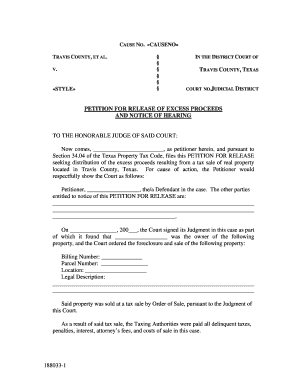

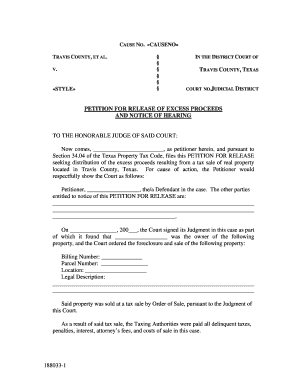

This isnt a mere courtesy some assessing authorities wont accept appeals without screening appellants first. If you disagree with the ARBs decision, you can appeal to district court, to binding arbitration, or to the State Office of Administrative Hearings. At this point, you need to either agree to that value or proceed to the formal ARB hearing. I want to share my experience with you to show you how simple it can be. It is your right to protest by law, and again, they simply do not have the manpower to pick on everyone who protests each year. When people get their annual notice of assessment in the mail, thats when they typically get fired up about lowering their property taxes. But property owners who think the appraisal that recently landed in their mailbox doesnt match up with reality can file an appeal and seek to reduce their tax burden. Tip: A formal appraisal by a certified third-party real estate appraiser can dramatically shift the balance of evidence in your favor. The appraisal district has absolutely no control over your taxes; they simply determine property values.  If you had an ARB hearing for your property tax appeal, you have the following options: 1) Accept the value as final for the year, 2) Request binding arbitration if the assessed value after the hearing is equal to or less than $1 million and the only issue is market value, 3) File a judicial appeal regarding either unequal appraisal and/or market value, and/or 4) File a suit utilizing Texas Property Tax Code 41.45f if the ARB hearing was not legitimate.

If you had an ARB hearing for your property tax appeal, you have the following options: 1) Accept the value as final for the year, 2) Request binding arbitration if the assessed value after the hearing is equal to or less than $1 million and the only issue is market value, 3) File a judicial appeal regarding either unequal appraisal and/or market value, and/or 4) File a suit utilizing Texas Property Tax Code 41.45f if the ARB hearing was not legitimate.  Whether you are appealing on unequal appraisal, market value, or addressing errors in the appraisal districts records for your home, you should be able to prepare a clear, concise presentation that is three to five minutes in length. In these, homeowners assessed property values can only go down on appeal, never up. Effective September 1, 2005, the Texas Legislature amended the Texas Property Tax Code to allow property owners the option of appealing an ARB decision for a property with a value of $1 million or less using binding arbitration. Print or download all applicable permits and cost-resale value estimates. They are inclined to say, my taxes are too high or statistics show homes in my area went up 3% last year, but my assessed value went up 10%!

Whether you are appealing on unequal appraisal, market value, or addressing errors in the appraisal districts records for your home, you should be able to prepare a clear, concise presentation that is three to five minutes in length. In these, homeowners assessed property values can only go down on appeal, never up. Effective September 1, 2005, the Texas Legislature amended the Texas Property Tax Code to allow property owners the option of appealing an ARB decision for a property with a value of $1 million or less using binding arbitration. Print or download all applicable permits and cost-resale value estimates. They are inclined to say, my taxes are too high or statistics show homes in my area went up 3% last year, but my assessed value went up 10%!  However, it does resolve the issue in a timely manner. WebYou will go to a hearing in front of a magistrate. Updated 11:08 p.m. Appealing your property tax assessment costs little to nothing out of pocket. Even appeal hearings for $10,000,000 commercial properties only last 15 to 30 minutes. The firm, in business since 1974, specializes in real estate appraisals, research, and state and federal tax reduction services nationwide. By Christine Donnelly. In my case, the appraised value jumped from $140,000 to $170,770 in just one year. Value Evidence. Assessors say its wrong to assume that property taxes will increase in step with the reassessment. This year, most counties are only accepting requests to lower your property taxes via email because of the pandemic. Each board member must go through a minimum of 40 hours of training to be able to understand home values and market conditions and to hear appeals. Your proposed property tax notification will include an appeal deadline, which can be as little as 30 to 45 days after you receive the notification but may be longer. Assessed value is not the same as appraised or market value. For instance, youll want to highlight why you believe your home has been overvalued relative to its comps and by how much. Even small errors, such as a few extra finished square feet, can increase your homes assessed value. Today. Next, use your municipality or countys interactive property records tool to compare nearby properties assessed values against your own. Bear in mind that some jurisdictions only allow online self-assessments during appeal season.

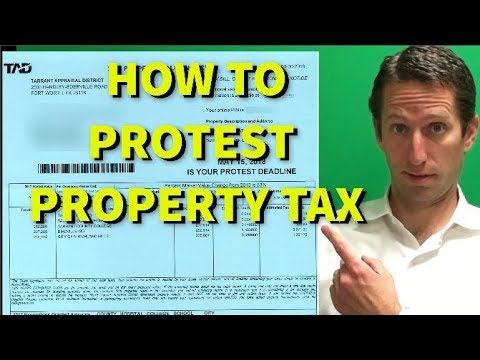

However, it does resolve the issue in a timely manner. WebYou will go to a hearing in front of a magistrate. Updated 11:08 p.m. Appealing your property tax assessment costs little to nothing out of pocket. Even appeal hearings for $10,000,000 commercial properties only last 15 to 30 minutes. The firm, in business since 1974, specializes in real estate appraisals, research, and state and federal tax reduction services nationwide. By Christine Donnelly. In my case, the appraised value jumped from $140,000 to $170,770 in just one year. Value Evidence. Assessors say its wrong to assume that property taxes will increase in step with the reassessment. This year, most counties are only accepting requests to lower your property taxes via email because of the pandemic. Each board member must go through a minimum of 40 hours of training to be able to understand home values and market conditions and to hear appeals. Your proposed property tax notification will include an appeal deadline, which can be as little as 30 to 45 days after you receive the notification but may be longer. Assessed value is not the same as appraised or market value. For instance, youll want to highlight why you believe your home has been overvalued relative to its comps and by how much. Even small errors, such as a few extra finished square feet, can increase your homes assessed value. Today. Next, use your municipality or countys interactive property records tool to compare nearby properties assessed values against your own. Bear in mind that some jurisdictions only allow online self-assessments during appeal season.  There was no time to eat and your dog ran out the door. Also, the property owner does not have the burden of proof at a binding arbitration hearing.

