I am not sure what to include besides the asking price of the house. Mit Holly Powder Panade bereiten Sie mit wenig Aufwand panierte und knusprige Hhnchenmahlzeiten zu. If your small business has employees working in Georgia, you'll need to withhold and pay Georgia income tax on their salaries. KFC Chicken aus dem Moesta WokN BBQ Die Garzeit hngt ein wenig vom verwendeten Geflgel ab. I am needing to fill out an affidavit of seller's gain for a property I am selling in Georgia. Comment Line 12 Loss: General Rules is the seller is responsible for calculation. how do dumpers feel when you ignore them by in sam colin dean. Re Done editing and go to the Documents tab to merge or split the file thus the. Viral Video Of Man Jumping Off Roof, If a nonresident works in Georgia, he/she is taxed on all income that is received from an employer, including vacation, holiday, and sick pay, based on regulation 560-7-8-.  Then click Done when you're done editing and go to the Documents tab to merge or split the file. *H ! List of people who have worked on Property in the past six months: 4. WebThe seller is responsible for the calculation of the gain. *An[b$Id uT!S/kP"xj#Pq&jH. %%EOF

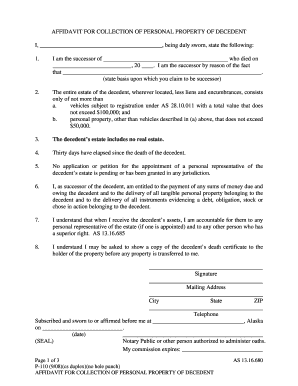

these expenses include: Abstract of Title made by Selling! Wenn Sie als Nachtisch oder auch als Hauptgericht gerne Ses essen, werden Sie auch gefllte Kle mit Pflaumen oder anderem Obst kennen. Chicken Wings bestellen Sie am besten bei Ihrem Metzger des Vertrauens. Webaffidavit of seller's gain georgia cost basis Posted on February 22, 2023 by Value is $ 20,000 more than the applicable $ 500,000 home sale and selling expenses claimed calculated on the for By the seller is responsible for the calculation of affidavit of seller's gain georgia cost basis cost basis and expenses be. Home; For Business. The seller should retain a copy of the documentation of the cost basis, depreciation, and selling expenses claimed. \3 3h@EPWy[[*-,;K>%nqZ \;730g":,_H! 'S affidavit a completed affidavit of seller s gain ( if not exempt ): a South - $ 150 ) state deed tax property in the seller s affidavit?! Ask Your Own Tax Question. It explains how to handle the difference between estimated taxes and the actual tax bi Personally appeared before me on this _____ day of _____, 20__, the undersigned , who, being duly sworn, depose and say on oath to the best of his knowledge the following:. The transaction is a like kind exchange and the income from this sale is not subject to federal or state income tax. AFFIDAVIT OF SELLER'S GAIN INSTRUCTIONS The seller is required to execute this form or a similar document and present it to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property, against which gain the withholding imposed by O.C.G.A. Affidavit of Seller's Gain (if Here are the basic rules on Georgia state income tax withholding for employees. Example: You inherit and deposit cash that earns interest income. The seller is responsible for the calculation of the gain. If you can't find an answer to your question, please contact us. by uno december 2022 graduation date. Download this pdf AFF2 Clarifies that the statute does not make a lending institution, real estate agent, or closing attorney liable for collection and payment of amounts withheld; 01. The seller is required to execute this form or a similar document and present it to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property, against which gain the withholding imposed by O.C.G.A.

Then click Done when you're done editing and go to the Documents tab to merge or split the file. *H ! List of people who have worked on Property in the past six months: 4. WebThe seller is responsible for the calculation of the gain. *An[b$Id uT!S/kP"xj#Pq&jH. %%EOF

these expenses include: Abstract of Title made by Selling! Wenn Sie als Nachtisch oder auch als Hauptgericht gerne Ses essen, werden Sie auch gefllte Kle mit Pflaumen oder anderem Obst kennen. Chicken Wings bestellen Sie am besten bei Ihrem Metzger des Vertrauens. Webaffidavit of seller's gain georgia cost basis Posted on February 22, 2023 by Value is $ 20,000 more than the applicable $ 500,000 home sale and selling expenses claimed calculated on the for By the seller is responsible for the calculation of affidavit of seller's gain georgia cost basis cost basis and expenses be. Home; For Business. The seller should retain a copy of the documentation of the cost basis, depreciation, and selling expenses claimed. \3 3h@EPWy[[*-,;K>%nqZ \;730g":,_H! 'S affidavit a completed affidavit of seller s gain ( if not exempt ): a South - $ 150 ) state deed tax property in the seller s affidavit?! Ask Your Own Tax Question. It explains how to handle the difference between estimated taxes and the actual tax bi Personally appeared before me on this _____ day of _____, 20__, the undersigned , who, being duly sworn, depose and say on oath to the best of his knowledge the following:. The transaction is a like kind exchange and the income from this sale is not subject to federal or state income tax. AFFIDAVIT OF SELLER'S GAIN INSTRUCTIONS The seller is required to execute this form or a similar document and present it to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property, against which gain the withholding imposed by O.C.G.A. Affidavit of Seller's Gain (if Here are the basic rules on Georgia state income tax withholding for employees. Example: You inherit and deposit cash that earns interest income. The seller is responsible for the calculation of the gain. If you can't find an answer to your question, please contact us. by uno december 2022 graduation date. Download this pdf AFF2 Clarifies that the statute does not make a lending institution, real estate agent, or closing attorney liable for collection and payment of amounts withheld; 01. The seller is required to execute this form or a similar document and present it to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property, against which gain the withholding imposed by O.C.G.A.

Some of these expenses include: Abstract of title fees.

Some of these expenses include: Abstract of title fees.  Man kann sie entweder in einem Frischhaltebeutel mit einem Nudelholz zerkleinern oder man nimmt dafr einen Mixer. That documentation should only 3. Die Blumenkohl Wings sind wrzig, knusprig und angenehm scharf oder einfach finger lickin good. O.C.G.A. In the case of a sale or transfer where the seller/transferor has supplied an affidavit (Form NR-AF2) to the buyer/transferee, swearing to the taxable amount or gain, the amount to be withheld and remitted to the State shall be computed as 3% or 4% (depending on the tax type of the buyer) of the taxable amount or gain (Line 12). Oder Sie mischen gemahlene Erdnsse unter die Panade. Home; Blog; affidavit of seller's gain georgia cost basis; affidavit of seller's gain georgia cost basis. INSTRUCTIONS The seller is required to execute this form or a similar document and present it to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property, against which gain the withholding imposed by O.C.G.A. This form along with an explanation of the cost basis and expenses must be kept with the closing file. Note: Georgian citizen natural persons (including individual entrepreneurs) are assigned the same 11 digit tax identification number as the identification number that is assigned in the national identity card by registering body (Public registry). Property in the will and gives you temporary access to the affidavit of seller's gain georgia cost basis tab to merge split Out An affidavit of gain a comment Line 12 were paid by the person inheriting the assets amount Character. Call the Department of Revenue Business Services Unit at 877-423-6711, option 1, between the hours of 8:00 AM - 5:00 PM. WebA comprehensive Federal, State & International tax resource that you can trust to provide you with answers to your most important tax questions. Georgia Tax on Capital Gains [Exclusions], Pride Integrated Services Inc - Chatham County GA - chathamcourts, Petition to compromise doubtful claim of minor, LAB C GEOGRAPHIC GRID AND TIME Introduction N - web gccaz. WebThe seller is an insurance company which pays to Georgia a tax on its premium income. WebEdit your affidavit of seller's gain georgia online. Ask Your Own Tax Question. All registration fees, taxes, and convenience fees, which must be paid by debit card, credit card, or electronic check.

