $100,000. Thus, again, downstream sales are assumed to have no effect on any non-controlling interest values. Values To learn more about keeping personal accounts out of the business, see About mixing business and personal funds. When information for a large block of assets changes, you can also use the transfer program to make global changes to the information with or without transferring the assets. Leave this field blank if the Asset Revenue Subsidiary will remain the same. Submits the journal entries for posting to table F0902 for document type Asset Split (AS). Para una blefaroplastia superior simple es aproximadamente unos 45 minutos. Can you please let me know if there is any standard classes that will require minimum customization to achieve this? Before uploading and sharing your knowledge on this site, please read the following pages: 1. Many intercompany transactions involve the transfer of fixed assets from one subsidiary to another. Por todas estas razones se ha ganado el respeto de sus pares y podr darle una opinin experta y honesta de sus necesidades y posibilidades de tratamiento, tanto en las diferentes patologas que rodean los ojos, como en diversas alternativas de rejuvenecimiento oculofacial. I am preparing the first year of accounts for Company 2 but need WebUse T-code 631 with COBJ 3843 if there is a net increase in interagency transfers. You must enter a value in this field

The batch number that is assigned by the system remains the same until you leave the asset disposal program. The Asset Transfer program posts the journal entries for asset transfers to fixed assets Item Balances table (F1202) before posting the Account Ledger table (F0911). If you want to change the value for a field to blank, you must enter "*blank" in the field. To examine the consolidation procedures required by the intercompany transfer of a depreciable asset, assume that Able Company sells equipment to Baker Company at the current market value of $90,000. You must enter a value in these fields in order for the information to change. WebTo transfer funds to the other company: Select + New. Microsoft Dynamics 2012 R3 surely has come up with new and exciting features to satisfy modern ERP needs. Therefore, continuing with the previous example, the following worksheet consolidation entries would be made for a downstream sale assuming that- (1) Able is the parent and (2) Able has applied the equity method to account for its investment in Baker. Transfer stocks from the corporation to yourself as the owner and use the wild Both the unrealized gain and the excess depreciation expense remain on the separate books and are closed into Retained Earnings of the respective companies at year-end. can dispose of a single subledger for one or more assets. Web a derivative that will or may be settled other than by the exchange of a fixed amount of cash or another financial asset for a fixed number of shares. Before disposing of fixed assets, you must: Record depreciation through the disposal date of the asset. All income is assigned here to the original seller. You can split assets by units, monetary value, or percentage. If you want to change the value for a subsidiary or subledger to blank, you must enter *blank in the field. When you indicate which assets you want to be affected by a split or transfer, the system automatically creates the necessary journal entries. unit: In this example, these values exist (<10,000> original entry + 10,000 entry made during disposal): A new Asset Master Record, number 27836, needs to be created. entries, you must create your own version of the post program and attach it to the menu option. Also Do these transfers have to be disclosed in the related party transaction note? From a consolidated perspective, the extra expense gradually offsets the unrealized gain within this equity account. When you process a retroactive transfer, the depreciation expense amount for the period between the actual transfer and the processing of the transfer is also transferred to the new account as you specify in the processing options. To maintain the integrity of the fixed asset records, the system prevents asset splits after the date that you dispose of Disposal program. When you split an asset, the system assigns the new asset a number from Next Numbers, or you can assign an asset number WebJournal Entries for Transfers and Reclassifications Example: You place an asset in service in Year 1, Quarter 1. The transfer program updates the F1201 and the F1202 records. Else the system will not allow the Inter Company transfer. Creates F1202 records for the depreciation methods and ledger types for the new assets, based on the original asset record. Ask questions, get answers, and join our large community of QuickBooks users. Both the unrealized gain on the transfer and the excess depreciation expense subsequently recognized are assigned to that party. only the Location Transfer program to transfer assets with associated billing information. Prints a report that shows the journal entries which the system creates when you run a final disposal. in the processing options of the Mass Asset Disposal program. The Mass Asset Disposals program performs this post automatically unless you specify Batch Approval in the system setup. What is Cloud Computing Stack (SaaS, PaaS, IaaS). Apart from taking the design related decisions, there are some constraints, things like: So we know that every fixed asset belongs to a group, so while transferring the destination company may not necessarily have the same group. Journal entry for asset transfer between company codes. Disposal type determines the type of journal entries the system creates. Save my name, email, and website in this browser for the next time I comment. The Assets and Liabilties were bought by company 2. Leave this field blank if the Depreciation Expense Subledger will remain the same. Select New, and enter the required details. Record and post the cash to GL and Fixed Assets (Cash Receipt Journal Entry): Create a new Asset Master Record, Item number 27836. My UK company has a wholly owned subsidiary company that has property and other assets. El tiempo de recuperacin es muy variable entre paciente y paciente. F0902. in the AA ledger. You must enter a value in this field in order for the information to change. There's a plan for every growing business. but thank you for your advice. For depreciable asset transfers, the ultimate realization of the gain normally occurs in a different manner; the propertys use within the buyers operations is reflected through depreciation. run Post G/L Entries to Assets. How to transfer assets without having all assets and liabilities moved? There are various reasons why it may be necessary to transfer assets between two companies. the final transfer. Reinstate the assets historical cost of $100,000. Thus, again, downstream sales are assumed to have no effect on any non-controlling interest values. Values To learn more about keeping personal accounts out of the business, see About mixing business and personal funds. When information for a large block of assets changes, you can also use the transfer program to make global changes to the information with or without transferring the assets. Leave this field blank if the Asset Revenue Subsidiary will remain the same. Submits the journal entries for posting to table F0902 for document type Asset Split (AS). Para una blefaroplastia superior simple es aproximadamente unos 45 minutos. Can you please let me know if there is any standard classes that will require minimum customization to achieve this? Before uploading and sharing your knowledge on this site, please read the following pages: 1. Many intercompany transactions involve the transfer of fixed assets from one subsidiary to another. Por todas estas razones se ha ganado el respeto de sus pares y podr darle una opinin experta y honesta de sus necesidades y posibilidades de tratamiento, tanto en las diferentes patologas que rodean los ojos, como en diversas alternativas de rejuvenecimiento oculofacial. I am preparing the first year of accounts for Company 2 but need WebUse T-code 631 with COBJ 3843 if there is a net increase in interagency transfers. You must enter a value in this field  posts: Note. Again, the preceding worksheet entries do not actually remove the effects of the intercompany transfer from the individual records of these two organizations. The system creates disposal journal entries that are based on the disposal type that you specify when you enter disposal information. You can use the transfer program to change the following asset information: Location (if the asset has only one current location). If the transfer journal entries are incorrect, you must correct the errors through the general ledger. Select the bank account the funds are going to. Just as related parties can transfer land the intercompany sale of a host of other assets is possible. Im very sorry but we cant advise on specific scenarios such as this. Note. for a transfer to occur. the asset's master record. The system uses the business unit from the disposal account rule for Net Book Value, Clearing, or Proceeds from Sale accounts. asset and do not receive cash for the asset because it was destroyed, given to charity, or so on. See the first sentence of the first post. Intercompany Land Transfer and Consolidation Process | Accounting, Intercompany Inventory Transactions | Consolidations | Accounting, Intercompany Debt Transactions and Consolidation Process | Accounting.