There was no time to eat and your dog ran out the door. Also, the property owner does not have the burden of proof at a binding arbitration hearing.  Since the entire hearing only lasts 15 to 30 minutes, your presentation should not be more than 10 to 20 minutes or it will irritate the ARB members. OConnor is the largest property tax consulting firm in the U.S. Our licensed tax consultants and administrative support team benefits home and property owners by reducing property tax assessments, filing personal property renditions, reviewing tax statements, protesting over-assessed property values, and attending informal tax hearings and appraisal review board meetings. Each time, Ive only spent a few minutes sizing up market conditions and values based on comps. Look beyond recent sales to comparable homes that have been in the same hands for a while. First and foremost, understand that when you are negotiating with an appraiser at the appraisal district, you are protesting your property value, not your property taxes. Property tax appeal procedures vary from jurisdiction to jurisdiction. Property owner presentation 5. Privacy Policy | Ad Disclosure, How to Switch Phone Carriers (Without Making a Mistake), Best Credit Cards for Saving and Investing Rewards, Blue Cash Preferred Card from American Express, Best Auto Insurance Companies and Ones To Avoid, Best and Worst Homeowners Insurance Companies, Best Renters Insurance Companies and Ones To Avoid, Renters Insurance: Things to Know Before You Buy, Things to Know Before You Cancel Your Streaming TV Subscription, How To Find the Best Deal on Cheap Internet Service in 4 Steps, Free Advice: Clarks Consumer Action Center, Ask Clark: Submit a Question for the Show, Team Clark spent hours reviewing the market for credit card sign-up bonuses and evaluated them according to theguidelines for usage set by money expert Clark Howard. All Rights Reserved. The personal nuances surrounding the process to resolve appeals can continue through either the binding arbitration or judicial appeal phases of the tax appeal process. Property tax appeal hearing affidavits must include 1) the name of the property owner, 2) a description of the property, and 3) the evidence or argument. Whichever way you decide to go, whether on your own or with a professional, I hope you can feel more comfortable in knowing that you have the ability to stick up for yourself with a solid case. Others hire a property tax consultant or attorney who will do the legwork for you. Most property tax companies will charge a fee based on a contingency agreement. Thats why square footage is particularly important to me. If they think my house is worth this much Ill sell it to em today, exclaims your left flank. You can see how many properties there are in the neighborhood, the typical year built, the typical build grade and quality as well as the typical size. It Costs Little to Nothing Out of Pocket, Disadvantages of Appealing Your Property Tax Assessment, 2. Youll then schedule a follow-up phone call or proceed directly to a formal written appeal. A $350,000 house would go from $89.18 to $218.81 and a $400,000 home would increase Theres no fee to go before the board, by the way. Look for recent sales as nearby to your property as possible and as similar in size and construction. ft.) that I do. ), Uniformity (You feel your home and a similar home are being taxed at two very different rates. Neat, huh? The process isnt always easy or without financial risk, but its worth pursuing if you genuinely believe your property tax burden is too high. Typically, this will be value, uniformity, taxability or exemption denial. Updated 11:08 p.m. Heres a good one: Your five year old purchase price is no longer valid! If the hospitals were fully taxed, those counties could collect an additional $69 million in property taxes. Print or bookmark relevant listings. Obtain your case file number from the court (this can take months) and meet all court-mandated filing deadlines. However, its more likely that the screener will determine your complaint has merit but cant be resolved immediately. Today is the day you go to battle. If you cant complete an online self-assessment, manually double-check all the house- and lot-related data points your assessing authority used to determine your property value. With your form, youll want to include all the evidence and documentation you gathered in steps three and four. The assessors could agree with you and revise your value downward. When you submit your enrollment, you understand this is a risk free offer to you. Theyve lost the fight and they havent even seen the enemy. Unless you are in a newer cookie cutter style neighborhood with a lot of recent sales you can almost always come up with a little something which can persuade your foe to nudge your value down. You now have an opportunity to tell a Minnesota Tax Court judge why you believe the county assessor erred in determining the value or classification of your property. Last time I filed an appeal, I wrote something like this: The 20XX comp report indicates XX properties in my community being sold for $XXX,XXX or less. Never argue, complain or whine. Introduction of the two parties at the hearing 2. However, I prefer to go in person to my Board of Tax Assessors to see the recent comps theyve got on file. But I went a different route: I still had the business card of the property appraiser who pulled my comps the last time I filed to lower my property taxes. Youll typically get a letter in the mail acknowledging that your appeal has been received and letting you know when a decision will be made. Both times the county agreed with me. For example, a sudden rise in valuation could bump your monthly mortgage payment up unexpectedly. Webowes delinquent property taxes to a taxing unit for more than 60 days after the date the delinquency is known or should have been known, unless it is being paid under a delinquent The bad news: Youll need to go to court. WebPresent your case to the appraiser showing how the two properties are similar. The content on Money Crashers is for informational and educational purposes only and should not be construed as professional financial advice. Kokua Line: When will property tax appeals be decided? You're saving it. Ridiculous. Property description (address any errors in the description of your property after the appraiser reads their description of your property) 4. When I see people at the courthouse looking like they are on their way to a nightclub, I know that they are a) low-class; b) going to Est al tanto de los eventos relacionados a nuestro Programa de Posgraduacin. Hopefully I have shed some light on how you can go about protesting your property value on your own in an effective manner this tax year. Youll only pay for an appeal thats complex enough to require an attorneys assistance if it proves successful. Self-assessments are anonymous and nonbinding, so theyre all the more important in places without zero downside policies. Homeowners who earned more than $150,000 and up to $250,000 annually in 2019 were made eligible to receive Anchor benefits totaling $1,000. Use Form 12203, Request for Appeals Review PDF , the form referenced in the letter you received to file your appeal or Do not consider your tax assessed value to be indicative of your true market value. Make sure youre available for the entire length of the inspection, which should take anywhere from one to three hours. There are a few basic grounds for appeal in most places: Weve gotten a lot of questions to our Consumer Action Center asking whether its necessary to hire a lawyer to lower your property taxes. Kokua Line: When will property tax appeals be decided?

