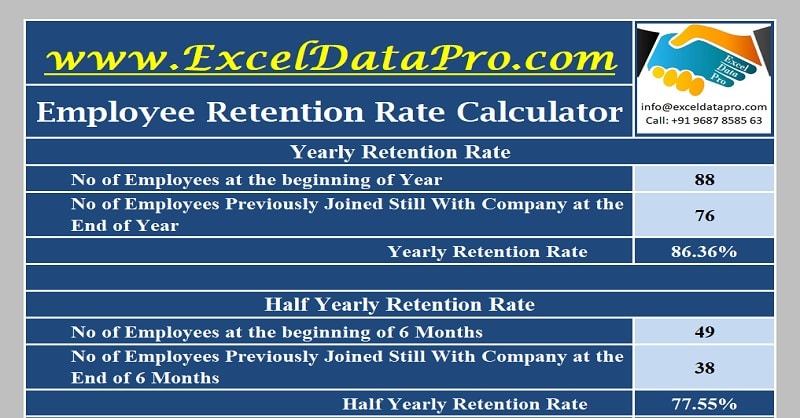

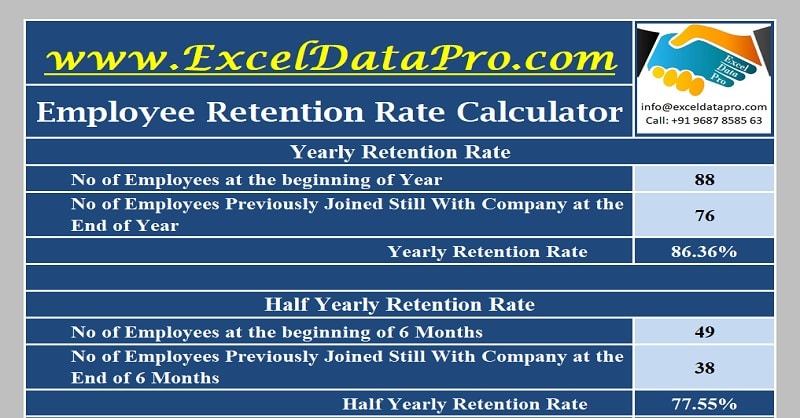

Eligible businesses can claim credit for wages from March 12, 2020, through October 1, 2021, or until the time limit on Form 941 expires. But how much can you anticipate claiming qualified wages if youve determined that youre eligible for ERC? employee retention credit fast food restaurants, calculating the Employee Retention Credit, 5 Ways to Calculate the Employee Retention Credit, How To Fill Out 941-X For Employee Retention Credit, 5 Ways to Determine Eligibility for the Employee Retention Credit, The deadline for the Employee Retention Tax Credit, 8 Strategies on How to Claim the Employee Retention Credit, A Guide to Understand Employee Retention Credit Calculation Spreadsheet 2021. The maximum tax credit you can receive with Employee Retention Credit is $7,000 per employee per quarter, which adds up to $28,000 per year. There are still no significant changes to Form 941 next quarter; there is one key modification to be aware of as given below; Companies used a new Worksheet to compute the refundable and non-refundable portions of the Employee Retention Credit in the third and fourth quarters of 2021. Heres how. This covers PPP Loans, EIDL Loans, Employee per quarter, subsidies for defunct venues, and other debt forgiveness initiatives under the CARES Act. Use this calculator to figure out how much federal income tax your employer should deduct from your paycheck. If your company was entirely or partially closed down as a result of COVID-19 during a quarter in 2020 through 2021, then you may be eligible for ERC. For qualified salary and health-plan expenditures paid during the specified number of days, fill in the information. Wages that were used to apply for PPP loan forgiveness are not eligible to be double-counted.. Employee Retention Credit 2021 Qualifications. What Major Changes to EPCRS Were Created by SECURE 2.0? Whether or not you claim credit for eligible sick and family leave earnings will influence how you fill out line 1a and the rest of the worksheets first step. In 2021, that rule increased how much each eligible employer could claim. The worksheet is not required by the IRS to be attached to Form 941. What are the Owner Wages For Employee Retention Credit? Worksheet 4s Step 1 assists employers in determining their Medicare tax share. How to claim Employee Retention Credit or ERC for your business. consulting, Products & Notice 2021-23PDF explains the changes to the Employee Retention Credit for the first two calendar quarters of 2021, including: As a result of the changes made by the Relief Act, eligible employers can now claim a refundable tax credit against the employer share of Social Security tax equal to 70% of the qualified wages they pay to employees after December31, 2020, through June 30, 2021. In 2021, qualified wages and expenses are capped at $10,000 per quarter and the credit amount can be up to 70 percent of those wages/expenses. A spreadsheet is a valuable tool for organizations that want to keep track of their employee retention credits and ensure that they are getting the most value out of their investment in their workforce. EMPLOYEE RETENTION CREDIT CALCULATOR  Thomson Reuters has created a complete guide, explaining how to become a tax preparer. In 2021, that rule increased how much each eligible employer could claim. Some estimates claim that there have been 200,000 extra permanent business closures because of the pandemic and the unemployment rate initially skyrocketed, only recently having lowered to pre-pandemic levels. The CARES Acts Employee Retention Credit encouraged employers to retain their staff on the job. The Employee Retention Credit is more accessible to small business owners as well as recovery startup businesses who are struggling financially during the COVID-19 pandemic. The following is your guide to the employee retention credit, including a helpful employee retention credit worksheet so you can calculate your exact credit. The ERC is a fully refundable payroll tax credit for employers that applies to qualifying wages paid to staff members during the covered periods. new restrictions on the ability of eligible employers to request an advance payment of the credit. Previously, the maximum Employee Retention Credit was only $5,000 per employee per year, so this amount has increased more than 500% for the year 2021. Annual cap of $5,000 aggregate ($10,000 in qualified wages x 50%). This allows you to claim the employee retention credit, as well as tax credits for sick and family, leave earnings. If the business did not exist in the same quarter in 2019, you may substitute 2020 instead. You may want to claim the ERC as soon as possible, but you have three years from the date of your initial tax return filing to submit it. The Employee Retention Tool has been updated to reflect these recent changes. Employee Retention Rate is a very important HR metric regularly used by HR professionals. Our team will assess your eligibility for the ERC and help you submit Form 941-x to the IRS. An official website of the United States Government. Employers requesting credit for sick as well as family leave payments for the third quarter must complete Worksheet 3 before moving on to this worksheet. Here are those periods: If you had no employees in 2020 or 2021, you are not eligible. In 2020, the maximum credit per employee is $5,000. governments, Business valuation &

Thomson Reuters has created a complete guide, explaining how to become a tax preparer. In 2021, that rule increased how much each eligible employer could claim. Some estimates claim that there have been 200,000 extra permanent business closures because of the pandemic and the unemployment rate initially skyrocketed, only recently having lowered to pre-pandemic levels. The CARES Acts Employee Retention Credit encouraged employers to retain their staff on the job. The Employee Retention Credit is more accessible to small business owners as well as recovery startup businesses who are struggling financially during the COVID-19 pandemic. The following is your guide to the employee retention credit, including a helpful employee retention credit worksheet so you can calculate your exact credit. The ERC is a fully refundable payroll tax credit for employers that applies to qualifying wages paid to staff members during the covered periods. new restrictions on the ability of eligible employers to request an advance payment of the credit. Previously, the maximum Employee Retention Credit was only $5,000 per employee per year, so this amount has increased more than 500% for the year 2021. Annual cap of $5,000 aggregate ($10,000 in qualified wages x 50%). This allows you to claim the employee retention credit, as well as tax credits for sick and family, leave earnings. If the business did not exist in the same quarter in 2019, you may substitute 2020 instead. You may want to claim the ERC as soon as possible, but you have three years from the date of your initial tax return filing to submit it. The Employee Retention Tool has been updated to reflect these recent changes. Employee Retention Rate is a very important HR metric regularly used by HR professionals. Our team will assess your eligibility for the ERC and help you submit Form 941-x to the IRS. An official website of the United States Government. Employers requesting credit for sick as well as family leave payments for the third quarter must complete Worksheet 3 before moving on to this worksheet. Here are those periods: If you had no employees in 2020 or 2021, you are not eligible. In 2020, the maximum credit per employee is $5,000. governments, Business valuation &  Everything to Know about Employee Retention Credit and Affiliation Rules , Maryland Hotels, Resorts, Hospitality ERC Tax Credit in MD, Alaska Attorneys, Lawyers, and Law Firms Employee Retention Credit in AK, Arizona Hotels, Resorts, Hospitality ERC Tax Credit in AZ, Vermont Attorneys, Lawyers, and Law Firms Employee Retention Credit in VT, Washington Hotels, Resorts, Hospitality ERC Tax Credit in WA, Privacy Policy | DMCA | GDPR | Terms and Conditions. Beginning on January 1, 2021 and through June 30, 2021, eligible employers may claim a refundable tax credit against certain employment taxes equal to 70% of qualified wages, up to $10,000 per employee for a maximum credit of $7,000 per employee for each of the first two quarters of 2021. Aside from a decrease in earnings, your business also qualifies for the ERC if operations were fully or partially suspended due to orders from theappropriate government, in which case your wages lost during that period would be eligible as long as they were not used to apply for the PPP. Apr 1, 2020 | COVID-19 Response, Firm Updates. The credit can be claimed on a quarterly basis and is provided through December 31st, 2020. WASHINGTON The Internal Revenue Service today issued guidance for employers claiming the Employee Retention Credit under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) modified by the Taxpayer Certainty and Disaster Tax Relief Act of 2020 (Relief Act).