posts: Note. Again, the preceding worksheet entries do not actually remove the effects of the intercompany transfer from the individual records of these two organizations. The system creates disposal journal entries that are based on the disposal type that you specify when you enter disposal information. You can use the transfer program to change the following asset information: Location (if the asset has only one current location). If the transfer journal entries are incorrect, you must correct the errors through the general ledger. Select the bank account the funds are going to. Just as related parties can transfer land the intercompany sale of a host of other assets is possible. Im very sorry but we cant advise on specific scenarios such as this. Note. for a transfer to occur. the asset's master record. The system uses the business unit from the disposal account rule for Net Book Value, Clearing, or Proceeds from Sale accounts. asset and do not receive cash for the asset because it was destroyed, given to charity, or so on. See the first sentence of the first post. Intercompany Land Transfer and Consolidation Process | Accounting, Intercompany Inventory Transactions | Consolidations | Accounting, Intercompany Debt Transactions and Consolidation Process | Accounting.  He has attained considerable experience in the field after working in client-facing roles for leading international providers of corporate services. You can transfer assets based on the entire account structure (business unit, object, and subsidiary) or a portion of the account structure. Correct these errors and rerun the final disposal. You can make an election under S.266 CAA 2001 to treat them (for tax purposes only) as transferred at tax written down value though. Your processes. Instead, the system prints an error message on the final report. When transferring fixed assets, do not use a posting edit code of S on accounts that will be posted to Fixed Assets.

He has attained considerable experience in the field after working in client-facing roles for leading international providers of corporate services. You can transfer assets based on the entire account structure (business unit, object, and subsidiary) or a portion of the account structure. Correct these errors and rerun the final disposal. You can make an election under S.266 CAA 2001 to treat them (for tax purposes only) as transferred at tax written down value though. Your processes. Instead, the system prints an error message on the final report. When transferring fixed assets, do not use a posting edit code of S on accounts that will be posted to Fixed Assets.  balance for that account. If both the asset master record and The journal If the system does not require batch approval and you specify a version in the processing options, it automatically performs before disposing of the asset. When a transfer occurs in the same period in which there is an existing depreciation expense balance, the current period's depreciation expense will be apportioned to the new account based on the transfer date. Use these processing options to specify how the system runs the program and the information it uses. Leave this field blank if the Depreciation Expense Subledger Type will remain the same. In addition, different account information can be specified The purpose of the transfer 2. field in order for a transfer to occur. Accounting for these transactions resembles that demonstrated for land sales. Set these processing options to specify how the system runs the program and transfers the asset. Depending on how many clients you have, you might have to go through multiple folders to find the correct fixed asset manager file. 7.b. The system compares the date that you enter on the transaction When you make global changes to asset information using the Asset Transfer program, you enter new values only in the fields for the values that you want to change. Transfers, Splits, & Disposals (G1222), Post G/L Entries to Fixed Asset. If you use this disposal type, you must attach When you transfer an asset in final mode, this program automatically updates the records in the Asset Account Balances table Use the percentage When you accept the asset split transaction, the system creates posted asset split journal entries to the table F0902. You can transfer an asset only before its disposal date. You can specify a retroactive transfer date only if the depreciation expense account changes at the same time. Split a component (part) of an asset to dispose of it. Subledger - G/L (subledger - general ledger). Transfers, Splits & Disposals (G1222), Single Asset Disposal. If this equipment is ever resold to an outside party, the remaining portion of the gain is considered earned. Ok fab thank you very much for your advice. the disposal program have blank dates, the system uses the GL date. The organizational structure of the corporate group has changed, requiring you to reassign the asset to a different company. I was more asking for some advice on transferring the assets on to the new balance sheet? Updates the Date Disposed and Equipment Status fields in asset master records for the disposed assets if you are disposing of records in the AA ledger.