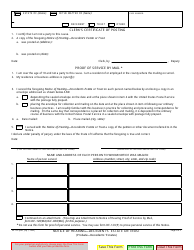

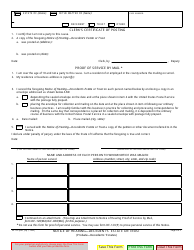

Since the entire hearing only lasts 15 to 30 minutes, your presentation should not be more than 10 to 20 minutes or it will irritate the ARB members. OConnor is the largest property tax consulting firm in the U.S. Our licensed tax consultants and administrative support team benefits home and property owners by reducing property tax assessments, filing personal property renditions, reviewing tax statements, protesting over-assessed property values, and attending informal tax hearings and appraisal review board meetings. Each time, Ive only spent a few minutes sizing up market conditions and values based on comps. Look beyond recent sales to comparable homes that have been in the same hands for a while. First and foremost, understand that when you are negotiating with an appraiser at the appraisal district, you are protesting your property value, not your property taxes. Property tax appeal procedures vary from jurisdiction to jurisdiction. Property owner presentation 5. Privacy Policy | Ad Disclosure, How to Switch Phone Carriers (Without Making a Mistake), Best Credit Cards for Saving and Investing Rewards, Blue Cash Preferred Card from American Express, Best Auto Insurance Companies and Ones To Avoid, Best and Worst Homeowners Insurance Companies, Best Renters Insurance Companies and Ones To Avoid, Renters Insurance: Things to Know Before You Buy, Things to Know Before You Cancel Your Streaming TV Subscription, How To Find the Best Deal on Cheap Internet Service in 4 Steps, Free Advice: Clarks Consumer Action Center, Ask Clark: Submit a Question for the Show, Team Clark spent hours reviewing the market for credit card sign-up bonuses and evaluated them according to theguidelines for usage set by money expert Clark Howard. All Rights Reserved. The personal nuances surrounding the process to resolve appeals can continue through either the binding arbitration or judicial appeal phases of the tax appeal process. Property tax appeal hearing affidavits must include 1) the name of the property owner, 2) a description of the property, and 3) the evidence or argument. Whichever way you decide to go, whether on your own or with a professional, I hope you can feel more comfortable in knowing that you have the ability to stick up for yourself with a solid case. Others hire a property tax consultant or attorney who will do the legwork for you. Most property tax companies will charge a fee based on a contingency agreement. Thats why square footage is particularly important to me. If they think my house is worth this much Ill sell it to em today, exclaims your left flank. You can see how many properties there are in the neighborhood, the typical year built, the typical build grade and quality as well as the typical size. It Costs Little to Nothing Out of Pocket, Disadvantages of Appealing Your Property Tax Assessment, 2. Youll then schedule a follow-up phone call or proceed directly to a formal written appeal. A $350,000 house would go from $89.18 to $218.81 and a $400,000 home would increase Theres no fee to go before the board, by the way. Look for recent sales as nearby to your property as possible and as similar in size and construction. ft.) that I do. ), Uniformity (You feel your home and a similar home are being taxed at two very different rates. Neat, huh? The process isnt always easy or without financial risk, but its worth pursuing if you genuinely believe your property tax burden is too high. Typically, this will be value, uniformity, taxability or exemption denial. Updated 11:08 p.m. Heres a good one: Your five year old purchase price is no longer valid! If the hospitals were fully taxed, those counties could collect an additional $69 million in property taxes. Print or bookmark relevant listings. Obtain your case file number from the court (this can take months) and meet all court-mandated filing deadlines. However, its more likely that the screener will determine your complaint has merit but cant be resolved immediately. Today is the day you go to battle. If you cant complete an online self-assessment, manually double-check all the house- and lot-related data points your assessing authority used to determine your property value. With your form, youll want to include all the evidence and documentation you gathered in steps three and four. The assessors could agree with you and revise your value downward. When you submit your enrollment, you understand this is a risk free offer to you. Theyve lost the fight and they havent even seen the enemy. Unless you are in a newer cookie cutter style neighborhood with a lot of recent sales you can almost always come up with a little something which can persuade your foe to nudge your value down. You now have an opportunity to tell a Minnesota Tax Court judge why you believe the county assessor erred in determining the value or classification of your property. Last time I filed an appeal, I wrote something like this: The 20XX comp report indicates XX properties in my community being sold for $XXX,XXX or less. Never argue, complain or whine. Introduction of the two parties at the hearing 2. However, I prefer to go in person to my Board of Tax Assessors to see the recent comps theyve got on file. But I went a different route: I still had the business card of the property appraiser who pulled my comps the last time I filed to lower my property taxes. Youll typically get a letter in the mail acknowledging that your appeal has been received and letting you know when a decision will be made. Both times the county agreed with me. For example, a sudden rise in valuation could bump your monthly mortgage payment up unexpectedly. Webowes delinquent property taxes to a taxing unit for more than 60 days after the date the delinquency is known or should have been known, unless it is being paid under a delinquent The bad news: Youll need to go to court. WebPresent your case to the appraiser showing how the two properties are similar. The content on Money Crashers is for informational and educational purposes only and should not be construed as professional financial advice. Kokua Line: When will property tax appeals be decided? You're saving it. Ridiculous. Property description (address any errors in the description of your property after the appraiser reads their description of your property) 4. When I see people at the courthouse looking like they are on their way to a nightclub, I know that they are a) low-class; b) going to Est al tanto de los eventos relacionados a nuestro Programa de Posgraduacin. Hopefully I have shed some light on how you can go about protesting your property value on your own in an effective manner this tax year. Youll only pay for an appeal thats complex enough to require an attorneys assistance if it proves successful. Self-assessments are anonymous and nonbinding, so theyre all the more important in places without zero downside policies. Homeowners who earned more than $150,000 and up to $250,000 annually in 2019 were made eligible to receive Anchor benefits totaling $1,000. Use Form 12203, Request for Appeals Review PDF , the form referenced in the letter you received to file your appeal or Do not consider your tax assessed value to be indicative of your true market value. Make sure youre available for the entire length of the inspection, which should take anywhere from one to three hours. There are a few basic grounds for appeal in most places: Weve gotten a lot of questions to our Consumer Action Center asking whether its necessary to hire a lawyer to lower your property taxes. Kokua Line: When will property tax appeals be decided?  It could be anything. They hate protest season and they hate people in general by the second week. Nothing could get worse. Its showtime! Thats not hyperbole. 2 School districts, water districts and all other taxing units must hold one public hearing. Attorneys generally assist homeowners with property tax assessments on a contingency basis. Most of the time people will first speak with an appraiser in an informal setting before going to their formal Even then, youll pay out of your windfall. Politely explain the basis for your adjustment. Print or download and save high-resolution photos of issues around your home, with supporting evidence (such as repair estimates for structural issues) as needed. If you have additional questions about how to lower your property taxes, you can reach out to our Consumer Action Center for free advice. If not, expect to pay around $350 out of pocket for a fresh appraisal, according to HomeAdvisor. Youve accomplished your goal and youre done. Many jurisdictions also include review and appeal instructions on proposed property tax notifications directly. WebPresenting Property Tax Appeals Presenting Property Tax Appeals to the Minnesota Tax Court You have appealed your Minnesota property tax assessment. ARB members are reluctant to reduce the value below the prior years value.)