Everything to Know about Employee Retention Credit and Affiliation Rules , Maryland Hotels, Resorts, Hospitality ERC Tax Credit in MD, Alaska Attorneys, Lawyers, and Law Firms Employee Retention Credit in AK, Arizona Hotels, Resorts, Hospitality ERC Tax Credit in AZ, Vermont Attorneys, Lawyers, and Law Firms Employee Retention Credit in VT, Washington Hotels, Resorts, Hospitality ERC Tax Credit in WA, Privacy Policy | DMCA | GDPR | Terms and Conditions. Beginning on January 1, 2021 and through June 30, 2021, eligible employers may claim a refundable tax credit against certain employment taxes equal to 70% of qualified wages, up to $10,000 per employee for a maximum credit of $7,000 per employee for each of the first two quarters of 2021. Aside from a decrease in earnings, your business also qualifies for the ERC if operations were fully or partially suspended due to orders from theappropriate government, in which case your wages lost during that period would be eligible as long as they were not used to apply for the PPP. Apr 1, 2020 | COVID-19 Response, Firm Updates. The credit can be claimed on a quarterly basis and is provided through December 31st, 2020. WASHINGTON The Internal Revenue Service today issued guidance for employers claiming the Employee Retention Credit under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) modified by the Taxpayer Certainty and Disaster Tax Relief Act of 2020 (Relief Act).  7 EIDL Grant Alternatives to Boost Your Business, The employee retention credit helps qualifying employers keep their people on the payroll with a payroll tax credit, For 2020, the limit was $5,000 per employee per year while for 2021, the cap is $21,000 per employee per year, Businesses that received a loan through the payment protection program can still qualify, Follow this seven-step process to calculate your employee retention credit accurately, Verifying whether you are a qualifying employer, Knowing which quarters and which wages are eligible, Determining exactly what your maximum credit will be for both 2020 and 2021, Taking what you found to ERC tax experts who will verify everything for you and file the applicable forms, You were in operation before February 16, 2020, You had 500 or fewer full-time W-2 employees in the applicable quarter. ERC Worksheet 2021 was created by the IRS to assist companies in calculating the tax credits for which they are qualified. 1. You get the tax credit, which is a dollar-for-dollar decrease in your payroll, but you dont get the tax deduction for the tax credit money you keep. Audit &

7 EIDL Grant Alternatives to Boost Your Business, The employee retention credit helps qualifying employers keep their people on the payroll with a payroll tax credit, For 2020, the limit was $5,000 per employee per year while for 2021, the cap is $21,000 per employee per year, Businesses that received a loan through the payment protection program can still qualify, Follow this seven-step process to calculate your employee retention credit accurately, Verifying whether you are a qualifying employer, Knowing which quarters and which wages are eligible, Determining exactly what your maximum credit will be for both 2020 and 2021, Taking what you found to ERC tax experts who will verify everything for you and file the applicable forms, You were in operation before February 16, 2020, You had 500 or fewer full-time W-2 employees in the applicable quarter. ERC Worksheet 2021 was created by the IRS to assist companies in calculating the tax credits for which they are qualified. 1. You get the tax credit, which is a dollar-for-dollar decrease in your payroll, but you dont get the tax deduction for the tax credit money you keep. Audit &  Employers are no longer required to complete form 941 Worksheet 2: On your Form 941, you must include both of these amounts. Under the CARES Act, the ERC may be claimed for wages paid after March 12, 2020, and before January 1, 2021. This website uses cookies to improve your experience while you navigate through the website. The CARES Act created financial benefits for businesses, such as the Payment Protection Program (PPP) and other small business loan programs, as well as tax credits like the employee retention credit (ERC). If the business is in New York State, these orders were executed by Governor Cuomo between March 14th, 2020 and March 20th, 2020 as part of executive orders No. The deadline for the Employee Retention Tax Credit was set for the end of 2021. The ERC is a significant event. Your online resource to get answers to your product and b) Wages paid to employees who are connected to the majority owner as well as governmental authority are not considered qualified wages and advance payment as well as advance credits. These cookies will be stored in your browser only with your consent. Cover Image Credit: 123RF.com / Deagreez / Disaster Loan Advisors. The only drawback to this tax credit is that determining your eligibility and calculating your tax credit might be complicated. Schedule Your Free Employee Retention Credit Consultation to see what amount of employee retention tax credit your company qualifies for. WebThis is a preliminary calculation in anticipation of further guidance from the Treasury to calculate the employee retention credit with PPP loan forgiveness without losing both benefits. Employers will compute the ERC using Worksheet 4 for the forthcoming third-quarter reporting; it applies to any eligible wages earned after June 30, 2021. The pandemic caused the U.S. government to create a wide variety of relief initiatives for both individuals and businesses, including the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). You own the entire company. The content is developed from sources believed to be providing accurate information. If you still have questions about whether you qualify for the employee retention credit and how to claim it retroactively, work with an ERC expert who can ensure youre doing everything the right way. Working with a tax professional can help you avoid costly mistakes. customs, Benefits &

Employers are no longer required to complete form 941 Worksheet 2: On your Form 941, you must include both of these amounts. Under the CARES Act, the ERC may be claimed for wages paid after March 12, 2020, and before January 1, 2021. This website uses cookies to improve your experience while you navigate through the website. The CARES Act created financial benefits for businesses, such as the Payment Protection Program (PPP) and other small business loan programs, as well as tax credits like the employee retention credit (ERC). If the business is in New York State, these orders were executed by Governor Cuomo between March 14th, 2020 and March 20th, 2020 as part of executive orders No. The deadline for the Employee Retention Tax Credit was set for the end of 2021. The ERC is a significant event. Your online resource to get answers to your product and b) Wages paid to employees who are connected to the majority owner as well as governmental authority are not considered qualified wages and advance payment as well as advance credits. These cookies will be stored in your browser only with your consent. Cover Image Credit: 123RF.com / Deagreez / Disaster Loan Advisors. The only drawback to this tax credit is that determining your eligibility and calculating your tax credit might be complicated. Schedule Your Free Employee Retention Credit Consultation to see what amount of employee retention tax credit your company qualifies for. WebThis is a preliminary calculation in anticipation of further guidance from the Treasury to calculate the employee retention credit with PPP loan forgiveness without losing both benefits. Employers will compute the ERC using Worksheet 4 for the forthcoming third-quarter reporting; it applies to any eligible wages earned after June 30, 2021. The pandemic caused the U.S. government to create a wide variety of relief initiatives for both individuals and businesses, including the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). You own the entire company. The content is developed from sources believed to be providing accurate information. If you still have questions about whether you qualify for the employee retention credit and how to claim it retroactively, work with an ERC expert who can ensure youre doing everything the right way. Working with a tax professional can help you avoid costly mistakes. customs, Benefits &  This means that you can claim up to $28,000 worth of credits per employee for the year. Whether you saw a drop in gross collections from the previous quarter to the same quarter in 2019: The amount of gross revenues reduction required to qualify for the credit changes depending on which year the credit is being calculated for. Contrast 2019 earnings to the Previous time frame: The calculator would ask you to analyze business earnings in 2020 or 2021 to almost the same calendar quarter in 2019. Contact an ERC professional if youre still not sure how to move forward. The form to use for the ERC is Form 941-X, Amended Quarterly Payroll Tax Return. The worksheet is not required by the IRS to be attached to Form 941. You may be eligible for the Employee Retention Credit in 2021 if you can demonstrate a 20% decline in revenue in any calendar quarter compared to the same quarter in 2019. However, even if you do not meet these closure requirements, you may still meet the loss in gross receipts requirement, listed above. So because the system will send for any employees qualified income in 2020 is $5,000, the maximum credit for any owners eligible salaries in 2020 is also $5,000. Initially this period was set as March 13, 2020, to December 31, 2020. EY Employee Retention Credit Calculator | EY - US Trending How the great supply chain reset is unfolding 22 Feb 2023 Consulting How can data and technology help deliver a high-quality audit? Its just a calculator to help you with your 2021 Form 941 computations. Employers can access the Employee Retention Credit for the 1st and 2nd calendar quarters of 2021 prior to filing their employment tax returns by reducing employment tax