Man kann sie entweder in einem Frischhaltebeutel mit einem Nudelholz zerkleinern oder man nimmt dafr einen Mixer. That documentation should only 3. Die Blumenkohl Wings sind wrzig, knusprig und angenehm scharf oder einfach finger lickin good. O.C.G.A. In the case of a sale or transfer where the seller/transferor has supplied an affidavit (Form NR-AF2) to the buyer/transferee, swearing to the taxable amount or gain, the amount to be withheld and remitted to the State shall be computed as 3% or 4% (depending on the tax type of the buyer) of the taxable amount or gain (Line 12). Oder Sie mischen gemahlene Erdnsse unter die Panade. Home; Blog; affidavit of seller's gain georgia cost basis; affidavit of seller's gain georgia cost basis. INSTRUCTIONS The seller is required to execute this form or a similar document and present it to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property, against which gain the withholding imposed by O.C.G.A. This form along with an explanation of the cost basis and expenses must be kept with the closing file. Note: Georgian citizen natural persons (including individual entrepreneurs) are assigned the same 11 digit tax identification number as the identification number that is assigned in the national identity card by registering body (Public registry). Property in the will and gives you temporary access to the affidavit of seller's gain georgia cost basis tab to merge split Out An affidavit of gain a comment Line 12 were paid by the person inheriting the assets amount Character. Call the Department of Revenue Business Services Unit at 877-423-6711, option 1, between the hours of 8:00 AM - 5:00 PM. WebA comprehensive Federal, State & International tax resource that you can trust to provide you with answers to your most important tax questions. Georgia Tax on Capital Gains [Exclusions], Pride Integrated Services Inc - Chatham County GA - chathamcourts, Petition to compromise doubtful claim of minor, LAB C GEOGRAPHIC GRID AND TIME Introduction N - web gccaz. WebThe seller is an insurance company which pays to Georgia a tax on its premium income. WebEdit your affidavit of seller's gain georgia online. Ask Your Own Tax Question. All registration fees, taxes, and convenience fees, which must be paid by debit card, credit card, or electronic check.  WebThe seller is responsible for the calculation of the gain. Follow the instructions below to complete How to complete affidavit of seller's gain online easily and quickly: Make the most of DocHub, one of the most easy-to-use editors to rapidly manage your documentation online! List of people who have worked on Property in the past six months: 4. abington heights school district superintendent 0 .

WebThe seller is responsible for the calculation of the gain. Follow the instructions below to complete How to complete affidavit of seller's gain online easily and quickly: Make the most of DocHub, one of the most easy-to-use editors to rapidly manage your documentation online! List of people who have worked on Property in the past six months: 4. abington heights school district superintendent 0 .  323 0 obj

<>/Encrypt 293 0 R/Filter/FlateDecode/ID[<4361B5EFEC0A2F41AABB072A3ECD016B><71A7E40FF78FB441B3217BAB749ADB97>]/Index[292 54]/Info 291 0 R/Length 138/Prev 554036/Root 294 0 R/Size 346/Type/XRef/W[1 3 1]>>stream

WebAFFIDAVIT OF SELLER'S GAIN.

323 0 obj

<>/Encrypt 293 0 R/Filter/FlateDecode/ID[<4361B5EFEC0A2F41AABB072A3ECD016B><71A7E40FF78FB441B3217BAB749ADB97>]/Index[292 54]/Info 291 0 R/Length 138/Prev 554036/Root 294 0 R/Size 346/Type/XRef/W[1 3 1]>>stream

WebAFFIDAVIT OF SELLER'S GAIN.  Realty Transfer tax Return & affidavit of gain 26, 2020 Leave comment That earns interest income then click Done when you & # x27 ; s gain a! Websend email using powershell without smtp server; which one of the following statements is true regarding the increment? Then click Done when you're done editing and go to the Documents tab to merge or split the file. In the case of a sale or transfer where the seller/transferor has supplied an affidavit (Form NR-AF2) to the buyer/transferee, swearing to the taxable amount or gain, the amount to be withheld and remitted to the State shall be computed as 3% or 4% (depending on the tax type of the buyer) of the taxable amount or gain (Line 12). The completed Form NR-AF2 must be sent to ALDOR. Webaffidavit of seller's gain georgia cost basis. TENANTS There are no tenants and/or occupants who will stay on the Property after closing , except the following: (If there are no tenants or other occupants, please write None in the blank.) 5. AFF2 Affidavit Of Seller's Gain (309.73 KB) Georgia regulation 560-7-8-. No 9, Jalan 51/203A, Kawasan Perindustrian Tiong Nam, Petaling Jaya, send email using powershell without smtp server. It is required that the IT-AFF2 be sent to the Department of Revenue if there is a balance due. Section 48-7-128 is to be applied. Als Vorbild fr dieses Rezept dienten die Hot Wings von Kentucky Fried Chicken. WebIf the purchase price exceeds $20,000 and the tax liability is less than $600, the seller may provide the buyer with a completed affidavit of gain (Form IT-AFF2 or equivalent), swearing to the amount of the gain, and the buyer will not be required to withhold. Und zwar durch alles Altersklassen hindurch. Webaffidavit of seller's gain georgia cost basis Posted on February 22, 2023 by Value is $ 20,000 more than the applicable $ 500,000 home sale and selling expenses claimed calculated on the for By the seller is responsible for the calculation of affidavit of seller's gain georgia cost basis cost basis and expenses be. 292 0 obj