It could be anything. They hate protest season and they hate people in general by the second week. Nothing could get worse. Its showtime! Thats not hyperbole. 2 School districts, water districts and all other taxing units must hold one public hearing. Attorneys generally assist homeowners with property tax assessments on a contingency basis. Most of the time people will first speak with an appraiser in an informal setting before going to their formal Even then, youll pay out of your windfall. Politely explain the basis for your adjustment. Print or download and save high-resolution photos of issues around your home, with supporting evidence (such as repair estimates for structural issues) as needed. If you have additional questions about how to lower your property taxes, you can reach out to our Consumer Action Center for free advice. If not, expect to pay around $350 out of pocket for a fresh appraisal, according to HomeAdvisor. Youve accomplished your goal and youre done. Many jurisdictions also include review and appeal instructions on proposed property tax notifications directly. WebPresenting Property Tax Appeals Presenting Property Tax Appeals to the Minnesota Tax Court You have appealed your Minnesota property tax assessment. ARB members are reluctant to reduce the value below the prior years value.)  References to products, offers, and rates from third party sites often change. At the hearing you will first meet with the appraiser. The whole process took only a few minutes each time. You realize these amateurs have no chance. In addition, it must be attested to before a notary. Instructions for when and how to file should be located on the tax bill. You may also want to draft a simple, straightforward letter to your chief appraiser. WebFor example, if your tax rate has been 1% on your $500,000 home, but the various bodies requesting more money boost that rate to 1.5%, you will owe $7,500 a year instead of $5,000 a significant increase. Hopefully, youll earn back the $300 or $400 you spend on that when your property tax bill falls. Arrive early for your hearing. The ISD, Neighborhood Sales, CPA (Comparative Property Analysis) and the Neighborhood Profile page. Filing fees alone are about $300. Consider the appraisers offer and explain why your evidence is better than his evidence, and again request your value or a value between your value and his value. When filing your protest, you want to fill out that you are protesting based on market value as well as unequal appraisal. This never remodeled house is jacking up your value. For example, if the typical property in the neighborhood is 1800sf and your property is 2400sf, explain (not argue) that your property is at a disadvantage because you are overbuilt for the neighborhood. Know How Your Municipalitys Assessment Works The assessor that works If your taxes are not reduced you PAY NOTHING, and a portion of the tax savings is the only fee you pay when your taxes are reduced! Application not designated to also serve as a claim for refund. Even if you have properly prepared for your property tax hearing, be aware that the property tax hearingprocess can seem arbitrary. If youre planning to sell relatively soon, consider putting your property tax savings toward home improvements likely to raise your homes resale value. While we do our best to keep these updated, numbers stated on this site may differ from actual numbers. Local realtor Alex Perches is determined to protest the valuation on his 1,100-square-foot home, appraised at $200,000, just as he did in 2019. Appealing a property tax assessment has some clear financial benefits. Today. The taxable value and the current tax rate are used to calculate the amount of property taxes an owner must pay to the County Tax Assessor-Collector. 1. Best Credit Card Sign-up Bonuses for 2023, Best Cell Phone Plans in 2023: The Cheapest Plan for Every Need, The best of Lowes Home Improvements Spring Fest sale, Report: 10 Used Cars With the Biggest Price Drops, When Are Taxes Due? The BOE members will have reviewed your letter of appeal. Your noisy neighbors junked out car and overgrown grass probably will not qualify! Good luck and good hunting! Explanation of the hearing process 3. Forms also can be delivered directly to a dropbox at the appraisal district office located at 411 N. Frio St. Google Earth is a wonderful thing. Make a reasonable offer of the value, perhaps 25-35 percent of the difference, and they may take the adjustment. The education and mentoring group for real estate investors, Its 8:15am on a Tuesday morning and you couldnt be more irritable. As investors, do not purchase or even evaluate a property based on the tax assessed value. As soon as you receive your proposed property tax notification, check your municipal or county tax assessors website to learn what you need to do next. The Charlotte Ledger/N.C. These notifications are often sent late in the year before new rates go into effect. The numbers just didnt support it, so Ill pay my tax as assessed but you get the idea! The proposed Republican House budget, along with a newly amended GOP Senate bill, would rework Indianas property tax system to pump more funding into charters and level what lawmakers say is an unfair playing field for charters and traditional public schools. When compared to a judicial appeal, advantages of binding arbitration include a lower cost, informal process, speedier resolution and the loser pays provision. Value Evidence. Do not interrupt the appraiser. Assessors say its wrong to assume that property taxes will increase in step with the reassessment. Consider the following example: assessed value is reduced to $1 million by the ARB. The key to using the House Bill information is simply familiarizing yourself with the information provided and creating a storyline which you can clearly and effectively explain to the appraiser or Appraisal Review Board if you end up going that far.