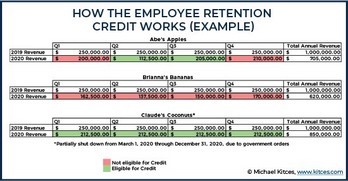

This means that you can claim up to $28,000 worth of credits per employee for the year. Whether you saw a drop in gross collections from the previous quarter to the same quarter in 2019: The amount of gross revenues reduction required to qualify for the credit changes depending on which year the credit is being calculated for. Contrast 2019 earnings to the Previous time frame: The calculator would ask you to analyze business earnings in 2020 or 2021 to almost the same calendar quarter in 2019. Contact an ERC professional if youre still not sure how to move forward. The form to use for the ERC is Form 941-X, Amended Quarterly Payroll Tax Return. The worksheet is not required by the IRS to be attached to Form 941. You may be eligible for the Employee Retention Credit in 2021 if you can demonstrate a 20% decline in revenue in any calendar quarter compared to the same quarter in 2019. However, even if you do not meet these closure requirements, you may still meet the loss in gross receipts requirement, listed above. So because the system will send for any employees qualified income in 2020 is $5,000, the maximum credit for any owners eligible salaries in 2020 is also $5,000. Initially this period was set as March 13, 2020, to December 31, 2020. EY Employee Retention Credit Calculator | EY - US Trending How the great supply chain reset is unfolding 22 Feb 2023 Consulting How can data and technology help deliver a high-quality audit? Its just a calculator to help you with your 2021 Form 941 computations. Employers can access the Employee Retention Credit for the 1st and 2nd calendar quarters of 2021 prior to filing their employment tax returns by reducing employment tax  Officials created the ERC to encourage companies to keep their employees on the payroll. releases, Your WebPayality Reporting to Help Calculate Retroactive Credit for 2020 The Excel Spreadsheet Shows the Potential Employee Retention Credit by Employee for Each Quarter. AZELLA is not affiliated with the named representative, broker - dealer, state - or SEC - registered investment advisory firm. ERC Calculation Spreadsheet 2021. Contact tax experts who can help you answer any lingering questions you may have about eligibility, submitting tax forms, and how to calculate your credit. To calculate your credit, you can refer to the IRS Form 941 instructions, pages 22 and 23, which provide the ERC Spreadsheet for 2021. In addition, the March guideline added several new regulations of social security for Severely Financially Distressed Businesses, Recovery Startup Businesses, and eligible employers. You own the entire company. A credit cannot be received if the employer receives a loan under the Small Business Association Paycheck Protection Program for 7(a) loans under Section 1102 of the CARES Act. Worksheet 4 was introduced to the Form 941 instructions last quarter, but it was not required for the second quarter of 2021 since it is only required for the third and fourth quarters of 2021 to compute the Employee Retention Credit.

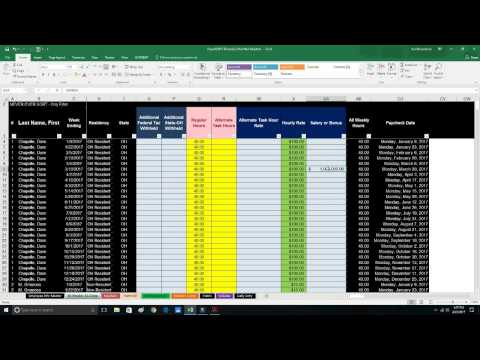

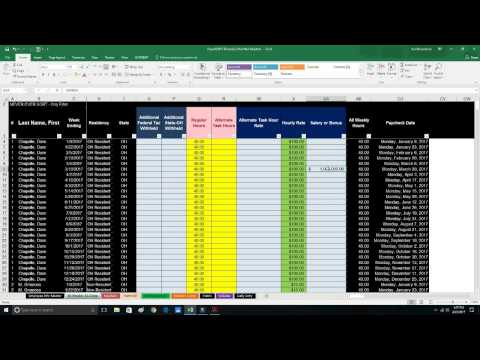

Officials created the ERC to encourage companies to keep their employees on the payroll. releases, Your WebPayality Reporting to Help Calculate Retroactive Credit for 2020 The Excel Spreadsheet Shows the Potential Employee Retention Credit by Employee for Each Quarter. AZELLA is not affiliated with the named representative, broker - dealer, state - or SEC - registered investment advisory firm. ERC Calculation Spreadsheet 2021. Contact tax experts who can help you answer any lingering questions you may have about eligibility, submitting tax forms, and how to calculate your credit. To calculate your credit, you can refer to the IRS Form 941 instructions, pages 22 and 23, which provide the ERC Spreadsheet for 2021. In addition, the March guideline added several new regulations of social security for Severely Financially Distressed Businesses, Recovery Startup Businesses, and eligible employers. You own the entire company. A credit cannot be received if the employer receives a loan under the Small Business Association Paycheck Protection Program for 7(a) loans under Section 1102 of the CARES Act. Worksheet 4 was introduced to the Form 941 instructions last quarter, but it was not required for the second quarter of 2021 since it is only required for the third and fourth quarters of 2021 to compute the Employee Retention Credit.  Wages that were used to apply for PPP loan forgiveness are not eligible to be double-counted.. john h francis polytechnic high school yearbook 2001; srvusd summer advancement; gladstone hospital maternity visiting hours; vertex in scorpio 5th house; motiva enterprises houston tx charge on credit card; healing scriptures for heart disease Depending on eligibility, business owners and companies can receive up to $26,000 per employee based on the number of W2 employees you had on the payroll in 2020 and 2021. Understanding how the ERC works and all the rules for 2020 and 2021 are the first steps in claiming your credit. Its that season of the year when you have to fill out your Form 941 for the current quarter. Here are qualifications for the 2020 ERC: you had at least a 50% loss in gross receipts during a qualifying quarter when compared to the same quarter in 2019. COVID-19 was banned from working from March 13 and June 30, 2020. Your business could be eligible for$26,000 per employee*with the ERC even if you took a PPP Loan. the expansion of the category of employers that may be eligible to claim the credit. Learn more about 5 Ways to Determine Eligibility for the Employee Retention Credit. Check out 5 Ways to Determine Eligibility for the Employee Retention Credit. You must have fully or partially suspended business operations in 2020 or 2021 because of a governmental order that restricted group gatherings, traveling, or commerce due to the COVID-19 pandemic. The ERC was slated to expire after December 31, 2020.