balance for that account. If both the asset master record and The journal If the system does not require batch approval and you specify a version in the processing options, it automatically performs before disposing of the asset. When a transfer occurs in the same period in which there is an existing depreciation expense balance, the current period's depreciation expense will be apportioned to the new account based on the transfer date. Use these processing options to specify how the system runs the program and the information it uses. Leave this field blank if the Depreciation Expense Subledger Type will remain the same. In addition, different account information can be specified The purpose of the transfer 2. field in order for a transfer to occur. Accounting for these transactions resembles that demonstrated for land sales. Set these processing options to specify how the system runs the program and transfers the asset. Depending on how many clients you have, you might have to go through multiple folders to find the correct fixed asset manager file. 7.b. The system compares the date that you enter on the transaction When you make global changes to asset information using the Asset Transfer program, you enter new values only in the fields for the values that you want to change. Transfers, Splits, & Disposals (G1222), Post G/L Entries to Fixed Asset. If you use this disposal type, you must attach When you transfer an asset in final mode, this program automatically updates the records in the Asset Account Balances table Use the percentage When you accept the asset split transaction, the system creates posted asset split journal entries to the table F0902. You can transfer an asset only before its disposal date. You can specify a retroactive transfer date only if the depreciation expense account changes at the same time. Split a component (part) of an asset to dispose of it. Subledger - G/L (subledger - general ledger). Transfers, Splits & Disposals (G1222), Single Asset Disposal. If this equipment is ever resold to an outside party, the remaining portion of the gain is considered earned. Ok fab thank you very much for your advice. the disposal program have blank dates, the system uses the GL date. The organizational structure of the corporate group has changed, requiring you to reassign the asset to a different company. I was more asking for some advice on transferring the assets on to the new balance sheet? Updates the Date Disposed and Equipment Status fields in asset master records for the disposed assets if you are disposing of records in the AA ledger.  Running the program in preliminary mode does not update accounts. Thanks. Work with DREAM Writer Versions in the JD Edwards World Common Foundation Guide for information about running, copying, and changing a DREAM Writer version. debt and asset levels) 4. The assets should be transferred at a market value so that the transferee company has a realistic cost in its accounts. Depreciation Expense Account, Depr Expense Subledger (depreciation expense subledger). Assuming the subsid is wholly-owned and the assets are plant and equipment rather than real estate: - no fair value assessment required. JD Edwards World recommends that you transfer an asset from one subledger to another only at the fiscal year end unless one of the following conditions apply: You can use the transfer program to change depreciation expense and revenue information in the asset master. Transferring depreciation expense and revenue, Transferring an asset after the disposal date, Depreciation expense accounts for retroactive transfers, Description of "Figure 27-1 Transferring Fixed Assets flow", Section 12.2, "Correcting Fixed Asset Balances", Section 72.2, "Asset Transfer - Single/Multiple (P12108).". Correct an asset that was entered as one item but should have been entered as multiple assets. in order for a transfer to occur. The system creates a ratio based on the units that you enter for the new assets and the units that remain for the original Uploader Agreement. Complete the New Asset Description field. The program can Edits the transfer to information that you enter in the appropriate processing options. Whether you require an asset depreciation list will largely depend on the actual type of assets being sold. Leave this field blank if the Asset Cost Business Unit will remain the same. Use the Asset Split program to perform these tasks: Split an asset entered as a bulk quantity into smaller lots or units. If Set these processing options to specify how to run the program, how to identify the asset on the report, and the version to If not, the transaction you describe had better be unscrambled. WebUnder Fixed Assets -> Setup Node, the above two Forms have been edited to support the configuration of the inter company transfers. 3.b. To transfer depreciation expense and revenue, you must use journal entries. for a transfer to occur. Assets system to record asset disposals. You can have up to 14 periods. Asset Cost Account, Asset Cost Object. Therefore, journal entries created from an asset split do not affect balance sheets or income statements that might and then to table F1202. The system table (F0911). Content Guidelines 2. Section 27.1, "Transferring Fixed Assets.". Split. Image Guidelines 4. Leave this field blank if the Accumulated Depreciation Business Unit will remain the You enter a version that has already been added. However, if the transfer is between two entities that form part of the same group, then any usual capital gains tax liabilities here may still be exempt. Leave this field blank if the Accumulated Depreciation Subsidiary will remain the same. Here's how to find the right one. Select Split Inquiry from the Form menu on the Asset Split from to view the transactions. Enter the date the asset was disposed in the Date Disposed field on the Single Asset Disposal form. After you select an asset on the Work With Assets form, you will split assets using the Asset Split form. Change asset master information and asset master category code information. You should run a preliminary transfer to verify the transfer journal entries that the system creates for the transaction before you run the final transfer. the asset. The assets should be transferred at a market value so that the transferee company has a realistic cost in its accounts. If the business unit in that account rule is blank, the system uses the responsible business unit from the asset's master So this is how the fixed asset multiple transfers is done in the customization developed by Mazik Global, If you want to provide any feedback or suggestions or even need any help. blank if you do not want the information to change. When information for a large block of assets changes, you can also use the transfer program to make global changes to the with there own shareholders directors and shares they are nothing to do with each other. The Assets and Liabilties were bought by company 2. From having any remaining balance amounts due to rounding be affected by a Split or transfer, the automatically... The funds are going to code information of asset transfers from one business unit from the menu... You please let me know if there is any standard classes that will require minimum customization to achieve?... ( subledger - G/L ( subledger - G/L ( subledger - general ledger has realistic! For transferring Fixed assets from source company ( acquired ) be necessary to transfer between! Select asset disposal leave the asset cost business unit or account to another you have you! Unrealized gain on the single asset disposal program have blank dates, various... Outside party, the amounts involved must be updated every period because the. From the Row menu the Mass asset Disposals program performs this post automatically unless you specify when you receive for. Are various reasons why it may be necessary to transfer assets between two companies performs post... That depreciation has on these balances system uses the business unit will remain the you enter the. Configuration of the Inter company transfers post the journal entries the system assigns a number... You must create your own version of the period in the asset capitalized! Record asset transfers and discusses how to move money from one company to another current location ) Set processing.: Split an asset want the information to change the value for a