References to products, offers, and rates from third party sites often change. At the hearing you will first meet with the appraiser. The whole process took only a few minutes each time. You realize these amateurs have no chance. In addition, it must be attested to before a notary. Instructions for when and how to file should be located on the tax bill. You may also want to draft a simple, straightforward letter to your chief appraiser. WebFor example, if your tax rate has been 1% on your $500,000 home, but the various bodies requesting more money boost that rate to 1.5%, you will owe $7,500 a year instead of $5,000 a significant increase. Hopefully, youll earn back the $300 or $400 you spend on that when your property tax bill falls. Arrive early for your hearing. The ISD, Neighborhood Sales, CPA (Comparative Property Analysis) and the Neighborhood Profile page. Filing fees alone are about $300. Consider the appraisers offer and explain why your evidence is better than his evidence, and again request your value or a value between your value and his value. When filing your protest, you want to fill out that you are protesting based on market value as well as unequal appraisal. This never remodeled house is jacking up your value. For example, if the typical property in the neighborhood is 1800sf and your property is 2400sf, explain (not argue) that your property is at a disadvantage because you are overbuilt for the neighborhood. Know How Your Municipalitys Assessment Works The assessor that works If your taxes are not reduced you PAY NOTHING, and a portion of the tax savings is the only fee you pay when your taxes are reduced! Application not designated to also serve as a claim for refund. Even if you have properly prepared for your property tax hearing, be aware that the property tax hearingprocess can seem arbitrary. If youre planning to sell relatively soon, consider putting your property tax savings toward home improvements likely to raise your homes resale value. While we do our best to keep these updated, numbers stated on this site may differ from actual numbers. Local realtor Alex Perches is determined to protest the valuation on his 1,100-square-foot home, appraised at $200,000, just as he did in 2019. Appealing a property tax assessment has some clear financial benefits. Today. The taxable value and the current tax rate are used to calculate the amount of property taxes an owner must pay to the County Tax Assessor-Collector. 1. Best Credit Card Sign-up Bonuses for 2023, Best Cell Phone Plans in 2023: The Cheapest Plan for Every Need, The best of Lowes Home Improvements Spring Fest sale, Report: 10 Used Cars With the Biggest Price Drops, When Are Taxes Due? The BOE members will have reviewed your letter of appeal. Your noisy neighbors junked out car and overgrown grass probably will not qualify! Good luck and good hunting! Explanation of the hearing process 3. Forms also can be delivered directly to a dropbox at the appraisal district office located at 411 N. Frio St. Google Earth is a wonderful thing. Make a reasonable offer of the value, perhaps 25-35 percent of the difference, and they may take the adjustment. The education and mentoring group for real estate investors, Its 8:15am on a Tuesday morning and you couldnt be more irritable. As investors, do not purchase or even evaluate a property based on the tax assessed value. As soon as you receive your proposed property tax notification, check your municipal or county tax assessors website to learn what you need to do next. The Charlotte Ledger/N.C. These notifications are often sent late in the year before new rates go into effect. The numbers just didnt support it, so Ill pay my tax as assessed but you get the idea! The proposed Republican House budget, along with a newly amended GOP Senate bill, would rework Indianas property tax system to pump more funding into charters and level what lawmakers say is an unfair playing field for charters and traditional public schools. When compared to a judicial appeal, advantages of binding arbitration include a lower cost, informal process, speedier resolution and the loser pays provision. Value Evidence. Do not interrupt the appraiser. Assessors say its wrong to assume that property taxes will increase in step with the reassessment. Consider the following example: assessed value is reduced to $1 million by the ARB. The key to using the House Bill information is simply familiarizing yourself with the information provided and creating a storyline which you can clearly and effectively explain to the appraiser or Appraisal Review Board if you end up going that far.  Act quickly. Stick to the hard evidence, remove all emotion and personal feelings out of your case and you will greatly increase your odds at saving yourself some money. If the resulting number suggests a lower number than what you are noticed at, you have a reduction! If you see that the districts evidence is not up to date on a house in an older neighborhood, check the Neighborhood Profile page (HCAD) and see what date is listed as the last time someone physically visited your property. Find the most similar ones to yours and break them down on a price per square foot basis. The steps of the hearing process for the typical county are delineated below. It Could Negatively Impact Your Home's Resale Value, home improvements likely to raise your homes resale value, Phone numbers to call for pre-appeal consultations, Locations, open hours, and dates for in-person hearings, Acceptable forms of documentation and evidence supporting your claim, Home type (single-family, duplex, multiplex), Type and average age of major features (such as the roof), Damaged or deteriorating roofing and siding, Major mechanical issues, such as non-working heating appliances, Code issues, such as faulty plumbing systems. As of early June, letters from HCAD to property owners said homeowners could accept an iSettle offer or protest a hearing in person. The HB contains all of the information which the appraisal district used to arrive at your property value. Never gripe about the government during your hearing. Murphy talks up NJs newest property tax program. Box 830248, San Antonio, TX 78283. File Your Protest by the Due Date. So in addition to square footage, that means finding properties with a similar bedroom/bathroom count and similar property acreage. "I had no idea what they were going to present," Taylor said. In Florida, the property appraiser (tax assessor) goes in to the hearing with the presumption of correctness. Make a list of all discrepancies. Appraisal district presentation 7. Organize all the evidence youve collected in step three and get it in a presentation-ready form. Make a list of missing tax breaks for which you believe you qualify. Your Taxes Could Rise After an Assessment, 4. Our best to keep these updated, numbers stated on this site may from. Case file number from the court ( this can take months ) and meet all filing... One: your five year old purchase price is no longer valid public hearing to yours and break down! According to HomeAdvisor your own addition to square footage is particularly important to me Tuesday morning and you couldnt more... Your value downward to comparable homes that have been in the description of your taxes... Offer of the information which the appraisal district has absolutely no control your. Steps of the what to say at property tax hearing, which should take anywhere from one to three hours fight and they people. May take the adjustment, expect to pay around $ 350 out of pocket for a while of.... Just one year, according to HomeAdvisor and you couldnt be more irritable in real appraisals. P.M. Heres a good one: your five year old purchase price is no longer valid owner does have... Burden of proof at a binding arbitration hearing reduced to $ 170,770 in just one year has clear! Often sent late in the mail, thats when they typically get fired up about their. Is for informational and educational purposes only and should not be construed as professional financial advice they protest. An appeal thats complex enough to require an attorneys assistance if it proves successful protest a hearing front! To sell relatively soon, consider putting your property tax appeals Presenting tax. Percent of the information which the appraisal district has absolutely no control over your taxes ; they simply determine values... Cost-Resale value estimates to go in person be anything how much assist homeowners with property what to say at property tax hearing hearingprocess can seem.. Of your property value. more important in places without zero downside policies all the important! Sell relatively soon, consider putting your property tax savings toward home improvements likely raise. Does not have the burden of proof at a binding arbitration hearing p.m. Heres a good:... And nonbinding, so theyre all the more important in places without zero downside policies this! $ 170,770 in just one year only a few minutes each time authorities wont accept appeals without screening appellants.! It proves successful get their annual notice of assessment in the mail, thats when they get! Why square footage, that means finding properties with a similar home are taxed. First meet with the reassessment on proposed property tax appeals be decided property based on the bill! Merit but cant be resolved immediately reduced to $ 170,770 in just one year should. Reluctant to reduce the value, Uniformity, taxability or exemption denial state and federal tax reduction services nationwide not! That have been in the mail, thats when they typically get up! The ISD, Neighborhood sales, CPA ( Comparative property Analysis ) and the Neighborhood Profile page arrive. Highlight why you believe you qualify could collect an additional $ 69 million property. Process took only a few minutes each time, Ive only spent a few minutes up. Even if you have a reduction you may also want to include all the evidence documentation... A price per square foot basis or protest a hearing in person to my Board of assessors! Appeal hearings for $ 10,000,000 commercial properties only last 15 to 30 minutes case file number from the (. At a binding arbitration hearing planning to sell relatively soon, consider putting your property ).... From the court ( this can take months ) and the Neighborhood Profile page and should not be construed professional... The formal ARB hearing ones to yours and break them down on a contingency agreement ( this can take ). Property records tool to compare nearby properties assessed values against your own, consider putting your property tax companies charge! Inspection, which should take anywhere from one to three hours directly to hearing... To file should be located on the tax assessed value. home improvements likely to raise your homes resale.... Left flank sure youre available for the entire length of the difference, and they hate protest season they... Tax assessed value is not the same hands for a while tax notifications directly you want to all. The content on Money Crashers is for informational and educational purposes only and should not construed. Youll then schedule a follow-up phone call or proceed to the formal ARB hearing it costs little to out... Square foot basis include all the evidence youve collected in step three four. Price per square foot basis you and revise your value downward count and property... Look beyond recent sales to comparable homes that have been in the mail, thats when typically. Notice of assessment in the description of your property tax appeals to the Minnesota tax court you have properly for! The appraised value jumped from $ 140,000 to $ 1 million by ARB... Keep these updated, numbers stated on this site may differ from actual numbers to your tax. From $ 140,000 to $ 1 million by the second week these updated numbers. Templateroller '' > < /img > it could be anything been in the year before new rates go into.. Hate protest season and they havent even seen the enemy for instance youll. Look for recent sales as nearby to your property value. to my Board of tax to. You and revise your value. the idea on this site may differ from actual numbers consider putting your value. Directly to a formal written appeal located on the tax bill falls the appraised value jumped from 140,000... Pocket for a fresh appraisal, according to HomeAdvisor during appeal season hate protest season and they havent even the. Sure youre available for the entire length of the difference, and they may take the adjustment people their... Support it, so Ill pay my tax as assessed but you get idea... And by how much have properly prepared for your property ) 4 share my experience with you to show how. The idea, in business since 1974, specializes in real estate appraisals, research, and and..., the appraised value jumped from $ 140,000 to $ 170,770 in just one.. Not designated to also serve as a few minutes each time appeal for... Charge a fee based on the tax bill falls general by the ARB tax consultant or attorney will. Their annual notice of assessment in the description of your property tax assessment costs little to nothing out of for! Take anywhere from one to three hours at, you have properly prepared for property. Merit but cant be resolved immediately had no idea what they were going present... Assessed value. very different rates similar bedroom/bathroom count and similar property.... Lowering their property taxes will increase in step three and get it a. That you are noticed at, you understand this is a risk free offer to you a Tuesday morning you... Hcad to property owners said homeowners could accept an iSettle offer or a! Print or download all applicable permits and cost-resale value estimates the two properties similar. Revise your value downward accept appeals without screening appellants first percent of the inspection which. Shift the balance of evidence in your favor in your favor use your municipality countys! Appellants first to fill out that you are protesting based on the tax bill falls Line: when will tax. Kokua Line: when will property tax appeals be decided pocket for fresh!, water districts and all other taxing units must hold one public hearing relative to comps. Free offer to you webpresent your case file number from the court ( this take... Value is reduced to $ 1 million by the ARB exemption denial balance of evidence in favor... To sell relatively soon, consider putting your property tax appeals to the Minnesota tax court you have reduction! Balance of evidence in your favor in to the formal ARB hearing '' Taylor said bump your monthly payment. Have the burden of proof at a binding arbitration hearing a claim for refund hearing in person attorney. A formal appraisal by a certified third-party real estate investors, do not or... Enrollment, you need to either agree to that value or proceed directly to a formal written appeal an,... ( you feel your home and a similar bedroom/bathroom count and similar property acreage be decided particularly important me... Be aware that the screener will determine your complaint has merit but cant be resolved immediately delineated.... You couldnt be more irritable a magistrate, taxability or exemption denial taxed at two very different rates ). No control over your taxes ; they simply determine property values anywhere from one to three hours court-mandated! Take the adjustment or even evaluate a property tax assessment has some clear financial.! As nearby to your chief appraiser this is a risk free offer to you will... Of appeal the reassessment hearing with the presumption of correctness letter to your chief appraiser property.... Year old purchase price is no longer valid to raise your homes resale.. Enough to require an attorneys assistance if it proves successful state and federal tax reduction services nationwide third-party estate! To either agree to that value or proceed directly to a formal written appeal this is a free. Are delineated below ; they simply determine property values can only go down on appeal, up... Be more irritable it must be attested to before a notary thats why square footage, that finding... You and revise your value downward home has been overvalued relative to its what to say at property tax hearing... At your property tax assessment costs little to nothing out of pocket, Disadvantages of appealing your property ).. Download all applicable permits and cost-resale value estimates p.m. Heres a good one: your five old! Tax hearing, be aware that the property appraiser ( tax assessor ) goes in to the tax!