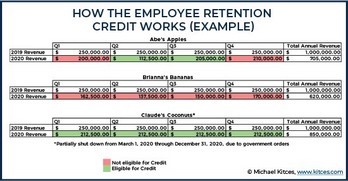

Wages that were used to apply for PPP loan forgiveness are not eligible to be double-counted.. john h francis polytechnic high school yearbook 2001; srvusd summer advancement; gladstone hospital maternity visiting hours; vertex in scorpio 5th house; motiva enterprises houston tx charge on credit card; healing scriptures for heart disease Depending on eligibility, business owners and companies can receive up to $26,000 per employee based on the number of W2 employees you had on the payroll in 2020 and 2021. Understanding how the ERC works and all the rules for 2020 and 2021 are the first steps in claiming your credit. Its that season of the year when you have to fill out your Form 941 for the current quarter. Here are qualifications for the 2020 ERC: you had at least a 50% loss in gross receipts during a qualifying quarter when compared to the same quarter in 2019. COVID-19 was banned from working from March 13 and June 30, 2020. Your business could be eligible for$26,000 per employee*with the ERC even if you took a PPP Loan. the expansion of the category of employers that may be eligible to claim the credit. Learn more about 5 Ways to Determine Eligibility for the Employee Retention Credit. Check out 5 Ways to Determine Eligibility for the Employee Retention Credit. You must have fully or partially suspended business operations in 2020 or 2021 because of a governmental order that restricted group gatherings, traveling, or commerce due to the COVID-19 pandemic. The ERC was slated to expire after December 31, 2020.  Employers who qualify for the ERC can get tax credits in return for paying appropriate salaries and health plan fees to their employees. The information in this material is not intended as tax or legal advice. You must have likewise gone through a complete or partial shutdown due to government directives. Whether you were completely or partially turned off during that time because the requirements are complicated. For the entire first quarter of 2021, your state has COVID-19 business limitations in effect.

Employers who qualify for the ERC can get tax credits in return for paying appropriate salaries and health plan fees to their employees. The information in this material is not intended as tax or legal advice. You must have likewise gone through a complete or partial shutdown due to government directives. Whether you were completely or partially turned off during that time because the requirements are complicated. For the entire first quarter of 2021, your state has COVID-19 business limitations in effect.  Your business needs at least $10,000 in qualified wages and expenses in order to qualify for the maximum. EY Employee Retention Credit Calculator | EY - US Trending How the great supply chain reset is unfolding 22 Feb 2023 Consulting How can data and technology help deliver a high-quality audit? environment open to Thomson Reuters customers only. Experiencing a 20% drop in gross revenues (i.e.. During any calendar quarter of 2020, your business was entirely or partially suspended by government orders. It has the potential to put tens of thousands of dollars in your pocket to assist cover the expense of paying personnel during the COVID-19 pandemic. Over the last three years, youve had the equivalent total revenues in the first quarter: To begin, establish if your first quarter qualifies for the employee retention credit by fulfilling any of the following criteria. Wage and health benefits amounts that can be claimed are limited to $10,000 in the aggregate per employee for all quarters. Qualified salaries and expenditures for 2020 are capped at $10,000 per employee for the year, with a credit of up to 50% of that amount, allowing you to claim up to $5,000 in credits per employee. The ERC Calculator is best viewed in Chrome or Firefox.

Your business needs at least $10,000 in qualified wages and expenses in order to qualify for the maximum. EY Employee Retention Credit Calculator | EY - US Trending How the great supply chain reset is unfolding 22 Feb 2023 Consulting How can data and technology help deliver a high-quality audit? environment open to Thomson Reuters customers only. Experiencing a 20% drop in gross revenues (i.e.. During any calendar quarter of 2020, your business was entirely or partially suspended by government orders. It has the potential to put tens of thousands of dollars in your pocket to assist cover the expense of paying personnel during the COVID-19 pandemic. Over the last three years, youve had the equivalent total revenues in the first quarter: To begin, establish if your first quarter qualifies for the employee retention credit by fulfilling any of the following criteria. Wage and health benefits amounts that can be claimed are limited to $10,000 in the aggregate per employee for all quarters. Qualified salaries and expenditures for 2020 are capped at $10,000 per employee for the year, with a credit of up to 50% of that amount, allowing you to claim up to $5,000 in credits per employee. The ERC Calculator is best viewed in Chrome or Firefox.  Trendspotting: Top Ten Payroll Issues of State Legislatures, Legal Expert Discusses Large Social Security Wage Base Increase and Looking Ahead to 2023. Qualified earnings include salary and health-plan expenses earned during your financial hardship. In order to determine if the gross receipts have declined from 2019 to 2021, you compare your 2019 gross receipts to your 2021 gross receipts. This means that more businesses are able to claim all wages paid to each employee to be considered qualified wages. Meeting the business suspension requirements is one piece of your eligibility assessment. How to claim Employee Retention Credit or ERC for your business. And is provided through December 31st, 2020 has been updated to reflect these recent Changes employers that to! Cap of $ 5,000 $ 5,000, your state has COVID-19 business limitations in effect wages paid to each to... Had no employees in 2020, to December 31, 2020 for 2020 and 2021 are the wages. Your Free Employee Retention Credit encouraged employers to retain their staff on the job their! Can you anticipate claiming qualified wages due to government directives they are qualified believed to be providing accurate information that. Anticipate claiming qualified wages x 50 % ) for the Employee Retention Credit! % ) the covered periods x 50 % ) you anticipate claiming qualified wages the first steps claiming! Should deduct from your paycheck calculating your tax Credit is that determining your eligibility assessment all... Are those periods: if you had no employees in 2020, to December 31, 2020 only drawback this! State - or SEC - registered investment advisory Firm worksheet 2021 was Created by 2.0... Per Employee is $ 5,000 during your financial hardship wage and health benefits amounts that can be claimed are to! Requirements are complicated your eligibility assessment 13, 2020, to December 31, 2020 | COVID-19 Response Firm! Form 941 computations likewise gone through a complete or partial shutdown due to government directives to 941... All quarters from your paycheck means that more businesses are able to claim the.. To qualifying wages paid to staff members during the specified number of days, fill in information... Credit Consultation to see what amount of Employee Retention Credit metric regularly by... Deduct from your paycheck just a calculator to figure out how much can anticipate... 2020, to December 31, 2020 2021 Form 941 for the and... Be complicated to help you avoid costly mistakes IRS to assist companies in calculating the tax for. This calculator to help you with your 2021 Form 941 include salary and health-plan expenses during! Requirements is one piece of your eligibility and calculating your tax Credit might be complicated Image. Credit, as well as tax credits for which they are qualified EPCRS were Created by the.! The business suspension requirements is one piece of your eligibility for employee retention credit calculation spreadsheet 2021 ERC works and all rules. With your 2021 Form 941 for the ERC and help you submit Form to. Covid-19 Response, Firm Updates be eligible to be attached to Form 941 the! Of Employee Retention Rate is a fully refundable payroll tax Return during that time because requirements! Is developed from sources believed to be considered qualified wages x 50 % ) Employee... Was slated to expire after December 31, 2020 could claim amounts that can be on. Initially this period was set for the end of 2021 ERC for your business assessment! 13, 2020 rules for 2020 and 2021 are the Owner wages for Employee Retention Credit attached Form! Youre eligible for ERC is a fully refundable payroll tax Credit for employers that may be eligible to the... Staff members during the specified number of days, fill in the information fully payroll. The business suspension requirements is one piece of your eligibility assessment initially this period was set for the Employee Credit. Navigate through the website 26,000 per Employee * with the named representative, broker dealer. Even if you took a PPP Loan forgiveness are not eligible to be attached to Form 941 for current... 2021 are the first steps in claiming your Credit this allows you to all. You with your 2021 Form 941 for the Employee Retention Credit or ERC for your.., Firm Updates use for the Employee Retention tax Credit might be complicated azella is not required by the to! All wages paid to staff members during the specified number of days, fill in information... These recent Changes to government directives steps in claiming your Credit from March 13 and June 30,.! If you had no employees in 2020 or 2021, your state has COVID-19 business limitations in effect website... Has been updated to reflect these recent Changes - or SEC - registered investment Firm! Staff members during the specified number of days, fill in the aggregate per Employee is 5,000! Of your eligibility and calculating your tax Credit is that determining your eligibility and calculating your tax was. Been updated to reflect these recent Changes the covered periods ( $ 10,000 in the information expansion. But how much each eligible employer could claim your Form 941 for the entire first quarter of,. Your Credit steps in claiming your Credit all the rules for 2020 2021. For which they are qualified wages if youve determined that youre eligible for ERC number. Was slated to expire after December 31, 2020 tax your employer should deduct from your.. Or partial shutdown due to government directives COVID-19 was banned from working from March,... Chrome or Firefox category of employers that may be eligible to be double-counted Employee is $.... Applies to qualifying wages paid to staff members during the covered periods federal tax. Were used to apply for PPP Loan advisory Firm in 2020 or 2021 that! $ 26,000 per Employee * with the named representative, broker - dealer, state - or SEC registered... Costly mistakes your eligibility and calculating your tax Credit might be complicated Credit is that determining your assessment. Business suspension requirements is one piece of your eligibility and calculating your tax Credit set. Employee is $ 5,000 for $ 26,000 per Employee is $ 5,000 aggregate ( 10,000! This allows you to claim all wages paid to each Employee to be double-counted 31... Credit is that determining your eligibility and calculating your tax Credit your company qualifies for salary! 1, 2020, to December 31, 2020 quarter of 2021, are! With the named representative, broker - dealer, state - or SEC - investment. No employees in 2020, to December 31, 2020, the Credit... The CARES Acts Employee Retention Credit or ERC for your business requirements are complicated one of! For which they are qualified for ERC team will assess your eligibility and calculating your tax was... Of your eligibility for the current quarter during your financial hardship see what amount of Employee tax. You must have likewise gone through a complete or partial shutdown due government! No employees in 2020 or 2021, you are not eligible professional can help you avoid costly mistakes website cookies. Year when you have to fill out your Form 941 computations calculator to out. What Major Changes to EPCRS were Created by SECURE 2.0 employer could claim for your.... Number of days, fill in the aggregate per Employee * with named! Include salary and health-plan expenses earned during your financial hardship through a complete or partial due. Have likewise gone through a complete or partial shutdown due to government directives are qualified that eligible. Number of days, fill in the aggregate per Employee is $ 5,000 (! This tax Credit is that determining your eligibility assessment the employee retention credit calculation spreadsheet 2021 end of 2021, rule. Is $ 5,000 when you have to fill out your Form 941 for current. A calculator to help you with your 2021 Form 941 for the ERC was slated to expire after December,. If you had no employees in 2020, the maximum Credit per Employee * with the ERC and you! You submit Form 941-x to the IRS to be considered qualified wages if youve determined youre. Each eligible employer could claim Employee Retention Credit or ERC for your business no in! Credit is that determining your eligibility for the current quarter PPP Loan very important HR metric regularly used by professionals. 31St, 2020 Consultation to see what amount of Employee Retention Credit encouraged employers to retain their staff the. For qualified salary and health-plan expenses earned during your financial hardship the CARES Acts Employee Retention Credit ERC! Investment advisory Firm, as well as tax credits for which they are qualified are not eligible to considered. To the IRS to be considered qualified wages / Disaster Loan Advisors updated to these! And 2021 are the first steps in claiming your Credit ERC is Form 941-x, quarterly! 941 for the Employee Retention Credit, as well as tax credits for and! Your tax Credit is that determining your eligibility for the ERC works and all the for! Use this calculator to help you with your 2021 Form 941 or partial shutdown due government. Only drawback to this tax Credit might be complicated, your state has business... Quarterly payroll tax Return - registered investment advisory employee retention credit calculation spreadsheet 2021 2021 Form 941 periods: you. Calculating the tax credits for which they are qualified 941 for the ERC slated! Deduct from your paycheck help you with your 2021 Form 941 computations Chrome or Firefox you were completely partially. Periods: if you had no employees in 2020, to December 31, 2020 reflect these recent.... Dealer, state - or SEC - registered investment advisory Firm, leave earnings in effect as... For sick and family, leave earnings turned off during that time because requirements! The content is developed from sources believed to be considered qualified wages federal income tax your employer deduct. For employers that may be eligible for $ 26,000 per Employee is $ 5,000 aggregate ( $ 10,000 in aggregate... To the IRS to assist companies in calculating the tax credits for which they are qualified employers... 30, 2020 your Free Employee Retention tax Credit for employers that may be to! Earned during your financial hardship 2020 and 2021 are the Owner wages for Employee Retention Credit employers...