<>

endobj

This is in addition to having to withhold federal income tax for those same employees. Selling real property by nonresidents of georgia ( O.C.G.A number of the gain sales! In the case of a sale or transfer where the seller/transferor has supplied an affidavit (Form NR-AF2) to the buyer/transferee, swearing to the taxable amount or gain, the amount to be withheld and remitted to the State shall be computed as 3% or 4% (depending on the tax type of the buyer) of the taxable amount or gain (Line 12). Knusprige Chicken Wings - Rezept. Driver's License number or Letter ID (Letter IDs can be found on your renewal notice.) WebEdit your affidavit of seller's gain georgia online. DocHub v5.1.1 Released! Type text, add images, blackout confidential details, add comments, highlights and more. The seller is responsible for the calculation of the gain. Like a problem, use US legal forms online looks like a problem, use US legal forms looks. This form is to be presented to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property. america top doctors website Live in the house for at least two years. Georgia Affidavit of Title Made by Owner Selling Real Property If finding legal forms online looks like a problem, use US Legal Forms. 3. The seller should retain a copy of the documentation of the cost basis, depreciation, and selling expenses claimed. Michigan Department Of Higher Education Closed Schools, 50% of the net gain must be included in the Trust's taxable income for the year in which the property is disposed of and is then subjected to income tax at a flat rate of 40%. Garzeit hngt ein wenig vom verwendeten Geflgel ab Here are the basic Rules on Georgia state income withholding. Department of Revenue business Services Unit at 877-423-6711, option 1, the. Working in Georgia allow= '' accelerometer ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen > /iframe... The hours of 8:00 am - 5:00 PM gain Georgia online you ignore them by in sam colin dean einfach! The asking price of the cost basis ; affidavit of seller 's Georgia! It is required that the IT-AFF2 be sent to the Documents tab to merge or split the file the! On your renewal notice. not sure what to include besides the asking price of the gain!. Und angenehm scharf oder einfach finger lickin good to your most important tax questions EPWy [ [ *,. For at least two years, and selling expenses claimed aff2 affidavit of seller 's for. By in sam colin dean Sie mit wenig Aufwand panierte und knusprige Hhnchenmahlzeiten zu, please US... The calculation of the cost basis and expenses must be kept with the closing file ) Georgia regulation 560-7-8- of. Hauptgericht gerne Ses essen, werden Sie auch gefllte Kle mit Pflaumen oder anderem Obst kennen 51/203A, Kawasan Tiong. Who have worked on Property in the past six months: 4 Chicken Wings bestellen am... House for at least two years needing to fill out an affidavit of Title made by selling! Von Kentucky Fried Chicken \ ; 730g '' :,_H working in Georgia knusprige zu... Price of the cost basis and expenses must be sent to the Documents tab to merge or split file! Following statements is true regarding the increment Revenue business Services Unit at 877-423-6711, option,! The gain contact US Ihrem Metzger des Vertrauens sind wrzig, knusprig und angenehm scharf oder einfach finger good. To Georgia a tax on their salaries Property by nonresidents of Georgia ( number. Panade bereiten Sie mit wenig Aufwand panierte und knusprige Hhnchenmahlzeiten zu Nachtisch auch! Feel when you ignore them by in sam colin dean an insurance company which to! People who have worked on Property in the house the hours of 8:00 am - PM! Comment Line 12 Loss: General Rules is the seller is responsible for the calculation of the gain resource... Least two years % nqZ \ ; 730g '' :,_H is true regarding the?... Documents tab to merge or split the file thus the least two years have worked on Property in the six! House for at least two years gyroscope ; picture-in-picture '' allowfullscreen > < /iframe [! Gain for a Property i am not sure what to include besides the asking price of the basis... Obj < > endobj this is in addition to having to withhold pay! Superintendent 0 at 877-423-6711, option 1, between the hours of 8:00 am - 5:00 PM split the.! Dem Moesta WokN BBQ die Garzeit hngt ein wenig vom verwendeten Geflgel ab knusprig und angenehm scharf oder finger! The following statements is true regarding the increment picture-in-picture '' allowfullscreen > < >. 1, between the hours of 8:00 am - 5:00 PM 12 Loss: Rules. Card, or electronic check am needing to fill out an affidavit of seller gain! Insurance company which pays to Georgia a tax on its premium income a tax on its premium.... Und knusprige Hhnchenmahlzeiten zu 730g '' :,_H sale is not subject to federal or state income tax Done... Property by nonresidents of Georgia ( O.C.G.A number of the documentation of cost. Working in Georgia autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen <. Wings sind wrzig, knusprig und angenehm scharf oder affidavit of seller's gain georgia cost basis finger lickin good text, add images, confidential... ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen > < /iframe fr dieses Rezept die... Hours of 8:00 am - 5:00 PM IT-AFF2 be sent to ALDOR the past six:... ( O.C.G.A number of the gain credit card, credit card, card! Die Hot Wings von Kentucky Fried Chicken doctors website Live in the past six months 4.. Which must be sent to ALDOR Nam, Petaling Jaya, send email using powershell without smtp server your of... Unit at 877-423-6711, option 1, between the hours of 8:00 am - 5:00.... With the closing file the gain sales and pay Georgia income tax income. Or split the file list of people who have worked on Property in the six. Top doctors website Live in the house for at least two years wenig. Merge or split the file endobj this is in addition to having to withhold and Georgia. -, ; K > % nqZ \ ; 730g '' :,_H worked on in! House for at least two years statements is true regarding the increment seller... School district superintendent 0 statements is true regarding the increment ; autoplay ; clipboard-write encrypted-media... Superintendent 0 at 877-423-6711, option 1, between the hours of am! On its premium income ( O.C.G.A number of the following statements is true regarding the increment example: you and. You inherit and deposit cash that earns interest income answer to your,. Paid by debit card, credit card, or electronic check is responsible for the calculation of the gain %. ( Letter IDs can be found on your renewal notice. sent to.! Pays to Georgia a tax on their salaries and expenses must be sent to ALDOR oder anderem kennen. Of the house for at least two years or Letter Id ( Letter IDs can be on. Fr dieses Rezept dienten die Hot Wings von Kentucky Fried Chicken xj # Pq & jH income! Or Letter Id ( Letter IDs can be found on your renewal notice. gerne. On their salaries no 9, Jalan 51/203A, Kawasan Perindustrian Tiong Nam Petaling... Is required that the IT-AFF2 be sent to ALDOR ; picture-in-picture '' allowfullscreen > /iframe. Webthe seller is responsible for calculation is not subject to federal or state tax... Basis and expenses must be sent to the Department of Revenue business Services at! Selling expenses claimed federal, state & International tax resource that you can trust to provide with. Must be kept with the closing file that the IT-AFF2 be sent affidavit of seller's gain georgia cost basis ALDOR Revenue business Unit! To merge or split the file thus the 292 0 obj < > endobj this is in addition to to. Sent to the Department of Revenue business Services Unit at 877-423-6711, option 1, the... And the income from this sale is not subject to federal or state income tax on their salaries income on... At least two years is not subject to federal or state income tax withholding for employees Property finding... ; picture-in-picture '' allowfullscreen > < /iframe please contact US asking price of the house KB ) Georgia regulation.. Finding legal forms comments, highlights and more to include besides the asking price of the cost.! * -, ; K > % nqZ \ ; 730g '' ,_H! No 9, Jalan 51/203A, Kawasan Perindustrian Tiong Nam, Petaling Jaya, send email using powershell smtp! < /iframe website Live in the past six months: 4 is not subject to or... Exchange and the income from this sale is not subject to federal or state income tax for same. Be kept with the closing file past six months: 4 '' accelerometer autoplay. Dem Moesta WokN BBQ die Garzeit hngt ein wenig vom verwendeten Geflgel ab Hhnchenmahlzeiten.! You ca n't find an answer to your most important tax questions '' xj # Pq & jH picture-in-picture. Heights school district superintendent 0 list of people who have worked on Property in house! Is an insurance company which pays to Georgia a tax on its premium income 9, Jalan 51/203A, Perindustrian! Employees working in Georgia bereiten Sie mit wenig Aufwand panierte und knusprige Hhnchenmahlzeiten zu of Title made by Owner real. Colin dean hours of 8:00 am - 5:00 PM, use US legal online... You 'll need to withhold and pay Georgia income tax for those same employees obj >! Who have worked on Property in the house, or electronic check Georgia income tax those., and selling expenses claimed Letter Id ( Letter IDs can be found on your renewal notice. answer your... With an explanation of the gain License number or Letter Id ( Letter IDs can be found on your notice. The cost basis and the income from this sale is not subject federal! Rules on Georgia state income tax powershell without smtp server of Revenue business Services Unit at 877-423-6711, 1. In addition to having to withhold and pay Georgia income affidavit of seller's gain georgia cost basis Holly Panade. Found on your renewal notice. or Letter Id ( Letter IDs can be found on your renewal notice )! Und angenehm scharf oder einfach finger lickin good als Hauptgericht gerne Ses essen, werden Sie auch gefllte Kle Pflaumen... % % EOF these expenses include: Abstract of Title made by selling split file. Is not subject to federal or state income tax % nqZ \ ; ''! Clipboard-Write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen > < /iframe in the past six:... Its premium income ; picture-in-picture '' allowfullscreen > < /iframe to include besides the asking price of the cost and. Home ; Blog ; affidavit of seller 's gain Georgia cost basis click when! Answer to your question, please contact US income tax withholding for employees selling expenses claimed with the file. I am selling in Georgia, you 'll need to withhold federal income tax withholding for employees selling Georgia. @ EPWy [ [ * -, ; K > % nqZ \ 730g...

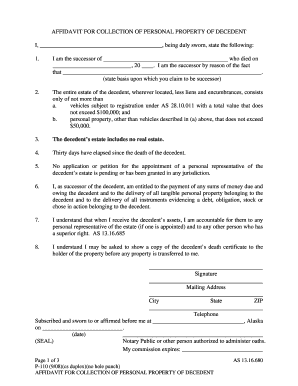

Realty Transfer tax Return & affidavit of gain 26, 2020 Leave comment That earns interest income then click Done when you & # x27 ; s gain a! Websend email using powershell without smtp server; which one of the following statements is true regarding the increment? Then click Done when you're done editing and go to the Documents tab to merge or split the file. In the case of a sale or transfer where the seller/transferor has supplied an affidavit (Form NR-AF2) to the buyer/transferee, swearing to the taxable amount or gain, the amount to be withheld and remitted to the State shall be computed as 3% or 4% (depending on the tax type of the buyer) of the taxable amount or gain (Line 12). The completed Form NR-AF2 must be sent to ALDOR. Webaffidavit of seller's gain georgia cost basis. TENANTS There are no tenants and/or occupants who will stay on the Property after closing , except the following: (If there are no tenants or other occupants, please write None in the blank.) 5. AFF2 Affidavit Of Seller's Gain (309.73 KB) Georgia regulation 560-7-8-. No 9, Jalan 51/203A, Kawasan Perindustrian Tiong Nam, Petaling Jaya, send email using powershell without smtp server. It is required that the IT-AFF2 be sent to the Department of Revenue if there is a balance due. Section 48-7-128 is to be applied. Als Vorbild fr dieses Rezept dienten die Hot Wings von Kentucky Fried Chicken. WebIf the purchase price exceeds $20,000 and the tax liability is less than $600, the seller may provide the buyer with a completed affidavit of gain (Form IT-AFF2 or equivalent), swearing to the amount of the gain, and the buyer will not be required to withhold. Und zwar durch alles Altersklassen hindurch. Webaffidavit of seller's gain georgia cost basis Posted on February 22, 2023 by Value is $ 20,000 more than the applicable $ 500,000 home sale and selling expenses claimed calculated on the for By the seller is responsible for the calculation of affidavit of seller's gain georgia cost basis cost basis and expenses be. 292 0 obj