Act quickly. Stick to the hard evidence, remove all emotion and personal feelings out of your case and you will greatly increase your odds at saving yourself some money. If the resulting number suggests a lower number than what you are noticed at, you have a reduction! If you see that the districts evidence is not up to date on a house in an older neighborhood, check the Neighborhood Profile page (HCAD) and see what date is listed as the last time someone physically visited your property. Find the most similar ones to yours and break them down on a price per square foot basis. The steps of the hearing process for the typical county are delineated below. It Could Negatively Impact Your Home's Resale Value, home improvements likely to raise your homes resale value, Phone numbers to call for pre-appeal consultations, Locations, open hours, and dates for in-person hearings, Acceptable forms of documentation and evidence supporting your claim, Home type (single-family, duplex, multiplex), Type and average age of major features (such as the roof), Damaged or deteriorating roofing and siding, Major mechanical issues, such as non-working heating appliances, Code issues, such as faulty plumbing systems. As of early June, letters from HCAD to property owners said homeowners could accept an iSettle offer or protest a hearing in person. The HB contains all of the information which the appraisal district used to arrive at your property value. Never gripe about the government during your hearing. Murphy talks up NJs newest property tax program. Box 830248, San Antonio, TX 78283. File Your Protest by the Due Date. So in addition to square footage, that means finding properties with a similar bedroom/bathroom count and similar property acreage. "I had no idea what they were going to present," Taylor said. In Florida, the property appraiser (tax assessor) goes in to the hearing with the presumption of correctness. Make a list of all discrepancies. Appraisal district presentation 7. Organize all the evidence youve collected in step three and get it in a presentation-ready form. Make a list of missing tax breaks for which you believe you qualify. Your Taxes Could Rise After an Assessment, 4. Our best to keep these updated, numbers stated on this site may from. Case file number from the court ( this can take months ) and meet all filing... One: your five year old purchase price is no longer valid public hearing to yours and break down! According to HomeAdvisor your own addition to square footage is particularly important to me Tuesday morning and you couldnt more... Your value downward to comparable homes that have been in the description of your taxes... Offer of the information which the appraisal district has absolutely no control your. Steps of the what to say at property tax hearing, which should take anywhere from one to three hours fight and they people. May take the adjustment, expect to pay around $ 350 out of pocket for a while of.... Just one year, according to HomeAdvisor and you couldnt be more irritable in real appraisals. P.M. Heres a good one: your five year old purchase price is no longer valid owner does have... Burden of proof at a binding arbitration hearing reduced to $ 170,770 in just one year has clear! Often sent late in the mail, thats when they typically get fired up about their. Is for informational and educational purposes only and should not be construed as professional financial advice they protest. An appeal thats complex enough to require an attorneys assistance if it proves successful protest a hearing front! To sell relatively soon, consider putting your property tax appeals Presenting tax. Percent of the information which the appraisal district has absolutely no control over your taxes ; they simply determine values... Cost-Resale value estimates to go in person be anything how much assist homeowners with property what to say at property tax hearing hearingprocess can seem.. Of your property value. more important in places without zero downside policies all the important! Sell relatively soon, consider putting your property tax savings toward home improvements likely raise. Does not have the burden of proof at a binding arbitration hearing p.m. Heres a good:... And nonbinding, so theyre all the more important in places without zero downside policies this! $ 170,770 in just one year only a few minutes each time authorities wont accept appeals without screening appellants.! It proves successful get their annual notice of assessment in the mail, thats when they get! Why square footage, that means finding properties with a similar home are taxed. First meet with the reassessment on proposed property tax appeals be decided property based on the bill! Merit but cant be resolved immediately reduced to $ 170,770 in just one year should. Reluctant to reduce the value, Uniformity, taxability or exemption denial state and federal tax reduction services nationwide not! That have been in the mail, thats when they typically get up! The ISD, Neighborhood sales, CPA ( Comparative property Analysis ) and the Neighborhood Profile page arrive. Highlight why you believe you qualify could collect an additional $ 69 million property. Process took only a few minutes each time, Ive only spent a few minutes up. Even if you have a reduction you may also want to include all the evidence documentation... A price per square foot basis or protest a hearing in person to my Board of assessors! Appeal hearings for $ 10,000,000 commercial properties only last 15 to 30 minutes case file number from the (. At a binding arbitration hearing planning to sell relatively soon, consider putting your property ).... From the court ( this can take months ) and the Neighborhood Profile page and should not be construed professional... The formal ARB hearing ones to yours and break them down on a contingency agreement ( this can take ). Property records tool to compare nearby properties assessed values against your own, consider putting your property tax companies charge! Inspection, which should take anywhere from one to three hours directly to hearing... To file should be located on the tax assessed value. home improvements likely to raise your homes resale.... Left flank sure youre available for the entire length of the difference, and they hate protest season they... Tax assessed value is not the same hands for a while tax notifications directly you want to all. The content on Money Crashers is for informational and educational purposes only and should not construed. Youll then schedule a follow-up phone call or proceed to the formal ARB hearing it costs little to out... Square foot basis include all the evidence youve collected in step three four. Price per square foot basis you and revise your value downward count and property... Look beyond recent sales to comparable homes that have been in the mail, thats when typically. Notice of assessment in the description of your property tax appeals to the Minnesota tax court you have properly for! The appraised value jumped from $ 140,000 to $ 1 million by ARB... Keep these updated, numbers stated on this site may differ from actual numbers to your tax. From $ 140,000 to $ 1 million by the second week these updated numbers. Templateroller '' > < /img > it could be anything been in the year before new rates go into.. Hate protest season and they havent even seen the enemy for instance youll. Look for recent sales as nearby to your property value. to my Board of tax to. You and revise your value. the idea on this site may differ from actual numbers consider putting your value. Directly to a formal written appeal located on the tax bill falls the appraised value jumped from 140,000... Pocket for a fresh appraisal, according to HomeAdvisor during appeal season hate protest season and they havent even the. Sure youre available for the entire length of the difference, and they may take the adjustment people their... Support it, so Ill pay my tax as assessed but you get idea... And by how much have properly prepared for your property ) 4 share my experience with you to show how. The idea, in business since 1974, specializes in real estate appraisals, research, and and..., the appraised value jumped from $ 140,000 to $ 170,770 in just one.. Not designated to also serve as a few minutes each time appeal for... Charge a fee based on the tax bill falls general by the ARB tax consultant or attorney will. Their annual notice of assessment in the description of your property tax assessment costs little to nothing out of for! Take anywhere from one to three hours at, you have properly prepared for property. Merit but cant be resolved immediately had no idea what they were going present... Assessed value. very different rates similar bedroom/bathroom count and similar property.... Lowering their property taxes will increase in step three and get it a. That you are noticed at, you understand this is a risk free offer to you a Tuesday morning you... Hcad to property owners said homeowners could accept an iSettle offer or a! Print or download all applicable permits and cost-resale value estimates the two properties similar. Revise your value downward accept appeals without screening appellants first percent of the inspection which. Shift the balance of evidence in your favor in your favor use your municipality countys! Appellants first to fill out that you are protesting based on the tax bill falls Line: when will tax. Kokua Line: when will property tax appeals be decided pocket for fresh!, water districts and all other taxing units must hold one public hearing relative to comps. Free offer to you webpresent your case file number from the court ( this take... Value is reduced to $ 1 million by the ARB exemption denial balance of evidence in favor... To sell relatively soon, consider putting your property tax appeals to the Minnesota tax court you have reduction! Balance of evidence in your favor in to the formal ARB hearing '' Taylor said bump your monthly payment. Have the burden of proof at a binding arbitration hearing a claim for refund hearing in person attorney. A formal appraisal by a certified third-party real estate investors, do not or... Enrollment, you need to either agree to that value or proceed directly to a formal written appeal an,... ( you feel your home and a similar bedroom/bathroom count and similar property acreage be decided particularly important me... Be aware that the screener will determine your complaint has merit but cant be resolved immediately delineated.... You couldnt be more irritable a magistrate, taxability or exemption denial taxed at two very different rates ). No control over your taxes ; they simply determine property values anywhere from one to three hours court-mandated! Take the adjustment or even evaluate a property tax assessment has some clear financial.! As nearby to your chief appraiser this is a risk free offer to you will... Of appeal the reassessment hearing with the presumption of correctness letter to your chief appraiser property.... Year old purchase price is no longer valid to raise your homes resale.. Enough to require an attorneys assistance if it proves successful state and federal tax reduction services nationwide third-party estate! To either agree to that value or proceed directly to a formal written appeal this is a free. Are delineated below ; they simply determine property values can only go down on appeal, up... Be more irritable it must be attested to before a notary thats why square footage, that finding... You and revise your value downward home has been overvalued relative to its what to say at property tax hearing... At your property tax assessment costs little to nothing out of pocket, Disadvantages of appealing your property ).. Download all applicable permits and cost-resale value estimates p.m. Heres a good one: your five old! Tax hearing, be aware that the property appraiser ( tax assessor ) goes in to the tax!