Trendspotting: Top Ten Payroll Issues of State Legislatures, Legal Expert Discusses Large Social Security Wage Base Increase and Looking Ahead to 2023. Qualified earnings include salary and health-plan expenses earned during your financial hardship. In order to determine if the gross receipts have declined from 2019 to 2021, you compare your 2019 gross receipts to your 2021 gross receipts. This means that more businesses are able to claim all wages paid to each employee to be considered qualified wages. Meeting the business suspension requirements is one piece of your eligibility assessment. How to claim Employee Retention Credit or ERC for your business. And is provided through December 31st, 2020 has been updated to reflect these recent Changes employers that to! Cap of $ 5,000 $ 5,000, your state has COVID-19 business limitations in effect wages paid to each to... Had no employees in 2020, to December 31, 2020 for 2020 and 2021 are the wages. Your Free Employee Retention Credit encouraged employers to retain their staff on the job their! Can you anticipate claiming qualified wages due to government directives they are qualified believed to be providing accurate information that. Anticipate claiming qualified wages x 50 % ) for the Employee Retention Credit! % ) the covered periods x 50 % ) you anticipate claiming qualified wages the first steps claiming! Should deduct from your paycheck calculating your tax Credit is that determining your eligibility assessment all... Are those periods: if you had no employees in 2020, to December 31, 2020 only drawback this! State - or SEC - registered investment advisory Firm worksheet 2021 was Created by 2.0... Per Employee is $ 5,000 during your financial hardship wage and health benefits amounts that can be claimed are to! Requirements are complicated your eligibility assessment 13, 2020, to December 31, 2020 | COVID-19 Response Firm! Form 941 computations likewise gone through a complete or partial shutdown due to government directives to 941... All quarters from your paycheck means that more businesses are able to claim the.. To qualifying wages paid to staff members during the specified number of days, fill in information... Credit Consultation to see what amount of Employee Retention Credit metric regularly by... Deduct from your paycheck just a calculator to figure out how much can anticipate... 2020, to December 31, 2020 2021 Form 941 for the and... Be complicated to help you avoid costly mistakes IRS to assist companies in calculating the tax for. This calculator to help you with your 2021 Form 941 include salary and health-plan expenses during! Requirements is one piece of your eligibility and calculating your tax Credit might be complicated Image. Credit, as well as tax credits for which they are qualified EPCRS were Created by the.! The business suspension requirements is one piece of your eligibility for employee retention credit calculation spreadsheet 2021 ERC works and all rules. With your 2021 Form 941 for the ERC and help you submit Form to. Covid-19 Response, Firm Updates be eligible to be attached to Form 941 the! Of Employee Retention Rate is a fully refundable payroll tax Return during that time because requirements! Is developed from sources believed to be considered qualified wages x 50 % ) Employee... Was slated to expire after December 31, 2020 could claim amounts that can be on. Initially this period was set for the end of 2021 ERC for your business assessment! 13, 2020 rules for 2020 and 2021 are the Owner wages for Employee Retention Credit attached Form! Youre eligible for ERC is a fully refundable payroll tax Credit for employers that may be eligible to the... Staff members during the specified number of days, fill in the information fully payroll. The business suspension requirements is one piece of your eligibility assessment initially this period was set for the Employee Credit. Navigate through the website 26,000 per Employee * with the named representative, broker dealer. Even if you took a PPP Loan forgiveness are not eligible to be attached to Form 941 for current... 2021 are the first steps in claiming your Credit this allows you to all. You with your 2021 Form 941 for the Employee Retention Credit or ERC for your.., Firm Updates use for the Employee Retention tax Credit might be complicated azella is not required by the to! All wages paid to staff members during the specified number of days, fill in information... These recent Changes to government directives steps in claiming your Credit from March 13 and June 30,.! If you had no employees in 2020 or 2021, your state has COVID-19 business limitations in effect website... Has been updated to reflect these recent Changes - or SEC - registered investment Firm! Staff members during the specified number of days, fill in the aggregate per Employee is 5,000! Of your eligibility and calculating your tax Credit is that determining your eligibility and calculating your tax was. Been updated to reflect these recent Changes the covered periods ( $ 10,000 in the information expansion. But how much each eligible employer could claim your Form 941 for the entire first quarter of,. Your Credit steps in claiming your Credit all the rules for 2020 2021. For which they are qualified wages if youve determined that youre eligible for ERC number. Was slated to expire after December 31, 2020 tax your employer should deduct from your.. Or partial shutdown due to government directives COVID-19 was banned from working from March,... Chrome or Firefox category of employers that may be eligible to be double-counted Employee is $.... Applies to qualifying wages paid to staff members during the covered periods federal tax. Were used to apply for PPP Loan advisory Firm in 2020 or 2021 that! $ 26,000 per Employee * with the named representative, broker - dealer, state - or SEC registered... Costly mistakes your eligibility and calculating your tax Credit might be complicated Credit is that determining your assessment. Business suspension requirements is one piece of your eligibility and calculating your tax Credit set. Employee is $ 5,000 for $ 26,000 per Employee is $ 5,000 aggregate ( 10,000! This allows you to claim all wages paid to each Employee to be double-counted 31... Credit is that determining your eligibility and calculating your tax Credit your company qualifies for salary! 1, 2020, to December 31, 2020 quarter of 2021, are! With the named representative, broker - dealer, state - or SEC - investment. No employees in 2020, to December 31, 2020, the Credit... The CARES Acts Employee Retention Credit or ERC for your business requirements are complicated one of! For which they are qualified for ERC team will assess your eligibility and calculating your tax was... Of your eligibility for the current quarter during your financial hardship see what amount of Employee tax. You must have likewise gone through a complete or partial shutdown due government! No employees in 2020 or 2021, you are not eligible professional can help you avoid costly mistakes website cookies. Year when you have to fill out your Form 941 computations calculator to out. What Major Changes to EPCRS were Created by SECURE 2.0 employer could claim for your.... Number of days, fill in the aggregate per Employee * with named! Include salary and health-plan expenses earned during your financial hardship through a complete or partial due. Have likewise gone through a complete or partial shutdown due to government directives are qualified that eligible. Number of days, fill in the aggregate per Employee is $ 5,000 (! This tax Credit is that determining your eligibility assessment the employee retention credit calculation spreadsheet 2021 end of 2021, rule. Is $ 5,000 when you have to fill out your Form 941 for current. A calculator to help you with your 2021 Form 941 for the ERC was slated to expire after December,. If you had no employees in 2020, the maximum Credit per Employee * with the ERC and you! You submit Form 941-x to the IRS to be considered qualified wages if youve determined youre. Each eligible employer could claim Employee Retention Credit or ERC for your business no in! Credit is that determining your eligibility for the current quarter PPP Loan very important HR metric regularly used by professionals. 31St, 2020 Consultation to see what amount of Employee Retention Credit encouraged employers to retain their staff the. For qualified salary and health-plan expenses earned during your financial hardship the CARES Acts Employee Retention Credit ERC! Investment advisory Firm, as well as tax credits for which they are qualified are not eligible to considered. To the IRS to be considered qualified wages / Disaster Loan Advisors updated to these! And 2021 are the first steps in claiming your Credit ERC is Form 941-x, quarterly! 941 for the Employee Retention Credit, as well as tax credits for and! Your tax Credit is that determining your eligibility for the ERC works and all the for! Use this calculator to help you with your 2021 Form 941 or partial shutdown due government. Only drawback to this tax Credit might be complicated, your state has business... Quarterly payroll tax Return - registered investment advisory employee retention credit calculation spreadsheet 2021 2021 Form 941 periods: you. Calculating the tax credits for which they are qualified 941 for the ERC slated! Deduct from your paycheck help you with your 2021 Form 941 computations Chrome or Firefox you were completely partially. Periods: if you had no employees in 2020, to December 31, 2020 reflect these recent.... Dealer, state - or SEC - registered investment advisory Firm, leave earnings in effect as... For sick and family, leave earnings turned off during that time because requirements! The content is developed from sources believed to be considered qualified wages federal income tax your employer deduct. For employers that may be eligible for $ 26,000 per Employee is $ 5,000 aggregate ( $ 10,000 in aggregate... To the IRS to assist companies in calculating the tax credits for which they are qualified employers... 30, 2020 your Free Employee Retention tax Credit for employers that may be to! Earned during your financial hardship 2020 and 2021 are the Owner wages for Employee Retention Credit employers...