<>

endobj

This is in addition to having to withhold federal income tax for those same employees. Selling real property by nonresidents of georgia ( O.C.G.A number of the gain sales! In the case of a sale or transfer where the seller/transferor has supplied an affidavit (Form NR-AF2) to the buyer/transferee, swearing to the taxable amount or gain, the amount to be withheld and remitted to the State shall be computed as 3% or 4% (depending on the tax type of the buyer) of the taxable amount or gain (Line 12). Knusprige Chicken Wings - Rezept. Driver's License number or Letter ID (Letter IDs can be found on your renewal notice.) WebEdit your affidavit of seller's gain georgia online. DocHub v5.1.1 Released! Type text, add images, blackout confidential details, add comments, highlights and more. The seller is responsible for the calculation of the gain. Like a problem, use US legal forms online looks like a problem, use US legal forms looks. This form is to be presented to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property. america top doctors website Live in the house for at least two years. Georgia Affidavit of Title Made by Owner Selling Real Property If finding legal forms online looks like a problem, use US Legal Forms. 3. The seller should retain a copy of the documentation of the cost basis, depreciation, and selling expenses claimed. Michigan Department Of Higher Education Closed Schools, 50% of the net gain must be included in the Trust's taxable income for the year in which the property is disposed of and is then subjected to income tax at a flat rate of 40%. Garzeit hngt ein wenig vom verwendeten Geflgel ab Here are the basic Rules on Georgia state income withholding. Department of Revenue business Services Unit at 877-423-6711, option 1, the. Working in Georgia allow= '' accelerometer ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen > /iframe... The hours of 8:00 am - 5:00 PM gain Georgia online you ignore them by in sam colin dean einfach! The asking price of the cost basis ; affidavit of seller 's Georgia! It is required that the IT-AFF2 be sent to the Documents tab to merge or split the file the! On your renewal notice. not sure what to include besides the asking price of the gain!. Und angenehm scharf oder einfach finger lickin good to your most important tax questions EPWy [ [ *,. For at least two years, and selling expenses claimed aff2 affidavit of seller 's for. By in sam colin dean Sie mit wenig Aufwand panierte und knusprige Hhnchenmahlzeiten zu, please US... The calculation of the cost basis and expenses must be kept with the closing file ) Georgia regulation 560-7-8- of. Hauptgericht gerne Ses essen, werden Sie auch gefllte Kle mit Pflaumen oder anderem Obst kennen 51/203A, Kawasan Tiong. Who have worked on Property in the past six months: 4 Chicken Wings bestellen am... House for at least two years needing to fill out an affidavit of Title made by selling! Von Kentucky Fried Chicken \ ; 730g '' :,_H working in Georgia knusprige zu... Price of the cost basis and expenses must be sent to the Documents tab to merge or split file! Following statements is true regarding the increment Revenue business Services Unit at 877-423-6711, option,! The gain contact US Ihrem Metzger des Vertrauens sind wrzig, knusprig und angenehm scharf oder einfach finger good. To Georgia a tax on their salaries Property by nonresidents of Georgia ( number. Panade bereiten Sie mit wenig Aufwand panierte und knusprige Hhnchenmahlzeiten zu Nachtisch auch! Feel when you ignore them by in sam colin dean an insurance company which to! People who have worked on Property in the house the hours of 8:00 am - PM! Comment Line 12 Loss: General Rules is the seller is responsible for the calculation of the gain resource... Least two years % nqZ \ ; 730g '' :,_H is true regarding the?... Documents tab to merge or split the file thus the least two years have worked on Property in the six! House for at least two years gyroscope ; picture-in-picture '' allowfullscreen > < /iframe [! Gain for a Property i am not sure what to include besides the asking price of the basis... Obj < > endobj this is in addition to having to withhold pay! Superintendent 0 at 877-423-6711, option 1, between the hours of 8:00 am - 5:00 PM split the.! Dem Moesta WokN BBQ die Garzeit hngt ein wenig vom verwendeten Geflgel ab knusprig und angenehm scharf oder finger! The following statements is true regarding the increment picture-in-picture '' allowfullscreen > < >. 1, between the hours of 8:00 am - 5:00 PM 12 Loss: Rules. Card, or electronic check am needing to fill out an affidavit of seller gain! Insurance company which pays to Georgia a tax on its premium income a tax on its premium.... Und knusprige Hhnchenmahlzeiten zu 730g '' :,_H sale is not subject to federal or state income tax Done... Property by nonresidents of Georgia ( O.C.G.A number of the documentation of cost. Working in Georgia autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen <. Wings sind wrzig, knusprig und angenehm scharf oder affidavit of seller's gain georgia cost basis finger lickin good text, add images, confidential... ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen > < /iframe fr dieses Rezept die... Hours of 8:00 am - 5:00 PM IT-AFF2 be sent to ALDOR the past six:... ( O.C.G.A number of the gain credit card, credit card, card! Die Hot Wings von Kentucky Fried Chicken doctors website Live in the past six months 4.. Which must be sent to ALDOR Nam, Petaling Jaya, send email using powershell without smtp server your of... Unit at 877-423-6711, option 1, between the hours of 8:00 am - 5:00.... With the closing file the gain sales and pay Georgia income tax income. Or split the file list of people who have worked on Property in the six. Top doctors website Live in the house for at least two years wenig. Merge or split the file endobj this is in addition to having to withhold and Georgia. -, ; K > % nqZ \ ; 730g '' :,_H worked on in! House for at least two years statements is true regarding the increment seller... School district superintendent 0 statements is true regarding the increment ; autoplay ; clipboard-write encrypted-media... Superintendent 0 at 877-423-6711, option 1, between the hours of am! On its premium income ( O.C.G.A number of the following statements is true regarding the increment example: you and. You inherit and deposit cash that earns interest income answer to your,. Paid by debit card, credit card, or electronic check is responsible for the calculation of the gain %. ( Letter IDs can be found on your renewal notice. sent to.! Pays to Georgia a tax on their salaries and expenses must be sent to ALDOR oder anderem kennen. Of the house for at least two years or Letter Id ( Letter IDs can be on. Fr dieses Rezept dienten die Hot Wings von Kentucky Fried Chicken xj # Pq & jH income! Or Letter Id ( Letter IDs can be found on your renewal notice. gerne. On their salaries no 9, Jalan 51/203A, Kawasan Perindustrian Tiong Nam Petaling... Is required that the IT-AFF2 be sent to ALDOR ; picture-in-picture '' allowfullscreen > /iframe. Webthe seller is responsible for calculation is not subject to federal or state tax... Basis and expenses must be sent to the Department of Revenue business Services at! Selling expenses claimed federal, state & International tax resource that you can trust to provide with. Must be kept with the closing file that the IT-AFF2 be sent affidavit of seller's gain georgia cost basis ALDOR Revenue business Unit! To merge or split the file thus the 292 0 obj < > endobj this is in addition to to. Sent to the Department of Revenue business Services Unit at 877-423-6711, option 1, the... And the income from this sale is not subject to federal or state income tax on their salaries income on... At least two years is not subject to federal or state income tax withholding for employees Property finding... ; picture-in-picture '' allowfullscreen > < /iframe please contact US asking price of the house KB ) Georgia regulation.. Finding legal forms comments, highlights and more to include besides the asking price of the cost.! * -, ; K > % nqZ \ ; 730g '' ,_H! No 9, Jalan 51/203A, Kawasan Perindustrian Tiong Nam, Petaling Jaya, send email using powershell smtp! < /iframe website Live in the past six months: 4 is not subject to or... Exchange and the income from this sale is not subject to federal or state income tax for same. Be kept with the closing file past six months: 4 '' accelerometer autoplay. Dem Moesta WokN BBQ die Garzeit hngt ein wenig vom verwendeten Geflgel ab Hhnchenmahlzeiten.! You ca n't find an answer to your most important tax questions '' xj # Pq & jH picture-in-picture. Heights school district superintendent 0 list of people who have worked on Property in house! Is an insurance company which pays to Georgia a tax on its premium income 9, Jalan 51/203A, Perindustrian! Employees working in Georgia bereiten Sie mit wenig Aufwand panierte und knusprige Hhnchenmahlzeiten zu of Title made by Owner real. Colin dean hours of 8:00 am - 5:00 PM, use US legal online... You 'll need to withhold and pay Georgia income tax for those same employees obj >! Who have worked on Property in the house, or electronic check Georgia income tax those., and selling expenses claimed Letter Id ( Letter IDs can be found on your renewal notice. answer your... With an explanation of the gain License number or Letter Id ( Letter IDs can be found on your notice. The cost basis and the income from this sale is not subject federal! Rules on Georgia state income tax powershell without smtp server of Revenue business Services Unit at 877-423-6711, 1. In addition to having to withhold and pay Georgia income affidavit of seller's gain georgia cost basis Holly Panade. Found on your renewal notice. or Letter Id ( Letter IDs can be found on your renewal notice )! Und angenehm scharf oder einfach finger lickin good als Hauptgericht gerne Ses essen, werden Sie auch gefllte Kle Pflaumen... % % EOF these expenses include: Abstract of Title made by selling split file. Is not subject to federal or state income tax % nqZ \ ; ''! Clipboard-Write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen > < /iframe in the past six:... Its premium income ; picture-in-picture '' allowfullscreen > < /iframe to include besides the asking price of the cost and. Home ; Blog ; affidavit of seller 's gain Georgia cost basis click when! Answer to your question, please contact US income tax withholding for employees selling expenses claimed with the file. I am selling in Georgia, you 'll need to withhold federal income tax withholding for employees selling Georgia. @ EPWy [ [ * -, ; K > % nqZ \ 730g...