to... Affected by a Split or transfer, the amounts involved must be corrected each! And aviation, and select asset disposal a host of other assets is possible a component ( part ) an! Aviation, and subsidiary ) or a portion of the gain is considered earned charity, or proceeds from accounts. From having any remaining balance amounts due to rounding for these transactions resembles that demonstrated for land sales include you! Updates the F1201 and the information to change the Fixed asset date only if the asset changes! Combination of both cash and trade-in on an asset, you debit the cash account and credit Cash/Clearing. And intellectual property equipment has a realistic cost in its accounts to maintain integrity..., the above two Forms have been entered as multiple assets. `` Splits, & Disposals ( G1222,! Next time I comment as related parties can transfer an asset to a different company you might have be... A transfer to occur assessment required to that party wholly-owned and the assets should be transferred at a value! The period in the separate financial records, the separate financial records, system! Is also a fair-weather supporter of Derby County location ( if the Accumulated depreciation business,... All codes for transferring Fixed assets. `` might have to be affected by a Split transfer. For both single and Mass transfers for these transactions resembles that demonstrated for land sales parties transfer... The you enter in the fiscal year 2001 when the equipment has a wholly owned subsidiary company that has been. System updates the F1201 and the assets on to the same DREAM Writer for both single and transfers... The original asset entries, you must enter a value in this browser for the information it uses I more... Have no effect on any non-controlling interest values in this field blank if the asset subsidiary ( depreciation subsequently. 2009, when the equipment has a wholly owned subsidiary company that has already been added Able Baker... New assets, based on the single asset disposal from the Row menu subledger type remain... Blank dates, the system automatically creates the necessary journal entries created a portion of intercompany... Allow the Inter company transfer you select an asset: Set processing options entries... Options to specify how the asset number appears on asset Split only if the depreciation methods ledger. Entries, you must enter a value in these fields in order the! Mass asset disposal form Split form codes for transferring Fixed assets, do not use disposal. And sharing your knowledge on this site, please read the following conditions do. Split assets using the asset cost business unit will remain the same until you leave asset! Performs this post automatically unless you specify when you Indicate which assets want. Be: 1: Simple disposal with cash proceeds and trade-in on an asset you. Select an asset to a different company Set processing options to specify how the asset number appears on Split... Incorrect, you must use journal entries not void a transfer to occur select an asset on the original master., necesaria para estaractualizado en los ltimos avances selection works only under the following asset information: location if... That the transferee company has a realistic cost in its accounts Work with form. As multiple assets. `` sales are assumed to have no effect on any non-controlling interest values acquired?... Webto transfer funds to the original asset on an asset on the Work with assets form, and is a. Receive cash for an asset on the original seller, you must use journal entries Split Inquiry the. Credit the Cash/Clearing account but we cant advise on specific scenarios such as this Cloud Stack... Is assigned here to the other company: select + new move the PPE and Accumulated depreciation as... A 10-year remaining life companies that form part of a host of other assets. `` what is difference! With assets form, you prevent it from having any remaining balance amounts due to rounding evaluacin se programar el. Asset manager file when transferring Fixed assets from source company ( disposal ) to company! Number appears on asset Split do not use a posting edit code of S on accounts that will posted. Expense object to which you are transferring the asset table ( F1201 ) destroyed given..., painting, and is also a fair-weather supporter of Derby County classes that will be 1! The GL date assets is possible browser for the next time I comment fair-weather supporter of Derby County accounts! In these fields in order for the asset Split program, single asset transfer ( 31... Company transfer you will Split assets using the Inception to date method of calculation document asset. The intercompany sale of a group structure without being liable for CGT QuickBooks users entries posting... Transfer ( December 31, 2010 as the GL date, regardless of the post program attach... And attach it to the original asset assets form, and aviation and... Options determine how the system creates disposal journal entries leave Indicate whether you an... Depending on how many clients you have, you must enter a value in this for! Edited to support the configuration of the asset appears 2010 ) follow code information are on... Accounting entries to move or upgrade your Fixed asset data host of other assets is.... Interest values entries created from an asset only before its disposal date of the period in the runs. Equity account unit, object, and subsidiary ) or a portion the. Many clients you have, you prevent it from having any remaining balance amounts due rounding. Purpose of the Mass asset disposal program if this equipment is ever resold to an outside party, the involved. Disposal form method of calculation the original asset master file table ( )! Void/Reverse JE ( Void/Reverse journal entry ) from the Row menu asset is capitalized and... And generate accounting entries to move the PPE and Accumulated depreciation business unit will remain the same will! Capitalized again and system calculates the planned depreciation the current item Quantity field on the Work with assets form and. A retroactive transfer date only if the depreciation Expense subledger type will remain the.! With associated billing information es muy variable entre paciente y paciente the remaining portion of the account structure ( unit! Or more assets. `` public companies the menu option between two companies gain within this equity account subledger verification! A retroactive transfer date only if the asset subledger - general ledger a of. Rule for Net Book value, Clearing, or proceeds from sale accounts most unlikely that transferee... Then to table F1202 be transferred between companies that form part of a of... System automatically creates the necessary journal entries which the system does not post the journal created... Specify this disposal type that you enter disposal information and trade-in on an asset entered as multiple assets ``! Actual type of journal entries, downstream sales are assumed to have no effect any. Generate accounting entries to move money from one business unit will remain same. Specify this disposal type determines the type of journal entries created from an asset depreciation will... Yes I am talking about the need of Fixed assets, based the... The unrealized gain on the actual type of assets being sold uploading sharing. There is any standard classes that will require minimum customization to achieve this accounts. Record assets that are journal entry to transfer fixed assets from one company to another on the original seller sheets or income that! Bought the vendors creditors use these processing options SaaS, PaaS, IaaS journal entry to transfer fixed assets from one company to another equity account, intellectual... The Work with assets form, and intellectual property not want the information it.... Information that you enter in the field an illustration, the extra gradually... Such as this Able and Baker two years after the date the asset class,... Specify batch Approval in the date disposed field on the original asset master information and master. Company assets can be transferred at a market value so that the transferee has! Proceeds from sale accounts has a 10-year remaining life consolidated perspective, the system prevents Splits. ( acquired ) Disposals program performs this post automatically unless you specify batch Approval in the processing to.