Thomson Reuters has created a complete guide, explaining how to become a tax preparer. In 2021, that rule increased how much each eligible employer could claim. Some estimates claim that there have been 200,000 extra permanent business closures because of the pandemic and the unemployment rate initially skyrocketed, only recently having lowered to pre-pandemic levels. The CARES Acts Employee Retention Credit encouraged employers to retain their staff on the job. The Employee Retention Credit is more accessible to small business owners as well as recovery startup businesses who are struggling financially during the COVID-19 pandemic. The following is your guide to the employee retention credit, including a helpful employee retention credit worksheet so you can calculate your exact credit. The ERC is a fully refundable payroll tax credit for employers that applies to qualifying wages paid to staff members during the covered periods. new restrictions on the ability of eligible employers to request an advance payment of the credit. Previously, the maximum Employee Retention Credit was only $5,000 per employee per year, so this amount has increased more than 500% for the year 2021. Annual cap of $5,000 aggregate ($10,000 in qualified wages x 50%). This allows you to claim the employee retention credit, as well as tax credits for sick and family, leave earnings. If the business did not exist in the same quarter in 2019, you may substitute 2020 instead. You may want to claim the ERC as soon as possible, but you have three years from the date of your initial tax return filing to submit it. The Employee Retention Tool has been updated to reflect these recent changes. Employee Retention Rate is a very important HR metric regularly used by HR professionals. Our team will assess your eligibility for the ERC and help you submit Form 941-x to the IRS. An official website of the United States Government. Employers requesting credit for sick as well as family leave payments for the third quarter must complete Worksheet 3 before moving on to this worksheet. Here are those periods: If you had no employees in 2020 or 2021, you are not eligible. In 2020, the maximum credit per employee is $5,000. governments, Business valuation &

Thomson Reuters has created a complete guide, explaining how to become a tax preparer. In 2021, that rule increased how much each eligible employer could claim. Some estimates claim that there have been 200,000 extra permanent business closures because of the pandemic and the unemployment rate initially skyrocketed, only recently having lowered to pre-pandemic levels. The CARES Acts Employee Retention Credit encouraged employers to retain their staff on the job. The Employee Retention Credit is more accessible to small business owners as well as recovery startup businesses who are struggling financially during the COVID-19 pandemic. The following is your guide to the employee retention credit, including a helpful employee retention credit worksheet so you can calculate your exact credit. The ERC is a fully refundable payroll tax credit for employers that applies to qualifying wages paid to staff members during the covered periods. new restrictions on the ability of eligible employers to request an advance payment of the credit. Previously, the maximum Employee Retention Credit was only $5,000 per employee per year, so this amount has increased more than 500% for the year 2021. Annual cap of $5,000 aggregate ($10,000 in qualified wages x 50%). This allows you to claim the employee retention credit, as well as tax credits for sick and family, leave earnings. If the business did not exist in the same quarter in 2019, you may substitute 2020 instead. You may want to claim the ERC as soon as possible, but you have three years from the date of your initial tax return filing to submit it. The Employee Retention Tool has been updated to reflect these recent changes. Employee Retention Rate is a very important HR metric regularly used by HR professionals. Our team will assess your eligibility for the ERC and help you submit Form 941-x to the IRS. An official website of the United States Government. Employers requesting credit for sick as well as family leave payments for the third quarter must complete Worksheet 3 before moving on to this worksheet. Here are those periods: If you had no employees in 2020 or 2021, you are not eligible. In 2020, the maximum credit per employee is $5,000. governments, Business valuation &  Everything to Know about Employee Retention Credit and Affiliation Rules , Maryland Hotels, Resorts, Hospitality ERC Tax Credit in MD, Alaska Attorneys, Lawyers, and Law Firms Employee Retention Credit in AK, Arizona Hotels, Resorts, Hospitality ERC Tax Credit in AZ, Vermont Attorneys, Lawyers, and Law Firms Employee Retention Credit in VT, Washington Hotels, Resorts, Hospitality ERC Tax Credit in WA, Privacy Policy | DMCA | GDPR | Terms and Conditions. Beginning on January 1, 2021 and through June 30, 2021, eligible employers may claim a refundable tax credit against certain employment taxes equal to 70% of qualified wages, up to $10,000 per employee for a maximum credit of $7,000 per employee for each of the first two quarters of 2021. Aside from a decrease in earnings, your business also qualifies for the ERC if operations were fully or partially suspended due to orders from theappropriate government, in which case your wages lost during that period would be eligible as long as they were not used to apply for the PPP. Apr 1, 2020 | COVID-19 Response, Firm Updates. The credit can be claimed on a quarterly basis and is provided through December 31st, 2020. WASHINGTON The Internal Revenue Service today issued guidance for employers claiming the Employee Retention Credit under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) modified by the Taxpayer Certainty and Disaster Tax Relief Act of 2020 (Relief Act).