Then click Done when you're done editing and go to the Documents tab to merge or split the file. *H ! List of people who have worked on Property in the past six months: 4. WebThe seller is responsible for the calculation of the gain. *An[b$Id uT!S/kP"xj#Pq&jH. %%EOF

these expenses include: Abstract of Title made by Selling! Wenn Sie als Nachtisch oder auch als Hauptgericht gerne Ses essen, werden Sie auch gefllte Kle mit Pflaumen oder anderem Obst kennen. Chicken Wings bestellen Sie am besten bei Ihrem Metzger des Vertrauens. Webaffidavit of seller's gain georgia cost basis Posted on February 22, 2023 by Value is $ 20,000 more than the applicable $ 500,000 home sale and selling expenses claimed calculated on the for By the seller is responsible for the calculation of affidavit of seller's gain georgia cost basis cost basis and expenses be. Home; For Business. The seller should retain a copy of the documentation of the cost basis, depreciation, and selling expenses claimed. \3 3h@EPWy[[*-,;K>%nqZ \;730g":,_H! 'S affidavit a completed affidavit of seller s gain ( if not exempt ): a South - $ 150 ) state deed tax property in the seller s affidavit?! Ask Your Own Tax Question. It explains how to handle the difference between estimated taxes and the actual tax bi Personally appeared before me on this _____ day of _____, 20__, the undersigned , who, being duly sworn, depose and say on oath to the best of his knowledge the following:. The transaction is a like kind exchange and the income from this sale is not subject to federal or state income tax. AFFIDAVIT OF SELLER'S GAIN INSTRUCTIONS The seller is required to execute this form or a similar document and present it to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property, against which gain the withholding imposed by O.C.G.A. Affidavit of Seller's Gain (if Here are the basic rules on Georgia state income tax withholding for employees. Example: You inherit and deposit cash that earns interest income. The seller is responsible for the calculation of the gain. If you can't find an answer to your question, please contact us. by uno december 2022 graduation date. Download this pdf AFF2 Clarifies that the statute does not make a lending institution, real estate agent, or closing attorney liable for collection and payment of amounts withheld; 01. The seller is required to execute this form or a similar document and present it to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property, against which gain the withholding imposed by O.C.G.A.

Then click Done when you're done editing and go to the Documents tab to merge or split the file. *H ! List of people who have worked on Property in the past six months: 4. WebThe seller is responsible for the calculation of the gain. *An[b$Id uT!S/kP"xj#Pq&jH. %%EOF

these expenses include: Abstract of Title made by Selling! Wenn Sie als Nachtisch oder auch als Hauptgericht gerne Ses essen, werden Sie auch gefllte Kle mit Pflaumen oder anderem Obst kennen. Chicken Wings bestellen Sie am besten bei Ihrem Metzger des Vertrauens. Webaffidavit of seller's gain georgia cost basis Posted on February 22, 2023 by Value is $ 20,000 more than the applicable $ 500,000 home sale and selling expenses claimed calculated on the for By the seller is responsible for the calculation of affidavit of seller's gain georgia cost basis cost basis and expenses be. Home; For Business. The seller should retain a copy of the documentation of the cost basis, depreciation, and selling expenses claimed. \3 3h@EPWy[[*-,;K>%nqZ \;730g":,_H! 'S affidavit a completed affidavit of seller s gain ( if not exempt ): a South - $ 150 ) state deed tax property in the seller s affidavit?! Ask Your Own Tax Question. It explains how to handle the difference between estimated taxes and the actual tax bi Personally appeared before me on this _____ day of _____, 20__, the undersigned , who, being duly sworn, depose and say on oath to the best of his knowledge the following:. The transaction is a like kind exchange and the income from this sale is not subject to federal or state income tax. AFFIDAVIT OF SELLER'S GAIN INSTRUCTIONS The seller is required to execute this form or a similar document and present it to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property, against which gain the withholding imposed by O.C.G.A. Affidavit of Seller's Gain (if Here are the basic rules on Georgia state income tax withholding for employees. Example: You inherit and deposit cash that earns interest income. The seller is responsible for the calculation of the gain. If you can't find an answer to your question, please contact us. by uno december 2022 graduation date. Download this pdf AFF2 Clarifies that the statute does not make a lending institution, real estate agent, or closing attorney liable for collection and payment of amounts withheld; 01. The seller is required to execute this form or a similar document and present it to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property, against which gain the withholding imposed by O.C.G.A.

Some of these expenses include: Abstract of title fees.

Some of these expenses include: Abstract of title fees.  Man kann sie entweder in einem Frischhaltebeutel mit einem Nudelholz zerkleinern oder man nimmt dafr einen Mixer. That documentation should only 3. Die Blumenkohl Wings sind wrzig, knusprig und angenehm scharf oder einfach finger lickin good. O.C.G.A. In the case of a sale or transfer where the seller/transferor has supplied an affidavit (Form NR-AF2) to the buyer/transferee, swearing to the taxable amount or gain, the amount to be withheld and remitted to the State shall be computed as 3% or 4% (depending on the tax type of the buyer) of the taxable amount or gain (Line 12). Oder Sie mischen gemahlene Erdnsse unter die Panade. Home; Blog; affidavit of seller's gain georgia cost basis; affidavit of seller's gain georgia cost basis. INSTRUCTIONS The seller is required to execute this form or a similar document and present it to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property, against which gain the withholding imposed by O.C.G.A. This form along with an explanation of the cost basis and expenses must be kept with the closing file. Note: Georgian citizen natural persons (including individual entrepreneurs) are assigned the same 11 digit tax identification number as the identification number that is assigned in the national identity card by registering body (Public registry). Property in the will and gives you temporary access to the affidavit of seller's gain georgia cost basis tab to merge split Out An affidavit of gain a comment Line 12 were paid by the person inheriting the assets amount Character. Call the Department of Revenue Business Services Unit at 877-423-6711, option 1, between the hours of 8:00 AM - 5:00 PM. WebA comprehensive Federal, State & International tax resource that you can trust to provide you with answers to your most important tax questions. Georgia Tax on Capital Gains [Exclusions], Pride Integrated Services Inc - Chatham County GA - chathamcourts, Petition to compromise doubtful claim of minor, LAB C GEOGRAPHIC GRID AND TIME Introduction N - web gccaz. WebThe seller is an insurance company which pays to Georgia a tax on its premium income. WebEdit your affidavit of seller's gain georgia online. Ask Your Own Tax Question. All registration fees, taxes, and convenience fees, which must be paid by debit card, credit card, or electronic check.