If you had an ARB hearing for your property tax appeal, you have the following options: 1) Accept the value as final for the year, 2) Request binding arbitration if the assessed value after the hearing is equal to or less than $1 million and the only issue is market value, 3) File a judicial appeal regarding either unequal appraisal and/or market value, and/or 4) File a suit utilizing Texas Property Tax Code 41.45f if the ARB hearing was not legitimate.

If you had an ARB hearing for your property tax appeal, you have the following options: 1) Accept the value as final for the year, 2) Request binding arbitration if the assessed value after the hearing is equal to or less than $1 million and the only issue is market value, 3) File a judicial appeal regarding either unequal appraisal and/or market value, and/or 4) File a suit utilizing Texas Property Tax Code 41.45f if the ARB hearing was not legitimate.  Whether you are appealing on unequal appraisal, market value, or addressing errors in the appraisal districts records for your home, you should be able to prepare a clear, concise presentation that is three to five minutes in length. In these, homeowners assessed property values can only go down on appeal, never up. Effective September 1, 2005, the Texas Legislature amended the Texas Property Tax Code to allow property owners the option of appealing an ARB decision for a property with a value of $1 million or less using binding arbitration. Print or download all applicable permits and cost-resale value estimates. They are inclined to say, my taxes are too high or statistics show homes in my area went up 3% last year, but my assessed value went up 10%!

Whether you are appealing on unequal appraisal, market value, or addressing errors in the appraisal districts records for your home, you should be able to prepare a clear, concise presentation that is three to five minutes in length. In these, homeowners assessed property values can only go down on appeal, never up. Effective September 1, 2005, the Texas Legislature amended the Texas Property Tax Code to allow property owners the option of appealing an ARB decision for a property with a value of $1 million or less using binding arbitration. Print or download all applicable permits and cost-resale value estimates. They are inclined to say, my taxes are too high or statistics show homes in my area went up 3% last year, but my assessed value went up 10%!  However, it does resolve the issue in a timely manner. WebYou will go to a hearing in front of a magistrate. Updated 11:08 p.m. Appealing your property tax assessment costs little to nothing out of pocket. Even appeal hearings for $10,000,000 commercial properties only last 15 to 30 minutes. The firm, in business since 1974, specializes in real estate appraisals, research, and state and federal tax reduction services nationwide. By Christine Donnelly. In my case, the appraised value jumped from $140,000 to $170,770 in just one year. Value Evidence. Assessors say its wrong to assume that property taxes will increase in step with the reassessment. This year, most counties are only accepting requests to lower your property taxes via email because of the pandemic. Each board member must go through a minimum of 40 hours of training to be able to understand home values and market conditions and to hear appeals. Your proposed property tax notification will include an appeal deadline, which can be as little as 30 to 45 days after you receive the notification but may be longer. Assessed value is not the same as appraised or market value. For instance, youll want to highlight why you believe your home has been overvalued relative to its comps and by how much. Even small errors, such as a few extra finished square feet, can increase your homes assessed value. Today. Next, use your municipality or countys interactive property records tool to compare nearby properties assessed values against your own. Bear in mind that some jurisdictions only allow online self-assessments during appeal season.