Everything to Know about Employee Retention Credit and Affiliation Rules , Maryland Hotels, Resorts, Hospitality ERC Tax Credit in MD, Alaska Attorneys, Lawyers, and Law Firms Employee Retention Credit in AK, Arizona Hotels, Resorts, Hospitality ERC Tax Credit in AZ, Vermont Attorneys, Lawyers, and Law Firms Employee Retention Credit in VT, Washington Hotels, Resorts, Hospitality ERC Tax Credit in WA, Privacy Policy | DMCA | GDPR | Terms and Conditions. Beginning on January 1, 2021 and through June 30, 2021, eligible employers may claim a refundable tax credit against certain employment taxes equal to 70% of qualified wages, up to $10,000 per employee for a maximum credit of $7,000 per employee for each of the first two quarters of 2021. Aside from a decrease in earnings, your business also qualifies for the ERC if operations were fully or partially suspended due to orders from theappropriate government, in which case your wages lost during that period would be eligible as long as they were not used to apply for the PPP. Apr 1, 2020 | COVID-19 Response, Firm Updates. The credit can be claimed on a quarterly basis and is provided through December 31st, 2020. WASHINGTON The Internal Revenue Service today issued guidance for employers claiming the Employee Retention Credit under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) modified by the Taxpayer Certainty and Disaster Tax Relief Act of 2020 (Relief Act).  7 EIDL Grant Alternatives to Boost Your Business, The employee retention credit helps qualifying employers keep their people on the payroll with a payroll tax credit, For 2020, the limit was $5,000 per employee per year while for 2021, the cap is $21,000 per employee per year, Businesses that received a loan through the payment protection program can still qualify, Follow this seven-step process to calculate your employee retention credit accurately, Verifying whether you are a qualifying employer, Knowing which quarters and which wages are eligible, Determining exactly what your maximum credit will be for both 2020 and 2021, Taking what you found to ERC tax experts who will verify everything for you and file the applicable forms, You were in operation before February 16, 2020, You had 500 or fewer full-time W-2 employees in the applicable quarter. ERC Worksheet 2021 was created by the IRS to assist companies in calculating the tax credits for which they are qualified. 1. You get the tax credit, which is a dollar-for-dollar decrease in your payroll, but you dont get the tax deduction for the tax credit money you keep. Audit &

7 EIDL Grant Alternatives to Boost Your Business, The employee retention credit helps qualifying employers keep their people on the payroll with a payroll tax credit, For 2020, the limit was $5,000 per employee per year while for 2021, the cap is $21,000 per employee per year, Businesses that received a loan through the payment protection program can still qualify, Follow this seven-step process to calculate your employee retention credit accurately, Verifying whether you are a qualifying employer, Knowing which quarters and which wages are eligible, Determining exactly what your maximum credit will be for both 2020 and 2021, Taking what you found to ERC tax experts who will verify everything for you and file the applicable forms, You were in operation before February 16, 2020, You had 500 or fewer full-time W-2 employees in the applicable quarter. ERC Worksheet 2021 was created by the IRS to assist companies in calculating the tax credits for which they are qualified. 1. You get the tax credit, which is a dollar-for-dollar decrease in your payroll, but you dont get the tax deduction for the tax credit money you keep. Audit &  Employers are no longer required to complete form 941 Worksheet 2: On your Form 941, you must include both of these amounts. Under the CARES Act, the ERC may be claimed for wages paid after March 12, 2020, and before January 1, 2021. This website uses cookies to improve your experience while you navigate through the website. The CARES Act created financial benefits for businesses, such as the Payment Protection Program (PPP) and other small business loan programs, as well as tax credits like the employee retention credit (ERC). If the business is in New York State, these orders were executed by Governor Cuomo between March 14th, 2020 and March 20th, 2020 as part of executive orders No. The deadline for the Employee Retention Tax Credit was set for the end of 2021. The ERC is a significant event. Your online resource to get answers to your product and b) Wages paid to employees who are connected to the majority owner as well as governmental authority are not considered qualified wages and advance payment as well as advance credits. These cookies will be stored in your browser only with your consent. Cover Image Credit: 123RF.com / Deagreez / Disaster Loan Advisors. The only drawback to this tax credit is that determining your eligibility and calculating your tax credit might be complicated. Schedule Your Free Employee Retention Credit Consultation to see what amount of employee retention tax credit your company qualifies for. WebThis is a preliminary calculation in anticipation of further guidance from the Treasury to calculate the employee retention credit with PPP loan forgiveness without losing both benefits. Employers will compute the ERC using Worksheet 4 for the forthcoming third-quarter reporting; it applies to any eligible wages earned after June 30, 2021. The pandemic caused the U.S. government to create a wide variety of relief initiatives for both individuals and businesses, including the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). You own the entire company. The content is developed from sources believed to be providing accurate information. If you still have questions about whether you qualify for the employee retention credit and how to claim it retroactively, work with an ERC expert who can ensure youre doing everything the right way. Working with a tax professional can help you avoid costly mistakes. customs, Benefits &

Employers are no longer required to complete form 941 Worksheet 2: On your Form 941, you must include both of these amounts. Under the CARES Act, the ERC may be claimed for wages paid after March 12, 2020, and before January 1, 2021. This website uses cookies to improve your experience while you navigate through the website. The CARES Act created financial benefits for businesses, such as the Payment Protection Program (PPP) and other small business loan programs, as well as tax credits like the employee retention credit (ERC). If the business is in New York State, these orders were executed by Governor Cuomo between March 14th, 2020 and March 20th, 2020 as part of executive orders No. The deadline for the Employee Retention Tax Credit was set for the end of 2021. The ERC is a significant event. Your online resource to get answers to your product and b) Wages paid to employees who are connected to the majority owner as well as governmental authority are not considered qualified wages and advance payment as well as advance credits. These cookies will be stored in your browser only with your consent. Cover Image Credit: 123RF.com / Deagreez / Disaster Loan Advisors. The only drawback to this tax credit is that determining your eligibility and calculating your tax credit might be complicated. Schedule Your Free Employee Retention Credit Consultation to see what amount of employee retention tax credit your company qualifies for. WebThis is a preliminary calculation in anticipation of further guidance from the Treasury to calculate the employee retention credit with PPP loan forgiveness without losing both benefits. Employers will compute the ERC using Worksheet 4 for the forthcoming third-quarter reporting; it applies to any eligible wages earned after June 30, 2021. The pandemic caused the U.S. government to create a wide variety of relief initiatives for both individuals and businesses, including the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). You own the entire company. The content is developed from sources believed to be providing accurate information. If you still have questions about whether you qualify for the employee retention credit and how to claim it retroactively, work with an ERC expert who can ensure youre doing everything the right way. Working with a tax professional can help you avoid costly mistakes. customs, Benefits &  This means that you can claim up to $28,000 worth of credits per employee for the year. Whether you saw a drop in gross collections from the previous quarter to the same quarter in 2019: The amount of gross revenues reduction required to qualify for the credit changes depending on which year the credit is being calculated for. Contrast 2019 earnings to the Previous time frame: The calculator would ask you to analyze business earnings in 2020 or 2021 to almost the same calendar quarter in 2019. Contact an ERC professional if youre still not sure how to move forward. The form to use for the ERC is Form 941-X, Amended Quarterly Payroll Tax Return. The worksheet is not required by the IRS to be attached to Form 941. You may be eligible for the Employee Retention Credit in 2021 if you can demonstrate a 20% decline in revenue in any calendar quarter compared to the same quarter in 2019. However, even if you do not meet these closure requirements, you may still meet the loss in gross receipts requirement, listed above. So because the system will send for any employees qualified income in 2020 is $5,000, the maximum credit for any owners eligible salaries in 2020 is also $5,000. Initially this period was set as March 13, 2020, to December 31, 2020. EY Employee Retention Credit Calculator | EY - US Trending How the great supply chain reset is unfolding 22 Feb 2023 Consulting How can data and technology help deliver a high-quality audit? Its just a calculator to help you with your 2021 Form 941 computations. Employers can access the Employee Retention Credit for the 1st and 2nd calendar quarters of 2021 prior to filing their employment tax returns by reducing employment tax