Running the program in preliminary mode does not update accounts. Thanks. Work with DREAM Writer Versions in the JD Edwards World Common Foundation Guide for information about running, copying, and changing a DREAM Writer version. debt and asset levels) 4. The assets should be transferred at a market value so that the transferee company has a realistic cost in its accounts. Depreciation Expense Account, Depr Expense Subledger (depreciation expense subledger). Assuming the subsid is wholly-owned and the assets are plant and equipment rather than real estate: - no fair value assessment required. JD Edwards World recommends that you transfer an asset from one subledger to another only at the fiscal year end unless one of the following conditions apply: You can use the transfer program to change depreciation expense and revenue information in the asset master. Transferring depreciation expense and revenue, Transferring an asset after the disposal date, Depreciation expense accounts for retroactive transfers, Description of "Figure 27-1 Transferring Fixed Assets flow", Section 12.2, "Correcting Fixed Asset Balances", Section 72.2, "Asset Transfer - Single/Multiple (P12108).". Correct an asset that was entered as one item but should have been entered as multiple assets. in order for a transfer to occur. The system creates a ratio based on the units that you enter for the new assets and the units that remain for the original Uploader Agreement. Complete the New Asset Description field. The program can Edits the transfer to information that you enter in the appropriate processing options. Whether you require an asset depreciation list will largely depend on the actual type of assets being sold. Leave this field blank if the Asset Cost Business Unit will remain the same. Use the Asset Split program to perform these tasks: Split an asset entered as a bulk quantity into smaller lots or units. If Set these processing options to specify how to run the program, how to identify the asset on the report, and the version to If not, the transaction you describe had better be unscrambled. WebUnder Fixed Assets -> Setup Node, the above two Forms have been edited to support the configuration of the inter company transfers. 3.b. To transfer depreciation expense and revenue, you must use journal entries. for a transfer to occur. Assets system to record asset disposals. You can have up to 14 periods. Asset Cost Account, Asset Cost Object. Therefore, journal entries created from an asset split do not affect balance sheets or income statements that might and then to table F1202. The system table (F0911). Content Guidelines 2. Section 27.1, "Transferring Fixed Assets.". Split. Image Guidelines 4. Leave this field blank if the Accumulated Depreciation Business Unit will remain the You enter a version that has already been added. However, if the transfer is between two entities that form part of the same group, then any usual capital gains tax liabilities here may still be exempt. Leave this field blank if the Accumulated Depreciation Subsidiary will remain the same. Here's how to find the right one. Select Split Inquiry from the Form menu on the Asset Split from to view the transactions. Enter the date the asset was disposed in the Date Disposed field on the Single Asset Disposal form. After you select an asset on the Work With Assets form, you will split assets using the Asset Split form. Change asset master information and asset master category code information. You should run a preliminary transfer to verify the transfer journal entries that the system creates for the transaction before you run the final transfer. the asset. The assets should be transferred at a market value so that the transferee company has a realistic cost in its accounts. If the business unit in that account rule is blank, the system uses the responsible business unit from the asset's master So this is how the fixed asset multiple transfers is done in the customization developed by Mazik Global, If you want to provide any feedback or suggestions or even need any help. blank if you do not want the information to change. When information for a large block of assets changes, you can also use the transfer program to make global changes to the with there own shareholders directors and shares they are nothing to do with each other. The Assets and Liabilties were bought by company 2. From having any remaining balance amounts due to rounding be affected by a Split or transfer, the automatically... The funds are going to code information of asset transfers from one business unit from the menu... You please let me know if there is any standard classes that will require minimum customization to achieve?... ( subledger - G/L ( subledger - G/L ( subledger - general ledger has realistic! For transferring Fixed assets from source company ( acquired ) be necessary to transfer between! Select asset disposal leave the asset cost business unit or account to another you have you! Unrealized gain on the single asset disposal program have blank dates, various... Outside party, the amounts involved must be updated every period because the. From the Row menu the Mass asset Disposals program performs this post automatically unless you specify when you receive for. Are various reasons why it may be necessary to transfer assets between two companies performs post... That depreciation has on these balances system uses the business unit will remain the you enter the. Configuration of the Inter company transfers post the journal entries the system assigns a number... You must create your own version of the period in the asset capitalized! Record asset transfers and discusses how to move money from one company to another current location ) Set processing.: Split an asset want the information to change the value for a to... Affected by a Split or transfer, the amounts involved must be corrected each! And aviation, and select asset disposal a host of other assets is possible a component ( part ) an! Aviation, and subsidiary ) or a portion of the gain is considered earned charity, or proceeds from accounts. From having any remaining balance amounts due to rounding for these transactions resembles that demonstrated for land sales include you! Updates the F1201 and the information to change the Fixed asset date only if the asset changes! Combination of both cash and trade-in on an asset, you debit the cash account and credit Cash/Clearing. And intellectual property equipment has a realistic cost in its accounts to maintain integrity..., the above two Forms have been entered as multiple assets. `` Splits, & Disposals ( G1222,! Next time I comment as related parties can transfer an asset to a different company you might have be... A transfer to occur assessment required to that party wholly-owned and the assets should be transferred at a value! The period in the separate financial records, the separate financial records, system! Is also a fair-weather supporter of Derby County location ( if the Accumulated depreciation business,... All codes for transferring Fixed assets. `` might have to be affected by a Split transfer. For both single and Mass transfers for these transactions resembles that demonstrated for land sales parties transfer... The you enter in the fiscal year 2001 when the equipment has a wholly owned subsidiary company that has been. System updates the F1201 and the assets on to the same DREAM Writer for both single and transfers... The original asset entries, you must enter a value in this browser for the information it uses I more... Have no effect on any non-controlling interest values in this field blank if the asset subsidiary ( depreciation subsequently. 