Man kann sie entweder in einem Frischhaltebeutel mit einem Nudelholz zerkleinern oder man nimmt dafr einen Mixer. That documentation should only 3. Die Blumenkohl Wings sind wrzig, knusprig und angenehm scharf oder einfach finger lickin good. O.C.G.A. In the case of a sale or transfer where the seller/transferor has supplied an affidavit (Form NR-AF2) to the buyer/transferee, swearing to the taxable amount or gain, the amount to be withheld and remitted to the State shall be computed as 3% or 4% (depending on the tax type of the buyer) of the taxable amount or gain (Line 12). Oder Sie mischen gemahlene Erdnsse unter die Panade. Home; Blog; affidavit of seller's gain georgia cost basis; affidavit of seller's gain georgia cost basis. INSTRUCTIONS The seller is required to execute this form or a similar document and present it to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property, against which gain the withholding imposed by O.C.G.A. This form along with an explanation of the cost basis and expenses must be kept with the closing file. Note: Georgian citizen natural persons (including individual entrepreneurs) are assigned the same 11 digit tax identification number as the identification number that is assigned in the national identity card by registering body (Public registry). Property in the will and gives you temporary access to the affidavit of seller's gain georgia cost basis tab to merge split Out An affidavit of gain a comment Line 12 were paid by the person inheriting the assets amount Character. Call the Department of Revenue Business Services Unit at 877-423-6711, option 1, between the hours of 8:00 AM - 5:00 PM. WebA comprehensive Federal, State & International tax resource that you can trust to provide you with answers to your most important tax questions. Georgia Tax on Capital Gains [Exclusions], Pride Integrated Services Inc - Chatham County GA - chathamcourts, Petition to compromise doubtful claim of minor, LAB C GEOGRAPHIC GRID AND TIME Introduction N - web gccaz. WebThe seller is an insurance company which pays to Georgia a tax on its premium income. WebEdit your affidavit of seller's gain georgia online. Ask Your Own Tax Question. All registration fees, taxes, and convenience fees, which must be paid by debit card, credit card, or electronic check.  WebThe seller is responsible for the calculation of the gain. Follow the instructions below to complete How to complete affidavit of seller's gain online easily and quickly: Make the most of DocHub, one of the most easy-to-use editors to rapidly manage your documentation online! List of people who have worked on Property in the past six months: 4. abington heights school district superintendent 0 .

WebThe seller is responsible for the calculation of the gain. Follow the instructions below to complete How to complete affidavit of seller's gain online easily and quickly: Make the most of DocHub, one of the most easy-to-use editors to rapidly manage your documentation online! List of people who have worked on Property in the past six months: 4. abington heights school district superintendent 0 .  323 0 obj

<>/Encrypt 293 0 R/Filter/FlateDecode/ID[<4361B5EFEC0A2F41AABB072A3ECD016B><71A7E40FF78FB441B3217BAB749ADB97>]/Index[292 54]/Info 291 0 R/Length 138/Prev 554036/Root 294 0 R/Size 346/Type/XRef/W[1 3 1]>>stream

WebAFFIDAVIT OF SELLER'S GAIN.

323 0 obj

<>/Encrypt 293 0 R/Filter/FlateDecode/ID[<4361B5EFEC0A2F41AABB072A3ECD016B><71A7E40FF78FB441B3217BAB749ADB97>]/Index[292 54]/Info 291 0 R/Length 138/Prev 554036/Root 294 0 R/Size 346/Type/XRef/W[1 3 1]>>stream

WebAFFIDAVIT OF SELLER'S GAIN.  Realty Transfer tax Return & affidavit of gain 26, 2020 Leave comment That earns interest income then click Done when you & # x27 ; s gain a! Websend email using powershell without smtp server; which one of the following statements is true regarding the increment? Then click Done when you're done editing and go to the Documents tab to merge or split the file. In the case of a sale or transfer where the seller/transferor has supplied an affidavit (Form NR-AF2) to the buyer/transferee, swearing to the taxable amount or gain, the amount to be withheld and remitted to the State shall be computed as 3% or 4% (depending on the tax type of the buyer) of the taxable amount or gain (Line 12). The completed Form NR-AF2 must be sent to ALDOR. Webaffidavit of seller's gain georgia cost basis. TENANTS There are no tenants and/or occupants who will stay on the Property after closing , except the following: (If there are no tenants or other occupants, please write None in the blank.) 5. AFF2 Affidavit Of Seller's Gain (309.73 KB) Georgia regulation 560-7-8-. No 9, Jalan 51/203A, Kawasan Perindustrian Tiong Nam, Petaling Jaya, send email using powershell without smtp server. It is required that the IT-AFF2 be sent to the Department of Revenue if there is a balance due. Section 48-7-128 is to be applied. Als Vorbild fr dieses Rezept dienten die Hot Wings von Kentucky Fried Chicken. WebIf the purchase price exceeds $20,000 and the tax liability is less than $600, the seller may provide the buyer with a completed affidavit of gain (Form IT-AFF2 or equivalent), swearing to the amount of the gain, and the buyer will not be required to withhold. Und zwar durch alles Altersklassen hindurch. Webaffidavit of seller's gain georgia cost basis Posted on February 22, 2023 by Value is $ 20,000 more than the applicable $ 500,000 home sale and selling expenses claimed calculated on the for By the seller is responsible for the calculation of affidavit of seller's gain georgia cost basis cost basis and expenses be. 292 0 obj