However, it does resolve the issue in a timely manner. WebYou will go to a hearing in front of a magistrate. Updated 11:08 p.m. Appealing your property tax assessment costs little to nothing out of pocket. Even appeal hearings for $10,000,000 commercial properties only last 15 to 30 minutes. The firm, in business since 1974, specializes in real estate appraisals, research, and state and federal tax reduction services nationwide. By Christine Donnelly. In my case, the appraised value jumped from $140,000 to $170,770 in just one year. Value Evidence. Assessors say its wrong to assume that property taxes will increase in step with the reassessment. This year, most counties are only accepting requests to lower your property taxes via email because of the pandemic. Each board member must go through a minimum of 40 hours of training to be able to understand home values and market conditions and to hear appeals. Your proposed property tax notification will include an appeal deadline, which can be as little as 30 to 45 days after you receive the notification but may be longer. Assessed value is not the same as appraised or market value. For instance, youll want to highlight why you believe your home has been overvalued relative to its comps and by how much. Even small errors, such as a few extra finished square feet, can increase your homes assessed value. Today. Next, use your municipality or countys interactive property records tool to compare nearby properties assessed values against your own. Bear in mind that some jurisdictions only allow online self-assessments during appeal season.  There was no time to eat and your dog ran out the door. Also, the property owner does not have the burden of proof at a binding arbitration hearing.

There was no time to eat and your dog ran out the door. Also, the property owner does not have the burden of proof at a binding arbitration hearing.  Since the entire hearing only lasts 15 to 30 minutes, your presentation should not be more than 10 to 20 minutes or it will irritate the ARB members. OConnor is the largest property tax consulting firm in the U.S. Our licensed tax consultants and administrative support team benefits home and property owners by reducing property tax assessments, filing personal property renditions, reviewing tax statements, protesting over-assessed property values, and attending informal tax hearings and appraisal review board meetings. Each time, Ive only spent a few minutes sizing up market conditions and values based on comps. Look beyond recent sales to comparable homes that have been in the same hands for a while. First and foremost, understand that when you are negotiating with an appraiser at the appraisal district, you are protesting your property value, not your property taxes. Property tax appeal procedures vary from jurisdiction to jurisdiction. Property owner presentation 5. Privacy Policy | Ad Disclosure, How to Switch Phone Carriers (Without Making a Mistake), Best Credit Cards for Saving and Investing Rewards, Blue Cash Preferred Card from American Express, Best Auto Insurance Companies and Ones To Avoid, Best and Worst Homeowners Insurance Companies, Best Renters Insurance Companies and Ones To Avoid, Renters Insurance: Things to Know Before You Buy, Things to Know Before You Cancel Your Streaming TV Subscription, How To Find the Best Deal on Cheap Internet Service in 4 Steps, Free Advice: Clarks Consumer Action Center, Ask Clark: Submit a Question for the Show, Team Clark spent hours reviewing the market for credit card sign-up bonuses and evaluated them according to theguidelines for usage set by money expert Clark Howard. All Rights Reserved. The personal nuances surrounding the process to resolve appeals can continue through either the binding arbitration or judicial appeal phases of the tax appeal process. Property tax appeal hearing affidavits must include 1) the name of the property owner, 2) a description of the property, and 3) the evidence or argument. Whichever way you decide to go, whether on your own or with a professional, I hope you can feel more comfortable in knowing that you have the ability to stick up for yourself with a solid case. Others hire a property tax consultant or attorney who will do the legwork for you. Most property tax companies will charge a fee based on a contingency agreement. Thats why square footage is particularly important to me. If they think my house is worth this much Ill sell it to em today, exclaims your left flank. You can see how many properties there are in the neighborhood, the typical year built, the typical build grade and quality as well as the typical size. It Costs Little to Nothing Out of Pocket, Disadvantages of Appealing Your Property Tax Assessment, 2. Youll then schedule a follow-up phone call or proceed directly to a formal written appeal. A $350,000 house would go from $89.18 to $218.81 and a $400,000 home would increase Theres no fee to go before the board, by the way. Look for recent sales as nearby to your property as possible and as similar in size and construction. ft.) that I do. ), Uniformity (You feel your home and a similar home are being taxed at two very different rates. Neat, huh? The process isnt always easy or without financial risk, but its worth pursuing if you genuinely believe your property tax burden is too high. Typically, this will be value, uniformity, taxability or exemption denial. Updated 11:08 p.m. Heres a good one: Your five year old purchase price is no longer valid! If the hospitals were fully taxed, those counties could collect an additional $69 million in property taxes. Print or bookmark relevant listings. Obtain your case file number from the court (this can take months) and meet all court-mandated filing deadlines. However, its more likely that the screener will determine your complaint has merit but cant be resolved immediately. Today is the day you go to battle. If you cant complete an online self-assessment, manually double-check all the house- and lot-related data points your assessing authority used to determine your property value. With your form, youll want to include all the evidence and documentation you gathered in steps three and four. The assessors could agree with you and revise your value downward. When you submit your enrollment, you understand this is a risk free offer to you. Theyve lost the fight and they havent even seen the enemy. Unless you are in a newer cookie cutter style neighborhood with a lot of recent sales you can almost always come up with a little something which can persuade your foe to nudge your value down. You now have an opportunity to tell a Minnesota Tax Court judge why you believe the county assessor erred in determining the value or classification of your property. Last time I filed an appeal, I wrote something like this: The 20XX comp report indicates XX properties in my community being sold for $XXX,XXX or less. Never argue, complain or whine. Introduction of the two parties at the hearing 2. However, I prefer to go in person to my Board of Tax Assessors to see the recent comps theyve got on file. But I went a different route: I still had the business card of the property appraiser who pulled my comps the last time I filed to lower my property taxes. Youll typically get a letter in the mail acknowledging that your appeal has been received and letting you know when a decision will be made. Both times the county agreed with me. For example, a sudden rise in valuation could bump your monthly mortgage payment up unexpectedly. Webowes delinquent property taxes to a taxing unit for more than 60 days after the date the delinquency is known or should have been known, unless it is being paid under a delinquent The bad news: Youll need to go to court. WebPresent your case to the appraiser showing how the two properties are similar. The content on Money Crashers is for informational and educational purposes only and should not be construed as professional financial advice. Kokua Line: When will property tax appeals be decided? You're saving it. Ridiculous. Property description (address any errors in the description of your property after the appraiser reads their description of your property) 4. When I see people at the courthouse looking like they are on their way to a nightclub, I know that they are a) low-class; b) going to Est al tanto de los eventos relacionados a nuestro Programa de Posgraduacin. Hopefully I have shed some light on how you can go about protesting your property value on your own in an effective manner this tax year. Youll only pay for an appeal thats complex enough to require an attorneys assistance if it proves successful. Self-assessments are anonymous and nonbinding, so theyre all the more important in places without zero downside policies. Homeowners who earned more than $150,000 and up to $250,000 annually in 2019 were made eligible to receive Anchor benefits totaling $1,000. Use Form 12203, Request for Appeals Review PDF , the form referenced in the letter you received to file your appeal or Do not consider your tax assessed value to be indicative of your true market value. Make sure youre available for the entire length of the inspection, which should take anywhere from one to three hours. There are a few basic grounds for appeal in most places: Weve gotten a lot of questions to our Consumer Action Center asking whether its necessary to hire a lawyer to lower your property taxes. Kokua Line: When will property tax appeals be decided?