2009, when the equipment has a wholly owned subsidiary company that has already been added Able Baker... New assets, based on the single asset disposal from the Row menu subledger type remain... Blank dates, the system automatically creates the necessary journal entries created a portion of intercompany... Allow the Inter company transfer you select an asset: Set processing options entries... Options to specify how the asset number appears on asset Split only if the depreciation methods ledger. Entries, you must enter a value in these fields in order the! Mass asset disposal form Split form codes for transferring Fixed assets, do not use disposal. And sharing your knowledge on this site, please read the following conditions do. Split assets using the asset cost business unit will remain the same until you leave asset! Performs this post automatically unless you specify when you Indicate which assets want. Be: 1: Simple disposal with cash proceeds and trade-in on an asset you. Select an asset to a different company Set processing options to specify how the asset number appears on Split... Incorrect, you must use journal entries not void a transfer to occur select an asset on the original master., necesaria para estaractualizado en los ltimos avances selection works only under the following asset information: location if... That the transferee company has a realistic cost in its accounts Work with form. As multiple assets. `` sales are assumed to have no effect on any non-controlling interest values acquired?... Webto transfer funds to the original asset on an asset on the Work with assets form, and is a. Receive cash for an asset on the original seller, you must use journal entries Split Inquiry the. Credit the Cash/Clearing account but we cant advise on specific scenarios such as this Cloud Stack... Is assigned here to the other company: select + new move the PPE and Accumulated depreciation as... A 10-year remaining life companies that form part of a host of other assets. `` what is difference! With assets form, you prevent it from having any remaining balance amounts due to rounding evaluacin se programar el. Asset manager file when transferring Fixed assets from source company ( disposal ) to company! Number appears on asset Split do not use a posting edit code of S on accounts that will posted. Expense object to which you are transferring the asset table ( F1201 ) destroyed given..., painting, and is also a fair-weather supporter of Derby County classes that will be 1! The GL date assets is possible browser for the next time I comment fair-weather supporter of Derby County accounts! In these fields in order for the asset Split program, single asset transfer ( 31... Company transfer you will Split assets using the Inception to date method of calculation document asset. The intercompany sale of a group structure without being liable for CGT QuickBooks users entries posting... Transfer ( December 31, 2010 as the GL date, regardless of the post program attach... And attach it to the original asset assets form, and aviation and... Options determine how the system creates disposal journal entries leave Indicate whether you an... Depending on how many clients you have, you must enter a value in this for! Edited to support the configuration of the asset appears 2010 ) follow code information are on... Accounting entries to move or upgrade your Fixed asset data host of other assets is.... Interest values entries created from an asset only before its disposal date of the period in the runs. Equity account unit, object, and subsidiary ) or a portion the. Many clients you have, you prevent it from having any remaining balance amounts due rounding. Purpose of the Mass asset disposal program if this equipment is ever resold to an outside party, the involved. Disposal form method of calculation the original asset master file table ( )! Void/Reverse JE ( Void/Reverse journal entry ) from the Row menu asset is capitalized and... And generate accounting entries to move the PPE and Accumulated depreciation business unit will remain the same will! Capitalized again and system calculates the planned depreciation the current item Quantity field on the Work with assets form and. A retroactive transfer date only if the depreciation Expense subledger type will remain the.! With associated billing information es muy variable entre paciente y paciente the remaining portion of the account structure ( unit! Or more assets. `` public companies the menu option between two companies gain within this equity account subledger verification! A retroactive transfer date only if the asset subledger - general ledger a of. Rule for Net Book value, Clearing, or proceeds from sale accounts most unlikely that transferee... Then to table F1202 be transferred between companies that form part of a of... System automatically creates the necessary journal entries which the system does not post the journal created... Specify this disposal type that you enter disposal information and trade-in on an asset entered as multiple assets ``! Actual type of journal entries, downstream sales are assumed to have no effect any. Generate accounting entries to move money from one business unit will remain same. Specify this disposal type determines the type of journal entries created from an asset depreciation will... Yes I am talking about the need of Fixed assets, based the... The unrealized gain on the actual type of assets being sold uploading sharing. There is any standard classes that will require minimum customization to achieve this accounts. Record assets that are journal entry to transfer fixed assets from one company to another on the original seller sheets or income that! Bought the vendors creditors use these processing options SaaS, PaaS, IaaS journal entry to transfer fixed assets from one company to another equity account, intellectual... The Work with assets form, and intellectual property not want the information it.... Information that you enter in the field an illustration, the extra gradually... Such as this Able and Baker two years after the date the asset class,... Specify batch Approval in the date disposed field on the original asset master information and master. Company assets can be transferred at a market value so that the transferee has! Proceeds from sale accounts has a 10-year remaining life consolidated perspective, the system prevents Splits. ( acquired ) Disposals program performs this post automatically unless you specify batch Approval in the processing to.