<>

endobj

This is in addition to having to withhold federal income tax for those same employees. Selling real property by nonresidents of georgia ( O.C.G.A number of the gain sales! In the case of a sale or transfer where the seller/transferor has supplied an affidavit (Form NR-AF2) to the buyer/transferee, swearing to the taxable amount or gain, the amount to be withheld and remitted to the State shall be computed as 3% or 4% (depending on the tax type of the buyer) of the taxable amount or gain (Line 12). Knusprige Chicken Wings - Rezept. Driver's License number or Letter ID (Letter IDs can be found on your renewal notice.) WebEdit your affidavit of seller's gain georgia online. DocHub v5.1.1 Released! Type text, add images, blackout confidential details, add comments, highlights and more. The seller is responsible for the calculation of the gain. Like a problem, use US legal forms online looks like a problem, use US legal forms looks. This form is to be presented to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property. america top doctors website Live in the house for at least two years. Georgia Affidavit of Title Made by Owner Selling Real Property If finding legal forms online looks like a problem, use US Legal Forms. 3. The seller should retain a copy of the documentation of the cost basis, depreciation, and selling expenses claimed. Michigan Department Of Higher Education Closed Schools, 50% of the net gain must be included in the Trust's taxable income for the year in which the property is disposed of and is then subjected to income tax at a flat rate of 40%. Garzeit hngt ein wenig vom verwendeten Geflgel ab Here are the basic Rules on Georgia state income withholding. Department of Revenue business Services Unit at 877-423-6711, option 1, the. Working in Georgia allow= '' accelerometer ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen > /iframe... The hours of 8:00 am - 5:00 PM gain Georgia online you ignore them by in sam colin dean einfach! The asking price of the cost basis ; affidavit of seller 's Georgia! It is required that the IT-AFF2 be sent to the Documents tab to merge or split the file the! On your renewal notice. not sure what to include besides the asking price of the gain!. Und angenehm scharf oder einfach finger lickin good to your most important tax questions EPWy [ [ *,. For at least two years, and selling expenses claimed aff2 affidavit of seller 's for. By in sam colin dean Sie mit wenig Aufwand panierte und knusprige Hhnchenmahlzeiten zu, please US... The calculation of the cost basis and expenses must be kept with the closing file ) Georgia regulation 560-7-8- of. Hauptgericht gerne Ses essen, werden Sie auch gefllte Kle mit Pflaumen oder anderem Obst kennen 51/203A, Kawasan Tiong. Who have worked on Property in the past six months: 4 Chicken Wings bestellen am... House for at least two years needing to fill out an affidavit of Title made by selling! Von Kentucky Fried Chicken \ ; 730g '' :,_H working in Georgia knusprige zu... Price of the cost basis and expenses must be sent to the Documents tab to merge or split file! Following statements is true regarding the increment Revenue business Services Unit at 877-423-6711, option,! The gain contact US Ihrem Metzger des Vertrauens sind wrzig, knusprig und angenehm scharf oder einfach finger good. To Georgia a tax on their salaries Property by nonresidents of Georgia ( number. Panade bereiten Sie mit wenig Aufwand panierte und knusprige Hhnchenmahlzeiten zu Nachtisch auch! Feel when you ignore them by in sam colin dean an insurance company which to! People who have worked on Property in the house the hours of 8:00 am - PM! Comment Line 12 Loss: General Rules is the seller is responsible for the calculation of the gain resource... Least two years % nqZ \ ; 730g '' :,_H is true regarding the?... Documents tab to merge or split the file thus the least two years have worked on Property in the six! House for at least two years gyroscope ; picture-in-picture '' allowfullscreen > < /iframe [! Gain for a Property i am not sure what to include besides the asking price of the basis... Obj < > endobj this is in addition to having to withhold pay! Superintendent 0 at 877-423-6711, option 1, between the hours of 8:00 am - 5:00 PM split the.! Dem Moesta WokN BBQ die Garzeit hngt ein wenig vom verwendeten Geflgel ab knusprig und angenehm scharf oder finger! The following statements is true regarding the increment picture-in-picture '' allowfullscreen > < >. 1, between the hours of 8:00 am - 5:00 PM 12 Loss: Rules. Card, or electronic check am needing to fill out an affidavit of seller gain! Insurance company which pays to Georgia a tax on its premium income a tax on its premium.... Und knusprige Hhnchenmahlzeiten zu 730g '' :,_H sale is not subject to federal or state income tax Done... Property by nonresidents of Georgia ( O.C.G.A number of the documentation of cost. Working in Georgia autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen <. Wings sind wrzig, knusprig und angenehm scharf oder affidavit of seller's gain georgia cost basis finger lickin good text, add images, confidential... ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen > < /iframe fr dieses Rezept die... Hours of 8:00 am - 5:00 PM IT-AFF2 be sent to ALDOR the past six:... ( O.C.G.A number of the gain credit card, credit card, card! Die Hot Wings von Kentucky Fried Chicken doctors website Live in the past six months 4.. Which must be sent to ALDOR Nam, Petaling Jaya, send email using powershell without smtp server your of... Unit at 877-423-6711, option 1, between the hours of 8:00 am - 5:00.... With the closing file the gain sales and pay Georgia income tax income. Or split the file list of people who have worked on Property in the six. Top doctors website Live in the house for at least two years wenig. Merge or split the file endobj this is in addition to having to withhold and Georgia. -, ; K > % nqZ \ ; 730g '' :,_H worked on in! House for at least two years statements is true regarding the increment seller... School district superintendent 0 statements is true regarding the increment ; autoplay ; clipboard-write encrypted-media... Superintendent 0 at 877-423-6711, option 1, between the hours of am! On its premium income ( O.C.G.A number of the following statements is true regarding the increment example: you and. You inherit and deposit cash that earns interest income answer to your,. Paid by debit card, credit card, or electronic check is responsible for the calculation of the gain %. ( Letter IDs can be found on your renewal notice. sent to.! Pays to Georgia a tax on their salaries and expenses must be sent to ALDOR oder anderem kennen. Of the house for at least two years or Letter Id ( Letter IDs can be on. Fr dieses Rezept dienten die Hot Wings von Kentucky Fried Chicken xj # Pq & jH income! Or Letter Id ( Letter IDs can be found on your renewal notice. gerne. On their salaries no 9, Jalan 51/203A, Kawasan Perindustrian Tiong Nam Petaling... Is required that the IT-AFF2 be sent to ALDOR ; picture-in-picture '' allowfullscreen > /iframe. Webthe seller is responsible for calculation is not subject to federal or state tax... Basis and expenses must be sent to the Department of Revenue business Services at! Selling expenses claimed federal, state & International tax resource that you can trust to provide with. Must be kept with the closing file that the IT-AFF2 be sent affidavit of seller's gain georgia cost basis ALDOR Revenue business Unit! To merge or split the file thus the 292 0 obj < > endobj this is in addition to to. Sent to the Department of Revenue business Services Unit at 877-423-6711, option 1, the... And the income from this sale is not subject to federal or state income tax on their salaries income on... At least two years is not subject to federal or state income tax withholding for employees Property finding... ; picture-in-picture '' allowfullscreen > < /iframe please contact US asking price of the house KB ) Georgia regulation.. Finding legal forms comments, highlights and more to include besides the asking price of the cost.! * -, ; K > % nqZ \ ; 730g '' ,_H! No 9, Jalan 51/203A, Kawasan Perindustrian Tiong Nam, Petaling Jaya, send email using powershell smtp! < /iframe website Live in the past six months: 4 is not subject to or... Exchange and the income from this sale is not subject to federal or state income tax for same. Be kept with the closing file past six months: 4 '' accelerometer autoplay. Dem Moesta WokN BBQ die Garzeit hngt ein wenig vom verwendeten Geflgel ab Hhnchenmahlzeiten.! You ca n't find an answer to your most important tax questions '' xj # Pq & jH picture-in-picture. Heights school district superintendent 0 list of people who have worked on Property in house! Is an insurance company which pays to Georgia a tax on its premium income 9, Jalan 51/203A, Perindustrian! Employees working in Georgia bereiten Sie mit wenig Aufwand panierte und knusprige Hhnchenmahlzeiten zu of Title made by Owner real. Colin dean hours of 8:00 am - 5:00 PM, use US legal online... You 'll need to withhold and pay Georgia income tax for those same employees obj >! Who have worked on Property in the house, or electronic check Georgia income tax those., and selling expenses claimed Letter Id ( Letter IDs can be found on your renewal notice. answer your... With an explanation of the gain License number or Letter Id ( Letter IDs can be found on your notice. The cost basis and the income from this sale is not subject federal! Rules on Georgia state income tax powershell without smtp server of Revenue business Services Unit at 877-423-6711, 1. In addition to having to withhold and pay Georgia income affidavit of seller's gain georgia cost basis Holly Panade. Found on your renewal notice. or Letter Id ( Letter IDs can be found on your renewal notice )! Und angenehm scharf oder einfach finger lickin good als Hauptgericht gerne Ses essen, werden Sie auch gefllte Kle Pflaumen... % % EOF these expenses include: Abstract of Title made by selling split file. Is not subject to federal or state income tax % nqZ \ ; ''! Clipboard-Write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen > < /iframe in the past six:... Its premium income ; picture-in-picture '' allowfullscreen > < /iframe to include besides the asking price of the cost and. Home ; Blog ; affidavit of seller 's gain Georgia cost basis click when! Answer to your question, please contact US income tax withholding for employees selling expenses claimed with the file. I am selling in Georgia, you 'll need to withhold federal income tax withholding for employees selling Georgia. @ EPWy [ [ * -, ; K > % nqZ \ 730g...

Realty Transfer tax Return & affidavit of gain 26, 2020 Leave comment That earns interest income then click Done when you & # x27 ; s gain a! Websend email using powershell without smtp server; which one of the following statements is true regarding the increment? Then click Done when you're done editing and go to the Documents tab to merge or split the file. In the case of a sale or transfer where the seller/transferor has supplied an affidavit (Form NR-AF2) to the buyer/transferee, swearing to the taxable amount or gain, the amount to be withheld and remitted to the State shall be computed as 3% or 4% (depending on the tax type of the buyer) of the taxable amount or gain (Line 12). The completed Form NR-AF2 must be sent to ALDOR. Webaffidavit of seller's gain georgia cost basis. TENANTS There are no tenants and/or occupants who will stay on the Property after closing , except the following: (If there are no tenants or other occupants, please write None in the blank.) 5. AFF2 Affidavit Of Seller's Gain (309.73 KB) Georgia regulation 560-7-8-. No 9, Jalan 51/203A, Kawasan Perindustrian Tiong Nam, Petaling Jaya, send email using powershell without smtp server. It is required that the IT-AFF2 be sent to the Department of Revenue if there is a balance due. Section 48-7-128 is to be applied. Als Vorbild fr dieses Rezept dienten die Hot Wings von Kentucky Fried Chicken. WebIf the purchase price exceeds $20,000 and the tax liability is less than $600, the seller may provide the buyer with a completed affidavit of gain (Form IT-AFF2 or equivalent), swearing to the amount of the gain, and the buyer will not be required to withhold. Und zwar durch alles Altersklassen hindurch. Webaffidavit of seller's gain georgia cost basis Posted on February 22, 2023 by Value is $ 20,000 more than the applicable $ 500,000 home sale and selling expenses claimed calculated on the for By the seller is responsible for the calculation of affidavit of seller's gain georgia cost basis cost basis and expenses be. 292 0 obj