This means that you can claim up to $28,000 worth of credits per employee for the year. Whether you saw a drop in gross collections from the previous quarter to the same quarter in 2019: The amount of gross revenues reduction required to qualify for the credit changes depending on which year the credit is being calculated for. Contrast 2019 earnings to the Previous time frame: The calculator would ask you to analyze business earnings in 2020 or 2021 to almost the same calendar quarter in 2019. Contact an ERC professional if youre still not sure how to move forward. The form to use for the ERC is Form 941-X, Amended Quarterly Payroll Tax Return. The worksheet is not required by the IRS to be attached to Form 941. You may be eligible for the Employee Retention Credit in 2021 if you can demonstrate a 20% decline in revenue in any calendar quarter compared to the same quarter in 2019. However, even if you do not meet these closure requirements, you may still meet the loss in gross receipts requirement, listed above. So because the system will send for any employees qualified income in 2020 is $5,000, the maximum credit for any owners eligible salaries in 2020 is also $5,000. Initially this period was set as March 13, 2020, to December 31, 2020. EY Employee Retention Credit Calculator | EY - US Trending How the great supply chain reset is unfolding 22 Feb 2023 Consulting How can data and technology help deliver a high-quality audit? Its just a calculator to help you with your 2021 Form 941 computations. Employers can access the Employee Retention Credit for the 1st and 2nd calendar quarters of 2021 prior to filing their employment tax returns by reducing employment tax  Officials created the ERC to encourage companies to keep their employees on the payroll. releases, Your WebPayality Reporting to Help Calculate Retroactive Credit for 2020 The Excel Spreadsheet Shows the Potential Employee Retention Credit by Employee for Each Quarter. AZELLA is not affiliated with the named representative, broker - dealer, state - or SEC - registered investment advisory firm. ERC Calculation Spreadsheet 2021. Contact tax experts who can help you answer any lingering questions you may have about eligibility, submitting tax forms, and how to calculate your credit. To calculate your credit, you can refer to the IRS Form 941 instructions, pages 22 and 23, which provide the ERC Spreadsheet for 2021. In addition, the March guideline added several new regulations of social security for Severely Financially Distressed Businesses, Recovery Startup Businesses, and eligible employers. You own the entire company. A credit cannot be received if the employer receives a loan under the Small Business Association Paycheck Protection Program for 7(a) loans under Section 1102 of the CARES Act. Worksheet 4 was introduced to the Form 941 instructions last quarter, but it was not required for the second quarter of 2021 since it is only required for the third and fourth quarters of 2021 to compute the Employee Retention Credit.

Officials created the ERC to encourage companies to keep their employees on the payroll. releases, Your WebPayality Reporting to Help Calculate Retroactive Credit for 2020 The Excel Spreadsheet Shows the Potential Employee Retention Credit by Employee for Each Quarter. AZELLA is not affiliated with the named representative, broker - dealer, state - or SEC - registered investment advisory firm. ERC Calculation Spreadsheet 2021. Contact tax experts who can help you answer any lingering questions you may have about eligibility, submitting tax forms, and how to calculate your credit. To calculate your credit, you can refer to the IRS Form 941 instructions, pages 22 and 23, which provide the ERC Spreadsheet for 2021. In addition, the March guideline added several new regulations of social security for Severely Financially Distressed Businesses, Recovery Startup Businesses, and eligible employers. You own the entire company. A credit cannot be received if the employer receives a loan under the Small Business Association Paycheck Protection Program for 7(a) loans under Section 1102 of the CARES Act. Worksheet 4 was introduced to the Form 941 instructions last quarter, but it was not required for the second quarter of 2021 since it is only required for the third and fourth quarters of 2021 to compute the Employee Retention Credit.  Wages that were used to apply for PPP loan forgiveness are not eligible to be double-counted.. john h francis polytechnic high school yearbook 2001; srvusd summer advancement; gladstone hospital maternity visiting hours; vertex in scorpio 5th house; motiva enterprises houston tx charge on credit card; healing scriptures for heart disease Depending on eligibility, business owners and companies can receive up to $26,000 per employee based on the number of W2 employees you had on the payroll in 2020 and 2021. Understanding how the ERC works and all the rules for 2020 and 2021 are the first steps in claiming your credit. Its that season of the year when you have to fill out your Form 941 for the current quarter. Here are qualifications for the 2020 ERC: you had at least a 50% loss in gross receipts during a qualifying quarter when compared to the same quarter in 2019. COVID-19 was banned from working from March 13 and June 30, 2020. Your business could be eligible for$26,000 per employee*with the ERC even if you took a PPP Loan. the expansion of the category of employers that may be eligible to claim the credit. Learn more about 5 Ways to Determine Eligibility for the Employee Retention Credit. Check out 5 Ways to Determine Eligibility for the Employee Retention Credit. You must have fully or partially suspended business operations in 2020 or 2021 because of a governmental order that restricted group gatherings, traveling, or commerce due to the COVID-19 pandemic. The ERC was slated to expire after December 31, 2020.

Wages that were used to apply for PPP loan forgiveness are not eligible to be double-counted.. john h francis polytechnic high school yearbook 2001; srvusd summer advancement; gladstone hospital maternity visiting hours; vertex in scorpio 5th house; motiva enterprises houston tx charge on credit card; healing scriptures for heart disease Depending on eligibility, business owners and companies can receive up to $26,000 per employee based on the number of W2 employees you had on the payroll in 2020 and 2021. Understanding how the ERC works and all the rules for 2020 and 2021 are the first steps in claiming your credit. Its that season of the year when you have to fill out your Form 941 for the current quarter. Here are qualifications for the 2020 ERC: you had at least a 50% loss in gross receipts during a qualifying quarter when compared to the same quarter in 2019. COVID-19 was banned from working from March 13 and June 30, 2020. Your business could be eligible for$26,000 per employee*with the ERC even if you took a PPP Loan. the expansion of the category of employers that may be eligible to claim the credit. Learn more about 5 Ways to Determine Eligibility for the Employee Retention Credit. Check out 5 Ways to Determine Eligibility for the Employee Retention Credit. You must have fully or partially suspended business operations in 2020 or 2021 because of a governmental order that restricted group gatherings, traveling, or commerce due to the COVID-19 pandemic. The ERC was slated to expire after December 31, 2020.  Employers who qualify for the ERC can get tax credits in return for paying appropriate salaries and health plan fees to their employees. The information in this material is not intended as tax or legal advice. You must have likewise gone through a complete or partial shutdown due to government directives. Whether you were completely or partially turned off during that time because the requirements are complicated. For the entire first quarter of 2021, your state has COVID-19 business limitations in effect.

Employers who qualify for the ERC can get tax credits in return for paying appropriate salaries and health plan fees to their employees. The information in this material is not intended as tax or legal advice. You must have likewise gone through a complete or partial shutdown due to government directives. Whether you were completely or partially turned off during that time because the requirements are complicated. For the entire first quarter of 2021, your state has COVID-19 business limitations in effect.  Your business needs at least $10,000 in qualified wages and expenses in order to qualify for the maximum. EY Employee Retention Credit Calculator | EY - US Trending How the great supply chain reset is unfolding 22 Feb 2023 Consulting How can data and technology help deliver a high-quality audit? environment open to Thomson Reuters customers only. Experiencing a 20% drop in gross revenues (i.e.. During any calendar quarter of 2020, your business was entirely or partially suspended by government orders. It has the potential to put tens of thousands of dollars in your pocket to assist cover the expense of paying personnel during the COVID-19 pandemic. Over the last three years, youve had the equivalent total revenues in the first quarter: To begin, establish if your first quarter qualifies for the employee retention credit by fulfilling any of the following criteria. Wage and health benefits amounts that can be claimed are limited to $10,000 in the aggregate per employee for all quarters. Qualified salaries and expenditures for 2020 are capped at $10,000 per employee for the year, with a credit of up to 50% of that amount, allowing you to claim up to $5,000 in credits per employee. The ERC Calculator is best viewed in Chrome or Firefox.