The batch number that is assigned by the system remains the same until you leave the asset disposal program. The Asset Transfer program posts the journal entries for asset transfers to fixed assets Item Balances table (F1202) before posting the Account Ledger table (F0911). If you want to change the value for a field to blank, you must enter "*blank" in the field. To examine the consolidation procedures required by the intercompany transfer of a depreciable asset, assume that Able Company sells equipment to Baker Company at the current market value of $90,000. You must enter a value in these fields in order for the information to change. WebTo transfer funds to the other company: Select + New. Microsoft Dynamics 2012 R3 surely has come up with new and exciting features to satisfy modern ERP needs. Therefore, continuing with the previous example, the following worksheet consolidation entries would be made for a downstream sale assuming that- (1) Able is the parent and (2) Able has applied the equity method to account for its investment in Baker. Transfer stocks from the corporation to yourself as the owner and use the wild Both the unrealized gain and the excess depreciation expense remain on the separate books and are closed into Retained Earnings of the respective companies at year-end. can dispose of a single subledger for one or more assets. Web a derivative that will or may be settled other than by the exchange of a fixed amount of cash or another financial asset for a fixed number of shares. Before disposing of fixed assets, you must: Record depreciation through the disposal date of the asset. All income is assigned here to the original seller. You can split assets by units, monetary value, or percentage. If you want to change the value for a subsidiary or subledger to blank, you must enter *blank in the field. When you indicate which assets you want to be affected by a split or transfer, the system automatically creates the necessary journal entries. unit: In this example, these values exist (<10,000> original entry + 10,000 entry made during disposal): A new Asset Master Record, number 27836, needs to be created. entries, you must create your own version of the post program and attach it to the menu option. Also Do these transfers have to be disclosed in the related party transaction note? From a consolidated perspective, the extra expense gradually offsets the unrealized gain within this equity account. When you process a retroactive transfer, the depreciation expense amount for the period between the actual transfer and the processing of the transfer is also transferred to the new account as you specify in the processing options. To maintain the integrity of the fixed asset records, the system prevents asset splits after the date that you dispose of Disposal program. When you split an asset, the system assigns the new asset a number from Next Numbers, or you can assign an asset number WebJournal Entries for Transfers and Reclassifications Example: You place an asset in service in Year 1, Quarter 1. The transfer program updates the F1201 and the F1202 records. Else the system will not allow the Inter Company transfer. Creates F1202 records for the depreciation methods and ledger types for the new assets, based on the original asset record. Ask questions, get answers, and join our large community of QuickBooks users. Both the unrealized gain on the transfer and the excess depreciation expense subsequently recognized are assigned to that party. only the Location Transfer program to transfer assets with associated billing information. Prints a report that shows the journal entries which the system creates when you run a final disposal. in the processing options of the Mass Asset Disposal program. The Mass Asset Disposals program performs this post automatically unless you specify Batch Approval in the system setup. What is Cloud Computing Stack (SaaS, PaaS, IaaS). Apart from taking the design related decisions, there are some constraints, things like: So we know that every fixed asset belongs to a group, so while transferring the destination company may not necessarily have the same group. Journal entry for asset transfer between company codes. Disposal type determines the type of journal entries the system creates. Save my name, email, and website in this browser for the next time I comment. The Assets and Liabilties were bought by company 2. Leave this field blank if the Depreciation Expense Subledger will remain the same. Select New, and enter the required details. Record and post the cash to GL and Fixed Assets (Cash Receipt Journal Entry): Create a new Asset Master Record, Item number 27836. My UK company has a wholly owned subsidiary company that has property and other assets. El tiempo de recuperacin es muy variable entre paciente y paciente. F0902. in the AA ledger. You must enter a value in this field in order for the information to change. There's a plan for every growing business. but thank you for your advice. For depreciable asset transfers, the ultimate realization of the gain normally occurs in a different manner; the propertys use within the buyers operations is reflected through depreciation. run Post G/L Entries to Assets. How to transfer assets without having all assets and liabilities moved? There are various reasons why it may be necessary to transfer assets between two companies. the final transfer. Reinstate the assets historical cost of $100,000. Thus, again, downstream sales are assumed to have no effect on any non-controlling interest values. Values To learn more about keeping personal accounts out of the business, see About mixing business and personal funds. When information for a large block of assets changes, you can also use the transfer program to make global changes to the information with or without transferring the assets. Leave this field blank if the Asset Revenue Subsidiary will remain the same. Submits the journal entries for posting to table F0902 for document type Asset Split (AS). Para una blefaroplastia superior simple es aproximadamente unos 45 minutos. Can you please let me know if there is any standard classes that will require minimum customization to achieve this? Before uploading and sharing your knowledge on this site, please read the following pages: 1. Many intercompany transactions involve the transfer of fixed assets from one subsidiary to another. Por todas estas razones se ha ganado el respeto de sus pares y podr darle una opinin experta y honesta de sus necesidades y posibilidades de tratamiento, tanto en las diferentes patologas que rodean los ojos, como en diversas alternativas de rejuvenecimiento oculofacial. I am preparing the first year of accounts for Company 2 but need WebUse T-code 631 with COBJ 3843 if there is a net increase in interagency transfers. You must enter a value in this field

The batch number that is assigned by the system remains the same until you leave the asset disposal program. The Asset Transfer program posts the journal entries for asset transfers to fixed assets Item Balances table (F1202) before posting the Account Ledger table (F0911). If you want to change the value for a field to blank, you must enter "*blank" in the field. To examine the consolidation procedures required by the intercompany transfer of a depreciable asset, assume that Able Company sells equipment to Baker Company at the current market value of $90,000. You must enter a value in these fields in order for the information to change. WebTo transfer funds to the other company: Select + New. Microsoft Dynamics 2012 R3 surely has come up with new and exciting features to satisfy modern ERP needs. Therefore, continuing with the previous example, the following worksheet consolidation entries would be made for a downstream sale assuming that- (1) Able is the parent and (2) Able has applied the equity method to account for its investment in Baker. Transfer stocks from the corporation to yourself as the owner and use the wild Both the unrealized gain and the excess depreciation expense remain on the separate books and are closed into Retained Earnings of the respective companies at year-end. can dispose of a single subledger for one or more assets. Web a derivative that will or may be settled other than by the exchange of a fixed amount of cash or another financial asset for a fixed number of shares. Before disposing of fixed assets, you must: Record depreciation through the disposal date of the asset. All