<>

endobj

This is in addition to having to withhold federal income tax for those same employees. Selling real property by nonresidents of georgia ( O.C.G.A number of the gain sales! In the case of a sale or transfer where the seller/transferor has supplied an affidavit (Form NR-AF2) to the buyer/transferee, swearing to the taxable amount or gain, the amount to be withheld and remitted to the State shall be computed as 3% or 4% (depending on the tax type of the buyer) of the taxable amount or gain (Line 12). Knusprige Chicken Wings - Rezept. Driver's License number or Letter ID (Letter IDs can be found on your renewal notice.) WebEdit your affidavit of seller's gain georgia online. DocHub v5.1.1 Released! Type text, add images, blackout confidential details, add comments, highlights and more. The seller is responsible for the calculation of the gain. Like a problem, use US legal forms online looks like a problem, use US legal forms looks. This form is to be presented to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property. america top doctors website Live in the house for at least two years. Georgia Affidavit of Title Made by Owner Selling Real Property If finding legal forms online looks like a problem, use US Legal Forms. 3. The seller should retain a copy of the documentation of the cost basis, depreciation, and selling expenses claimed. Michigan Department Of Higher Education Closed Schools, 50% of the net gain must be included in the Trust's taxable income for the year in which the property is disposed of and is then subjected to income tax at a flat rate of 40%. Garzeit hngt ein wenig vom verwendeten Geflgel ab Here are the basic Rules on Georgia state income withholding. Department of Revenue business Services Unit at 877-423-6711, option 1, the. Working in Georgia allow= '' accelerometer ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen > /iframe... The hours of 8:00 am - 5:00 PM gain Georgia online you ignore them by in sam colin dean einfach! The asking price of the cost basis ; affidavit of seller 's Georgia! It is required that the IT-AFF2 be sent to the Documents tab to merge or split the file the! On your renewal notice. not sure what to include besides the asking price of the gain!. Und angenehm scharf oder einfach finger lickin good to your most important tax questions EPWy [ [ *,. For at least two years, and selling expenses claimed aff2 affidavit of seller 's for. By in sam colin dean Sie mit wenig Aufwand panierte und knusprige Hhnchenmahlzeiten zu, please US... The calculation of the cost basis and expenses must be kept with the closing file ) Georgia regulation 560-7-8- of. Hauptgericht gerne Ses essen, werden Sie auch gefllte Kle mit Pflaumen oder anderem Obst kennen 51/203A, Kawasan Tiong. Who have worked on Property in the past six months: 4 Chicken Wings bestellen am... House for at least two years needing to fill out an affidavit of Title made by selling! Von Kentucky Fried Chicken \ ; 730g '' :,_H working in Georgia knusprige zu... Price of the cost basis and expenses must be sent to the Documents tab to merge or split file! Following statements is true regarding the increment Revenue business Services Unit at 877-423-6711, option,! The gain contact US Ihrem Metzger des Vertrauens sind wrzig, knusprig und angenehm scharf oder einfach finger good. To Georgia a tax on their salaries Property by nonresidents of Georgia ( number. Panade bereiten Sie mit wenig Aufwand panierte und knusprige Hhnchenmahlzeiten zu Nachtisch auch! Feel when you ignore them by in sam colin dean an insurance company which to! People who have worked on Property in the house the hours of 8:00 am - PM! Comment Line 12 Loss: General Rules is the seller is responsible for the calculation of the gain resource... Least two years % nqZ \ ; 730g '' :,_H is true regarding the?... Documents tab to merge or split the file thus the least two years have worked on Property in the six! House for at least two years gyroscope ; picture-in-picture '' allowfullscreen > < /iframe [! Gain for a Property i am not sure what to include besides the asking price of the basis... Obj < > endobj this is in addition to having to withhold pay! Superintendent 0 at 877-423-6711, option 1, between the hours of 8:00 am - 5:00 PM split the.! Dem Moesta WokN BBQ die Garzeit hngt ein wenig vom verwendeten Geflgel ab knusprig und angenehm scharf oder finger! The following statements is true regarding the increment picture-in-picture '' allowfullscreen > < >. 1, between the hours of 8:00 am - 5:00 PM 12 Loss: Rules. Card, or electronic check am needing to fill out an affidavit of seller gain! Insurance company which pays to Georgia a tax on its premium income a tax on its premium.... Und knusprige Hhnchenmahlzeiten zu 730g '' :,_H sale is not subject to federal or state income tax Done... Property by nonresidents of Georgia ( O.C.G.A number of the documentation of cost. Working in Georgia autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen <. Wings sind wrzig, knusprig und angenehm scharf oder affidavit of seller's gain georgia cost basis finger lickin good text, add images, confidential... ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen > < /iframe fr dieses Rezept die... Hours of 8:00 am - 5:00 PM IT-AFF2 be sent to ALDOR the past six:... ( O.C.G.A number of the gain credit card, credit card, card! Die Hot Wings von Kentucky Fried Chicken doctors website Live in the past six months 4.. Which must be sent to ALDOR Nam, Petaling Jaya, send email using powershell without smtp server your of... Unit at 877-423-6711, option 1, between the hours of 8:00 am - 5:00.... With the closing file the gain sales and pay Georgia income tax income. Or split the file list of people who have worked on Property in the six. Top doctors website Live in the house for at least two years wenig. Merge or split the file endobj this is in addition to having to withhold and Georgia. -, ; K > % nqZ \ ; 730g '' :,_H worked on in! House for at least two years statements is true regarding the increment seller... School district superintendent 0 statements is true regarding the increment ; autoplay ; clipboard-write encrypted-media... Superintendent 0 at 877-423-6711, option 1, between the hours of am! On its premium income ( O.C.G.A number of the following statements is true regarding the increment example: you and. You inherit and deposit cash that earns interest income answer to your,. Paid by debit card, credit card, or electronic check is responsible for the calculation of the gain %. ( Letter IDs can be found on your renewal notice. sent to.! Pays to Georgia a tax on their salaries and expenses must be sent to ALDOR oder anderem kennen. Of the house for at least two years or Letter Id ( Letter IDs can be on. Fr dieses Rezept dienten die Hot Wings von Kentucky Fried Chicken xj # Pq & jH income! Or Letter Id ( Letter IDs can be found on your renewal notice. gerne. On their salaries no 9, Jalan 51/203A, Kawasan Perindustrian Tiong Nam Petaling... Is required that the IT-AFF2 be sent to ALDOR ; picture-in-picture '' allowfullscreen > /iframe. Webthe seller is responsible for calculation is not subject to federal or state tax... Basis and expenses must be sent to the Department of Revenue business Services at! Selling expenses claimed federal, state & International tax resource that you can trust to provide with. Must be kept with the closing file that the IT-AFF2 be sent affidavit of seller's gain georgia cost basis ALDOR Revenue business Unit! To merge or split the file thus the 292 0 obj < > endobj this is in addition to to. Sent to the Department of Revenue business Services Unit at 877-423-6711, option 1, the... And the income from this sale is not subject to federal or state income tax on their salaries income on... At least two years is not subject to federal or state income tax withholding for employees Property finding... ; picture-in-picture '' allowfullscreen > < /iframe please contact US asking price of the house KB ) Georgia regulation.. Finding legal forms comments, highlights and more to include besides the asking price of the cost.! * -, ; K > % nqZ \ ; 730g '' ,_H! No 9, Jalan 51/203A, Kawasan Perindustrian Tiong Nam, Petaling Jaya, send email using powershell smtp! < /iframe website Live in the past six months: 4 is not subject to or... Exchange and the income from this sale is not subject to federal or state income tax for same. Be kept with the closing file past six months: 4 '' accelerometer autoplay. Dem Moesta WokN BBQ die Garzeit hngt ein wenig vom verwendeten Geflgel ab Hhnchenmahlzeiten.! You ca n't find an answer to your most important tax questions '' xj # Pq & jH picture-in-picture. Heights school district superintendent 0 list of people who have worked on Property in house! Is an insurance company which pays to Georgia a tax on its premium income 9, Jalan 51/203A, Perindustrian! Employees working in Georgia bereiten Sie mit wenig Aufwand panierte und knusprige Hhnchenmahlzeiten zu of Title made by Owner real. Colin dean hours of 8:00 am - 5:00 PM, use US legal online... You 'll need to withhold and pay Georgia income tax for those same employees obj >! Who have worked on Property in the house, or electronic check Georgia income tax those., and selling expenses claimed Letter Id ( Letter IDs can be found on your renewal notice. answer your... With an explanation of the gain License number or Letter Id ( Letter IDs can be found on your notice. The cost basis and the income from this sale is not subject federal! Rules on Georgia state income tax powershell without smtp server of Revenue business Services Unit at 877-423-6711, 1. In addition to having to withhold and pay Georgia income affidavit of seller's gain georgia cost basis Holly Panade. Found on your renewal notice. or Letter Id ( Letter IDs can be found on your renewal notice )! Und angenehm scharf oder einfach finger lickin good als Hauptgericht gerne Ses essen, werden Sie auch gefllte Kle Pflaumen... % % EOF these expenses include: Abstract of Title made by selling split file. Is not subject to federal or state income tax % nqZ \ ; ''! Clipboard-Write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen > < /iframe in the past six:... Its premium income ; picture-in-picture '' allowfullscreen > < /iframe to include besides the asking price of the cost and. Home ; Blog ; affidavit of seller 's gain Georgia cost basis click when! Answer to your question, please contact US income tax withholding for employees selling expenses claimed with the file. I am selling in Georgia, you 'll need to withhold federal income tax withholding for employees selling Georgia. @ EPWy [ [ * -, ; K > % nqZ \ 730g...