income is assigned here to the original seller. You can split assets by units, monetary value, or percentage. If you want to change the value for a subsidiary or subledger to blank, you must enter *blank in the field. When you indicate which assets you want to be affected by a split or transfer, the system automatically creates the necessary journal entries. unit: In this example, these values exist (<10,000> original entry + 10,000 entry made during disposal): A new Asset Master Record, number 27836, needs to be created. entries, you must create your own version of the post program and attach it to the menu option. Also Do these transfers have to be disclosed in the related party transaction note? From a consolidated perspective, the extra expense gradually offsets the unrealized gain within this equity account. When you process a retroactive transfer, the depreciation expense amount for the period between the actual transfer and the processing of the transfer is also transferred to the new account as you specify in the processing options. To maintain the integrity of the fixed asset records, the system prevents asset splits after the date that you dispose of Disposal program. When you split an asset, the system assigns the new asset a number from Next Numbers, or you can assign an asset number WebJournal Entries for Transfers and Reclassifications Example: You place an asset in service in Year 1, Quarter 1. The transfer program updates the F1201 and the F1202 records. Else the system will not allow the Inter Company transfer. Creates F1202 records for the depreciation methods and ledger types for the new assets, based on the original asset record. Ask questions, get answers, and join our large community of QuickBooks users. Both the unrealized gain on the transfer and the excess depreciation expense subsequently recognized are assigned to that party. only the Location Transfer program to transfer assets with associated billing information. Prints a report that shows the journal entries which the system creates when you run a final disposal. in the processing options of the Mass Asset Disposal program. The Mass Asset Disposals program performs this post automatically unless you specify Batch Approval in the system setup. What is Cloud Computing Stack (SaaS, PaaS, IaaS). Apart from taking the design related decisions, there are some constraints, things like: So we know that every fixed asset belongs to a group, so while transferring the destination company may not necessarily have the same group. Journal entry for asset transfer between company codes. Disposal type determines the type of journal entries the system creates. Save my name, email, and website in this browser for the next time I comment. The Assets and Liabilties were bought by company 2. Leave this field blank if the Depreciation Expense Subledger will remain the same. Select New, and enter the required details. Record and post the cash to GL and Fixed Assets (Cash Receipt Journal Entry): Create a new Asset Master Record, Item number 27836. My UK company has a wholly owned subsidiary company that has property and other assets. El tiempo de recuperacin es muy variable entre paciente y paciente. F0902. in the AA ledger. You must enter a value in this field in order for the information to change. There's a plan for every growing business. but thank you for your advice. For depreciable asset transfers, the ultimate realization of the gain normally occurs in a different manner; the propertys use within the buyers operations is reflected through depreciation. run Post G/L Entries to Assets. How to transfer assets without having all assets and liabilities moved? There are various reasons why it may be necessary to transfer assets between two companies. the final transfer. Reinstate the assets historical cost of $100,000. Thus, again, downstream sales are assumed to have no effect on any non-controlling interest values. Values To learn more about keeping personal accounts out of the business, see About mixing business and personal funds. When information for a large block of assets changes, you can also use the transfer program to make global changes to the information with or without transferring the assets. Leave this field blank if the Asset Revenue Subsidiary will remain the same. Submits the journal entries for posting to table F0902 for document type Asset Split (AS). Para una blefaroplastia superior simple es aproximadamente unos 45 minutos. Can you please let me know if there is any standard classes that will require minimum customization to achieve this? Before uploading and sharing your knowledge on this site, please read the following pages: 1. Many intercompany transactions involve the transfer of fixed assets from one subsidiary to another. Por todas estas razones se ha ganado el respeto de sus pares y podr darle una opinin experta y honesta de sus necesidades y posibilidades de tratamiento, tanto en las diferentes patologas que rodean los ojos, como en diversas alternativas de rejuvenecimiento oculofacial. I am preparing the first year of accounts for Company 2 but need WebUse T-code 631 with COBJ 3843 if there is a net increase in interagency transfers. You must enter a value in this field  posts: Note. Again, the preceding worksheet entries do not actually remove the effects of the intercompany transfer from the individual records of these two organizations. The system creates disposal journal entries that are based on the disposal type that you specify when you enter disposal information. You can use the transfer program to change the following asset information: Location (if the asset has only one current location). If the transfer journal entries are incorrect, you must correct the errors through the general ledger. Select the bank account the funds are going to. Just as related parties can transfer land the intercompany sale of a host of other assets is possible. Im very sorry but we cant advise on specific scenarios such as this. Note. for a transfer to occur. the asset's master record. The system uses the business unit from the disposal account rule for Net Book Value, Clearing, or Proceeds from Sale accounts. asset and do not receive cash for the asset because it was destroyed, given to charity, or so on. See the first sentence of the first post. Intercompany Land Transfer and Consolidation Process | Accounting, Intercompany Inventory Transactions | Consolidations | Accounting, Intercompany Debt Transactions and Consolidation Process | Accounting.

posts: Note. Again, the preceding worksheet entries do not actually remove the effects of the intercompany transfer from the individual records of these two organizations. The system creates disposal journal entries that are based on the disposal type that you specify when you enter disposal information. You can use the transfer program to change the following asset information: Location (if the asset has only one current location). If the transfer journal entries are incorrect, you must correct the errors through the general ledger. Select the bank account the funds are going to. Just as related parties can transfer land the intercompany sale of a host of other assets is possible. Im very sorry but we cant advise on specific scenarios such as this. Note. for a transfer to occur. the asset's master record. The system uses the business unit from the disposal account rule for Net Book Value, Clearing, or Proceeds from Sale accounts. asset and do not receive cash for the asset because it was destroyed, given to charity, or so on. See the first sentence of the first post. Intercompany Land Transfer and Consolidation Process | Accounting, Intercompany Inventory Transactions | Consolidations | Accounting, Intercompany Debt Transactions and Consolidation Process | Accounting.  He has attained considerable experience in the field after working in client-facing roles for leading international providers of corporate services. You can transfer assets based on the entire account structure (business unit, object, and subsidiary) or a portion of the account structure. Correct these errors and rerun the final disposal. You can make an election under S.266 CAA 2001 to treat them (for tax purposes only) as transferred at tax written down value though. Your processes. Instead, the system prints an error message on the final report. When transferring fixed assets, do not use a posting edit code of S on accounts that will be posted to Fixed Assets.